Publications & presentations

The HKIoD

Introduction

The Hong Kong Institute of Directors is Hong Kong’s premier body representing professional Directors working together to promote good corporate governance and to contribute towards advancing the status of Hong Kong, both in China and internationally.

The Hong Kong Institute of Directors was incorporated in Hong Kong on 1 February 1996 under the Companies Ordinance. Members of Institute of Directors (UK) Hong Kong Branch converted to Members of The Hong Kong Institute of Directors (the “HKIoD”) on 1 July 1997.

The HKIoD currently provide its members with the following services:

- Continuing professional development and training programmes and activities in Cantonese, English and Putonghua for directors;

- Up-to-date information and publications relevant to the role of directors;

- A network of support and resources for directors and associations with equivalent bodies internationally.

Recent Developments in Corporate Governance in Hong Kong and the PRC

Hong Kong

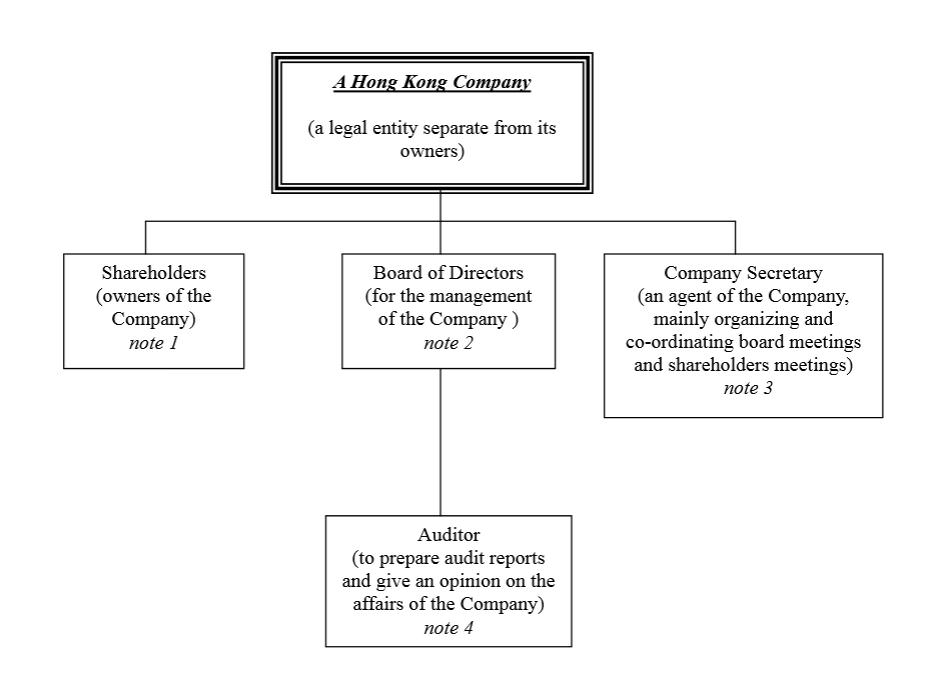

The Statutory Hong Kong Company Structure

In Hong Kong, the minimal basic statutory structure required of a company pursuant to the Companies Ordinance of Hong Kong is as follows:

- A company is an artificial person with a separate legal identity. It is separate from its shareholders and can enter into contracts, sue and be sued, or own property as a natural person. In Hong Kong, a company is required to have a minimum of two shareholders.

- Every Hong Kong company must have at least two directors. However, the articles of association of the company may provide otherwise, as long as the minimum number of directors does not fall below two. It is however not a requirement under the Companies Ordinance for a company to retain a supervisor.

- The company secretary is regarded as the chief administrative officer of the company, with power to bind the company in matters dealing with administration (Case of Panorama Developments (Guildford) Limited). Although the company secretary is an agent of the Company, whether, and to what extent, the secretary has power to act on behalf of the company is a question of fact.

- Every Hong Kong company is required to keep proper books of accounts which give a “true and fair view” of the company’s financial position. Unless the company is a dormant company, audited accounts must be presented to the members of the company at an annual general meeting within a certain time.

Corporate Governance in Hong Kong

The failure of a number of prominent corporations, both close to home and overseas, in recent years has put the spotlight on the serious consequences of lapses in corporate governance. Consequently corporate governance has been put very much at the top of the agenda, both in government policy discussions and in the minds of investors.

