IPOs

Two Methods of Listing

- Historically – 2 models for PRC companies to list on the Exchange:

- Directly via an H share listing

- Indirectly via a red chip listing

- H share companies are enterprises incorporated as joint stock limited companies in the PRC which have received CSRC approval to list in Hong Kong.

- Red chip companies are enterprises that are incorporated outside of the PRC (normally in Hong Kong, the Cayman Islands or Bermuda) and are controlled by PRC entities or individuals.

- For the purpose of quoting statistics, the Exchange uses the terms:

- “Red chip” to refer to overseas incorporated entities controlled by PRC government entities.

- “Non-H share Mainland private enterprises” to refer to overseas incorporated entities controlled by PRC individuals.

H-share Listing

- Legal Basis:

- The PRC Securities Law (1999) and the Special Regulations (1994) on the Overseas Offering and Listing of Shares by Joint Stock Limited Companies & Mandatory Provisions for Companies Listing Overseas issued by the State Council

- The China Securities Regulatory Commission (the “CSRC”) shall be the responsible authority

- Resolving the difference between Hong Kong law and PRC law:

- The Mandatory Provisions for Companies Listing Overseas jointly issued by the SFC, the Exchange and the Chinese authorities

- Enhance basic shareholder protection under a Chinese company’s Articles of Association to a standard similar to Hong Kong company law

- CSRC Regulation:

- the Notice on Issues Concerning Enterprises’ Overseas Listing Applications

- Requirements:

- Compliance with China’s industrial policies, foreign investment policies and regulations of fixed assets investments;

- More stringent rules on business subject to foreign investment restriction/prohibition or industries that are under state monopoly;

- Encouraged areas: high-end manufacturing, high-tech development, modern services, new energy, environment protection, energy saving

- Restricted areas: high polluting/energy-consuming projects, mining activities of certain natural resources

- Catalogue for Guiding Foreign Investment in Industry (Jan 2012)

- “4-5-6 Rule”: The applicant must have RMB 400 million of net assets; raise US50 million of funds; and have after-tax profit of more than RMB 60 million

- There was rumour in 2007 that the CSRC had an unofficial policy of approving overseas listings only if the amount to be raised exceeds US$1 billion;

- The trend was for large PRC companies to conduct dual listings in Hong Kong and Shanghai;

- This measure aimed to absorb excess liquidity in the Mainland while providing Mainland investors with more investment opportunity;

- In 2012, there have been reports that the CSRC will lower the thresholds and allow more SME to list overseas.

Requirements for GEM applicants

- No financial requirements;

- To have duly incorporated as a joint limited company;

- To not have committed any material breach of relevant laws and regulations for the previous 2 years;

- To meet the GEM Listing Rule requirements; and

- To have retained a qualified sponsor to support the application and act as an underwriter

Procedure

| Timeline | Actions required |

| 3 months prior to the submission of Form A1 |

Submit to the CSRC:

|

| Before appointing parties involved in the listing | Report to the CSRC a list of potential parties |

| 5 days prior to the submission of Form A1 | Submit the initial application materials to the CSRC |

| 10 days prior to the hearing day |

Submit the following to the CSRC:

|

Round-trip Investment or Red-chip Listing

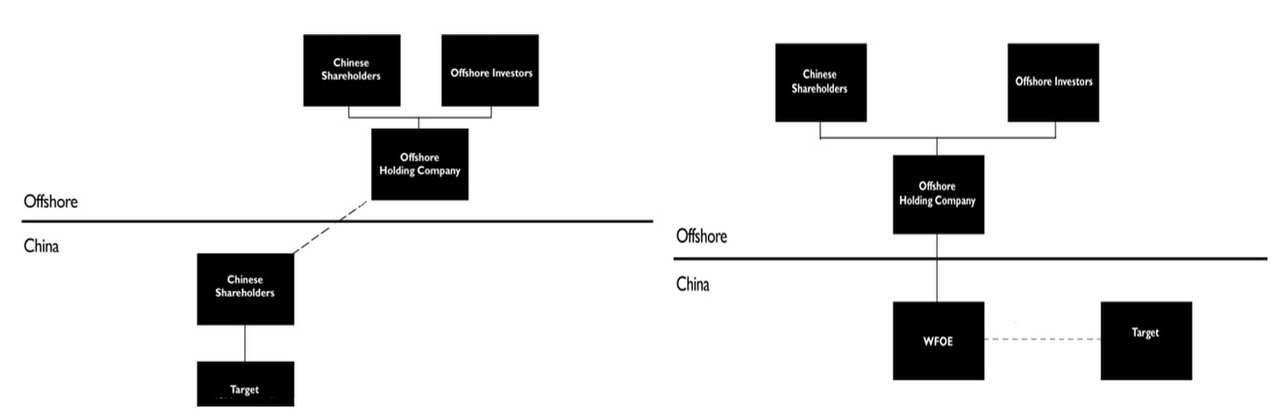

Round-trip investment

- A Chinese resident establishes or controls an offshore holding company and uses the offshore company to control a Chinese company or business, with a view to benefitting from foreign investor status and/or facilitating foreign investment in a domestic business which may be subject to foreign investment restrictions.

