Crowd funding Regulation

- Hong Kong has yet to introduce specific regulations to lighten the regulation of crowd funding in order to improve financing for start-ups and tech companies.

- In the UK, specific regulations have been introduced to facilitate loan-based crowd funding platforms which are perceived to be less risky than other types of crowd funding.

- Online crowd funding platforms operating in Hong Kong are governed by Hong Kong’s existing regulatory regime for offering securities and money lending and the opportunities are thus fairly limited.

Crowd funding Statistics

- Since 2011 – crowd funding projects have more than tripled, and current campaigns are projected to raise more than USD$34.4 billion worldwide in 2016.*

- Massolution, a research, advisory and implementation firm that specialises in crowdsourcing solutions, expects that the global crowd funding industry will account for more funding than the venture capital industry and angel investing by 2016.**

- Crowd funding industry had a market valuation of US$880 million in 2010; its valuation was worth US$35 billion in 2015.

- World Bank estimates crowd funding industry will reach US$90 billion by 2020.**

- China has the largest P2P lending market (approximately US$40 billion in August 2015).

- As of the end of 2014, North America’s crowd funding volume stood at US$9.46 billion, while crowd funding raised US$3.4 billion in Asia and US$3.26 billion in Europe.

* http://jumpstartmag.com/news/personal-crowdfunding-fringebacker/

What is Crowd funding?

- Definition: use of small amounts of money, obtained from a large number of individuals or organisations, to fund a project, a business or personal loan, and other needs through an online web-based platform.** Definition used in the OICU-IOSCO Research Paper “Crowd funding: An Infant Industry Growing Fast” by Eleanor Kirby and Shane Worner (March 2014)

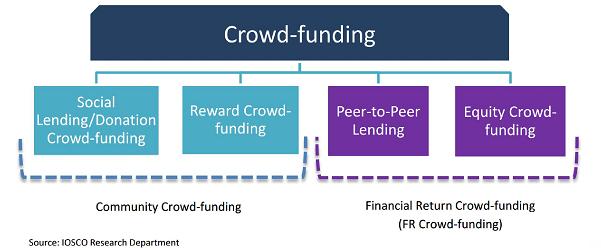

- 4 main sub-categories:

Peer-to-peer lending (P2P Lending)

- Online platforms match lenders (investors) with borrowers (issuers) to provide unsecured loans to individuals or projects.

- Borrower

- either be a business or an individual

- P2P Lenders

- typically involves a number of lenders providing money for small parts of the overall loan required by the borrower

- loan parts are then aggregated by the online platform

- when there is enough to cover the required loan, the loan is originated and paid to the borrower

- Interest rate

- usually set by the platform and the borrower will repay the loan with interest

- typically higher than the savings rate available to the lender but lower than a traditional loan available to the borrower, depending on the borrower’s evaluated risk

- paid to the lender until the loan matures, or the borrower repays early

- or defaults.

- 2 key types of P2P Lending business models: notary model & client segregated account model

Notary Model

- Operation

- The crowd funding platform acts as an intermediary between the lender and the borrower, matching them to each other

- The loan is originated by a bank and the platform issues a note to the lender for the value of their contribution to the loan

- In some jurisdictions, this note is considered to be a security which shifts the risk of non-repayment of the loan from the bank to the lenders

- Fee

- Both lenders and borrowers pay a fee to the crowd funding platform.

Client Segregated Account Model

- Operation

- The crowd funding platform matches an individual lender with an individual borrower and a contract is entered into between them with little involvement by the intermediary platform.

- Lenders can bid on loans in an auction style and all funds of the lenders and borrowers are separated from the crowd funding platform’s balance sheet and go through a legally segregated client account, over which the platform has no claim in the event that the platform collapses.

- The contractual obligations between borrower and lender thus continue despite any collapse or failure of the crowd funding platform.

- Fee

- Both lenders and borrowers pay a fee to the platform.

- The platform provides the service of collecting loan repayments and performing preliminary assessments of borrowers’

- A variation on this model uses a trust fund

- lenders purchase units or shares in a trust structure, with the platform acting as the trustee who manages the fund

- the platform uses the fund to match borrowers and lenders and the platform administers the loan repayments

- as it is a trust, it is legally separate from the platform itself which prevents the investors suffering loss if the platform fails.

Equity crowd funding

- Investors:

- invest in a project or business (normally a start-up); and

- in return receive an interest in shares or debt instruments issued by a company or a share of the profits or income generated from the relevant crowd funding arrangement managed by 3rd party

- Enables a number of investors to invest through an online platform and gain an interest in the business

- Normal Use: early stage small start-ups with limited access to other funding sources due to their small size and maturity

- Investments involve a number of risks, particularly

- a relatively high risk of failure;

- dilution of initial shareholdings through further issues; and

- the absence of a secondary market making equity stakes illiquid.

- Currently a small sector, often with many regulatory impediments preventing small public equity raisings or strict limits on the size of retail investments.

Reward/ pre-sale crowd funding

- Payer receives returns in the form of physical goods or services in return for sums paid.

Donation crowd funding

- Sums are raised for charitable causes.

Regulatory perspective: reward/pre-sale crowd funding and donation crowd funding differ from the first two types.

- They do not provide a financial return in the form of a yield or return on investment.

