Myanmar

Mineral policy of government of Myanmar

- To boost production to meet growing domestic needs and to increase foreign exchange earnings

- To invite participation in terms of technical know-how and investment from sources within the country and abroad

- Emphasis on development of copper, gold lead/zinc Iron and steel coal nickel and construction-related industrial minerals such as cement making minerals, dimension stones and aggregates

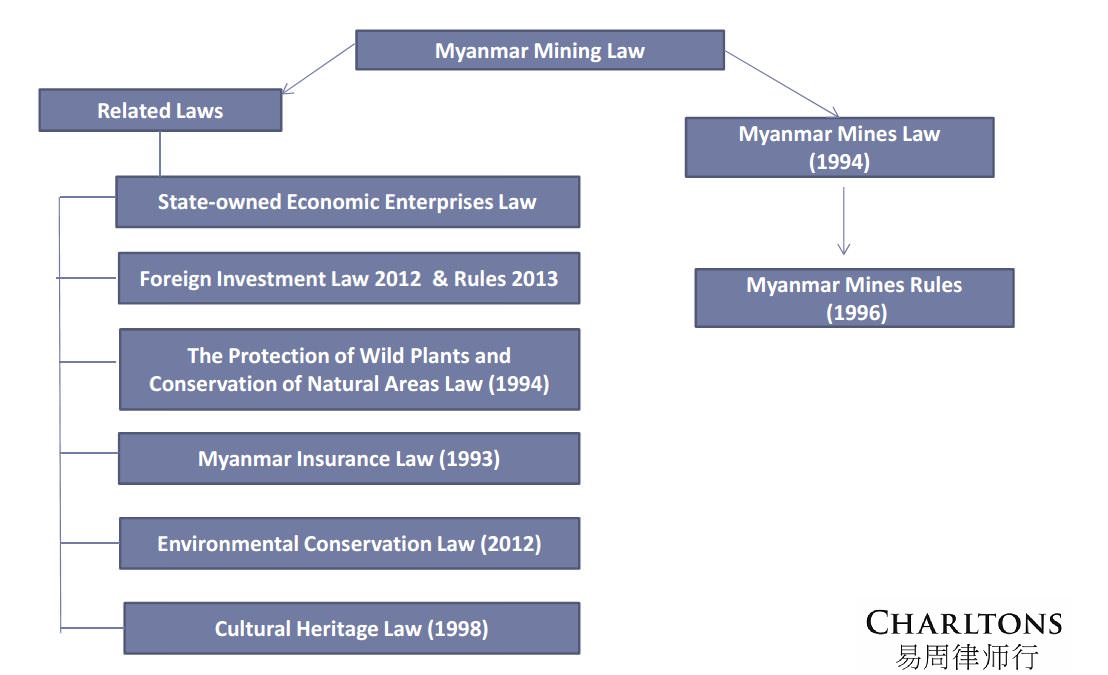

Mineral related Legislation in Myanmar

Myanmar mines law 1994*

Objectives

- Implementation of the Government’s Mineral Resources Policy;

- To meet domestic demand and increase exports;

- To promote the development of local and foreign investment;

- To provide an approval framework for the issuing of licences;

- To improve the use, conservation, and research of mineral resources;

- Environmental protection

* New draft mining law expected in 2013

Proposed amendments to the mining rules

| Description | Existing Mining permit , Time and Area | Future Mining Permit, Time and Area |

|

Mineral Prospecting Permit |

A period not exceeding 1 year.

|

Remain Unchanged |

|

Mineral Exploration Permit and Feasibility Study |

A period not exceeding 3 years.

|

Remain Unchanged |

|

Large Scale Mineral Production Permit |

A period not exceeding 25 years shall be permitted.

|

A period not exceeding 25 years shall be permitted. The land area depends on investment amount and ore deposit. Extension period not exceeding 5 years at a time. ( may get 3 times to extend ) |

|

Medium Scale Mineral Production Permit |

Not Include in Previous Law |

Not more than 10 Year Designated land area which shall not exceed 1Km2 Extension period not exceeding one year on four occasions. |

|

Small Scale Mineral Production Permit |

A period not more than 5 years.

|

A period not more than 5 years. Designated land area which shall not exceed 50 acres Extension period not exceeding one year on four occasions. |

|

Subsistence Mineral Production Permit |

A period not exceeding 1 year.

