IPOs

Executive summary

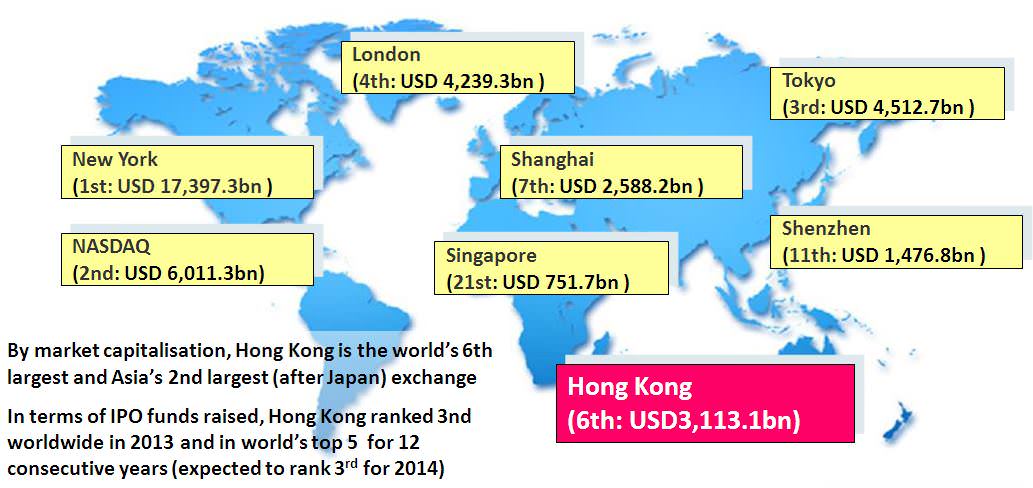

- Hong Kong market is the 6th largest stock market in the world

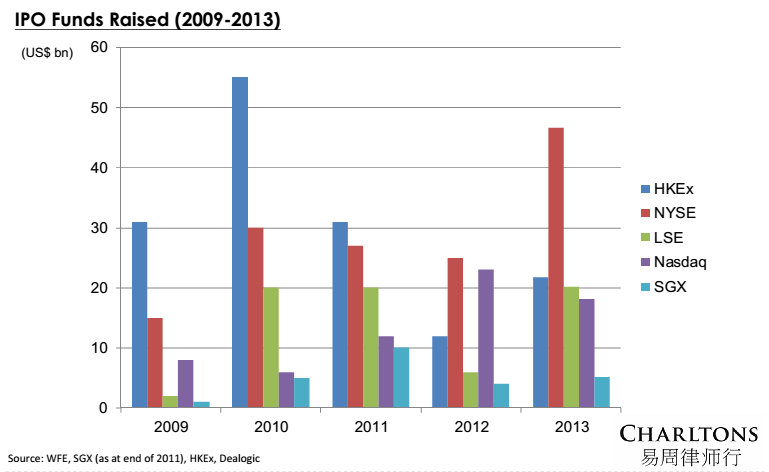

- Hong Kong ranked 3rd worldwide in terms of IPO funds raised (only after NYSE and Nasdaq) in 2013

- VIE structures can be listed on The Hong Kong Stock Exchange (HKEx) subject to complying with requirements of listing decision

- certain businesses maybe subject to PRC’s foreign investment restriction if they belong to certain industry sectors (Restricted Industries)

- Restricted industries include compulsory education, news agencies and internet-related services

- Key Hong Kong listing requirements:

- three financial criteria: (1) the profit test ; (2) the market capitalisation/revenue test; or (3) the market capitalisation/revenue/ cashflow test

- A 3-year track record period requirement is usually applied to a listing applicant

- HKEx may also accept a shorter trading record period and/or may vary or waive the financial standards requirements on certain circumstances

- Maintain at all times a minimum public float of 25% of the Company’s total issued share capital

- Key U.S. listing requirements

- minimum quantitative requirements, which vary depending on expected size and structure of the transaction

- no 3-year track record period requirements

- qualitative requirements, including adherence to minimum shareholder meeting/annual report requirements, public disclosure requirements and corporate governance requirements of the listing rules

- Way forward, we recommend:

- to meet with representatives from the HKEx; and

- to submit a formal pre-IPO enquiry to the HKEX

- HKEx will usually reply within two weeks of the submission of pre-IPO enquiry

- HKEx may may have further questions and may refer to the Listing Committee for initial decision on whether in principle the IPO application can proceed

Hong Kong – a leading international market

-

By market capitalisation, Hong Kong is the world’s 6th largest and Asia’s 2nd largest (after Japan) exchange

-

In terms of IPO funds raised, Hong Kong ranked 3nd worldwide in 2013 and in world’s top 5 for 12 consecutive years (expected to rank 3rd for 2014)

