Establishing Investment Funds in Hong Kong

-

1. Introduction

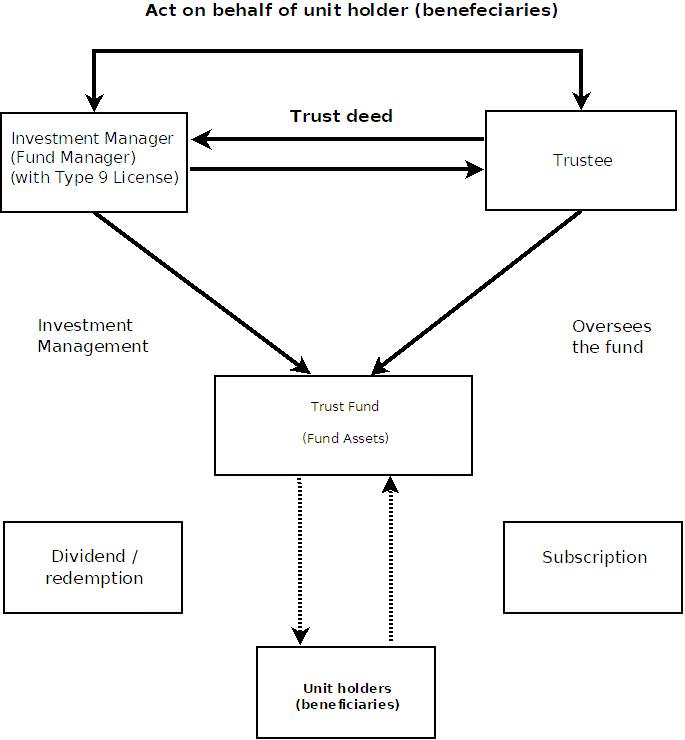

Hong Kong is an international asset management and fund distribution centre with over 2,000 retail investment funds authorised by the SFC. The two principal types of fund structures offered in Hong Kong are unit trusts and corporate funds. As of 31 August 2020, it is also possible to establish funds in the form of Limited Partnerships. Funds offered in Hong Kong, whether publicly or privately, can be established in Hong Kong or offshore.

Funds can be established in Hong Kong either in corporate form as open-ended fund companies (OFCs), Limited Partnership Funds (LPFs) or in the form of a unit trust. OFCs are incorporated under Part IVA of the Securities and Futures Ordinance (Cap. 571) (the SFO) which was implemented on 30 July 2018 specifically to allow open-ended funds to be set up in Hong Kong in corporate form; previously this had been prevented by restrictions on capital reduction under Hong Kong’s Companies Ordinance (Cap. 622 of Laws of Hong Kong) (the CO). Prior to the implementation of the OFC regime, many of the funds offered in Hong Kong were incorporated offshore, typically as Cayman Islands exempted companies, given the popularity of corporate fund structures. A key aim of the 2018 OFC regime was thus to encourage more funds to domicile in Hong Kong.

Significant improvements were made to the regime for private OFCs in September 2020, removing the restrictions on the types of assets private OFCs can invest in and allowing intermediaries licensed or registered for Regulated Activity Type 1 to act as their custodians. The removal of investment restrictions is particularly welcome and is expected to encourage more private funds to domicile in Hong Kong.

This note provides a summary of the requirements for establishing and offering funds in Hong Kong in the form of an OFC and unit trust and for marketing and distributing an offshore fund in Hong Kong.

OFC Funds Overview

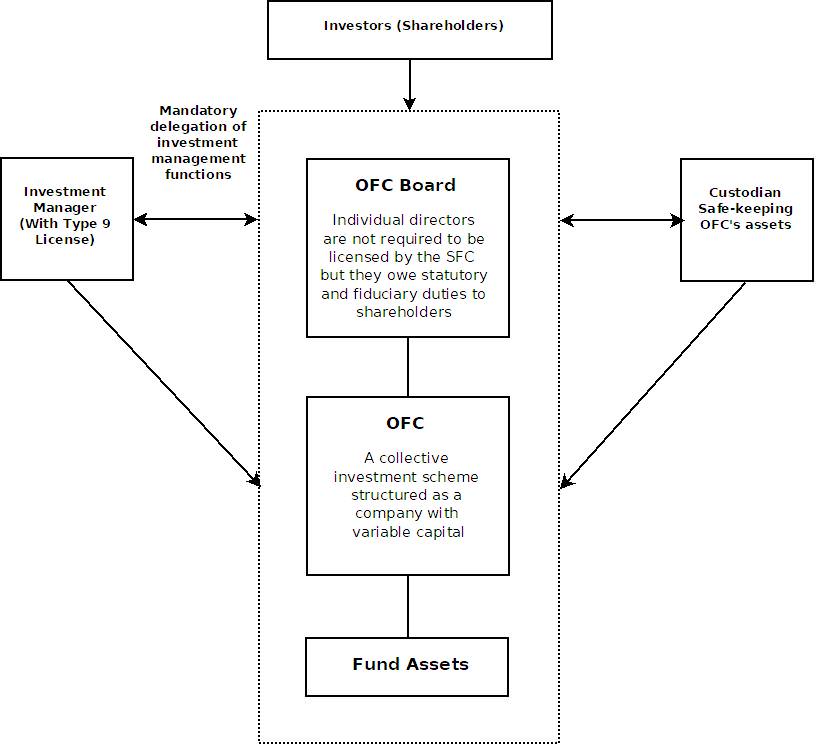

An OFC is an open-ended fund in corporate form domiciled in Hong Kong. Unlike unit trusts, an OFC is a separate legal entity with a board of directors; each director owes fiduciary duties and statutory duties of care, skill and diligence to the OFC.

Key features of an OFC are that:

-

its assets must be segregated and entrusted to a custodian for safekeeping;

-

it must appoint an investment manager which is licensed or registered with the Securities and Futures Commission (SFC) to conduct regulated activity Type 9 (asset management);

-

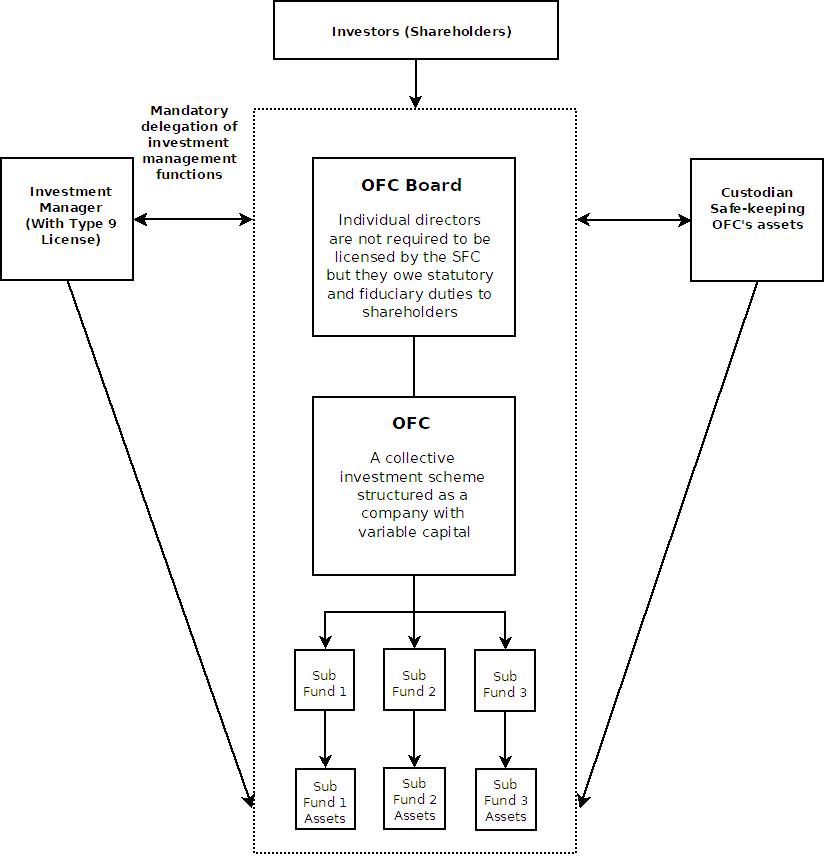

it can be structured to have sub-funds, each of which will operate as a “protected cell” – i.e. the assets and liabilities of each sub-fund belong only to that specific sub-fund and are not available to the creditors of another sub-fund in the event of its insolvency. However, although the principle of segregation of sub-funds’ liabilities is recognised under the SFO, there is no guarantee that courts in overseas jurisdictions will give effect to it.