- As much as a quarter of China’s official FDI is actually masked as Chinese funds coming home

- Also used for preparing companies for offshore listings in Hong Kong, the US or elsewhere. This is known as “Red-chip Listing”

- With the growth of its own domestic capital markets and the development of its financial services industry and related legal infrastructure, the Chinese government has sought to curtail the use of this structure

- Absorb excess domestic liquidity to curb the inflationary pressure at home and stop currency from abroad which has created appreciation pressure on the RMB

- The Chinese government would prefer the parent companies of Chinese companies to be Chinese so as to able it to monitor their shareholdings, control their foreign currency flows and continue to tax them.

Circular 75

- The State Administration of Foreign Exchange of China (the “SAFE”) published the Notice on Relevant Issues Concerning Administration of Foreign Exchange for Domestic Residents’ Financing through Overseas Special Purpose Vehicles and Round Trip Investment

- To tighten the regulatory oversight on the setting up of offshore companies directly or indirectly controlled by onshore entities for the purpose of acquiring domestic equity and assets – Special Purpose Vehicle (“SPV”) – the first step of red-chip listing

Target of Circular 75

- “domestic legal person” → any enterprise established under the laws of China

- “domestic natural person” → Chinese residents AND foreign nationals who habitually reside in China for economic reasons → Chinese residents CANNOT circumvent the rules by changing his/her nationality

Round-trip Investment

Circular 75 defined “round-trip investment” as the acquisition of domestic equity or assets through an SPV by:

- purchasing the shares of the onshore company in cash or with the shares of the SPV (share swap);

- setting up a wholly foreign-owned enterprise which controls domestic equity or assets; or

- increasing the authorised capital of the onshore company.

Requirements

- Registration with the SAFE prior to the setting up of an SPV or the acquisition of domestic equity or assets via the SPV

- Profits, dividends, and foreign exchange income resulting from capital change of the SPV must be remitted to China within 180 days → including the proceeds of offshore listing of the SPV

Subsequent development – Circular 106 and Circular 77

The SAFE published Circular 106 and Circular 77 in 2007 and 2009 respectively to implement Circular 75

- The onshore target of the SPV must have a minimum operating history of 3 years;

- The definition of “round trip investment” was expanded to cover “Greenfield” investments in offshore companies in which no pre-existing domestic equity or assets are involved; and

- Residents that concluded a round-trip investment before completing registration with the SAFE were barred from retroactive registration.

Subsequent development – Circular 19

Two years later, the SAFE introduced Circular 19 to relax the stringent requirements imposed by Circular 106 and Circular 77

- the 3-year requirement was removed;

- Circular 19 expressly allows domestic residents to conduct direct investment via non-SPV à acquisition of domestic equity or assets via an offshore company which has genuine operation and is not set up for evading restriction on round-trip investment/red-chip listing will be allowed; and

- implicitly allows retroactive registration of an unregistered SPV by paying penalty

- The introduction of Circular 19 suggests that although round-trip investment is not welcome by the Chinese authorities, too much restriction is not feasible

Circular 10 – the M & A Rules

- The Provisions on the Takeover of Domestic Enterprises by Foreign Investors (the “M&A Rules” or “Circular 10”) jointly issued by Ministry of Commerce (“MOFCOM”) came into effect on 8 Sept 2006

- Since Circular 10 has come into force, there have been virtually no approvals for restructurings of Chinese companies into offshore holding companies

Key Features

- Require CSRC approval for IPOs involving offshore SPVs holding China assets;

- Impose restrictions on “round-trip” investments;

- Allow the use of foreign companies’ shares in the acquisition of China companies (share swap)

- Require Central MOFCOM approval for foreign acquisition of control of PRC company which involves a key industry, national security concerns or ownership change of a well-known Chinese brand

Scope of Circular 10

- Equity Acquisition: a foreign investor’s purchase of equity in an enterprise other than a foreign invested enterprise (“FIE”) (i.e. a domestic company) or the subscription by a foreign investor for new shares in a domestic company resulting in the conversion of the domestic company to a FIE

- Asset Acquisition:

- a foreign investor’s establishment of a FIE which purchases and operates the assets of a domestic enterprise; and

- a foreign investor’s purchase of assets from a domestic enterprise which are then invested in a FIE established to operate such assets

- All acquisitions covered by Circular 10 require central or provincial MOFCOM approval

Acquisition Price

- The acquisition price of the equity or assets must be based on an asset valuation report prepared by a PRC asset valuation company à an acquisition price below the appraised value is prohibited

- This reflects the government’s sensitivity to tax evasion and prohibit diversion of any capital abroad in a disguised form

- Transactions involving state-owned equity interests or assets must comply with special regulations

MOFCOM Approval Requirement

- Central MOFCOM approval required where an offshore co established or controlled by a Chinese company or individuals is to acquire a Chinese company affiliated with such person(s) (irrespective of transaction amount or industry)

