IPOs

Introduction

- In February 2015, Russia signed the International Organisation of Securities Commissions’ Multilateral Memorandum of Understanding Concerning Consultation and Cooperation and HKEx of Information (the IOSCO MMoU)

- In January 2016, Hong Kong Stock Exchange (HKEx) issued a Russia Country Guide setting requirements for Russian companies on meeting the standards for protecting shareholders’ rights equivalent to those of Hong Kong

- Listing of depositary receipts (HDR) is possible only on the Main Board of the Hong Kong Stock Exchange

The current list of signatories to the IOSCO MMoUS is available at: http://www.iosco.org/library/index.cfm?section=mou_siglist

Hong Kong: A Leading International Stock Market

Source: SFC based on data from the World Federation of Exchanges and Bloomberg. Figures for Hong Kong includes the GEM board; figures for the London SE Group include those of London Stock Exchange and Borsa Italiana; figures for the NYSE Euronext include those of Euronext Amsterdam, Euronext Brussels, Euronext Lisbon and Euronext Paris; and figures for the Japan Exchange Group includes those of Tokyo Stock Exchange and Osaka Securities Exchange.

Benefits of listing on Hong Kong Stock Exchange (HKEx)

- HKEx – international exchange allowing full access to international investors and listing of foreign companies which meet its requirements

- Strategic position as gateway between Mainland China and rest of the world

- International listing venue of choice for Mainland China companies

- Currently 1,326 Chinese companies are listed on HKEx

- Chinese companies account for over 50% of Hong Kong’s listed market in terms of number of listed companies and over 80% in terms of market capitalisation

- Increasing number of overseas companies listed on HKEx in recent years

- Number of companies listed on HKEx as at February 2021 = 2,545

- 2,178 on the Main Board and

- 367 on GEM

- Deep primary and secondary market liquidity

- 154 new listings in 2020 raised HK$ 398 billion

- Hong Kong ranked 2nd in 2020 by IPO funds raised

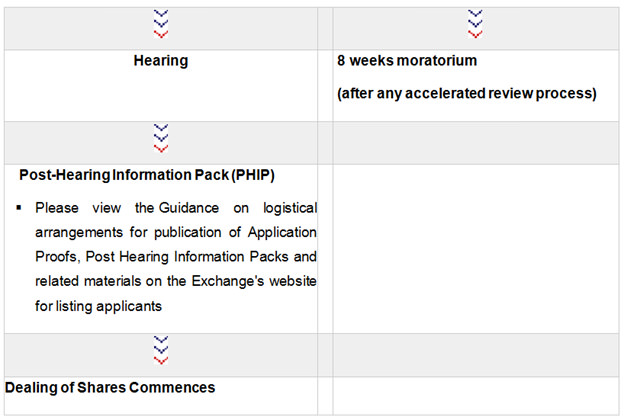

HKEx: Top IPO Funds Raising Platform

- The Stock Exchange of Hong Kong (SEHK or the HKEx or the Exchange) was the second largest IPO market in 2020 in terms of funds raised.

- A total of US$50.3 billion IPO funds was raised in Hong Kong in 2020.

- There were 154 new listings in 2020:

- o Main Board – 146

- o GEM – 8

Source: Hong Kong Exchanges and Clearing Limited and KPMG

Gateway to China: Shanghai-Hong Kong Stock Connect

- Shanghai-Hong Kong Stock Connect pilot programme launched in November 2014 allows HK and Mainland Chinese investors to trade shares listed on the other market via the exchange/clearing house in their local market

- South-bound trading – allows Mainland investors to trade following shares listed on HKEx:

- o constituent stocks of Hang Seng Composite LargeCap and MidCap Indexes; and

- o all H-shares with corresponding A shares listed on Shanghai Stock Exchange (SSE)

- North-bound trading – allows HK investors to invest in:

- o constituent stocks of SSE 180 and 380 Indexes; and

- o SSE-listed A shares that have corresponding H shares listed on HKEx

- Trading is subject to Aggregate and Daily Quotas

|

Aggregate Quota |

Daily Quota |

|

|

Northbound Trade |

RMB 300 billion | RMB 13 billion |

|

Southbound Trade |

RMB 250 billion | RMB 10.5 billion |

- Quotas apply on “net buy” basis: cross-boundary sales allowed regardless of quota balance

- Mainland investors restricted to institutional investors and individuals holding RMB500,000 in cash & securities

- All HK and overseas investors eligible for North-bound trading

- On 5 December 2016, Shenzhen-Hong Kong Stock Connect has been launched with the same principle and design as Shanghai Connect

