Hong Kong Consults on Paperless Securities Market

Introduction

On 28 January 2019, the Securities and Futures Commission (SFC), Hong Kong Exchanges and Clearing Limited (HKEX) and the Federation of Share Registrars Limited (FSR) released a joint consultation paper on a new mechanism for implementing an uncertificated securities market regime in Hong Kong (Consultation Paper).

The Consultation Paper proposes a framework to modernize the existing securities market regime in Hong Kong that is still reliant on the use of paper documents, such as documents to evidence or transfer legal title of securities, including shares. Such reliance requires most investors to use the Central Clearing and Settlement System (CCASS) to hold and transfer their listed securities, which are “immobilised” and held in the name of a single nominee – HKSCC Nominees Limited (HKSCC-NOMS). This structure means that investors hold and transfer only the beneficial interest in securities but not the legal title to the securities. The proposed operational model for implementing an uncertificated securities market in Hong Kong (Uncertificated Securities Market) aims to provide investors with the option of holding securities in their own name in electronic form.

The proposed operational model (Revised Model) is based on the model that was previously proposed in 2010, revised to deal with concerns raised by the market.

| Existing Model | 2010 Model | Revised Model | |

| Structure within the clearing and settlement system |

|

|

|

| Account types within the clearing and settlement sytem |

|

|

|

| Account types outside the clearing and settlement system |

|

|

|

| Options for investors to hold securities in own name |

|

|

|

| Structure of the register of members or register of holders (ROM) |

|

|

|

| Interface between HKSCC’s systems and share registrars’ systems |

|

|

|

| Stamp duty collection |

|

|

|

Source: Joint Consultation Paper on a Revised Operational Model for Implementing an Uncertificated Securities Market in Hong Kong. SFC, HKEX, FSR.

The current operational model of the Hong Kong securities market

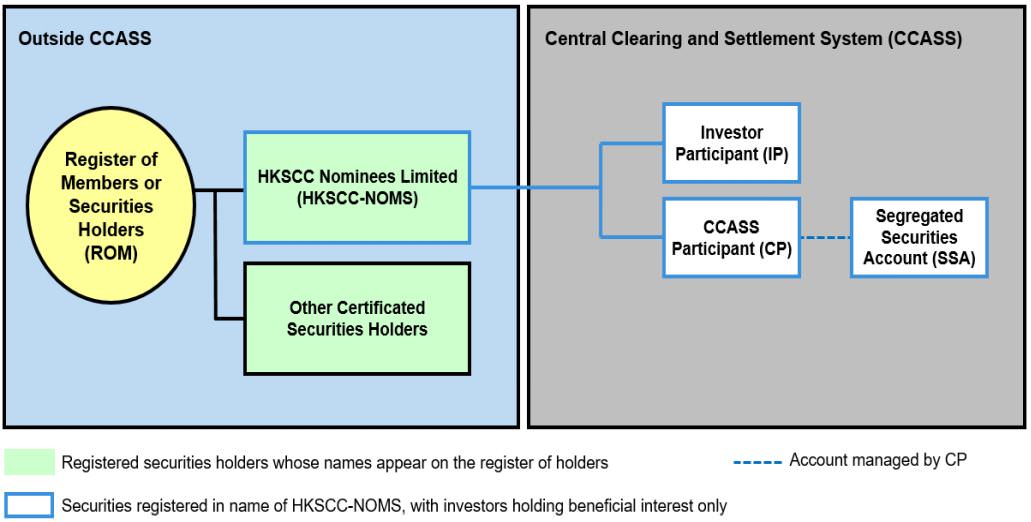

Diagram 1 – current operational model

Source: Joint Consultation Paper on a Revised Operational Model for Implementing an Uncertificated Securities Market in Hong Kong. SFC, HKEX, FSR.