Hong Kong’s business community has continuously been urged to seek improvements in corporate governance and to uphold the highest professional ethics and integrity. A number of important corporate governance initiatives have been carried out or are under way. The Hong Kong government and other corporate regulatory bodies, such as the Stock Exchange of Hong Kong (the “HKEx”) and the Securities and Futures Commission (the “SFC”), are making good progress in bringing good corporate governance standards into effect. Steps taken include:

- the government, together with the SFC and the HKEx, has drawn up an action plan for 2003 to further improve corporate governance in Hong Kong – the “Corporate Governance Action Plan”;

- the publication by the HKEx of the Consultation Conclusions on Proposed Amendments to the Listing Rules Relating to Corporate Governance Issues in January 2003 (the original consultation paper was published in January 2002);

- the effective implementation of the Securities and Futures Ordinance in April this year;

- the release of two consultation papers in May with proposals to enhance the investor protection regime: one on the regulation of sponsors and independent financial advisers (released jointly by the SFC and the HKEx) and the other on empowering the SFC to take derivative actions for minority shareholders of a listed company (released jointly by the SFC and the Financial Services and the Treasury Bureau (FSTB));

- the introduction of the Companies (Amendment) Bill 2003 to the Legislative Council to implement some of the proposals for improving shareholder remedies made under Phase I of the Corporate Governance Review (the consultation paper for the Review was released in July 2001); and

- the release of recommendations in Phase II of the Corporate Governance Review by the Standing Committee on Company Law Reform for public consultation.

Corporate Governance Action Plan

The government, together with the SFC and the HKEx, has drawn up an action plan for 2003 to further improve corporate governance in Hong Kong.

The aim of the plan is to upgrade the quality of the equity market to maintain Hong Kong’s competitiveness as an international financial centre and the preferred support base for companies operating in the Mainland. The plan identified priority areas and devised a timeframe for implementation of the various improvement measures.

The plan is divided into five priority areas. They are:

Priority I: Upgrading the Listing Rules and Listing Functions

By 1st quarter 2003:

HKEx to complete streamlining of the listing process in order to improve quality control at the point of entry by focusing on critical matters.

By 2nd quarter 2003:

HKEx to introduce amendments to the Listing Rules and promulgate a revised Code on Best Practice to implement various corporate governance measures consulted on since January 2002 (i.e. the publication by the HKEx of the Consultation Conclusions on Proposed Amendments to the Listing Rules Relating to Corporate Governance Issues in January 2003 (the original consultation paper was published in January 2002) – see below separate heading).

By 4th quarter 2003:

The Administration to follow up the recommendations of the expert group appointed by the Financial Secretary scheduled for publication in March 2003 with a view to improving Listing Functions; and delineating the roles of FSTB, SFC and HKEx under the tiered regulatory structure.

By phases, starting from the 2nd quarter to 4th quarter 2003:

HKEx to amend the Listing Rules to improve the initial and continuing listing requirements and delisting procedures, following consultation started in July and November 2002.

Priority II: Tightening the regulation of IPO intermediaries

By 1st quarter 2003:

HKEx to consult the market on amendments to the Listing Rules to tighten regulation of IPO intermediaries, in particular sponsors and financial advisers. The aim is for implementation in 2nd half of 2003.

SFC to put forward proposals to the Standing Committee on Company Law Reform (SCCLR) on amendments to the Companies Ordinance to extend the prospectus-related liability to IPO sponsors, and possibly, other IPO intermediaries, for ensuring quality disclosure to investors. The consultation paper on the regulation of sponsors and independent financial advisers was jointly released by the SFC and the HKEx in May.

By 3rd quarter 2003:

FSTB, in consultation with the Hong Kong Society of Accountants, to finalise legislative proposals to enhance the regulation of the accountancy profession.

Priority III: Effective Roll Out of the Securities and Futures Ordinance (see below separate heading)

By 1 April 2003:

The plan is that the SFC should formulate an effective strategy for enforcing the SFO, in particular with regard to execution of “dual filing”, enquiries into corporate misconduct, regulation of licensed IPO sponsors, cooperation with HKEx in combating pre-IPO market manipulation, etc. The SFC to adopt a case specific approach as a corporate regulator under the SFO and “dual filing”. The SFO is currently in place.

Priority IV: Successful completion of SCCLR Phase II Corporate Governance Review (see below separate heading)

By 1st quarter 2003:

The Administration, the SFC and HKEx to render full support to the SCCLR for completion of its Phase II Review, with the SFC and HKEx putting forward further proposals to SCCLR, including amendments to the Companies Ordinance on related party transactions, shareholders’ rights, disclosure requirements, liability of professional advisers relating to misstatements in listing documents etc. The Consultation Paper on Proposals made in Phase II of the Review was published in June 2003.