OFC Chart 1 - Single Fund

OFC Chart 2 – Umbrella Fund with Sub-funds

Key Advantages of OFC structure

-

An OFC is a separate legal entity whereas a unit trust is a relationship which relies on the trustee to enforce the contractual obligations entered into by the trustee on the trust’s behalf.

-

Private OFCs are not subject to investment restrictions.

-

An OFC is able to cancel shares to permit fund redemptions which is not possible for conventional companies incorporated under the CO;

-

OFCs are allowed to make distributions out of capital provided that they can meet solvency and disclosure requirements.

-

An OFC can be structured as an umbrella fund, which offers investment managers the flexibility to establish sub-funds with different strategies, rather than having to establish a separate fund for each strategy.

-

The assets and liabilities of individual sub-funds can be legally segregated.

-

A Hong Kong OFC structure means that the fund and the fund and investment managers are all regulated by Hong Kong law, and will not have to comply with the laws of different offshore jurisdictions.

-

An OFC which is authorised by the SFC for retail distribution can benefit from various mutual fund recognition arrangements entered into by the SFC (including arrangements with the regulators of China, Switzerland, France, the United Kingdom, Luxembourg and the Netherlands).

-

International investors are generally more familiar with funds in a corporate structure.

-

The SFC has adopted a one-stop process for establishing an OFC. Applicants need only submit an application to the SFC, which will then liaise with the Companies Registry.

Key Drawbacks of OFC structure

-

Restrictions on investments

Public OFCs are subject to the same restrictions on the asset classes in which they can invest as other publicly offered Hong Kong funds as set out in the SFC Handbook for Unit Trusts and Mutual Funds, Investment-Linked Assurance Schemes and unlisted Structured Investment Products.[1] Private OFCs are not subject to any restrictions on the types of assets they invest in.

-

Requirement for Hong Kong licensed Investment Manager

An OFC’s investment management function must be delegated to an investment manager which holds an SFC licence or registration to conduct asset management (regulated activity Type 9) and is approved by the SFC.

-

Custodian requirement

OFCs must appoint a custodian acceptable to the SFC which meets the eligibility requirements for custodians of SFC-authorised funds set out in the Code on Unit Trusts and Mutual Funds (UT Code), irrespective of whether the fund will be publicly or privately offered. Alternatively, in the case of a private OFC, Type 1 licensed/registered intermediaries are eligible to act as custodians provided certain conditions are met.

While, many private hedge funds do not have a custodian and instead appoint prime brokers, this may not satisfy the requirements for custodians and the SFC clarified in the Consultation Conclusions on Enhancements to the OFC Regime that a custodian must be appointed, regardless of the type of assets underlying a private OFC (as per s. 112ZA of the SFO).

The custodian and investment manager must be separate legal entities.

-

-

Board of directors

An OFC’s board of directors must have a minimum of two directors who are natural persons over 18 years old. At least one director must be an independent director who is not a director or employee of the custodian. The appointment of an OFC’s directors requires SFC approval which will check that they have relevant qualifications and/or experience and are “fit and proper” to act as directors. In contrast, some offshore jurisdictions, such as the Cayman Islands, only require the registration of directors and impose no approval or qualification requirements.

-

SFC approval required for post-registration changes

Certain post-registration changes require SFC approval. For example, any change in the appointment of a director, custodian or investment manager is subject to SFC approval. SFC approval is also required for a change of name of an OFC or its sub-fund, the establishment of a new sub-fund and termination of an OFC or a sub-fund.

-

Segregation of liability

The “protected cell” concept is relatively new and there is a risk that overseas courts may not give effect to OFCs’ segregation of liability feature.

2. Regulatory Regime governing OFCs

The regulatory regime governing OFCs (the OFC Regulatory Regime) comprises:

-

Part IVA of the SFO which sets out the legal framework for establishing an open-ended fund company;

-

the Securities and Futures (Open-ended Fund Companies) Rules (OFC Rules) and the Code on Open-ended Fund Companies (OFC Code) which contain the detailed legal and regulatory requirements for OFCs; and

-

the Securities and Futures (Open-ended Fund Companies) (Fees) Regulation (Fees Regulation) which provides for the fees chargeable by the SFC and the Companies Registry in respect of OFCs.

The OFC Regulatory Regime provides for OFCs which are to be publicly offered in Hong Kong (public OFCs), and more relaxed provisions for non-public OFCs (private OFCs). Public OFCs must be authorised by the SFC which requires that they meet the requirements of the Handbook for Unit Trusts and Mutual Funds, Investment-Linked Assurance Schemes and Unlisted Structured Investment Products (SFC Products Handbook, including the UT Code). The OFC Code is divided into two sections: Section 1 applies to all OFCs, while Section II applies only to private OFCs.

The legal capacity of an OFC is similar to that of a conventional company under the Companies Ordinance. It has limited liability so the liability of shareholders is limited to their shares in the OFC.

3. Establishment Process and OFC Names

3.1 The establishment process

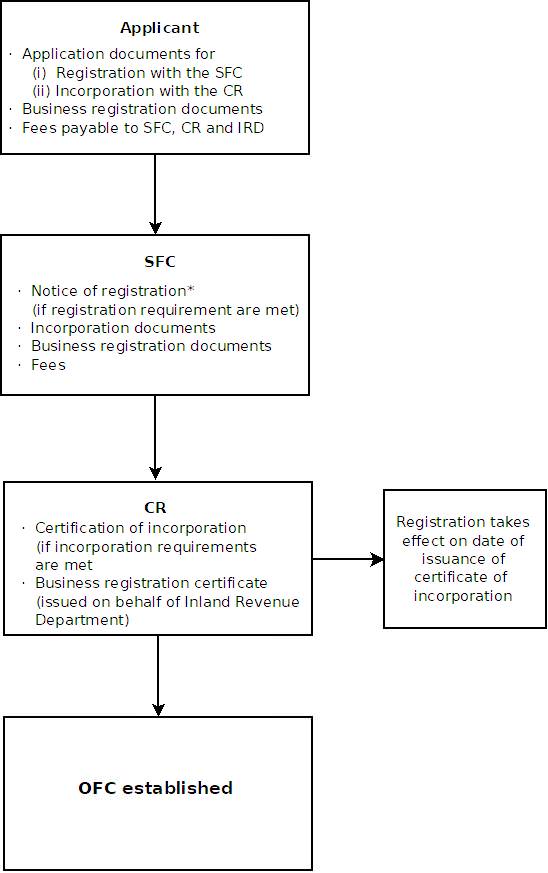

The SFC will adopt a one-stop process for OFC registration, incorporation and business registration, which requires direct dealings only with the SFC.

The SFC will then notify the Companies Registry (CR) of the registration of an OFC, the CR will issue a certificate of incorporation, and the SFC will complete the registration process. Business registration with the Inland Revenue Department is conducted in the same manner. For the procedures for setting up an OFC, please refer to the section “Procedures for establishing an OFC” below.

As to processing times, the SFC has said that public OFC applications should be processed within the same time frame as other public funds, i.e. between one and three months from receipt of the application. Private OFCs will be registered as soon as practicable, normally within one month.

3.2 OFC name

- end with “open-ended fund company” or “OFC”;

- not be the same as that of an existing OFC; and

- not be misleading or undesirable.

An OFC’s name, and any subsequent change to it, is subject to review and approval by the SFC. The process for change of name is also conducted under the one-stop approach.

3.3 Instrument of incorporation

Under Part IVA of the SFO, an OFC must have an instrument of incorporation which sets out:

-

the company name;

-

a statement that the company’s registered office is situated in Hong Kong;

-

the objects of the company;

-

provision as to the types of property in which the company will invest;

-

statements that:

-

the company is an open-ended fund company with variable share capital;

-

the company’s paid-up share capital will always be equal to its net asset value;

-

the company’s shareholders are not liable for the company’s debts;

-

the company’s scheme property is entrusted to a custodian for safe keeping in compliance with the law; and

-

-

any other matters prescribed by the OFC Rules.

The instrument of incorporation must provide that “the object of the OFC is the operation of the company as a collective investment scheme”.

An OFC’s instrument of incorporation can be amended, and any material change must be filed with the SFC within 15 days of the change.

The template for an OFC’s instrument of incorporation is available on the SFC’s website.

4. General Principles for OFCs

An open-ended fund company and its key operators must comply with the following

General Principles of the OFC Code:

-

acting fairly;

-

diligence and competency;

-

proper protection of assets;

-

managing conflicts of interest;

-

disclosure;

-

regulatory compliance; and

-

complying with constitutive documents.

5. Key Operators

The first key operators of an OFC are those stated in an OFC’s incorporation form. Both offering documents and the instrument of incorporation must include the circumstances in which the key operators will cease to hold office and the removal procedures.

