On 08 January 2021, Charltons presented Webinar 1 of Charltons Online Crypto Regulation Forum

On 8 January 2021, Julia Charlton presented the first of a 7 part webinar series on Crypto Regulation, with a focus on key terminology, crypto developments and trends and different regulatory approaches, before turning to a discussion of virtual asset regulation, in particular FATF Standards and revised recommendations (which apply to Hong Kong) as an example of international standard setting in the crypto sphere.

Register here for further webinars in Charltons Online Crypto Regulation Forum

Hong Kong Crypto Regulation

Webinar 1 – 8 January 2021

REGULATORY APPROACHES

- Outright ban

- Severe restrictions on use

- Specific regulatory framework

- Regulate to the extent they fall within existing categories of regulated financial instruments

BTC Price / Market Cap. 2020 YTD

Source : Refinitiv © Financial Times

8,164 cryptocurrencies (with a total market cap. of US$893bn)

US$614bn market cap of Bitcoin

Consumer Crypto Use

18-20% crypto adoption rates in Brazil, Colombia and Mexico

11,497 Bitcoin ATMs installed worldwide

Institutional Interest

36% of institutional investors own crypto

60% of institutional investors actively looking at crypto investment

0.5% of all BTC in circulation is held in the treasuries of publicly traded companies

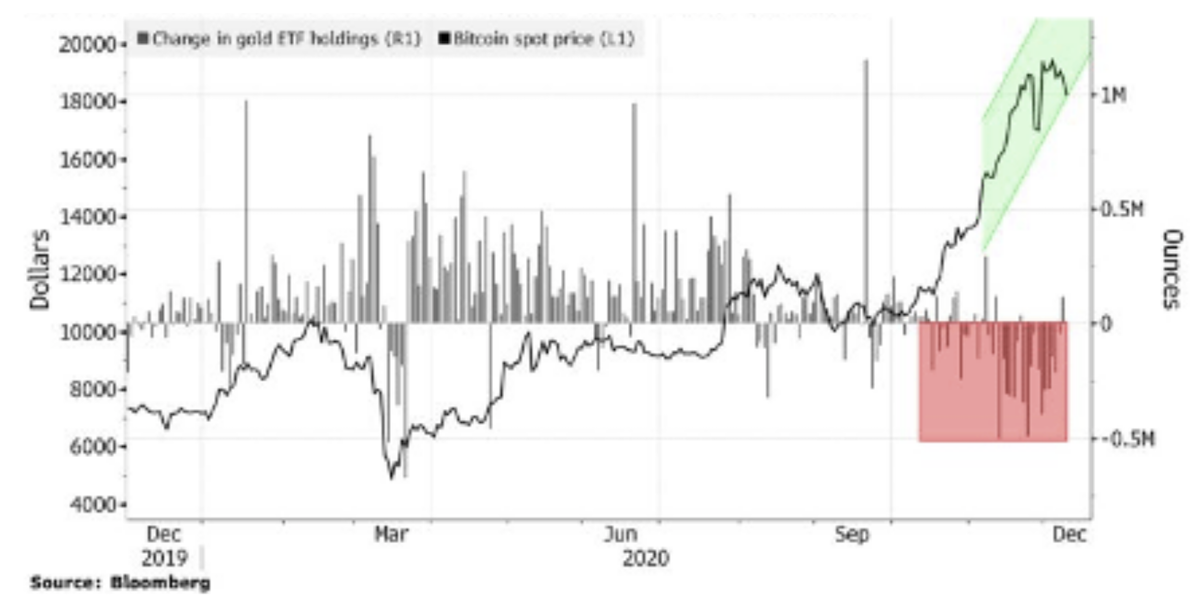

INSTITUTIONAL HOLDINGS: GOLD VS. BTC

INTEREST OF TRADITIONAL FINANCIAL PLAYERS

FEB 2020 – JP Morgan launched JPM Coin

JUL 2020 – Matthew McDermott appointed as Goldman Sachs’ new Global Head of Digital Assets

DeFi

US$7.7 bn tied up in the DeFi market

STABLECOINS

Binance USD market cap. Nov 2019 – Sep 2020

Facebook’s Libra

CBDCs

- improving financial inclusion

- maintaining the central bank’s relevance in the monetary system

RISKS ASSOCIATED WITH CRYPTO

- Fraud

- Financial Crime

- Security

- Misselling and market abuse activities

- Failure

- Volatility

Benefits of Crypto

- More efficient and cheaper transactions

- Alternative to the traditional banking sector

- Financial access for the world’s unbanked

FATF STANDARDS ON AML/CFT

Member Countries must:

- regulate VASPs for AML/CFT purposes;

- license or register VASPs; and

- subject VASPs to effective systems for monitoring and supervision

Implementation of Fatf Recommendations – June 2020

- 32 regulatory authorities had introduced regulation of VASPs (EU 5MLD, Singapore Payment Services Act 2019)

- 3 regulatory authorities had prohibited VASPs

- 19 jurisdictions had not yet implemented a regime regulating VASPs

Virtual Asset Service Providers

- exchanges virtual assets and fiat currencies

- exchanges different forms of virtual assets

- transfers virtual assets

- provides safekeeping and/or administration of virtual assets or instruments enabling control over virtual assets

- participates in and provides financial services related to an issuer’s offer and/or sale of a virtual asset

INR.15

- apply risk-based approach and address AML/CFT risks

- require licensing or registration of VASPs

- ensure VASPs are subject to adequate AML/CFT regulation and supervision

- apply all FATF preventative measures

- designate a competent authority

- place certain requirements on competent authorities to protect against ML/TF

- empower competent authorities to ensure VASPs’ compliance with AML/CFT obligations

- put in place sanctions to deal with non-compliance

APPLICATION OF FATF GUIDANCE

- recommendations do not apply to a person who is not engaging in the activities as a business for or on behalf of another person

- may not be a VASP if simply provides a forum for buyers and sellers of virtual assets to post bids and offers and parties trade at an outside venue

THE “TRAVEL RULE”

- obtain and hold originator and beneficiary information including their name and account number;

- transmit the information to the beneficiary VASP or financial institution; and

- make the information available on request to the appropriate authorities

Compliance with the Travel Rule and Challenges

To Comply:

- be able to identify when they are transacting with another VASP

- identify whether the counterparty VASP is licensed or registered in a jursidiction and adequately supervised for AML/CFT purposes

Challenges:

- conducting timely counterparty due diligence in a secure manner

- peer-to-peer transfers not involving a VASP or financial institution are not explicitly subject to AML/CFT obligations

32 FATF members and FSRBs in total which have introduced a regulatory regime for VASPs

3 FATF members and FSRBs in total which have prohibited VASPs

EU AML DIRECTIVES

- harmonised definition of money laundering offences

- enhanced definition of “criminal activity”

- increased minimum prison sentence for natural persons to 4 years

- extension of criminal liability to legal persons

IMPLEMENTATION IN OTHER JURISDICTIONS

SINGAPORE

Payment Services Act 2019

HONG KONG

SFC Position Paper: Regulation of Virtual Asset Trading Platforms (Nov 2019)

SFC-licensed virtual asset exchanges trading at least 1 security token subject to AML/CTF obligations of AMLO

FSTB Consultation Paper (Nov 2020)

Proposed licensing regime for virtual asset exchanges not trading security tokens. Exchanges will be subject to AML/CTF obligations of AMLO

TRENDS IN USE OF VIRTUAL ASSETS FOR ML/TF PURPOSES

- generally one type of virtual asset was used

- where more than one type of virtual asset was used, this typically involved the layering of illicit proceeds

- virtual assets are also used in fund-raising activities for terrorism and to evade financial sanctions

RISK LANDSCAPE

- use of VASPs registered or operating in jurisdictions that lack effective AML/CFT regulation and the use of multiple VASPs; and

- continued use of tools and methods to increase the anonymity of transactions

STABLECOINS – INCREASEd ML/TF RISKS

- Anonymity

- Global Reach

- Layering

- Potential for Mass Production

APPLICATION OF FATF RECOMMENDATIONS TO STABLECOINS

- entities within the stablecoin ecosystem will have AML/CFT obligations under the FATF Recommendations if they meet the definition of financial institution or a VASP (as set out in Recommendation 15)

- where central governance bodies exist within the stablecoin ecosystem, they will generally be obliged entities under the FATF Recommendations

RESIDUAL RISKS IDENTIFIED BY FATF

- risks associated with anonymous peer-to-peer transactions via un-hosted wallets

- risks from weak or non-existent AML/CFT regulation by some jurisdictions

- risks associated with stablecoins having a decentralised governance structure