Publications & presentations

SMEs IN HONG KONG

Small and medium enterprises [SMEs] in Hong Kong are defined as those which employ fewer than 100 people in manufacturing and fewer than 50 in non-manufacturing activity. There are about 300,000 of them and they represent 98% of the total business establishments in the Special Administrative Region. They employ 1.37 million people which is about 60% of total employment outside the government sector. Their prosperity and success is therefore of the greatest importance to the economic well being of Hong Kong and its people.

THE CONCEPT OF CORPORATE GOVERNANCE AND ITS IMPORTANCE

Corporate governance is the system by which companies and other enterprises are controlled. The basic purpose of all commercial enterprises is to preserve and enhance the investments which created them; that is to create wealth, not only in the short term but in perpetuity. Good corporate governance can make a great contribution to success, bad governance makes failure more likely. It is therefore in the interests of all enterprises to consider whether they can improve their system of governance.

All around the developed world a great deal of attention has been paid to corporate governance over the last two decades. Competitive pressures are growing, community expectations are increasing, and the standards required for success are rising. In response, many new techniques have been developed which, if applied appropriately, can be of real practical assistance to individual enterprises and can make a substantial contribution to the health of the economy.

There is no single right way in which companies should be governed but there are fundamental principles which will assist all enterprises to survive and succeed, including:

- Comply with the law.

- Earn the respect of their stakeholders – customers, creditors, employees, suppliers and the communities within which they operate.

- Lower the cost of capital by establishing and maintaining a sound reputation.

- Identify and manage the risks facing them.

- Adopt and develop systems which enhance the quality of decision making.

WHAT GOVERNANCE PRACTICES DO HONG KONG SMEs NEED?

