IPOs

I. INTRODUCTION

1. General

The GEM was originally established as an alternative market to the Main Board in November 1999 to provide capital formation opportunities for growth companies. Accordingly, unlike the Main Board, the GEM currently does not have a profit record, revenue or other financial standards requirements.

On 2 May 2008, the Stock Exchange published its Consultation Conclusions on its July 2007 Consultation Paper on GEM. The Consultation Conclusions set out the amendments which will be made to the GEM Listing Rules with effect from 1 July 2008 and implement the Stock Exchange’s proposal to reposition GEM as a stepping stone to the Main Board. The most significant changes include the imposition of higher initial entry criteria, namely requirements for:

- Aggregate operating cash flow of at least HK$20 million over the preceding 2 years;

- A minimum market capitalisation of HK$100 million (rather than the current effective HK$46 million);

- Public float of at least HK$30 million and 25% (or 15% – 25% if the issuer has a market capitalisation of at least HK$10 billion; and

- The latest 2 financial years under substantially the same management

The Exchange will also delegate the power to approve new listings from the Listing Committee to the Listing Division.

Subject to the requirements of the Listing Rules, companies incorporated in Hong Kong, the PRC, the Cayman Islands and Bermuda may be listed on the GEM. This paper will focus on the listing of a PRC company on the GEM.

2. Legal and Regulatory System

The legal system in the PRC, unlike that in Hong Kong, is not based on a common law system. The Chinese Company Law, effective from 1st July 1994, is also different from the company law in Hong Kong. To resolve the differences, the Exchange and the SFC liaised with the Chinese authorities, and as a result, the Special Regulations on the Overseas Offering and Listing of Shares by Joint Stock Limited Companies (the “Special Regulations”) were promulgated on 4th August 1994, and the Mandatory Provisions for Companies Listing Overseas (the “Mandatory Provisions”) on 27th August 1994.

The Special Regulations and the Mandatory Provisions are applicable to Chinese companies seeking listings overseas. In particular, the latter enhance basic shareholder protection under a Chinese company’s Articles of Association, to a similar standard to that provided under Hong Kong Company Law. The Mandatory Provisions include provisions relating to the rights of shareholders, directors’ fiduciary duties, corporate governance matters, financial disclosures, situations requiring a separate vote by holders of overseas listed foreign shares, and a mechanism for resolving disputes by arbitration.

PRC companies issuing shares in Hong Kong are subject not only to relevant Chinese laws and regulations, but also to Hong Kong applicable laws and non-statutory codes. These include:

- The Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”);

- the Companies Ordinance, the Securities and Futures Ordinance; and

- the Code on Takeovers and Mergers, and the Code on Share Repurchases

The Listing Rules are as applicable to Chinese issuers as they are to Hong Kong and overseas incorporated issuers. However, in view of the existence of two separate markets (domestic and foreign) for the securities of Chinese issuers, and the differences between the Chinese and Hong Kong legal systems, some additional requirements, modifications and exceptions are set out in Chapter 25 of the GEM Listing Rules, specifically designed for Chinese issuers. H Shares can be subscribed for and traded in other currencies in addition to Hong Kong dollars.

II. GEM QUALIFICATIONS FOR LISTING

Chapter 12 of the GEM Listing Rules sets out the basic requirements that must be met before any initial listing of equity securities on the GEM. Chapter 25 contains additional requirements, modifications and exceptions to those requirements which apply to PRC incorporated companies.

1. Main Requirements for GEM Listing

The main requirements for GEM listing are summarised below. The Exchange retains an absolute discretion to accept or reject applications for listing and compliance with the relevant conditions will not necessarily ensure that a listing will be granted. The requirements set out below are not exhaustive and the Exchange may impose additional requirements in any particular case.

- Incorporation

The PRC issuer must be duly incorporated in the PRC as a joint stock limited company.

- Suitability for Listing

While GEM applicants are not required to demonstrate past profits or meet other financial standards, both the issuer and its business must, in the opinion of the Exchange, be suitable for listing (Rule 11.05). The Exchange may, in its discretion, refuse a listing of a PRC issuer’s securities if it believes that it is not in the interest of the Hong Kong public to list them.

- Active Business Pursuits (Rule 11.12)

Generally, except where a new applicant meets the requirements as set out under the paragraph “Shorter Period of Business Pursuits” below, a new applicant must demonstrate that, throughout the period of 24 months immediately preceding the date of submission of the listing application, it has, either by itself or through one or more of its subsidiaries, actively pursued one focused line of business under substantially the same management and ownership as exist at the time of the application for listing. It must also make a statement of active business pursuits in the listing document providing both qualitative and quantitative information, in a reasonable level of detail, about the activities and performance of the issuer during that 24 month period.The requirement for a new applicant to be able to demonstrate its active business pursuits is specific to the GEM. While GEM applicants are not required to demonstrate past profits or revenue, a new applicant must be able to demonstrate that it has a business of both substance and potential. A business will only be regarded as having the requisite substance if the applicant can show that it has spent at least the 24 month period (or such shorter period accepted by the Exchange) prior to the issue of the listing document making substantial progress in building up that business.Examples of measurements of progress that may be relevant are as follows (see Note 4 to Rule 14.15):-

- sales and marketing activity (such as turnover, customer or client base, number of retail outlets or concessions, geographic mix and marketing strategy);

- production factors (such as equipment, premises and raw materials required and production processes);

- deployment of human resources (such as number, expertise, experience and turnover of personnel);

- product and/or process developments (such as phase of development);

- licensing developments (including details of type, purpose, expiry date, parties and financial effect);

- patent or other intellectual property protection (such as status of trade mark and patent registration in each market);

- joint ventures, collaborations or other business arrangements into which the applicant has entered (including details of the parties thereto and the purpose of any such arrangement, expiry date and financial effect);

- funding arrangements (such as the equity and debt finance previously obtained);

- in the case of infrastructure project companies, details of projects, project locations, concessions or mandates awarded, phases of development, pre-construction or construction;

- regulatory approvals obtained; and

- such matters as are otherwise relevant to the product, service or activity in question.

