IPOs

I. INTRODUCTION

1. General

With the rapid development and further opening up of the Chinese economy, listing on overseas stock exchanges became an important means for PRC companies to access international funds. Since the first listings of Chinese companies’ shares on the Hong Kong Stock Exchange (Exchange) in the 1980s and 1990s, the Exchange has become the overseas listing venue of choice for PRC companies.

Historically, there have been two routes for PRC companies to list on the Exchange: directly by way of an H share listing or indirectly via a “red chip” listing.

H share companies are joint stock limited companies incorporated in the PRC which have received approval from the China Securities Regulatory Commission (“CSRC”) to list in Hong Kong. They are different from so-called red chip companies which are incorporated outside the PRC (usually in Hong Kong, the Cayman Islands or Bermuda), are controlled by PRC entities or individuals and conduct most of their business in the PRC.

For the purposes of quoting statistics, the Exchange uses the term “red chip” to refer to companies incorporated outside the PRC which are controlled by PRC government entities. It uses the term Non-H Share Mainland Private Enterprises to refer to companies incorporated outside the PRC which are controlled by PRC individuals.

To give some indication of the significance of China as a source of IPOs for the Exchange, there were 2,528 listed companies on the Exchange at the end of November 2020. Among them, 1308 (or 52%) were Mainland enterprises, including 290 H-share companies, 175 red-chip companies and 843 Mainland private enterprises. Together, Mainland enterprises accounted for 80.0% of the market capitalization and 86.9% of the equity turnover of listings on the Exchange at the end of November 2020. [1]

The Exchange is the world’s 5th largest stock exchange in terms of market capitalization, and the third largest in Asia after Japan and Shanghai. [2] In terms of IPO funds raised, however, Hong Kong ranked second among the world’s exchanges in 2020. [3]

There were a total of 154 new listings in 2020, [4]raising USD 50.3 billion, an increase of 24.5% from 2019.

2. Benefits of Listing

There are many reasons for listing on the Exchange, but specifically in relation to Chinese companies, the following reasons should be borne in mind:

- access to international funds: Hong Kong is a regional and international financial centre, and a base for some of the world’s most successful fund managers;

- active post-listing trading which facilitates subsequent fund-raising. This is attributable to an active interest in, and more in-depth understanding of, the China market due to geographical and cultural proximity, a high concentration of analysts focused on China and the existence of a separate Hang Seng Chinese Enterprise Index;

- securing the interest and confidence of international investors who are familiar with the standards of regulation in Hong Kong;

- enhanced profile and reputation through participation in an international financial centre located in the financial hub of the Asia Pacific region; and

- positive pressure on the management of Chinese issuers to appreciate and follow international standards in terms of transparency and protection of minority shareholders.

3. Stock Connect

The Shanghai-Hong Kong Stock Connect pilot programme was launched in November 2014 and the Shenzhen-Hong Kong Connect was launched on 5 December 2016 allowing certain Mainland Chinese investors to invest directly in Hong Kong listed stocks. Under the Southbound Trading Link, Mainland investors can trade in the constituent stocks of the Hang Seng Composite LargeCap and MidCap Indexes, and all H-shares with corresponding A shares listed on the Shanghai and Shenzhen Stock Exchange.

4. Main Board vs GEM Market

The Exchange has 2 boards – the Main Board and the Growth Enterprise Market or GEM. The Main Board caters for more established companies that are able to meet its profit or other financial requirements. GEM has lower entry criteria and acts as a stepping stone to Main Board listing: GEM listed companies may transfer to the Main Board once they are able to meet the Main Board eligibility criteria.

The post-listing obligations of GEM companies are now broadly similar to those of Main Board listed companies. The principal difference in the ongoing obligations of Main Board and GEM companies is that quarterly reporting is a Listing Rule requirement for GEM companies, whilst for Main Board issuers it is still a Recommended Best Practice only (under the Corporate Governance Code).

5. Applicable Hong Kong Laws and Non-statutory Codes

An issuer listing in Hong Kong will be subject to the Rules Governing the Listing of Securities on The Exchange of Hong Kong Limited (the “Listing Rules”), the Companies Ordinance, the Companies (Winding-Up and Miscellaneous Provisions) Ordinance, the Securities and Futures Ordinance; and the Code on Takeovers and Mergers and the Code on Share Buy-backs.

The Listing Rules are as applicable to Chinese issuers as they are to Hong Kong and overseas incorporated issuers. However, in view of the existence of two separate markets (domestic and foreign) for the securities of Chinese issuers, and the differences between the Chinese and Hong Kong legal systems, some additional requirements, modifications and exceptions are set out in Chapter 19A of the Main Board Listing Rules and in Chapter 25 of the GEM Listing Rules, specifically designed for Chinese incorporated issuers (i.e. H share issuers). H shares can be subscribed for and traded in other currencies in addition to Hong Kong dollars.

Red chip companies and non-H share Mainland private enterprises, on the other hand, as companies incorporated outside the PRC, are required to meet the additional requirements of Chapter 19 of the Main Board Rules (Chapter 24 of the GEM Rules) for overseas companies, assuming that they are not incorporated in Hong Kong.

Hong Kong Sponsor Due Diligence Guidelines

In 2013, Charltons led a group of 20 leading Hong Kong corporate law firms and 40 investment banks in the production of the Hong Kong Sponsor Due Diligence Guidelines. The Guidelines provide practical guidance on the due diligence that needs to be conducted on companies listing on the Hong Kong Stock Exchange in order to comply with requirements that came into effect on 1 October 2013.

The Guidelines contain 3 main sections:

- Standards – these are statements of sponsors’ due diligence obligations under Hong Kong’s regulatory regime;

- Guidance – guidance as to the market’s interpretation of the Standards; and

- Recommended Steps – these set out practical steps which would generally be expected to meet the Standards in a typical case.

The Guidelines provide a comprehensive handbook for companies considering a Hong Kong listing and the professional parties involved – sponsors, lawyers, accountants etc. The guidelines incorporate all relevant regulatory standards and guidance from the Hong Kong regulators as well as industry guidance.

The English version of the Due Diligence Guidelines was published in September 2013 and the latest version (2020) is available free online at http://duediligenceguidelines.com. The Chinese version of the Guidelines is also available free online at http://duediligenceguidelines.com/zh-hant/.

6. PRC Regulatory Requirements for H Share Issuers

The China Securities Regulatory Commission (CSRC) is the regulatory authority responsible for authorizing all overseas listings by PRC incorporated companies. [5]

The CSRC Guidelines

The CSRC’s “Guidelines for Supervising the Application Documents and Examination Procedures for the Overseas Stock Issuance and Listing of Joint Stock Companies” (the “Guidelines”) came into effect on 1 January 2013. These removed the financial requirements for PRC companies seeking to list overseas in the form of joint stock companies (i.e. H share companies). Previously, Chinese joint stock companies seeking an offshore listing were required to:

- have RMB 400 million of net assets,

- raise US50 million of funds and

- have after-tax profit of more than RMB 60 million in the preceding year (the “4-5-6 Requirements”).

Under the Guidelines, the 4-5-6 Requirements were replaced by a requirement that Chinese joint stock companies seeking an overseas listing must satisfy the CSRC that they meet the listing requirements of the overseas stock exchange.

The 4-5-6 Requirements had previously meant that the H share companies listing in Hong Kong were mainly large state-owned enterprises, since small and medium sized private companies (“SMEs”) found it difficult to satisfy the rules. The Guidelines provided Chinese SMEs with an alternative to a domestic IPO.

The Guidelines also simplified the application process for PRC companies seeking to list overseas. Before they came into force, potential overseas issuers were required to submit to the CSRC all relevant corporate documents for approval 3 months before the submission of the listing application to the overseas exchange (e.g. the submission of A1 form to the Hong Kong Exchange). Under the Guidelines, this requirement was removed.