|

Remain Unchanged |

Proposed amendments to the mining rules in relation to gold mining

| Description | Existing Mining permit , Time and Area | Future Mining Permit, Time and Area |

| Small Scale Permit | 20 acres and below | 5 acres and below |

| Medium Scale Permit | Not mentioned | Not more than 50 acres |

| Large Scale Permit |

No area limit

Depend upon the size of ore deposits and expected LOM |

50 acres and above |

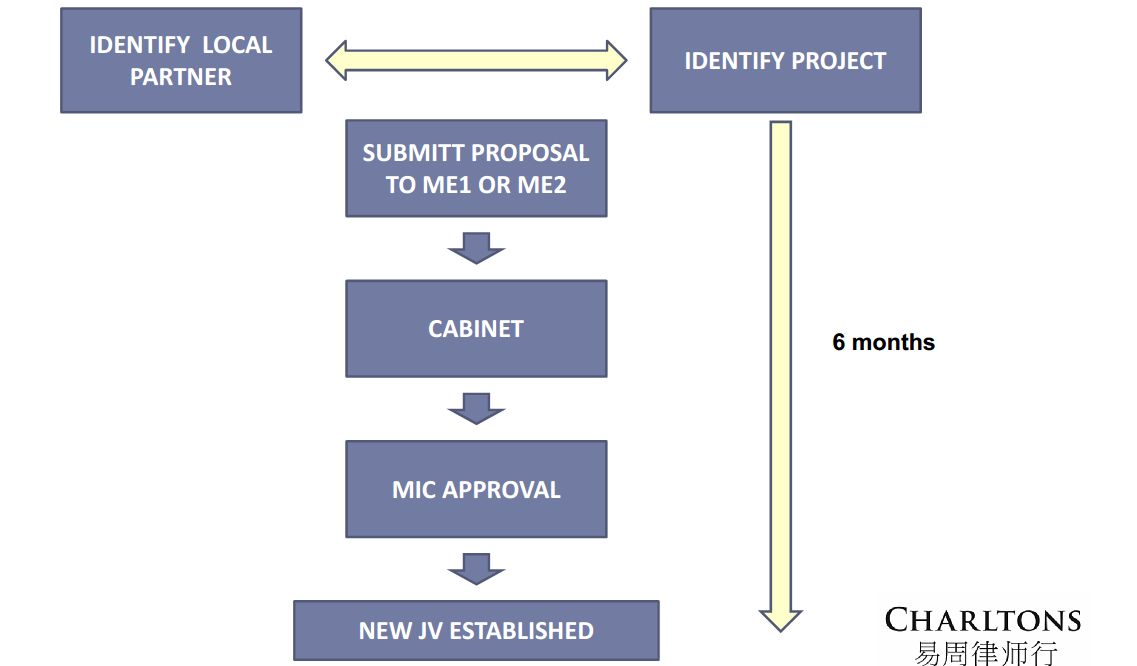

Investment process

- Introductory letter

- Identify local partner and execute project MoU

- Work with DGSE to review available areas and conduct site visit

- Prepare and submit project proposal to relevant State Owned Enterprise ME1 or ME2

- Negotiate a draft joint venture and/or production sharing agreement with the relevant Ministry (this will include formal arrangement with local partner to form a new JV Entity)

- Submit draft agreement to cabinet for approval

- Submit to Myanmar Investment Commission

- Execute Formal Agreement & establish Local JV Entity to hold the asset and operate the project.

Project proposal documentation

- Company registration documentation

- Company profile

- Recommendation and endorsement of the applicant’s embassy in Myanmar (or relevant embassy responsible for Myanmar)

- Financial bank statements

- List of Board of directors

- Initial work programme

- Map of the proposed area with coordinates

- Mine closure plan

- Environmental impact study

Examples of FDI mining projects

| Company | Type of Mineral |

| Conerstone Resource (Myanmar) Ltd ( Australia ) | Zinc Ore |

| Myanmar Ponepipet Co.,Ltd (Thailand) | 72% Tin Concentrate |

| Myanmar CNMC Nickel Co.,Ltd ( China ) | Ferronickel |

| Simco Song Da Joint Stock Company ( Vietnam ) | Marble |

| Asia Pacific Mining Ltd (China) | Lead, Zinc, Copper, Gold |

| Nobel Gold Limited ( Russia ) | Gold and associated minerals |

| North Mining Investment Co.,Ltd (China) | Ferronickel |

| De Rui Feng Investment Co.,Ltd ( China ) | Tin-Tungsten |

Mining FDI – case studies

| Description | Viet Nam Simco Sounda | China Non Ferrous Metal Corporation (CNMC) |

| Area | Nay Pu Taung, Taunggok Township, Rakhine State | Taguang Taung, Thabeikkyin Township ,Mandalay Region |

| Investment | US$ 18.5 million | US$ 787.899 Million |

| Signing | 16.3.2012 | 28.7.2008 |

| Development Period | 20 Months | 36 Months |

| Proposed Production Per Year |

Marble Block – 30,000 m3 Marble Slab – 100,000 m3 |

Ferro Nickel – 51416 Tons Ni = 25.49 % |

| Royalty | 3 % | 4 % |

| Production Sharing Contract Ratio (Government : Company ) |

20 : 80 (Below – US$ 649) 25 : 75 (Between – US$ 650 – 749) 30 : 70 ((Above –US$ 750) |