Source: World Federation of Exchanges (as at end of November 2013), Hong Kong Exchange and Clearing Limited

Benefits of listing on Hong Kong Stock Exchange (HKEx)

- HKEx – international exchange allowing full access to international investors and

- listing of foreign companies which meet its requirements

- Strategic position as gateway between Mainland China and rest of the world

- International listing venue of choice for Mainland China companies

- Increasing number of overseas companies listed on HKEx in recent years

- Number of companies listed on HKEx at end Aug 2014 = 1,716

- 1,509 on the Main Board and

- 207 on the Growth Enterprise Market (GEM)

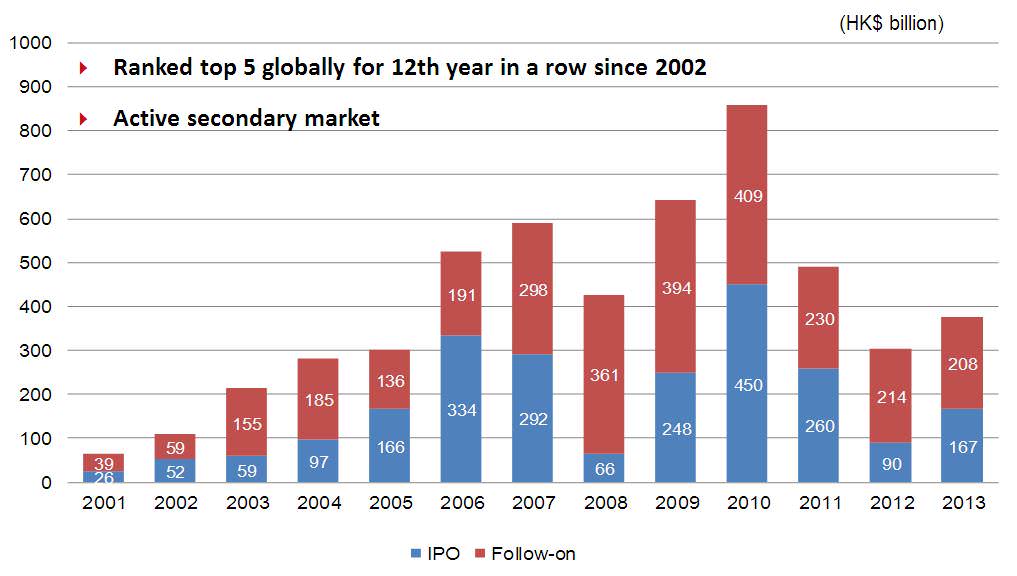

- Deep primary and secondary market liquidity

- 110 new listings in 2013 raised HKD 168.9 billion (up 85% from 2012)

- 1st 8 months 2014 – 84 new listings* on HKEx raised HK$126.4 billion (up 127% compared to same period in 2013)

- * includes transfers from the Main Board to GEM

- Equity funds raised by listed cos post-IPO in 2013 = HK$209.9 billion

- Ernst & Young predict HK$99.3 billion of IPOs in 2nd half of 2014 and HKEx to rank 3rd for IPO fundraising in 2014 (after NYSE and Nasdaq)

Why List in Hong Kong?

- No. 1 International Financial Centre in Asia

- Access to Mainland Chinese investors currently through Qualified Domestic Institutional Investor programme

- In October 2014, the launch of Shanghai-Hong Kong Stock Connect will allow Mainland Chinese investors to invest directly in HK’s listed stocks for the 1st time. Expected to broaden investor base, add liquidity and momentum to the HK market

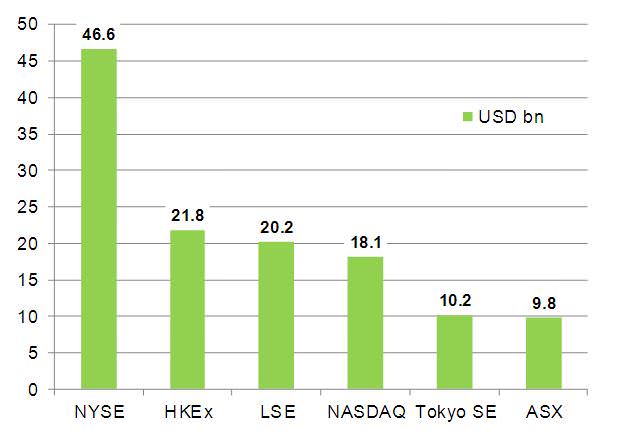

IPO Funds Raised (2013)

Gateway to China: Shanghai-Hong Kong Stock Connect

- The October 2014 launch of Shanghai-Hong Kong Stock Connect pilot programme will allow HK and Mainland Chinese investors to trade shares listed on the other market via the exchange/clearing house in their local market