Approaches to P2P Lending Regulation

- Regulation of crowd funding activities varies across jurisdictions

- Currently 5 key regulatory approaches to P2P Lending:

- Activities are either exempt or unregulated due to lack of definition;

- Crowd funding platforms are regulated as intermediaries;

- Crowd funding platforms are regulated as banks;

- The US model under which there are two levels of regulation: Federal regulation through the Securities and Exchange Commission and state level regulations, where platforms must apply on a state-by-state basis; and

- Prohibition of P2P lending.

- Other possible form of regulation:

- regulation as a collective investment scheme (CIS) where a platform actively manages investors’ money and automatically invests their money while providing them with a limited choice.

Approaches to Equity Crowd funding Regulation

- There are 3 main approaches to regulation:

- Regulation that prohibits crowd funding completely;

- Regulation that permits crowd funding but creates high barriers to entry; and

- Regulation allowing the industry to exist within strict limits.

- Some have sought to treat equity crowd funding as exempt, or lighten the regulation of the issuing of shares in return for crowd funding investment in order to provide funding for SMEs

- Some consider P2P Lending in particular to be an efficient vehicle for funding start-ups and SMEs

- Some are seeking to encourage the practice but without compromising investor protection through specific, targeted regulation

- e.g. UK

Examples of Crowd funding in Hong Kong

P2P Lending:

- Welend: further details below

- Bestlend: further details below

- Monexo

Donation Crowd funding:

- Fringebacker: provides reward-based crowd funding for creative projects and direct fundraising for charities.

- SparkRaise: hybrid rewards and donation crowd funding platform expecting to launch in 2016.

Reward Based Crowd funding:

- Dreamna: supporting creative projects and rewards sponsors with a unique product or experience.

Equity Crowd funding:

- Investable: connects professional investors with start-up companies. It is an ‘invite-only’ platform for ‘professional’ investors. In Hong Kong, for individuals to qualify as professional investors, they must have an investment portfolio (cash and securities) of at least HK$8 million.

Hong Kong Private Companies

Restrictions on Private Companies

- A Hong Kong company is a private company if its articles:

- restrict a member’s right to transfer shares;

- limit the number of members to 50; and

- prohibit any invitation to the public to subscribe for any shares or debentures of the company; and

it is not a company limited by guarantee (s.11 of the Companies Ordinance).

- In order for an invitation to acquire shares or debentures (e.g. bonds) to not constitute an “invitation to the public” – the invitation must be restricted to a limited number of investors. This is difficult to achieve where an online platform is used to invite investors.

Companies incorporated outside Hong Kong should check whether there any restrictions under the laws of their jurisdiction of incorporation or their constitutive documents on offering their shares and debentures.

* Securities and Futures Commission’s (SFC) May 2014 “Notice on Potential Regulations Applicable to, and Risks of, Crowd funding Activities”

Hong Kong Regulation of Crowd funding

- Hong Kong has not introduced specific laws or regulations in relation to crowd funding.

- In May 2014, the SFC issued “Notice on Potential Regulations Applicable to, and Risks of, Crowd funding Activities” (the Notice).*

- The Notice stated that Crowd funding activities such as peer-to-peer lending in Hong Kong and equity crowd funding are potentially subject to the following Hong Kong regulatory provisions:

- restrictions on offers of shares or debentures to the public under the Companies (Winding Up and Miscellaneous Provisions) Ordinance (C(WUMP)O);

- prohibition on the issue of Unauthorised Invitations to the Public under s.103(1) of the SFO;

- prohibition on carrying on a “regulated activity” under the SFO without being licensed/registered to do so by the SFC; and

- prohibition on carrying on a money lending business without a money lender’s licence under s.7 of the Money Lenders Ordinance (MLO) (Cap. 163).

* Securities and Futures Commission’s (SFC) May 2014 “Notice on Potential Regulations Applicable to, and Risks of, Crowd funding Activities”

Restrictions on Offers of Shares or Debentures to the Public under the (C(WUMP)O)

- The offer of shares or debentures to the “public” is regulated by C(WUMP)O

- For Hong Kong incorporated companies, any prospectus issued (s.38 C(WUMP)O) by or on behalf of the company, and in the case of overseas companies, any prospectus distributed in Hong Kong (s.342) must:

- comply with the detailed contents requirements of C(WUMP)O (notably the Third Schedule); and

- be registered with the Registrar of Companies.

- A “prospectus” is defined as any prospectus, notice, circular, brochure, advertisement or other document which:-

- offers any shares or debentures of a company to the public for purchase or subscription; or

- is calculated to invite offers by the public to subscribe for or purchase any shares or debentures of a company.

- A company which issues a prospectus which does not comply with the disclosure and registration requirements, and every person who is knowingly a party to the issue, commits an offence under C(WUMP)O and will be liable to a fine.

- The provision of information on the internet in relation to investment-based crowd funding (involving investment in equity or debt securities) is likely to constitute the issue of a prospectus in breach of C(WUMP)O.

- Exemptions (17th Schedule to C(WUMP)O):

- Consider whether these exemptions are available and suitable for particular crowd funding platforms

- Most require access to the information to be restricted which poses difficulties for online crowd funding platforms in practice

- Exemptions (17th Schedule to C(WUMP)O) available to:

- Offers to not more than 50 persons

- Limitation is on the number of offers made (not offers accepted) thus the exemption would only apply to an online crowd funding platform if access could be restricted to 50 persons.

- Upper limit of 50 takes into account offers by the same person in reliance on the same exemption made in the preceding 12 months which prevents offers being staggered to make offers to larger numbers of investors.

