SFC Survey on Integrating Environmental, Social and Governance Factors and Climate Risks in Asset Management

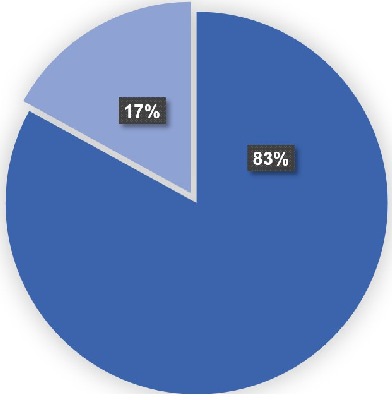

The Securities and Futures Commission (SFC) has published the findings of its Survey on Integrating Environmental, Social and Governance (ESG) Factors and Climate Risks in Asset Management which investigated how, and to what extent, SFC-licensed asset management firms consider ESG factors in their investment strategies. Published in December 2019, the survey was conducted as part of the SFC’s Strategic Framework for Green Finance announced in 2018. It found that 83% of the surveyed asset investment firms had taken at least one ESG factor into consideration when evaluating companies’ investment potential.

The SFC and other overseas regulators and central banks have acknowledged that environmental factors, particularly those related to climate change, are a source of financial risk,[1] with extreme weather events causing disruption to supply chains, affecting production capacity and increasing business costs. The provision of information on ESG risks is now considered essential to allow investors to make informed investment decisions and investors are increasingly regarding ESG factors as a proxy for management quality. The UK Sustainable Investment and Finance Association (UKSIF) conducted a similar survey of fund manager products and engagement strategies on climate change-related financial risk in early 2019.[2]

SFC Green Finance Framework [3]

The SFC has been focusing on policy developments in green finance since 2016. The SFC identified two key areas in regulating green finance initiatives:

- disclosure of climate-related risks and opportunities by listed companies to the standard recommended by the Task Force on Climate-related Financial Disclosure (TCFD); and

- the integration of environmental, social and governance factors into the investment process by SFC-licensed asset managers in making informed investment decisions.

Five pragmatic strategies are outlined by the SFC in its green finance framework proposal, including the current ESG survey; (1) enhancing listed companies’ reporting of environmental information; (2) conducting a survey of licensed asset management firms’ attitudes on sustainable investment practices; (3) facilitating the development of a wide range of green-related investments; (4) supporting investor awareness in green finance and investment-related matters; and (5) promoting Hong Kong as an international green finance centre.

ESG Factors in the SFC-licensed Asset Managers’ Investment Process

The SFC survey revealed that most of the firms surveyed were in favour of strengthening ESG disclosure rules for HKEx-listed companies in order to provide investors with decision-useful ESG information. The Hong Kong Stock Exchange published its Consultation Conclusions on Review of the Environmental, Social and Governance Reporting Guide and Related Listing Rules on 18 December 2019 setting out significant improvements to the ESG governance and disclosure framework for Hong Kong-listed companies. The Listing Rule amendments will take effect for financial years commencing on or after 1 July 2020. The survey found that the participating SFC-licensed asset managers consider ESG to be an important factor in investment decision making, particularly given the influence of international treaties on climate change, such as the Paris Agreement.[4]

|

Figure 1. SFC-licensed Asset Managers’ Consideration of ESG factors, including Climate Change

|

83% of the firms surveyed have taken at least one ESG factor into account in their investment decision analysis. |

|

Figure 2. ESG factors as source of financial risk

|

68% of the asset management firms which considered ESG factors in their investment decisions acknowledged that ESG factors could be a source of financial risks and have an impact on investment portfolios. |

|

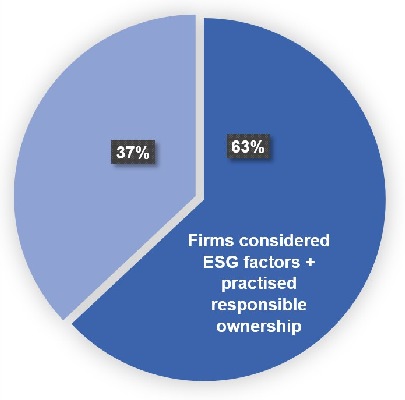

Figure 3. SFC-licensed Asset Management Firms Practised Responsible Ownership

|

63% of the asset management firms which considered ESG factors in their investment decisions had practiced responsible ownership through voting and corporate engagement in order to influence corporate ESG management by exercising shareholders’ rights. |

