IPOs

Introduction

- Historically – 2 models for PRC companies to list on the Exchange:

- Directly via an H share listing

- Indirectly via a red chip listing

- H share companies are enterprises incorporated as joint stock limited companies in the PRC which have received CSRC approval to list in Hong Kong.

- Red chip companies are enterprises that are incorporated outside of the PRC (normally in Hong Kong, the Cayman Islands or Bermuda), are controlled directly or indirectly by PRC government entities and conduct most of their business in the PRC.

- Non-H share Mainland private enterprises are overseas incorporated entities controlled by Chinese individuals.

- Of the 1,793 listed companies on the Exchange at the end of June 2015, 906 (or 50.5%) were Mainland enterprises, including 210 H-share companies, 143 red-chip companies and 553 Mainland private enterprises.

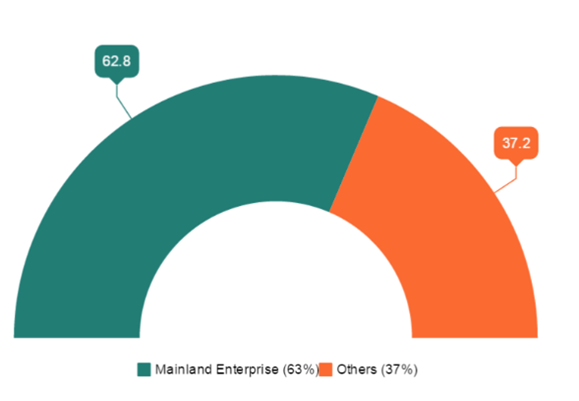

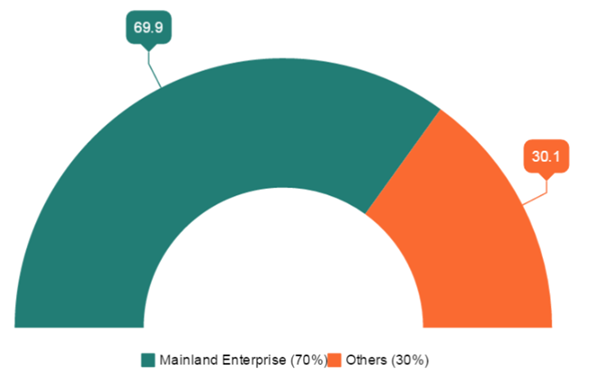

- Together, Mainland enterprises accounted for 8% of the market capitalisation and 69.9% of the equity turnover of all listings on the Exchange (as at end June 2015).

HKEx Market Capitalisation HKEx Equity Turnover

HKEx Ranking Overview

2014

- Hong Kong Exchange: world’s 7th largest by market capitalisation (3rd in Asia after Shanghai & Japan)

- IPO market: ranked 2nd in the world in IPO funds raised (after New York).

- HK ranked in top 5 for last 13 years.

- 122 new listings (including transfer of listings) raised HKD 227.7 bln (US$29.5 bln) (up 34.79% from 2013)

Stock Exchange Rankings First Half 2015

- Hong Kong Exchange ranked 1st for IPO funds in 1H2015 raising HK$129 billion (US$16.7 bln) in 51 IPOs, slightly ahead of Shanghai which raised US$16.67 bln in 77 IPOs.

- For Hong Kong – this represented a 58% increase compared to 1H2014.

Ranking Exchange No. of IPOs FundsRaisedin US$bln 1 HongKong 51 16.7 2 Shanghai 77 16.67 3 NewYork 38 13.00 4 London 51 9.39 5 Madrid 6 8.50 6 Nasdaq 76 8.23 7 Shenzhen 108 7.01 8 Paris(Euronext)Stockholm 19 3.64 9 NasdaqOMXNordicExchange 28 3.53 10 SIXSwissExchange 1 2.46 Source: Dealogic and HKEx as of 30 June 2015. Hong Kong Stock Exchange Bi-monthly Newsletter (May-June 2015)

- % of HK IPOs issued in upper pricing range rose from 32% to 57% from 1Q2015 to 2Q2015.

Global IPO Statistics

- Global IPO funds raised in 1H 2015 dropped 13% compared to the 1H 2014, despite a 6% increase in the number of IPOs to 631.

- Decrease in IPO activity in 1H most marked in Europe and the US.

- Fueled by Chinese stock market boom, China saw a significant increase in listings in 1H 2015:

- 77 IPOs on the Shanghai Exchange (SE) raised US$16.67 bln; and

- 108 IPOs on the Shenzhen Exchange (SSE) raised US$7.01 bln.

- Hong Kong raised US$16.7 bln in 51 IPOs in 1H 2015 – up 58% on IPO funds raised in 1H 2014.

- Hong Kong expected to take the top spot for the full year 2015 – having lost it to the NYSE from 2012 to 2014

Source: Ernst & Young

HK Listings of PRC Companies

- Hong Kong listed the world’s 2nd and 3rd largest IPOs in 1H 2015

Huatai Securities

- raised US$4.5 bln

- oversubscribed x 280

GF Securities

- raised US$3.6 bln

- oversubscribed x 180

- Listing applications filed before July/August sell-off mainly from financial sector (e.g. Bank of Jinzhou (now stalled), Guangdong Join-Share Financing Guarantee Investment Co., and China Reinsurance (Group) Corp.)

| Hong Kong IPOs with funds raised equal to or over HKD 1 billion during 1H 2015 | |||||||

|

Stock code |

Company |

Funds raised(HKD ’million) |

IPO Subscription |

Date of listing |

The first trading day |

||

| Price range (HKD) | IPO price (HKD) | Closing price (HKD) | +/- (%) | ||||

| 1310 | HKBN Ltd | 6,674 | 8.0-9.0 | 9.0 | 12 Mar 2015 | 9.0 | – |

| 3906 | Fuyao Glass | 8,495 | 14.8-16.8 | 16.8 | 31 Mar 2015 | 19.2 | +14.29% |

| 0776 | GF Securities | 32,079 | 15.65-18.85 | 18.85 | 10 Apr 2015 | 25.4 | +34.74% |

| 6826 | Shanghai Haohai | 2,362 | 48.5-59.0 | 59.0 | 30 Apr 2015 | 58.5 | -0.85% |

| 6839 | Yunnan Water | 1,918 | 5.0-5.8 | 5.8 | 27 May 2015 | 6.45 | +11.21% |

| 6886 | Huatai Securities | 38,757 | 24.8 | 24.8 | 1 Jun 2015 | 26.05 | +5.0% |

| 1530 | 3S Bio | 6,343 | 8.3-9.1 | 9.1 | 11 Jun 2015 | 9.32 | +2.42% |

| 2686 | AAG Energy | 2,284 | 3.0-3.7 | 3.0 | 23 Jun 2015 | 2.78 | -7.33% |

| 1528 | RS Macalline | 7,219 | 11.18-13.28 | 13.28 | 26 Jun 2015 | 12.74 | -4.07% |

| 3396 | Legend Holding | 15,169 | 39.8-43.0 | 42.98 | 29 Jun 2015 | 42.95 | -0.07% |

| Source: KPMG | |||||||

PRC IPO Market & Impact on Hong Kong

PRC IPO Market

- Early 2012: SSE became the world’s worst performing market.

- Oct 2012: CSRC suspended new listings on PRC exchanges for 15 months amid crackdown on accounting fraud and insider dealing.

- Jan 2014: Resumption of IPO application processing to provide a financing alternative to bank lending.

- Jun 2014: start of bull run.

- Chinese companies took advantage of surging share prices to raise funds in listings in Shanghai and Shenzhen.

- 1H2015 – 77 listings on SSE raise US$16.7 billion – SSE ranks ahead of NYSE for IPO fundraising.

- 12 Jun 2015 – Shanghai Stock market hit 7-year high as millions of private investors entered stock market.

- SSE dropped 30% within a month from 12 June 2015.

- SZE lost more than 40%.

- SE and SZE together lost > US$3 trillion in market capitalisation in a month.

- By 8 July, > 50% of companies listed on SSE and SZE filed for trading halts to cut further losses.

- To try to stop the crash, China’s Central government:

- Imposed a ban on short selling (police investigations were carried out to stop malicious short selling);

- Suspended new listings;

- Provided brokers with cash to buy shares (backed by the Central Bank);

- Instructed state-owned entities to buy shares;

- Allowed property to be used as collateral for margin loans; and

- Imposed a 6-month ban on shareholders holding more than 5% of a company’s shares from selling.