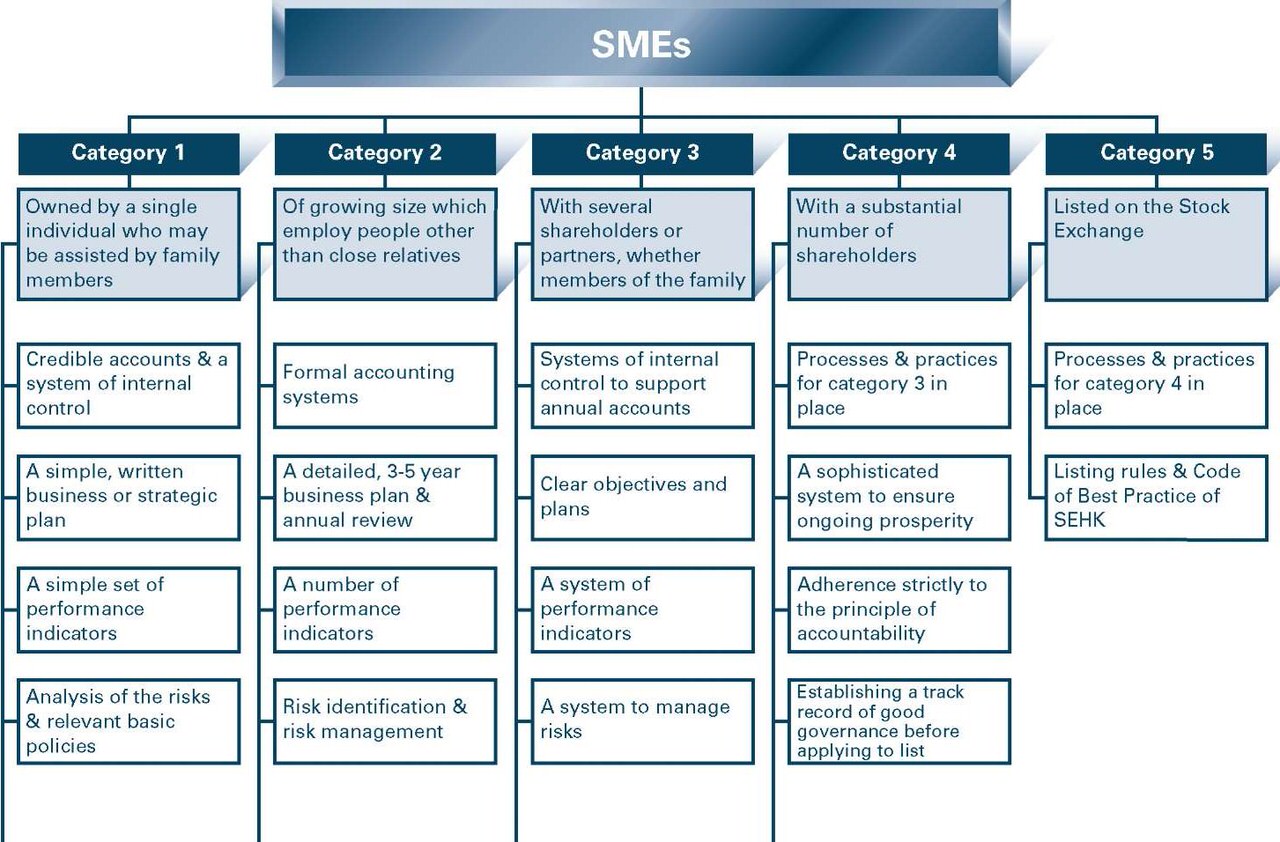

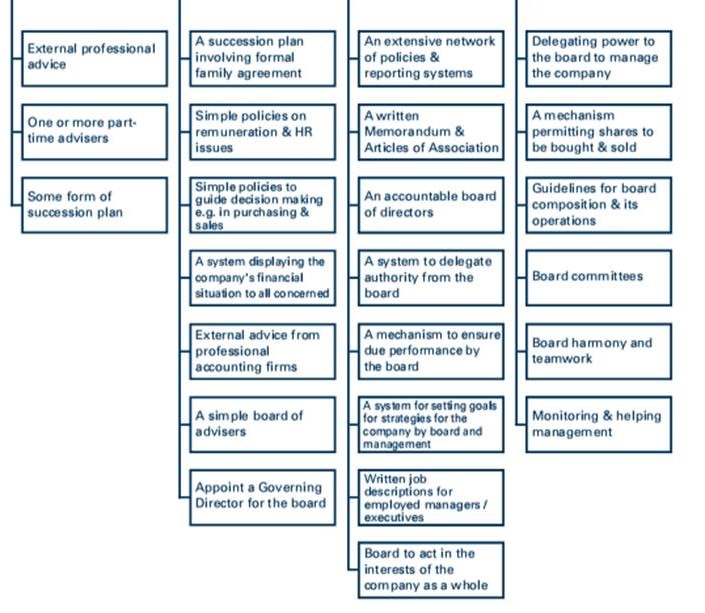

The governance systems likely to be useful to small enterprises are much simpler than those required by larger ones and, in order to clarify what structures and procedures are likely to be of value in particular circumstances, these Guidelines divide the SMEs of Hong Kong into five categories:

- Small entities owned and operated by single individuals or a few family members.

- Larger entities employing non-family members, whose owners may include a few family members.

- Medium sized companies with several shareholders including some outside the family.

- Large medium private or public companies with a substantial number of shareholders.