Market Trends: Hong Kong and Overseas-based Asset Management Firms

The SFC survey found that Hong Kong asset management firms tend to have weaker ESG investment processes relating to research and portfolio management and government and oversight measures than firms with overseas parent companies. The latter are typically more supportive of international green finance initiatives, such as the Financial Stability Board’s Task Force on Climate-related Financial Disclosures and the United Nations Principles for Responsible investment.[5] However, 64% of the firms actively involved in asset management in Hong Kong indicated that they plan to develop or improve their ESG practices in the next two years. Many are planning to publicly disclose more ESG investment-related information.

Market Trends: ESG Investment and the Size of Hong Kong SFC-licensed Asset Management Firms

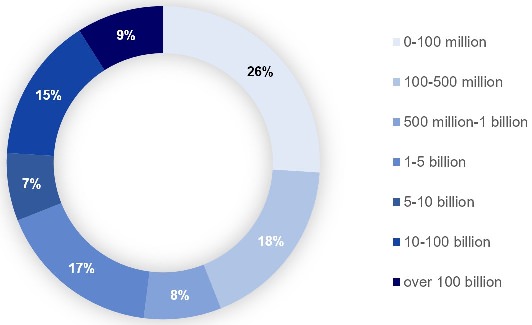

The survey’s findings further revealed that the size of licensed asset management firms is not decisive in terms of their ESG investment process; in fact, 26% of asset management firms with ESG investment processes relating to research and portfolio management have less than HK$100 million in assets under management, contrary to the general perception that only larger firms with greater resources can afford to include ESG factors in their investment decision process due to the cost burden.

Figure 4. AUM of surveyed asset management firms with ESG investment processes relating to research and portfolio management

SFC-Licensed Asset Managers’ ESG Governance and Oversight Measures

The survey found that, of the 83% of licensed asset management firms which considered ESG factors, 35% have implemented governance and oversight measure consistently, rather than on an ad hoc basis. The remaining 65% responded that they did not have any oversight measures in place, it therefore remains unclear how they managed to apply an ESG investment approach consistently.

Some of those firms have processes in place for fundamental analysis and due diligence to ensure that ESG investment recommendations and products align with their own ESG investment approach. Others have ESG criteria and methodologies in place for portfolio construction and monitoring any deviations.

Measures taken by Hong Kong asset management firms usually include the following:

| 1. |

Board-approved ESG policy, which covers:

|

| 2. | Clearly defined roles and responsibilities, with effective escalation and communication channels; |

| 3. | Specific board members overseeing ESG investments, risk assessment and management of climate risks. |

Hong Kong SFC-licensed Asset Managers’ ESG Investment Management and Strategies

The survey revealed a number of investment strategies that Hong Kong asset management firms adopt in order to systematically integrate ESG factors into their investment decisions and strategies analysis, including the following seven typical investment strategies:

| Investment strategies | Description | |

|---|---|---|

| 1. | Negative/ Exclusionary screening | A comparably resource-light strategy. It focuses on the exclusion from a fund or portfolio of certain sectors, companies or practices based on specific ESG criteria. This approach is widely adopted by many institutions, such as the Government Pension Fund of Norway. |

| 2. | Corporate engagement and shareholder action | Use of shareholder power to influence corporate behaviour, including through communicating with senior management of companies, filing shareholder proposals, and proxy voting guided by ESG guidelines. |

| 3. | ESG integration | Systematic and explicit inclusion by investment managers of ESG factors into financial analysis. |