Priority V: Early implementation of SCCLR Recommendations from its Phase I Corporate Governance Review

By 1st quarter 2003:

FSTB and SFC to release a joint consultation paper on empowering the SFC to conduct derivative actions on behalf of minority shareholders of a listed company, including legal issues, scope and effectiveness of remedies, and possible implementation arrangements. Consultation, which started in May 2003, was completed on 26 July 2003.

By 2nd quarter 2003:

FSTB to introduce to LegCo a Companies (Amendment) Bill to enhance corporate governance by implementing SCCLR Phase I recommendations relating to shareholders’ remedies.

By 4th quarter 2003:

FSTB, in consultation with the listed sector and the accountancy profession, to finalise and take forward a proposal to establish a Financial Reporting Review Panel to investigate financial statements of companies and enforce changes thereto.

Consultation Conclusions on Proposed Amendments to the Listing Rules Relating to Corporate Governance Issues

This is one of the priority areas identified in the Corporate Governance Action Plan announced by the Secretary for Financial Services and the Treasury.

In January 2002, HKEx issued a consultation paper – “Consultation Paper on Proposed Amendments to the Listing Rules Relating to Corporate Governance Issues”. This Consultation Paper looks at corporate governance requirements from the perspective of the Listing Rules. The consultation was part of HKEx’s ongoing efforts to strengthen the corporate governance practices of issuers in Hong Kong and ensuring Hong Kong’s standards are in line with the best current international practices, in light of its particular circumstances.

The HKEx has stated that the majority of the proposals will be adopted or adopted with modifications, and drafting of the revised Main Board and GEM Rules based on the consultation conclusions is now in progress. Included in the action agenda are amendments to the Listing Rules and the Code of Best Practice; completion of the streamlining of the listing process; and improvements to the initial and continuing listing requirements and de-listing procedures. The proposed rule changes do not include a requirement for quarterly reporting. However, it is proposed that a Code of Best Practice be adopted and that each company should be required to have at least three independent directors.

The HKEx’s efforts have been complemented by moves to strengthen the statutory obligations on listed companies through the introduction of revised standards in the SFO, in particular the enhanced regime for disclosure of interests in securities and the requirement for dual filing. HKEx’s efforts have also been complemented by proposals from the Standing Committee on Company Law Reform, including proposals for a statutory requirement for connected transactions to be approved by disinterested shareholders, a derivative right of action and the strengthening of the unfair prejudice remedy.

The HKEx recognised that there have been global developments in corporate governance since the consultation process began in January 2002 and the new policies arising from the consultation conclusions are a partial response to the prevailing issues.

There were 167 responses to the consultation, including submissions from issuers, market practitioners and a variety of organisations. Respondents generally supported most of the

proposals.

Minimum number of independent non-executive directors

The HKEx will amend the Main Board and GEM Rules to require issuers to appoint at least three independent nonexecutive directors (INEDs), as a move towards its long-term aim to increase the number of INEDs on the board. In addition, the HKEx will recommend as a good practice in the revised Code of Best Practice that INEDs comprise at least one-third of the board, with the one-third rounded down when it is not a whole number. There will be a one-year transitional period for issuers to comply with the new INED requirement, and the requirement will be reviewed two or three years after implementation.

Issuers will be required to inform the Exchange and publish an announcement immediately if the number of its INEDs falls below the minimum requirement. Issuers will be required to appoint a sufficient number of INEDs to meet the minimum requirement under the Rules within three months after the number of INEDs has fallen below the minimum number required.

The existing Main Board and GEM Rules set out the basic principles for determining independence of INEDs. The HKEx will include more guidance to assist issuers in assessing independence of INEDs. To ensure that INEDs are able to properly discharge their responsibility to provide an objective view on the assessment of issuers’ financial statements and participate in the audit committee, the HKEx will amend the rules to require

issuers to appoint at least one INED who has appropriate professional qualifications or experience in financial matters.

Code of Best Practice

The HKEx will adopt a balanced and disclosure-based approach to regulate board practices of issuers. The Code of Best Practice will contain two tiers of recommendations. The first tier will contain minimum standards of board practices. The second tier will be the recommended good practices serving as guidelines for issuers’ reference. Issuers will be required to include a report on corporate governance in their annual reports and disclose information relating to

their corporate governance practices in the report. They will also be required to disclose any deviation from the minimum standards in their report on corporate governance.

The HKEx believes the proposed rule changes will strengthen its existing rules and Code of Best Practice, particularly from the perspective of protecting shareholders’ rights, advancing board practices and increasing the transparency of issuers. The HKEx also believes the strengthening of the Rules is an ongoing process and will continue to review the Rules from time to time to ensure they are in line with the best current market practices and international standards. In promoting high standards of corporate governance, the HKEx can assist by setting the minimum standards of board practices in the Rules and Code of Best Practice. However, the HKEx is of the view that the ultimate success of the Rules changes will depend upon the full support and commitment from issuers and directors.