Gateway to China: Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect

- Shanghai-Hong Kong Stock Connect Average Daily Southbound turnover as of January 2021 was HK$35,211 million

- Shanghai-Hong Kong Stock Connect Average Daily Northbound turnover as of January 2021 was RMB$61,298 million

- Shenzhen-Hong Kong Stock Connect Southbound Average Daily Southbound turnover as of January 2021 was HK$34,648 million

- Shenzhen-Hong Kong Stock Connect Average Daily Northbound turnover as of January 2021 was RMB$39,084 million

- Total trade volume for Southbound Trading for the period from November 2014 to October 2019 amounted to HKD8,748 billion

- Total trade volume for Northbound Trading for the period from November 2014 to October 2019 amounted to RMB17,411 billion

Source: Hong Kong Exchanges and Clearing Limited

Benefits of HK listing

- Established legal system based on English common law + regulatory framework = investor confidence

- Numerous tax advantages, currency convertibility, free transferability of securities and no restrictions on capital flow

- Opportunities for overseas cos to raise profile and visibility in China and Asia-Pacific region

- Branding opportunities for companies in the luxury goods sector – attracted listings of high profile companies such as Prada, Coach, Inc., L’Occitane and Samsonite

- China’s position as a major consumer of energy, minerals & metals has attracted mining & natural resource companies

- e.g. Swiss commodities giant Glencore International AG, Russia-based United Company Rusal PLC, Kazakhstan copper miner Kazakhmys PLC and Brazilian metals and mining company Vale S.A.

- Vale S.A = 1st overseas company to list on HKEx in form of Hong Kong Depositary Receipts (HDRs). HDR listings allowed on Main Board (but not GEM)

Overseas listings

|

Issuer |

Country of Operations/Headquarters |

Country of Incorporation |

Sector |

Year of Listing |

Funds Raised |

|

Glencore International plc |

Headquartered in Switzerland |

Jersey |

Natural Resources |

May 2011 |

77.75 |

|

RUSAL |

Russia |

Jersey |

Natural Resources |

January 2010 |

17.39 |

|

Mongolian Mining Corporation |

Mongolia |

Cayman Islands |

Natural Resources |

October 2010 |

5.81 |

|

PRADA SpA |

Italy |

Italy |

Luxury |

June 2011 |

19.23 |

|

Samsonite International SA |

Headquartered in United States |

Luxembourg |

Luxury Goods |

June 2011 |

10.09 |

|

L’Occitane |

France |

Luxembourg |

Luxury Goods |

May 2010 |

5.5 |

|

SECONDARY LISTINGS BY WAY OF INTRODUCTION |

|||||

|

Vale SA (HDR Listing) |

Brazil |

Brazil |

Natural Resources |

December 2010 |

|

|

Kazakhyms PLC |

Kazakhstan |

United Kingdom |

Natural Resources |

June 2011 |

|

|

Coach, Inc (HDR Listing) |

United States |

United States |

Luxury Goods |

December 2011 |

|

Hong Kong’s Markets

- Main Board – caters for established companies able to meet its profit or other financial requirements.

- GEM – a second standalone market for small and mid-sized companies, and has lower admission criteria than Main Board listings.

- The post-listing obligations of GEM and Main Board companies are broadly similar. Key difference – quarterly reporting is mandatory for GEM companies but only recommended for Main Board companies

Principal Listing Requirements

|

Main Board |

GEM |

|

|

Operating History and Management |

A Main Board applicant must have a trading record of not less than 3 financial years with:

Exception: Under the market capitalization/revenue test, the Exchange may accept a shorter trading record period under substantially the same management if the new applicant can demonstrate that:

|

A GEM applicant must have a trading record of at least 2 full financial years with:

|

Principal Listing Requirements (Cont’d)

|

Main Board |

GEM |

||||

|

Financial Tests |

Applicants must meet one of 3 financial tests below: |

A GEM applicant must have :

|

|||

| 1. Profit Test | 2. Market Cap/ Revenue Test | Market Cap/ Revenue / Cash flow Test | |||

|

Profit |

Profit in respect of the most recent financial year of not less than HK$20,000,000 and, in respect of the two preceding years, be in aggregate of not less than HK$30,000,000 |

||||

|

Market Cap |

At least HK$500 million (US$64 million) at the time of listing |

At least HK$4 billion (US$515 million) at the time of listing |

HK$2 billion (US$257 million) at the time of listing |

||

Principal Listing Requirements (Cont’d)

|

Main Board |

GEM |

||||

|

Financial Tests |

Applicants must meet one of 3 financial tests below: |

A GEM applicant must have :

|

|||

| 1. Profit Test | 2. Market Cap/ Revenue Test | 3. Market Cap/ Revenue / Cash flow Test | |||

|

Revenue |

– |

At least HK$500 million (US$64 million) for the most recent audited financial year |