- Parties to an acquisition must declare whether they are affiliated – if parties are under common control, identities of the ultimate controlling parties must be disclosed to approving authorities

- Use of trusts/or other arrangements to avoid this requirement is expressly prohibited (Article 15)

SPV

- SPV: an overseas company that is directly or indirectly controlled by a Chinese company or Chinese individuals and is established for the purpose of achieving an overseas listing of shares

- Use of offshore SPV to achieve offshore listing of Chinese company is effectively prevented, as Central MOFCOM approval is always required for SPV’s acquisition of affiliated Chinese company and CSRC approval required for listing of SPV on overseas exchange

- Listing price of SPV’s shares on overseas exchange may not be less than the valuation of the onshore equity interest as determined by a PRC asset valuation company

- Proceeds of offshore listing, as well as dividends and proceeds of changes in the capital of domestic shareholders must be repatriated to China within 6 months / 180 days

- Where shares of offshore SPV are swapped for those of its affiliated Chinese company, offshore SPV must complete overseas listing w/in one year after Chinese company receives its new business licence. If listing not completed w/in one year, MOFCOM’s approval of share swap becomes invalid and transaction must be unwound

SHARE SWAPS BY FOREIGN ACQUIRERS

Circular 10 allows new or existing shares in an overseas company (including an SPV) to be used as consideration for acquisition of a Chinese company’s shares if certain requirements are met:

- overseas co must be legally established in a jurisdiction with a well-developed legal system governing company regulation

- overseas co must be listed in a jurisdiction with a well-developed securities exchange (except an SPV)

- overseas co and its management must not have been sanctioned by any supervisory authority in preceding 3 years

- shares must be legally held and lawfully transferable under applicable laws

- title to the shares must not be disputed and shares must not be subject to any lien or other encumbrance

- overseas co shares (except those of an SPV) must be traded on a recognised overseas exchange (other than an over-the-counter exchange)

- traded prices of overseas co’s shares (other than those of an SPV) must have been stable for the previous year

Chinese co or its shareholders must engage an M&A consultant registered in China to conduct due diligence as to accuracy of application documents, the financial status of overseas company and compliance with M&A Rules

Share swap requires Central MOFCOM approval

NATIONAL ECONOMIC SECURITY REVIEW

Central MOFCOM approval required for a transaction which results in foreign investors acquiring actual control of a Chinese enterprise and which:

- involves any “key” industry

- will or may affect “national economic security”

- may result in a change of control of a domestic enterprise owning well-known trademarks or traditional Chinese brands

If parties fail to report a transaction, MOFCOM and other relevant authorities may require the termination or unwinding of the transaction or measures to mitigate any adverse impact of the transaction on the national economy. No guidance on meaning of terms such as “key industries” or “national economic security” is available.

ANTI-COMPETITION

Circular 10 contains antitrust provisions requiring a foreign investor’s acquisition of a Chinese company which gives rise to antitrust issues to be reported to MOFCOM if certain thresholds met:

- EITHER the combined worldwide turnover of all business operators involved in the concentration exceeded RMB 10 billion in the previous financial year OR the combined China revenue of all business operators involved in the concentration exceeded RMB 2 billion in the previous financial year AND

- The China revenue of each of at least two business operators exceeded RMB 400 million in the previous financial year

Establishment of New National Security Review System for M&A of Chinese Enterprises by Foreign Investors

New system set out in 2 sets of provisions:

- Notice on Establishment of a Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (“Circular 6”) came into effect on 5 March 2011 – sets out broad principles of national security review system (incl. industry sectors/transaction types subject to review

- Regulations on Implementation of the Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (“Circular 53”) which came into effect on 1 September 2011 – Circular 53 deals with procedures for implementation of the new review system

- “National security” (under AML) → military-related manufacturing, power production and grids, petroleum, gas and petrochemicals, telecom manufacturing, coal, civil aviation and shipping

Circular 6

National security review required for:

- A foreign investor’s acquisition of an interest (which need not be a “controlling interest”) in a Chinese company involved in the military and national defence industries or related industries or which is located near major sensitive military facilities, and

- A foreign investor’s acquisition of “actual control” of a Chinese company involved in a sensitive sector, such as important agricultural products, important energy and resources, important infrastructure facilities, important transport services, key technology and the manufacture of major equipment, etc., which may affect national security

Actual Control

For M&A of Chinese enterprises in category (2) above, transaction only requires national security review if foreign investor would acquire “actual control”

Foreign investor will acquire actual control if it becomes the controlling shareholder or de facto controller of the Chinese enterprise, which it will do in following circumstances:

- A foreign investor, its parent company and subsidiaries together hold 50% or more of shares of Chinese enterprise after M&A

- Multiple foreign investors hold 50% or more of shares of Chinese enterprise after M&A

- A foreign investor holds < 50% of shares of Chinese enterprise after M&A, but voting rights enjoyed by foreign investor are sufficient to exert a major influence on shareholders’ or board resolutions

- Other circumstances exist which may give foreign investor actual control of matters such as business decisions, financial affairs, human resources, technologies, etc.