- South-bound trading – will allow Mainland investors to trade following shares listed on HKEx:

- constituent stocks of Hang Seng Composite LargeCap and MidCap Indexes; and

- all H-shares with corresponding A shares listed on Shanghai Stock Exchange (SSE)

- North-bound trading – will allow HK investors to invest in:

- constituent stocks of SSE 180 and 380 Indexes; and

- SSE-listed A shares that have corresponding H shares listed on HKEx

- Trading subject to Aggregate and Daily Quotas

Aggregate Quota Daily Quota Northbound Trade RMB 300 billion RMB 13 billion Southbound Trade RMB 250 billion RMB 10.5 billion - Quotas apply on “net buy” basis: cross-boundary sales allowed regardless of quota balance

- Mainland investors restricted to institutional investors and individuals holding RMB500,000 in cash & securities

- All HK and overseas investors eligible for North-bound trading

- Scheme may be expanded in future

World Top Five in IPO Funds Raised

Source: Hong Kong Exchanges and Clearing Limited

Global Leader in IPO Funds Raised

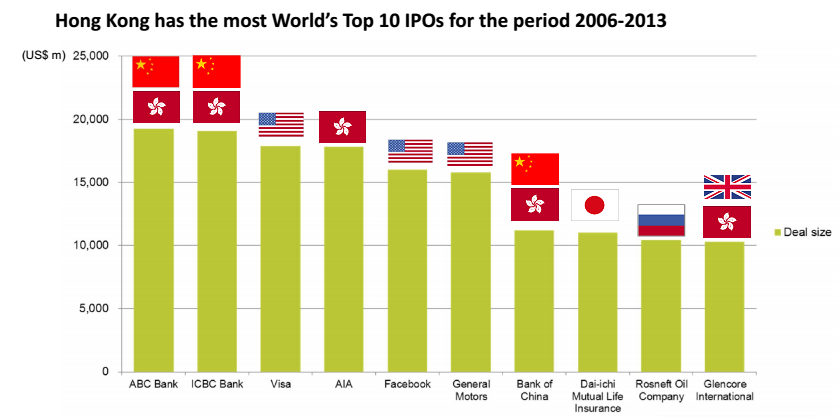

World’s Top IPOs

Source: Blomberg, WFE, WEF, WSJ

Gateway to Mainland China

| Unit | Total | Mainland Enterprise | % of Total | |

| As at 31 December 2013 | ||||

| No. of listed companies | Number | 1,643 | 797 | 49% |

| Market capitalisation | HK$bn | 24,043 | 13,691 | 57% |

| As of 31 December 2013 | ||||

| Total equity funds raised | HK$bn | 374.3 | 308.6 | 82% |

| – IPO funds raised | HK$bn | 166.5 | 152.2 | 91% |

| – Post IPO funds raised | HK$bn | 207.8 | 156.3 | 75% |

| – Average daily turnover | HK$bn | 62.6 | 32.9 | 72% |

Source: Hong Kong Exchanges and Clearing Limited

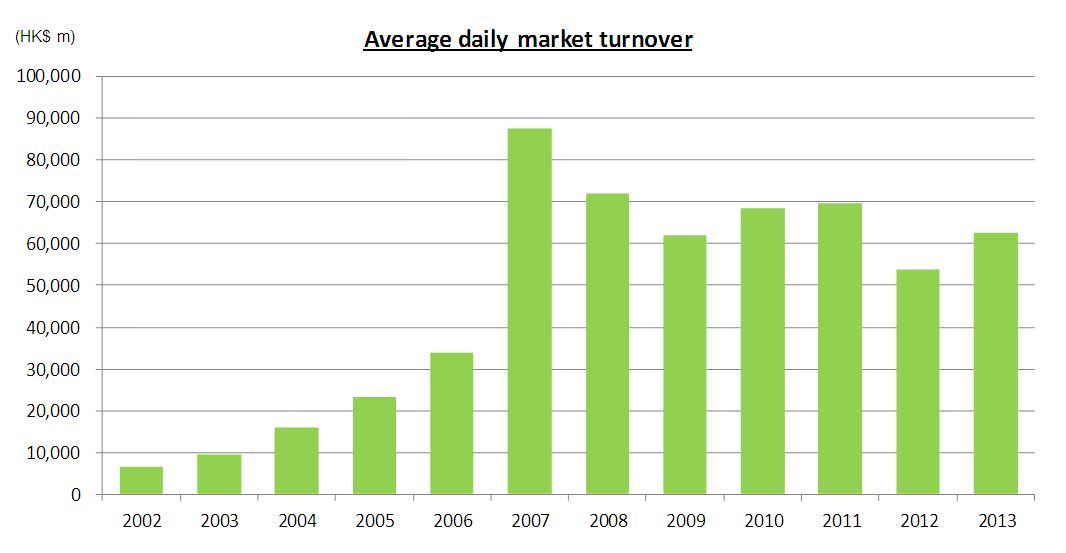

Strong Market Liquidity

Source: Hong Kong Exchanges and Clearing Limited

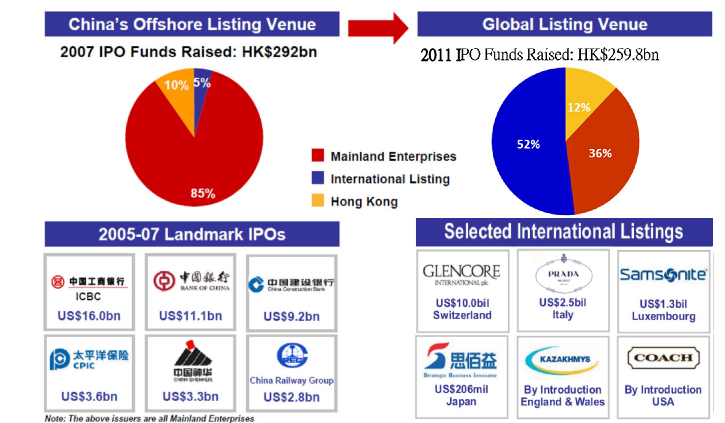

Hong Kong is Transforming into an International Listing Platform

Source: Hong Kong Exchanges and Clearing Limited

Hong Kong’s Markets

- Main Board – caters for established companies able to meet its profit or other financial requirements.

- Growth Enterprise Markets (“GEM”) – a second board for smaller growth companies. Has lower admission criteria and provides a stepping stone to Main Board listing.

- The post-listing obligations of GEM and Main Board companies are broadly similar. Key difference – quarterly reporting is mandatory for GEM companies but only recommended for Main Board companies

Listing of PRC companies on HKEx

- Historically – 2 models for PRC companies to list on the HKEx:

- Directly via an H share listing

- Indirectly via a red chip listing

- H share companies are enterprises incorporated as joint stock limited companies in the PRC which have received approval from the China Securities Regulatory Commission (“CSRC”) to list in Hong Kong.