The following are the key characteristics of the existing securities market regime in Hong Kong:

-

Nominee structure: all securities held within CCASS are registered in the name of a single nominee, HKSCC-NOMS, resulting in investors holding only a beneficial interest in the securities that are held through CCASS;

-

Securities can be held through CCASS in the following ways:

- through a CP account, which is an account that holds securities of multiple investors and is opened and managed by a clearing or custodian participant (CP);

- through a stock segregated account (SSA), which is a stock segregated account with statement service that holds securities of a specific investor and is opened and managed by a CP;

- through an IP account, which is an account that is opened and managed by an investor admitted by Hong Kong Securities Clearing Company Limited (HKSCC) as an investor participant (IP) and that holds the IP’s own securities;

-

Investors can choose to hold securities in their own name, but only in paper form and outside of CCASS;

-

The register of securities holders (ROM) is kept and maintained by the issuer’s share registrar only;

- No electronic interface exists between CCASS and share registrars’ systems, meaning that any deposit or withdrawal of securities into or out of CCASS (i.e. transfers of legal title) is a paper-based process;

-

Stamp duty payable in respect of securities transactions effected on the Stock Exchange of Hong Kong Limited (SEHK) is collected and paid through the SEHK. This is done electronically. Off-exchange transactions require stamp duty to be collected and paid directly to the Stamp Office by the parties concerned or their intermediaries and the production of the relevant instruments of transfer and/or contract notes to the Stamp Office for physical stamping;

-

Issuers do not possess a complete record of all registered securities holders’ identification numbers;

-

Upon receiving a takeover offer, the shareholders are required to surrender their share certificates and signed instruments of transfer if they accept the offer;

-

Shareholders can pledge their shares by delivering the share certificates and signed instruments of transfer to the pledgee; and

-

There is currently no requirement for share registrars to be approved by the SFC.

The proposed Revised Model

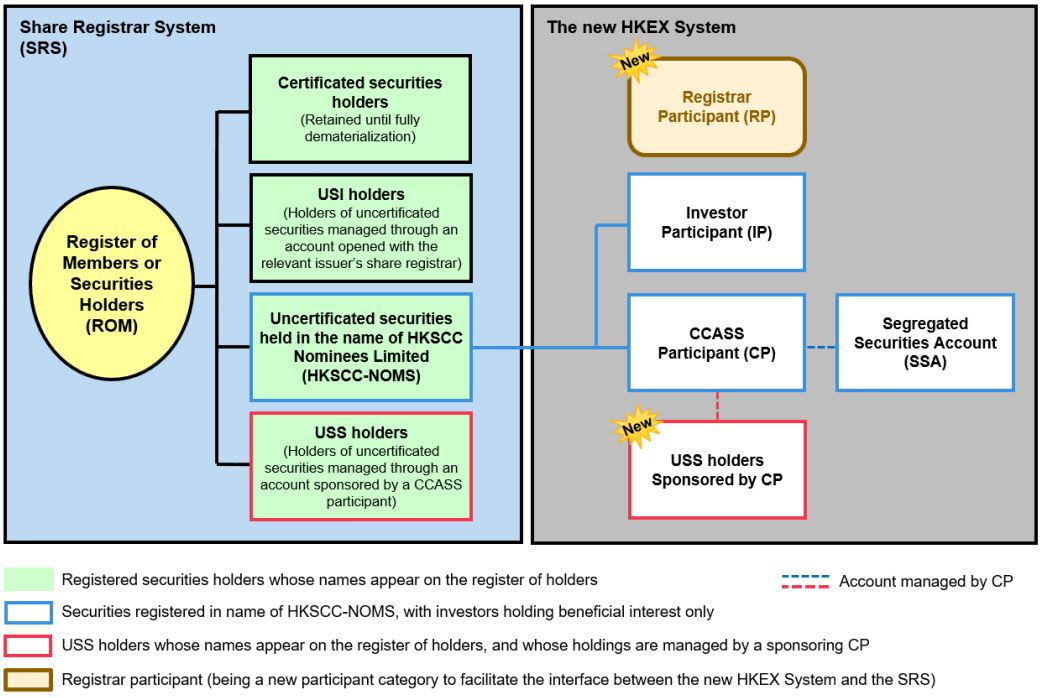

Diagram 3 – Revised Model

Source: Joint Consultation Paper on a Revised Operational Model for Implementing an Uncertificated Securities Market in Hong Kong. SFC, HKEX, FSR.