At least HK$500 million (US$64 million) for the most recent audited financial year |

||

|

Cash flow |

– |

– |

Positive cash flow from operating activities of at least HK$100 million (US$13 million) in aggregate for the 3 preceding financial years |

||

Principal Listing Requirements (Cont’d)

|

Main Board |

GEM |

|

|

Public Float |

|

|

|

Spread of Shareholders |

|

|

|

||

Other Listing Requirements

- Accountants’ Report: A listing document must include an accountants’ report on the financial information for the track record period. The latest period reported on must end no more than 6 months before the date of the listing document.

- Independent non-Executive Directors: INEDs must make up at least 1/3 of the Board. The minimum number of INEDs is three, and one must have appropriate professional qualifications or accounting or related financial management expertise.

- Authorised Representatives: Issuers must appoint two authorised representatives – either 2 directors or a director and the company secretary.

- Share Registrar: Issuers must employ an approved share registrar in Hong Kong to maintain register of members.

- Audit Committee: Issuers must establish an audit committee made up of non-executive directors only. It must have a minimum of three members, at least one of whom must be an INED with appropriate professional qualifications or accounting or related financial management expertise. The majority of members must be INEDs, and it must be chaired by an INED.

- Remuneration Committee: Issuers must establish a remuneration committee chaired by an INED and comprising a majority of INEDs.

- Process Agent for Overseas Issuer: An overseas company must appoint a person authorised to accept service of process and notices on its behalf in Hong Kong.

- Compliance Adviser: Newly listed companies must appoint a compliance adviser for the period starting on the listing date and ending on the date of publication of results for the first full financial year commencing after listing (for MB issuers) and on the date of publication of results for the second full financial year commencing after listing (for GEM issuers).

- Compliance Officer (for GEM issuers only): GEM issuers must appoint one of their executive directors as a compliance officer.

Eligibility of Overseas Listing Applicants for HK listing

- Listing Rules provide for listing of companies incorporated in Hong Kong, the PRC, the Cayman Islands and Bermuda (Recognised Jurisdictions)

- Exchange has accepted companies from 25 jurisdictions (Acceptable Jurisdictions)* for listing:

- Austria, Australia, Brazil, the British Virgin Islands, Canada (Alberta, British Columbia and Ontario), Cyprus, England & Wales, France, Germany, Guernsey, India, Ireland, Israel, the Isle of Man, Italy, Japan, Jersey, Republic of Korea, Labuan, Luxembourg, Netherlands, Russia, Singapore, the United States (State of California, State of Delaware and State of Nevada).

- Exchange/SFC Joint Policy Statement Regarding the Listing of Overseas Companies (JPS) sets out criteria for acceptance of overseas listing applicants

- Key requirements relate to:

- shareholder protection standards and

- regulatory co-operation arrangements between statutory securities regulator(s) in the applicant’s jurisdiction of incorporation and its place of central management and control (if different) and Hong Kong’s Securities and Futures Commission (SFC)

*Source: https://www.hkex.com.hk/listing/rules-and-guidance/listing-of-overseas-companies/list-of-acceptable-overseas-jurisdictions?sc_lang=en

Eligibility of Overseas Listing Applicants (Cont’d)

Equivalent Standards of Shareholder Protection to Hong Kong

- Applicants incorporated in a jurisdiction new to listing must demonstrate how the laws and regulations of their country of incorporation, their constitutional documents and the arrangements they adopt as a whole meet the key shareholder protection standards set out in the Joint Policy Statement, i.e.:

- the matters which require approval by a super-majority of shareholders’ votes (e.g. material changes to the company’s constitutive documents or the voluntary winding-up of the company);

- a requirement that any change to the company’s constitutional document to increase an existing shareholder’s liability to the company must be agreed by the shareholder in writing;

- the appointment, removal and remuneration of auditors must be approved by a majority of shareholders or another body that is independent of the board; and

- proceedings at general meetings.

Eligibility of Overseas Listing Applicants (Cont’d)

- listing applicant incorporated in an Acceptable Jurisdiction can refer to HKEx’s Country Guide

- If arrangements set out in that Country Guide is adopted, the issuer will not need to provide a detailed explanation of how it meets the key shareholder protection standards

- applicants incorporated in other jurisdictions need to demonstrate how the laws and regulations of their country of incorporation, their constitutional documents and the arrangements they adopt as a whole meet the key shareholder protection standards set out in the JPS.