5.1 Directors

An OFC’s board of directors must have at least two directors who are natural persons over 18 years old. A director of an OFC cannot be an undischarged bankrupt, except with leave of the court. At least one director must be an independent director who is not a director or employee of the custodian.

Subsequent board appointments are made by the OFC’s board or by shareholders’ resolution, subject to SFC approval. A register of directors must be kept, and the current index of directors must be made available to the CR, with which the OFC must file notices of any change of directors.

Directors’ eligibility

To be eligible for appointment as an OFC director, a person must have technical knowledge, the ability to perform their duties, and satisfactory expertise in the relevant business. A director’s qualifications will be assessed in the context of the fund’s nature, investment objectives and its policy.

Appointed directors owe the OFC fiduciary duties and the duty to exercise reasonable care, skill and diligence, and must also comply with their statutory duties and applicable codes and guidelines when discharging their functions in respect of an OFC.

The experience and expertise of the persons appointed as directors of an OFC, taken together, must be appropriate for carrying on the business of the OFC. According to Chapter 5 of the SFC Code, an OFC’s directors must be of good repute, appropriately qualified, experienced and proper for the purpose of carrying out the business of the OFC. Examples of factors that the SFC will consider include:

-

whether the person has relevant qualifications and/or experience; and

-

whether the person, or any business with which the person has been involved, has been found by any court or competent authority to have breached any company, securities or financial markets laws and regulations, has been held for fraud or other misfeasance, or has been disciplined by, or disqualified from, any professional body.

Documents to support the eligibility of the proposed directors

An OFC applicant must submit the proposed directors’ profiles, including their qualifications, work experience, and licensing status etc.

5.2 Overseas directors – process agent requirement

Overseas directors must appoint a process agent, who may be:

-

an individual whose usual residential address is in Hong Kong;

-

a company formed and registered under the CO in Hong Kong; or

-

a firm of solicitors or certified public accountants in Hong Kong.

The OFC must keep a record of process agents appointed.

5.3 Investment manager

An OFC’s investment management function must be delegated to an investment manager which is licensed or registered with the SFC for carrying on Type 9 (asset management) regulated activity. A written investment management agreement must be in place at all times, stating the delegation of the investment management functions to the investment manager.

The investment manager must comply with the General Principles and other relevant provisions of the OFC Code. It will also have to comply with the Fund Manager Code of Conduct, the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission, and other applicable SFC codes and guidelines.

Investment manager eligibility

An investment manager of an OFC must be:

-

licensed or registered for Type 9 (asset management) regulated activity with the SFC; and

-

and remain fit and proper, at and after the registration of the OFC.

If it ceases to meet the eligibility requirements under the SFO, an investment manager must retire.

Investment manager’s duties

An OFC’s investment manager’s principal duties are to:

-

carry out the OFC’s investment management functions according to the instrument of incorporation and investment management agreement and in the best interests of the OFC and its shareholders; and

-

fulfil its duties and functions in compliance with applicable laws and regulations.

Requirements for investment managers

The requirements under the Fund Manager Code of Conduct include that investment managers must ensure that they have sufficient resources and experience for the proper performance of their duties, considering the type and nature of assets they are managing and the markets in which the OFC invests.

Supporting information for an application for appointment as an investment manager

An OFC applicant is required to submit to the SFC information relating to the proposed investment manager’s licence or registration for regulated activity Type 9 (asset management), or its application for a Type 9 licence or registration.

5.4 Custodian

An OFC’s investment property is required to be entrusted to a custodian for safe-keeping by Part IVA of the SFO, regardless of the type of assets underlying the OFC. A custodian incorporated outside of Hong Kong must appoint a process agent, unless it is a registered non-Hong Kong company under Part 16 of the CO which has an authorised representative on whom documents may be served in Hong Kong.

On cessation of office, a custodian must provide either a “statement of circumstances” if it considers there are circumstances to be brought to the attention of the OFC’s shareholders or creditors, or a statement to the OFC that there are no such circumstances.

Custodian’s eligibility

An OFC’s custodian must meet the eligibility requirements for custodians of SFC-authorised funds set out in the UT Code, that is, it must be:

-

a Hong Kong licensed bank or a bank incorporated outside Hong Kong which is regulated and supervised by an overseas supervisory authority acceptable to the SFC;

-

a trust company registered under Hong Kong’s Trustee Ordinance which is a subsidiary of a bank falling within (i) above; or

-

a trust company which is a trustee of any registered scheme as defined in the Mandatory Provident Fund Schemes Ordinance.

The custodian must also be:

-

independently audited and have minimum paid-up share capital and non-distributable capital reserves of HK$10 million (or its foreign currency equivalent); or

-

have minimum paid-up share capital and non-distributable capital reserves of less than HK$10 million and be a wholly-owned subsidiary of a substantial financial institution which:

-

issues a standing commitment to subscribe sufficient additional capital up to the required amount, if so required by the SFC; or

-

undertakes that it would not let its wholly-owned subsidiary default and would not, without the SFC’s prior approval, voluntarily dispose of, or allow the custodian to issue or dispose of, share capital if that would result in it ceasing to be a wholly-owned subsidiary of the substantial financial institution.

-

In the case of a private OFC, a Type 1 licensed/registered intermediary is also eligible to act as the custodian if it meets the following conditions:

-

its licence or registration is not subject to the condition that it cannot hold client assets;

-

it maintains paid-up share capital of HK$10 million and liquid capital of HK$3 million at all times;

-

the private OFC is the client of the intermediary in respect of its Type 1 regulated activity (a six-month grace period is allowed to permit a Type 1-licensed intermediary to continue to act as a custodian for a private OFC after it ceases to be the intermediary’s client in respect of its Type 1 business. The Type 1-licensed intermediary must inform the SFC prior to, or as soon as practicable upon, the private OFC ceasing to be its client and must arrange for the transfer of the scheme property to a new custodian as soon as practicable);

-

it has at least one responsible officer or executive officer responsible for the overall management and supervision of its custodial function; and

-

it is independent of the investment manager. In order to fulfil this requirement, the SFC requires the custodian to be a separate legal entity from the investment manager. Internal controls must also be in place to ensure that persons fulfilling the custodian function / safeguarding of the OFC’s scheme property are functionally independent of those fulfilling the OFCs investment management functions, which includes ensuring distinct and separate reporting lines.

Overseas entities subject to equivalent regulation to Type 1 licensed intermediaries in their home jurisdiction are also eligible to act as custodians for private OFCs if the requirements in 4.2(d) of the Code on Unit Trusts and Mutual Funds are met (i.e. that the entity is authorised to act as a trustee / custodian of a fund and is prudentially regulated and supervised by an overseas supervisory authority acceptable to the SFC).

Trust companies are also eligible to act as a custodian of a private OFC if they meet the requirements in 4.2(b) and 4.2(c) of the Code on Unit Trusts and Mutual Funds. However, under the proposed regime for regulated activity 13 regulating the trustees/custodians of SFC-authorised funds, trust companies will become ineligible unless they obtain a Type 13 licence.

Custodian’s duties

The OFC custodian’s main duties include:

-

a statutory duty to take reasonable care, skill and diligence to ensure the safe keeping of the scheme property entrusted to it (same for sub-custodian);[2]

-

proper segregation of the OFC’s assets from:

-

the assets of the investment manager;

-

the assets of the custodian /sub-custodian throughout the custody chain; and

-

the assets of other clients of the custodian throughout the custody chain and the assets of the investment manager’s affiliates, unless held in an omnibus client account with adequate safeguards to ensure that assets of the OFC are properly recorded;

-

-

safe-keeping and record keeping of assets. Custodians must maintain up-to-date records of all fund property belonging to the OFC; and

-

exercising due care in the selection, appointment and ongoing monitoring of its delegates, including sub-custodians.

In relation to the safekeeping of assets, the OFC Code requires custodians to:

-

have sufficient expertise and experience in safekeeping the asset classes in which the OFC invests; and

-

maintain adequate internal controls and systems commensurate with the custodial risks specific to the type and nature of the assets in which the OFC invests.[3]

In relation to the custody of digital assets, SFC custodians should assess their expertise, competence and operational capabilities to ensure that such assets are properly safeguarded and effectively segregated. As for unlisted investments, the SFC has stated that custodians should assess and understand the nature and custody risks of such investments by an OFC to ensure that they are properly safeguarded.[4]

Additional Requirements for Custodians of Private OFCs (Appendix A to the OFC Code)

Custodians of private OFCs must also comply with the requirements of Appendix A to the OFC Code (Requirements for Safekeeping of Private OFC Scheme Property under 7.3(g) of the OFC Code) which sets out the general requirements and expectations for custodians, in addition to requirements in relation to:

-

the receipt and holding of money and securities on behalf of a private OFC;

-

the selection and appointment of sub-custodians;

-

the keeping of accounting and other records; and

-

risk management.