| 4. | Norms-based screening | Screening of investments against minimum standards of business practice based on international norms. |

| 5. | Positive/ Best-in-class screening | Investment in sectors, companies or projects selected for positive ESG performance relative to industry peers. |

| 6. | ESG-themed/ Thematic investing | Investment in themes or assets specifically related to ESG (e.g. clean energy, green technology or sustainable agriculture). |

| 7. | Impact/ Community investing | Targeted investments aimed at solving environmental or social problems, and including community investing, where capital is specifically directed to traditionally underserved individuals or communities, as well as financing that is provided to businesses with a clear environmental or social purpose. |

However, the SFC noted that the majority of asset owners do not engage with licensed asset management firms to understand their ESG investment preferences, and that some are not entirely satisfied with the ESG investment services provided by asset management firms in Hong Kong. Discussion of climate risks is almost non-existent in client engagement and suitability assessments. The SFC further pointed out that the gap in expectations between asset management firms and their clients is due to the limited number of ESG investment product offerings in the Hong Kong local market.

Risk Management in ESG Investment

Risk management plays a significant role in investment strategies when asset management firms integrate ESG factors into their investment processes. The potential risks identified include those set out in the table below.

| Examples of climate-related risks and potential financial impacts from the Finance Stability Board’s TCFD Final Recommendations Report | ||

|---|---|---|

| Type | Climate-related risks | Potential financial impacts |

| Transition Risks | Policy and Legal | |

|

|

|

| Technology | ||

|

|

|

| Market | ||

|

|

|

| Physical Risks |

Acute

Chronic

|

|

In terms of climate change-related investment strategies and risks management, a gap between the expectations of asset owners and Hong Kong asset management firms emerges when they are hold different views on ESG factors. The survey revealed that only 23% of SFC-licensed asset management firms that consider ESG factors in their investment decisions have processes in place to manage the financial impact of physical risks[7] and transition risks[8] arising from climate change. However, the majority of asset owners expect asset management firms to identify, assess and manage relevant risks when making investment decisions. The processes used to manage climate risks were found to include:

- Information on ESG policy

- Results of ESG risks assessment, including climate risks

- List of ESG investment products

- ESG experience and knowledge of staff

- Deviations from ESG criteria

- Scenario analysis on climate risks

SFC-licensed Asset Managers’ Disclosure of ESG Practices

Of the 660 SFC-licensed asset management firms which took ESG factors into consideration in making investment decisions, 68% reported that information about their own ESG practices was not available and the majority of them did not disclose climate risk assessments.

All the asset owners surveyed considered transparent disclosure on ESG practices to be essential for reducing greenwashing and identifying Hong Kong asset management firms with stronger ESG practices. Asset owners look for the outcome of ESG impact as well as financial performance. They also focus on the rationale behind investment decisions and the analysis of asset-specific ESG risks. Examples of ESG information disclosed by surveyed asset management firms are as follows:

- incident monitoring mechanisms which flag major climate change-related incidents so that portfolio managers adjust investment portfolios as appropriate;

- incorporating results from ongoing climate risk assessments in the development of the firm’s investment strategies;

- the use of scenario analysis according to the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) to assess the potential financial implications of climate risks on investment portfolios;

- climate risk assessment procedures defined within the firm’s risk management policy; and

- senior management oversight of climate risk assessment and management strategy.

SFC’s ESG Survey Conclusions

The key findings of the SFC survey are summarised in the table below.