The key features of the Revised Model are:

-

The Revised Model will operate under the new system to be introduced by HKEX to replace CCASS (HKEX System), and not under CCASS;

-

The current nominee structure will be retained, and therefore securities held with intermediaries and through the HKEX System will remain registered in the name of HKSCC-NOMS;

-

Account types currently existing in CCASS will be retained in the HKEX System, with the addition of a new “USS” account;

-

Investors will be presented with the choice of holding securities in certificated form (but for a limited period only) or in uncertificated form:

-

uncertificated securities may be held through a CP account, an SSA or an IP account. In each case, the securities will be registered in the name of HKSCC-NOMS and investors will hold only a beneficial interest in them;

-

uncertificated securities may be held in investors’ own names and managed through an account opened with the issuer’s share registrar (USI account); or

-

in the case of institutional investors, uncertificated securities may be held in their own name and managed through an account within the HKEX System (USS account) opened with a clearing or custodian participant who will “sponsor” the account;

-

The register of securities holders will continue to be kept and maintained only by the issuer’s share registrar;

-

Share registrars’ systems will be responsible for evidencing and effecting transfers of legal title to securities without paper documents; and

- A new participant category – “registrar participants” – will be introduced into the HKEX System in order to establish an electronic interface between HKSCC’s and share registrars’ systems to facilitate communication on the movement of uncertificated securities into/out of the HKEX System.

USS and USI accounts

A USS account will only be available to institutional investors. It will exist within the HKEX System and allow institutional investors to hold securities in their own name and have them managed by a local custodian. Relevant details of the institutional investors, such as their identification numbers, will be passed by the sponsoring CP through the HKEX System to the relevant share registrar approved under the new share registrar regime (Approved Share Registrar). The Approved Share Registrar will then be able to establish each institutional investor’s identity and the sponsoring CP’s authority and enter such information in the ROM.

Communications between the investors holding securities through a USS account (USS holders) and an issuer will be conducted through the issuer’s share registrar, but via the sponsoring CP and the new HKEX System. Instructions to the issuer relating to the following matters will be required to be sent via the sponsoring CP and the HKEX System:

-

applications for IPO securities to be credited to the USS account upon allotment;

-

disposal of securities already reflected in the USS account;

-

acquisition of securities to be credited to the USS account upon completion of the acquisition;

-

the receipt of corporate communications from the issuer;

-

the submission of voting instructions (including the appointment of proxies as allowed) and confirmations of attendance at general meetings of the issuer;

-

the exercise of other common corporate action rights (e.g. election of scrip or cash dividend, rights subscription, etc.); and

-

receipt of securities (non-cash) entitlements from the issuer (e.g. bonus issues, subscription warrants, rights, etc.).

The regulating authorities are currently consulting the market on the extent of legal limitations to cash entitlements being paid to a USS holder via its sponsoring CP.

USS holders will receive regular statements of their registered holdings in electronic form from their sponsoring CP via the HKEX System, along with an electronic confirmation regarding successful allotment or transfer of uncertificated securities in their own name.

USI accounts, on the other hand, will exist outside of the HKEX System and instead in the relevant issuer’s share registrar’s systems (Share Registrar System) and will be available to all investors, including institutional investors. The Approved Share Registrar will conduct basic checks to verify the investor’s identity and obtain the relevant information, including the investor’s identification number, name and address, to open the account and enter this information into the ROM. Communications between the investors holding securities through this account (USI holders) and the issuer will be conducted through the share registrar. The FSR is currently looking into designing an online platform to act as a single access point for communicating with multiple issuers and their share registrars. Regular electronic statements of registered holdings and confirmations on successful allotment or transfer of uncertificated securities will be provided by the relevant issuer’s Approved Share Registrar to USI holders.