- May refer for guidance to the methods used to show equivalent shareholder protection standards specified in a Country Guide for an Acceptable Jurisdiction or methods used by those incorporated in one of the four Recognised Jurisdictions

Eligibility of Overseas Listing Applicants (Cont’d)

Regulatory Cooperation Arrangements

- Statutory securities regulator in listing applicant’s (a) jurisdiction of incorporation and (b) place of central management and control (if different) must:

- be a full signatory of the IOSCO Multilateral Memorandum of Understanding Concerning Consultation and Cooperation and HKEx of Information (the “IOSCO MMOU”); or

- have entered an appropriate bilateral agreement with the SFC providing adequate arrangements for mutual assistance and exchange of information

- Russia – signed the IOSCO MMoU on 16 February 2015

- previously barred by lack of bilateral arrangement on regulatory cooperation

- Several Russian oil giants, e.g. Lukoil, suspended listing plans in HK in 2013

- 2 Russian-based companies currently listed in Hong Kong: Rusal and IRC Limited

- neither is incorporated in Russia (Rusal = Jersey Co; and IRC Limited = HK Co)

- In January 2016, HKEx released a Country Guide on Russia*

- “Subject to Russian incorporated issuers meeting the conditions set out in the Country Guide, HKEx does not consider Russian shareholder protection standards to be materially different to its own”

*http://www.hkex.com.hk/-/media/HKEX-Market/Listing/Rules-and-Guidance/Other-Resources/Listing-of-Overseas-Companies/A-List-of-Acceptable-Overseas-Jurisdictions/cg_russia.pdf?la=en

Eligibility of Overseas Listing Applicants (Cont’d)

Regulatory Cooperation Arrangements (cont’d)

- Rusal is the only HK IPO restricted to institutional and professional investors or other investors ordering at least HK$1 million of shares each

- SFC refused to allow retail participation given Rusal’s high debt levels

- have entered an appropriate bilateral agreement with the SFC providing adequate arrangements for mutual assistance and exchange of information

- Gazprom was reported to be planning a Hong Kong listing in 2014 following its June 2014 listing of American Depositary Receipts (ADRs) on the Singapore Stock Exchange

Listing Hong Kong Depositary Receipts

- Companies can list on the Main Board in form of ordinary shares or depositary receipts (HDRs) representing a given number of underlying shares

- HDRs cannot be listed on the GEM and companies must list ordinary shares

- HDR listing framework was introduced in July 2008

- an initiative to encourage the listing of more foreign companies on HKEx

- Pre-2008: Listing Rules required companies to:

- list in the form of ordinary shares; and

- maintain a share register or a branch of their share register in Hong Kong

- Requirements effectively barred the listing of companies from jurisdictions which prohibit the issue of shares overseas or the maintenance of an overseas share register

- HDRs introduced as a solution aimed at encouraging listing of companies from Russia, India, Taiwan, Kazakhstan, Mongolia and Vietnam

Listing Hong Kong Depositary Receipts (Cont’d)

- Currently, only 1 company has listed HDRs on HKEx (which is a secondary listing)

- Japanese retail clothing business, Fast Retail-DRS (listed in Hong Kong in March 2014) – primary listing on the Tokyo Stock Exchange

Listing Requirements for HDR Issuers

- Same as those for issuers of shares

- Must satisfy the listing criteria set out in Chapter 8 of Main Board Rules

- No requirement for the issuer to be already listed on an overseas exchange

- Additional requirements set out in Chapter 19B of Main Board Rules

Listing Hong Kong Depositary Receipts (Cont’d)

Additional Requirements

- Public Float

- At least 25% of the issuer’s total issued share capital must be held by the public at all times

- HKEx may accept a lower public float of 15%-25% for companies with an expected market capitalisation at the time of listing of >HK$10 billion

- Total shares and shares represented by HDRs of the issuer held by the public on both HKEx and any relevant overseas market(s) will count towards the 25% (Rule 19B.08) for HDRs fungible with the underlying shares

- HDR Requirements

- HDRs must be freely transferable

- Securities the HDRs represent must be fully paid & free from all liens and restriction on the right of transfer to the depositary

- HDRs may be issued in respect of newly issued shares and/or in respect of shares placed with a depositary by existing shareholders provided that the issuer applies to be the issuer of such depositary receipts and assumes the obligations and duties imposed on an issuer by the Listing Rules

Listing Hong Kong Depositary Receipts (Cont’d)

Additional Requirements (cont’d)

- Register of HDRs

- An approved share registrar is required to maintain a HK register & transfers of the HDRs

- Only HDRs registered in HK are permitted to be traded on HKEx

- Depositary

- Depositary must:

- be duly incorporated and operate in conformity with its constitutional documents;