- Red chip companies are enterprises that are incorporated outside of the PRC (normally in Hong Kong, the Cayman Islands or Bermuda), are controlled by PRC entities or individuals and conduct most of their business in the PRC.

- For the purpose of quoting statistics, the Exchange uses the terms:

- “Red chip” to refer to overseas incorporated entities controlled by PRC government entities; and

- “Non-H share Mainland private enterprises” to refer to overseas incorporated entities controlled by PRC individuals.

- Of the 1,711 listed companies on the Exchange at the end of July 2014, 851 were Mainland enterprises, including 195 H-share companies, 130 red-chip companies and 526 Mainland private enterprises.

- Together, Mainland enterprises accounted for 57.6% of the market capitalisation and 70.1% of the equity turnover of all listings on the Exchange (as at end July 2014).

- Hong Kong Exchange: world’s 6th largest (2nd in Asia after Japan) by market capitalisation.

- IPO market: ranked 2nd in the world in IPO funds raised (after New York) in 2013. HK ranked in top 5 for last 12 years.

- 10 new listings in 2013, raised HKD 166.5 billion (up 85% from 2012).

2014

- According to Ernst & Young, 2013 marked end of 2-year decline in IPO activity.

- 2014 expected to be record year for IPOs globally.

- First 7 months of 2014 – 76 new listings (up from 33 in same period in 2013) raised HK$105,972 mln (increase of 137% over same period in 2013).

- Majority of new issuers are SMEs.

China Market: Impact on HK

- Beijing resumed processing of IPO applications in January 2014 following 15-month freeze on IPOs in attempt to prop up Shanghai market, the world’s worst performing market in 2012.

- Aim of IPO resumption = to create funding alternative to bank lending as government seeks to halt build-up in bad loans.

- Shanghai’s disappointing performance in 1st half 2014 prevented CSRC fast-tracking listing approvals due to fear of causing fall in stock prices.

- Approx. 600 listing applications currently waiting for CSRC approval.

- On 19 August 2014, CSRC approved 11 new listings: 5 on the Shanghai Stock Exchange, 5 on Shenzhen’s Nasdaq-style ChiNext market, and 1 on Shenzhen’s SME board.

- New listings expected to drag markets down as retail investors shun existing stocks to chase first-day gains on newly listed stocks: almost all recent IPOs have seen share prices rise the 1st day trading limit of 44%.

- CSRC has limited approvals to smaller listings to avoid massive fundraisings which would drain liquidity from the market.

- Hong Kong Exchange benefits as cash-strapped companies switch listing plans to HKEx.