No guidance as to what will constitute a “major influence” on board and shareholders’ resolutions

Transaction Types subject to Review

Following types of M&A transactions subject to the security review process:

- A foreign investor’s purchase of existing equity of a non-foreign-invested enterprise in China, or its subscription for newly issued equity of a non-foreign-invested enterprise in China, thereby converting it to a foreign-invested enterprise (“FIE”)

- A foreign investor’s purchase of the existing equity of an FIE from Chinese shareholders or its subscription of new equity of an FIE

- A foreign investor establishes an FIE, and either: (i) purchases and operates the assets acquired from a domestic enterprise through such FIE; or (ii) purchases the equity of a domestic enterprise through such FIE or

- A foreign investor purchases the assets of a domestic enterprise directly and uses the purchased assets to invest and establish an FIE to operate such assets

(Contrast under M&A Rules: MOFCOM clarified in December 2008 guidance that a foreign investor’s purchase of equity of an existing FIE is not subject to the M&A Rules)

Relevant Factors in the Security Review

Relevant factors are:

- impact of the M&A transaction on national security, incl. domestic product manufacturing capacity, domestic service provision capacity, and relevant equipment and facilities needed for national security

- impact of the M&A transaction on stable operation of national economy

- impact of the M&A transaction on social order

- impact of the M&A transaction on R&D capabilities for key technologies related to national security

Circular 53

Anti-Avoidance

Circular 53 makes clear that in determining whether an M&A transaction should be the subject of a national security review, MOFCOM will look at the substance and actual impact of the transaction, rather than just its form

Specifies that foreign investors should not seek to avoid national security review process by any means, including, without limitation, use of nominee shareholding structures, trusts, multi-level investment and reinvestment structures, leases, loans, contractual control arrangements and offshore transactions

Provision may impact structuring of PRC M&A transactions: in particular so-called VIE structures which involve contractual provisions giving foreign investors de facto control may be subject to MOFCOM scrutiny where the transaction impacts “national security”

VIE structure has been used widely to circumvent restrictions on foreign investment in certain industries and the restriction on so-called “round trip investments” by Chinese residents

The Security Review Process

The national security review process can be commenced in one of 3 ways:

- The foreign investor or investors involved in the M&A of a domestic enterprise can file an application for security review with MOFCOM which will carry out a preliminary review. Only Central MOFCOM is competent to conduct such national security review

- The review process can be initiated by a third party such as government agencies, national industry associations, enterprises in the same industry and enterprises upstream or downstream of the target (e.g. customers or suppliers)

- The process may commence following a referral from a regional MOFCOM office to Central MOFCOM

Prior to filing an application, foreign investor may request a meeting with MOFCOM to discuss procedural issues but results of discussion not binding on MOFCOM

The preliminary national security review of an M&A transaction involving a foreign investor is carried out by Central MOFCOM. The new regime also established an inter-ministerial panel (the “Ministerial Panel”) led by the State Council with responsibility for substantive and final review

M&A Security Review Timeline

- On receipt of application for national security review, MOFCOM considers whether application is complete and if it is, MOFCOM will notify applicant that application has been accepted

- If MOFCOM considers that the M&A transaction should be referred to the Ministerial Panel for national security review, it will forward the application to the Ministerial Panel within 5 working days

- MOFCOM will notify applicant w/in 15 working days that application has been referred for national security review. During that period, the M&A transaction and any approval procedure being conducted at any regional MOFCOM office must be put on hold. If the applicant is not notified that a national security review will be conducted within 15 working days, it may proceed with the transaction without regard to national security issues

- If an M&A transaction is submitted to it for review, Ministerial Panel first conducts a general review by collection of written opinions. On receipt of the referral from MOFCOM, the Ministerial Panel has five working days to solicit opinions in writing from relevant government departments, which must submit written opinions w/in 20 working days

- If all relevant departments agree that M&A transaction will not have any impact on national security and a special review is unnecessary, Ministerial Panel will inform MOFCOM w/in 5 working days. MOFCOM will inform applicant and regional MOFCOM office w/in 5 working days

- If one or more of government departments considers that M&A transaction may affect national security, the Ministerial Panel will initiate a special review procedure w/in 5 working days of receipt of the departments’ written opinions

- Special review procedure may take up to 60 working days at end of which Ministerial Panel will inform MOFCOM of its decision and MOFCOM will inform applicant

- If there is a significant disagreement among members of Ministerial Panel on whether M&A transaction will impact national security, transaction must be referred to State Council for a decision. No time limit is set for the making of the State Council’s decision

Security Review Potential Outcomes

The new regime provides for 3 possible outcomes:

- If transaction will not impact national security, the applicant can proceed with the transaction subject to obtaining other necessary foreign investment approvals

- If transaction is likely to impact national security and has not yet been implemented, the relevant parties must terminate the transaction