- Offers only to professional investors (as defined in SFO)

- Professional investors under the SFO fall into two main categories:

- institutional investors – e.g. regulated banks, regulated investment intermediaries, authorised funds, insurers and pension schemes etc.; and

- “high net worth investors” as defined under the Securities and Futures Professional Investor Rules (the PI Rules).

- High net worth investors include:

- an individual, who either alone or with any of his or her associates* on a joint account, has a portfolio of > HK$8 million or its equivalent in any foreign currency at the relevant date (an “associate” in relation to an individual, means the spouse or child of the individual);

- a corporation or partnership with:

- a portfolio of > HK$8 million or its equivalent in any foreign currency; or

- total assets of >HK$40 million or its equivalent in any foreign currency; and

- any corporation the sole business of which at the relevant date is to hold investments and which at the relevant date is wholly owned by any one or more of the following persons: an individual who, either alone or with any of his or associates on a joint account, falls within the description in (1); or (ii) a corporation or partnership that falls within the description in (2).

For an online platform to rely on this exemption, access would need to be restricted to “professional investors” who would need to provide proof of their professional status before being given access to the platform.

* An “associate” in relation to an individual, means the spouse or child of the individual

- Professional investors under the SFO fall into two main categories:

- Offers for which the total consideration payable < HK$5 million

- reliance on this exemption is likely to be problematic

- restriction is on the number of offers made (which is potentially unlimited where the information is available on the internet) rather than the number of offers accepted

- upper limit of HK$5 million takes into account offers by the same person in reliance on the same exemption made in the preceding 12 months.

- Offers where the minimum consideration payable (for shares) or the minimum principal amount to be subscribed (for debentures) < HK$500,000

- exemption requires a minimum investment amount of HK$500,000

- Offers to not more than 50 persons

Prohibition on the Issue of Unauthorised Invitations to the Public under s.103(1) SFO

- s.103(1) SFO prohibits the issue, or possession for the purposes of issue, of an advertisement, invitation or document containing an invitation to the public (together “investment advertisement”):

- to enter into or offer to enter into:

- an agreement to acquire, dispose of, subscribe for or underwrite securities; or

- a regulated investment agreement; or

- to acquire an interest in or participate in, or offer to acquire an interest in or participate in, a collective investment scheme, unless the issue is authorised by the SFC.

- to enter into or offer to enter into:

- s.103(10) contains deeming provisions whereby:

- any advertisement, invitation or document which consists of or contains information likely to lead, directly or indirectly, to the doing of any act referred to in s.103(1)(a) or (b) is regarded as an advertisement, invitation or document which is or contains an invitation to do such act; and

- any advertisement, invitation or document which is or contains an invitation directed at, or the contents of which are likely to be accessed or read (whether concurrently or otherwise) by, the public is deemed to be or contain an invitation to the public.

- Information inviting investment in equity or debt securities or in a CIS available on a website is likely to be regarded as an “invitation to the public” requiring SFC authorisation in the absence of an available exemption.

Exemptions

- Offers exempt under the Seventeenth Schedule to C(WUMP)O

- Offers of shares or debentures which fall within any of the exemptions in the 17th Schedule to C(WUMP)O are exempt from the s.103(1) SFO prohibition by virtue of s.103(2)(ga) SFO.

- Offers only to professional investors

- The issue of investment advertisements in respect of securities, structured products or interests in a collective investment scheme only to professional investors are exempt by virtue of s.103(k) SFO.

- Reliance on this exemption raises the same issues as the professionals exemption under C(WUMP)O

- Offers not to the public

- although not strictly an exemption, since the prohibition is of invitations to the public, an offer would not contravene this provision if it is structured not to be a public offer.

- no bright line test set as to how many offerees are considered to constitute the public.

- reliance would require access to the information to be restricted.

Penalty for beach of section 103 SFO

Section 103(3) SFO sets out the penalty for a person who commits an offence under section 103(1):

- on conviction on indictment to a fine of HK$500,000 and to imprisonment for 3 years and, in the case of a continuing offence, to a further fine of HK$20,000 for every day the offence continues; or

- on summary conviction to a fine at level 6 and imprisonment for 6 months, and in the case of a continuing offence, to a further fine of HK$10,000 for every day the offence continues.

Unlicensed Carrying on of a Regulated Activity under the SFO

- Even where an exemption is available in respect of an offer or invitation of investment products under C(WUMP)O and the SFO, operators of crowd funding platforms may commit an offence for conducting “regulated activities” as defined in the SFO without being licensed or registered to do so.

- Types of regulated activities potentially involved in crowd funding which require licensing include:

- Type 1: Dealing in Securities

- Type 4: Advising on Securities

- Type 6: Advising on Corporate Finance

- Type 7: Providing Automated Trading Services

- Type 9: Asset Management

- Consider how and whether operators of crowd funding platforms need to be licensed or registered with the SFC

- There are few, if any exemptions, currently available

- e.g. the regulated activity of “dealing in securities” is widely defined.

- A person “deals in securities” if he, whether as principal or agent, makes or offers to make an agreement with another person, or induces or attempts to induce another person to enter into or offer to enter into an agreement to acquire, dispose of, subscribe for or underwrite securities.

- Information posted in relation to investment-based crowd funding is likely to be within that definition.

- Exemption for dealing with professional investors in paragraph (v) A of the definition of dealing in securities in Schedule 5 SFO would not be available:

- available only to a person who acts as principal in the transaction (this would not cover a crowd funding platform)

- applies only to dealings with institutional investors (the definition of professional investors applicable to the exemption does not apply to professional

- investors sunder the PI Rules (such as high net worth investors)).

