IPOs

Scope of this presentation

- This presentation explores some key Hong Kong law issues relating to a possible spin-off of a wholly owned subsidiary of a Main Board listed company on the Growth Enterprise Market (“GEM”) of the The Stock Exchange of Hong Kong Limited (“HKSE”).

- This presentation is intended to provide an general overview and outline only of matters specified herein and is not a substitute for specific advice relating to specific circumstances or issues. No attempt has been made to cover every relevant point in exhaustive details.

Possible spin-off structures

Spin-off structures

- It may be possible for a Main Board listed company to dispose of a wholly owned subsidary (“Business”) into a new investment vehicle to achieve a spin-off listing on the GEM. This can be structured in one of two ways:

- Distribution in specie

This would involve:

- the new spin-off entity (“Newco”) issuing new shares to the existing listed company (“Listco”) (which would then distribute the shares to its shareholders pro-rata to their existing shareholding in Listco) or to the shareholders of Listco directly, in consideration for the acquisition of the Business; and

- the Newco seeking a listing on GEM whereby shareholders (including other principal shareholders of Listco) who wish to exit will sell their shares in the new listing

- Preferential right of subscription

This would involve:

- the Newco finance the acquisition of the Business from Listco by equity financing (e.g. private placement) or debt financing (e.g. bridging loan);

- Listco distribute the relevant proceeds of the sale of the Business to its shareholders and at the same time giving them an option to exercise a preferential right to subscribe to Newco’s listing (existing shareholders would be given assured entitlement to Newco’s shares pro-rata to their existing shareholding in Listco); and

- the listing of the Newco whereby shareholders who wish to exit will not subscribe to the listing.

- Distribution in specie

- In both scenarios, the existing controlling shareholders of Listco should be able to retain control over the Business, if desired. However, there are inherent risks in each scenario:

- in a distribution in specie scenario:

- the reduction of share value of Listco as a result of the disposal of the Business may not be recovered if Newco fails to list; and

- if Newco fails to list, shareholders wishing to exit will also be stuck in the unlisted Newco.

- in a preferential right to subscription scenario:

- a failure to list Newco would cause a failure to recover loss in value in Listco as a result of disposal of the Business;

- Newco would have incurred debt (if the initial acquisition of the Business was financed by debt/loan) which would need to be repaid otherwise than from proceeds of listing if Newco fails to list; and

- if Newco proposes to finance the initial acquisition of the Business by equity financing, such as a private placement, there must be sufficient incentives for potential investors to subscribe to the placement (for example, easier access to interests in the Business, or a discount in consideration to acquiring such interests directly).

- In both scenarios, any agreements binding on Listco must be examined and any veto rights, consent or restrictions relating to the disposal of material assets or business which are relevant must be dealt with

LISTING RULE REQUIREMENTS RELATING TO A SPIN-OFF ON GEM

Notifiable transaction – Disposal of the Business to Newco

- The disposal of the Business by Listco will likely be a notifiable transaction for Listco pursuant to which it is likely that (depending on the size tests), the transaction would be subject to the requirements of Chapter 14 of the Rules Governing the Listing of Securities on the HKSE (“Listing Rules”).

- Assuming, but subject to proper computation, the relevant percentage ratios (i.e. assets ratio, profits ratio, revenue ratio and consideration ratio) set out in Rule 14.07 of the Listing Rules is either less than 5% or 5% or more but less than 25%, then the proposed transaction will be classified as a “discloseable transaction” in which case, the following requirements of Chapter 14 are relevant:

- notification to the HKSE as soon as possible after the terms of the transaction has been finalised

- publication of an announcement in accordance with Rule 2.07C of the Listing Rules (such announcement to include details of Business disposed, details of gain or loss accrued to Listco and basis of calculation thereof etc.)