Sub-custodians

There are no restrictions on the eligibility of sub-custodians appointed by custodians of private OFCs. A custodian of a private OFC must however be satisfied that any sub-custodian(s) appointed are suitably qualified and competent in the safekeeping of the fund’s property and must be subject to ongoing monitoring. In any event, the responsibilities and obligations with respect to the safekeeping of the fund’s property remain with the private OFC custodian.

A private OFC custodian must have written internal control policies and procedures for:

-

the selection of sub-custodians for the safekeeping of the private OFC’s scheme property;

-

the monitoring of its sub-custodian(s) on an on-going basis; and

-

addressing any actual or potential conflicts of interest arising from the appointment and oversight of the sub-custodian.

6. Administrative Matters

6.1 Corporate matters

An OFC is able to issue multiple classes of shares, and to specify the rights attached to its shares, in its instrument of incorporation. The rights attached to a class of shares may be varied only as far as the company’s instrument of incorporation provides for the variation of those rights.

The ownership of shares in an OFC is recorded by noting shareholders’ particulars and holdings in the register of shareholders, which must be kept at the OFC’s registered office, or at another address filed with the CR. The register must be kept in English or Chinese. There is no requirement for the issue of share certificates. Shareholders of an OFC have access to their own shareholding information in the register.

The process for transferring shares includes lodging an instrument of transfer with the OFC, which must register the transfer or send a refusal notice to the transferee and transferor.

6.2 Meetings and resolutions

Part 5 of the OFC Rules sets out key provisions relating to the conduct of OFCs’ meetings (such as the notice period for holding meetings, and the rights of relevant parties to attend) and the passing of resolutions (including voting thresholds). Chapter 8 of the OFC Code requires detailed meeting logistics to be set out in an OFC’s instrument of incorporation. Public OFCs must also comply with relevant requirements of the SFC Products Handbook.

6.3 Auditors and financial reports

The directors of an OFC must appoint an auditor for each financial year.

The OFC Rules require that the auditor must be independent of the investment manager, the custodian, and the directors of the OFC. The auditor has the right to attend and be heard at general meetings, a right of access to information and other privileges. The auditor may either resign, or be removed by an ordinary resolution, at a general meeting. The OFC Rules set out provisions as to auditors’ eligibility, rights and cessation of office, which are similar to those for conventional companies.

If an auditor resigns, it will need to provide a “statement of circumstances” to the OFC indicating circumstances to be brought to the attention of shareholders and creditors, or a statement that no such circumstance exist. A copy of the “statement of circumstances” must be submitted to the SFC at the same time.

An OFC is required to prepare an annual report for each financial year, unless the SFC agrees that it need not file a financial report, and must publish it within four months of the end of the OFC’s financial year. The OFC’s financial statements and the auditor’s report must be included in the annual report. According to the OFC Code, the annual report is expected to contain information on the OFC’s investment portfolio, assets, liabilities, income and expenses in order to enable shareholders to make an informed judgement on the development of the activities and the results of the OFC’s performance.

Hong Kong Financial Reporting Standards or International Financial Reporting Standards may be used for preparing the report. Public OFCs will also need to prepare an interim report as per the SFC Products Handbook, while private OFCs will be given discretion to determine whether preparation of an interim report is necessary.

7. Segregated Liability of Sub-funds and Cross Sub-fund Investments

Part IVA of the SFO allows OFCs with an umbrella and sub-fund structure to segregate the liability of sub-funds (protected cells). An umbrella OFC is permitted to have both publicly-offered and privately-offered sub-funds, and the OFC will need to disclose the type of sub-funds. Any addition, change of name or termination of sub-funds must be approved by the SFC under the OFC Rules.

The following terms are implied in an umbrella OFC’s contracts and transactions under the OFC Rules:

-

the party contracting with the OFC agrees not to seek to have recourse to any assets of a sub-fund to discharge any liability not incurred on behalf of that sub-fund;

-

if the party contracting with the OFC succeeds in having recourse to assets of a sub-fund in discharge of a liability not incurred on behalf of that sub-fund, the party is liable to pay to the OFC a sum equal to the value of the benefit it obtained; and

-

if the party contracting with the OFC succeeds in seizing or attaching or otherwise levying execution against any assets of a sub-fund in respect of a liability which was not incurred on behalf of that sub-fund, it will hold those assets or the proceeds of the sale of such assets on trust for the OFC, and will keep those assets or proceeds separate and identifiable as trust property.

An OFC’s offering document(s) must include a statement as to the segregated liability of its sub-funds, and a warning that protected cells may not be recognised by foreign courts.

The OFC Rules enable cross sub-fund investments by an umbrella OFC, and the OFC Code requires disclosure of such investments.

8. Requirements for Private OFCs

Basic disclosure and operational requirements for private OFCs are set out in Section II of the OFC Code.

The OFC Code provides that an OFC must not be a business undertaking for general commercial or industrial purposes, i.e. an OFC should not be used for a business which engages predominantly in:

-

the purchase, sale and/or exchange of goods or commodities, and/or supply of services; and/or

-

the production of goods or construction of properties.

The instrument of incorporation and offering document of a private OFC must set out its fund operations, such as pricing, dealing arrangements, valuation, distribution policy, use of leverage and fees and charges. The offering document must be filed with the SFC after the OFC is registered and after any changes are made. Private OFCs can pursue the investment strategies set out in their instrument of incorporation and offering documents. The OFC Code provides flexibility to set out the operational matters of the fund, including fees and charges, in its offering documents and/or the instrument of incorporation, as appropriate.

8.1 Investment restrictions for private OFCs

As of 11 September 2020, all investment restrictions on private OFCs under the OFC Code have been removed. However, the OFC Code has been amended to require that:

-

custodians and investment managers must have sufficient expertise and experience in managing and safekeeping asset classes in which the OFC invests;

-

offering documents must contain clear disclosure of all material risks specific to the type and nature of assets in which an OFC may invest;

-

proper records must be kept; and

-

adequate internal controls and systems commensurate with the custodial risk specific to the type and nature of the assets in which the OFC invests must be in place.

8.2 OFC Changes

Material changes to the instrument of incorporation of a private OFC are allowed only with shareholders’ approval. The change must either:

-

be approved by a resolution passed by such majority of shareholders as is specified in the instrument of incorporation; or

-

be the subject of a certification in writing by the OFC’s directors that the custodian does not object to the alteration and, in the directors’ opinion, the alteration:

-

is necessary to make possible compliance with fiscal or statutory, regulatory or official requirements; or

-

does not:

-

materially prejudice shareholders’ interests;

-

release the directors, the investment manager or any other person from liability to shareholders to a material extent; or

-

increase the costs and charges payable from the scheme property of which reasonable prior notice has been provided to shareholders, and the scheme changes must be effected in accordance with the offering document and/or the instrument of incorporation. For any immaterial scheme change, the board of director’s certification that it is an immaterial change should be obtained, and a confirmation of no objection from the custodian; or

-

- is necessary to correct a manifest error.

-

9. Restrictions for Public OFCs

Public OFCs must comply with the requirements of Part I of the OFC Code and the requirements for publicly offered funds set out in the SFC Products Handbook and the UT Code.

9.1 Investment restrictions

An OFC which will be publicly offered in Hong Kong must be authorised by the SFC under section 104 SFO. SFC authorisation will only be granted if the OFC meets the requirements of the UT Code which include the core investment restrictions set out in Chapter 7. The key restrictions are:

-

Spread of investments: limits on single entity and group exposure

The fund must not invest in, or be exposed to: (a) a single entity in an amount equal to 10% of the fund’s total net asset value; or (b) entities within the same group in an amount equal to 20% of the fund’s total net asset value, through:

-

investments in the securities of the entity or entities;

-

exposure to the entity or entities through the underlying assets of financial derivatives; and

-

net counterparty exposure to the entity or entities arising from transactions in over-the-counter financial derivative instruments.

-

-

Cash deposits

A fund cannot invest 20% or more of its total net asset value in cash deposits with the same entity or group of entities.

-

Shares of a single entity

A fund cannot hold more than 10% of the ordinary shares of any single entity.

-

Unlisted products

A fund cannot invest 15% or more of its total net asset value in securities, financial products or instruments that are neither listed, quoted nor dealt in on a market.