The Guidelines aimed to ease fundraising pressure on stock markets in the PRC and promote the development of small and medium companies in the PRC.

[2] https://www.sfc.hk/-/media/EN/files/SOM/MarketStatistics/a01.pdf

[3] https://assets.kpmg/content/dam/kpmg/cn/pdf/en/2020/12/china-hk-ipo-2020-review-and-outlook-for-2021.pdf

[4] https://www2.hkexnews.hk/new-listings/new-listing-information/main-board?sc_lang=en

[5] Securities Law (Article 10) and the Special Provisions of the State Council on Issuing and Listing of Shares Abroad by Companies Limited by Shares (Article 5)

7. Conversion of B shares to H shares

In December 2012, China International Marine Containers Group became the first PRC B share company to convert its B-share listing into an H-share listing on the Exchange by way of introduction following approval by the CSRC and the Exchange.

Listing by way of introduction

Listing by introduction is a means of listing shares already in issue on another stock exchange where no marketing arrangements are required because the shares are already widely held. As only existing shares are listed by introduction, no additional funds are raised.

Listing Rule 7.15 states that an introduction will only be permitted in exceptional circumstances if there has been a marketing of the securities in Hong Kong within the six months prior to the proposed introduction where such marketing was made conditional on listing being granted for those securities. Furthermore, there may be other factors, such as a pre-existing intention to dispose of securities, a likelihood of significant public demand for the securities or an intended change of the issuer’s circumstances, which would render an introduction unacceptable to the Exchange. An introduction will not be permitted if a change in the nature of the business is contemplated.

There are problems which may hinder B shares conversion to H shares due to regulatory differences such as differences in accounting systems and financial reporting and requirements of independent non-executive directors (“INEDs”).

Exchange Guidance Letter GL53-13 provides guidance to issuers seeking to list by way of introduction on arrangements to facilitate liquidity of issuers’ securities to meet demand on the Hong Kong market during the initial period after listing.

Listing decision HKEx-LD52-2013 provides a detailed explanation for the Exchange’s decision to allow an un-named company listed on a PRC stock exchange to convert its entire B shares into H shares to be listed on the Exchange by way of introduction.

8. Regulation of Red Chip Listings

Circular 10 – the M&A Rules

In the past, the reorganisation and PRC regulatory approval process for red-chip listings was more straightforward than that for H-share listings. However, that changed with the issue of the Provisions on the Takeover of Domestic Enterprises by Foreign Investors (the “M&A Rules” or “Circular 10”), which came into effect in September 2006.

Issued by the Ministry of Commerce (“MOFCOM”), with six other governmental departments, the M&A Rules represented a significant step in the development of China’s regulation of foreign acquisitions of Chinese companies. The requirements imposed had significant consequences both for round-trip investments and red-chip listings. Since the M&A Rules came into force, there have been virtually no approvals for restructurings of Chinese companies into offshore holding companies.

In a red-chip listing of a PRC domestic company, the PRC shareholders would set up an offshore holding company typically in the Cayman Islands or Bermuda. The offshore company would then purchase the PRC company which would become its wholly owned subsidiary.

The use of an offshore SPV to achieve an offshore listing of a Chinese company is effectively prevented by the M&A Rules, since MOFCOM approval at the central government level is required for:

- the establishment of an offshore SPV for the purpose of achieving an overseas listing where the offshore company is directly or indirectly controlled by a Chinese company or Chinese individuals; and

- the acquisition by the offshore SPV of the affiliated Chinese company.

The M&A Rules additionally require CSRC approval for the listing of an SPV holding China assets on an overseas stock exchange.

The M&A Rules impose an obligation on the parties to an acquisition to declare whether they are affiliated. If two parties to a transaction are under common control, the identities of the ultimate controlling parties must be disclosed to the approving authorities, together with an explanation of the purpose of the M&A transaction and a statement as to whether the appraised value represents fair market value. The use of trusts or other arrangements to avoid this requirement is expressly prohibited (Article 15).

A further hurdle to a red chip listing is that the M&A Rules provide that the listing price of the SPV’s shares on the overseas exchange may not be less than the valuation of the onshore equity interest as determined by a PRC asset valuation company.

There is also a requirement that the proceeds of the offshore listing, as well as dividends and the proceeds of changes in the capital of Chinese shareholders must be repatriated to China within 180 days / 6 months.

Circular 10 did not however put a stop to offshore financings and listings of Chinese companies. The number of both has remained high, although many such deals involved companies that were restructured prior to Circular 10’s effective date. Other Chinese businesses have been listed using different re-organisation structures to take them outside the ambit of Circular 10. Chief among these has been the variable interest entity (“VIE”) structure.

In 2012, China Zhongsheng Resources Holdings Limited (2623.hk), originally a PRC company, transformed itself into a Sino-foreign enterprise and then a wholly foreign-owned enterprise and successfully listed in Hong Kong. The company only commenced the red-chip restructuring in 2010 after the implementation date of Circular 10. At various stages of the restructuring, approvals of the provincial bureau of commerce were granted. The company’s successful listing is seen as a circumvention of the regulations prohibiting red-chip listing. It remains to be seen whether the listing resulted from a change in MOFCOM’s policy towards red-chip listing, or merely an exception based on the company’s particular facts and circumstances.

It should also be noted that On July 14, 2014, the State Administration of Foreign Exchange (“SAFE”) of the PRC issued the SAFE Circular Relating to Foreign Exchange Administration of Offshore Investment, Financing and Return Investment by Domestic Residents Utilizing Special Purpose Vehicles (“Circular 37”). Circular 37 repeals and replaces the “Circular 75” (Notice Regarding Certain Administrative Measures on Financing and Inbound Investments by PRC Residents Through Offshore Special Purpose Vehicles), which specifically permits domestic residents to establish or control offshore special purpose vehicles for the limited purposes of equity financing and return investment (i.e. investment of proceeds from such financing in the subsidiaries of such SPVs in China) subject to certain PRC regulatory approval. Circular 37 significantly expands the scope of foreign exchange registrations that PRC domestic residents can make for their offshore investments and financings, liberalizes cross-border capital outflow by domestic residents, and relaxes certain requirements for foreign exchange registrations by domestic residents.

9. VIE structures

Alternative structures have been used to address the challenges to round trip investments posed by Circular 10 and Circular 37. Many of these have involved variations on the VIE structure.

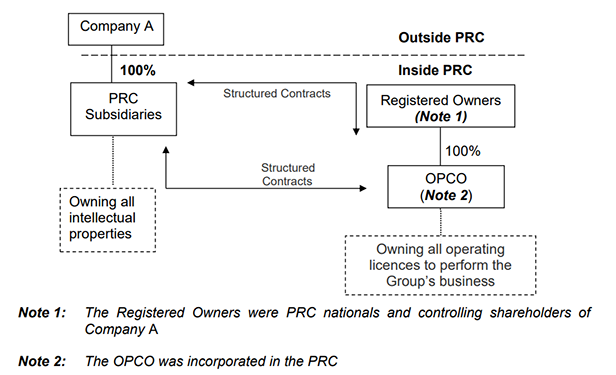

VIE structures are used to obtain an overseas listing of PRC businesses which operate in industries subject to restrictions on foreign investment under PRC law (“restricted businesses”) (e.g. internet content provision, media, telecom). Under a VIE structure, all relevant licences and permits for operating the restricted business are held by PRC operating companies (OPCOs) which are wholly owned by PRC shareholders, and the foreign investors control and obtain economic benefits from the OPCO through a series of agreements referred to as “contractual arrangements” or structured contracts.