- depending on how the Newco is structured, the transaction could constitute connected transaction in which case independent shareholders’ approval may be required

Sufficient level of operations – to be maintained by Listco following disposal of Business

- Listco must satisfy the HKSE that it continues to carry out, directly or indirectly, a sufficient level of operations or have tangible or intangible assets of sufficient value to warrant the continued listing of Listco following the disposal of the Business (LR 6.01(3) & 13.24)

- In particular, paragraph 2.3 of Practice Note 17 of the Listing Rules states that “Issuers that are unable to comply with rule 13.24 may be suspended – either at the request of the issuer or at the direction of the Exchange. Resumption of trading in the securities of these issuers will only be permitted where they are able demonstrate that they comply with rule 13.24” and LR6.04 states that the continuation of a suspension for a prolonged period without the issuer taking adequate action to obtain restoration may lead to the Exchange cancelling the listing

- Given that the Business do not appear to be significant to the overall business of Listco, we are of the view that the above requirements should not be problematic for Listco

Practice Note 3 – HKSE’s policy and principles relating to spin-offs on the GEM

- Practice Note 3 (PN3) to the Rules Governing the Listing of Securities on the GEM of the HKSE (“GEM Listing Rules”) sets out the HKSE’s policy on spin-offs on the GEM as well as principles which the HKSE will consider in determining whether to approve such spin-off application submitted to it. In any case, the Listing Division should be consulted at an early stage of any spin-off proposal.

- PN3 states that the HKSE will consider, inter alia, the following:

- whether Newco will satisfy the requirements of the HKSE relating to new listing applicants, including the basic listing criteria contained in Chapter 11 of the GEM Listing Rules

- as set out and analysed in the next section of this presentation

- whether 3 years has lapsed following the listing of Listco prior to the spin-off application

- this would not be problematic as we understand the Listco was listed in 1970

- whether Newco should be able to function independently of Listco as regards its business and operations, directorship and management, administrative capability

- Newco and its management should be structured that it may operate independently and in the interests of its shareholders as a whole and not in the interests of Listco where there are actual or potential conflicts

- although sharing of administrative, non-management functions such as secretarial services are normally permitted, Newco must be able to carry out essential administrative functions independently

- ongoing and future connected transactions between Newco and Listco would need to be properly transacted under Chapter 20 of the GEM Listing Rules

- whether there will be a clear delineation between the businesses retained by Listco and the business of Newco

- this should not be problematic as the Business to be spun-off is very different from the core business of Listco

- whether Listco, excluding any interests in Newco, will have sufficient assets and operations of its own to support its separate listing status

- this should not be problematic as the Business to be spun-off is only a small part of Listco’s overall business

- whether there are clear commercial benefits, both to Listco and Newco, in the spin-off which should be elaborated in the listing document

- whether there would be adverse impact on the interests of shareholders of Listco resulting from the spin-off

Assured entitlements of existing shareholders

- subject to waiver by resolution in general meeting of Listco, existing shareholders of Listco must be provided assured entitlements in shares in Newco, either by way of a distribution in specie of existing shares in Newco or by way of preferred application in any offering of existing or new shares in Newco

- the percentage of shares to be allocated to assured entitlement tranche could be determined by directors of Listco as long as all shareholders of Listco will be treated equally

Announcement

- announcement of the spin-off must be made by the time it lodges a Form 5A (Application Form of listing) and prior thereto, an announcement may be necessary if there is any leakage of information or significant, unexplained movement in the price or turnover volume of Listco’s securities

GEM LISTING RULES REQUIREMENTS THAT WOULD NEED TO BE SATISFIED BY NEWCO FOR LISTING ON GEM

Listing of Newco on the HKSE

- The main requirements to be met for a GEM listing is set out in Chapter 11 of the GEM Listing Rules

- The Newco may be incorporated in a jurisdiction other than Hong Kong although companies incorporated in overseas jurisdictions are also subject to the additional requirements of Chapter 24 of the GEM Listing Rules

- The GEM Listing Rules allow the listing of companies incorporated in Hong Kong, China, Bermuda and the Cayman Islands. Further, the GEM Listing Rules also allow the listing of companies:

- from any jurisdiction which provides standards of shareholder protection that are at least equivalent to those required under Hong Kong law; or

- whose constitutional documents can be amended to provide equivalent standards of shareholder protection

Listing requirements: financial test – application to Newco

Newco must meet the following financial requirements set out in Chapter 11:

- adequate trading record of at least two financial years (unless otherwise accepted by the HKSE) comprising positive cash flow generated (of no less than HK$20,000,000 in aggregate for the two immediately preceding financial years) from operating activities in the ordinary course of business before changes in working capital and taxes paid

- expected market capitalisation of Newco must be at least HK$100 million which shall be calculated on the basis of all issued share capital of Newco upon listing

Qualifications for listing on GEM – application to Newco

Further, Newco must satisfy the following requirements:

- in the opinion of the Exchange be suitable for listing

There are a number of situations whereby the Exchange may consider the applicant unsuitable for listing. For instance, if the applicant’s whose assets consists solely or substantially of cash or short-dated securities

- ownership continuity for at least one preceding financial years

This means continuous ownership and control of the voting rights attaching to the shares held by a controlling shareholder, or where there is no controlling shareholder, the single largest shareholder.

- management continuity for at least two preceding financial years

This means that the management of Newco (including key board and management positions) must be held by substantially the same persons, stable and not fluctuating for an extended period of time

Public float and shareholders spread requirements of a GEM listing- application to Newco

In addition, the HKSE will need to be satisfied:

- at least 25% of Newco’s outstanding shares will be publicly held at all times. This requirement may be lowered to 15-25% where expected market capitalisation at the time of listing is over HK$10 bn

- market capitalisation of shares held by public at listing must exceed HK$30 million

- Newco will have a minimum of 100 shareholders at the time of listing (which can include employee shareholders)

- not more than 50% of Newco’s securities held by the public at the time of listing may be beneficially owned by its 3 largest public shareholders

Important documents / disclosures to be included in the listing document – application to Newco

- Financial statements of Newco must be prepared under either IFRS, or HKFRS or other accounting standards acceptable to the HKSE (e.g. US GAAP). The accountant’s report to be included in the listing document must be no longer than 6 months prior to date of listing document

- Newco must provide a working capital statement (and the sponsor must provide confirmations to the Exchange) stating that, after due and careful enquiry, it is satisfied that it and its subsidiary undertakings have sufficient working capital for the group’s requirements for at least 12 months from the date of listing document

- Newco must provide disclosures of competing business of controlling shareholder(s) (i.e. person or person acting together entitled to exercise 30% or more voting power at general meeting of issuer or controls its board) with businesses carried by it

Sponsor requirement – application to Newco

- In accordance with requirement of Rule 6A.02 of the Listing Rules, when applying for a listing, Newco will be required to appoint an independent sponsor to assist with its listing application

- sponsors must be a corporation or an authorised financial institution licensed or registered under applicable laws to advise on corporate finance matters (i.e. corporate financial advisers licensed by the Securities and Futures Commission)

- the sponsor will be responsible for organising Newco for listing on the HKSE such as preparing necessary listing documents and filing the formal listing application and all supporting documentation required by the HKSE. It will also be the principal channel communication between Newco and the HKSE

- the Sponsor must also conduct due diligence inquiries on Newco (often with the assistance of qualified lawyers) to ensure compliance with the GEM Listing Rules and that the listing document contains accurate and complete information about Newco (for further information regarding such enquiries, please refer to Hong Kong Sponsor Due Diligence Guidelines at duediligenceguidelines.com)

Corporate requirements – application to Newco

- Process agent (if overseas issuer): if Newco is an overseas issuer, it must appoint and maintain through the period its securities are listed a person authorised to accept services of process and notices on its behalf in Hong Kong

- Share register: Newco must maintain a register of shareholders in Hong Kong

- Company secretary: a company secretary of Newco must be appointed who is either a member of the Hong Kong Institute of Companies Secretaries, a solicitor or barrister qualified in Hong Kong, a professional accountant or such person as HKSE with relevant academic or professional qualification satisfactory to the HKSE

- Authorised representatives: Newco must appoint 2 authorised representatives to act at all times as its principal channel of communication with the HKSE. These can be either 2 directors or a director with the company secretary unless in exceptional circumstances. Contact details of the nominated authorised representatives (or suitable alternates) must be supplied to the Exchange