-

Government and other public securities

Despite the restrictions under paragraphs (i) and (iii) above, a fund can invest up to 30% of its total net asset value in Government and other public securities of the same issuer.

-

Commodities

Funds cannot invest in physical commodities unless approved by the SFC on a case-by-case basis taking into account the liquidity of the commodities and appropriate additional safeguards where necessary.

-

Real estate

Retails funds cannot invest in any type of real estate (including buildings) or interests in real estate (including options or rights). The prohibition does not however extend to shares in real estate companies and interests in real estate investment trusts.

9.2 Other restrictions on retail funds

The following restrictions also apply to retail funds:

-

Retail funds cannot lend, assume, guarantee, endorse or otherwise become liable (directly or contingently) for another person’s obligation or indebtedness;

-

No short sales are allowed which would result in the fund’s liability to deliver securities exceeding 10% of its total net asset value;

-

Short selling is only allowed in securities which are actively traded on a market which permits short selling;

-

A fund cannot invest in any security of any class in a company or body in which a director or officer of the management company individually owns more than 0.5% of the total nominal amount of all the issued shares of that class, or where the directors and officers of the management company collectively own more than 5% of those securities;

-

A fund cannot borrow more than 10% of its total net asset value; and

-

Specific restrictions apply to investments in financial derivative instruments.

10. Redemption Restrictions

An OFC is a corporate fund vehicle with a variable capital which is able to impose restrictions on redemption. In line with the OFC Code’s General Principles, where an OFC imposes redemption restrictions, these restrictions must be clearly disclosed in the OFC’s offering documents.

11. Offering Documents

Offering documents for both public and private OFCs must comply with the disclosure requirements in the OFC Code and with the general principle that disclosure should be clear, concise and effective. Offering documents must include the following disclosures:

whether the OFC is private or public;

its nature as an OFC with variable capital and limited liability;

for an umbrella OFC, a statement on the segregated liability between sub-funds and warning regarding the enforceability of such segregation in foreign courts;

circumstances for cessation of office of key operators and removal procedures;

custody arrangements of the OFC’s property and associated material risks;

termination: summary of circumstances for termination, the parties who may apply and any requirement for shareholders’ approval;

manner in which shareholders may obtain information about the OFC and make enquires; and

-

the following statements regarding the SFC’s registration of the OFC or an umbrella OFC:

For a private OFC

A statement that:

“This is not an OFC authorised under section 104 of the Securities and Futures Ordinance (“SFO”) for offer to the public and its offering documents have not been authorised by the SFC under section 105 of the SFO. SFC registration is not a recommendation or endorsement of an OFC nor does it guarantee the commercial merits of an OFC or its performance. It does not mean the OFC is suitable for all investors nor does it represent an endorsement of its suitability for any particular investor or class of investors.”

For a public OFC

A statement that:

“SFC registration and authorisation do not represent a recommendation or endorsement of an OFC nor do they guarantee the commercial merits of an OFC or its performance. They do not mean the OFC is suitable for all investors nor do they represent an endorsement of its suitability for any particular investor or class of investors.”

For an umbrella OFC

A statement that:

“Important - while section 112S of the SFO provides for segregated liability between sub-funds, the concept of segregated liability is relatively new. Accordingly, where claims are brought by local creditors in foreign courts or under foreign law contracts, it is not yet known how those foreign courts will react to section 112S of the SFO.”

Private OFCs must also disclose their investment scope and restrictions in their offering document.

Offering documents for private OFCs must be filed with the SFC as soon as is practicable after issue by the OFC. In the case of any amendment, the revised offering document must be submitted within seven days of the issue of the revised document.

Ongoing disclosure of information should be disseminated in a timely and efficient manner.

-

The offering documents for Public OFCs must also meet the requirements of Appendix C of the UT Code.

The offering document of a Public OFC must also include:

the name, registered address and place and date of creation of the fund;

details of its investment objectives and policy including a summary of investment and borrowing restrictions;

selection criteria, nature and policy of the collateral held by the fund;

a summary of the fund’s valuation and pricing policies and procedures;

details of its liquidity risk management;

application and redemption procedures;

dividend distribution policy;

the level of all fees and charges payable by the investor;

details of Hong Kong and principal taxes levied;

particulars of financial reports that will be made available; and

required warnings.

12. Conversion of a Private OFC into a Public OFC and vice versa

A private OFC may seek SFC authorisation to become a public OFC if it is able to satisfy the requirements for the authorisation of publicly offered funds set out in the SFC Products Handbook and UT Code.

A public OFC may become a private OFC by applying to the SFC for a withdrawal of authorisation and complying with the relevant requirements applicable to private OFCs under the OFC Code.

An application for conversion can be made by submitting the relevant documents evidencing compliance with the applicable requirements. Applicants should also refer to the SFC Products Handbook for the requirements on withdrawal of authorisation and other relevant materials on the SFC website including the Frequently Asked Questions on Post Authorisation Compliance Issues of SFC-authorised Unit Trusts and Mutual Funds and Frequently Asked Questions on Revamped Post Authorisation Process of SFC-authorised Unit Trusts and Mutual Funds.

13. Exchange Traded Funds (ETFs)

A public OFC can be an ETF if it meets the UT Code’s requirements for ETFs.

14. Supervision and Enforcement

The SFC has investigatory, supervisory and intervention powers, which it is able to exercise in cases of non-compliance. The SFC is able to exercise disciplinary powers against the investment manager of an OFC for misconduct which is prejudicial to the interest of the investing public, as per the provisions of Part IX of the SFO. The SFC can also bring enforcement actions against the OFC and its key operators.

15. Profits Tax and Stamp Duty Implications

15.1 Liability to Hong Kong profits tax

Hong Kong profits tax is charged on every person carrying on a trade, profession or business in Hong Kong in respect of profits arising in or derived from Hong Kong from such trade, profession or business (excluding profits arising from the sale of capital assets) by section 14 of the Inland Revenue Ordinance (Cap. 112) (the IRO). Certain exemptions are available.

15.2 Public OFCs: profits tax exemption

A mutual fund, unit trust or similar investment scheme is exempted from Hong Kong profits tax if it is:

authorised as a collective investment scheme by the SFC; or

a bona fide widely held investment scheme which complies with the requirements of a supervisory authority acceptable to the SFC.[5]

Accordingly, a public OFC authorised by the SFC is exempt from Hong Kong profits tax.

15.3 Private OFCs

An exemption is available for “funds” [6] which are defined in similar terms to the definition of a “collective investment scheme” under the SFO.[7]

The IRO defines a “fund” as an arrangement in respect of property where:

- either:

the property is managed as a whole by, or on behalf of, the person operating the arrangement; or

the contributions of the participating persons, and the profits or income from which payment is made to them, are pooled under the arrangement, or both;

the participating persons do not have day-to-day control over the management of the property (whether or not they have the right to be consulted on, or to give directions in respect of, the management); and

the actual or pretended purpose or effect of the arrangement is to enable the participating persons, whether by acquiring any right, interest, title or benefit in the property or any part of the property or otherwise, to participate in or receive profits, income, payments or other returns.

Exclusions from the “fund” definition

The exemption is not available for the following arrangements which are excluded from the “fund” definition:

public funds authorised by the SFC - as noted above, SFC-authorised funds are already exempt from profits tax under section 26A(1A) of the IRO;

business undertakings for general commercial or industrial purposes – these include activities involving the purchase, sale or exchange of goods or commodities, supply of services, production of goods or construction of immovable property, property development or property holding, insurance and finance (other than through eligible private equity investments); and

intra-group arrangements – these are arrangements: (a) in which all the participants in the arrangement are corporations in the same group of companies as the operator of the arrangement; or (b) in which all the participants in the arrangement are employees or close relatives of such employees of the same corporate group as the operator of the arrangement.

15.4 Transactions eligible for profits tax

Subject to anti-avoidance provisions, a fund is exempt from profits tax on profits earned from the following transactions (section 20AN IRO):

Qualifying transactions

These are transactions in asset classes specified in Schedule 16C to the IRO which include: securities; shares, debentures, bonds, etc. issued by a private company; futures contracts; foreign exchange contracts; deposits made with a bank; certificates of deposits; exchange-traded commodities; foreign currencies; OTC derivative products; and an investee company’s shares co-invested under the Innovation and Technology Venture Fund Scheme;

Eligibility for the profits tax exemption for qualifying transactions requires the fund to satisfy one of following conditions:

-

the qualifying transactions of the fund are carried out or arranged in Hong Kong by or through a person licensed or registered with the SFC; or

-

the fund is a qualified investment fund, i.e. a fund in respect of which:

-

at all times after the final closing of sale of interests: (A) the number of independent investors exceeds 4; and (B) the capital commitments made by investors exceed 90% of the aggregated capital commitments; and

-

the originator of the fund (i.e. the person who originates or sponsors the fund and has the power to make investment decisions on behalf of the fund) and its associates are entitled to no more than 30% of the net proceeds of the fund’s transactions, after deducting the portion attributable to their capital contributions (which is proportionate to that attributable to the investors’ capital contributions).