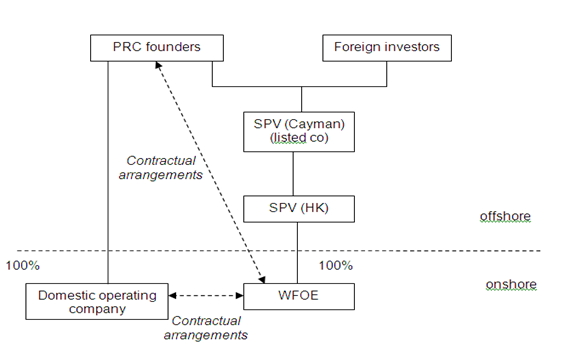

In a typical VIE structure, the PRC shareholder(s) establish an offshore SPV (usually incorporated in Bermuda or the Cayman Islands) which will normally become the listed company. The offshore SPV will establish a subsidiary in the PRC which will be a wholly foreign-owned enterprise (“WFOE”). The WFOE will enter into contractual arrangements with the OPCOs and their PRC shareholders which give it control over the OPCOs and enable the listed company to consolidate their financial results in the group’s financial statements.

The VIE structure was first adopted by Sina in its 2000 listing on Nasdaq, followed by a number of leading internet or media companies listed overseas, including Sohu, Netease, Baidu, Focus Media, Youku and Dangdang (all listed on Nasdaq or NYSE) and Tencent and Alibaba (both listed on the Exchange, although Alibaba subsequently delisted).

Over the years, the VIE structure was never officially or publicly blessed by the PRC authorities, although it was generally regarded as a structure established to intentionally circumvent the restrictions on foreign investment. In the past, however, it was at least acquiesced by the Chinese regulatory authorities.

A typical VIE structure is illustrated in the following diagram:

Typical contents of contractual arrangements between domestic company and the WFOE

Control over the OPCO is exercised through a series of contractual arrangements between (1) the PRC shareholder(s) and the WFOE; and (2) the OPCOs and the WFOE.

These contractual arrangements will normally include:

- Exclusive service agreement;

- Call option agreement;

- Equity pledge agreement;

- Loan Agreement; and

- Voting right agreement or power of attorney.

Exclusive Service Agreement

The exclusive service agreement is entered into between the WFOE and the OPCO pursuant to which the WFOE provides exclusive consulting, management or technology support services to the OPCOs for a fee for the purpose of shifting the profits of the OPCOs to the WFOE.

Call Option Agreement

The call option agreement is entered into between the WFOE and the PRC shareholder pursuant to which the WFOE is granted the option to acquire or designate a third party to acquire, all or a portion of the equity interest in the OPCO at the lowest permitted price under the applicable PRC laws and regulations.

Equity Pledge Agreement

The equity pledge agreement is entered into between the WFOE and the PRC shareholder, pursuant to which the PRC shareholder pledges all its equity interests in the OPCOs in favour of the WFOE to secure the due performance by the OPCOs of their obligations under the contractual arrangements. The equity pledge agreement is required to the registered with the local Administration of Industry and Commerce to perfect the security interest.

Loan Agreement

The loan agreement is entered into between the WFOE and the PRC shareholder, pursuant to which the WFOE grants a loan to the PRC shareholder for the purpose of capitalising the OPCOs.

Voting Rights Agreement or Power of Attorney

The voting rights agreement or power of attorney is entered into between the WFOE and the PRC shareholder pursuant to which the PRC shareholder irrevocably grants the WFOE all its shareholder rights, including voting rights.

Risks involved

However, just because VIE structures have been widely used does not mean they are legally risk-free. The continued existence of VIE structures very much depends on the “policy-winds” among government officials.

The risks associated with use of the VIE structure essentially fall into two categories: (i) the regulatory risk that the structure might be declared to be invalid by the PRC authorities; and (ii) the risk that the contractual arrangements on which it relies will be unenforceable or insufficient to retain control over the OPCO. With regard to both these issues, comfort needs to be sought from the PRC legal advisers.

The principal regulatory risk probably arises where the OPCO operates in a sector which is subject to restrictions on foreign investment. Although the foreign investor does not directly own equity in the OPCO, there is the possibility that the Chinese regulatory authorities could regard it as de facto foreign investment. Failure to obtain the required foreign investment approvals could lead to the Chinese authorities requiring the structure to be unwound. Another risk is that VIE structures could be declared to be subject to the requirement for MOFCOM approval under the M&A Rules.

Use of the VIE structure to facilitate foreign investment in areas subject to restrictions on such investment has however been common for a number of years and many of China’s best known companies have used the structure to obtain foreign venture capital financing and list offshore.

There have been attempts by individual PRC regulators to restrict or curtail the use of the structure in specific industries or to circumscribe its use in the past. For example, in relation to value added telecommunications businesses, a circular issued by the PRC Ministry of Information Industry in 2006, requires certain key assets, including trademarks and domain names, to be held by the company with the value added telecommunications service provider licence or its shareholders. As a result, in a VIE structure, the OPCO needs to hold key assets and cannot lease or license them from the WFOE. Although this increases the potential loss suffered by the WFOE if it loses control of the OPCO, the circular can also be regarded as acknowledging the use of the VIE structure in the value added telecommunications industry.

Another example is the notice of general administration of press and publication issued in 2009 – targeting the online gaming business. Under the notice, foreign investors are not allowed to control or participate in a domestic online gaming business by setting up a joint venture company, through contractual arrangements, or providing technical support.

In September 2011, the measures on the security review system of mergers and acquisitions of Chinese enterprise by foreign investors were issued. These require MOFCOM approval for foreign investment in industries deemed sensitive to China’s national security interests. The measures specifically prohibit foreign investors from adopting indirect or contractual arrangements so as to avoid the national security review requirements. This is considered to take aim specifically at VIE structures.

A potential risk is that a VIE structure will be declared invalid on public policy grounds. Buddha Steel, a small steel maker, applied for listing in the United States through a VIE structure. In March 2011, it was advised by the local government authorities of Hebei Province that the VIE contractual arrangements contravened existing Chinese management policies relating to foreign invested enterprises and as a result, were against public policy. Buddha Steel terminated the VIE contracts and withdrew its listing application.

Buddha Steel has not however been viewed as an indication of Chinese authorities’ disapproval of the VIE structure. Rather, it has been seen as the regulatory authorities tightening control on foreign investment in certain core and important industries, including the steel production industry.

China’s Foreign Investment Law

The PRC Foreign Investment Law (the “2019 FIL”) was passed by the National People’s Congress on March 2019 and went into effect on January 1, 2020. The PRC Ministry of Commerce first published a consultation draft of the 2019 FIL in January 2015 (the “2015 Draft FIL”) against the backdrop of increased concern over the legality and validity of the structured contracts used in VIE arrangements. The key changes in relation to VIEs proposed by the 2015 Draft FIL are that:

- the legal validity of VIE structures will be recognised;

- a VIE structure “controlled” by a foreign investor will have to comply with restrictions on investment in “restricted” and “prohibited” industries.

Control is defined in Article 18 of the draft FIL as:

- holding (directly or indirectly) more than 50% of the shares, voting rights or similar equity interests;

- having the right or ability to appoint or nominate at least half of the board of directors (or of a similar governance body);

- having the ability to exercise a major influence on shareholders’ or directors’ decisions; or

- having the ability to have a decisive influence over an entity’s operations, finances, human resources or technology through contract, trust or other arrangements (contractual control).

Article 18 of the 2015 Draft FIL further stipulated that a cross-border transaction that results in the “actual control” of a domestic enterprise being transferred to a foreign investor is also regarded as a form of foreign investment, thus subject to PRC foreign investment regulations.

As a result of the uncertainty related to the legality and regulatory regime of VIE structures proposed by the 2015 Draft FIL, the Exchange updated Listing Decision 43-3 and Guidance Letter 77-14 to recommend listed issuers with VIE structures to consult the Exchange in advance to seek guidance regarding novel issues.