- Exemption where a person as principal, acquires, disposes of, subscribes for or underwrites securities (para. (v) B of the definition of dealing in securities in Schedule 5 SFO) would not apply as:

- requires the person to act as principal; and

- there is doubt that “disposes of” would extend to cover marketing activities.

Code of Conduct Requirements

- Where a crowd funding platform carries on a regulated activity for which a licence is required, the platform would also be required to:

- comply with the requirements of the SFC’s Code of Conduct for Persons Licensed by or Registered with the SFC which contain provisions requiring licenseintermediaries to establish clients’ financial situation and investment experience etc.; and

- ensure that investment products recommended to the client are suitable for the particular client.

Penalty for breach of licensing/registration requirement

Section 114(8) SFO sets out the penalty for carrying on a business in a regulated activity or holding oneself out as carrying on such a business without being licensed or registered:

- on conviction on indictment to a fine of HK$5,000,000 and to imprisonment for 7 years and, in the case of a continuing offence, to a further fine of HK$100,000 for every day the offence continues; or

- on summary conviction to a fine of HK$500,000 and imprisonment for 2 years, and in the case of a continuing offence, to a further fine of HK$10,000 for every day the offence continues.

Individuals employed to carry on a business in a regulated activity are also required to be licensed or registered with the SFC. Failure to obtain the necessary licence or registration is subject to the following penalties under Section 114(9) SFO:

- on conviction on indictment to a fine of $1,000,000 and to imprisonment for 2 years and, in the case of a continuing offence, to a further fine of $20,000 for every day during the offence continues; or

- on summary conviction to a fine at level 6 and imprisonment for 6 months, and in the case of a continuing offence, to a further fine of $2,000 for every day during the offence continues.

Money Lending

- P2P lending, may constitute the carrying on of a money lending business requiring a money lender licence under s.7 of the MLO.

- In Hong Kong, platforms such as WeLend and BestLend both facilitate online lending but are not pure P2P Lending platforms.

- Welend

- has apparently facilitated nearly HK$1 billion in loans since it founded in July 2013

- however describes itself as an online lender rather than a pure P2P Lending platform as it only accepts loans from lenders in the company’s private network

- apparently has a number of big-name investors including Li Ka-shing’s TOM Group and US-based Sequoia Capital*

- Welend’s online platform (https://www.welend.hk/en/about-us) only enables borrowers to apply for loans online

- loans which can be applied for include personal loans of amounts ranging from HK$3,000 to HK$300,000 at rates as low as 1.00% APR and with maturities of between 14 days to over 4 years

- specific categories of loans include debt consolidation loans to allow the clearing of loan and credit card debt, wedding loans and mobile phone purchase and prepaid mobile expense loans

- Welend is a licensed money lender so that the loans made to borrowers are regulated by the MLO.

* China Daily. “Strictly Among Peers”. Luo Weiteng. 6 February 2015.

(http://www.chinadailyasia.com/focus/2015-02/06/content_15224604.html).

- This is not true P2P Lending – P2P lending is where the platform matches borrowers and lenders and the loans are entered directly between the borrowers and lenders. The reason this model is not adopted in HK appears to be the concern that P2P Lending by individuals or businesses might constitute the carrying on of business as a money lender, which would require the individual or business to be a licensed money lender under the MLO

- Bestlend.com

- the internet financing platform of Haitong International Securities Group Limited

- matches borrowers in need of funding with licensed money lenders in Hong Kong

- borrowers can choose their preferred offer among the loan quotes provided

- nearly 30 licensed money lenders are apparently collaborating with Bestlend.com

- Advantage for the licensed money lenders – gain access to a wider customer base through the platform

- Entire lending process takes place online allowing direct contact between borrowers and lenders enhancing efficiency and apparently minimising borrowing costs

- Bestlend does not apparently take any fee for its services.

- Primary purpose of the platform from Bestlend’s perspective is to accumulate credit data which Haitong can use for other business purposes such as securities.

- Haitong will also work with consumer credit reporting company Transunion to generate credit rating reports on borrowers*.* Haitong/Bestlend Press Release “Haitong International Sets Foot in Internet Finance by Launching First P2P Online Lending Platform in Hong Kong”. 22 January 2015. (http://www.htisec.com/english/aboutus/press/20150209115340.pdf)

The Money Lenders Ordinance (“MLO”)

- Requires that anyone wishing to carry on business as a money lender must apply to a licensing court for a licence.

- The term “money lender” is defined in s.2 MLO:

- “every person whose business (whether or not he carries on any other business) is that of making loans or who advertises or announces himself or holds himself out in any way as carrying on that business”.

- Certain persons and loans specified in Schedule 1 to the MLO are excluded from the definition.

- Examples of exempted loans:

- a loan made bona fide by an employer to his employee;

- a loan made to a company secured by a mortgage, charge, lien or other encumbrance: (a) which is registered, or to be registered, under the Companies Ordinance; or (b) which would, in the case of a company incorporated by any other Ordinance or incorporated or established outside Hong Kong, be able to be registered under the Companies Ordinance if it were a company incorporated under that Ordinance;

- a loan made by a company under a bona fide credit-card scheme operated by the company to any holder of a credit-card issued under that scheme; and

- a loan made bona fide for the purchase of immovable property on the security of a mortgage of that property and a loan made bona fide to refinance such a mortgage; and

- a loan made by a company, firm or individual whose ordinary business does not primarily or mainly involve the lending of money, in the ordinary course of that business.