- If transaction has already had, or may have, a material impact on national security, MOFCOM will terminate transaction or require that other remedial measures are taken, e.g. require foreign investor to transfer equity or assets, to eliminate the transaction’s threat to national security

The Impact

The effective prohibition on round-trip investments was confirmed in MOFCOM’s December 2008 Foreign Investment Examination and Approval Management Guidance Handbook which states that a round-trip investment may only be approved in 2 circumstances if:

- the offshore acquirer is a listed company or

- the formation of the offshore acquirer has been duly approved

- the offshore acquirer has commenced operations and

- the acquisition will be funded from profits of the offshore acquirer

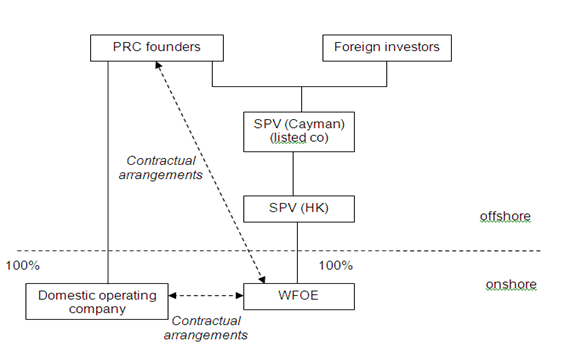

VIE structures

- An investment structure traditionally adopted as part of an offshore restructuring to allow indirect foreign investment in “restricted” sectors (e.g. internet content provision, media, telecom)

- Under a VIE structure, the domestic operating company engaging in a business or industry subject to restrictions on foreign investment is typically wholly owned by the domestic shareholders, and the foreign investors control and obtain economic benefits from the domestic operating company through a series of contractual arrangements.

- Used to allow PRC domestic company to list overseas

- First adopted by Sina for listing on Nasdaq (2000), followed by Sohu, Netease, Baidu, Focus Media, Youku and Dangdang (listed on Nasdaq / NYSE) and Tencent and Alibaba (listed on HKSE)

- The VIE structure has never been officially blessed by the PRC authorities, although some signs of acquiescence have been seen

- A typical structure is illustrated in the following diagram:

Typical contents of contractual arrangements between domestic company and the WFOE

- Exclusive Service Agreement

- The WFOE provides exclusive consultancy, management and technology services to the domestic company in return for a fee à shifting profit from domestic company to the WFOE

- Call Option Agreement

- The WFOE is granted the option to acquire all or portion of the equity interest of the domestic company at the lowest permitted price

- Equity Pledge Agreement

- The domestic shareholder will enter a registered pledge for all its equity interests in favour of the WFOE to secure due performance of the contractual obligations

- Loan Agreement

- The WFOE will grant a loan to the domestic shareholder for capitalising the domestic company

- Voting rights agreement / Power of attorney

- The domestic shareholder irrevocably grants the WFOE all its shareholder rights (incl. voting rights)

Risks involved

- Regulatory risk of structure being declared invalid by PRC authorities

- Risk that contractual arrangements will be unenforceable or insufficient to retain control over VIE

- The measures on security review system of M & A of Chinese enterprises by foreign investors (Sept 2011)

- Foreign investors are prohibited from adopting various forms of indirect control of domestic entities so as to avoid national security review

- As a matter of practice, PRC legal advisers will usually include in their legal opinion that on the basis of the principle of non-retrospectivity of laws, the status of existing VIE structures and contractual arrangements should not be affected if there is any change in future

- In relation to value added telecommunications businesses, a circular issued by the PRC Ministry of Information Industry in 2006, requires certain key assets, including trademarks and domain names, to be held by the company with the value added telecommunications service provider licence or its shareholders.

- Notice of general administration of press and publication à foreign investors are not allowed to control or participate in a domestic online gaming business by setting up a joint venture company and/or through contractual arrangements

- Public policy – Buddha Steel was required to withdraw its listing application

- The withdrawal might be more an indicator that the regulatory authorities are tightening control on foreign investment in certain core industries than a disapproval of VIE structure

- Foreign investors are prohibited from adopting various forms of indirect control of domestic entities so as to avoid national security review

The mysterious CSRC report

- An internal CSRC report disclosed in Sept 2011 (apparently advocating prior MOFCOM approval of VIE structures)

- Raised concerns about national security (particularly regarding internet industry and asset-heavy industries)

- Suggested that all VIE structures should obtain CSRC approval

- Desirability of PRC companies in emerging industries listing onshore

- Possible negative impact of prohibiting VIE structures addressed e.g. restriction of fund raising activities by companies unable to list on domestic exchanges

- No official confirmation on the genuineness of the report

Case study: Wal-Mart’s acquisition of Yihaodian

- MOFCOM approved the acquisition of Niu Hai (Yihaodian) by Wal-Mart

- To safeguard the restricted area of business, MOFCOM imposed the following conditions:

- The acquisition should be confined to the direct sales business

- Without prior approval for engaging in VATS business, Niu Hai should not provide internet services to other parties

- Wal-Mart is not allowed to use VIE to engage in VATS business currently operated by Yihaodian