- Independent Non-executive Directors (INEDs): Newco must have at least 3 INEDs on its board (at least one with appropriate professional qualifications or accounting or related management expertise). Such directors shall not have more than 1% of Newco’s issued share capital and have no material interest in Newco’s principal business activities or its connected persons. Further, the number of INEDs must represent at least one-third of Newco’s board

- Audit committee: Newco must establish an audit committee made up of at least 3 non-executive directors (at least one of which shall be an INED with appropriate professional qualifications or accounting or related management expertise, and whom shall be the chair of the committee)

- Remuneration committee: Newco must establish an remuneration committee made up of INEDs

- Compliance adviser: Newco is required to retain a compliance adviser from the commencing of its listing and ending on the publication of its financial results for the second full financial year after listing. Such compliance advisors must be licensed by the SFC to conduct sponsor work. Newco should consult with the compliance adviser and seek their advice prior to such events as: the publication of any regulatory disclosures; when completing notifiable or connected transactions; when there are any change of use of IPO proceeds etc.

- Compliance officer: Newco must appoint one of their executive directors as a compliance officer

Documentary requirements – application to Newco

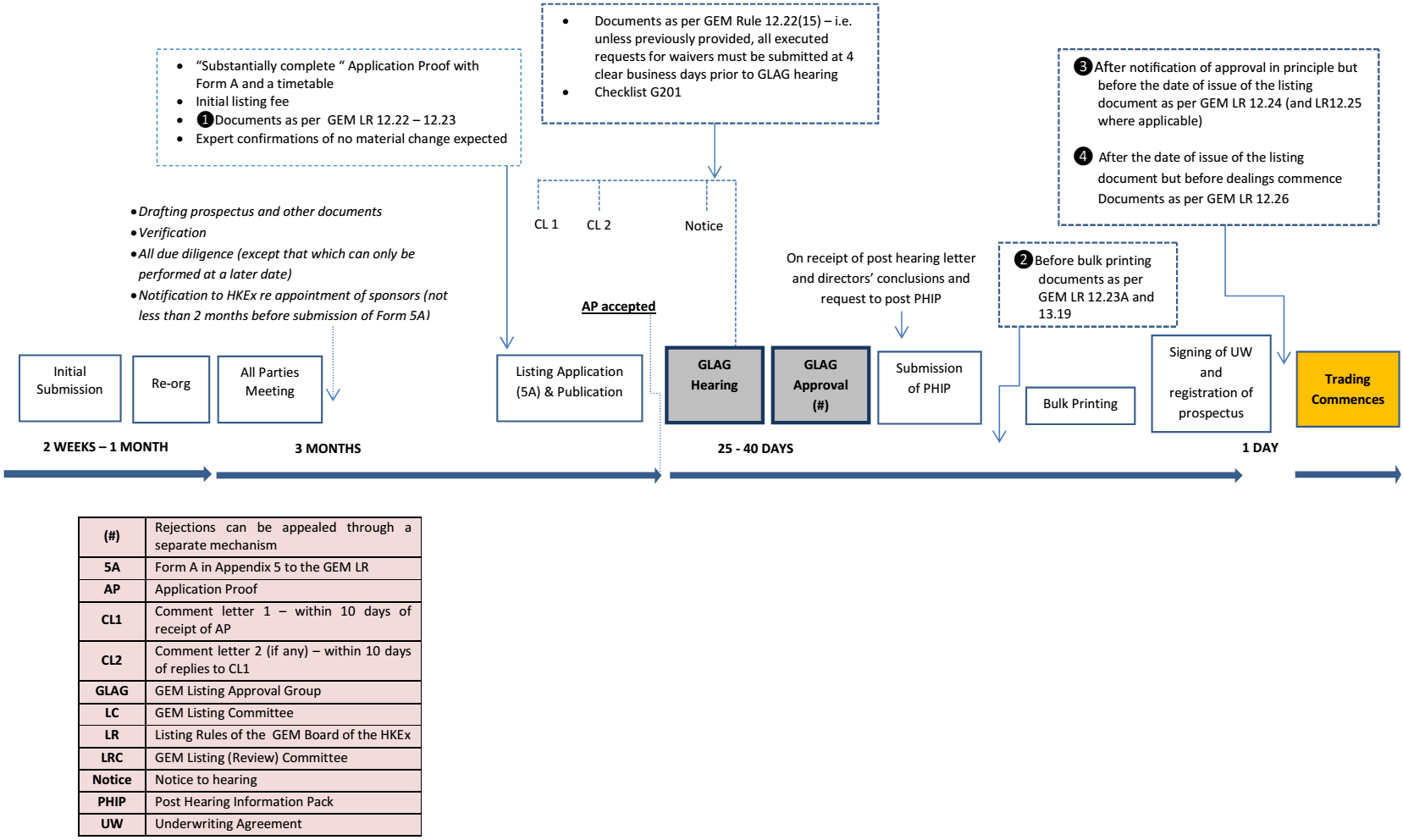

| ❶ Documents as per GEM LR 12.22 – 12.23 | ❷ Before bulk printing documents as per GEM LR 12.23A and 13.19 | ❸ After notification of approval in principle but before the date of issue of the listing documents as per GEM LR 12.24A (and LR12.25 where applicable) | ❹ After the date of issue of the listing document but before dealings commence documents as per GEM LR 12.26 |

|

|

|

|

GEM IPO timeline – application to Newco

Listing fees

- Initial listing fee: an initial listing fee shall be payable on the application for listing based on the monetary value of the equity securities to be listed. The initial listing fee is payable at the same time as the submission of the listing application. The initial listing fee for listing on GEM range from HK$100,000 to HK$200,000 depending on size of the listing. Schedule of initial listing fee can be found at: http://www.hkex.com.hk/eng/listing/listreq_pro/listing_fees.htm