However, the concept of “actual control” introduced in the 2015 Draft FIL was not adopted in the formally promulgated 2019 FIL, and VIE structure is not included in the scope of foreign investment under regulation. Therefore, the legality of VIE structure remains in the grey area and regulatory risk that VIE structure might be declared to be invalid by the PRC authorities in the future remains.

10. Exchange’s Approach to Listing VIE Structures: Listing Decision 43-3

The Exchange’s approach to the listing of applicants using VIE structures is set out in its Listing Decision 43-3 which was first issued in 2005. It has been updated a number of times. The Exchange generally allows listing applicants using a VIE structure (also known as “Contractual Arrangements”) to list provided that it is satisfied as to the reasons for adopting the structure and the listing applicant meets the requirements set out in that Listing Decision. VIE structures are normally only accepted for listing where they are used for restricted businesses. Where a VIE structure is used for an unrestricted business, the Listing Division will normally refer the case to the Listing Committee.

Under the disclosure-based approach, the Exchange will not consider an applicant using a VIE structure to be unsuitable for listing if it has complied with all relevant PRC laws and regulations. The listing decision requires appropriate regulatory assurance to be obtained from the relevant regulatory authorities. In the absence of such regulatory assurance, the applicant’s PRC legal counsel must include a statement in its legal opinion to the effect that all possible actions or steps taken to enable it to reach its legal conclusions have been taken.

The PRC legal opinion must also confirm that the Contractual Arrangements would not be deemed as “concealing illegal intentions with a lawful form” and thus void under PRC contract law. [6] This requirement was added in November 2013 following a ruling by China’s Supreme Court in October 2012 that arrangements which sought to give control to Chinachem Financial Services, a Hong Kong company, over a shareholding stake in China Minsheng Banking Corporation, were invalid. The court found that the arrangements had been entered into with the intention of circumventing restrictions under PRC law on foreign investment in China’s banking sector and were thus invalid and unenforceable since they “concealed illegal intentions with a lawful form”. Some commentators have argued that the case undermines the viability of the VIE structure. However, the issues in the Chinachem decision were different to those arising in a typical VIE structure. For example, the case was concerned with the validity of entrustment arrangements which are not normally used in a VIE structure.

Listing applicants which adopt a VIE structure for restricted businesses are required to demonstrate that they have taken all reasonable steps to comply with all applicable PRC rules (other than the restriction on foreign ownership).

Where PRC laws and regulations specifically prohibit foreign investors from using agreements or contractual arrangements to gain control of or operate a foreign restricted business (e.g. on-line gaming business which is subject to GAPP’s notice 13 [7]), the PRC legal opinion on the Contractual Arrangements must:

- include a positive confirmation:

- that the use of the Contractual Arrangements does not constitute a breach of those laws and regulations; or

- that the Contractual Arrangements will not be deemed invalid or ineffective under those laws and regulations; and

- be supported by appropriate regulatory assurance, where possible, to demonstrate the legality of the Contractual Arrangements.

The Exchange also expects the Contractual Arrangements to be narrowly tailored to achieve the applicant’s business aims and minimise the potential for conflict with PRC laws and regulations.

The listing applicant using a VIE structure and its sponsor are required to:

- provide reasons for the use of Contractual Arrangements in its business operation;

- unwind the Contractual Arrangements as soon as the law allows the business to be operated without them. The shareholders of the OPCO must undertake that, subject to relevant laws and regulations, they will return to the listing applicant any consideration they receive in the event that the applicant acquires the OPCO shares when unwinding the Contractual Arrangements. This undertaking must be included in the listing document;

- ensure that the Contractual Arrangements:

- include a power of attorney granted by the OPCOs’ PRC shareholders to the applicant’s directors and their successors (including a liquidator replacing the listing applicant’s directors) giving them the power to exercise all rights of the PRC shareholders (the OPCO’s shareholders must ensure that the power of attorney does not give rise to potential conflicts of interest; the power of attorney should be granted in favour of officers or directors of the applicant who are not also shareholders of the OPCO);

- include dispute resolution clauses providing:

- for arbitration and that arbitrators may award remedies over the shares or land assets of the OPCOs, injunctive relief or order the winding up of the OPCOs;

- provide the courts of competent jurisdictions with the power to grant interim remedies in support of the arbitration pending formation of the arbitral tribunal. The courts of HK, the applicant’s place of incorporation, the place of incorporation of the OPCOs and the place where the principal assets of the OPCOs are located should be specified as having jurisdiction for this purpose; and

- encompass dealing with the assets of the OPCOs and not only the right to manage its business and the right to revenue. This is to ensure that the liquidator can seize the OPCOs’ assets in a winding-up for the benefit of the listing applicant’s shareholders or creditors.

The Exchange revised Listing Decision 43-3 in April 2018 to note heightened concerns over the legality and validity of VIE structures to hold interests in PRC businesses which are subject to foreign ownership restrictions following publication of the then new PRC Foreign Investment Law (“FIL”). The amendments encourage listing applicants which use Contractual Arrangements to hold interests in PRC businesses to contact the Exchange at the earliest possible opportunity to seek informal and confidential guidance. The undertakings typically required by the Exchange will be to ensure that the listing applicant is controlled by PRC nationals. The aim is to ensure that the listing applicant will not be regarded as controlled by foreign investors which are prohibited from investing in certain industries and subject to restrictions on investing in others. The types of undertakings typically required by the Exchange are as discussed above. Listing Decision 43-3 has not been yet amended by the Exchange since the implementation of the FIL in January 2020.

Disclosure Requirements

Listing applicants using Contractual Arrangements for the entire or part of their business are required to disclose the following information in the prospectus:

- detailed discussion about the OPCOs’ registered shareholders and a confirmation that appropriate arrangements have been made to protect the applicant’s interests in the event of their death, bankruptcy or divorce;

- the extent to which the applicant has arrangements to address the potential conflicts of interest between the applicant and the OPCO’s registered shareholders;

- reasons why the directors believe that each of the Contractual Arrangements is enforceable under PRC laws and regulations;

- the economic risks the applicant bears as the primary beneficiary of the OPCO, such as its share of OPCO’s financial losses, the circumstances in which the applicant would be required to provide financial support to the OPCO, and other events that could expose the applicant to loss;

- whether the applicant has encountered any interference from any PRC governing bodies in operating their business through the OPCO under the Contractual Arrangements;

- the limitations in exercising the option to acquire ownership in the OPCO with a separate risk factor explaining the limitations;

- the Contractual Arrangements must be included as material contracts in the “Statutory and General Information” section and must be available on the applicant’s website;

- a corporate structure table in the “Summary” section must be included for the purpose of illustrating the Contractual Arrangements;

- details of any insurance purchased to cover the risks relating to the Contractual Arrangements or prominent disclosure that those risks are not covered by any insurance;

- separate disclosure of revenue from structured contract arrangements if the listing applicant generates revenue from other subsidiaries apart from the OPCO;

- a positive confirmation from the PRC legal advisers that the Contractual Arrangements Contractual Arrangements would not be deemed as “concealing illegal intentions with a lawful form” and void under the PRC contract law;

- the prospectus should include at least the following Contractual Arrangements- related risk factors:

- the PRC government may determine that the Contractual Arrangements do not comply with applicable regulations;

- the Contractual Arrangements may not provide control as effective as direct ownership;

- the PRC shareholders may have potential conflicts of interest with the applicant; and

- Contractual Arrangements may be subject to scrutiny by the PRC tax authorities and additional tax may be imposed.

Disclosure of the Contractual Arrangements (other than the risk factors associated with them) should be presented in a standalone section.

PRC property issues

The listing of PRC companies often involves properties situated in the PRC. Despite the rapid development of the property market and title registration system, many issues relating to titles of PRC properties remain unresolved. Therefore, potential PRC listing applicants may face difficulties in evidencing their ownership in those properties due to uncertainty involved in the application process for the relevant land use right certificate and/or building ownership certificate.