- Companies listed on the stock exchange.

| Category 1. | While a skilful entrepreneur will probably be able to keep most of the details of his business in his head he will probably benefit from a basic system of credible accounts and internal control, a simple business plan with performance indicators, some form of risk identification and risk management, and a succession plan that will provide for the continuance of the business should the entrepreneur be unable to continue. Some form of regular outside advice is also likely to be beneficial. |

| Category 2. | As enterprises grow in size they usually employ people other than family members and become more complex in other ways. All of the basic governance mechanisms likely to be used by category 1 enterprises will probably be developed further and written policies may be necessary, at least in some areas. In addition, other policies, covering such matters as employment, are likely to be required. The entrepreneur may well benefit from more external advice, particularly in the accounting area, and may well feel the need for some form of board of advisers which is likely to include family members, including probable successors. |

| Category 3. | Once a company has several shareholders it becomes necessary to consider their rights, and it may be important to demonstrate that the company offers attractive investment possibilities. Additional shareholders bring additional responsibilities: a Memorandum and Articles of Association, and a representative board of directors, will probably be necessary. The need to satisfy other shareholders means that the accounting and control systems will have to be more reliable, and since in larger companies, planning and risk management will become more important, the relevant systems will be more sophisticated. In these companies the legal obligations of the entrepreneur, and the practical needs of the business, will be more complex and onerous. |

| Category 4. | These companies have a substantial number of shareholders, and as a consequence, there is a separation of ownership from control and the board has a responsibility to act in the interests of the company as a whole. The board must be accountable to the shareholders and it must hold management accountable to it. Not only must all the governance systems needed by category 3 companies be developed to a greater degree of sophistication but additional mechanisms will be required. The composition of the board, its harmony and teamwork, communications with shareholders, the functions of the board and its relationship with management will all take on a greater importance. |

| Category 5. |

These companies are listed on the stock exchange and are bound by the listing rules. Inevitably their governance systems will be even more sophisticated than those of category 4 companies. |