- Annual fee: an annual listing fee calculated by reference to the nominal value of the securities which are or are to be listed on the HKSE is payable. This fee is payable in advance in one instalment. The annual listing fee for GEM companies range from HK$100,000 to HK$200,000 depending on size of the listing. Schedule of annual fee can be found at: http://www.hkex.com.hk/eng/listing/listreq_pro/annual_listing_fees.htm

Charltons

- Charltons’ extensive experience in corporate finance makes us uniquely qualified to provide a first class legal service

- Charltons have representative offices in Shanghai, Beijing and Yangon

- Charltons was named the “ Corporate Finance Law Firm of the Year in Hong Kong ” in the Corporate Intl Magazine Global Award 2014

- “Boutique Firm of the Year” was awarded to Charltons by Asian Legal Business for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015

- “Hong Kong’s Top Independent Law Firm” was awarded to Charltons in the Euromoney Legal Media Group Asia Women in Business Law Awards 2012 and 2013

- “Equity Market Deal of the Year” was awarded to Charltons in 2011 by Asian Legal Business for advising on the AIA IPO

- Excellent links and networks with law firms worldwide.

- Julia Charlton was named a “Leading Lawyer” by Asia Law & Practice for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015.

- “Asian Restructuring Deal of the Year” 2000 awarded to Charltons by International Financial Law Review for their work with Guangdong Investment Limited.

- Finalist for China Law & Practice’s “Deal of the Year (M&A)” 2007 for the work on Zijin Mining Group Co Ltd.’s bid for Monterrico Metals plc.

Practice Area

|

|

Attributes of the Charltons team

The Charltons’ team is composed of individuals with the following knowledge and skills:

- a detailed knowledge of Hong Kong law and practice in relation to IPOs and equity fund raising transactions of public companies

- extensive experience of providing legal services for Hong Kong and PRC-related IPO transactions

- in-depth knowledge of the Listing Rules of both GEM and the Main Board of the Hong Kong Stock Exchange

- depth and range of experience in advising companies in connection with IPO and Listing transactions

Charltons has considerable experience in helping companies to list on the Main Board and the GEM Board of the Hong Kong Stock Exchange

Charltons’ approach

- Charltons is committed to apply a fresh solution-oriented approach to the provision of legal services to our clients. We seek to combine legal excellence with efficiency and economy

- our lawyers who give legal advice is sensitive to the clients’ relevant business or industry environment