- The most direct reference to VIE by Chinese authorities so far

- However, the decision is not an indicator of any policy changes towards VIE structure

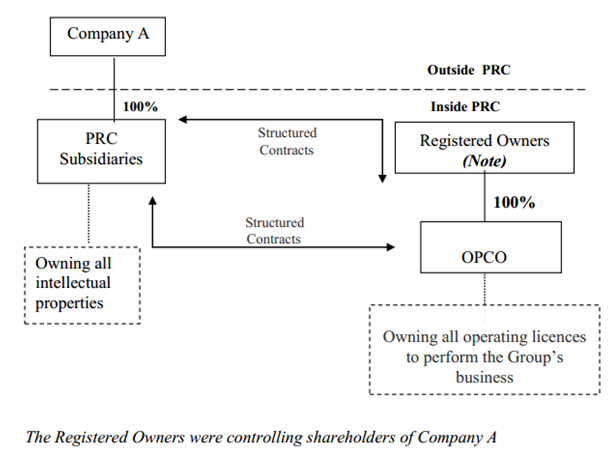

Recent views of the HKSE: Listing Decision 43-3 revised in August 2012

- A disclosure-based approach will be adopted in considering listing applications involving VIE

- HKSE will not consider an applicant unsuitable for listing if all relevant PRC laws and regulations have been complied with

- Appropriate regulatory assurance should be obtained from the relevant regulatory authorities

- Without regulatory assurance, the applicant’s legal counsel will be required to make a statement to the effect that all possible actions or steps have been taken

- Requirements for an applicant using VIE and its sponsor:

- Provide reasons for the use of structured contracts in its business operation

- Unwind the structured contracts as soon as the law allows the business to be operated without them

- Ensure the structured contracts encompass dealing with the assets of the domestic company, not only the right to manage and the right to revenue

Ensure the structured contracts contain:

- a power of attorney granted by the domestic shareholder to the applicant’s directors giving them the power to exercise all rights of the domestic shareholder

- Dispute resolution clauses providing:

- for arbitration and that remedies over the shares, land or assets, injunctive relief or winding up order of the domestic operating company may be awarded

- the courts of competent jurisdictions (HK, the applicant’s place of incorporation, the place of incorporation of the domestic company, the location of the domestic company’s principal assets) with the power to grant interim remedies in support of the arbitration pending formation of the arbitral tribunal

- for provisions that grant the right to dispose of the assets of the restricted business (in case of liquidation)

- For the first time, the Exchange made it clear that if VIE structures are adopted in non-restricted business areas, the Listing Division of the Exchange will normally refer the case to the Listing Committee to determine suitability for listing

- Prospectus disclosure requirements:

- detailed discussion about the restricted business’ registered shareholders and a confirmation that appropriate arrangements have been made to protect the applicant’s interests;

- arrangements to address the potential conflicts of interest between the applicant and the registered shareholders;

- Reason why the directors believe that each of the contractual arrangements is enforceable under PRC and local law;

- The economic risks the applicant bears as the primary beneficiary of the restricted business;

- Whether the applicant has encountered any interference from any PRC governing bodies

- The limitations in exercising the option to acquire ownership in the restricted business with a separate risk factor explaining the limitations

- The contracts forming the Contractual Arrangements must be included as material contracts in the “Statutory and General Information” section and must be available on the applicant’s website;

- The corporate structure table in the “Summary” section must be included;

- “Risk Factors” section:

- The PRC government may determine that the VIEs do not comply with applicable regulations;

- The VIEs may not provide control as effective as direct ownership;

- The domestic shareholders may have potential conflicts of interest with the applicant; and

- VIEs may be subject to scrutiny by the PRC tax authorities and additional tax may be imposed.

Foreign Direct Investment in China

- In 2009, China was the second largest recipient of FDI, attracting US$95 billion

- In 2010, China attracted FDI of US$105.7 billion

- In the months to November 2011, FDI into China reached US$103.8 billion

Major Policy Documents

- Opinions of the State Council on Further Improving the Work of Utilizing Foreign Investment (“2010 State Council Opinions”) – April 2010

- The 12th Five Year Plan (“FYP”) – approved March 2011

- The “Guiding Opinions on Promoting the International Development of Strategic Emerging Industries” (“Guiding Opinions”) – September 2011

- The Catalogue for Guiding Foreign Investment in Industry (2011 edition) (“New Catalogue”) – effective 30 January 2012

Opinions on Further Improving the Work of Utilizing Foreign Investment (“2010 State Council Opinions”)

- Issued by the State Council of China on 13 April 2010

- A high level policy document spelling out broadly the industries and geographic regions in which foreign investment is to be encouraged

- cover five key areas:

- promoting foreign investment in specific high tech and environmentally friendly industries

- encouraging foreign investment in China’s central and western regions

- diversifying the use of foreign investment

- streamlining the foreign investment approval system

- improving the investment environment for foreign investors

Promoting foreign investment in specific high tech and environmentally friendly industries

