Joint Consultation Paper Issued on Proposed Changes to Hong Kong Listing Regulation

The Securities and Futures Commission (SFC) and the Stock Exchange of Hong Kong (the Exchange) have issued a joint consultation paper (see archive) (Consultation Paper) on proposed changes to the decision-making and governance structure of the Exchange in relation to listing regulation. Under the proposed reforms, which do not require any legislative changes, the SFC and the Exchange will work more closely on listing policies and decisions. The proposals include:

establishing a Listing Policy Committee to decide on listing policy, replacing the Listing Committee as the oversight body of the listing function;

establishing a Listing Regulatory Committee to decide on matters in relation to initial public offerings (IPOs) and post-IPO matters that have suitability concerns or broader policy implications. It will also replace the Listing (Review) Committee as the review body of the Listing Committee’s decisions;

establishing a Listing Regulatory (Review) Committee to review the Listing Regulatory Committee’s decisions on specified matters, replacing the Listing Appeals Committee as the Exchange’s highest review body; and

publishing decisions of the Listing Regulatory Committee, Listing Regulatory (Review) Committee, Listing (Disciplinary) Committee and the Listing (Disciplinary Review) Committee routinely.

The stated aims of these reforms are to achieve closer coordination between the SFC and the Exchange; streamline the decision-making process for decisions that raise suitability issues or broader policy implications; allow the SFC earlier and more direct input on listing policy matters and listing regulation; simplify the initial listing application process; and establish clearer accountability and oversight for the administration of the Listing Rules. As a result of being allowed more direct input on listing policy and regulation, the SFC would no longer issue separate comments on new applicants’ statutory filings. Listing applicants and their sponsors may use the pre-IPO enquiry process to help resolve suitability issues.

The three-month consultation ends on 19 September 2016.

The Committees

The Listing Committee

The Listing Committee would continue to decide on listing applications that do not raise concerns as to the suitability of the listing applicant and its business or have broader policy implications. It will also put forward non-binding views to the new Listing Policy Committee and Listing Regulatory Committee on matters reserved for their decision. The only change to the Listing Committee’s composition will be that the Exchange’s Chief Executive will cease to be a member and will instead become a member of the Listing Policy Committee.

The Listing Policy Committee

Function

The proposed Listing Policy Committee would be responsible for proposing Listing Rule amendments and initiating and directing overall listing policy and the conduct of public consultations. It would proactively identify and address issues of public interest arising from new or prospective market developments or practices and in related areas such as the conduct of issuers and intermediaries. The Listing Policy Committee would also replace the Listing Committee as the body responsible for overseeing the listing function and the Listing Department’s performance in listing regulation.

Composition

The new committee would comprise eight persons in total representing the bodies currently involved in policy-related decisions: the Chairperson and two Deputy Chairpersons of the Listing Committee, the Chief Executive of the Exchange, the Chairperson of the Takeovers Panel, the CEO of the SFC, the Executive Director of the SFC’s Corporate Finance Division and another senior executive nominated by that Executive Director. The Chairperson of the Listing Committee would act as the Chairperson of the Listing Policy Committee. Decisions would require majority support, and the Chairperson would not have a casting vote, even in the event of a deadlock.

Conduct of Meetings

The Listing Policy Committee is expected to meet quarterly. Its members and the Head of Listing will be able to propose matters for discussion and matters to be discussed will be presented to the Listing Committee in advance of any meeting. Views given by Listing Committee Members will be disseminated to the Listing Policy Committee by the Listing Department before the meeting. Most meetings are expected to be attended by all eight members, though the required quorum would be four members so long as they include the Chief Executive of the Exchange, the Listing Committee investor representative and any two of the Chairperson of the Takeovers Panel and the members of the SFC. To allow some flexibility in the attendance of Listing Policy Committee meetings, a single individual may be appointed as an alternate by any of the Chief Executive of the Exchange, the Listing Committee investor representative, the Chairperson of the Takeovers Panel and the CEO of the SFC. No other member may appoint an alternate.

The Listing Regulatory Committee

Function

The proposed Listing Regulatory Committee would be responsible for overseeing, giving guidance on and deciding matters arising in the day-to-day administration of the Listing Rules (including in relation to (a) practice and guidance notes, and (b) applications, transactions and submissions by listing applicants or listed issuers that require the Exchange’s approval, consent or vetting submissions):

that involve the suitability for listing of a new applicant and its business under rule 8.04 of the Listing Rules;

that are of a novel, potentially controversial or sensitive nature;

that appear to have policy implications, whether arising from a listing application, a transaction by a listed issuer or otherwise; or

where the decision will have general effect (together LRC Matters).