- Government intervention slightly revived the PRC stock market which rose by 6% in the coming weeks.

- Shanghai Composite Index (SCI) plunged again by 8.5% on 27 July , the worst fall in the index since the Global Financial Crisis in 2007.

- China stocks plummeted again in the last week of August as the depreciation of the yuan and lacklustre factory growth figures fanned concerns re. the Chinese economy. Falls have erased gains earlier in the year.

- New listings on SSE and SSZ remain suspended.

- Beijing’s IPO reform proposals to move to a “registration” system have been delayed until the Shanghai and Shenzhen share prices stabilise.

- Currently 500 Chinese companies have sought approval for A-share listing.

Benefits of a Hong Kong listing

- access to international funds

- active post-listing trading & a separate Hang Seng Chinese Enterprise Index

- interest and confidence of international investors

- enhanced profile and reputation

- more transparent management

Hong Kong’s markets

- Main Board – caters for established companies able to meet its profit or other financial standards.

- Growth Enterprise Market (“GEM”) – has lower admission criteria and acts as a stepping stone to the Main Board.

- The post-listing obligations of GEM companies are now broadly similar to those of Main Board listed companies. The principal difference in the ongoing obligations of Main Board and GEM companies is that quarterly reporting is a Listing Rule requirement for GEM companies whilst for Main Board issuers it is still a Recommended Best Practice only (under the Corporate Governance Code).

Applicable HK laws and non-statutory codes

- Rules Governing the Listing of Securities on The Exchange of Hong Kong Limited (the Listing Rules)

- Listing Rules have modifications and additional requirements for H share issuers (MB Chapter 19A GEM Chapter 25)

- Companies Ordinance and Companies (Winding-up and Miscellaneous Provisions) Ordinance

- Securities & Futures Ordinance

- Code on Takeovers and Mergers and Code on Share Buybacks

- Additional requirements of Chapter 19 of the Main Board Rules (Chapter 24 of the GEM Rules) (Red chip companies and non-H share Mainland private enterprises)

PRC Regulatory Requirements for H Share Issuers

- The China Securities Regulatory Commission (the “CSRC”) = responsible authority for overseeing overseas listing of Chinese enterprises.

- CSRC’s Guidelines for Supervising the Application Documents and Examination Procedures for the Overseas Stock Issuance and Listing of Joint Stock Companies (Guidelines) came into effect 1 January 2013.

- Guidelines removed financial requirements for H share listings – previously under “4-5-6 Requirements”, listing applicants were required to:

- have RMB 400 million of net assets;

- raise US50 million of funds; and

- have after-tax profit of more than RMB 60 million

- Under new Guidelines, Chinese joint stock companies listing overseas must satisfy CSRC that they meet listing requirements of overseas stock exchange.

- 4-5-6 Requirements previously meant that majority of H share companies were large state-owned enterprises.

- New Guidelines provide Chinese SMEs with alternative route to domestic IPO.

- New Guidelines also simplified application process – e.g. removed requirement for submission of documentation to CSRC 3 months before submission of overseas listing application.

- New Guidelines aimed at easing fundraising pressure on PRC exchanges and promoting development of Chinese SMEs.

B shares conversion to H shares

- China Int’l Marine Containers Group: the first PRC B share company to convert its B-share listing into H-share listing by way of introduction in December 2012.

- Listing by introduction is a means of listing shares already in issue on another stock exchange where no marketing arrangements are required because the shares are already widely held. As only existing shares are listed by introduction, no additional funds are raised.

- An introduction will only be permitted in exceptional circumstances if there has been a marketing of the securities in Hong Kong within the 6 months prior to the proposed introduction where the marketing was made conditional on listing being granted for those securities.(LR 7.15);

- Guidance Letter GL53-13 which provides guidance to issuers seeking to list by way of introduction on arrangements to facilitate liquidity of issuers’ securities to meet demand on the Hong Kong market during the initial period after listing;

- Listing Decision HKEx-LD52-2013 provides a detailed explanation for its decision to allow an un-named company (Company A) listed on a PRC stock exchange to convert its entire B shares into H shares to be listed on the Exchange by way of introduction.

Regulation of Red Chip Listings: Circular 10 – the M & A Rules

- The Provisions on the Takeover of Domestic Enterprises by Foreign Investors (the “M&A Rules” or “Circular 10”) jointly issued by Ministry of Commerce (“MOFCOM”) and 6 other governmental departments came into effect on 8 Sept 2006.

- Use of offshore SPV to achieve offshore listing of Chinese company is effectively prevented, as Central MOFCOM approval is always required for:

- establishment of offshore SPV to achieve overseas listing where offshore company is directly or indirectly controlled by a Chinese company or Chinese individuals; and

- the offshore SPV’s acquisition of the affiliated Chinese company.

- CSRC approval also required for overseas listing of SPV holding China assets.

- Parties to an acquisition must declare whether they are affiliated – if parties are under common control, identities of the ultimate controlling parties must be disclosed to approving authorities.

- Use of trusts/or other arrangements to avoid this requirement is expressly prohibited (Article 15).

- Listing price of SPV’s shares on overseas exchange may not be less than the valuation of the onshore equity interest as determined by a PRC asset valuation company.

- Proceeds of offshore listing, as well as dividends and proceeds of changes in the capital of domestic shareholders must be repatriated to China within 6 months / 180 days

The listing of China Zhongsheng Resources Holdings in 2012

- Originally a PRC company, transformed into a Sino-foreign enterprise and then a WFOE;

- Only commenced red-chip restructuring after the implementation of Circular 10;

- Approvals of provincial bureau of commerce were granted at various stages;

- Seen as a circumvention of Circular 10;

- Remains to be seen whether it was a change of MOFCOM’s policy or a mere exception.

VIE structures

- Alternative structures have been used to address the challenges posed by Circular 10 and Circular 75.

- Many of these have involved variations on the VIE structure – uses series of contracts (rather than direct equity interest) to give foreign investors control of a domestic Chinese company.

- Main uses:

- to circumvent prohibition or restrictions on foreign investment in specific industries (e.g. internet content provision, media, telecom);

- to achieve an offshore listing of Chinese companies without having to seek MOFCOM approval under Circular 10.

- VIE structure was first adopted by Sina (listed on Nasdaq in 2000).

- A number of leading internet and media companies followed suit and listed overseas:

- Sohu, Netease, Baidu, Focus Media, Youku and Dangdang (all listed on Nasdaq or NYSE) and Tencent and Alibaba.com (both listed on HKSE, although Alibaba.com delisted in 2012). Alibaba.com relisted on NYSE in 2014 in the world’s largest ever IPO, raising US$25 bln.

- Since 1999, more than 200 Chinese companies listed in the US used the VIE structure. These are primarily internet and education companies subject to restrictions on foreign investment.

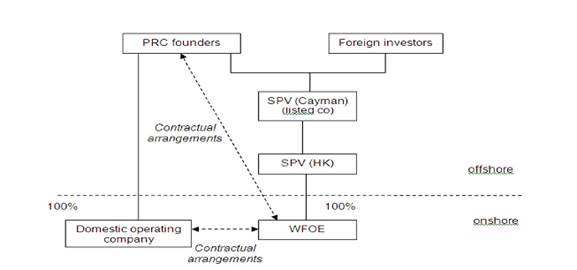

A typical VIE structure is illustrated in the following diagram:

In the diagram above, the domestic operating company (or OPCO) is the VIE.

- In typical VIE structure – PRC shareholders establish an offshore SPV (usually in Bermuda/Cayman Islands) to be the listed company.

- Offshore SPV – sometimes through another SPV – establishes a subsidiary in the PRC which will be a wholly foreign-owned enterprise (“WFOE”).

- WFOE enters contractual arrangements with the domestic operating company (the VIE) and its Chinese shareholders which:

- give it control over VIE;

- enable listco to consolidate VIE’s financial results in group’s financial statements

- VIE’s equity is owned by Chinese individuals or the Chinese State.

- VIE holds all relevant licences/permits for operating the regulated business in China.

- Structure relies on loophole in China’s foreign direct investment law which currently regulates direct investments by foreign shareholders, but does not explicitly regulate foreign investment achieved through contractual arrangements (although this will change under the new draft Foreign Investment Law).