- be a suitably authorised and regulated financial institution acceptable to HKEx; and

- have adequate experience in issuing and managing DR programmes in HK or overseas

- Depositaries do not require a depositary licence

- Depositary must:

Listing Hong Kong Depositary Receipts (Cont’d)

Additional Requirements (cont’d)

- Deposit Agreement

- Issuers are required to enter into a Deposit Agreement with the depositary (acting as the agent of the issuer for the benefit of HDR holders)

- Agreement should

- stipulate rights, duties and obligations of the depositary, issuer, HDR holders, and custodian and to set out the fee structure of the depositary

- define the procedures for the replacement or removal of the depositary and/or the custodian and should specify the procedures for amending the agreement

- Governing law of agreement must be HK law or any other law that is generally used in accordance with international practice

Listing Hong Kong Depositary Receipts (Cont’d)

Additional Requirements (cont’d)

- Number of Authorised HDRs

- HDRs seeking to list on the Main Board can represent any number of shares

- Issuer may apply to list a greater number of HDRs than will be issued for capital raising to allow for future conversions of the underlying shares into HDRs

- Any combination of HDRs issued for capital raising or issued as a result of conversion of underlying shares will be permitted and listing approvals will be given for specific purposes and amounts

- No further application for listing HDRs is required for the creation of listed HDRs resulting from the conversion of shares into HDRs

- No further listing of HDRs is needed for any further issue of shares, provided that the original amount of listed HDRs is not exceeded

- Depositary will monitor the level of outstanding HDRs on a day-to-day basis

- Conversion of shares into HDRs will be rejected if this would cause the number of authorised HDRs to be exceeded

- Listing must be sought for all further issues of HDRs in excess of the amount of HDRs already listed

Listing Hong Kong Depositary Receipts (Cont’d)

Additional Requirements (cont’d)

- Rights of HDR Holders

|

Rights of shareholders |

Rights of HDR Holders |

|

| Nature of rights | reinforced by statute in the issuer’s jurisdiction of incorporation |

|

| Restrictions | local laws may prohibit foreign investors from holding shares directly | No such restriction |

- HDR holders who want to enforce their rights as shareholders may choose to convert their HDRs into shares of the issuer

- Exercise of voting rights: depositary will send information on resolutions and voting procedures to the HDR holders and will pass the HDR holders’ voting instructions back to the issuer

Listing Mining and Natural Resources Companies

- Qualifying a Mineral Company may earn the listing applicant a waiver from the requirement to meet the financial tests of Main Board Rule 8.05:

- major Activities (whether directly or through a subsidiary company):

- include exploration for, and/or extraction of, natural resources such as minerals or petroleum; and

- representing 25% or more of the total assets, gross revenue or operating expenses of the applicant and its subsidiaries.

- directors and senior management, taken together, have >5 years’ experience relevant to exploration and/or extraction activity the company is pursuing (Main Board Rule 18.04)

- Detailed in listing documents

- major Activities (whether directly or through a subsidiary company):

Other Key Requirements

- Portfolio of Indicated Resources* or Contingent Resources** Requirement

- applicant should have at least a portfolio of Indicated Resources (in the case of minerals) / Contingent Resources (in the case of petroleum) identifiable an accepted reporting standards and substantiated in the report of an independent expert (a Competent Person)

* based requirement in 2004 Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code)

** based on requirement in 2007 Petroleum Resources Management System (PRMS)

Listing Mining and Natural Resources Companies (Cont’d)

Other Key Requirements (cont’d)

- Rights of Active Participation

- Applicant must demonstrate it has the right to actively participate in the exploration for and/or extraction of resources through:

- control over a majority (by value) of assets it invested in and adequate rights over the exploration for and/or extraction of resources (usually means interest of >50%) & compulsory full disclosure of details of exploration and/or extraction rights; or

- adequate rights arising under arrangements acceptable to HKEx, giving it sufficient influence in decisions over the exploration for and/or extraction of the resources

- Arrangements which may be acceptable include joint ventures, production sharing contracts or specific government mandates.

- Applicant must demonstrate it has the right to actively participate in the exploration for and/or extraction of resources through:

- HKEx will adopt a purposive approach to determine what is appropriate in specific circumstances and places the onus on applicants to demonstrate the adequacy of their rights and sufficiency of influence.

Secondary Listing by way of Introduction

- Companies with primary listing on certain stock markets recognised by HKEx are eligible for secondary listing by way of introduction

- key criteria: comparable standards of shareholder protection to HK’s

- Moscow Exchange is not recognised*

- Russian applicants must make require a line-by-line analysis of Russian standards against HK’s

* See paragraph 91 of the HKEx/SFC Joint Policy Statement Regarding the Listing of Overseas Companies.