| 1. | ESG factors consideration | The majority (83%) of the Hong Kong firms surveyed were actively considering ESG factors in their investment strategies and decisions; |

| 2. | ESG factors consideration | SFC-licensed asset management firms acknowledged that climate-related ESG factors can pose a potentially material financial risk (68% of those firms which considered ESG factors); |

| 3. | ESG factors consideration | The licensed asset managers surveyed had practiced responsible ownership through voting and corporate engagement in order to influence corporate ESG management by exercising shareholders’ rights (63% of those firms which considered ESG factors); |

| 4. | Market trends | The general perception that only larger sized asset management firms can afford the cost of ESG investment process is not accurate, smaller sized firms can also play an active role; |

| 5. | Market trends | Hong Kong asset management firms generally lag behind their overseas-based counterparts in terms of ESG practices; |

| 6. | Investment Management | Certain firms (35%) which considered ESG factors have implemented monitoring and systematic strategies to integrate ESG factors into their investment process on a consistent basis; |

| 7. | Risk Management | Hong Kong asset management firms which integrated ESG factors in their investment process also focused on risk management controls to flag major incidents; |

| 8. | Risk Management | A minority (23%) of the licensed asset management firms which considered ESG factors in their investment process would have processes in place to cope with the financial impact of physical and transition risks; |

| 9. | Disclosure | A majority (68%) of the SFC-licensed asset management firms surveyed responded that information about their ESG practices is not available for disclosure. |

SFC Proposals for Hong Kong’s Asset Management Industry

The survey identified significant interest among SFC-licensed asset management firms in stepping up their ESG efforts and managing environmental and climate risks which lends support to the SFC’s plan to bring its green finance initiatives forward. The SFC is proposing to align its regulatory regime more closely with global standards and intends to deliver three outcomes in the near term:

-

to set expectations for SFC-licensed asset management firms in areas such as governance and oversight, investment management, risks management and disclosure;

-

to provide practical guidance, best practices and training in collaboration with industry and relevant stakeholders to enhance the capacity of Hong Kong-licensed asset management firms to meet the SFC’s expectations; and

-

to establish an industry group to exchange views on environmental and climate risks, as well as sustainable finance.

[1] An increasing number of Sovereign Wealth Fund are engaging ESG factors into their investment strategies, such as Norway’s’ Government Pension Fund – Global, Singapore’s Government of Singapore Investment Corp., and New Zealand’ s New Zealand Superannuation Fund.

[2] UK Sustainable Investment and Finance Association, “2019 Survey of Fund Manager’s Attitudes to Climate Risk and Investment in Fossil Fuel Companies” (April 2019). Available at: https://uksif.org/wp-content/uploads/2019/04/Oil-Pressure-Gauge-survey-booklet-2019.pdf

[3] SFC, “Strategic Framework for Green Finance” (21 September 2019). Available at : https://www.sfc.hk/web/EN/files/ER/PDF/SFCs%20Strategic%20Framework%20for%20Green%20Finance%20-%20Final%20Report%20(21%20Sept%202018….pdf

[4] The Paris Agreement aims to strengthen the global response to the threat of climate change by keeping a global temperature rise this century below 2 degree Celsius above pre-industrial levels and to pursue efforts in limiting the temperature increase to 1.5 degrees Celsius. It aims to strengthen the ability of countries in dealing with the impacts of climate change. One of the objectives of the agreement is to provide an enhanced transparency of action and support through a more robust transparency framework. Available at: https://unfccc.int/files/essential_background/convention/application/pdf/english_paris_agreement.pdf

[5] There are six United Nations’ principles for responsible investment, which included (1) Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes, (2) Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices, (3) Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest, (4) Principle 4: We will promote acceptance and implementation of the Principles within the investment industry, (5) Principe 5: We will work together to enhance our effectiveness in implementing the Principles, (6) Principle 6: We will each report on our activities and progress towards implementing the Principles. Available at: https://www.unpri.org/pri/an-introduction-to-responsible-investment/what-are-the-principles-for-responsible-investment.

[6] Norges Bank, “Observation and Exclusion of Companies”. Available at: https://www.nbim.no/en/the-fund/responsible-investment/exclusion-of-companies/

[7] Physical risks are those associated with climate change and related extreme weather events which may have financial implications for companies (Definition from the SFC).

[8] Transition risks are those associated with the viability of a business during the transition to a lower-carbon economy due to factors such as policy changes, social preferences and technological developments (Definition from the SFC).