- our lawyers regularly contribute to legal and business publication as well as government consultations. We can provide seminars and in-house education for clients and always available to discuss ways we can help our clients

- our lawyers seek to achieve high levels of efficiency in communicating with clients and to be accessible and responsive at all times

- our lawyers aim to exceed clients’ expectations – we achieve this by understanding clients’ needs, committing and planning to meet those needs, creatively resolving issues faced by clients, meeting clients’ timetables and regular monitoring and reviewing our performance

Team Profile: Julia Charlton

Julia Charlton – Partner

- Julia, LL.B (1st class Honours), A.K.C (Kings College, London) was admitted as a solicitor in England & Wales in 1985 and has practised as a solicitor in Hong Kong since 1987.

- Julia is a member of the Listing Committee of the Stock Exchange of Hong Kong Limited and the Takeovers Panel and the Takeovers Appeal Panel of the SFC.

- Julia was named a “Leading Lawyer” by Asia Law & Practice for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015.

- Julia was named a “Leading Advisor” by Acquisition International for 2013.

- Julia was also named the “Capital Markets Lawyer of the Year – Hong Kong” in the Finance Monthly Global Awards 2014.

- Julia has extensive experience in China work and is a Mandarin speaker.

Recent IPO experience

- Medicskin Holdings Limited (listed on the GEM, December 2014, Hong Kong legal adviser to the Company)

- Orient Securities International Holdings Limited (listed on GEM, January 2014, Hong Kong legal adviser to Sponsor)

- Mastercraft International Holdings Limited (listed on GEM, July 2012, Hong Kong legal adviser to the Sponsor)

- Branding China Group Limited (listed on GEM, April 2012, Hong Kong legal adviser to Sponsor)

- AIA Group Ltd (listed on the Main Board, October 2010, Hong Kong legal adviser to AIG)

- United Company RUSAL Plc (listed on the Main Board, January 2010, Hong Kong legal adviser to controlling shareholder)

- China Titans Energy Technology Group Co., Limited (listed on the Main Board, May 2010, Hong Kong legal adviser to Sponsor)

- Mingfa Group (International) Company Limited (listed on the Main Board, November 2009, Hong Kong legal adviser to Company)

Other selected IPO experience

- Mingfa Group (International) Company Limited (listed on the Main Board, November 2009, Hong Kong legal adviser to Company)

- Greens Holdings Limited (listed on the Main Board, November 2009, Hong Kong legal adviser to Company)

- China All Access (Holdings) Limited (listed on the Main Board, September 2009, Hong Kong legal adviser to the Sponsor)

- China Tianyi Fruit Holdings Limited (listed on Main Board, January 2008, Hong Kong legal adviser to the Sponsor)

- China High Speed Transmission Equipment Group Co., Ltd. sponsored by Morgan Stanley (listed on Main Board in 2007, Charltons acted as the Hong Kong legal adviser to the Company. Market capitalisation on listing was approximately HK$2,442,000,000 (US$313,600,000))

- Zhejiang Shibao Co., Ltd., (listed on the GEM in May 2006, Charltons acted as the Hong Kong legal adviser to the Company)

- Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co. Ltd. (listed on GEM of the Exchange in August 2002, Charltons acted as the Hong Kong legal adviser to the Sponsor)

- Tianjin TEDA Biomedical Engineering Co. Ltd. (listed on GEM of the Exchange in June 2002, Charltons acted as the Hong Kong legal adviser to the Sponsor)

- Zheda Lande Scitech Ltd. (listed on GEM of the Exchange in May 2002, Charltons acted as the Hong Kong legal adviser to the company)

- TradeEasy Holdings Ltd. (listed on GEM of the Exchange in March 2002, Charltons acted as the Hong Kong legal adviser to the company) (it is now renamed as Merdeka Resources Holdings Limited)

- Bon Holdings Ltd. (listed on the Main Board of the Exchange in April 2000, Charltons acted as the Hong Kong legal adviser to the Sponsor)

What we can do for you

As your legal adviser, we will work conscientiously and closely with you to meet your needs and to ensure your compliance with Hong Kong laws and regulations