- While China’s IPO pipeline remains blocked, Chinese companies are seeking HK listings: particularly real estate and financial services companies (such as city commercial banks).

- Companies reported to be planning an HKEx listing include BAIC Motor (potentially the largest listing by a Chinese carmaker), China General Nuclear Power Group, Bank of Shanghai, Shengjing Bank and China Railway Materials Co Ltd.

- Launch of Shanghai-Hong Kong Stock Connect scheduled for Oct. 2014 – expected to add liquidity and widen investor base in HK stock market, adding further momentum to the market.

- Ernst & Young predicting HK$99.3 billion of IPOs in 2nd half of 2014 and HKEx to rank 3rd for IPO fundraising in 2014 (after the NYSE and Nasdaq).

- High valuations for tech stocks in US have prompted new Chinese listings on NYSE and NASDAQ including online retailer JD.com Inc., and Alibaba.

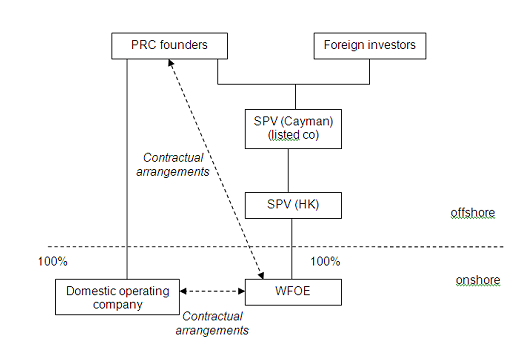

VIE structures

- A structure to allow an overseas listing of PRC businesses in certain industries, subject to restrictions on foreign investment under PRC law (restricted businesses) (e.g. internet content provision, media, telecom).

- Under a VIE structure, all relevant licences/permits for operating the restricted business are held by PRC operating companies (OPCOs) wholly owned by PRC shareholders; foreign investor’s control and obtain of economic benefits are not based on ownership of the OPCOs’ equity or possession of a majority of its holding rights, but through a series of contractual arrangements or structured contracts.

- Typically the PRC shareholders establish an offshore company (usually Bermuda/Cayman Islands) which will become the Listco. The Listco establishes a subsidiary in the PRC which is a wholly owned foreign enterprise (WOFE).

- WOFE enters contractual arrangements with OPCOs and PRC shareholders giving it control of the OPCOs and enabling Listco to consolidate their financial results.

- The VIE structure was first adopted by Sina for listing on Nasdaq (2000), followed by Sohu, Netease, Baidu, Focus Media, Youku and Dangdang (listed on Nasdaq / NYSE) and Tencent and Alibaba.com (listed on HKSE, Alibaba.com delisted in 2012).

- The VIE structure, however, has never been officially blessed by the PRC authorities, although some signs of acquiescence have been seen.

- A typical VIE structure is illustrated in the following diagram:

Typical contents of contractual arrangements between domestic company and the WFOE

- Exclusive Service Agreement

- The WFOE provides exclusive consultancy, management and technology services to the OPCOs in return for a fee -> shifting profit from OPCOs to the WFOE

- Call Option Agreement

- The WFOE is granted the option to acquire all or portion of the equity interest of the OPCOs at the lowest permitted price

- Equity Pledge Agreement

- The PRC shareholder will enter a registered pledge for all its equity interests in the OPCOs in favour of the WFOE to secure due performance of the contractual obligations

- Loan Agreement

- The WFOE will grant a loan to the PRC shareholder for capitalising the OPCOs

- Voting rights agreement / Power of attorney

- The PRC shareholder irrevocably grants

Risks involved

- Regulatory risk of structure being declared invalid by PRC authorities:

- failure to obtain required foreign investment approvals could lead to PRC authorities requiring structure to be unwound; or

- VIE structures could be declared to be subject to requirement for MOFCOM approval under M&A Rules.

- Risk that the contractual arrangements will be unenforceable or insufficient to retain control over VIE.

- As regards future regulatory changes, the PRC legal advisers usually include in their legal opinion that on the basis of the principle of non-retrospectivity of laws, the status of the existing VIE structures and contractual arrangements should not be affected if there is any change in future.

Mitigating the Risks

- Alibaba’s blockbuster IPO was debuted on 19 September 2014 and had raised a total amount of US$25 billion. It was ranked as the world’s biggest ipo to date.

- The Alibaba listing was operated under the VIE structure. However, the listing had mitigated investors’ risks by holding most of its assets in the foreign-owned part of its business -> Alibaba’s PRC operating companies hold only 7.5% of the group’s assets and generate 11.9% of its revenue.

- seen as significantly reduce risk of abuse by the PRC operating companies’ shareholders.