- Exempted category (v) (loans by a company, firm or individual whose ordinary business does not primarily or mainly involve the lending of money in the ordinary course of that business) may be an exemption on which P2P lenders are able to rely.

- It will however be difficult in the case of any individual lender to determine at what point the lender is “carrying on a business of lending money”.

Regulation of Money Lenders’ Transactions

- Money lenders’ transactions are regulated under Part III MLO

- Form of Agreement

- For a loan agreement entered into by a money lender and any security given in respect of it to be enforceable the agreement must be in writing and signed personally by the borrower and a copy of the agreement must be given to the borrower at the time of signing.

- Any such agreement or security will be unenforceable if it is proved that the agreement was not signed by the borrower before the money was lent or the security given.

- The agreement is required to contain all the terms and must in particular set out:

- the name and address of the money lender;

- the name and address of the borrower;

- the name and address of the surety, if any;

- the amount of the principal of the loan in words and figures;

- the date of the making of the agreement;

- the date of the making of the loan;

- the terms of repayment of the loan;

- the form of security for the loan, if any;

- the rate of interest charged on the loan expressed as a rate per cent per annum, or the rate per cent per annum represented by the interest charged as calculated in accordance with Schedule 2 MLO; and

- a declaration as to the place of negotiation and completion of the agreement for the loan.

A court may however give effect to an agreement which does not comply with the provisions of s.18 if it considers that to do so would be equitable in the circumstances.

- Duty to Provide Information

- A money lender has a duty to provide specified information to any borrower upon receipt of a written demand from the borrower and payment of its expenses.

- In respect of any loan for which security is provided, a money lender must also provide to the surety within 7 days of the making of the agreement:

- a copy of the loan agreement;

- a copy of the security instrument (if any); and

- a written statement signed by the money lender showing the total amount payable by the borrower under the agreement and the various amounts comprised in that total sum with the date, or the mode of determining the date, when each becomes due.

- A surety may also make a written request to receive a statement of the amounts payable under the agreement at any time during its continuance.

- Early Payment by Borrower

- A borrower must be allowed to repay early on giving written notice to the money lender and on payment of all amounts payable as principal together with interest computed up to the date of such payment.

- The effective rate of interest paid must not exceed the effective rate of interest which would have been payable under the agreement if the borrower had not exercised his right to repay early.

- Illegal Agreements

- A loan agreement will be illegal if it provides directly or indirectly for:

- the payment of compound interest;

- prohibiting the repayment of the loan by instalments; or

- the rate or amount of interest being increased by reason of any default in the payment of sums due under the agreement.

- A loan agreement may however provide that if default is made in the payment of any sum due, the money lender may charge simple interest on that sum from the date of the default until the sum is paid at an effective rate not exceeding the effective rate payable in respect of the principal.

- A loan agreement will be illegal if it provides directly or indirectly for:

- Charges for Expenses not Recoverable

- A loan agreement may not provide for the payment by the borrower of any sum for on account of costs, charges or expenses (other than stamp duties or similar duties) incidental to or relating to the negotiations for or the granting of the loan or any guarantee or security to be given in respect of the loan.

- It is also illegal for any person to receive any sum for or on account of such costs, charges or expenses or to demand or receive any remuneration or reward whatsoever from a borrower for or in connection with a loan (s.27 MLO).

- Restriction on Money-lending Advertisements

- Any advertisement, circular, business letter or other similar document published by a money lender must show the name of the money lender as specified in his licence in a manner which is no less conspicuous than any other name (s.26).

- Where any such document purports to show the rate of interest at which the money lender is willing to make loans, the proposed rate of interest must be shown as a rate per cent per annum and in a manner which is no less conspicuous than any other matter mentioned.

- Any advertisement must clearly show the number of the money lender’s licence.

- Applying for a Licence

- Licence applications are, initially, submitted to the Registrar of Companies as Registrar of Money Lenders (who is appointed by the Chief Executive).

- A copy is also sent to the Commissioner of Police who may carry out an investigation in respect to the application and object to the application if appropriate (s.9 MLO).

- The application is advertised, and any member of the public who has an interest in the matter has the right to object.

- Licences are granted for a period of 12 months and must be renewed annually.

Consequences of Failure to Comply with the Money Lenders Ordinance

- It is an offence punishable by a fine of HK$100,000 and imprisonment for 2 years for a person to carry on business as a money lender without a licence (s.32 MLO).

- Where any person is convicted of an offence under the MLO, the magistrate may order that such person shall be disqualified from holding a licence for such period not exceeding 5 years from the date of such conviction as may be specified in the order (s.32 MLO).

- Any loan agreement entered into by a money lender and any security taken in respect of such loan will not be enforceable if the money lender was not licensed at the date of the loan agreement or the taking of the security (s.23 MLO).

Anti-Money Laundering and Counter-Terrorist Financing Regulation

- In Hong Kong, legislation dealing with money laundering and terrorist financing includes:

- Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance (AMLO);

- Drug Trafficking (Recovery of Proceeds) Ordinance (DTROP);

- Organized and Serious Crimes Ordinance (OSCO); and

- United Nations (Anti-Terrorism Measures) Ordinance (UNATMO).

- AMLO

- came into effect on 1 April 2012

- imposes on financial institutions requirements regarding customer due diligence and record-keeping.

- DTROP, OSCO and UNATMO

- require reporting of suspicious transactions regarding money laundering or terrorist financing.

- Financial institutions (for the purposes of the AMLO) include banks and other types of “authorised institutions” under the Banking Ordinance and entities which are licensed corporations under the SFO (e.g. licensed securities dealers, asset managers etc.)