The Exchange issued a guidance letter in relation to the requirements for title certificates of PRC properties (HKEx-GL19-10). Below is a summary of the guidance letter:

- For infrastructure project companies and property companies, the relevant title certificates of PRC properties are a pre-requisite for listing approval;

- For mineral and exploration companies, the Listing Rules require them to obtain adequate rights to participate actively in the exploration and extraction of resources. Title certificates are normally required to prove their rights;

- For other companies, the Exchange no longer requires title certificates of PRC properties. Instead, it expects listing applicants to disclose in the prospectus the risks to their operations of not having the relevant title certificates

Practice Note 12 of the Listing Rules provides that where the issue of a land use right certificate is pending, a properly approved land grant or land transfer contract in writing accompanied by a PRC legal opinion as to the validity of the approval may be acceptable as evidence of a transferee’s pending title to the land to be granted or transferred.

[7] “Notice Regarding the Consistent Implementation of the ‘Stipulations on “Three Provisions”’ of the State Council and the Relevant Interpretations of the State Commission Office for Public Sector Reform and the Further Strengthening of the Administration of Pre-examination and Approval of Internet Games and the Examination and Approval of Imported Internet Games” (Xin Chu Lian [2009] No. 13) published jointly by PRC General Administration of Press and Publication, National Copyright Administration, and National Office of Combating Pornography and Illegal Publications on 28 September 2009.

II. QUALIFICATIONS FOR MAIN BOARD LISTING OF H SHARE COMPANIES

The Listing Rules set out the basic requirements that must be met before any initial listing of equity securities on the Hong Kong Exchange.

- Incorporation

The issuer must be duly incorporated as a joint stock limited company in China. This is in order to ensure that the issuer is subject to the Chinese Company Law.

- Suitability for Listing (Rule 8.04)

The company and its business must, in the opinion of the Exchange, be suitable for listing. This means, for example, that the nature of the company’s business and its management must be in keeping with the standards of integrity which the Exchange endeavours to uphold and that there will be sufficient public interest in the business of the company and in its shares. The Exchange may have concerns if a company is heavily dependent on one product or customer. In such situations, it is advisable to seek a preliminary view of the Listing Committee at an early stage of the application process.

In addition, the Exchange will not normally regard as suitable for listing a company or its group (other than an investment company) whose assets consist wholly or substantially of cash or short-dated securities, except where the issuer or group is solely or mainly engaged in the securities brokerage business. Other factors which the Exchange will take into account in determining suitability are set out in the Exchange’s Guidance Letters HKEx-GL 68-13 and 68-13A.

- Operating History and Management

The basic requirement is that a Main Board listing applicant must have a trading record period of at least 3 financial years with:

- management continuity for at least the 3 preceding financial years; and

- ownership continuity and control for at least the most recent audited financial year.

An exception exists for companies applying to list under the market capitalisation/revenue test. For these companies, the Exchange may accept a shorter trading record period under substantially the same management if the applicant can demonstrate that:

- its directors and management have sufficient and satisfactory experience of at least 3 years in the line of business and industry of the new applicant; and

- management continuity for the most recent audited financial year.

- Financial Tests

Main board listing applicants are required to satisfy one of the following 3 tests: the Profit Test; the Market Capitalisation/Revenue Test; or the Market Capitalisation/Revenue/Cash Flow Test.

The Profit Test (Rule 8.05(1))

The applicant or its group (excluding any entities whose results are recorded in the applicant’s financial statements using the equity method of accounting) must have recorded profits of at least HK$20 million in the most recent financial year and aggregate profits of at least HK$30 million in the two years before that. Such profit must exclude any income or loss of the applicant (or its group) generated by activities outside the ordinary and usual course of its business.

Applicants listing under the profits test must also have an expected market capitalisation at the time of listing of at least HK$500 million. This is calculated on the basis of all issued share capital of the applicant including the class of shares to be listed and all other classes of securities that are either unlisted or listed on other regulated markets at the time of listing. The expected issue price of the shares for which listing is sought is used to determine the market value of securities that are unlisted or listed on other markets.

The Market Capitalisation/Revenue/Cash Flow Test (Rule 8.05(2))

If a listing applicant has an expected market capitalisation at the time of listing of at least HK$2 billion at the time of listing, there is no profit requirement. Instead the applicant will meet the financial requirement if it has:

- revenue of at least HK$500 million for the most recent audited financial year; and

- positive cash flow from operating activities carried out by the applicant or its group of at least HK$100 million in aggregate for the three preceding financial years.

The Market Capitalisation/Revenue Test (Rule 8.05(3))

- If an applicant has an expected market capitalisation at listing of at least HK$4 billion, it will meet the financial requirement for listing if it has revenue of at least HK$500 million for the most recent audited financial year.

This test is for larger listing applicants that are able to generate substantial revenue.

Calculation of revenue:

For both the Market Capitalisation/Revenue Test and the Market Capitalisation/Revenue/Cashflow Test, only revenue arising from the applicant’s principal activities and not items of revenue or gains arising incidentally will be recognised.

Revenue from “book transactions” is disregarded.

Financial Requirement Waivers (Rule 8.05B)

The Exchange may also accept a shorter trading record period and/or may vary or waive the financial standards requirements for:

- mineral companies whose directors and management have at least five years’ relevant experience in mining and/or exploration activities;

- newly formed “project” companies (for example a company formed to construct a major infrastructure project); or

- in exceptional circumstances, if the applicant or its group has a trading record of at least two financial years and the Exchange is satisfied that the applicant’s listing is in the interests of the applicant and its investors.

- Shares in Public Hands (Rule 8.08)

There must be an open market in the securities for which listing is sought. In general, this means that not less than 25% of the listing applicant’s total issued share capital having an expected market capitalisation at the time of listing of at least HK$125 million, must be held by the public (Rule 8.08(1)(a)), i.e. owned by persons who are not “connected persons” of the issuer or persons whose securities have been financed by a connected person or who are accustomed to take instructions from a connected person in relation to their shares (Rule 8.24). “Connected persons” of a PRC issuer include directors, supervisors, chief executives or substantial shareholders (i.e. holders of 10% of the voting power at general meetings) of the PRC issuer or any of its subsidiaries or an associate of any of them (Rule 1.01).

Where a listing applicant has more than one class of securities apart from the H shares, the total securities of the listing applicant held by the public (on all regulated markets including the Hong Kong Stock Exchange) must be at least 25% of the issuer’s total issued share capital. However, the H shares must not be less than 15% of the issuer’s total issued share capital, and have an expected market capitalisation at the time of listing of not less than HK$125 million (Rule 8.08(1)(b)).

Exchange’s Discretion to Accept Lower Public Float (Rule 8.08(1)(d))

For large companies, with an expected market capitalisation in excess of HK$10 billion, the percentage required to be in public hands, may, at the Exchange’s discretion, be lower (but not lower than 15%) provided that:

- the Exchange is satisfied that the number of securities and their distribution will enable the market to operate properly with a lower percentage;

- the issuer makes appropriate disclosure of the lower prescribed percentage of public float in the listing document;

- the issuer confirms the sufficiency of public float in successive annual reports after listing; and

- a sufficient proportion (to be agreed in advance with the Exchange) of any securities to be marketed contemporaneously in and outside Hong Kong, must normally be offered in Hong Kong.

This public float waiver is available only on initial listing. It cannot be applied for post-listing if the issuer subsequently satisfies the HK$10 billion market capitalisation requirement.

- Minimum Number of Shareholders at Time of Listing

Securities new to listing must have an adequate spread of shareholders. The number will depend on the size and nature of the issue, but there must be a minimum of 300 holders.

In addition, not more than 50% of the securities in public hands at the time of listing can be beneficially owned by the three largest public shareholders (Rule 8.08(3)).