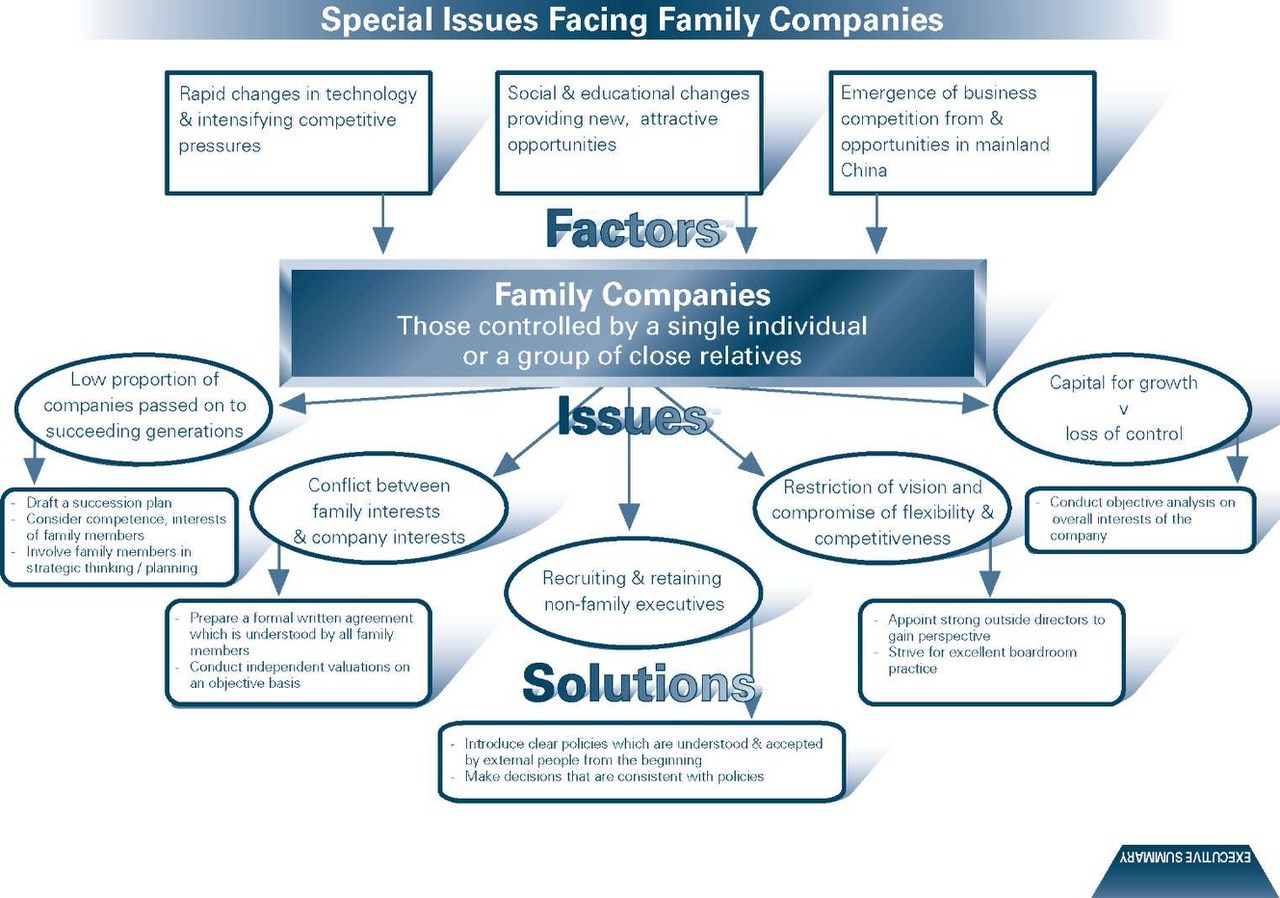

THE SPECIAL ISSUES OF FAMILY COMPANIES

A high proportion of SMEs in Hong Kong are family companies. They enjoy several substantial advantages, principally:

- Since there is little or no separation of ownership from control, decision making can be streamlined.

- The personal incentives of those involved are usually very strong.

- The loyalty of family workers often increases stability.

But family connections have always had other implications for businesses and rapid technological changes, increasing competitive pressures, social and educational changes, and developments in mainland China have created new challenges and opportunities. As a result family companies face five special issues which lead to less than half of all family companies being carried on by the second generation, and which prudent company controllers need to take into account. They are:

| 1. Succession. | It is becoming increasingly difficult to find second generation family members who are sufficiently able and well trained, and at the same time willing and sufficiently patient to take over the leadership of the family company at a time that is suitable to the founder. The difficulties in the transfer from the second to the third generation are even greater. Careful planning for succession will prove valuable. |

| 2. Diverging interests. | It is common for family considerations to diverge from company interests, particularly in such areas as the position of incompetent family members. It is prudent to identify possible points of divergence and to deal with them before they become damaging. |

| 3. Non-family executives. | The growing importance of specialist skills requires the recruitment of non-family executives who frequently are reluctant to be subordinate to less competent family members. Well thought out and credible personnel policies are important. |

| 4. Narrow perspectives. | In a fast changing competitive environment it is valuable to introduce broad perspectives into the company’s decision making which sometimes test the flexibility of family entrepreneurs. |

| 5. Shortage of capital. |

Family companies frequently find it difficult to provide sufficient capital to take advantage of technical innovations without diluting family control. Careful financial planning is vital. |

Prudent and early consideration of the appropriate governance structures and mechanisms will contribute substantially to the satisfactory resolution of these issues.