List of Approved Stock Exchanges: https://www1.mpfa.org.hk/eng/legislation_regulations/legulations_ordinance/guidelines/current_version/investment/files/Annex_A_to_III_4.pdf

Restrictions Following a New Listing

- Moratorium on Disposal of Shares by Controlling Shareholders

- Controlling shareholder indicated in listing document must not:

- dispose of, or enter into any agreement to dispose of or otherwise create any options, rights, interests or encumbrances in respect of, any of the shares which the listing document shows to be beneficially owned by him during the period commencing on the date by reference to which disclosure of the shareholding of the controlling shareholder is made in the listing document and ending on the date which is 6 months from the date on which dealings in the applicant’s securities commence on HKEx; or

- dispose of, or enter into any agreement to dispose of or otherwise create any options, rights, interests or encumbrances in respect of, any of the shares which the listing document shows to be beneficially owned by him, if such disposal or the exercise or enforcement of such options, rights, interests or encumbrances, would result in him ceasing to be a controlling shareholder in the period of 6 months commencing on the date on which the period referred to above expires.

- Offers for sale included in the listing document are not subject to these restrictions

- As long as minimum public shareholding requirement is met, controlling shareholder may purchase additional shares and dispose of such shares during the relevant periods

- Controlling shareholder indicated in listing document must not:

Restrictions Following a New Listing (Cont’d)

- No further Issues of Shares within 6 Months of Listing

- Further issues of shares or securities convertible into shares of a listed issuer, or the entering into of any agreement for such an issue, within 6 months from first day of trading are not allowed except for:

- the issue of shares pursuant to a share option scheme under Chapter 17 of the Listing Rules;

- the exercise of conversion rights attaching to warrants issued as part of the IPO;

- any capitalisation issue, capital reduction or consolidation or sub-division of shares; and

- the issue of shares or securities pursuant to an agreement entered into before the commencement of dealing and disclosed in the issuer’s listing document.

- Further issues of shares or securities convertible into shares of a listed issuer, or the entering into of any agreement for such an issue, within 6 months from first day of trading are not allowed except for:

Restrictions Following a New Listing (Cont’d)

- Restriction on Fundamental Change in the Nature of Business

- An issuer may not effect any acquisition, disposal or other transaction or arrangement (or series thereof) leading to a fundamental change in principal business activities described in its listing document 12 months after listing

- Waiver may be granted if:

- the circumstances are exceptional; and

- transaction is approved by a resolution of the issuer’s independent shareholders (any controlling shareholder, or if none any chief executive or directors, and their associates must abstain from voting in favour)

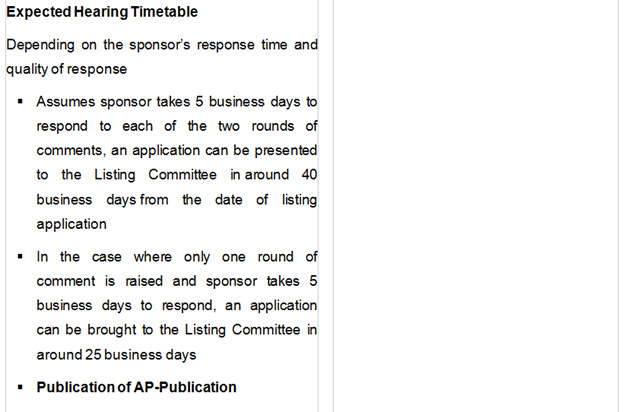

The Listing Process

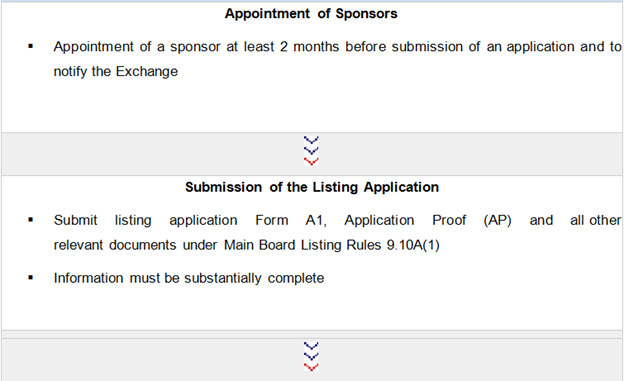

- Appointment of a Sponsor

- Applicant must appoint one or more sponsors

- Sponsors must:

- be corporate finance advisers holding relevant SFC licences;

- be independent of the applicant from the date of submission of the listing application until the date of listing; and

- comply strictly with the Listing Rules relating to sponsors

- Sponsors’ duties:

- preparing the issuer for listing, the submission of the application for listing;

- dealing with HKEx on all matters concerning the application; and

- ensuring issuer’s suitability to list, that information contained in the prospectus is complete and accurate in all material respects and that the issuer’s directors will be able to honour their obligations under the Listing Rules post-listing

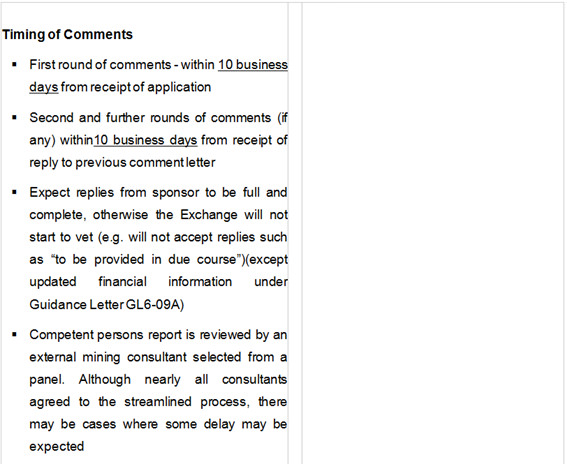

The Listing Process (Cont’d)

- Applying to List

- Sponsor will submit:

- the listing application form (Form A1)

- a draft of the listing document which must be substantially complete except for information which can only be incorporated at a later date (the Application Proof)

- all supporting documents; and

- the listing application fee

- Submission time:

- at least two months after the signing of the sponsor engagement letter

- if there is more than one sponsor, two months after the date the last sponsor to be appointed signed the engagement letter

- Others requirements:

- Application Proof must be published on HKEx’s website

- information contained in the Application Proof, the Form A1 and other documents submitted with Form A1 is required to be substantially complete, except for information that, by its nature, can only be finalised and included at a later date

- Sponsor will submit:

The Listing Process (Cont’d)

- Applying to List (cont’d)

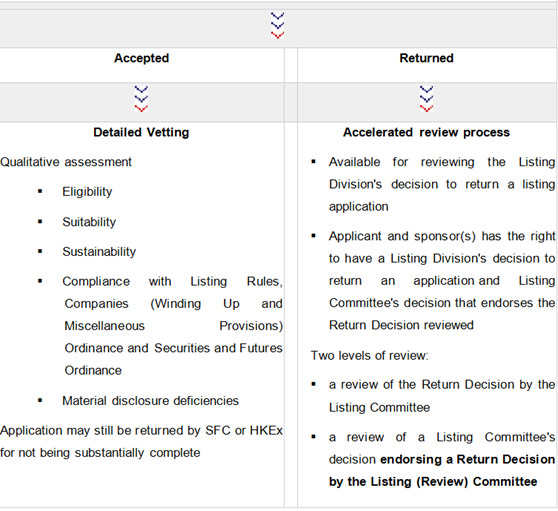

- Return of application:

- HKEx may return application if information is not considered to be substantially complete

- Returned of an application will be published on HKEx’s website (showing names of applicant and sponsor(s), date of decision to return application (Return Decision)

- Refund of initial list fees if first comment letter has not been issued

- Re-application:

- Resubmission of Form A1 and a new Application Proof 8 weeks after the date of the Return Decision

- Significance of requirement:

- sponsor’s due diligence process should be completed before application submission

- directors of the applicant should ensure that information in the Application Proof (and the final form listing document) is accurate and complete in all material respects and is not misleading or deceptive

- Return of application:

The Listing Process – Conduct of Due Diligence

- Directors of a listing applicant are primarily responsible for ensuring that the information included in the company’s listing document is accurate and complete in all material respects and not misleading

- Any person who authorises the issue of a listing prospectus containing information that is untrue or misleading in a material respect is criminally liable unless he can prove that he had reasonable grounds to believe that the information was true

- Company directors may be liable to compensate any person who suffers loss by reason of relying on an untrue statement.

- Listing Rules and Paragraph 17 of the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission (Code of Conduct) impose obligations on the listing applicant’s sponsor(s) to conduct due diligence on the listing applicant’s group in order to ensure information in the listing prospectus is true and complete in all material respects

- Paragraph 17.4(a) of the Code of Conduct – sponsors should:

- perform all reasonable due diligence before submitting a listing application except in relation to matters that by their nature can only be dealt with at a later date

- ensure that all material information as a result of due diligence on the listing applicant has been included in the Application Proof

The Listing Process – Conduct of Due Diligence (Cont’d)

- “Matters that by their nature can only be dealt with at a later date”

- matters which cannot be ascertained, finalised or fulfilled at the time a listing application is submitted

E.g.:

- – determination of the size and structure of an offering;

- – preparation of an indebtedness statement or a working capital forecast; and

- – a change in financial position since the most recent reporting period and changes in circumstances and developments or events arising subsequent to the submission of the application.