After listing, there is no requirement for a minimum number of shareholders. The issuer must however comply with the minimum public float requirement.

- Market Capitalisation

The expected market capitalisation at the time of listing of a new applicant must be at least HK$500 million and the expected market capitalisation of the securities held by the public must be at least HK$125 million. If a PRC issuer is listing under the Market Capitalisation/Revenue/Cash Flow Test or Market Capitalisation/Revenue Test it must have an expected market capitalisation at the time of listing of HK$2 billion or HK$4 billion, respectively. Most companies at the time of initial flotation have a market capitalisation of around HK$200 million. Further issues of securities of a class already listed are not subject to this limit, and, in exceptional cases, a lower expected initial market capitalisation may be acceptable, although the Exchange will have to be satisfied as to the marketability of the securities.

Determination of Market Capitalisation at Time of Listing

The expected market capitalisation at the time of listing is calculated on the basis of all issued share capital of the issuer including not only the class to be listed on the Exchange but also any other classes of securities of the issuer that are either unlisted or listed on other regulated markets at the time of listing (Rule 1.01).

The expected issue price of the securities to be listed on the Exchange is used in determining the market value of other classes of securities which are unlisted or listed on other regulated markets (Rule 8.09A). Accordingly, in the case of an H share issuer which also has an A share listing, the expected issue price of the H shares will also be applied to the A shares and any unlisted shares in determining the PRC issuer’s market capitalisation at the time of listing.

- Working Capital Sufficiency (Rule 8.21A)

A listing applicant must include a working capital statement in the listing document. In making the statement, the applicant must be satisfied after due and careful enquiry that it and its subsidiary undertakings have sufficient working capital for the group’s present requirements, that is for at least the next 12 months from the date of publication of the listing document. Applicants whose business is wholly or substantially the provision of financial services and whose solvency and capital adequacy are subject to prudential supervision by another regulatory body are not required to comply with this provision. The applicant’s sponsor must provide written confirmation to the Exchange that:

- it has obtained written confirmation from the listing applicant as to the sufficiency of the working capital available to the group for at least 12 months from the date of the listing document; and

- it is satisfied that this confirmation has been given after due and careful enquiry by the applicant and that the persons or institutions providing finance have stated in writing that the financing facilities exist.

- Competing Businesses

The Main Board Rules allow competing businesses of an applicant’s directors and controlling shareholders provided that full disclosure is made at the time of listing and, in the case of the directors, on an on-going basis (Rule 8.10). The Exchange may also require the appointment of a sufficient number of INEDs to ensure that the interests of the general body of shareholders are adequately represented.

In the case of a PRC issuer, “controlling shareholder” means any shareholder or other person or group of persons together entitled to exercise, or control the exercise of 30% (or such other amount as may from time to time be specified in applicable PRC law as being the level for triggering a mandatory general offer or for otherwise establishing legal or management control over a business enterprise) or more of the voting power at general meetings of the new applicant or who is in a position to control the composition of a majority of the board of directors of the new applicant. According to Article 216(2) of the Chinese Company Law, “controlling shareholder” means a shareholder whose shareholding accounts for 50% or more of the total share capital of the new applicant, or a shareholder whose shareholding is less than 50% but whose voting rights pursuant to such shareholding are sufficient to have a major impact on the resolutions of the shareholders’ meeting or shareholders’ assembly. For the purposes of Listing Rule 8.10, the Exchange will normally not consider a PRC Governmental Body (including central, provincial or local level governments but excluding entities under the PRC government that engage in commercial business or operate another commercial entity) as a “controlling shareholder” of a PRC issuer.

- Accountants’ Report and Accounting Standards

An issuer must include in its listing document an accountants’ report prepared in accordance with Chapter 4 of the Listing Rules. The accountants’ report must be prepared by professional accountants qualified under the Professional Accountants Ordinance who are independent of the issuer to the same extent as is required of an auditor under the Companies Ordinance and in accordance with the Hong Kong Institute of Certified Public Accountants’ requirements on independence.

The accountants’ report must cover the 3 financial years immediately preceding the listing and the latest financial period reported on must not have ended more than 6 months before the date of the listing document.

The financial history of results and balance sheets included in the accountants’ report of a PRC issuer may be prepared in accordance with Chinese financial reporting standards as an alternative to Hong Kong or International Financial Reporting Standards (Rule 4.11) and to be audited under Chinese accounting standards. The Exchange will also accept a firm of practising accountants which has been approved by China’s Ministry of Commerce and the China Securities Regulatory Commission as being suitable to act as a reporting accountant and auditor for a PRC company listing in Hong Kong.

- Directors and Supervisors

The board of directors of a listed company is collectively responsible for the issuer’s management and operations. Directors of listed companies are expected to fulfill fiduciary duties and duties of skill, care and diligence to a standard established by Hong Kong law (Rules 3.08). Each director and supervisor of a PRC company must satisfy the Exchange that he has the character, experience and integrity and is able to demonstrate a standard of competence commensurate with his position as director or supervisor of a listed company (Rules 3.09 and 19A.18(2)).

- Independent Non-Executive Directors (“INEDs”)

The board of directors is required to include a minimum of 3 INEDs (Rule 3.10), and INEDs must make up at least one third of the board (Rule 3.10A). One INED must have appropriate professional qualifications or accounting or related financial management expertise (Rule 3.10). The Rules (MB Rule 3.13) contain guidelines for the determination of INED’s independence.

INEDs are required to provide the Exchange with written confirmation of their independence in accordance with those guidelines at the time of submission of their declaration and undertaking. They must also provide annual confirmations of their independence to the listed issuer.

Issuers are required to inform the Exchange and publish an announcement if they fail to comply with the requirements in relation to INEDs. The issuer will have three months to rectify the situation.

Every INED must satisfy the Exchange that he has the character, integrity, independence and experience to fulfill his role effectively. INEDs of PRC issuers must additionally be able to demonstrate an acceptable standard of competence and adequate commercial or professional experience to ensure that the interests of the general body of shareholders will be adequately expressed. In addition, at least one INED of a PRC issuer must be ordinarily resident in Hong Kong (Rule 19A.18(1)).

- Audit Committee and Remuneration Committee

Audit Committee

The establishment of an audit committee is a compulsory requirement under Rule 3.21. The committee must be made up of non-executive directors only, the majority of which must be INEDs of the listed issuer. The committee must have a minimum of 3 members, at least one of whom must be an INED with appropriate professional qualifications or accounting or related financial management expertise. The committee must be chaired by an INED.

The duties and procedures of the audit committee are Code provisions under Section C.3 of the Corporate Governance Code set out in Appendix 14 to the Main Board Rules.

Remuneration Committee

Listed issuers are also required by Rule 3.25 to establish a remuneration committee which must be chaired by an INED and have INEDs as a majority of its members. The issuer’s board of directors must approve and provide written terms of reference for the remuneration committee which deals clearly with its authority and duties. The terms of reference of the remuneration committee are required to include, as a minimum, the duties specified in Code Provision B.1.2 of the Corporate Governance Code.

If an issuer fails to comply with the requirements in relation to audit and remuneration committees, it must inform the Exchange, publish an announcement giving reasons for such failure and must ensure that it complies with the requirements within three months.

- Sponsor

A new applicant seeking a listing of equity securities on the Main Board must appoint one or more sponsors under a written engagement agreement to assist with its listing application (Rule 3A.02). Only firms that are licensed under part V of the Securities and Futures Ordinance for Regulated Activity Type 6 (Advising on Corporate Finance) and are permitted by their licence to conduct sponsor work are allowed to act as sponsors to new listing applicants. At least one sponsor must be independent of the listing applicant. The sponsor must be appointed (and if there is more than one sponsor, the last sponsor to be appointed must be appointed) at least 2 months before the submission of the listing application.