With regard to ROM entries, both USI holders and USS holders will be reflected as registered owners of uncertificated securities in the relevant ROM. Where an investor holds securities both in certificated and in uncertificated form, the ROM will reflect their total holdings, showing the respective number in each form. For USS holders, the Approved Share Registrar will also keep a note of its sponsoring CP but may not reflect this in the ROM.

In addition, neither USI holders nor USS holders will have any direct relationship with HKSCC and they will not be a party to HKSCC’s rules or operational procedures, although they may be indirectly subject to those rules and procedures by virtue of the client documentation and arrangements governing their relationship with their sponsoring CP.

Stamp duty

The Securities and Futures and Companies Legislation (Uncertificated Securities Market Amendment) Ordinance 2015 (USMO) introduced amendments to the Stamp Duty Ordinance (SDO) to facilitate the stamping of off-exchange securities transactions in the Uncertificated Securities Market environment. Although the details have yet to be finalized, it is expected that stamp duty will be paid and collected through share registrars and/or intermediaries. This will require declarations to be made as to whether any ad valorem stamp duty is chargeable, and if so, whether the stamp duty has been paid. The declarations will be made by the intermediaries and/or share registrar, specifically:

-

Where transfers involve moving securities into or out of a CP, an SSA or USS account, the declarations should be made by the intermediary that opened the account;

-

Where transfers involve moving securities into or out of a USI account, the declarations should be made by the relevant share registrar; and

-

Where transfers involve moving securities into or out of an IP account, the responsibility for making declarations will depend on where the securities are moved from or to.

Unique identification number

It is proposed to require registered securities holders (not the beneficial owners who hold securities through intermediaries) to provide a unique identification number[1] to the issuer in order to ensure effective operation of the electronic mechanisms of the Uncertificated Securities Market. The identification number of securities holders will not be included in the ROM and it will not be available for public inspection. It is contemplated that this requirement will be applied prospectively, for example, when effecting transfers of securities after implementing the requirement to provide identification numbers, or when applying for securities issued after such implementation, etc.

Consolidation of holdings for entitlements distribution

To summarise the above, institutional investors who would like to hold securities in their own name will be able to do so in certificated form (albeit only for a limited time), through a USI account or through a USS account opened with a sponsoring CP.

The proposed requirement for registered securities holders to provide identification numbers, will allow issuers to consolidate holdings belonging to the same registered holder. In view of this, the Consultation Paper is also seeking views on whether securities entitlements (rights issues, share dividends, bonus shares etc.) should also be calculated on the basis of such consolidated position, and if so, how would entitlements be distributed. The Consultation Paper proposes to require calculation on the basis of total registered holdings for those investors that hold securities in both certificated form and in a USI account, and the subsequent crediting of entitlements to the investor’s USI account. For institutional investors, it is expected that they will be unlikely to hold securities in certificated form and thus it is proposed to calculate their entitlements separately in respect of each USS account they hold, and distribute accordingly.

ROM reconciliation

The securities balances of USS holders will be reflected in both the relevant ROM and the relevant USS account. To ensure that the balances in the two records are the same, HKSCC and Approved Share Registrar will conduct daily reconciliations of the two records.

Common platform

The FSR is also contemplating a common platform across share registrars (Common Platform) to provide a point of communication among USI holders, issuers and Approved Share Registrars, and allow USI holders to manage their entire portfolio of registered securities holdings, whether in certificated or uncertificated form. The FSR will provide further details in due course. Although the Common Platform will be connected with the Share Registrar Systems, it will differ from them in that the Common Platform is intended to serve as a common access portal to the Share Registrar System of each Approved Share Registrar.