The 2010 State Council Opinions confirmed that the Foreign Investment Catalogue would be revised to encourage foreign investment in:

- high-end manufacturing

- high-tech development

- modern services

- new energy

- environment protection

- energy saving

Foreign investment in high polluting and high-energy-consuming projects or in industries already suffering from overcapacity, would be restricted

Specific measures to benefit qualified foreign investment include:

- the introduction of an exemption for qualified foreign-invested research and development centres from China customs duty and value-added tax on the import of goods required for research work

- discounted land prices at 70% of the statutory minimum price for some qualified projects failing under the “encouraged” category

- the improvement of procedures for determining new and high technology enterprises to enable foreign invested enterprises (“FIEs”) to benefit from the status

Encouraging foreign investment in China’s central and western regions

- the encourage FDI in labour intensive industries meeting environmental protection standards

- local governments to offer incentives (e.g. preferential corporate income tax treatment)

- Foreign banks encouraged to set up operating branches in the central and western regions

Diversifying Foreign Investment

- foreign investors to be encouraged to buy into Chinese enterprises through mergers and acquisitions

- foreign investors encouraged to become strategic investors in companies listed on China’s domestic stock exchanges

- China will expand the qualifications for foreign issuers authorized to issue RMB-denominated bonds

- China aims to list more qualified FIEs on its domestic stock exchanges

- China will expedite, on a pilot basis, market opening to foreign-invested guarantee companies

- China to encourage investment from foreign-invested venture capital and private equity funds, and improve exit mechanisms

FDI Approval System Reform

Commitment to streamlining and simplifying China’s foreign investment approval process

Provincial level branches of MOFCOM and the National Development and Reform Commission (NDRC) should have authority to approve foreign investment projects with a total investment amount of up to US$300 million (increased from US$100 million) in the “encouraged” or “permitted” categories under the Foreign Investment Catalogue

Increased threshold does not apply to projects expressly reserved for approval at the central government level

The threshold for foreign-invested projects under the “restricted” category requiring central level approval remains at US$50 million

The increased approval authority of provincial level authorities formally implemented by MOFCOM’S “Circular on Delegating the Examination and Approval Power for Foreign Investment Projects” (10 June 2010) and the NDRC’S “Circular on Effectively Delegating Approval Authority for Foreign-Invested Projects” (4 May 2011)

Improvements to the Investment Environment for Foreign Investors

Proposals include:

- measures to improve foreign exchange control procedures for foreign invested enterprises

- regulators to be permitted to delay or extend the approved capital contribution schedule for foreign investors encountering temporary financial difficulties

12th Five Year Plan – Strategic Emerging Industries (SEI)

- approved by the National People’s Congress in March 2011

- Key aspects: economic restructuring, the environment and energy efficiency, scientific development and developing SEIs

- introduces 7 strategic emerging industries (“SEI”) designated as the drivers for China’s future economic development

- The seven SEIs are:

- Bio-technology

- New energy

- High-end equipment manufacturing

- Energy conservation, environmental protection

- Clean-energy vehicles

- New materials

- Next-generation IT

- Central government aims to grow these seven industries from 5% of GDP in 2010, to 8% by 2015 and 15% by 2020

Guiding Opinions on Promoting the International Development of Strategic Emerging Industries

- jointly issued by MOFCOM and the NDRC on 8 September 2011

- provide a broad framework for adoption of specific policies to develop SEIs and to attract FDI in SEIs

- FDI in SEIs to be actively promoted

- R&D by foreign investors and joint sino-foreign R&D to be encouraged

2011 New Guidelines for Foreign Direct Investment

- Catalogue for Guiding Foreign Investment in Industry (Foreign Investment Catalogue) revised December 2011 (“New Catalogue”)

- New Catalogue came into force on 30 January 2012 replacing the 2007 version

- Cornerstone of China’s regulatory regime for foreign investment

- Structure unchanged: divides China’s industrial sectors into “encouraged,” “restricted” and “prohibited” categories

- New Catalogue reflects priorities established by the 2010 State Council Opinions and the 12th Five Year

- Prioritizes foreign investment in high-technology industries, high-end manufacturing, energy conservation, environmental protection and advanced services

Further opening-up to foreign investment

Compared to the 2007 catalogue, the New Catalogue :

- increased the number of industries in the encouraged category by 3 to a total of 354 industries

- removed 7 industries from the “restricted” category to leave 80 industries in this category

- removed 1 industry from the “prohibited” category leaving 39 industries in this category

- reduced by 11 the number of industries subject to restrictions on foreign investment equity ratio

Encourage transformation and upgrading of the manufacturing industry

- new products and technologies in the textile, chemical and mechanical manufacturing industries added to the “encouraged” category

- collection and treatment of waste electronic appliances and electronic products, mechanical and electrical equipment, and batteries added to the “encouraged” category

- whole vehicle manufacturing removed from the “encouraged” category

- production of polysilicon and chemical products using coal as a raw material removed from the “encouraged” category

Cultivation of strategic new industries

- foreign investment encouraged in the seven strategic emerging industries identified under the 12th Five Year Plan