- Compliance Adviser

A PRC issuer is required to retain a compliance adviser for the period commencing on the date of listing and ending on the publication of its financial results for the first full financial year after listing (Rule 3A.19). A compliance adviser must be either a corporation licensed or an authorised institution registered to advise on corporate finance matters under the Securities and Futures Ordinance. Only firms who are permitted by their SFC licence or registration to conduct sponsor work are allowed to act as compliance advisers to companies listed on the Main Board or GEM. A compliance adviser must act impartially but is not required to be independent of the issuer. An issuer is not obliged to appoint as its compliance adviser the same firm that acted as the sponsor of its initial public offering.

Issuers are required to consult with, and if necessary, seek advice from their compliance advisers on a timely basis in the following 4 situations:

- before publication of any regulatory announcement, circular or financial report;

- where a notifiable or connected transaction is contemplated;

- where the issuer proposes to use the IPO proceeds differently to the manner detailed in the listing document or where the issuer’s business activities, developments or results deviate from any forecast, estimate or other information in the listing document; and

- where the Exchange makes an inquiry of the issuer under Rule 13.10 regarding unusual movements in the price or trading volume of its securities (Rule 3A.23).

The Exchange may also require an issuer to appoint a compliance adviser at any other time after the first full financial year after listing, for example if the issuer has breached the Listing Rules (Rule 3A.20). In this case the Exchange will specify the period of appointment and the circumstances in which the compliance adviser must be consulted.

A compliance adviser to a PRC issuer is additionally required to inform the issuer on a timely basis of any amendment or supplement to the Listing Rules and any change to Hong Kong’s laws, regulations or codes which apply to the issuer. The compliance adviser is further required to advise the PRC issuer on continuing compliance with the Listing Rules and applicable laws and regulations (Rule 19A.06(3)). Where the PRC issuer’s authorised representatives are expected to be frequently outside Hong Kong, the compliance adviser must act as the issuer’s principal channel of communication with the Exchange (Rule 19A.06(4)).

- Mandatory Provisions for Articles of Association

The mandatory provisions which must be incorporated in the issuer’s Articles of Association, (as set out in Appendix 3 and Appendix 13 Part D Section 1) of the Main Board Listing Rules) are designed to provide a sufficient level of shareholder protection. Additional requirements for PRC issuers include, among others, provisions to reflect the different nature of domestic shares and overseas listed foreign shares (including H shares) and the different rights of their respective holders (Rule 19A.01(3)).

- Arbitration (Rule 19A.01(3))

Disputes involving holders of H shares arising from the issuer’s articles of association or from any rights or obligations conferred or imposed by the Company Law of the PRC or other relevant PRC laws and regulations must be settled by way of arbitration. The dispute may be heard, at the option of the claimant, at either the China International Economic and Trade Arbitration Commission or the Hong Kong International Arbitration Centre. The arbitral award will be final and binding on the parties to it.

- Service Agent (Rule 19A.13(2))

The issuer must appoint, and maintain throughout the period its securities are listed on the Exchange the appointment of, a person authorised to accept service of process and notices on its behalf in Hong Kong. The Exchange must be notified of such appointment, any termination of such appointment, and contact details of the appointee.

If changes in PRC law or market practices materially alter the validity or accuracy of the rules relating to PRC companies, the Exchange may impose additional requirements or make listing of the equity securities of a PRC issuer subject to special conditions, as the Exchange thinks appropriate.

- Receiving Agent (Rule 19A.51)

A PRC issuer must appoint a receiving agent in Hong Kong who will receive from the issuer, and hold, pending payment, in trust for H shareholders, dividends declared and other monies owing in respect of H shares.

- Share Register

PRC issuers must maintain a register for H shares in Hong Kong (Rule 19A.13(3)(a)). Any rectification of such register will fall under the jurisdiction of the Hong Kong courts.

- Management Presence

A new applicant applying for a listing on the Exchange must have sufficient management presence in Hong Kong. This will normally mean that at least two of its executive directors must be ordinarily resident in Hong Kong (Rule 8.12). This requirement applies to Chinese issuers, except as otherwise permitted by the Exchange at its discretion. PRC issuers will generally seek a waiver from the Exchange from this requirement. In considering such waiver application, the Exchange will have regard to, among other considerations, the new applicant’s arrangements for maintaining regular communication with the Exchange, including but not limited to, retaining a compliance adviser and ensuring that its authorised representatives are readily contactable by the Exchange.

- Authorised Representatives

Every issuer must appoint 2 authorised representatives to act at all times as the issuer’s principal channel of communication with the Exchange (Rule 3.05). The authorised representatives must be either 2 directors or a director and the company secretary unless the Exchange, in exceptional circumstances, agrees otherwise. The responsibilities of an authorised representative include:

- at all times (particularly prior to commencement of trading in the morning) being the principal channel of communication between the Exchange and the listed issuer and supplying the Exchange with his contact details (including home and office telephone and facsimile numbers);

- to ensure that whenever he is outside Hong Kong suitable alternates are appointed, available and known to the Exchange and to give the Exchange their contact details in writing.

Where a PRC issuer’s authorised representatives are expected to be frequently outside Hong Kong, the Compliance Adviser must act as the issuer’s principal channel of communication with the Exchange.

- Company Secretary (Rule 3.28)

A person will be qualified to act as company secretary if by virtue of his/her academic or professional qualifications or relevant experience he/she is, in the opinion of the Exchange, capable of discharging the functions of a company secretary. The academic or professional qualifications which the Exchange considers acceptable are membership of The Hong Kong Institute of Chartered Secretaries and being a Hong Kong solicitor, barrister or certified public accountant.

In assessing a person’s relevant experience, the Exchange will consider the individual’s length of employment with the issuer and other issuers and the roles he has played, the person’s familiarity with the Listing Rules and other relevant Hong Kong laws and regulations, relevant training undertaken and professional qualifications in other jurisdictions.

A company secretary is not required to be resident in Hong Kong.

- Communication

There must be adequate communication and cooperation agreements in place between the Exchange and the relevant securities regulatory authorities in the PRC. If the PRC issuer has securities listed on another stock exchange, there must also be adequate communication arrangements in place with that stock exchange.

Main Board Application Procedure

At the time of applying to list, an applicant must submit a draft listing document (the Application Proof), the information in which must be “substantially complete” except in relation to information that by its nature can only be finalised and incorporated at a later date (Main Board Rule 9.03(3)).

The Exchange has the power to return a listing application on the grounds that the information in the listing application or the Application Proof is not “substantially complete” (Main Board Rule 2B.01A and 9.03(3)).

If the Exchange returns a listing application to a sponsor before issuing its first comment letter to the sponsor, the initial listing fee will be refunded but in other cases it will be forfeited. If an application is returned, a new application cannot be submitted until 8 weeks after the Return Decision. The names of the applicant and sponsor(s) together with the return date will also be published on the Exchange’s website.

Before submitting the listing application, the sponsor is required to perform all reasonable due diligence on the listing applicant (except in relation to matters that can only be dealt with later). Sponsors also have a duty to report to the Exchange any material information concerning non-compliance with the Listing Rules or other regulatory requirements relevant to the listing. This duty continues after the sponsor ceases to act for a listing applicant if the information came to the knowledge of the sponsor whilst it was acting as the sponsor.

Other documents which are required to be submitted with the listing application include:

- Written confirmation by each director/supervisor that the information in the Application Proof is accurate and complete in all material respects and not misleading or deceptive;

- Confirmation from the reporting accountants that no significant adjustment is expected to be made to their draft reports included in the Application Proof (Guidance Letter HKEx-GL58-13));

- Confirmations from experts that no material change is expected to be made to their reports included in the Application Proof (see Guidance Letter HKEx-GL60-13);

- Draft letter from the sponsor confirming that it is satisfied that the directors’ statement as to sufficiency of working capital has been made by the directors after due and careful enquiry; and

- A certified copy of the applicant’s certificate of incorporation or equivalent.