- Foreign investors have no direct interest in VIE operating regulated business: the restrictions/prohibitions under foreign investment laws do not apply.

- WFOE’s business scope = provision of consultancy services related to VIE’s business. Service agreement between WFOE and VIE is used to stream VIE’s revenue to the WFOE.

Typical contents of contractual arrangements between VIE and the WFOE

- Exclusive Service Agreement

- The WFOE provides exclusive services (e.g. consultancy, management and technology) to the VIE in return for a fee “ shifting revenue from the VIE to the WFOE

- Call Option Agreement

- The WFOE (or the offshore SPV) is granted the option to acquire all or a portion of the equity interest in the VIE at the lowest permitted price (or to nominate a third party to do so)

- Equity Pledge Agreement

- The PRC shareholders will enter a registered pledge for all their equity interest in the VIE in favour of the WFOE to secure due performance its contractual obligations

- Loan Agreement

- The WFOE will grant a loan to the PRC shareholders to capitalise the VIE

- Voting rights agreements

- VIE’s PRC shareholders and directors give WFOE (or the offshore SPV) the right to appoint representatives to vote at VIE board and shareholder meetings

- Powers of attorney

- Executed by PRC shareholders in favour of WFOE (or the offshore SPV)

- Irrevocably grant WFOE/SPV all shareholder rights (incl. voting rights)

Risks involved

- VIE structure has been controversial for some time.

- Key risks:

- Regulatory risk that the PRC authorities will deem the structure to be illegal;

- Risk that the Chinese courts will not enforce the contractual arrangements; or

- Risk that VIE’s Chinese shareholders might abscond with its assets or damage its reputation.

Regulatory Risk

- Risk of structure being declared invalid by PRC authorities:

- Where VIE operates in sector subject to restrictions on foreign investment – PRC authorities could regard it as de facto foreign investment and require the structure to be unwound; or

- VIE structures could be declared to be subject to requirement for MOFCOM approval under M&A Rules.

- Current practice regarding future regulatory changes – PRC legal advisers usually include in their legal opinion that on the basis of the principle of non-retrospectivity of laws, the status of existing VIE structures should not be affected by future law changes.

- Regulators and academics have criticised VIE structure in the past.

- Individual PRC regulators circumscribed its use in specific industries:

- In relation to value added telecommunications businesses, a circular issued by the PRC Ministry of Information Industry in 2006, requires certain key assets, including trademarks and domain names, to be held by the company with the value added telecommunications service provider licence or its shareholders.

- Notice of general administration of press and publication → foreign investors are not allowed to control or participate in a domestic online gaming business by setting up a joint venture company and/or through contractual arrangements.

- The measures on security review system of M&A of Chinese enterprises by foreign investors (Sept 2011)

- Foreign investors are prohibited from adopting indirect or contractual arrangements to avoid national security review procedures

- Public policy concerns – Buddha Steel was required to withdraw its listing application

- The withdrawal considered more an indication that the regulatory authorities were tightening control on foreign investment in certain core industries rather than a disapproval of VIE structure

2011 CSRC report

- Rumours of leaked internal CSRC report in Sept 2011 proposing more stringent regulation of VIE structures:

- Recommending offshore listings using VIE structures should obtain MOFCOM and CSRC approval

- Raised concerns about national security (particularly regarding internet industry and asset-heavy industries) and desirability of PRC companies in emerging industries listing onshore

- Recognised possible negative impact of prohibiting VIE structures e.g. restriction of fund raising activities for companies unable to list on domestic exchanges

- Suggested that existing overseas listed VIE structures be grandfathered

- No official confirmation on the genuineness of the report

Wal-Mart’s acquisition of Yihaodian

- MOFCOM’s August 2012 decision approving Wal-mart’s acquisition of Niu Hai (Yihaodian) contained the most direct reference to VIE’s to date.

- One of the conditions imposed was that Wal-Mart was not allowed to use a VIE structure to engage in the VATS business then operated by Yihaodian.

- Decision primarily concerned with Wal-mart’s anti-competitive effect in VATS business, whether achieved through a VIE or not.

Risk that contractual arrangements will be unenforceable or insufficient to retain control over VIE

- US report “The Risks of China’s Internet Companies on U.S. Stock Exchanges” (Sept. 2014) considered it highly probable that a Chinese court would not enforce the contractual arrangements

- Risk that PRC shareholders (as legal owners of VIE) operate it, or dispose of it, contrary to interests of WFOE and offshore SPV. Risk compounded by difficulties for SPV of enforcing contractual arrangements against PRC shareholders.

The Alipay Scandal

- In 2011, Alibaba Chairman, Jack Ma, transferred ownership of Alipay, Alibaba’s payment arm, out of a VIE to a structure he controlled personally, allegedly without majority approval of Alibaba’s shareholders (i.e. of Yahoo and Japan’s Softbank).

- Ma claimed the transfer was necessary because Alipay could not obtain an operational licence if held by foreigners.

- Effect – Alibaba ceased to have indirect control over Alipay and Yahoo could no longer consolidate Alipay in its financial results, which resulted in a fall of almost 10% in Yahoo’s market capitalisation.

Mitigating the Risks

- Alibaba’s blockbuster IPO on NYSE in September 2014 raised US$25 billion, making it the largest ever IPO in the world

- Alibaba still operates under a VIE structure. However, has mitigated investors’ risks by holding most of its assets in the foreign-owned part of its business. Alibaba’s PRC operating companies hold only 7.5% of the group’s assets and generate 11.9% of its revenue.

- This structure seen as significantly reducing risk of abuse by the PRC operating companies’ shareholders.

- Also mitigates other problems such as deferred taxes and foreign exchange controls;

- Comparison of amount of business conducted in PRC OPCOs (i.e. the VIEs) under Alibaba & Baidu VIE structures with that of New Oriental, listed on NYSE in 2006:

ALIBABA BAIDU NEW ORIENTAL % of revenue in OPCOS 11.9% 28.3% 99.1% % of assets in OPCOS 7.5% 10.1% 65.5% Net income in OPCOS 0% 0% 151.5% - Minimise risks by (i) diversifying shareholdings in Chinese OPCOS so that no single shareholder, or related shareholders, have control; and (ii) ensuring controllers of PRC OPCOS get greater returns from stakes in offshore cos than from PRC OPCOS (thus less likely to sever VIE structure);

Source: Paul Gillis, China Accounting Blog, “Alibaba sets the VIE gold standard”

Draft Foreign Investment Law

- A draft Foreign Investment Law (Draft FIL) and explanatory notes were published by the Ministry of Commerce (MOFCOM) on 19 January 2015 which has major implications for the VIE structure.

- Draft FIL proposes major changes to the regulation of foreign investment in China & was open for public consultation until 17 February 2015.

- Although the new law is still in draft form 6 months after consultation close, it has already led to concerns around VIE’s general sustainability and a wave of VIE restructuring.

- Under the Draft FIL, foreign investors will:

- no longer be subject to a separate regulatory regime from Chinese investors

- be subject to restrictions on foreign investment in “restricted” industries

- be barred from investment in “prohibited” industries, as set out in a new negative list to be included in the Foreign Investment Law (FIL).

- Key changes in relation to VIEs proposed by the Draft FIL are:

- the legal validity of VIE structures will be recognised;

- however, a VIE controlled by a foreign investor will be treated as a foreign investor (under Article 11) and must comply with restrictions on investment in “restricted” and “prohibited” industries.

- Prohibited industries will be industries in which no foreign investment (including through a VIE structure) will be permitted.

- Restricted industries will be industries in which foreign investment will be permitted subject to prior MOFCOM approval.

- The restrictions/conditions applicable to specific restricted industries may include:

- a limit on the amount that can be invested and a requirement for further approval of any further investment exceeding that limit;

- specified ratios of foreign to Chinese shareholders;

- geographic restrictions; and

- requirements for local hires.

- The Negative List which will apply under the FIL will be published by the State Council later stage (Article 23 Draft FIL) and so it is not yet known how this will compare to the existing Foreign Investment Catalogue which also specifies industrial sectors in which foreign investment is either prohibited or restricted.

Definition of Foreign Investor

- Under Article 11 Draft FIL, foreign investors are widely defined as:

- individuals who are not Chinese citizens;

- enterprises incorporated under foreign laws;

- organs of foreign governments;

- international institutions; and

- domestic entities controlled by any of the above.