- Practice Note 21 to the Listing Rules & Paragraph 17 of the Code of Conduct set out specific steps sponsors should take when conducting due diligence on a new listing applicant

- Sponsors’ due diligence obligations depend on whether the information is included in an “expert section” of the listing document

- i.e. any report, valuation or opinion made by an expert (e.g accountants, property valuers or lawyers) who have consented to the inclusion of their report, valuation or opinion in the listing document

The Listing Process – Conduct of Due Diligence (Cont’d)

Expert Reports

- Standard: at the time of issue of the listing document, the sponsor (as a non-expert) must have no reasonable grounds to believe and must not believe that information in the expert report is untrue, misleading or contains any material omissions

- Main emphasis: sponsors cannot take expert reports at face value

- Due diligence on the report in 4 key areas:

- the expert’s qualification, experience and independence;

- the expert’s scope of work;

- the bases and assumptions underlying the report; and

- a review of the expert report in the light of all other information known to the sponsor to identify any inconsistency or irregularity

The Listing Process – Conduct of Due Diligence (Cont’d)

Non-Expert Sections of Listing Document

Non-expert sections = all sections of a listing document which are not “expert reports”

- Standard: sponsor must:

- “have reasonable grounds to believe and should believe that:

- the information in the non-expert sections of the listing document is true, accurate and complete in all material respects and not misleading or deceptive in any material respect;

- there are no matters or facts the omission of which would make any information in the non-expert sections of a listing document or any other part of the listing document misleading in a material respect”.

- approach due diligence with professional scepticism and a questioning mind

- undertake independent verification of all material information, including documents provided, and statements and representations made, by the listing applicant and its directors

- “have reasonable grounds to believe and should believe that:

The Listing Process – Conduct of Due Diligence (Cont’d)

Sponsors’ Record Keeping Obligations

- Standard: sponsor must:

- keep records, including relevant supporting documents and correspondence, within its control relating to:

- the transaction team and any subsequent variations within the transaction team;

- a due diligence record including the a due diligence plan and changes to the due diligence plan and reasons for them;

- the bases for the opinions, assurances and conclusions required under paragraph 17 of the Code of Conduct;

- the results of due diligence performed together with its assessment of these results

- records of the bases for the opinions, assurances and conclusions required should include internal discussions and any actions taken prior to these opinions and assurances being given or conclusions being reached

- retain records of listing assignment in HK for >7 years after completion or termination of the transaction

- keep records, including relevant supporting documents and correspondence, within its control relating to:

The Listing Process – Conduct of Due Diligence (Cont’d)

Sponsors’ Obligations

- Standard: sponsor must (cont’d):

- satisfy itself as to matters such as:

- the suitability of the listing applicant and its business for listing.

(Factors HKEx considers are set out in Guidance Letter GL68-13); - that the listing applicant satisfies the criteria for listing;

- that the applicant has established procedures, systems and controls for complying with the Listing Rules;

- that the applicant’s directors collectively and individually have the experience, qualifications and competence required for a director of a HK-listed company

- the suitability of the listing applicant and its business for listing.

- satisfy itself as to matters such as:

- Paragraph 17.6(f) of the Code of Conduct sets out the interview practices that a sponsor is expected to adopt in its interviews of the applicant’s customers, suppliers, franchisees and distributors. Sponsors must:

- select interviewees independently based on objective and proportional criteria, for example, those with whom the listing applicant has entered into high value transactions or entities with special or unusual characteristics; and

- carry out interviews directly with the person or entity selected with minimal involvement of the listing applicant

The Listing Process – Conduct of Due Diligence (Cont’d)

- Paragraph 17.6(f) of the Code of Conduct

- Sponsors must (cont’d) :

- follow up on any incomplete or unsatisfactory responses or outstanding matters and must keep a reasonably accurate and complete record of the interview

The Listing Process – Conduct of Due Diligence (Cont’d)

- HKEx requirements on due diligence set out standards that sponsors are expected to achieve without much practical guidance

- Charltons acted as the co-ordinating law firm in producing a set of “Hong Kong Due Diligence Guidelines”

- set out what is considered to be “good market practice” in the conduct of IPO due diligence

- produced by a group of some 50 investment banks, 20 law firms and representatives of the Big 4 accounting firms, all active in the Hong Kong IPO market

- available free online at www.duediligenceguidelines.com

The Listing Process (Cont’d)