-

-

Incidental transactions

Incidental transactions are transactions incidental to a qualifying transaction. However, a fund cannot enjoy the profits tax exemption for the profits earned from an incidental transaction if the trading receipts from the transaction exceed 5% of the total receipts of qualifying transactions and incidental transactions in the relevant period. If the 5% threshold is exceeded, all receipts from incidental transactions will be chargeable to profits tax.

OFC exempt transaction

This is a transaction carried out by an OFC in assets that are not specified in Schedule 16C to the IRO. In other words, an OFC is not restricted to qualifying transactions in order to enjoy the profits tax exemption. However, Section 20AS of the IRO provides that the profits tax exemption is not available to an OFC which:

-

carries on a direct trading or direct business undertaking in Hong Kong in assets that are not specified in Schedule 16C to the IRO (“non-Schedule 16C assets”); or

-

holds non-Schedule 16C assets that it utilises to generate income.

The IRO does not elaborate on the meaning and scope of “a direct trading or direct business undertaking in Hong Kong”.

Moreover, as discussed under “Investment restrictions for private OFCs” above, a private OFC is subject to investment restrictions under Chapter 11 of the OFC Code. These require that 90% of the gross asset value of a private OFC must be invested in (i) securities, futures contracts and SFC-authorised real estate funds; and/or (ii) cash, bank deposits, certificates of deposit, foreign currencies and foreign exchange contracts.

Sub-funds of OFCs

According to section 20AT of the IRO, if the instrument of incorporation of an OFC (the “main company”) provides for the division of its scheme property (as defined by section 112A of the SFO) into separate parts (each of which is a sub-fund), each sub-fund will be regarded as an OFC for the purpose of computing the sub-fund’s assessable profits. It follows that if the condition for profits tax exemption under section 20AN of the IRO (as set out above) is met in respect of a sub-fund, the sub-fund would enjoy the profits tax exemption, even if the condition is not met in respect of another sub-fund of the main company.

Special Purpose Entities (SPEs) under a fund

The IRO also provides a tax exemption for profits earned from transactions of special purpose entities SPEs (SPEs) set up by a fund for the sole purpose of holding and administering any of the following eligible private equity investments[8]:

-

transactions in bonds, stocks, debentures, shares or notes (Specified Securities) issued by private companies (whether incorporated in Hong Kong or elsewhere) or interposed special purpose entities between the fund and such private companies;

-

transactions in options, rights or interests in, or in respect of, Specified Securities; and

-

transactions in certificates of interest or participation in, temporary or interim certificates for, receipts for, or warrants to subscribe for or purchase, Specified Securities.

The extent of the tax exemption will be the percentage of the qualified fund’s ownership of the SPE in the assessment year.

15.5 Circumstances in which the profits tax exemption does not apply

According to Sections 20AP and 20AQ of the IRO, the profits tax exemption under sections 20AN and 20AO of the IRO will NOT apply to a fund or SPE where the fund or SPE invests in a private company that holds, directly or indirectly, more than 10% of its assets in immovable property (excluding infrastructure) in Hong Kong, or in the share capital of another private company holding immovable property in Hong Kong.

Provided that the 10% immovable property threshold is not exceeded, the profits tax exemption will apply to a fund or SPE in respect of transactions in the Specified Securities of a private company provided that one of the following conditions is met:

-

it has held the investments in the Specified Securities for at least 2 years; or

-

if the fund or SPE disposes of the Specified Securities with 2 years of their acquisition, it either:

-

does not control the relevant private company; or

-

if it does control the relevant private company, less than 50% of the private company’s assets are invested (directly or indirectly) in short-term assets which are assets that

are not specified in Schedule 16C IRO;

are not immovable property in Hong Kong; and

have been held by the company for less than 3 consecutive years before the date of disposal.

-

15.6 Anti-round tripping provisions

To prevent Hong Kong residents using a fund structure to try to avoid or minimise their tax liability, Section 20AX of the IRO provides that any Hong Kong residents who are associates of a fund will be responsible for the tax liability which would have been payable but for the section 20AN exemption in proportion to their beneficial interest in the fund where the Hong Kong resident has an ownership interest of 30% or more in the fund. The following constitute a 30% ownership interest:

a holding of 30% or more of the issued share capital of a fund which is a corporation;

an entitlement to 30% or more of the profits of a fund which is a partnership;

an interest in 30% or more of the value of the trust estate of a fund which is a trustee of a trust estate; or

30% or more of the ownership interests in a fund which is not within paragraphs (i) to (iii) above,

The provision will not however apply if the Commissioner of the Inland Revenue is satisfied that the fund’s beneficial interests are bona fide widely held.

15.7 Stamp duty

The IRO is silent on the stamp duty treatment of OFCs. Where shares in a public OFC (which has been authorised by the SFC) are transferred by way of redemption and issue of new shares, no stamp duty is chargeable by virtue of section 52 of the Stamp Duty Ordinance (Cap. 117 of the Laws of Hong Kong).[9]

16. Establishing an OFC

Flow Chart

16.1 How to establish an OFC

The key steps required to establish an OFC are:

-

registration of the OFC by the SFC;

-

issue of a Certificate of Incorporation by the Registrar of Companies; and

-

issue of a Business Registration Certificate by the Registrar of Companies on behalf of the Inland Revenue Department (IRD).

A one-stop approach applies and the applicant submits all application documents and associated fees to the SFC.

16.2 Application documents

An applicant has to submit to the SFC:

-

all application documents for: (a) registration with the SFC; (b) incorporation with the CR; and (c) business registration with the IRD; and

-

fees payable to the SFC, CR and IRD.

Application documents for OFC registration with the SFC

The documents which need to be submitted for registration of the OFC are:

-

a duly signed and completed Application Form which:

-

for public OFCs or publicly offered sub-funds refers to the “Application Form for Registration of a Public Open-ended Fund Company or Establishment of a Publicly Offered Sub-fund of an Open-ended Fund Company” set out in the Annex to the “Application Form for Unit Trusts and Mutual Funds, Investment-Linked Assurance Schemes and Unlisted Structured Investment Products”. The information required includes (among others):

-

whether the proposed public OFC is a single fund or an umbrella fund with sub-fund(s)

-

name of the single proposed public OFC or the umbrella proposed public OFC and its sub-fund(s)

-

names of the proposed directors (each of whom must be at least 18 years of age and must not be an undischarged bankrupt);

-

name of the investment manager (which must be licensed or registered for Type 9 (asset management) regulated activity or have made an application for a Type 9 licence or registration);

-

name of the custodian; and

-

registered office address.

-

-

for private OFCs or privately offered sub-funds of an OFC, Application Form refers to the “Application Form for Registration of a Private Open-ended Fund Company or Establishment of a Privately Offered Sub-fund of an Open-ended Fund Company”. The information required includes (among others):

-

whether the proposed private OFC is a single fund or an umbrella fund with sub-fund(s);

-

name of the single proposed private OFC or the umbrella proposed private OFC and its sub-fund(s);

-

names of the proposed directors (each of whom must be at least 18 years of age and must not be an undischarged bankrupt);

-

name of the investment manager (which must be licensed or registered for Type 9 (asset management) regulated activity or have made an application for a Type 9 licence or registration) ;

-

name of the custodian; and

-

registered office address.

-

-

-

a duly signed and completed Information Checklist;

-

for public OFCs or publicly offered sub-funds, the Information Checklist is the “Information Checklist for Application for Registration of a Public Open-ended Fund Company or Establishment of a Publicly Offered Sub-fund of an Open-ended Fund Company” set out in the Schedule to the “Information Checklist for Application for Authorization of Unit Trusts and Mutual Funds under the Revamped Process”;

-

for private OFCs or privately offered sub-funds of an OFC, the Information Checklist refers to the “Information Checklist for Application for Registration of a Private Open-ended Fund Company or Establishment of a Privately-offered Sub-fund of an Open-ended Fund Company”;

-

-

a copy of the instrument of incorporation signed by each of the proposed directors;

-

documents (including any confirmations and/or undertakings) required to be submitted by the Information Checklist; and

-

a cheque payable to the “Securities and Futures Commission” in respect of the registration fee for a private OFC or the authorization fee for a public OFC.