Definition of Control

- Article 18 Draft FIL defines control as:

- Holding (directly or indirectly) > 50% of the shares, voting rights or similar equity interests;

- Having the right or ability to appoint or nominate at least half of the board of directors (or similar governance body);

- Having the ability to exercise a major influence on shareholders’ or directors’ decisions; or

- Having the ability to have a decisive influence over an entity’s operations, finances, human resources or technology through contract, trust or other arrangements (contractual control).

- The concept of de facto control is introduced for the first time.

- PRC government no longer limits the concept of control to equity ownership but adopts substantive assessment criteria regarding the definition of control.

- Contractual control – expressly covers VIE structures.

- Under Article 15 of the Draft FIL, foreign investment specifically includes a foreign investor acquiring control of a Chinese entity either directly or by means of contractual, trust or other arrangements (Article 15 Draft FIL).

- The use of a VIE structure to acquire control of a Chinese company thus constitutes foreign investment.

- The use of a VIE structure (or similar structures such as shadow shareholdings or trusts) to circumvent foreign investment restrictions will be prohibited.

- Article 149 specifies the potential legal consequences of a VIE structure, or other structures such as shadow shareholdings, trusts, contractual control arrangements and offshore transactions, being used to circumvent the restrictions on foreign investment in prohibited or restricted industries.

- Consequences include:

- an order to cease carrying on business;

- an order to dispose of assets or shares;

- a fine of up to RMB 1 million or 10% of the amount invested;

- imprisonment for up to one year for those responsible; and

- confiscation of illegal gains.

De Facto Chinese Investors

- Draft FIL distinguishes between a VIE which is controlled by foreign investors and one which is ultimately controlled by Chinese investors, by creating a new category of foreign investor – the de facto Chinese investor.

- Chinese investors include:

- Chinese nationals;

- the PRC government and its subordinate departments/institutions; and

- Chinese entities which are controlled by Chinese nationals or the PRC government and its subordinate departments/institutions.

- A foreign investor which is ultimately controlled by Chinese investors will be able to apply to MOFCOM for treatment as a de facto Chinese investor to invest in an industry categorised as “restricted” by the Negative List.

- The Draft FIL does not specify whether de facto Chinese investors will be treated in exactly the same way as Chinese investors – i.e. whether they will be permitted to invest in prohibited industries. This is thought to be unlikely.

- It is thought that the exception may be intended to give the authorities a basis for distinguishing between VIE structures used to list Chinese companies on foreign equity markets but which remain controlled by Chinese investors (such as Alibaba, Baidu and Tencent) from those VIEs used by foreign investors to circumvent China’s foreign investment laws.

Existing VIE Structures

- MOFCOM has proposed three regulatory options for existing VIEs in the explanatory note and has invited public comments on the proposals.

- The options are:

- Existing VIE structures controlled by Chinese investors would be allowed to continue under the same structure on filing a report with MOFCOM confirming that they are under Chinese control;

- Existing VIE structures with a de facto Chinese controller would be required to apply to MOFCOM for recognition that they are subject to the de facto control of Chinese investors. These companies would be able to continue to operate in their current form if such recognition is granted by MOFCOM; or

- Existing VIE structures controlled by foreign investors would have to apply to MOFCOM for foreign investment approval. MOFCOM and other relevant regulatory bodies would grant approvals on a case-by-case basis.

- If adopted, the first two options mean that a VIE structure will be allowed to continue only if it is controlled by Chinese investors.

- Under the 3rd option, the continuance of a foreign-controlled VIE structure will be assessed, raising the possibility that it may be required to be unwound.

Implications for VIE structures

In the long term, the importance of VIE structures is expected to diminish as the Chinese government loosens foreign investment related regulations.

- In June, the Ministry of Industry and Information Technology issued a notice on Liberalising Foreign Equity Ratio Limitation on Online Data Processing and Transaction Processing Services (Operating E-commerce) 2015 as an extension of the liberalised e-commerce policy current in force in the Shanghai Free Trade Zone.

- Foreign investors can now hold 100% equity in companies that operate e-commerce platforms providing online data processing and transaction processing services. This would allow foreign ownership of online marketplaces such as Ebay or Taobao.

- Commentators have noted that the FIL, if implemented, will favour VIE structures with dual-class share structures giving “control” to the Chinese shareholders in the VIE.

- These will allow the VIE to qualify as a de facto Chinese investor which is allowed to invest in restricted industries without the VIE’s Chinese shareholders having to take a majority equity stake in the offshore listco (or its parent).

- Professor Gillis of Peking University’s Guanghua School of Management noted that the draft FIL could benefit the US stock exchanges to the detriment of the Hong Kong Exchange as Hong Kong does not currently allow the listing of companies with dual-share structures or other weighted voting rights (WVR) structures.

- Chinese companies listed on the US Exchanges (e.g. Alibaba and Baidu) which use either dual class share or other WVR structures to give their Chinese founders control should be allowed under the Draft FIL.

- Companies such as Tencent, which is listed in Hong Kong and uses a VIE structure, but not a dual share structure, run the risk of breaching the foreign investment restrictions.

Weighted Voting Rights

- 29th August 2014 – Exchange published a Concept Paper on whether companies with WVR structures should be permitted to list on the Exchange.

- WVR structures = structures which give certain persons voting power or other related rights which are disproportionate to shareholdings

- E.g. dual-class share structures with unequal voting rights

- E.g. give existing controllers enhanced or exclusive rights to appoint directors (usually a majority) to the board of directors

- US Exchanges allow companies of all types with WVR structures to list – Google, Facebook, Visa and Mastercard all have WVR structures. Many of China’s most successful tech companies, including Alibaba Group, have WVR structures and are listed on the US exchanges.

- MB Listing Rule 8.11 prohibits listing of WVR structures: “The share capital of a new applicant must not include shares of which the proposed voting power does not bear a reasonable relationship to the equity interest of such shares when fully paid (“B shares”).” (Rule 8.11)

- The Exchange can agree to list a WVR company if the circumstances are exceptional, but no company with a WVR structure has been listed under this exception.

- Concept Paper sought views on:

- whether Hong Kong should allow the listing of companies with WVR structures which would require the Listing Rules to be amended to remove the existing prohibition on the listing of such companies

- whether, if they are to be allowed to list, restrictions should be imposed.

- SFC published conclusions to the August Concept Paper on 19 June 2015

- Exchange proposed to allow WVR structures subject to a further consultation after consulting stakeholders.

- Proposed features of the further consultation set out in Consultation Conclusions:

- WVR structures will only be allowed for new listing applicants: anti-avoidance language will be included to prevent issuers already listed at the date the new rules come into effect circumventing this restriction;

- a very high expected market capitalisation test (in addition to existing listing criteria);

- “enhanced suitability” criteria that will identify features the Exchange expects such companies to have related to the applicant’s business and the contribution of the founder(s);

- restrictions on who can hold WVRs and the percentage shareholding interest such persons hold in the applicant prior to listing and requirements for such persons to retain WVRs post-listing; a very high expected market capitalisation test (in addition to existing listing criteria);

- only WVR structures in the form of different classes of shares will be allowed;

- those allowed to hold WVRs will have to maintain a minimum shareholding for the rights to survive;

- holders of WVRs will be “connected persons” under the Listing Rules;

- enhanced corporate governance measures will be required focussed on INEDs, setting up a Corporate Governance Committee, the role of Compliance Advisers and shareholder communications.

- SFC published response on 25 June 2015 detailing its objections to the Exchange’s proposals.

- Exchange responded the same day that it would engage with the SFC and the Exchange’s Listing Committee to determine the best way forward in light of the SFC’s views on listing WVRs.

Implications of the Draft FIL

- Draft FIL remains a draft only.

- Currently no indication of when it will be finalised and implemented.

- Its potential implications must however be considered when considering adopting a VIE structure for the offshore listing of a Chinese company engaged in a restricted or prohibited industry.

- The Exchange’s guidance on the listing of VIE structures is set out in its Listing Decision 43-3 and Guidance Letter 77-14.

- These were updated on 27 August 2015 to refer to the Draft FIL.