- manufacture of key component parts for new energy vehicles and next-generation internet system equipment based on IPv6 added to “encouraged category”, and removes the equity ratio requirement for new energy electricity-generating equipment

Promotion of the development of service industries

- nine service industries added to the “encouraged” category including motor vehicle charging stations, venture capital enterprises, intellectual property rights services, marine oil pollution clean-up services and vocational skills training services

- medical service institutions moved from the “restricted” to the “permitted” category

- financial leasing companies moved from the “restricted” to the “permitted” category (but foreign investment in banks and other financial institutions (including insurance companies) remains restricted)

- in the real estate sector, construction of villas (single family homes) moved from the “restricted” to the “prohibited” sector

Promote coordinated regional development

- items removed from the “encouraged” category may be included in the proposed revisions to the Catalogue for Guiding Foreign Investment in the Dominant Industries of the Central and Western Regions 2008 expected this year

- will encourage foreign investment in labour-intensive projects that meet environmental protection requirements in central and western regions

Relationship with other industrial policies and Bilateral Treaties

- in case of discrepancies between Catalogue and other industrial policies, State Council rules published or treaties that China has entered into with other countries, the latter will prevail

China Approves 12th 5 Yr Plan for Western Regions

- 20 February 2012: China State Council announced approval of 12th Five Year Plan for Further Promoting the Economy of the Western Regions

- Aim: narrow gap between wealthy coastal regions and under-developed western regions

- 12 provinces: Xinjiang, Tibet, Inner Mongolia, Guangxi, Ningxia, Gansu, Qinghai, Sichuan, Chongqing, Shaanxi, Guizhou and Yunnan consolidated into economic zones

- Key to success will be infrastructure development

- Western China to be better integrated in national transport network by connecting it with booming Yangtze River Delta, Pearl River Delta and Bohai Bay Zone Regions

- Region’s railway network expected to expand by circa 15,000 km by 2015. Investment in highways, airports, and oil and gas network expected

- Over last 5 yrs, western provincial economies expanded by average of 13.6% and over 365,000 km of highways and 8,000 km of railways built

- Plan has strong ecological focus: by 2015, almost 20% of land is required to be covered by forests

- 15% cut in energy use per GDP unit required from that at end of 2010

Cross-border Direct Investment in RMB

- MOFCOM issued the Notice on Cross-border Direct Investment in RMB on 12 October 2011 (“MOFCOM Notice”)

- “Cross-border direct investment in RMB” refers to direct investment in a Chinese company by a foreign investor using legitimately obtained offshore RMB funds.

- RMB funds will be “legitimately obtained” if :

- obtained from RMB settlement of cross-border trade

- RMB profits and RMB funds from share transfer, capital reduction, liquidation and advance recovery of investment obtained from within China and remitted out of China

- raised outside China, including from offshore issues of RMB-denominated bonds or other securities

- offshore RMB can be invested in any industry (subject to compliance with all other regulations governing foreign investment), but using offshore RMB to purchase Chinese listed securities or financial derivatives or for entrustment loans is prohibited

FDI made in RMB subject to the same rules and regulations governing foreign investment as investments made in foreign currencies, including the requirement for approvals from Central MOFCOM or its provincial counterparts

Central MOFCOM approval required for:

- investment of RMB funds of RMB 300 million or more

- investment in the sectors of financing guarantee, financial leasing, microfinance or auction

- investment in a foreign-funded investment company, a foreign-funded venture capital enterprise or a foreign-funded equity investment enterprise

- investment in an industry under the macroeconomic control of the government, such as cement, iron and steel, electrolytic aluminum and shipbuilding

Additional documents to be submitted for RMB FDI are:

- a certificate or explanation as to the source of the RMB funds

- a statement as to how the funds will be used

- a standard government form, the Statement on Cross-border Direct Investment in RMB

PBOC Administrative Measures on RMB Settlement in Foreign Direct Investment

- published by PBOC on 13 October 2011

- significantly simplify approval process for repatriating RMB funds to China

- repatriation of offshore RMB to foreign-invested enterprises no longer requires PBOC approval, whether in the form of debt or capital contribution

- application for opening an RMB settlement account need only be made to the Chinese receiving bank which is then required to make a filing with the local branch of PBOC only after opening of the account

- Chinese receiving banks given primary responsibility for monitoring the use of RMB funds repatriated into China

Relaxation of withholding tax on earnings of foreign companies

- The SAT reduced the withholding tax on dividends repatriated from China by 50% (from 10% to 5%)

- The new tax reduction also applies to QFII

- The new tax reduction will only apply to companies and shareholders based in foreign countries where they have double taxation agreements with China, including Hong Kong, Singapore and United Kingdom

- The current arrangement does not have any conditions attached, unlike the previous reduction in 2009

- In 2011, almost USD 65 billion of dividends was repatriated and USD 8.6 billion withholding tax was collected

- It is hoped that the reduction can save foreign investors billions of dollars of tax payments, therefore encouraging more foreign investments in China