- Although money lenders are not financial institutions for the purposes of the AMLO, Hong Kong’s Licensed Money Lenders Association Ltd. has issued a guideline on “Anti-Money Laundering and Counter-Terrorist Financing”* which members of the association are recommended to follow in order to maintain the same regulatory standard against money laundering and terrorist financing.

The Way Forward and Key Risks

- Have been calls for Hong Kong to relax its regulatory regime to facilitate crowd funding.

- The lack of certainty surrounding the legality of crowd funding activities is a major problem for all parties involved – investors, entities raising funds and crowd funding platforms.

- Key risk for those raising funds – possibility of crowd funding platform being closed down by regulators.

- Safest method = reward-based crowd funding – not regulated.

- Considerable doubt as to legality of securities-based crowd funding (where crowd invests in return for securities – shares or debt).

- Problems with P2P lending proper arise from the need for individual lenders to be licensed money lenders.

- Key advantage of introducing regulation of crowd funding – create certainty as to legality of activity.

- E.g. for P2P lending – could introduce a new regulated activity of operating an online loan-based crowd funding platform and regulations to address relevant concerns as in the UK.

*FSTB Press release

LCQ1: Regulation of Crowdfunding. Wednesday, March 18, 2015

Crowd – funding in the United Kingdom

- The first Financial Services Authority (now the Financial Conduct Authority (“FCA”)) regulated crowd funding platform launched in the UK was Abundance Generation, approved in July 2011 and launched to the public in the spring of 2012.

- Abundance Generation provides debt finance to UK-based renewable energy developers.

- 6 July 2012: Seedrs Limited launched as the first equity crowd funding platform to have received regulatory approval anywhere in the world, from the FCA.

- February 2013: CrowdCube which launched in 2011, became FCA authorised.

- prior to obtaining FCA authorisation, Crowdcube apparently operated by taking advantage of a loophole for offers to the same group of existing shareholders

- when an investor signed up to Crowdcube’s website it becomes a “shareholder” without the standard rights

- Crowdcube also takes shares in companies looking to raise capital

- therefore when the investment “opportunities” were advertised they were targeted at the same group of existing shareholders

- this is a legal promotion under FCA regulations.

UK Regulation of Crowd funding

- The FCA regulates firms providing the following types of crowd funding:

- Loan-based crowd funding platforms:

- where people lend money to individuals or businesses in the hope of a financial return in the form of interest payments and a repayment of capital over time (this excludes some business-to-business loans); and

- Investment-based crowd funding platforms:

- where people invest directly or indirectly in new or established businesses by buying shares or debt securities, or units in an unregulated collective investment scheme.

- Firms operating such platforms require FCA authorisation where they conduct a regulated activity (as specified in the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 as amended).

- Loan-based crowd funding platforms:

Investment-based Crowd funding

- The FCA confirmed in the 2014 Policy Statement* that firms operating investment-based crowd funding platforms are regulated by the FCA if, in doing so, they carry on a regulated activity.

- Firms will need to be authorised if they:

- arrange (bring about) deals in relation to equity or debt securities or units in a collective investment scheme;

- agree to carry on a regulated activity; or

- establish, operate or wind up an unregulatecollective investment scheme.

Restriction on Direct Offer Financial Promotions to Retail Clients

- The Policy Statement also sets out new rules which impose restrictions on providing direct offer financial promotions (being a promotion which contains an offer or invitation and specifies the manner of response or provides a form by which a response can be made) in respect of “non-readily realisable securities” (i.e. equity or debt securities for which there is no secondary market).

* Policy Statement PS14/4 on the “FCA’s Regulatory Approach to Crowdfunding over the Internet and the Promotion of Non-readily Realisable Securities by other Media” “Media”

- Under the rules, direct offer financial promotions in respect of such securities can only be provided to the following types of retail clients:

- those who are certified or self-certify as sophisticated investors;

- those who are certified as high net worth investors;

- those who confirm that, in relation to the investment promoted, they will receive regulated investment advice or investment management services from an authorised person; or

- those who certify that they will not invest more than 10% of their net assets in non-readily realisable securities.

- Where no advice is provided to retail clients, an appropriateness test applies which requires firms to check that clients have the knowledge or experience to understand the risks involved.

- Consumer credit market, including loan-based crowd funding (both peer-to-peer (P2P) and peer-to-business lending) has been regulated by the FCA since 1 April 2014.

- New rules set out in the Policy Statement created a new regulated activity of “operating an electronic system in relation to lending” (i.e. operating a loan-based crowd funding platform)

- Aim: to enhance the regulation of peer-to-peer lending platforms which were not regulated under the previous Consumer Credit Act regime.

- The rules provide transitional relief until April 2017 for the full capital requirements.

Transitional arrangements

- The FCA has assumed the Office of Fair Trading’s (OFT) responsibility for the consumer credit market and firms holding an appropriate OFT licence

- Operating loan-based crowd funding platforms in March 2014 were able to apply for interim permission to continue conducting the activity

- interim permission allowed these firms to remain in the market pending application for full authorisation – the authorisation process is not completed yet by the FCA according to their February 2015 review report.

- New firms entering the market after the commencement of the rules are required to obtain FCA authorisation before commencing operations.

Scope of Application of the New Rules

- Under Article 36H of the Financial Services and Markets Act 2000, a regulated electronic system includes one that:

- facilitates lending by providing a complete service that enables individuals to lend; from finding borrowers and checking their credit status, to collecting or arranging for the collection of repayments; and

- is able to determine the agreements for lenders and borrowers to enter into, taking account of any parameters set by them.