Listing decision 43-3

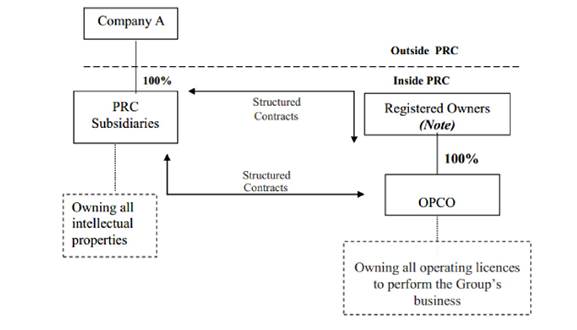

The Registered Owners were controlling shareholders of Company A

- Listing Decision 43-3 on VIE structures first issued in 2005 – updated several times, most recently in August 2015.

- Exchange generally allows listing of applicants using a VIE structure provided:

- it is satisfied as to reasons for the use of structured contracts; and

- listing applicant complies with requirements of the listing decision.

- A disclosure-based approach is adopted in considering listing applications involving VIE.

- VIE structures normally accepted only for restricted businesses. Where VIE structure used for an unrestricted business, case is referred to Listing Committee.

- Exchange will not consider an applicant unsuitable for listing if all relevant PRC laws and regulations have been complied with.

- Appropriate regulatory assurance should be obtained from the relevant regulatory authorities.

- In the absence of regulatory assurance, PRC legal opinion must include a statement to the effect that all possible actions or steps have been taken to enable it to reach its legal conclusions.

- PRC legal opinion must confirm that structured contracts would not be deemed as “concealing illegal intentions with a lawful form” and thus void under PRC contract law.

- Listing applicants in restricted businesses must demonstrate that they have taken all reasonable steps to comply with applicable PRC rules (other than foreign ownership restriction).

- Where PRC laws/regulations specifically prohibit foreign investors using contractual arrangements to gain control of or operate a foreign restricted business (e.g. on-line gaming business), PRC legal opinion must:

- confirm that:

- the use of structured contracts does not breach the relevant laws/regulations;

- the structured contracts will not be deemed invalid or ineffective under those laws/regulations; and

- be supported by appropriate regulatory assurance, where possible, to demonstrate the legality of the structured contracts.

- confirm that:

- Requirements for an applicant using VIE and its sponsor:

- provide reasons for the use of structured contracts in its business operation

- unwind the structured contracts as soon as the law allows the business to be operated without them. OPCO’s shareholders must undertake to return to the listing applicant any consideration received if the applicant acquires OPCO shares when structured contracts are unwound

- ensure the structured contracts:

- include a POA by OPCO’s PRC shareholders granting listco’s directors (and successors) power to exercise all shareholders’ rights. OPCO’s shareholders must ensure that the POA does not give rise to any potential conflicts of interest. Where OPCO’s shareholders are officers or directors of listco, POA must be granted in favour of other unrelated officers or directors of listco.

- contain dispute resolution clauses which:

- provide for arbitration and that remedies over the shares, land or assets, injunctive relief or winding up order of the domestic operating company may be awarded;

- give the courts of competent jurisdictions (HK, the applicant’s place of incorporation, the place of incorporation of the domestic company, the location of the domestic company’s principal assets) the power to grant interim remedies in support of the arbitration pending formation of the arbitral tribunal; and

- encompass dealing with OPCO’s assets and not only the right to manage its business and the right to revenue.

- Prospectus disclosure requirements include:

- detailed discussion about the OPCO’s registered shareholders and a confirmation that appropriate arrangements have been made to protect the applicant’s interests;

- arrangements to address the potential conflicts of interest between the applicant and OPCO’s registered shareholders;

- reasons why the directors believe that each of the contractual arrangements is enforceable under PRC laws and regulations;

- the economic risks the applicant bears as the primary beneficiary of the OPCO and in what way the applicant shares the losses of the OPCO;

- whether the applicant has encountered any interference from any PRC governing bodies in operating its business through the OPCO; and

- the limitations in exercising the option to acquire ownership in the OPCO with a separate risk factor explaining the limitations.

- Disclosure on structured contracts (other than risk factors) should be consolidated in one standalone section.

- Risk factors required to be disclosed include:

- The government may determine the structured contracts do not comply with applicable regulations;

- The structured contracts may not provide control as effective as direct ownership;

- The PRC shareholders may have potential conflicts of interest with the listing applicant;

- Structured contracts may be subject to scrutiny by the tax authorities and additional taxes may be imposed.

Draft PRC Foreign Investment Law – section added August 2015

The Listing Decision notes that:

- it is based in part on the conclusion that structured contracts comply with PRC laws, rules and regulations and are legal and binding;

- following publication of the draft PRC Foreign Investment Law, concerns over the legality and validity of structured contracts may be heightened; and

- Listing applicants using structured contracts to hold interests in PRC businesses are encouraged to contact the Exchange as early as possible to seek informal and confidential guidance.

PRC Property Issues

- Many issues relating to title to PRC properties remain unresolved;

- Potential PRC listing applicants may face difficulties in evidencing their ownership due to uncertainty in the application process for the land use right certificate and/or building ownership certificate;

Exchange’s guidance letter (HKEx-GL19-10)

- For infrastructure project companies and property companies, the relevant title certificates of PRC properties are a pre-requisite for listing approval;

- For mineral and exploration companies, the Listing Rules require them to obtain adequate rights to participate actively in the exploration and extraction of resources. Title certificates are normally required to prove their rights;

- For other companies, the Exchange no longer requires title certificates of PRC properties. Instead, it expects listing applicants to disclose in the prospectus the risks to their operations of not having the relevant title certificates.

- Practice Note 12 of the Listing Rules provides that where the issue of a land use right certificate is pending, a properly approved land grant or land transfer contract in writing accompanied by a PRC legal opinion as to the validity of the approval may be acceptable as evidence of a transferee’s pending title to the land to be granted or transferred.

Pre-IPO Investment

Pre-IPO Equity Investment

- In October 2012, the Exchange published a guidance letter (HKEx-GL43-12) to consolidate its past listing decisions on pre-IPO investments. Last updated in July 2013.

- Pre-IPO investments generally take the form of private placements to investors of preference shares or convertible bonds exchangeable into ordinary shares.

- The purpose → provide the company with cash to fund its operations in the period prior to listing on the Exchange.

Applicable Listing Rules

Main Board Listing Rule 2.03(2) (GEM Rule 2.06(2)):

- the issue and marketing of securities must be conducted in a fair and orderly manner and potential investors must be given sufficient information for making a properly informed assessment of an issuer.

Main Board Listing Rule 2.03(4) (GEM Rule 2.06(4)):

- all holders of listed securities must be treated fairly and equally.

- Exchange considers that where the investment is made very shortly before an IPO, the pre-IPO investor cannot be said to have taken any special risk different from that taken by the IPO investors, which would justify the pre-IPO investor having protections under the terms of the pre-IPO investment.

- The general principle is that atypical special rights or rights which do not extend to all other shareholders are not permitted to survive after listing.

PERMISSIBILITY OF SPECIAL RIGHTS/OBLIGATIONS

- The 28/180 Day Requirement – Pre-IPO investments are required to be completed either at least 28 clear daysbefore the date of the first submission of the first listing application form or 180 clear days before the first day of trading. Pre-IPO investments are only considered completed when the funds are irrevocably settled and received by the applicant.

- Price Adjustments – Disallowed: Any price adjustment provisions, such as a guaranteed discount to the IPO price or share price or an adjustment linked to the market capitalisation of the shares.

- Put or Exit Options – Disallowed: All put or exit options which grant pre-IPO investors the right to put back the investments to the applicant or its controlling shareholder. The only event in which a put or exit option is allowed is when the terms of the pre-IPO investment state that the put or exit option can only be exercised if listing does not take place.

- Director Nomination Rights – Disallowed: Pre-IPO investors may exercise a right to nominate or appoint a director before listing, BUT that director would be subject to the retirement and re-appointment requirements in the articles after listing.

- Veto rights – Disallowed: contractual right given to pre-IPO investors to veto the applicant’s major corporate actions such as passing a resolution to wind up the company, any change to the business carried on by the group, and the amalgamation by any group member with any other company, etc.

- Anti-dilution Rights: Listing Rules provide that securities cannot be offered to the issuer’s existing shareholders on a preferential basis and they must not be given preferential treatment in the allocation of securities.