Securities and Futures Ordinance

The SFO, which came into force on 1 April 2003, was one of the five priorities detailed in the Corporate Governance Action Plan. Significant areas of changes brought about by the SFO are notably the following:

- corporate disclosure enhancements embodied in Part XV – the time limit for disclosure of dealings has been reduced from five days to three business days and the percentage disclosure limit for substantial shareholders has been reduced from 10% to 5%.

- The scope of investigations into listed companies conducted by the SFC has been widened considerably. The SFC can now more effectively enquire into corporate misconduct which prejudices shareholders’ interests.

- The market misconduct provisions of the SFO establish civil and criminal liability for six separate market misconduct offences including the provision of false and misleading information inducing securities transactions. There are also now private rights of action for investors to bring an action against listed companies or their responsible officers to seek compensation for losses caused by false or misleading communications by listed companies or market misconduct.

- The new “dual filing” regime for listing applications and ongoing disclosures, partnered with the HKEx, introduced through changes to subsidiary legislation, will strengthen disclosure standards, since misleading and false disclosure can give rise to both civil and criminal consequences. The SFC has been working closely with the HKEx to ensure that the system operates efficiently and effectively.

- additional powers to be given to the SFC to obtain documents and seek explanations from parties closely related to a listed company under investigation.

- the establishment of the Market Misconduct Tribunal as a civil tribunal to deal with all types of market misconduct and not just insider dealing as was previously the case.

- exemption from civil liability for auditors who report fraud or misconduct committed by listed companies to the SFC.

Three months after the SFO regime commenced in Hong Kong, the SFC announced that it would take a tough stance against dishonest non-compliance with Part XV. In a press release, the SFO stated that from 1 July 2003, its prosecution efforts on Part XV will focus on (in order of priority):

- non-disclosure of interests;

- false or misleading disclosure; and

- late disclosure (which could also amount to non-disclosure).

Corporate Governance Review by the Standing Committee on Company Law Reform

A review of corporate governance has been conducted by the Standing Committee on Company Law Reform (“SCCLR”), with the aim of identifying areas of possible improvement in Hong Kong’s corporate governance environment.

Founded in 1984, the SCCLR was formed to advise the Financial Secretary on amendments to the Companies Ordinance and related ordinances to ensure that Hong Kong’s company law continues to meet the needs of the business community. Members include lawyers, accountants, company secretaries, businessmen, academics, representatives of government departments and regulatory bodies.

Phase 1 of the review was completed in July 2001 and a public consultation paper – “Corporate Governance Review by The Standing Committee on Company Law Reform – A Consultation Paper on Proposals Made in Phase I of the Review” was published with a view to addressing public concerns regarding corporate governance standards in Hong Kong.

The 2001 Consultation Paper contained a total of 21 proposals regarding directors, shareholders and corporate reporting. Some of these proposals are being taken forward in the form of proposed amendments to the Companies Ordinance, whilst others (e.g., empowering the SFC to conduct derivative actions for minority shareholders) are subject to further consultation.

The findings of the following four consultancy studies on corporate governance were also published: –

(a) A Comparative survey and analysis of the development of corporate governance standards in other jurisdictions;

(b) A survey of the attitudes of international institutional investors towards Corporate Governance Standards in Hong Kong;

(c) The roles and functions of audit, nomination and remuneration committees; and

(d) An economic analysis co-relating the performance of listed companies with their shareholders’ profile.

The first three studies were conducted by Professor Judy Tsui of the Hong Kong Polytechnic University and Professor Ferdinand Gul of the City University of Hong Kong. The fourth study was conducted by Professor Larry Lang, Mr C K Low and Dr Raymond So of the Chinese University of Hong Kong.

The SCCLR on 11 June 2003 issued its Corporate Governance Review Phase II Consultation Paper which details further proposals to enhance Hong Kong’s corporate governance regime. Publication of this Consultation Paper is one of the targets detailed in the Corporate Governance Action Plan announced by the Secretary for Financial Services. The SCCLR’s proposals relate to different aspects of directorship (including directors’ roles, duties, qualifications, training and remuneration, as well as connected transactions, board procedures and board committees etc.); shareholders’ rights and conflicts of interests; corporate reporting with focus mainly on external auditors and corporate regulation.

On proposals relating to “Directors”:

SCCLR recommends the adoption of a set of non-statutory guidelines on directors’ duties, and re-affirms its previous proposals to improve the general legal position on self-dealing by directors, as well as proposals on shareholders’ approval for significant transactions involving directors.