- also mitigates other problems on deferred taxes and foreign exchange controls;

- Comparison of amount of business conducted in PRC OPCOS under Alibaba & Baidu VIE structures with that of New Oriental, listed on NYSE in 2006:

| ALIBABA | BAIDU | NEW ORIENTAL | |

| % of Revenue in OPCOS | 11.9% | 28.3% | 99.1% |

| % of Assets in OPCOS | 7.5% | 10.1% | 65.5% |

| Net income in OPCOS | 0% | 0% | 151.5% |

Source: Paul Gillis, China Accounting Blog, “Alibaba sets the VIE gold standard”

- Minimise risks by (i) diversifying shareholdings in Chinese OPCOS so that no single shareholder, or related shareholders, have control; and (ii) ensuring controllers of PRC OPCOS get greater returns from stakes in offshore cos than from PRC OPCOS (thus less likely to sever VIE structure);

- Risk of China authorities declaring structure illegal – thought harm to Chinese economy makes this unlikely.

HKEx Listing Decision 43-3

- Listing Decision 43-3 on VIE structures first issued in 2005 – updated several times, most recently in April 2014.

- HKSE generally allows listing of applicants using a VIE structure provided:

- it is satisfied as to reasons for the use of structured contracts; and

- listing applicant complies with requirements of the listing decision.

- A disclosure-based approach is adopted in considering listing applications involving VIE.

- VIE structures normally accepted only for restricted businesses. Where VIE structure is used for an unrestricted business, the case is referred to Listing Committee.

- HKSE will not consider an applicant unsuitable for listing if all relevant PRC laws and regulations have been complied with.

- Appropriate regulatory assurance should be obtained from the relevant regulatory authorities.

- In the absence of regulatory assurance, the PRC legal opinion must include a statement to the effect that all possible actions or steps have been taken to enable it to reach its legal conclusions.

- The PRC legal opinion must confirm that the structured contracts would not be deemed as “concealing illegal intentions with a lawful form” and thus void under PRC contract law.

- Listing applicants in restricted businesses must demonstrate that they have taken all reasonable steps to comply with applicable PRC rules (other than foreign ownership restriction).

- Where PRC laws/regulations specifically prohibit foreign investors using contractual arrangements to gain control of or operate a foreign restricted business (e.g. on-line gaming business), the PRC legal opinion must:

- confirm that:

- the use of structured contracts does not breach the relevant laws/regulations;

- the structured contracts will not be deemed invalid or ineffective under those laws/regulations; and

- be supported by appropriate regulatory assurance, where possible, to demonstrate the legality of the structured contracts.

- confirm that:

- Requirements for an applicant using VIE and its sponsor:

- provide reasons for the use of structured contracts in its business operation

- unwind the structured contracts as soon as the law allows the business to be operated without them. OPCOs’ shareholders must undertake to return to the listing applicant any consideration received if the applicant acquires OPCO shares when structured contracts are unwound

- ensure the structured contracts:

- include a Power of Attorney (POA) by OPCOs’ PRC shareholders granting Listco’s directors and their successors (including liquidator) power to exercise all shareholders’ rights

- contain dispute resolution clauses which:

- provide for arbitration and that remedies over the shares, land or assets, injunctive relief or winding up order of the domestic operating company may be awarded;

- give the courts of competent jurisdictions (HK, the applicant’s place of incorporation, the place of incorporation of the domestic company, the location of the domestic company’s principal assets) the power to grant interim remedies in support of the arbitration pending formation of the arbitral tribunal; and

- encompass dealing with OPCOs’ assets and not only the right to manage its business and the right to revenue.

Key Requirements for MB listing

a) Suitability for listing

- Must satisfy Exchange that applicant and its business are suitable for listing

b) Operating History and Management

- A Main Board applicant must have a trading record period of, and management continuity for, at least 3 financial years and ownership continuity and control for at least the most recent audited financial year

Exceptions:

- Under the market capitalisation/ revenue test, the Exchange may accept a shorter trading record period under substantially the same management if the new applicant can demonstrate that:

- its directors and management have sufficient and satisfactory experience of at least 3 years in the line of business and industry of the new applicant; and

- management continuity for the most recent audited financial year

Key Requirements for MB listing

c) Financial Tests – Applicants must meet one of the three financial

| 1. Profit Test | 2. Market Cap / Revenue Test | 3. Market Cap / Revenue / Cashflow Test | |

| Profit | At least HK$50 million in the last 3 financial years (with profits of at least HK$20 million recorded in the most recent year, and aggregate profits of at least HK$30 million recorded in the 2 years before that) | – | – |

| Market Cap | At least HK$200 million at the time of listing | At least HK$4 billion at the time of listing | HK$2 billion at the time of listing |

| Revenue | – | At least HK$500 million for the most recent audited financial year | At least HK$500 million for the most recent audited financial year |

| Cashflow | – | – | Positive cashflow from operating activities of at least HK$100 million in aggregate for the 3 preceding financial years |