Key processes under the Revised Model

Initial Public Offering (IPO)

After application for securities in an IPO, such securities can be credited into an IP account, a CP account, a USI account or a USS account. Paper application forms and use of paper cheques and cashier orders are expected to be phased out.

For a USI or USS account, the following are the key features of the processes with IPO securities:

-

The account must have been opened at the time of submitting the application;

-

Multiple applications from the same investor will be rejected (same as the present practice);

-

In cases where securities are allotted on the business day prior to the listing day, the relevant share registrar will update the provisional ROM with conditional holdings, which will become unconditional on the listing day;

-

For USI accounts, the application form and subscription monies will have to be submitted electronically via the system designated by the issuer, and any refund of subscription monies will be credited directly to the bank account designated by the USI holder; and

-

For USS accounts, the application form and subscription monies will have to be submitted through the relevant sponsoring CP and through the new HKEX System, and any refund of subscription monies will be credited directly to the sponsoring CP’s designated bank account.

The Consultation Paper points out that such transition to paperless application and settlement may enable a shortened IPO settlement timetable.

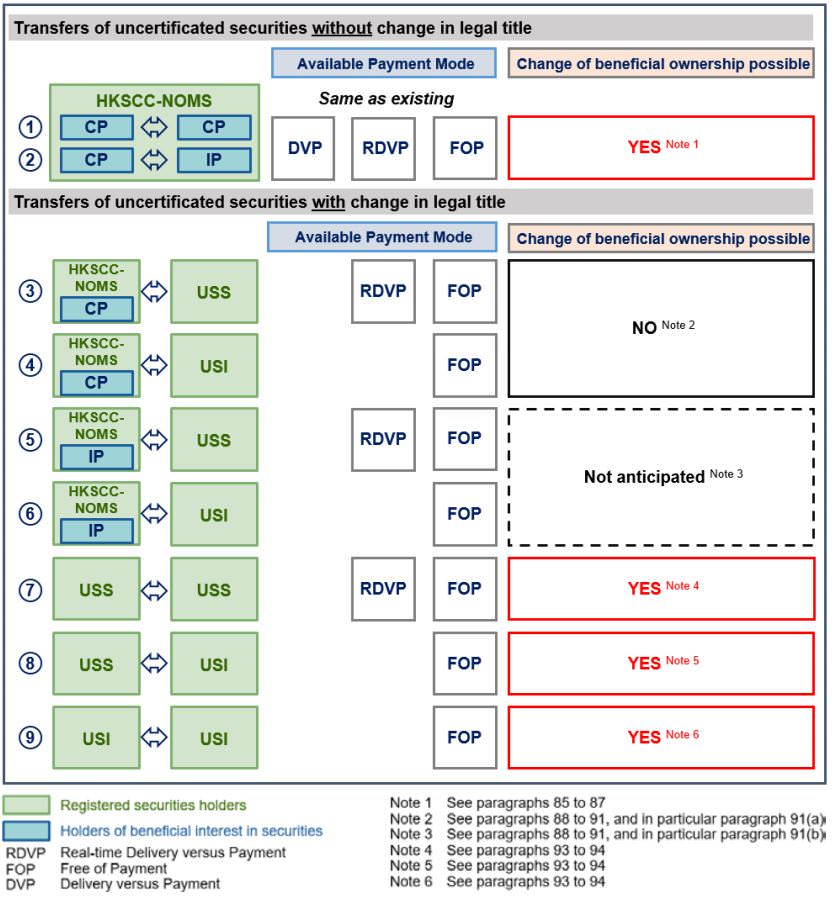

Transfers

The table below outlines the different types of transfers which may happen in the Uncertificated Securities Market environment and the available options for settling the corresponding money leg:

Source: Joint Consultation Paper on a Revised Operational Model for Implementing an Uncertificated Securities Market in Hong Kong. SFC, HKEX, FSR.