The Listing Regulatory Committee would also replace the current Listing (Review) Committee as the review body for decisions of the Listing Committee, except in relation to disciplinary matters.

Composition

Its six members would include the Chairperson and two Deputy Chairpersons of the Listing Committee one of whom must be an investor representative, the Executive Director and two other senior directors of the SFC’s Corporate Finance Division. To avoid potential conflicts of interest and situations where decisions are made in the first instance and subsequently reviewed by the same people, not all members of the Listing Policy Committee will be members of the Listing Regulatory Committee.

Conduct of Meetings

The Listing Regulatory Committee would meet much more frequently than the Listing Policy Committee. Meetings would be chaired by the Chairperson of the Listing Committee, who would not have a casting vote on any decision. All decisions would require majority support. The required quorum is any four members (or their alternates) representing an even number of Listing Committee members (one of whom must be a Listing Committee investor representative) and SFC members. If a member is unable to attend a meeting, an alternate may attend on that member’s behalf. Alternates for Listing Committee members will be drawn by rotation from a designated pool of alternates, comprising other Listing Committee members. Alternates for SFC members must be a senior director of the Corporate Finance Division or, if none are available, any other senior director chosen by the Executive Director (or CEO of the SFC, where there is a conflict of interests).

The Listing Regulatory (Review) Committee

Function

A third committee, the Listing Regulatory (Review) Committee, would be created to replace the Listing Appeals Committee as the Exchange’s highest review body. It would review the listing decisions of the Listing Regulatory Committee on specified matters.

Composition

Its members would consist of the Chairperson of the SFC, the CEO of the SFC, a non-executive director of the SFC nominated by the SFC board and three former members of the Listing Committee nominated by the Listing Nominating Committee (each an LNC-nominated member). Four additional former members of the Listing Committee would be nominated to serve as alternates for the LNC-nominated members. The chairperson and deputy chairperson(s) would also be chosen by the Listing Nominating Committee from among the LNC-nominated members.

New Applicant’s Listing of Equity Securities

Vetting and approval of IPO applications

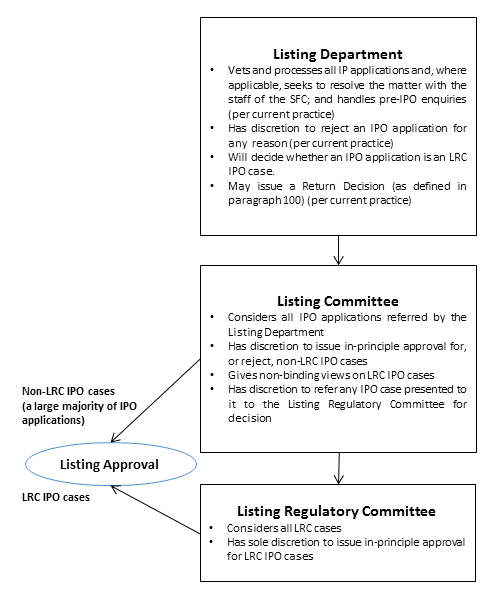

The Listing Department would continue to be primarily responsible for vetting IPO applications. The current procedures will continue whereby the Listing Department informs the SFC of novel, controversial or sensitive matters and matters involving public policy implications.1 It is expected that the Listing Department and SFC staff will be able to resolve most of these cases and if not, they will be referred to the Listing Regulatory Committee for decision. The Listing Department will continue to have the discretion to reject any IPO application (including one raising concerns as to suitability), without referring it to the Listing Regulatory Committee (subject to review).

IPO applications that involve suitability concerns or broader policy implications will be referred to the new Listing Regulatory Committee for in-principle approval (LRC IPO cases). Applications will not however be automatically referred only because they involve one or more matters cited in the Exchange’s guidance letter on suitability for listing (see archive) (Suitability Guidance). The matter(s) must give rise to reasonable doubt as to the applicant’s suitability for listing. IPO applications may be designated as an LRC IPO case by the Listing Department during the vetting process.

The Listing Committee will consider all IPO applications (including LRC IPO cases) that are referred by the Listing Department, but it will only approve or reject applications which do not involving suitability concerns or broader policy implications. The Listing Committee will also be able to designate any IPO application as an LRC IPO case: thus if an IPO application was not designated as an LRC IPO case by the Listing Department, the Listing Committee may still refer it to the Listing Regulatory Committee for decision. The Listing Department will inform the listing applicant’s sponsor as soon as reasonably practicable of a decision (whether by the Listing Department or the Listing Committee) to refer the application to the Listing Regulatory Committee.