Anti-dilution rights allowed pre-Listing

Pre-IPO investors can exercise anti-dilution rights at time of IPO if:

- the allocation is necessary to give effect to the pre-existing contractual rights of the pre-IPO investors

- full disclosure in prospectus of the pre-IPO investors’ pre-existing contractual entitlement and the number of shares to be subscribed by the pre-IPO investors

- the proposed subscription will be conducted at the offer price of the IPO

Anti-dilution rights disallowed post-Listing

- Anti-dilution rights should be extinguished on listing so as to comply with Main Board Rule 13.36 (GEM Rule 17.39) on pre-emptive rights.

Profit Guarantee

Profit guarantee allowed

- If it is settled by a shareholder (rather than the listing applicant) and the compensation is not linked to the market price or capitalisation of the shares.

Profit guarantee disallowed

- If the profit guarantee is to be settled by the applicant or is linked to the market price or market capitalisation of the shares.

- Negative Pledges – Disallowed: Negative pledges will generally be disallowed UNLESS they are widely accepted provisions in loan agreements, are not egregious and do not contravene the fairness principle in the Listing Rules.

Widely accepted provisions include:

- pledges not to create or effect any mortgage, charge, pledge, lien or other security interest on an applicant’s assets and revenues; and

- pledges not to dispose of any interest in the economic rights or entitlements of a share the controlling shareholder owns or controls to any person.

Prior Consent for Corporate Actions/Changes in Articles – Disallowed unless not egregious and not contrary to Listing Rules

Example of corporate actions/changes in articles

- a declaration of dividend;

- the sale, lease or transfer of a substantial part of the applicant’s business or assets;

- any amendments to the applicant’s constitutional documents; and

- any change in executive directors.

- Exclusivity Rights and No More Favourable Terms – Disallowed unless “Fiduciary Out” Provision: Terms that the applicant is not allowed to issue any shares, options, warrants or rights to any direct competitor of the pre-IPO investor or to other investors on more favourable terms. These rights will be disallowed after listing UNLESS the investment agreement is modified to include an explicit “fiduciary out” clause allowing directors of the applicant to ignore the terms if complying with the terms would prevent them from carrying out their fiduciary duties.

- Information Rights – Allowed: right to receive corporate information from the applicant. Allowed ONLY IF pre-IPO investor receives only published information or information which is made available to the general public at the same time.

- For PSI, the issuer needs to comply with the statutory PSI disclosure regime in Part XIVA SFO.

- Right of First Refusal and Tag-along Rights – Allowed: A right granted to the pre-IPO investor to purchase the shares at the same price and on the same terms as a proposed sale of shares to a third party purchaser, or, if the pre-IPO investor does not purchase the shares, the right granted to it to include its shares for sale together (i.e. tag along) with the shares of the controlling shareholder

- Qualified IPOs – Allowed: Term providing for pre-IPO investor to receive compensation if applicant does not achieve IPO at or above a specified amount by a set date. This term will be allowed IF the amount to be compensated is set out in the investment agreement or can be derived from the compensation provisions under the agreement. Otherwise, it will be viewed as an amendment or variation to the original terms of the agreement and the 28 Day/180 Day Requirement applies.

- Lock-up and Public Float:

- Pre-IPO investors are usually required by the applicant to lock-up their pre-IPO shares for a period of six months or more. These shares are counted as part of the public float so long as Main Board Listing Rule 8.24 (shares are not financed directly or indirectly by a core connected person of the applicant) is fulfilled.

- Prospectus disclosure requirements for pre-IPO investments are set out in Guidance Letter HKEx-GL43-12.

- Guidance Letter HKEx-GL44-12 sets out specific guidance on pre-IPO investments in convertible instruments (e.g. convertible bonds, notes, loans and convertible preference shares).

Pre-IPO Investment in Convertible Instruments

- In October 2012, the Exchange published a guidance letter (HKEx-GL44-12) to set out the current practice in dealing with convertible instruments issued to pre-IPO investors. Guidance on general principles re. special rights attached to pre-IPO investments can be found in GL43-12.

- The purpose → to set out the current practice in dealing with convertible instruments (i.e. convertible or exchangeable bonds, notes or loans and convertible preference shares) issued to pre-IPO investors.

Applicable Listing Rules

Main Board Listing Rule 2.03(2) (GEM Rule 2.06(2)):

- the issue and marketing of securities must be conducted in a fair and orderly manner and potential investors must be given sufficient information for making a properly informed assessment of an issuer.

Main Board Listing Rule 2.03(4) (GEM Rule 2.06(4)):

- all holders of listed securities must be treated fairly and equally.

- The concern with pre-IPO convertible instruments is that while these do not constitute shares, they may be structured so as to provide investors with a risk-return profile which is similar to, or better than, that of a shareholder.

- In the past, the Exchange has requested removal of conversion price reset mechanisms of convertible instruments and the termination of all atypical special rights for holders. This is to ensure the fair and equal treatment of all shareholders under the Rules.

Current Practice in Dealing With Convertible Instruments

- Conversion price linked to IPO price or market capitalisation

- The conversion price for convertible instruments should be a fixed dollar amount or at the IPO price;

- Where instruments will be converted into shares at a price based on a guaranteed discount to the applicant’s IPO price, or the conversion is linked to market capitalisation, this will create two different prices for the same securities at listing, which is inconsistent with the Rules;

- Discount to the applicant’s IPO price or any linkage to the market capitalisation of shares may also give rise to concerns that the pre-IPO investors do not bear the same investment risk as public investors.

- Conversion price reset

- Any conversion price reset mechanism should be removed as they are contrary to the principles of the Listing Rules.

- Example: where the conversion price reset mechanism is based on the lower of a fixed price and a floating price, the price reset mechanism allows conversion at a discount to the fixed price. As the share price declines, the formulae would lead to more shares being issued, leading to greater dilution and greater potential for share price reduction which can work in a spiral.

- Mandatory or Partial Conversions

- Partial conversion is only allowed if all atypical special rights are terminated after listing – this prevents the situation where a pre-IPO investor enjoys special rights as a bondholder, from converting a significant portion of their convertible instruments into shares while remaining entitled to the special rights by retaining a portion of the convertible instruments.

- Redemptions and Early Redemptions

- Certain convertible instruments give holders the option to redeem early at a price enabling the holders to receive a fixed internal rate of return (IRR) on the principal amount of the instruments redeemed.

- Upon maturity, all outstanding instruments will be payable at a price including the same fixed IRR.

- (note: IRR is the interest rate needed in the discounting of cash flows to their present value so the investment’s net present value is equal to zero)

- Exchange regards the IRR on the principal amount of the convertible instruments to be redeemed as compensation for the investment and risk undertaken by the holders.

- Early redemption is allowed and should be distinguished from other cases where the holders do not undertake any risk and the investment money is not yet paid.

- Disclosure Requirements

- Additional disclosure is required due to the complexity of convertible instruments and their terms.

- Additional information must be disclosed in “Financial Information” and “Risk Factors” sections of the prospectus, to explain the impact of the instruments on the applicant, including if the applicant was called upon to redeem before maturity date.

- The additional disclosure requirements include:

- Qualitative analysis on the cash flow and cash position in the event of redemption;

- Terms and impact of early redemption;

- Maximum number of shares that would be converted;

- Change in shareholding in the “Risk Factor” section; and

- Expected source of case inflows upon listing.

- Additional information to be disclosed in interim and annual reports to inform investors of the dilution impact:

- Number of shares that may be issued upon full conversion of the outstanding convertible instruments;

- Dilutive impact on the issued share capital and respective shareholdings of the substantial shareholders;

- Dilutive impact on earnings per share;

- Analysis on the applicant’s financial and liquidity position at the relevant point in time, and discussion of its ability to meet its redemption obligations;

- Number of shares that may be issued and the dilutive impact on shareholdings and earnings per share assuming that the holders have elected to have all interests under the instruments to be paid in kind; and

- Analysis on the applicant’s share price at which the holders will be indifferent to whether the instruments are converted or redeemed.

Cornerstone Investors

- Cornerstone Investors are usually large institutional investors or well-known individuals who are given a guaranteed allocation of shares in an IPO;

- Cornerstone placings are common, especially in difficult market conditions. Aim = to demonstrate confidence in the IPO.

Exchange’s Guidance Letter (HKEx-GL51-13)

- No direct or indirect benefits are allowed to be given by side letter or otherwise to Cornerstone Investors, except for a guaranteed allocation of shares at the IPO price;

- Such practice would be misleading to the public and would violate the principle that all holders of listed securities must be treated fairly and equally;

- The non-disclosure of the existence of benefits would violate the requirements of the Listing Rules that all material information should be included in the prospectus.