- Transfers of securities within the HKEX System (Transfers (1) and (2) in the above diagram)

Transfers between different CP accounts, IP accounts and SSAs in the HKEX System will not result in any change of legal title and the securities will remain registered in the name of HKSCC-NOMS at all times. The process for such transfers will remain largely the same as now. Options for settling the money leg and the process of collecting and paying related stamp duty will also remain the same.

- Transfers of uncertificated securities to or from HKSCC-NOMS (Transfers (3) to (6) in the above diagram)

Deposit and withdrawal of securities into and out of a CP account, IP account or SSA in the HKEX System by a USI or USS holder will result in a change of legal title, and such processes will be effected through both the HKEX System and the Share Registrar System electronically.

USS holders will have the option to transfer securities on a free-of-payment (FOP) basis or on a real-time-delivery-versus-payment (DRVP) basis, while USI holders will be able to transfer their securities only on an FOP basis.

The sponsoring CP or share registrar will need to make declarations on whether stamp duty is payable and whether it has been paid. It is however highlighted that most such transfers are not expected to entail a change in beneficial interest and are not expected to require stamp duty collection.

- Other transfers of uncertificated securities (Transfers (7) to (9) in the above diagram)

Transfers between two USI holders, between two USS holders or between a USI holder and a USS holder will result in a change of legal title and are likely to result in a change in beneficial interest. Such transfers are therefore likely to be subject to ad valorem stamp duty. Transfers will be effected electronically and, in the case of USI holders as parties to transfer, through the relevant Share Registrar System, or in the case of a USS holder being a party to the transfer – through both the HKEX System and Share Registrar System.

- Transfers of certificated securities

Such transfers will continue to be paper-based until the final deadline for dematerialization set by the regulators comes into effect.

- Transfers on half-day trading days

It is proposed that securities settlement and transfers within the HKEX System be made available on all Hong Kong business days and off-exchange trade settlement and transfer services be offered on half-day trading days as well.

Corporate actions

For securities held through a CP account or IP account, the corporate action processes under the Revised Model will substantially remain unchanged, and all corporate action instructions and entitlements will continue to be routed through the HKEX System.

Separately, the SFC is working with HKEX to enhance the position of investors who hold a beneficial interest only, in order to facilitate and encourage their participation in voting without additional undue costs.

With regard to a USI or USS account, while they will be treated as equally as possible, there will be differences in the routing of instructions and entitlements:

- Conveying instructions

USI holders can convey their corporate action instructions through the relevant Share Registrar System, while USS holders will need to route their corporate action instructions via their sponsoring CP and the HKEX System.

- Securities entitlements

In cases where corporate actions affect a holder’s securities balance, for a USI holder the securities entitlements will be credited to the relevant USI account and the USI holder will be notified by the relevant share registrar of the change by day-end on a payment date, while for a USS holder these entitlements will be credited to the relevant USS account and the timing and manner of notification will be governed by the client documentation and arrangement between the USS holder and its sponsoring CP.

- Cash entitlements

Cash payments resulting from corporate actions will be credited directly to the relevant USI holders’ designated bank account, while in the case of USS holders, the Consultation Paper invites market views on how critical the legal limitations are for directing cash payments to the sponsoring CP.

- Voting

USI and USS holders will both have the right to vote and to attend and speak at meetings of the issuer and will be entitled to appoint proxies. Depending on the sponsoring CP’s operation, arrangements, and service level, an earlier cut-off time for USS holders might be implemented.

- Takeovers

As it will not be possible for shareholders who hold their shares in uncertificated form to surrender share certificates and signed instruments of transfer upon acceptance of the takeover offer (whether conditional or unconditional), it is proposed that USI and USS holders should consent to earmarking and “locking” their shares until the offer is declared unconditional. This means there cannot be any movement or transfer of such shares, and the shares would remain registered in the name of the relevant USI or USS holder. The consent to “locking” the shares will need to be given at the time of accepting the offer through the Share Registrar System (for USI holders) or the sponsoring CP and the HKEX System (for USS holders). It is proposed that the transfer of shares to the offeror would not be registered until payment has been made to accepting shareholders.