- For both Tests 2 & 3, only revenue from principal activities (not revenue from incidental activities) will be recognised. Revenue from “book transactions” is disregarded

Waivers for shorter track record period:

- Exchange may also accept a shorter trading record period and/or may vary or waive the financial standards requirements for:

- newly formed “project” companies (for example a company formed to construct a major infrastructure project); or

- in exceptional circumstances, if the applicant or its group has a trading record of at least 2 financial years and the Exchange is satisfied that the applicant’s listing is in the interests of the applicant and its investors

d) Shares in public hands

- At least 25% of applicant’s total share capital having a market capitalisation at listing of at least HK$50 million must be held by the public

- If listing applicant has more than 1 class of securities, the total securities held by the public on all regulated market(s) including the Exchange must be at least 25% of the issuer’s total issued share capital. The class of securities for which listing is sought must not be less than 15% of the issuer’s total issued share capital, having an expected market capitalisation of at least HK$50 million

- The Exchange may, at its discretion, accept a lower percentage of between 15% and 25% for issuers with an expected market capitalisation at listing of > HK$10 billion

e) Minimum number of shareholders

- Minimum number of shareholders at listing – 300

- Not more than 50% of the publicly held shares can be beneficially owned by the 3 largest public shareholders

Other Listing Requirements

- Accountants’ Report: A listing document must include an accountant report on the financial information for the track record period. The latest period reported on must end no more than 6 months before the date of the listing document.

- Independent non-Executive Directors: Must be at least 3: one must have appropriate professional qualifications or accounting or related financial management expertise. From 31 December 2012, INEDs must make up at least 1/3 of the Board.

- Authorised Representatives: Must be at least 2: either 2 directors or a director and the company secretary.

- Share Registrar: Issuer must employ an approved share registrar in HK to maintain register of members.

- Audit Committee: Must be made up of non-executive directors only; have 3 or more members; one must have appropriate professional qualifications or accounting or related financial management expertise; majority of members must be INEDs.

- Remuneration Committee: Majority of members (incl. Chairman) must be INEDs.

- Process Agent for Overseas Issuer: An overseas company must appoint a person authorised to accept service of process and notices on its behalf in Hong Kong.

- Compliance Adviser: Newly listed companies must appoint a Compliance Adviser for the period starting on the listing date and ending on the date of publication of results for the first full financial year commencing after listing (for MB issuers) and on the date of publication of results for the second full financial year commencing after listing (for GEM issuers).

Eligibility of Overseas Listing Applicants for HK listing

- Listing Rules provide for listing of companies incorporated in Hong Kong, the PRC, the Cayman Islands and Bermuda (Recognised Jurisdictions)

- Exchange has also accepted companies from 21 other jurisdictions (Acceptable Jurisdictions) for listing:

- Australia, Brazil, the British Virgin Islands, Canada (Alberta), Canada (British Columbia), Canada (Ontario), Cyprus, France, Germany, Guernsey, the Isle of Man, Italy, Japan, Jersey, the Republic of Korea, Labuan, Luxembourg, Singapore, the United Kingdom and the states of California and Delaware in the United States of America

- Exchange/SFC Joint Policy Statement Regarding the Listing of Overseas Companies sets out criteria for acceptance of overseas listing applicants

- Key requirements relate to:

- shareholder protection standards and

- regulatory co-operation arrangements between statutory securities regulator(s) in the applicant’s jurisdiction of incorporation and its place of central management and control (if different) and Hong Kong’s Securities and Futures Commission (SFC)

- Equivalent Standards of Shareholder Protection to Hong Kong

- Applicants incorporated in a jurisdiction new to listing must demonstrate how the laws and regulations of their country of incorporation, their constitutional documents and the arrangements they adopt as a whole meet the key shareholder protection standards set out in the Joint Policy Statement

- Regulatory Cooperation Arrangements

- Statutory securities regulator in listing applicant’s (a) jurisdiction of incorporation and (b) place of central management and control (if different) must:

- be a full signatory of the IOSCO Multilateral Memorandum of Understanding Concerning Consultation and Cooperation and the Exchange of Information (the “IOSCO MMOU”); or

- have entered an appropriate bi-lateral agreement with the SFC providing adequate arrangements for mutual assistance and exchange of information

- Statutory securities regulator in listing applicant’s (a) jurisdiction of incorporation and (b) place of central management and control (if different) must:

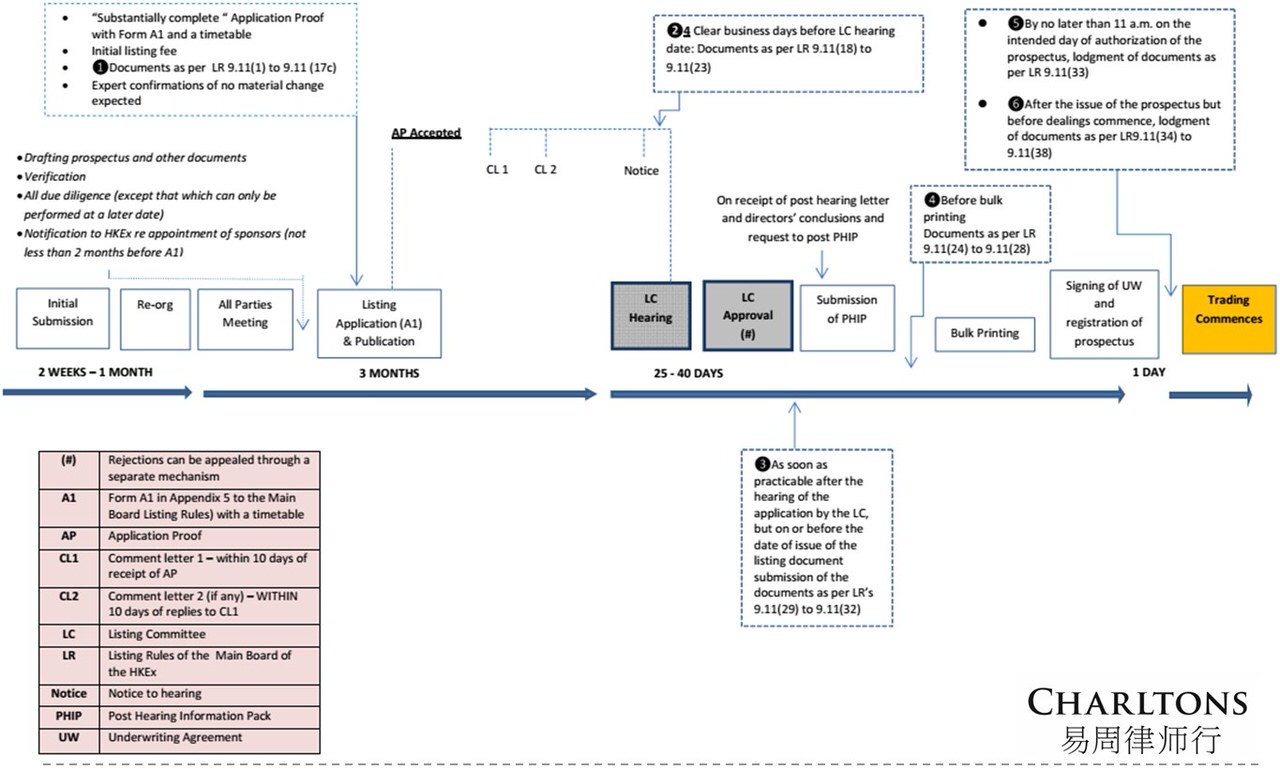

Documents Required to be Submitted in Support of a MB Listing Application

| Documents as per LR 9.11(1) to 9.11(17c) | 4 Clear days before LC hearing date: Documents as per under LR 9.11(18) to 9.11(23) | As soon as practicable after the hearing of the application by the LC, but on or before the date of issue of the listing document submission of the documents as per LR’s 9.11(29) to 9.11(32) |

|---|---|---|

|

|

|

| Before bulk printing Documents as per LR 9.11(24) to 9.11(28) | By no later than 11 a.m. on the intended day of authorization of the prospectus, lodgment of documents as per LR 9.11(33) (In case of a listing document which constitutes a prospectus under the CO) | After the issue of the prospectus but before dealings commence, lodgment of documents as per LR9.11(34) to 9.11(38) |

|

|

|

IPO timeline

Requirements for a listing – Hong Kong vs U.S.

| Hong Kong | United States (note) | |

| Financial test |

|

|

| Operating history and management |

A Main Board applicant must have a trading record of not less than 3 financial years with:

Exception:

|

|

| Other listing requirements |

|

|

| Historical financial information disclosure |

|

|

Note: extract of information regarding U.S. law by Debevoise & Plimpton LLP, subject to effective modification in practice.

* This may be lowered to 15% to 25% if the issuer’s market capitalisation exceeds HK$10 billion

Hong Kong listing – pros and cons

| Advantages | Disadvantages | |

| Hong Kong listing |

|

|

U.S. listing – pros and cons

| Advantages | Disadvantages | |

| U.S. listing |

|

|

* Sarbanes-Oxley Act was enacted in 2002 with an aim to protect investors in response to the failures of several large companies like Enron and WorldCom. The act, however, requires full disclosures regarding (i) audit committee financial experts; and (ii) codes of ethics for its senior financial officers, and to adhere to such is extremely costly.