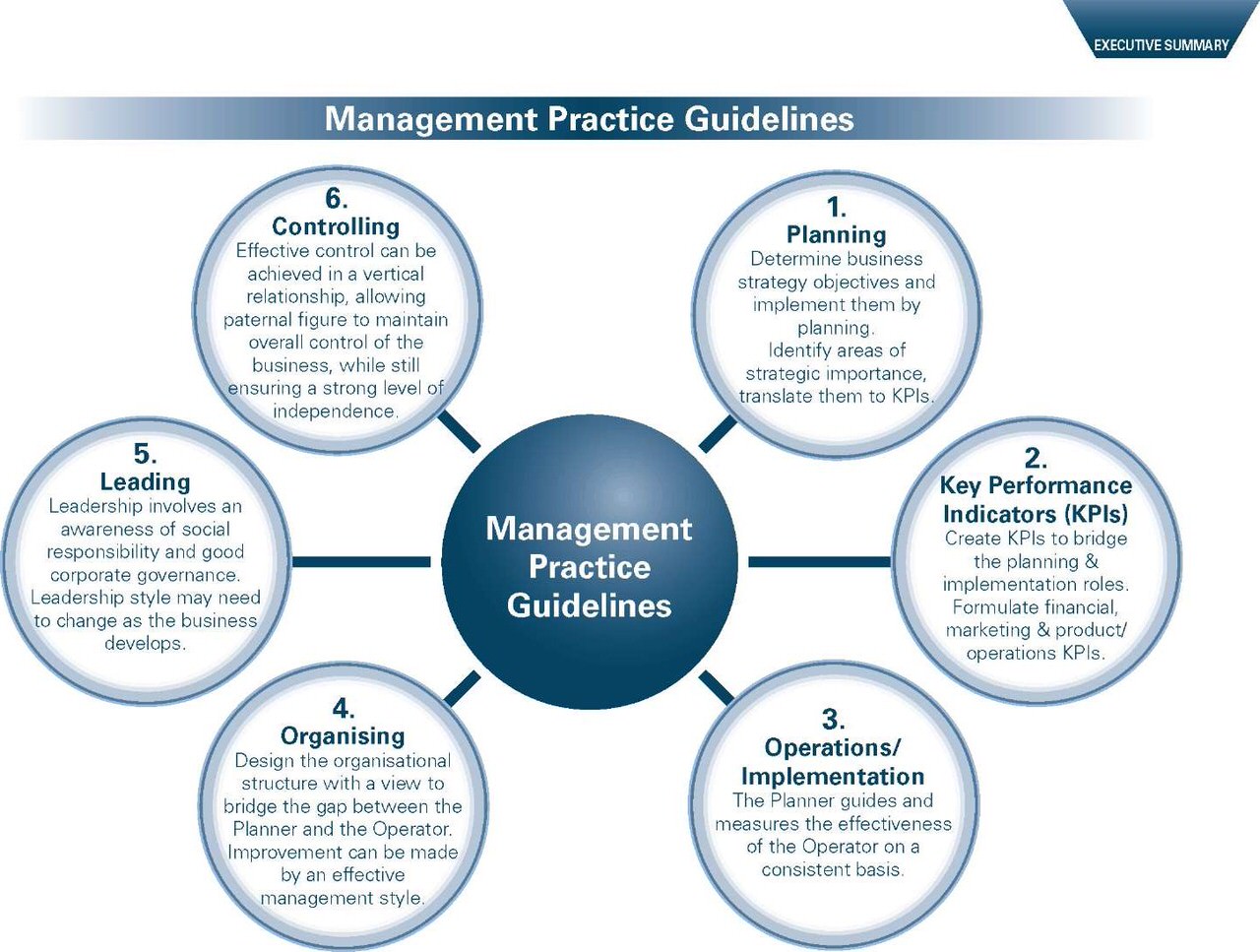

INTEGRATING MANAGEMENT PRACTICES WITH GOVERNANCE

The main focus of good corporate governance is on company boards and the controllers of smaller enterprises, because they alone can take the major decisions. But, in all but the smallest enterprises, once the main structures and policies have been put in place much detail must be added by those responsible for day-to-day management. Thus management practice has to be integrated with good governance.

There is no single simple system for governing well. Companies and other enterprises vary so much in size, ownership structure, complexity, traditions and the personalities involved that the principles of good governance have to be adapted to particular circumstances. This may take a great deal of thought and the purpose of these guidelines is to assist entrepreneurs and directors in selecting and developing the most appropriate systems for their organisations. If that is done well both the individual enterprises and the economy of Hong Kong will be strengthened.