- Pledging

To enable pledging in the absence of share certificates and signed instruments of transfer, a “locking arrangement” will be introduced, pursuant to which pledged shares in uncertificated form will be “locked” and administered by the relevant Approved Share Registrar pursuant to the terms agreed among the pledger, pledgee and Approved Share Registrar.

Where the securities entitlements are in the form of rights, the provisional allotment letters will be issued in electronic form.

Scope and phased approach to full dematerialization

Product scope

It is proposed to introduce the Uncertificated Securities Market gradually and in phases. It is intended that the first focus will be shares, starting with Hong Kong-incorporated companies’ shares and then moving on to shares of overseas-incorporated companies. In particular, three overseas jurisdictions – the Cayman Islands, Mainland China and Bermuda – will be the focus of the introduction of the Uncertificated Securities Market. Preliminary assessment indicates that it should be possible to bring companies incorporated in these jurisdictions within the Uncertificated Securities Market regime.

The next focus of the Uncertificated Securities Market’s introduction will be listed funds and “share-like securities”, in particular SFC-authorised listed funds, such as open-ended exchange traded funds, leveraged and inverse products, closed-ended funds and REITs, and rights issues, subscription warrants and depositary receipts. It is also intended to focus on products issued under Hong Kong law first, and then move on to those issued under overseas laws.

Extension of the Uncertificated Securities Market initiative to other listed products is being considered by the regulators.

Timeline to full dematerialisation

The Consultation Paper reiterates that although it will be necessary to retain a paper option, the ultimate aim is to remove the paper option entirely.

Paperless IPOs only

It is proposed to first require all IPO securities to be issued in uncertificated form only, starting with the shares of Hong Kong companies. A date will be determined after which the specified class of securities can only be issued in uncertificated form, and there will be no option to convert these IPO securities into certificated form after their issuance. It will, however, be possible to offer IPO securities in paperless form prior to that date, and a “pilot” period may be introduced to test the mechanism.

No rematerialization option

It is proposed that there will remain no option to rematerialize securities that are in uncertificated form.

Existing securities held within the new HKEX System

It is also proposed that securities held within the HKEX System and registered in the name of HKSCC-NOMS will be dematerialized early on and in batches, starting with the shares of Hong Kong companies, and that a “pilot” batch may be introduced to test the process. This process of dematerialization will require HKSCC to return any title documents relating to securities to the relevant share registrar for cancellation, and the share registrar to record the uncertificated securities in the relevant ROM. It will not, however, be possible for investors holding stock or securities in the name of HKSCC-NOMS to withdraw them from the HKEX System and hold them in the certificated form after dematerialization. Therefore, an advance notice will be given prior to each dematerialization exercise.

Existing securities held outside the new HKEX System>

For securities held outside the HKEX System, there will continue to be an option of holding securities in paper form, but it will be available for a limited time only. The final deadline will be implemented for Hong Kong companies’ shares first. After such deadline, (i) any transfer of securities held in certificated form will have to incorporate a dematerialization process; (ii) any new securities issued to the certificated securities holder will be issued in uncertificated form and credited to a USI account; and (iii) any cash entitlements payable to the certificated holder will need to be paid into their designated bank account or by cheque.

Encouraging electronic communications

It is further proposed to gradually encourage issuers and registered securities holders to communicate electronically through various possible requirements and added charges. The Consultation Paper invites market views on this proposal.

Further legislative amendments

Changes to the operational model

The USMO’s provisions relating to issuers’ need to have a “split” ROM and HKSCC’s envisaged role of “system operator” will be amended. Provisions relating to the approval and regulation of share registrars will be expanded and supplemented.

Facilitating implementation of the Uncertificated Securities Market initiative

Certain provisions in the SDO that require the use of paper instruments of transfer will be amended, and ROM requirements will be aligned with those for companies whose shares can be held in uncertificated form.