The Listing Department will present LRC IPO cases to the Listing Regulatory Committee after the Listing Committee has given its comments. The listing applicant and its sponsor(s) will be informed of the Listing Committee’s views so that they can make representations to the Listing Regulatory Committee in response to those views. Before reaching a decision, the Listing Regulatory Committee will consider any representations made by the listing applicant or its sponsor(s) in response to the Listing Committee’s comments. The Listing Regulatory Committee meeting will be held as soon as practicable after the relevant Listing Committee hearing, taking into account any request for an extension from the listing applicant and/or its sponsor(s).

The following diagram describes the proposed vetting and approval process for IPOs:

Pre-IPO Enquiries

Prospective listing applicants will continue to be able to seek informal guidance from the Listing Department before submitting a listing application. At this stage, the Listing Regulatory Committee may give a preliminary indication of its position on any pre-IPO enquiry involving an LRC Matter (including whether a particular listing applicant or its business is suitable for listing) on the request of the Listing Department. The Listing Department may seek guidance on any pre-IPO enquiry that does not involve an LRC Matter from the Listing Committee.

Matters Involving Listed Issuers

Vetting and Approval of Post-IPO Matters

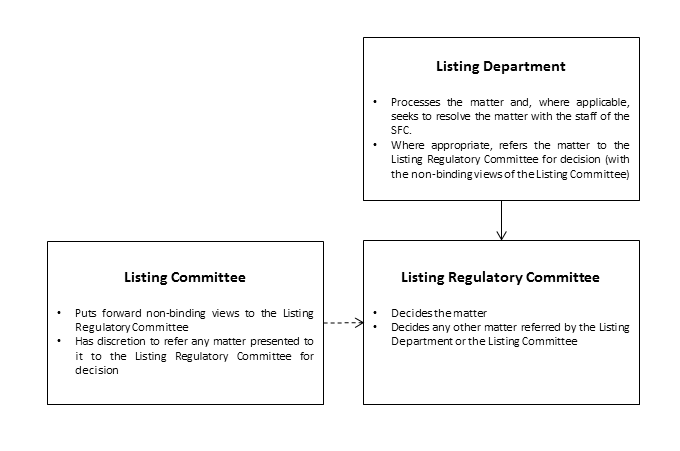

Most post-IPO matters would continue to be decided by the Listing Department. The existing procedures will continue whereby the Listing Department informs the SFC of novel, controversial or sensitive matters and matters involving public policy implications.2 It is expected that the Listing Department and SFC staff will be able to resolve most of these cases and if not, they will be referred to the Listing Regulatory Committee for decision. Post-IPO matters involving suitability concerns or broader policy implications (Post-IPO LRC Matters) would be referred to the Listing Regulatory Committee by the Listing Department for decision after obtaining the non-binding views of the Listing Committee. The Listing Committee will also have the discretion to designate any post-IPO matter presented to it for decision as a Post-IPO LRC Matter. Listed issuers would be notified as soon as reasonably practicable if a post-IPO matter is referred to the Listing Regulatory Committee.

The Listing Committee’s non-binding views on a Post-IPO LRC Matter will be made known to the listed issuer who will be entitled to make submission to the Listing Regulatory Committee to address the Listing Committee’s comments.

The following diagram describes the vetting and approval process for post-IPO matters that are referred to the Listing Regulatory Committee:

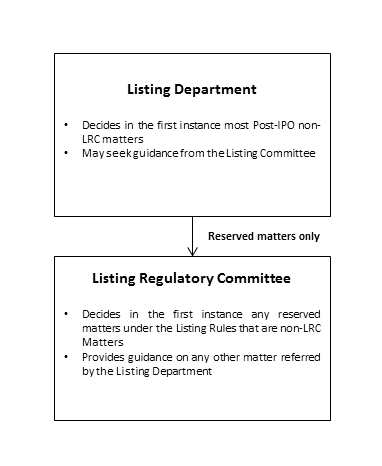

Post-IPO matters that do not involve suitability concerns or broader policy implications will continue to be decided by the Listing Department unless they involve a matter reserved for the Listing Committee under the Listing Rules. The Listing Committee will decide on reserved matters under the Listing Rules which are not Post-IPO LRC Matters. These reserved matters include the power to cancel listing and the power to impose disciplinary sanctions under rules 2A.08 and 2A.09 of the Listing Rules. The Listing Committee will also give guidance to the Listing Department on post-IPO matters that are not Post-IPO LRC Matters on request.