Applicants establishing a public OFC must also submit the documents required for SFC authorisation. Any changes to the draft documentation made during the application process must be marked up.

The documents applying for OFC registration should be submitted to the SFC at the same time as the documents applying for authorisation of a proposed public OFC. The SFC will process the registration and authorisation in tandem.

16.3 Documents for application for OFC incorporation by CR

The documents required to be submitted include:

-

incorporation form (Form OFCNC1)(SFC) (to be signed by any director of the OFC);

-

a copy of the instrument of incorporation;

-

notice to the Business Registration Office (IRBR3); and

-

a cheque for incorporation fees, business registration fee and levy payable to the CR.

16.4 One-stop workflow

An applicant should submit to the SFC the application documents for the OFC registration together with the documents for incorporation by the CR and business registration by the IRD, as well as the cheque payable to the CR.

If the SFC’s registration requirements are met, the SFC will send a notice of registration to the CR together with the applicant’s documents and fees for incorporation by the CR and business registration by the IRD.

If the incorporation requirements are satisfied, the Registrar of Companies will issue the Certificate of Incorporation and Business Registration Certificate to the applicant. The SFC’s registration of the OFC takes effect on the date of issue of the Certificate of Incorporation.

A public OFC must be authorised by the SFC. Accordingly, the public OFC must also comply with all applicable authorisation requirements set out in the SFC Products Handbook.

16.5 The expected processing time for registration of a public OFC and private OFCThe expected processing time for registration of a public OFC and private OFC

The SFC will process the registration and authorisation of a public OFC in tandem so that the processing time for a public OFC should be between one and three months from the take-up date of the application.

In the case of private OFCs, if the documents are in order and the registration requirements are met, a registration would be granted as soon as practicable and should take less than one month after the application is taken up by the SFC.

16.6 Template instrument of incorporation

The templates of the instrument of incorporation setting out the baseline contents are available on the SFC website.

OFCs are free to include other provisions in their instruments of incorporation and make variations as appropriate, provided that this would not result in non-compliance with the OFC Regulatory Regime (e.g. the instrument of incorporation must contain the provisions mandated under section 112K of the SFO).

In the case of a public OFC, the SFC Products Handbook must also be complied with.

16.7 Lapse of an application relating to an OFC

An application will lapse if:

-

in the case of an application for registration of an OFC or approval of the establishment of a sub-fund of an SFC-registered OFC, six months have elapsed since the application was taken up and no registration/ approval has been granted; or

-

in the case of an application for approval of change of name or appointment of key operator(s) of an OFC, no approval is granted within the applicable processing time period as indicated in the first requisition issued by the SFC (if issued).

The SFC will issue a letter of mindedness to remind and inform the applicant of the lapse of the application. In the case of an application of registration of a private OFC or approval of establishment of a privately offered sub-fund, the reminder will be issued when four months have elapsed from the take-up date of the application. Applicants will also be reminded that their application will generally lapse at the expiry of the 6-month Period specified in the first requisition (if issued by the SFC).

Once an application has lapsed or been refused, the applicant will have to make a fresh application to set up or obtain SFC authorisation for an OFC.

17. Post-registration changes to an OFC

17.1 Application to add a new-sub fund to an existing umbrella fund

To start an application, an applicant must submit to the SFC:

a duly signed and completed Application Form;

a duly signed and completed Information Checklist;

documents (including any confirmations and/or undertakings) required by the Information Checklist; and

a cheque payable to “Securities and Futures Commission” for the application fee.

During the application process, all changes to draft documentation must be duly marked up.

The application documents required for the establishment and authorisation of a new publicly offered sub-fund should be submitted to the SFC at the same time. The SFC will process the establishment and authorisation of a new publicly offered sub-fund in tandem.

17.2 Changes to a SFC-registered OFC that requires the SFC’s approval

The following changes to an OFC require SFC approval:

appointment of a director, custodian or investment manager ;

change of name of an OFC or sub-fund of an OFC;

establishment of a new sub-fund under an OFC; and

termination of an OFC or a sub-fund and cancellation of registration of an OFC.

A duly signed and completed application form and the relevant information checklist should be submitted to the SFC with the applicable fee.

17.3 Change of key operators of an OFC

For a private OFC

For the appointment of a director, custodian or investment manager, the following documents should be submitted:

-

a duly signed and completed “Application Form for Approval of Appointment of Director, Custodian or Investment Manager of an Open-ended Fund Company”;

-

a duly signed and completed “Information Checklist for Application for Approval of Appointment of Director, Custodian or Investment Manager of a Private Open-ended Fund Company”; and

-

a fee payable to the SFC.

An OFC should also notify the SFC of:

-

a resolution to remove a director; and

-

the cessation of the appointment of the investment manager or custodian of the OFC or a sub-fund of the OFC.

-

For a public OFC

On a change in the key operators of a public OFC, the following documents should be submitted:

Appointment of Director Appointment of Custodian or Investment Manager “Application Form for Approval of Appointment of Director, Custodian or Investment Manager of an Open-ended Fund Company” Duly signed and completed “Information Checklist for:

-

a Change of Director of a Public Open-ended Fund Company; or

-

a Change of Name of a Public Open-ended Fund Company or a Publicly Offered Sub-fund of an Open-ended Fund Company” (“Public OFC Director/ Name Change Information Checklist”); and

The notice to shareholders relating to the change (if any) after issuance.

(Note: no “Filing Form for Notice of Scheme Change(s) falling within 11.1B of the UT Code and Do Not Require SFC’s Prior Approval” (“11.1B Filing Form”) needs to be filed for any notice issued for such change where it falls within 11.1B of the UT Code.)(“Note on 11.1B Filing”

Only the following documents applicable to SFC-authorised funds for a 11.1 scheme change under the UT Code need to be submitted:

-

duly signed and completed “Application Form for Scheme Change(s)”; and

-

“List of Confirmations of Compliance related to Application for Approval of Scheme Change(s) pursuant to 11.1 of the UT Code”, including the confirmation required in relation to an OFC in the Annex

((a) and (b) are collectively referred to as the “11.1 Scheme Change Documents”).

Director cessation of appointment Custodian or Investment Manager cessation of appointment On cessation of a directorship, the following documents should be submitted

-

the above Public OFC Director/ Name Change Information Checklist (please also refer to the Note on 11.1B Filing above); and

-

notice to SFC of a resolution to remove a director.

The 11.1 Scheme Change Documents above.

These apply to changes which fall under 11.1 of the UT Code such as cessation of office, change of regulatory status and change of investment delegate.

-

17.4 Change of name of an OFC or its sub-fund(s)

For a private OFC or its sub-fund(s)

On a change of name, a duly signed and completed “Application Form for Approval of Change of Name of an Open-ended Fund Company or Sub-fund of an Open-ended Fund Company” must be submitted to the SFC.

-

For a public OFC or its sub-fund(s)

In respect of a change of name of a public OFC or its sub-fund, the following documents should be submitted to the SFC:

-

a duly signed and completed “Application Form for Approval of Change of Name of an Open- ended Fund Company or Sub-fund of an Open-ended Fund Company”;

-

a duly signed and completed Public OFC Director/ Name Change Information Checklist; and

-

the notice to shareholders relating to the change (if any) after issuance.

(Note: no 11.1B Filing Form is required, please refer to the Note on 11.1B Filing above.)

-

17.5 Fees payable for a change subject to SFC approval

For public OFCs and their publicly offered sub-funds, there is no separate fee payable for post-establishment changes requiring SFC approval. An annual fee payable in respect of public OFCs as an SFC-authorised fund.

For private OFCs, a fee of HK$300 is payable on an application for:

-

an approval of the appointment of director, custodian or investment manager;

-

an approval of a change of name; and

-

a cancellation of registration.

A fee of HK$300 is also payable for the termination or change of name of a sub-fund of a private OFC. For details, please refer to the section, “Fees applicable to OFCs” below.

17.6 Alteration to instrument of incorporation

A registered OFC can amend its instrument of incorporation. In the case of a public OFC, the amendments must comply with the SFC Products Handbook requirements on effecting changes to its constitutive documents. Private OFCs should make a post change filing with the SFC in respect of the alteration to its instrument of incorporation, but do not need SFC approval.

Material changes

Material changes to an OFC’s instrument of incorporation must be approved by shareholders. According to Chapter 12 of the OFC Code, material changes include:

-

material changes to the OFC’s investment objectives and policy; and

-

other changes which may materially prejudice shareholders’ rights.