12 : 88 (US$ 20001- 25000) 15.75 : 84.25 (US$ 25001- 29000) 20 : 80 (US$ 29001- 35000) 23.75 : 76.25 (US$ 35001- 42000) 28 : 72 (US$ 42001- 50000) 32 : 68 (Above –US$ 50000) |

Advising the mining and natural resources industry

Charltons assists natural resource companies together with individuals, institutional investors and financial institutions and other professional parties involved in the mining and natural resources industry with: –

- Capital Raising – equity, debt and loan financing

- Mergers & Acquisitions

- Public Market Offers

- Mining Agreements

- IPO’s and pre IPO enquiries

- IP protection

- Establishment of operations in Hong Kong and the PRC

Capital raising – advising mineral & natural resource companies

Charltons is committed to assisting mineral companies to put in place the most suitable investment structure to accommodate their development plans. Charltons advises on the following : –

- Placings to existing shareholders (where option is available)

- Share sale / subscription agreements and shareholder agreements

- Injection of PE capital via both incorporated and unincorporated joint ventures

- Where applicable the drafting and/or review of “off-take” agreements

- Due Diligence

- The preparation of information memoranda or other investor “teasers”

Capital raising – advising investors

Charltons is experienced in acting for private equity and institutional investors. We understand their objectives and the risk minimization strategies they employ in relation to: –

- The cyclical nature of commodity demand

- Unpredictability surrounding exploration and production costs

- Access to transport infrastructure, management, to labour

- Changing national regulations

- Geo-political concerns

- Local inflation

- Environmental compliance

- Currency volatility

- Risks associated with sustainability and mine-rehabilitation

- Geographic remoteness

- Community relations

- Longer investment horizon

At Charltons we understand the factors that influence mining investors and are experienced in advising on the legal safeguards that should be put in place to protect them. We assist investors balance the goals of risk minimization and profit maximization.

Selected Legal Services

- Due diligence

- Placings to existing shareholders (where option is available)

- Drafting share sale / subscription agreements and shareholder agreements

- IP protection where investor / farm-in party contributes IP

- Injection of PE capital via both incorporated and unincorporated joint ventures

- Where applicable the drafting and/or review of “off-take” agreements

- Exit strategies (including Hong Kong IPOs)

- Representing PE investor as shareholder

- Advising the PE investor’s board representative (where applicable)

- Putting in place corporate governance policies and practices to protect investor / investment

- Conflicts of interests with the invested company

- Freedom to transfer interests

- Investor rights

- Anti-dilution provisions

- Tag / drag along rights

- Borrowing and charges

- IP transfers

Capital raising – advising lenders

We are experienced in advising lenders on the legal aspects of mining project financing, including senior, mezzanine, subordinated and convertible debt together with more traditional corporate debt financing arrangements. We can also advise on bridge financing and other credit facility arrangements and assist listed and private companies and financial institutions on debt purchases.

Our services include advising on: –

- proposed project structure (including where applicable SPVs established to facilitate debt arrangement)

- primary financing documents

- due diligence

- provision of security and/or reviewing or drafting security documents as required

- insurance arrangements and review of insurance documentation

- the legal aspects of life of mine plans and development plans

- hedging arrangements

- off-take agreements, infrastructure agreements, construction agreements, equipment agreements, operating agreements, maintenance agreements, and product purchase agreements

Capital raising – deal highlights

Highlights for transactions with a debt / loan financing component

- Advising Zijin Mining Group Co., Ltd (“Zijin”) – a Hong Kong and Shanghai listed miner – on its acquisition of Norton Gold Fields Limited, an ASX-listed gold miner, included reviewing the bid implementation deed, an AUD$38 million loan agreement and the ASX announcement from a Hong Kong legal perspective together with drafting Zijin’s public announcement in Hong Kong.

- Advising EIG Global Energy Partners on their postponed Chapter 21 – “Investment Vehicle” (Fund) listing in Hong Kong. Our work included drafting relevant sections of the prospectus, advising on pre-IPO restructuring, advising on a loan amendment negotiation and successfully completing an “Investor Advisor” licencing application with the SFC.

- Advising one of Australia’s largest iron ore producers on a range of project financing options – work included preparation for a Hong Kong listing (postponed at the A1 filing stage), including prospectus drafting together advices on restructuring and pre-IPO capital raising Presently providing on-going advice in relation to a private debt /equity fund raising worth approximately US $3.6 billion.