The following diagram describes the vetting and approval process for post-IPO matters that are not referred to the Listing Regulatory Committee:

Reviews of Listing Decisions

Reviews of Decisions Involving a New Applicant*

Non-LRC IPO cases

Where the Listing Department rejects a non-LRC IPO case, the listing applicant will have the right to have that decision reviewed by the Listing Committee. Under the Consultation Paper, thea new Listing Regulatory Committee would replace the Listing (Review) Committee to review the decisions of the Listing Committee. For non-LRC IPO cases, where the Listing Committee (a) rejects a listing application, or (b) endorses or modifies the Listing Department’s decision to reject an application, the listing applicant will have the right to have the decision reviewed by the Listing Regulatory Committee. The decision of the Listing Regulatory Committee on a review of a non-LRC IPO case will be conclusive.

A decision by the Listing Department to return a listing application on the ground that the application and its related documents are not substantially complete (Return Decision) is not treated as a rejection under the Listing Rules. A listing applicant and/or its sponsor(s) will have the right to seek a review of a Return Decision by the Listing Committee. If the Listing Committee endorses a Return Decision, there is a right to a second review by the Listing Regulatory Committee whose decision will be conclusive and binding on the listing applicant and its sponsor(s).

LRC IPO cases

A decision of the Listing Department to reject an LRC IPO case will be reviewed by the Listing Regulatory Committee on application by the listing applicant. Where the Listing Regulatory Committee rejects a new listing application or endorses or modifies a decision of the Listing Department to reject a listing application, the listing applicant will have the right to have the decision reviewed by a third committee, the Listing Regulatory (Review) Committee. The Listing Regulatory (Review) Committee would replace the Listing Appeals Committee as the Exchange’s final review body.

Reviews Involving a Listed Issuer

Post-IPO LRC Matters

Post-IPO matters involving LRC Matters will be decided either (a) by the Listing Department after consulting with the SFC in accordance with the existing procedures under the Memorandum of Understanding Governing Listing Matters between the SFC and the Exchange or (b) by the Listing Regulatory Committee.

Where the Listing Department makes a decision on any post-IPO matter involving an LRC Matter, the decision may be reviewed by the Listing Regulatory Committee on application by the listed issuer. If the Listing Regulatory Committee endorses the Listing Department’s decision, or makes its own decision on an LRC Matter, the listed issuer may request that the decision be reviewed by the Listing Regulatory (Review) Committee.

Post-IPO non-LRC Matters

Post-IPO matters not involving LRC Matters will continue to be decided by the Listing Department in most cases. Its decisions may be reviewed by the Listing Committee on request by the listed issuer. Decisions of the Listing Committee may be referred to the Listing Regulatory Committee for review on the issuer’s request.

In cases not involving an LRC Matter, the Listing Regulatory Committee will replace the Listing Appeals Committee as the final review body for the following decisions under the Listing Rules:

rejection of an authorised representative (rule 2B.07(3) of the Listing Rules); and

rejection of a lifting of suspension of trading (rule 2B.07(4) of the Listing Rules).

In addition, even where a post-IPO matter does not involve an LRC Matter, the Listing Regulatory Committee will replace the Listing (Review) Committee, and the Listing Regulatory (Review) Committee will replace the Listing Appeals Committee for the following types of review decisions under the Listing Rules:

cancellation of a listing (rule 2B.07(5) of the Listing Rules); and

direction of resumption of trading (rule 2B.07(6) of the Listing Rules.

Where the Listing Committee overturns or modifies a Listing Department decision, the Listing Department will have the right to have the Listing Committee’s decision reviewed by the Listing Regulatory Committee. The procedure to be followed is:

The Listing Department will notify the listed issuer as soon as practicable of its decision to seek a review by the Listing Regulatory Committee and its reasons for doing so.

The relevant party may, within three business days, request that the Listing Department provide a reasoned decision in writing and the Listing Department must provide its reasoned decision within 10 business days of receipt of such request.

The Listing Regulatory Committee’s review hearing will be held as soon as practicable following (i) the relevant party’s confirmation that it does not intend to request a written reasoned decision, or (ii) the day on which the Listing Department provides its written reasoned decision.

Both the relevant party and the Listing Department will be entitled to attend the review hearing and to make submissions. The relevant party may be accompanied by one representative of each of the sponsor, the authorised representatives, the legal adviser, the financial adviser and the listed issuer’s auditors.