The Exchange will comment on the Application Proof within 10 business days from receipt of the application.

Assuming only one round of comments and the submission of a response within 5 business days, the Exchange expects a listing application to be able to be heard by the Listing Committee within 25 business days from the submission of the application. If there are 2 rounds of Exchange comments, assuming sponsor takes 5 business days to respond, the listing application can be heard by the Listing Committee within around 40 business days.

If the listing is approved at the Listing Committee hearing, the Exchange will issue a letter requiring the posting of a near-final draft of the listing document (“PHIP”) on the Exchange’s website. This must be submitted for publication before distribution of the red-herring prospectus to institutional or other professional investors and before book-building commences.

The most important thing is to ensure that the Application Proof which is submitted with the listing application contains all required information to avoid the application being returned by the Exchange. This requirement means that sponsors must complete the vast majority of their due diligence on the listing applicant’s group before submitting the listing application.

III. QUALIFICATIONS FOR GEM LISTING

Chapter 11 of the GEM Listing Rules sets out the basic requirements that must be met before any initial listing of equity securities on the GEM. Chapter 25 contains additional requirements, modifications and exceptions to those requirements which apply to PRC incorporated companies.

- Incorporation

The PRC issuer must be duly incorporated in the PRC as a joint stock limited company.

- Suitability for Listing

Both the issuer and its business must, in the opinion of the Exchange, be suitable for listing (Rule 11.06). The Exchange may, in its discretion, refuse a listing of a PRC issuer’s securities if it believes that it is not in the interest of the Hong Kong public to list them (Rule 25.07(1)). Factors considered by the Exchange in determining suitability are set out in the Exchange’s Guidance Letters HKEx-GL 68-13 and 68-13A.

- Cash Flow Requirement

A GEM listing applicant must have a positive cashflow from operating activities in the ordinary and usual course of business of at least HK$30 million in total for the 2 financial years immediately preceding the issue of the listing document.

- Statement of Business Objectives (Rule 14.19)

A new applicant must include in its listing document a statement of business objectives setting out the following information:

- general information as to (a) the overall business objectives of the new applicant; and (b) the market potential for the new applicant’s business pursuits over the period comprising the remainder of the current financial year of the applicant and the 2 financial years thereafter;

- a detailed description of the new applicant’s objectives for each of the products, services or activities (and any other objectives) analysed over the period comprising the remainder of the current financial year of the applicant and the 2 financial years thereafter;

- a detailed explanation as to how the applicant proposes to achieve the stated business objectives; and

- a clear explanation of all bases and assumptions in support of the new applicant’s assessment of its market and growth potential, business objectives and/or description of how it proposes to achieve its business objectives.

GEM issuers are required to report on the achievement of the business objectives stated in their listing documents in the annual and half year reports published in the first 2 full financial years after listing.

- Operating History and Management

A GEM listing applicant must have:

- management continuity for at least two completed financial years; and

- ownership continuity and control for at least 1 completed financial year, immediately before the issue of the listing document. In both cases, continuity must continue until the date of listing.

The Exchange may accept a trading record period of less than 2 financial years and waive or vary the ownership and management requirements for:

- newly formed project companies; (for example a coy formed for the purpose of major infrastructure project)

- mineral companies where the directors and senior management have > 5 years’ relevant experience; and

- in exceptional circumstances under which the Exchange considers it desirable to accept a shorter period.

Where the Exchange accepts a shorter period, the applicant must nevertheless meet the cash flow requirement of HK$30 million for that shorter trading record period.

- Market Capitalisation

The required expected market capitalisation of a new listing application at the time of listing is HK$150 million.

- Public Float

There must be an open market in the securities for which listing is sought. The minimum public float requirement is in line with the Main Board requirement, that is 25% or, in the Exchange’s discretion, between 15% and 25% for companies with a market capitalisation of more than HK$10 billion. Shares held by the public must however have a market capitalisation of at least HK$45 million at the time of listing (Rule 11.23(2)(a)). If the issuer has more than one class of shares, the total shares in public hands (on all regulated market(s) including the Exchange) at the time of listing must be at least 25% of the issuer’s total issued share capital and the shares for which listing is sought must be at least 15% of the total issued share capital with an expected market capitalisation of HK$45 million at the time of listing.

- Minimum Number of shareholders

The equity securities in the hands of the public should, as at the time of listing, be held among at least 100 persons (including those whose equity securities are held through CCASS) (Rule 11.23(2)(b)).

In addition, not more than 50% of the securities in public hands at the time of listing can be beneficially owned by the three largest public shareholders.

- Accountants’ Report

A new applicant must have an accountants’ report covering at least the 2 financial years immediately preceding the issue of the listing document (Rule 11.10).The Exchange also encourages an issuer with a longer operating history of more than two years to voluntarily disclose three years’ financial results in the accountants’ report. The latest financial period reported on by the reporting accountants must not have ended more than 6 months before the date of the listing document (Rule 11.11).

- Directors and Supervisors

The board of directors of an issuer is collectively responsible for the management and operations of the issuer (Rule 5.01). Every director and supervisor must satisfy the Exchange that he has the character, experience and integrity and is able to demonstrate a standard of competence commensurate with his position as a director or supervisor of the issuer (Rules 5.02 and 25.13(2)).

- Independent Non-executive Directors

Independent non-executive directors (“INEDs”) must make up at least one third of the issuer’s board of directors and there must be at least 3 INEDs. At least one INED must have appropriate professional qualifications or accounting or related financial management expertise (Rule 5.05). Each INED must confirm his independence in accordance with guidelines under Rule 5.09 to the Exchange at the time of submission of his declaration, undertaking and acknowledgement.

INEDs of PRC issuers are further required to demonstrate an acceptable standard of competence and adequate commercial or professional experience to ensure that the interests of the general body of shareholders will be adequately represented (Rule 25.13).

- Audit Committee and Remuneration Committee

Every issuer must establish an audit committee comprising non-executive directors only and a minimum of 3 members, at least one of whom is an INED with appropriate professional qualifications or accounting or related financial management expertise (Rule 5.28). The majority of the committee members must be INEDs of the issuer. The audit committee must be chaired by an INED. The duties of the audit committee must include at least the following matters:

- reviewing, in draft form, the issuer’s annual report and accounts, half-year report and quarterly reports and providing advice and comments thereon to the issuer’s board of directors; and

- reviewing and supervising the issuer’s financial reporting and internal control procedures (C.3 of Appendix 15).

Listed issuers must also establish a remuneration committee with specific written terms of reference which deal clearly with its authority and duties. A majority of the members of the remuneration committee should be independent non-executive directors and the committee must be chaired by an INED. The terms of reference of the remuneration committee should include, as a minimum, the duties as specified in paragraph B.1.2 of Appendix 15.

If an issuer fails to comply with the requirements in relation to audit and remuneration committees, it must inform the Exchange, publish an announcement giving reasons for such failure and must ensure that it complies with the requirements within three months.

- Sponsor

A new applicant seeking a listing of equity securities on GEM must appoint one or more sponsors to assist with its listing application. At least one sponsor must be independent of the listing applicant. The listing application cannot be submitted less than 2 months after the appointment of the last sponsor to be appointed.

- Compliance Adviser

A PRC issuer is required to retain a compliance adviser for the period commencing on the date of listing and ending on the publication of its financial results for the second full financial year after listing (Rule 6A.19). A compliance adviser must be either a corporation licensed or authorised institution registered to advise on corporate finance matters under the Securities and Futures Ordinance. It must also be permitted to undertake sponsor work.

GEM issuers are required to consult with, and if necessary, seek advice from their compliance advisers in the same situations as MB issuers.

- Compliance Officer

A GEM issuer must appoint one of its executive directors as its compliance officer. The compliance officer’s responsibilities must include, as a minimum:-