- The new regulations apply to loans meeting certain criteria, including that the investor and/or borrower must be:

- an individual;

- a partnership consisting of two or three persons not all of whom are bodies corporate; or

- an unincorporated body of persons which does not consist entirely of bodies corporate and is not a partnership.

- These criteria mean that business-to-business loans are not FCA-regulated.

- Only principal firms (and not their appointed representatives) can perform the new regulated activity.

Regulations

- The FCA considers loan-based crowd funding activities to be generally less risky than investment-based crowd funding activities.

- The new regime is primarily disclosure-based and includes:

- minimum capital requirements;

- a requirement for firms to take reasonable steps to ensure that existing loans continue to be managed in the event of platform failure;

- rules that firms must follow when holding client money, to minimise the risk of loss due to fraud, misuse and poor record-keeping and to provide for the return of money in the event of firm failure;

- rules on dispute resolution to allow users first to complain to the firm before complaining to the Financial Ombudsman Service; and

- reporting requirements for firms to send information to the FCA in relation to their financial position, client money holdings, complaints and loans they have arranged.

- Disclosure

- To address the risk of non-repayment and lenders’ potential ineligibility for the statutory compensation scheme*, peer-to-peer agreements are categorised as “designated investment business” in the FCA Handbook so that key parts of the handbook apply.

- In addition to the rules on financial promotions which require all communications to be fair, clear and not misleading in order to ensure that platform providers are providing a balanced view and sufficient information, peer-to-peer agreements are also required to disclose information allowing lenders to make an informed lending decision including but not limited to:

- expected and actual default rates based on past and future performance;

- a description of how loan risk is assessed;

- details of the creditworthiness assessment;

- details of likely actual rates of return;

- exit options for investors; and

- impact of the failure of the firm, including the lack of FSCS cover.

* Financial Services Compensation Scheme (FSCS) set up under the Financial Services and Markets Act 2000: http://www.fscs.org.uk/

The FSCS currently does not cover loan-based crowd funding unless the P2P firm operating the platform in question in in default.

- Capital Requirements

- P2P firms are required to hold a minimum of the higher of:

- £20,000 as capital (which will be increased to £50,000 from 1 April 2017); or

- 2% of the first £50 million of total value of loaned funds outstanding; 0.15% of the next £200m of total value of loaned funds outstanding; 0.1% of the next £250m of total value of loaned funds outstanding; and 0.05% of any remaining balance of total value of loaned funds outstanding above £500m*.

- Firms with transition permission are not subject to these requirements until they receive full FCA authorisation (at the latest by 1 April 2016).

- If the total value of loans outstanding increases by 25%, firms are required to notify the FCA.

* The types of financial resources that a firm must hold to meet their capital requirement are detailed in IPRU(INV)12.3.2R.

- P2P firms are required to hold a minimum of the higher of:

- Client Money

- P2P firms are also required to comply with the client money rules in terms of monies received from lenders and in terms of acting as a conduit for borrower repayments to ensure proper administration of loans in the event of platform failure.

- The conduit function is important particularly since lenders often do not know the actual identity of the borrower and the amount of their investment may not be large enough to justify them seeking repayment.

CONC

- Peer-to-peer agreements which involve individual or relevant persons borrowers are subject to more stringent regulation under the new Consumer Credit sourcebook (CONC) which provides enhanced protections to borrowers.

- If the platform is captured by CONC, it must:

- provide an adequate explanation of the key features of the credit agreement to borrowers;

- assess the creditworthiness of borrowers;

- comply with the financial promotions rules;

- allow the borrower 14 days to withdraw from the agreement; and

- provide post-contract information where the borrower is in arrears or default.

Unregulated and Exempt Activities

- The FCA does not regulate firms that only operate donations-based, pre-payment or rewards-based crowd funding platforms. They do not require FCA authorisation.

- Activities or organisations which fall within the scope of statutory exemptions from the FCA authorisation requirement or regulation (e.g. Enterprise Schemes) are also not regulated by the FCA.

- The FCA published a subsequent review* of the new regulations in February 2015.

- conclusion: there is currently no need to change the regulatory approach to crowd funding

- FCA however issued specific warnings concerning online platforms, namely, misleading information and the deletion of negative comments

- FCA stated that they will continue to monitor the market and will take appropriate actions if market risks require it to do so or if there are changes to EU regulations.

“A Review of the Regulatory Regime for Crowd funding and the Promotion of Non-readily Realisable Securities by Other Media”

http://www.fca.org.uk/static/documents/crowdfunding-review.pdf

Update on the United Kingdom Crowd funding (February 2016)

- As of February 2016, there has been no changes/updates to the FCA regulations since its review of the regulatory regime for crowd funding in February 2015.

- FCA had targeted to carry out a full post-implementation review of the crowd funding market and regulatory framework sometime in 2016 to identify whether changes are required.

Additional Risks

- Risks for all types of crowd funding:

- Investor over-optimism: this could be a risk if investors are inexperienced and if due diligence or disclosure has been poor. This can lead to further problems if investors subsequently claim they have been misled and seek redress.

- Lack of experience: many of the firms running platforms lack regulatory experience or, with regards to loan-based crowd funding, lending experience.

- Risk of platform failure.

- Conflict of interest: this could lead to consumer detriment. For example, if a platform’s remuneration is linked to transactions (as is usually the case), and if new platforms are seeking to establish a presence in the market quickly, new firms may be motivated to exaggerate possible returns and downplay risks.