For transactions between directors or connected parties with an associated company, the SCCLR is inclined to adopt, in relation to the definition of “associate”, the test of control through the exercise of dominant influence to determine whether the company is associated with another company. The approval of disinterested shareholders would be required in relation to such transactions.

The Consultation Paper also contains extensive recommendations on Board procedures, the structure of the Board and the role of non-executive directors. SCCLR holds the view that the Listing Rules should make audit committees mandatory, with at least one independent non-executive director on the committee with financial expertise. The establishment of nomination and remuneration committees should remain as a best practice.

Noting the importance of directors’ qualifications and training, SCCLR recommends that the Code of Best Practice (of the Listing Rules) should contain a requirement that a listed company should disclose the arrangements made to train its directors.

With increasing public concern over directors’ remuneration, SCCLR recommends that listed companies should disclose individual director’s remuneration packages by name in their annual financial statements.

On proposals relating to “Shareholders”:

SCCLR re-confirms its previous proposals on self-dealing by controlling shareholders, but seeks views on how “controlling shareholders” should be defined for the purpose of connected transactions. SCCLR also makes a number of proposals to enhance the effectiveness and transparency of company general meetings.

On proposals relating to “Corporate Reporting”:

SCCLR puts forward recommendations to enhance and strengthen the functioning and quality of external auditors. These include imposing a duty on employees (in addition to directors) to provide information to auditors and that there should be mandatory rotation of the lead and concurring partners every five years.

On proposals relating to “Corporate Regulation”:

SCCLR seeks the views of the public on whether, in principle, statutory backing should be given to the Listing Rules together with tougher statutory sanctions including civil fines against non-compliance. SCCLR also seeks views on whether the regulation of unlisted companies needs to be improved.

The SCCLR will consider comments received from the public on the proposals before making recommendations to the Government on specific measures to upgrade Hong Kong’s corporate governance standards. The public consultation will end on 30 September 2003.

Following is a list of major proposals in “A Consultation Paper on Proposals made in Phase II of the Corporate Governance Review”

(1) Proposals relating to different aspects of Directorship

* The SCCLR reconfirms some of its previous proposals (Chapter 3 sections 8 , 9 & 10) as follows –

(a) The Companies Ordinance should set out the general prohibition against directors voting at board meetings on transactions in which they have an interest, with exceptions for immaterial transactions.

(b) For transactions or arrangements above a certain threshold value involving directors or persons connected with directors, the approval of disinterested shareholders voting on a poll should be obtained.

(c) Requirements for disinterested shareholders’ approval for connected party transactions should be extended to transactions between a company and an “associated company” and not limited to transactions between the company and “subsidiaries”. The views of the public are being sought on whether the test of control through the exercise of dominant influence should be adopted for the purpose of defining “associated companies”.

(d) These proposals should apply to all listed and unlisted public companies in Hong Kong including companies registered under Part XI of the Companies Ordinance.

* In relation to directors’ duties, SCCLR recommends the adoption of non-statutory guidelines stating the principles of law. (Chapter 3, section 7)

* Board Procedures including the frequency of full board meetings and the delivery of agenda and board papers to all directors should be improved and included in the Code of Best Practice. (Chapter 3, section 12)

* The Listing Rules should be amended to make it mandatory that all listed companies should establish an audit committee. At least one independent non-executive director (INED) on a listed company’s audit committee should have some “financial expertise”. (Chapter 3, section 13)

* The Code of Best Practice should be amended to make the establishment of nomination and remuneration committees in listed companies a recommended best practice. (Chapter 3, section 13)

* The boards of listed companies should have a minimum of three INEDs, and where nomination committees exist, they should take a more systematic approach to identifying suitable NEDs. The Code of Best Practice should provide that listed companies should disclose the system for deciding the remuneration of their NEDs in their annual reports. The Code should also provide that directors of listed companies should disclose the number of other directorships which they hold in their companies’ annual reports. (Chapter 3, section 14)

* On directors’ qualification and training, the Code of Best Practice should contain a requirement that a listed company has to disclose the arrangements made to train its directors, and in particular new NEDs, on both an initial and continuous basis. (Chapter 3, section 15).

* The Listing Rules and the Companies Ordinance should be amended to require listed companies to disclose full details of all elements of individual directors’ remuneration package. The Companies Ordinance should be amended to require unlisted public companies or private companies, if directed to do so by holders of not less than 5% of all the nominal issued share capital of the company, to disclose full details of all elements of individual directors’ remuneration package. SCCLR also seeks views on the need to make specific disclosures on key aspects of a company’s remuneration policy. (Chapter 3, section 16)

(2) Proposals relating to Shareholders’ Rights and Conflicts of Interests

* SCCLR reconfirms its previous proposals (Chapter 4, section 17) that –

(a) Subject to certain exceptions (e.g., transactions entered into by liquidators) connected transactions must be disclosed and subject to a disinterested shareholders’ vote made by poll.