- Advising Zijin on the sale by its wholly owned subsidiary Golden Lake Mining (BVI) Limited of convertible bonds in Glencore Finance (Europe) S.A. to Morgan Stanley & Co. International PLC.

Capital raising – advising borrowers

We are experienced in advising sponsors and borrowers on the legal aspects of mining project financing. We have advised some of the leading PRC and international natural resource companies on their debt offerings. We are also always happy to help junior miners, who may be unfamiliar with the debt financing option, better understand the process so they can make the right choice as to what financing model best suits them.. Among other things, Charlton’s assists borrowers with the following: –

- Drafting and/or reviewing primary financing documents

- The provision of security and/or reviewing or drafting security documents as required

- Coordinating the due diligence process on behalf of the miner borrower

- Reviewing and/or drafting off-take agreements, infrastructure agreements, construction agreements, equipment agreements, operating agreements, maintenance agreements, and product purchase agreements

- Equity contributions (where the financing model combines both debt and equity)

- The legal aspects of life of mine plans and development plans

- Hedging arrangements

- The Listing Agreement (where applicable)

- Options, warrants, and similar rights

- Convertible debt securities

Mergers and acquisitions

We are frequently retained by major domestic and international mineral companies, financial institutions and leading international law firms to provide strategic counsel in M&A transactions. We advise on:-

- Takeovers, mergers and acquisitions in both private and public markets

- Due diligence investigations

- Management/leveraged buyouts

- Privatisations

- Group restructurings and reorganizations

- Corporate finance and structuring

Mergers and acquisitions – acquisitions in the PRC

Charltons is experience in advising, in cooperation with PRC counsel, on acquisitions in the PRC and on disposals of mining assets by Chinese mining state-owned Enterprises (“SOEs”) including:-

- Direct Equity Acquisitions

- Offshore / Indirect Acquisition

- Asset Acquisitions

- Governmental Approval Processes for PRC Acquisitions

- Documentation

- Approval Process and Timing

- Non-Governmental Consents and Approvals

- Foreign Exchange Issues

- Additional Information for Listed Companies

Mining due diligence – some key considerations

Charltons is experienced in coordinating the legal due diligence process for miners contemplating an acquisition. We work closely with local lawyers, geologists and independent technical experts to help miners manage the due diligence process

- Mine Retirement / Mine Rehabilitation

- Mine Inventory

- Mining Equipment

- Customers & suppliers

- Risk Factors

- Foreign Investment

M&A deal highlights

- Advised Zijin on its acquisition of Commonwealth & British Minerals Plc., a wholly- owned subsidiary of Avocet mining Plc. The target company owned significant gold assets in Tajikistan

- Advised Zijin in relation to the acquisition of KazakhGold Group Ltd., a company listed in the U.K.

- Advised Golden Resource Mining (BVI) Limited, a wholly owned subsidiary of Zijin on its off-market cash takeover bid for all the issued share capital of Indophil Resources NL, an Australian publicly-listed company with copper-gold projects in the Asia-Pacific region

- Zijin on its acquisition of Kyrgyz and Kazak gold assets from Summer Gold

- Advised Zijin on its acquisition of certain Iranian assets owned by Rio Tinto Mineral Development Limited pursuant to an international auction process

- Advised Hunan Nonferrous Metals Corporation Limited on a proposed A-Share issue

- Advised Zijin Mining Group Co., Ltd on its acquisition of Long Province Resources Limited which holds various gold exploration interests in the PRC

- Advised Zijin Mining Group Co., Ltd on its proposed acquisition of copper-molybdenum interests in Peru held by a wholly owned subsidiary of Inca Pacific Resources Inc., a TSX and Lima listed miner

- Advised a PRC consortium company, Xiamen Zijin Tongguan Investment Development Company Limited, in relation to a cash offer to acquire Monterrico Metals Plc, an AIM-listed miner with copper assets in Peru (first ever Chinese takeover of a UK listed company)

- Advised CST Mining Group Limited – a Hong Kong listed miner – on its disposal of CST Resources Limited which holds 70% interest in one of the largest recent copper discoveries in Southern America

Advising mining companies – mining agreements

Charltons advises mineral companies on a wide variety of mining related agreements including: –

- Infrastructure agreements

- Mining service agreements – mining operations, mineral handling haulage and loading, general service obligations, safety management, environmental management, tailings management, rehabilitation, management mine water management

- Off-take / take or pay agreements

- Farm-in / farm-out agreements

- Consultancy contracts

- Asset sale and purchase agreements

- Royalty agreements

- Exploration and development joint venture agreements