Cornerstone investments are generally permitted, provided that:

- the placing must be at the IPO price;

- the IPO shares placed are subject to a lock-up period (usually 6 months after listing);

- the cornerstone investors will not have board representation and are independent of the listing applicant, its connected persons and their respective associates;

- details of the cornerstone investors and the placing arrangement are included in the listing document; and

- the shares placed will be part of the public float under rule 8.08 of the Rules provided the investors are members of the public under rule 8.24.

Cornerstone Investors must be reclassified as pre-IPO investors if the investors receive any direct or indirect benefits such as

- a waiver of brokerage commission;

- a put option from the controlling shareholder or any other person to buy back the shares after the listing;

- sharing of underwriting commissions;

- an assurance that the listing applicant will re-invest the proceeds from the IPO in funds that are managed by the Cornerstone Investor;

- an agreement to allow an allocation of shares in another IPO; or

- any other transaction or arrangement entered into on non-arm’s length commercial terms in relation to the acquisition of the IPO shares.

Qualifications for MB listing of H share Cos

- Incorporation

- PRC issuer must be incorporated as a joint stock limited company in PRC.

- Suitability for listing

- Must satisfy Exchange that applicant and its business are suitable for listing

- Operating History and Management

- A Main Board applicant must have a trading record period of, and management continuity for, at least 3 financial years and ownership continuity and control for at least the most recent audited financial year.

Exception:

- Under the market capitalisation/ revenue test, the Exchange may accept a shorter trading record period under substantially the same management if the new applicant can demonstrate that:

- its directors and management have sufficient and satisfactory experience of at least 3 years in the line of business and industry of the new applicant; and

- management continuity for the most recent audited financial year.

- Financial Tests – Applicants must meet one of the three financial tests:

Profit Market Cap Revenue Cash flow 1. Profit test At least HK$50 million in the last 3 financial years (with profits of at least HK$20 million recorded in the most recent year, and aggregate profits of at least HK$30 million recorded in the 2 years before that) At least HK$200 million at the time of listing 2. Market cap/Revenue test At least HK$4 billion at the time of listing At least HK$500 million for the most recent audited financial year 3. Market cap/Revenue/Cash flow test HK$2 billion at the time of listing

At least HK$500 million for the most recent audited financial year

Positive cash flow from operating activitie so fat least HK$100 million in aggregate for the 3 preceding financial years

- For both Tests 2 & 3, only revenue from principal activities (not revenue from incidental activities) will be recognised. Revenue from “book transactions” is disregarded.

- Shares in public hands

- The Rules require:

- a 25% public float;

- that the expected market capitalisation of shares held by the public at the time of listing must be at least HK$50 million.

- Where a listing applicant has more than 1 class of securities apart from the H shares, the total securities held by the public on all regulated market(s) including the Exchange must be at least 25% of the issuer’s total issued share capital. The H shares must not be less than 15% of the issuer’s total issued share capital, having an expected market capitalisation at the time of listing of at least HK$50 million.

- For large companies, with an expected market capitalisation in excess of HK$10 billion, the percentage required to be in public hands, may, at the Exchange’s discretion, be lower (but not lower than 15%) provided that:

- the Exchange is satisfied that the number of securities and their distribution will enable the market to operate properly with a lower percentage;

- the issuer makes appropriate disclosure of the lower prescribed percentage of public float in the listing document;

- the issuer confirms the sufficiency of public float in successive annual reports after listing; and

- a sufficient proportion (to be agreed in advance with the Exchange) of any securities to be marketed contemporaneously in and outside Hong Kong, must normally be offered in Hong Kong.

- The waiver cannot be applied for post-listing if the issuer subsequently satisfies the HK10 billion market capitalisation requirement

Exchange’s Discretion to Accept Lower Public Float (Rule 8.08(1)(d))

- The Rules require:

- Minimum number of shareholders

- The minimum number of shareholders at the time of listing is 300.

- Not more than 50% of the publicly held shares can be beneficially owned by the 3 largest public shareholders.

- Market capitalisation at time of listing

Minimum expected market capitalisation of new applicant is:

- HK$200 million for Profit Test applicants;

- HK$4 billion for Market Capitalisation/Revenue Test applicants; or

- HK$2 billion for Market Capitalisation/Revenue/Cash Flow Test applicants.

- Expected market capitalisation at the time of listing is calculated on the basis of all issued share capital of the applicant including:

- the class of securities to be listed;

- any other class(es) of securities whether unlisted or listed on another regulated market.

- The expected issue price of the securities to be listed is used to determine the market value of securities that are unlisted or listed on other markets.

- Working capital sufficiency

- Listing document must contain confirmation of sufficient working capital for at least next 12 months.

- The sponsor must provide written confirmation to the Exchange that it has obtained written confirmation from the applicant as to the sufficiency of the working capital and it is satisfied that the issuer’s confirmation is given after due and careful enquiry.

- Sponsor to confirm existence of financing facilities.

- Competing Businesses

The Main Board Listing Rules allow competing businesses of an applicant’s directors and “controlling shareholder(s)” provided that full disclosure is made at the time of listing and on an on-going basis.

- A “controlling shareholder” is person(s) controlling 30% or more of the voting power at general meetings; or the composition of a majority of the board of directors (PRC Governmental Bodies are not “controlling shareholders”).

- Accountants’ report and accounting standards

Requirements:

- must cover 3 financial years prior to issue of listing document

- may be prepared in accordance with Chinese accounting standards as an alternative to Hong Kong or International Financial Reporting Standards

- Exchange may accept a Chinese firm of accountants as the reporting accountant and auditor of an H share company (if approved by China’s Ministry of Commerce and the China Securities Regulatory Commission). H share company’s accounts can be prepared in accordance with financial reporting standards issued by China Accounting Standards Committee and the China Ministry of Finance

- Directors and supervisors

- Collectively responsible for management and operations of listed issuer.

- Fiduciary duties and duties of due skill and care (Rules 3.08).

- Character, experience and integrity requirement (Rules 3.09 and 19A.18(2)).

- Independent non-executive directors

Minimum Number of INEDs

- Rules require appointment of a minimum of 3 INEDs. At least 1/3 of an issuer’s board must be INEDs (MB Rule 3.10A). Listed issuer to inform the Exchange and publish an announcement immediately if the number of its INEDs falls below the minimum or it does not have one qualified INED. It will have 3 months to rectify the situation.

Qualification of INEDs

- Rules require appointment of at least one INED with appropriate professional qualifications or accounting or related financial management expertise.

Independence will be questioned when the INED:

- holds more than 1% of the issued share capital;

- has received the issuer’s shares as a gift or with financial assistance from the issuer or a connected person;

- is a partner or director of a professional adviser to the issuer within the previous year or an employee involved in giving advice;

- is or was in the previous 2 years a director or executive of the issuer, its group companies or connected persons.

- Committees

- Establishment of an audit committee and remuneration committee is compulsory under Main Board Rules.

- Audit Committee must be made up only of non-executive directors, the majority must be INEDs of the issuer. Minimum of 3 members: at least one must be an INED with appropriate professional qualifications or accounting or related financial management expertise.

- Remuneration Committee must be made up of a majority of INEDs with written terms of reference and chaired by an INED.

- Sponsor

- A new applicant seeking a listing of equity securities on the Main Board must appoint one or more sponsors under a written engagement agreement to assist with its listing application (Rule 3A.02). Only firms that are licensed under part V of the Securities and Futures Ordinance for Regulated Activity Type 6 (Advising on Corporate Finance) and are permitted by their licence to conduct sponsor work are allowed to act as sponsors to new listing applicants.

- At least one sponsor must be independent of the listing applicant. The sponsor(s) must be appointed at least 2 months before submission of the listing application.

- Compliance adviser

- PRC issuer must appoint a compliance adviser for the period commencing on initial listing and end on the publication of financial results for the first full financial year after listing.

- A compliance adviser must be either a corporation licensed or an authorised institution registered to advise on corporate finance matters under the SFO.

- Issuers must consult their compliance adviser:

- before publication of any regulatory announcement or report, circular or financial report;

- where a notifiable or connected transaction is contemplated (including share purchases and share repurchases);

- where the issuer proposes to use IPO proceeds other than as set out in the Listing Document or where its business activities, developments or results differ from information in the Listing Document; and

- where the Exchange makes an inquiry as to unusual movements in the price or trading volume of the issuer’s securities.