The Listing Department and the relevant party will provide each other and the Listing Regulatory Committee with copies of papers to be presented at the hearing.

The decision of the Listing Regulatory Committee will be final.

Disciplinary Matters

It is proposed that each disciplinary hearing be chaired by a practising or retired senior counsel, and that each decision be published following the hearing. Prior to the relevant disciplinary hearing, the Listing Department would seek guidance from the Listing Regulatory Committee to the extent that the disciplinary matter involves suitability concerns or broader policy implications. The Listing Regulatory Committee would only provide guidance on the matter involving suitability issues or broad policy implications; it would not comment on the specific facts and circumstances of the relevant case. Such guidance would be provided to the respondent to the disciplinary hearing before the hearing commences, and to the Listing (Disciplinary) Committee during the proceedings.

The Listing Disciplinary Chairperson Group

It is proposed that a Listing Disciplinary Chairperson Group be formed, consisting of no less than five practising or retired senior counsel (or persons with equivalent qualifications). Disciplinary hearings would be chaired by members from this group, as long as that member does not chair both the first instance hearing and review hearing for the same action. Members of this group must be nominated by the Listing Nominating Committee and appointed to the Listing Committee solely to chair and act as members of any Listing (Disciplinary) Committee or Listing (Disciplinary Review) Committee.

The Listing (Disciplinary) Committee

The Listing (Disciplinary) Committee would decide on disciplinary matters in the first instance. When the Listing Department initiates disciplinary proceedings, the Secretary would arrange for a member of the Listing Disciplinary Chairperson Group to chair the first instance hearing. The Listing (Disciplinary) Committee would arrange for no less than four Listing Committee members to act as members of the Listing (Disciplinary) Committee for the proceedings.

The Listing (Disciplinary Review) Committee

Rulings by the Listing (Disciplinary) Committee may be reviewed by the Listing (Disciplinary Review) Committee. Upon application for review, the Secretary would arrange for a member of the Listing Disciplinary Chairperson Group to chair the Listing (Disciplinary Review) Committee. The Chairperson of the Listing (Disciplinary Review) Committee would arrange for no less than four members of the Listing Committee (none of whom participated in the first instance hearing) to act as members of the Listing (Disciplinary Review) Committee for the review.

Publication of Decisions

Under the proposed reforms, the Listing Regulatory Committee, Listing Regulatory (Review) Committee, Listing (Disciplinary) Committee and the Listing (Disciplinary Review) Committee would publish their decisions routinely on the Exchange’s website as soon as practicable after the relevant hearing. Where a review of a hearing is not requested, the first instance decision would be published at the end of the period allowed for a review to be requested.

In exceptional circumstances, where the publication of a decision in relation to an IPO application might be unduly prejudicial to the applicant’s interests, the publication may be made on a “no-names” basis. Delayed or “no-names” publications may also be allowed, again in exceptional circumstances, where the relevant decision is price sensitive or where confidentiality needs to be preserved.

Responding to the Joint Consultation Paper

The proposed reforms are intended to be considered as a whole; the Consultation Paper does not pose consultation questions. However, the SFC and the Exchange request that comments to the consultation be arranged according to the following headings:

Policy development

Listing applications by new applicants

Matters involving listed issuers

Reviews of listing decisions

Disciplinary matters

Oversight of the listing function

Publication of decisions

Composition and Procedures of the Listing Policy Committee

Composition and Procedures of the Listing Regulatory Committee

Composition and Procedures of the Listing Regulatory (Review) Committee

Composition and Procedures of the Listing (Disciplinary) Committee, the Listing (Disciplinary Review) Committee and the Listing Disciplinary Chairperson Group

Other matters

Comments may be submitted before 19 September 2016 by one of the following means:

| To the SFC: | To the Exchange: | |

|---|---|---|

| by hand or by post: |

Corporate Finance Division Securities and Futures Commission 35/F, Cheung Kong Center 2 Queen’s Road Central Hong Kong Re: Consultation Paper on Proposed Enhancements to the Exchange’s Decision-Making and Governance Structure for Listing Regulation |

Corporate Communications Department c/o Hong Kong Exchanges and Clearing Limited 12/F, One International Finance Centre 1 Harbour View Street Central, Hong Kong Re: Consultation Paper on Proposed Enhancements to the Exchange’s Decision-Making and Governance Structure for Listing Regulation |

| by fax: | (852)2810 5385 | (852)2524 0149 |

| by e-mail: |

(subject line: “Consultation Paper on Proposed Enhancements to the Exchange’s Decision-Making and Governance Structure for Listing Regulation”) |

|