- Fraud and money laundering: instances of fraud and money laundering can occur. If there are numerous or high-profile instances of fraud, this will affect the confidence that consumers have in the crowd funding sector.

- Technological problems: problems with technology, IT security or the internet could lead to risks for investors. Consumer data may be vulnerable to theft, misuse, or loss if security measures prove insufficient.

- Risks for reward-based crowd funding (Borrowers Specific):

- Legal risks: two of the most common legal risks for borrowers from reward-based crowd funding are “production delays” and “IPR infringement”:

- Production delays: with reward-based crowd funding, investors will expect to receive their rewards for backing a project.

- production delays are not uncommon – a 2013 study by Ethan Mollick, assistant professor of management at The Wharton School of the University of Pennsylvania, found that only 25% of Kickstarter projects were delivered on time*.

- unreasonable delays could lead to legal action seeking compensation (e.g. for breach of contract).

- IPR infringement: a reward (product) could infringe another company’s IPR, which could lead to the company being embroiled in a legal action.

- Example: Nbition Development (Nbition) which raised nearly US1 million on Kickstarter for its Arist coffee machine and won the Best ICT Start-Up Grand award at the end of 2014. Nbition was sued for IPR infringement by Danish coffee machine maker, Scanomat.

- Many platforms require borrowers to disclose their ideas on the platform to attract funds. There is a risk that the borrower’s project ideas could be copied.

- Production delays: with reward-based crowd funding, investors will expect to receive their rewards for backing a project.

- Legal risks: two of the most common legal risks for borrowers from reward-based crowd funding are “production delays” and “IPR infringement”:

- Reputation Risk: legal risks and other general crowd funding risks (e.g. insufficient IT security safeguards to minimise the chances of sensitive data being stolen) can damage reputations.

- Example: Nbition – repeated delays in production, the IPR infringement claim and stealing of sensitive data led to negative publicity. 5% of backers demanded refunds.

- Main risk for investors – non-repayment of loans: non-repayment of capital or non-payment of interest, either because of borrower default, fraud or platform failure. The following methods could minimise this risk:

- only deal with borrowers with good creditworthiness;

- putting contingency funds in place that aim to cover lost capital in the event of borrower default; and

- facilitate secured loans, where there is collateral that may be sold to repay capital.

* Auto lend is where investors instruct the platform to lend their money to multiple borrowers.

- Counterparty (or credit risk)

- Liability for the platform: if a lender does not receive funds collected from the borrower due to failure of the crowd funding platform, the borrower may be liable to the lender if there are insufficient financial safeguards against the platform’s failure.

- Risk of fraud

- Uncertainty over the reputation and the security of a platform: it might be difficult for lenders and borrowers to find independent information about the reputation of crowd funding platforms because a platform is not required to comply with legal information or disclosure requirements. This is particularly true in Hong Kong since crowd funding is not specifically regulated and the crowd funding industry in Hong Kong is still at the infancy stage.

- Lack of transparency or misleading information

- Borrowers cannot be certain that a risk assessment of their project is conducted in accordance with generally applicable standards and rules.

- Legal Risk

- Uncertainties over rights and obligations vis-à-vis the parties involved: this occurs if the crowd funding platform fails to disclose sufficient and reasonable information regarding the services that will be provided by the platform and a description of the contractual rights and obligations that would apply to lenders and borrowers.

- Potential copyright infringement: some platforms require borrowers to disclose their ideas on the platform to promote their business to attract potential lenders. As a result, the borrower’s project ideas could be copied.

- Liquidity Risk: Borrowers can face liquidity problems if the delivery of funds is delayed after the required financial threshold has been met, potentially undermining the success of the project. This occurs due to a lack of or an insufficient timeline of fund availability from the platform.

- Operational Risk: a borrower could suffer a loss (loss of potential funds) when a crowd funding platform experiences technical issues.

About Charltons

- Charltons’ extensive experience in corporate finance makes us uniquely qualified to provide a first class legal service

- Charltons have representative offices in Shanghai, Beijing and Yangon

- Charltons was named the “Corporate Finance Law Firm of the Year in Hong Kong” in the Corporate Intl Magazine Global Award 2014

- “Boutique Firm of the Year” was awarded to Charltons by Asian Legal Business for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015

- “Hong Kong’s Top Independent Law Firm” was awarded to Charltons in the Euromoney Legal Media Group Asia Women in Business Law Awards 2012 and 2013

- “Equity Market Deal of the Year” was awarded to Charltons in 2011 by Asian Legal Business for advising on the AIA IPO

Disclaimers

- This presentation is prepared by Charltons for information purposes only and does not constitute legal advice. Specific legal advice should be sought in relation to any particular situation.

- Charltons does not accept responsibility or liability for any loss or damage suffered or incurred by you or any other person or entity however caused (including, without limitation, negligence) relating in any way to this presentation including, without limitation, the information contained in or provided in connection with it, any errors or omissions from it however caused (including without limitation, where caused by third parties), lack of accuracy, completeness, currency or reliability or you, or any other person or entity, placing any reliance on this presentation, its accuracy, completeness, currency or reliability. Charltons does not accept any responsibility for any matters arising out of this presentation.

- As a Hong Kong legal adviser, Charltons is only qualified to advise on Hong Kong law and we express no views as to the laws of any other jurisdictions. The information in this presentation on the position in the United Kingdom represents only our understanding of the position and has not been independently verified by us.