(b) The definition of connected person in relation to controlling shareholder should be incorporated in the law.

(c) The court’s power to determine whether or not a transaction constitutes a waste of corporate assets should be preserved.

(d) Failure to comply with the rule should render the transaction voidable at the instance of the company or any shareholder.

(e) These proposals should apply to all listed and unlisted companies in Hong Kong including companies registered under Part XI of the Companies Ordinance.

* SCCLR seeks public’s view on how controlling shareholder should be defined for the purpose of connected transactions; i.e., whether it should be defined in accordance with a substantial shareholder under the Listing Rules; a controlling shareholder under the Listing Rules; a subsidiary as defined in the Companies Ordinance or a person having the right to exercise dominant influence over the company.

* To enhance the effectiveness and transparency of company general meetings, the SCCLR makes the following proposals –

(a) A Hong Kong company should be permitted to hold a general meeting at more than one location. The meeting should take place at the venue specified by the notice of the meeting which would be regarded as the principal venue, but subsidiary or satellite venues should be allowed. Both visual and audio real time communications should be permitted by legislation.

(b) The timing of the Annual General Meeting (AGM) should be changed to within a certain period after the end of each financial year of the company. For private companies with a share capital and companies limited by guarantee, the period should be nine months and for other public companies, the period should be six months.

(c) Notices should be given personally or sent by post to shareholders unless the shareholders agree to adopt electronic means of communication including the use of personal identification numbers.

(d) There should be a requirement of minimum information to be given in the meeting notices regarding the proposed resolutions.

(e) Absentee voting should be permitted. Electronic voting should be permitted and there should be rules and guidance for such voting procedures.

(f) the empowerment of proxies should be reformed.

(3) Proposals relating to Corporate Reporting with focus mainly on external auditors

* The Companies Ordinance should be amended to remove the requirement for the shareholders to fix the auditors’ remuneration or determine the manner of how it is to be fixed (Chapter 5, section 22).

* To improve auditors’ access to information, the present requirement for directors and officers of the company to provide such information and explanations as the auditors think necessary should be extended to include employees.

* Outgoing auditors should be required to volunteer material information to their successors.

* The Government and the Hong Kong Society of Accountants (HKSA) should undertake work to identify the types of non-audit services which are incompatible with the principles underlying auditor independence and enhance the disclosure of the nature and value of all services provided by auditors to audit clients, defining what falls into the categories of audit, audit-related and non-audit.

* There should be mandatory rotation of both the lead and concurring audit partners every five years.

(4) Proposals relating to Corporate Regulation

* The SCCLR seeks further views from the public on whether statutory backing should be given to the Listing Rules together with tougher statutory sanctions including civil fines against non-compliance and whether the regulation of unlisted companies needs to be improved and if so, how should this be addressed in terms of institutional change. (Chapter 6)

Conclusion

In closing, it is clear from the government initiatives that there is considerable emphasis in Hong Kong on improving corporate governance. The government, the SFC and the HKEx appear determined to work cohesively in achieving this goal – clearly this is a direct response to previous criticisms that there are many people involved in setting corporate governance requirements and a need for one body to take responsibility for corporate governance to make sure that all parties are co-ordinated and working together. It is also interesting to note that investor – led corporate governance initiatives – for example the beginning of shareholder activism at AGMs (previously very rare in Hong Kong) has become increasingly common over recent months in Hong Kong.

The PRC

Corporate Governance in the PRC

Regulators and policy makers in the PRC have come a long way since the PRC’s implementation of the Company Law which went into effect on 1 July 1994. The year 2002 – “The Year of Corporate Governance’, was a title bestowed by the Chinese Securities Regulation Committee (CSRC). This underlines the increased importance given by the authorities to the improvement of corporate governance practices in China. As China begins to implement its commitments under the WTO, the policy focus on corporate governance in China sends a strong signal that the government is committed to further market reforms with intensified efforts to develop modern corporate governance practices.

China with its background of a state-owned planned economy, has followed a unique path in market reforms, it enjoys the learning advantage of a late starter, taking best practices from other economies to avoid pitfalls. It has creatively borrowed and applied market concepts and lessons from the experience of other countries

Evolution of Corporate Culture in China

China in modern times has a relatively short history of corporate culture.