Immaterial changes

Immaterial changes to the instrument of incorporation can be made with:

-

shareholders’ approval; or

-

the board of directors certifying in writing that the nature of the proposed change falls within paragraph 12.2(b) of the OFC Code and obtain the custodian’s confirmation that it has no objection.

17.7 Notice to shareholders of the changes

Reasonable prior notice must be given to shareholders of any material changes which may affect investors’ investment decisions, or materially impact on shareholders’ rights.

Notification of scheme changes should be provided to shareholders in accordance with the offering documents and/or the instrument of incorporation. The circumstances and procedures for effecting a scheme change must be set out clearly in the offering documents.

18. SFC post-registration filings

Filings should be made with the SFC as required by the OFC Regulatory Regime, for example, the following must be filed with the SFC:

annual report

interim report (if any)

offering documents

notice to the SFC of a resolution to remove a director

cessation of investment manager or custodian

alteration of instrument of incorporation

statement of circumstances issued by auditor or custodian

A public OFC also needs to comply with relevant requirements applicable to SFC-authorised funds including those under the SFC Products Handbook.

19. CR Filings

Various changes are required to be reported to the CR before the specified deadlines, including:

change of company name

change of address of registered office

change of directors (appointment / cessation of appointment / change in particulars)

alteration of instrument of incorporation.

The CR has 25 specified forms for OFCs which can be downloaded from the CR’s website at https://www.cr.gov.hk/en/ofc/specified-forms.htm

However, the following CR forms should be submitted via the SFC as SFC approval of these matters is required:

OFCNC1(SFC) – Incorporation Form

OFCNC2(SFC) – Notice of Change of Company Name

OFCD1(SFC) – Notice of Appointment of Director

All other CR forms should be submitted to the CR directly.

20. Fees Applicable to OFCs

20.1 Fees payable to the SFC

| Public OFC | Private OFC | |

|---|---|---|

| Single OFC |

Application fee: HK$20,000 Authorisation fee: HK$10,000 Post-authorisation Annual fee: HK$6,000 |

Application and registration fee: HK$5,000 Post registration Per application for each item of change: HK$3,000 |

| Umbrella OFC | ||

| For the umbrella |

Application fee: HK$40,000 Authorisation fee: HK$20,000 Post-authorisation Annual fee: HK$7,500 |

Application and registration fee: HK$10,000 Post registration Per application for each item of change: HK$300 |

For each sub-fund |

Application fee: HK$5,000 Authorisation fee: HK$2,500 Post-authorisation Annual fee: HK$4,500 |

Application and registration fee: HK$1,250 Post registration Per application for each item of change: HK$300 |

| All OFCs |

Application for a modification or waiver of requirements of the OFC Rules: HK$6,000 |

|

20.2 Fees payable to the CR

The fee payable to the CR for the incorporation of an OFC is HK$3,034.

The fees payable in respect of the OFC’s business registration (BR) are as follows:

-

for a one-year BR certificate, a fee of HK$2,000 and a levy of HK$250 are payable;

-

for a three-year BR certificate, a fee of HK5,200 and a levy of HK$750 are applicable.

Please refer to the websites of the CR and the IRD for updates as to any fee waiver that may be applicable from time to time.

Note: Separate cheques should be issued for the fees payable to the SFC and to the CR respectively.

21. Arrangement or Compromise with Creditors of an OFC

According to Part 9 of the OFC Rules, an OFC can propose to enter into an arrangement or compromise with its creditors, its shareholders or both. The court may order the summoning of a meeting of creditors or shareholders and require an explanatory statement to accompany the notice summoning the meeting. If 75% of the creditors, or shareholders, or both, that are party to the proposed arrangement or compromise, agree to that arrangement or compromise, the court may sanction it.

The court may facilitate a reconstruction or amalgamation if:

-

the arrangement or compromise is proposed for the purpose of, or in connection with, a scheme for the reconstruction of one or more OFCs; and

-

the property or undertaking of any OFC concerned in the scheme is to be transferred to another OFC.

22. Termination, Cancellation of SFC-Registration and Winding-up of an OFC

An OFC can be terminated via an application to the SFC. The OFC Rules prescribe that the OFC and its key operators must ensure that the termination is carried out fairly, and takes due account of the best interests of its shareholders. The directors and investment manager are required to ensure fair valuation of assets and to address any conflicts of interests. The termination process should be disclosed to investors in an appropriate and timely manner.

The termination procedures are set out in section I of Chapter 10 of the OFC Code. They require a termination proposal to be submitted to the SFC supported by justifications and a solvency statement (i.e. a confirmation that the open-ended fund company will be able to meet all its liabilities within 12 months from the date of the confirmation), and notice to be given to shareholders. The termination of an OFC must be conducted in accordance with its instrument of incorporation. An application for termination can be submitted to the SFC only after the OFC’s assets have been fully distributed to shareholders.

22.1 Key steps for termination of an OFC

The principal steps for terminating an OFC include:

-

the OFC submits a termination proposal with an explanation of the proposed arrangements with a solvency statement approved by the board of directors which confirms the OFC’s ability to meet its liabilities within the following 12 months;

-

the OFC issues a termination notice to shareholders (the SFC’s approval is required for public OFCs), after which the OFC must not be marketed and must not accept new subscriptions;

-

after realisation of the assets, settlement of liabilities and distribution of proceeds to shareholders, an OFC should apply to the SFC for cancellation of its registration by submitting:

-

a duly signed and completed “Application Form for Cancellation of Registration of an Open-ended Fund Company or Termination of a Sub-fund of an Open-ended Fund Company” to the SFC; and

-

for a private OFC, a duly completed “Information Checklist for Termination of a Private OFC or Privately Offered Sub-fund under Chapter 10 of the Code on Open-ended Fund Companies”;

-

for a public OFC, the applicable requirements under the SFC Products Handbook should be complied with, and a duly completed “On-Going Compliance Form For Notice of Mergers/Restructuring/Termination/Withdrawal of Authorization” should be submitted;

-

certain documents should be submitted with the above forms, for example:

-

the OFC’s final accounts accompanied by the auditor’s report;

-

a declaration signed by the OFC’s board of directors and the investment manager confirming that the realisation of assets and distribution of proceeds are complete, and that there are no outstanding liabilities.

Note: the applicant should ensure that the OFC has no outstanding tax liabilities by obtaining a tax clearance letter from the IRD.

-

-

in the case of a public OFC, an application for withdrawal of authorisation;

-

-

the OFC must notify investors in writing prior to and upon cancellation of registration, explaining the reasons for the termination and cancellation of registration;

-

cancellation of registration with the CR takes place automatically upon cancellation of registration with the SFC. No separate application to the CR is required.

-

an application for termination will lapse if no approval is granted within the applicable processing time period as indicated in the first requisition issued by the SFC.

22.2 Cancellation of registration by the SFC

The SFC has the power to cancel registration of an OFC (other than on an OFC’s application) in any of the circumstances described in section 112ZI of the SFO, i.e. if:

-

it appears to the SFC that, with respect to the company, the requirements for registration are no longer met;

-

it appears to the SFC that the company or a director, an investment manager, a custodian or a sub-custodian of the company has contravened:

-

any of the relevant provisions (being any provision of the SFO);

-

any notice or requirement given or made by the SFC under or pursuant to the SFO; or

-

any condition imposed in respect of the OFC’s registration;

-

-

it appears to the SFC that the company or a director, an investment manager, a custodian or a sub-custodian of the company has knowingly or recklessly provided to the SFC any information that is false or misleading in a material particular in purported compliance with:

-

any of the relevant provisions (being any provision of the SFO);

-

any notice or requirement given or made by the SFC under or pursuant to the SFO; or

-

any of the conditions imposed in respect of the registration of the company;

-

-

the SFC is not satisfied that the continued registration of the company is in the interest of the investing public; or

-

an order for the winding-up of the company has been made by a court under the OFC Rules.

The OFC’s registration with the CR will be automatically removed when the cancellation of its registration takes effect.

22.3 Winding up an OFC

On a termination of an OFC by way of a statutory winding-up, the OFC must comply with the OFC Rules. The OFC’s registration will be automatically cancelled upon completion of the winding-up. The OFC should keep the SFC informed as to the material progress of the winding-up, comply with any SFC information requests regarding the winding-up, and provide such notifications to the SFC as are required under the OFC Rules.

23. Overseas Corporate Funds’ Redomiciliation as Hong Kong OFCs

The existing OFC regime does not provide for OFC re-domiciliation, however, as proposed in the December 2019 Consultation Paper on enhancements to the OFC regime, a statutory re-domiciliation mechanism will be introduced to Part IVA of the SFO allowing overseas corporate funds to re-domicile in Hong Kong as OFCs.