Rule-making powers for the SFC to specify the timeline towards full dematerialization will also be introduced.

Amendments will also be introduced to ensure protection and finality of instructions in respect of transfer of securities without paper documents.

The provisions in the Companies Ordinance that allow the use of paper documents in communications between companies and shareholders are proposed to be amended, so that the SFC will be able to introduce rules mandating companies and their shareholders to use electronic communications in certain cases.

It is also proposed that the limit on the number of proxies that may be appointed by a shareholder of a listed company be reinstated back to 2 proxies, as was the case prior to 2014. The rationale for this change is that there have been numerous cases of abuse of the ability to appoint multiple proxies where appointed proxies have used different means of disrupting company meetings if their requests are denied. The two proxy limit will be reinstated only for individual (i.e. non-corporate) shareholders.

The deadline for submitting proxy materials is proposed to be amended from 48 hours before the meeting time to one clear business day before the meeting day, so as to avoid the misunderstanding which arises from the holding of several listed companies’ meetings on the same day but at different times.

Regulation of share registrars in the Uncertificated Securities Market environment

In light of the expanded role of share registrars envisaged by the Revised Model, it is proposed to introduce a regime to allow the SFC to regulate share registrars directly and more robustly. The current requirement to appoint an approved share registrar applies only to corporations issuing listed shares. Therefore, the Consultation Paper proposes to extend the scope of application to cover issuers of units or shares in listed funds, share rights, subscription warrants and depositary receipts. Nonetheless, listed funds will be exempted from the requirement if all units or shares of such funds listed in Hong Kong are held within CCASS (or the new HKEX System) and are not allowed to be withdrawn and registered in the name of an investor.

The Consultation Paper notes that internationally, regulation of share registrars is uncommon, and that any regime for such regulation must allow sufficient flexibility and not be overly prescriptive. It is proposed that the SFC’s investigation and supervision powers under Part VIII of the Securities and Futures Ordinance (SFO) be expanded to cover regulation of share registrars, and that the rule-making powers under the SFO relating to approval and regulation of share registrars be set out in greater detail.

Other amendments

SFC Codes and Guidelines, rules of the HKEX and the General Rules of CCASS and the CCASS Operational Procedures issued by HKSCC will also need amendments. The regulators plan to consult the market on these amendments at a later stage.

Summary of the effect of the proposed changes on stakeholders

To summarise, the Revised Model will have the following effect on the market participants:

Investors:

-

will have the option of holding securities in their own name and without paper documents;

-

will continue to be able to hold securities through intermediaries as they do today; and

-

will be able to continue to hold their existing securities in certificated form but for a limited period only.

Intermediaries:

-

may continue to provide services to clients as they do today;

-

will be presented with new business opportunities to serve institutional clients that wish to hold securities in their own name but have them managed by a custodian;

-

may provide “sponsoring” services but may then be required to enhance operational processes and systems; and

-

will need to migrate to the HKEX System that will replace CCASS.

Issuers:

-

will need to take steps to facilitate dematerialization of a particular class of securities within a specified timeline once the timeline for dematerialization of such class has been designated.

Share registrars:

-

only share registrars approved under the Approved Share Registrar regime will be able to operate systems for evidencing and effecting transfers of legal title to securities without paper documents; and

-

Approved Share Registrars will become subject to the SFC’s direct oversight.

HKEX:

-

New system changes will be proposed to support the Revised Model, including introduction of the USS account feature and a new participant category for share registrars.

Proposed timetable

The consultation period will last for 3 months until 27 April 2019. A conclusions paper is aimed to be issued by July 2019. Based on the regulators’ current assessment, implementation of the Uncertificated Securities Market regime will start in early 2022.

[1] Hong Kong Identity Card for Hong Kong residents, most recently issued passport for other individuals, and Hong Kong company registration number or equivalent for companies.