The period of transition to a more market – orientated economy:

| Period | Events |

| 1978 to 1984 |

1. Reform of SOEs by giving SOEs more autonomy in management; 2. Further decision-making power is granted by the government to these SOEs; 3. SOEs are given the ability to retain some profits. |

| 1984 to 1987 |

1. SOEs started paying income tax rather than turning over profits to the State; 2. However there was still little distinction between the functions of the government and those of the SOEs. |

| 1987 to 1992 |

1. There was a gradual separation of ownership and management in SOEs when the contractual system was implemented (where some SOEs were contracted by the State to manufacture or provides services in return for fees); 2. SOEs were required to assume own responsibilities for profits and losses. 3. The early 1990s saw the establishment of the Shanghai and Shenzhen Stock Exchanges and 1993 saw the listing of the first mainland companies on the Hong Kong Stock Exchange. |

| 1993 until present |

1. Implementation of the PRC Company Law in 1 July 1994 which provides a legal framework for the structure of modern PRC enterprises; 2. Creation of PRC capital markets allowed SOEs to become listed companies; 3. Current rapid growth of the non-State sector, including private enterprise and foreign investment companies. 4. China now has the second largest equity capital market in Asia (after Japan) in terms of market capitalisation. |

Major corporate governance issues for listed companies in China

- State ownership: the state owns about 50% of all the shares of listed companies leading to a lack of clarity as to who represents the state as a shareholder in the listed companies during the transition;

- Concentrated ownership: the largest shareholder, which is usually the state, holds on average about 45% of the total shares in a listed company;

- Related party transactions between a controlling shareholder or a group company and the listed company are often detrimental to minority shareholders;

- Boards consist of mainly executive directors. They are few independent directors, leading to “insider control”;

- Executives underpaid – the management of major listed State Owned Enterprises are still chosen by the government. There lacks a market for professional managers and proper incentives; and

- Information disclosure is in many cases not timely and accurate, and not easily understandable by investors.

Role of the CSRC

The CSRC is the centralised market regulatory body in China and has played a crucial role in improving the quality of listed companies by selecting them on merit via a listing committee. The development of securities markets in China since the commencement of the opening and reform of China inevitably led to the establishment of a centralised market regulatory body. The establishment of the State Council Securities Commission (the “SCSC”) and the China Securities Regulatory Commission (the “CSRC”) in October 1992 marked the formation of this regulatory body. The SCSC is the State authority responsible for exercising centralised market regulation. The CSRC is the SCSC’s executive branch responsible for conducting supervision and regulation of the securities markets in accordance with the law.

In April 1998, pursuant to the State Council Reform Plan, the SCSC and the CSRC were merged to form one ministry rank unit directly under the State Council. Both the power and the functions of the CSRC have been strengthened after the reform. A centralised securities supervisory system was thus established.

The CSRC’s basic functions are:

- To establish a centralised supervisory system for securities and futures markets and to assume direct leadership over securities and futures market supervisory bodies.

- To strengthen the supervision over securities and futures business, stock and futures exchange markets, listed companies, fund management companies investing in the securities, securities and futures investment consulting firms, and other intermediaries involved in the securities and futures business.

- To raise the standard of information disclosure.

- To prevent and handle financial crises.

- To organise the drafting of laws and regulations for securities markets. To study and formulate the principles, policies and rules related to securities markets.

- To formulate development plans and annual plans for securities markets.

- To exercise centralised supervision of securities business.

Its major responsibilities are:

- Studying and formulating policies and development plans regarding securities and futures markets; drafting relevant laws and regulations on securities and futures markets; and working out relevant rules on securities and futures markets;

- Supervising securities and futures markets and exercising vertical power of authority over regional and provincial supervisory institutions of the market;

- Overseeing the issuance, trading, custody and settlement of equity shares, convertible bonds, and securities investment funds; approving the listing of corporate bonds; and supervising the trading activities of listed government and corporate bonds;

- Supervising the listing, trading and settlement of domestic futures contracts; and monitoring domestic institutions engaged in overseas futures businesses in accordance with relevant regulations;

- Supervising the behaviour of listed companies and their shareholders who are liable for relevant information disclosure in securities markets;

- Supervising securities and futures exchanges and their senior management in accordance with relevant regulations, and securities associations in the capacity of the competent authorities;

- Supervising securities and futures companies, securities investment fund managers, securities registration and settlement companies, futures settlement institutions, and securities and futures investment consulting institutions; approving in conjunction with the People’s Bank of China, the qualification of fund custody institutions and supervising their fund custody business; formulating and implementing rules on the qualification of senior management for the above-mentioned institutions; and granting qualification of the people engaged in securities and futures-related business;

- Supervising direct or indirect issuance and listing of shares overseas by domestic enterprises; supervising the establishment of securities institutions overseas by domestic institutions; and supervising the establishment of domestic securities institutions by overseas organizations;

- Supervising information disclosure and proliferation related to securities and futures and being responsible for the statistics and information resources management for securities and futures markets;

- Granting, in conjunction with relevant authorities, the qualification of law firms, accounting firms, asset appraisal firms, and professionals in these firms, engaged in securities and futures intermediary businesses, and supervising their relevant business activities;

- Investigating and penalizing activities violating securities and futures laws and regulations;

- Managing the foreign relationships and international cooperation affairs in the capacity of the competent authorities; and

- Any other duties as commissioned by the State Council.