- A compliance adviser to a PRC issuer is additionally required to inform the issuer on a timely basis of any amendment or supplement to the Listing Rules and any change to Hong Kong’s laws, regulations or codes which apply to the issuer and on continuing compliance with the Listing Rules and applicable laws and regulations.

- Mandatory Provisions for Articles of Association

- Apart from provisions set out in Appendix 3 and Appendix 13 Part D Section 1) of the Listing Rules, additional requirements for PRC issuers include, among others, provisions to reflect the different nature of domestic shares and overseas listed foreign shares (including H shares) and the different rights of their respective holders (Rule 19A.01(3)).

- Arbitration (Rule 19A.01(3))

- Disputes involving holders of H shares and arising from a PRC issuer’s articles of association, or from any rights or obligations conferred or imposed by the Company Law and any other relevant laws and regulations concerning the affairs of the PRC issuer, are to be settled by arbitration in either Hong Kong or the PRC at the election of the claimant.

- Service agent (Rule 19A.13(2))

- The PRC issuer must appoint and maintain the appointment of a person authorised to accept service of process and notices on its behalf in Hong Kong.

- Receiving agent (Rule 19A.51)

- The PRC issuer must appoint a receiving agent in Hong Kong to receive dividends declared and other monies owing in respect of H shares.

- Share register (Rule 19A.13(3)(a))

- PRC issuers must maintain a register for H shares in Hong Kong

- Management Presence (Rule 8.12)

- This will normally mean that at least two of the executive directors must be ordinarily resident in Hong Kong. PRC issuers will generally seek a waiver from the Exchange from this requirement.

- Authorised Representatives (Rule 3.05)

- Every issuer must appoint 2 authorised representatives to act at all times as the issuer’s principal channel of communication with the Exchange (either 2 directors or a director and the company secretary)

Responsibilities of an authorised representative

- being the principal channel of communication between the Exchange and the listed issuer; and

- to ensure that whenever he is outside Hong Kong suitable alternates are appointed, available and known to the Exchange.

- Company Secretary (Rule 3.28)

- The academic or professional qualifications which the Exchange considers acceptable are membership of The Hong Kong Institute of Chartered Secretaries and being a Hong Kong solicitor, barrister or certified public accountant.

- A company secretary is not required to be resident in Hong Kong.

- Communication

- There must be adequate communication and cooperation agreements in place between the Exchange and the relevant securities regulatory authorities in the PRC. If the PRC issuer has securities listed on another stock exchange, there must also be adequate communication arrangements in place with that stock exchange.

Determination of Market Capitalisation

Listing Application Procedure

- At the time of application to list, an applicant must submit a draft listing document (the Application Proof) the information in which must be “substantially complete” except in relation to information that by its nature can only be finalised and incorporated at a later date (MB Rule 9.03(3));

- The Exchange has the power to return a listing application on the ground that the information in the listing application or Application Proof is not “substantially complete” (MB Rule 2B.01A & 9.03(3));

- If the Exchange returns a listing application to a sponsor before issuing its first comment letter to the sponsor, the initial listing fee will be refunded but in other cases it will be forfeited;

- If an application is returned, a new application cannot be submitted until 8 weeks after the Return Decision;

- The names of the applicant and sponsor(s) together with the return date will also be published on the Exchange’s website;

- Before submitting the listing application, the sponsor is required to perform all reasonable due diligence on the listing applicant (except in relation to matters that can only be dealt with later);

- Sponsors also have a duty to report to the Exchange any material information concerning non-compliance with Listing Rules or other regulatory requirements relevant to the listing.

Other documents which must be submitted with the listing application include:

- Written confirmation by each director/supervisor that the information in the Application Proof is accurate and complete in all material respects and not misleading or deceptive;

- Reporting accountants’ confirmation that no significant adjustment is expected to be made to the draft reports included in the Application Proof (Guidance Letter HKEx-GL58-13));

- Experts’ confirmation – that no material change is expected to be made to their reports included in the Application Proof (see Guidance Letter HKEx-GL60-13);

- Draft letter from the sponsor confirming that it is satisfied that the directors’ sufficiency of working capital statement has been made by the directors after due and careful enquiry; and

- Certified copy of the applicant’s certificate of incorporation or equivalent.

- The Exchange will comment on the Application Proof within 10 business days from receipt of the application.

- Second and further rounds of comments (if any) are given within 10 business days from receipt of reply to the previous comment letter.

- If there is only one set of comments from Exchange, assuming sponsor takes 5 business days to respond, the listing application can be heard by the Listing Committee within around 25 business days.

- If there are 2 rounds of Exchange comments, assuming sponsor takes 5 business days to respond, the listing application can be heard by the Listing Committee within around 40 business days.

- If the listing is approved at the Listing Committee hearing, the Exchange will issue a letter requiring the posting of a near-final draft of the listing document (PHIP) on the Exchange’s website. This must be submitted for publication before distribution of the red herring prospectus to institutional or other professional investors and before book-building commences.

GEM Listing – Qualifications

- Chapter 11 of the GEM Listing Rules sets out the basic requirements that must be met before any initial listing of equity securities on the GEM. Chapter 25 contains additional requirements, modifications and exceptions to those requirements which apply to PRC incorporated companies.

- Incorporation

The PRC issuer must be duly incorporated in the PRC as a joint stock limited company.

- Suitability for Listing

Both the issuer and its business must, in the opinion of the Exchange, be suitable for listing (Rule 11.06). The Exchange may, in its discretion, refuse a listing of a PRC issuer’s securities if it believes that it is not in the interest of the Hong Kong public to list them (Rule 25.07(1)).

- Cash Flow Requirement

A GEM listing applicant must have a positive cashflow from operating activities in the ordinary and usual course of business of at least HK$20 million in total for the 2 financial years immediately preceding the issue of the listing document.

- Statement of Business Objectives (Rule 14.19)

A new applicant must include in its listing document a statement of business objectives setting out the following information:

- The overall business objectives;

- The market potential for the business over the period of the remainder of the current financial year of the applicant and the two financial years thereafter; and

- A detailed description of the new applicant’s objectives for each of the products, services or activities (and any other objectives) analysed over the period comprising the remainder of the current financial year of the applicant and the two financial years thereafter (Rule 14.19).

- half year reports published in the first 2 full financial years after listing.

- Operating history and management

New applicants must have a trading record of at least two financial years with:

- Management continuity throughout the 2 preceding financial years; and

- Ownership continuity and control throughout the preceding full financial year.

The Exchange may accept a shorter trading record and/or waive or vary the ownership and management requirements for:

- newly-formed ‘project’ companies; (for example a coy formed for the purpose of major infrastructure project);

- Mineral companies where the directors and senior management have > 5 years’ relevant experience; and

- in exceptional circumstances under which the Exchange considers it desirable to accept a shorter period, provided the cash flow requirement of HKD 20 million for that shorter trading period is met.

- Market Capitalisation

GEM applicants must have a market cap of > HK$100 million at the time of listing.

- Public float

- Minimum 25% of the issuer’s total issued share capital (HK$30 million minimum) must be held by the public at all times (11.23(7)). If the issuer has more than one class of securities, the total securities in public hands at the time of listing must be 25% of the issuer’s total issued share capital and the securities for which listing is sought must be at least 15% of the total issued share capital with an expected market cap of HK$30 million at listing.

- Issuers with an expected market cap of over HK$10 billion may have a lower percentage of between 15% – 25% (11.23(10)).

- Minimum Number of shareholders

- There must be at least 100 public shareholders at the time of listing (Rule 11.23(2)(b)).

- In addition, not more than 50% of the securities in public hands at the time of listing can be beneficially owned by the three largest public shareholders.

- Accountants’ Report and Accounting Standards

- Must cover at least 2 financial years and can be prepared in accordance with either Chinese accounting standards, HK Financial Reporting Standards or International Financial Reporting Standards.

- Directors and Supervisors

- The board of directors of an issuer is collectively responsible for the management and operations of the user.

- Independent Non-Executive Directors (Same as MB applicants)

- A Minimum of 3 INEDs and INEDs must make up one third of board.

- One INED must have professional qualifications or accounting or related financial management expertise.