The CSRC has one chairman, four vice-chairmen, one secretary general, and two deputy secretaries generals. It has 13 functional departments or offices, 3 subordinate centers, and one special committee. It also has 10 regional offices set up in key cities around the country and a missionary office in every province, autonomous region, cities directly under the jurisdiction of the State Council, and cities enjoying the provincial-level status in the state economic plan.

Recent Important Initiatives

Introduction of a Code of Corporate Governance

This is the first developed and enforced code in relation to corporate governance practices for Chinese listed companies. The Code, issued on 7 January 2001, is mandatory for all listed companies and will be incorporated into the listing rules of the PRC’s two stock exchanges. Consistent with the basic principles of the Company Law, the Securities Law and other relevant laws and regulations, as well as the commonly accepted standards in international corporate governance, the Code of Corporate Governance for Listed Companies (the “Code”) is formulated to promote the establishment and improvement of corporate structures and systems by listed companies, to standardise the operation of listed companies and to develop the securities market of the PRC.

The Code is the major measuring standard for evaluating whether a listed company has a good corporate governance structure, and if major problems exist with the corporate governance structure of a listed company, the securities supervision and regulation authorities may instruct the company to make corrections in accordance with the Code.

- The Code stipulates the rights and responsibilities of shareholders, directors, the management, stakeholders, and information disclosure

- It protects shareholders’ rights as the basic goal of corporate governance;

- It seeks to ensure equitable treatment of shareholders, including minority and foreign shareholders;

- It seeks to ensure that related party transactions are fair and transparent, and are agreed by the independent directors

- It calls for shareholder activism and for a role to be played by institutional investors.

System of Independent Directors for Chinese Listed Companies

On 16 August 2001, the CSRC overhauled the insider- controlled board structure traditionally evident in most PRC companies by promulgating the Guidelines for Introducing Independent Directors to the Board of Directors of Listed Companies. These Guidelines require at least one-third of the board of directors of PRC listed companies to be independent directors.

The Guidelines also require that independent directors spend enough time on the companies in which they hold directorships. One director may not hold more than 5 directorship positions concurrently. Further, it is required that independent directors must be “adequately active” (in accordance with the Guidelines) in the affairs of listed companies, their roles must not be merely “ornamental”.

In brief, the Guidelines define “independence” as independent from:

- controlling shareholders;

- management; and/or

- not having major business relationships with the listed company concerned.

The independence of candidates for independent directors must be assessed and approved by the CSRC before they can be voted to be independent directors at shareholders’ meetings. Candidates for independent directors must make a public declaration on their independence and his/her particulars relevant to determining independence must be publicized in newspapers. Independent directors can not work in a listed company for more than 6 years.

Major roles and responsibilities of independent directors include:

- protection of shareholders’ rights and the interests of the company – paying particular attention to minority interests;

- vetting and approval of major related party transactions;

- sitting as chairs of the auditing, remuneration and nomination committees of a listed company – a major constituent of these committees must be made up of independent directors.

Compulsory Training for Directors of Listed Companies and Investors Education

The CSRC currently provides monthly training classes for independent director candidates in Shanghai and Beijing. It has trained over 5,000 independent director candidates during the last 10 months. There are also monthly training courses for directors already on the board of listed companies held by the two stock exchanges, which aim to train all the directors in three years.

The objectives of the compulsory training is to equip directors with a broad knowledge and understanding of the applicable rules and regulations for listed companies, as well as to keep directors informed of the latest changes and developments in the securities industry. The CSRC has organized and held these training courses in the past with the assistance of academic institutions such as the Tsinghua University.

In addition, the CSRC holds various investors education sessions in major cities throughout China and through media, including the internet.

Other corporate governance measures include requirements for quarterly reporting by listed companies and the timely publication of announcements. The Chinese authorities however recognise that although much has been achieved, general standards and a number of recent highly-publicised scandals mean that there is little room for complacency. The CSRC Chairman recently commented that the securities market would not develop without a crack-down on securities fraud.