Active Business Pursuits may be carried out by a subsidiary provided that:

- the new applicant must control the composition of the board of directors of that subsidiary and of any intermediate holding company; and

- the new applicant must have an effective economic interest of not less than 50% in that subsidiary (Rule 11.13).

Focused Business

For a new applicant to be considered suitable for listing, it should be actively engaged in one focused line of business rather than two or more disparate businesses. The reason for this is that the Exchange expects an applicant’s management to be devoting its attention towards advancing one core business rather than a variety of concerns which compete or may compete for their attention.

Shorter Period of Business Pursuits

Under Rule 11.14, the Exchange may accept a shorter period of active business pursuits in the following circumstances:-

- in respect of newly-formed “project” companies (for example a company formed for the purposes of a major infrastructure project);

- in respect of natural resource exploitation companies; and

- in exceptional circumstances under which the Exchange considers it desirable to accept a shorter period.

Under Rule 11.12(2) and (3), the Exchange may also accept a period of active business pursuits of not less than 12 months before the date of submission of the listing application if the following conditions are satisfied:

- the new applicant has actively pursued its focused line of business for not less than 12 months;

-

- the new applicant has turnover of not less than HK$ 500 million in the last 12 months reported on in the accountants’ report included in its listing document; or

- it has total assets of not less than HK$ 500 million as shown in the balance sheet for the last period reported on in the accountants’ report included in its listing document; or

- the expected market capitalisation of the new applicant’s securities at the time of listing is not less than HK$ 500 million;

- the new applicant’s securities in the hands of the public at the time of listing must have a market capitalisation of not less than HK$ 150 million and must be held among at least 300 shareholders with the largest 5 and largest 25 holding in aggregate not more than 35% and 50%, respectively; and

- the offering price of the new applicant’s shares at its IPO is not less than HK$1.00.

- Business Objectives (Rule 14.19)

A new applicant must include in its listing document a statement of business objectives setting out the following information

- general information as to (a) the overall business objectives of the new applicant; and (b) the market potential for the new applicant’s active business pursuits over the period comprising the remainder of the current financial year of the applicant and the 2 financial years thereafter;

- a detailed description of the new applicant’s objectives for each of the products, services or activities identified in its statement of active business pursuits (and any other objectives) analysed over the period comprising the remainder of the current financial year of the applicant and the 2 financial years thereafter;

The statement of business objectives should specify particular strategies, critical paths or milestones against which the applicant’s progress may, in the future, be compared.

- Accountants’ Report

A new applicant must have an accountants’ report prepared in accordance with Chapter 7 of the GEM Listing Rules. In the case of a new applicant, the accountants’ report must cover at least the 2 financial years immediately preceding the issue of the listing document (and covering at least 24 months of active business pursuits) or, if the applicant meets the conditions of Rule 11.12(3), at least the 12 month period from the commencement of its active business pursuits.

In the case of a new applicant, the latest financial period reported on by the reporting accountants must not have ended more than 6 months before the date of the listing document.

- Open Market for Securities Listed

There must be an open market in the securities for which listing is sought. This will normally mean that for any class of equity securities, at least the “minimum prescribed percentage” of such class of securities must be held in the hands of the public.

In the case of a PRC issuer, the requirement that there must be an open market in the securities for which listing is sought means that at least the “minimum prescribed percentage” of any class of listed securities must be held by the public (Rule 25.08). The “minimum prescribed percentage” is determined as follows:-

- if at any time there are existing issued securities of the PRC issuer other than H shares, then (i) 100% of the H shares must be held by the public, except as otherwise permitted by the Exchange in its discretion; (ii) H shares held by the public must constitute not less than 10% of the total existing issued share capital of the PRC issuer; and (iii) the aggregate amount of H shares and such other securities held by the public must constitute not less than the following percentage of the total existing issued share capital of the issuer:-

- 25% for issuers with market capitalisation not exceeding HK$4,000 million;

- the higher of (i) the percentage that would result in the market value of the securities to be in public hands equal to HK$1,000 million and (ii) 20%, for issuers with market capitalisation exceeding HK$4,000 million.

- if there are no existing issued securities of the PRC issuer other than H shares, the H shares held by the public must constitute not less than the minimum percentage set out above.

The above requirements as to the minimum percentage of H shares and other securities (if any) of the PRC issuer which must be held by the public apply at all times. If any of these percentages falls below the prescribed minimum, the Exchange is entitled to cancel the listing or suspend trading until the position has been rectified.

H shares held by the public must have an expected market value of not less than the higher of HK$30 million or the expected initial market capitalisation of the applicable minimum prescribed percentage at the time of listing (Rule 25.09).

The equity securities in the hands of the public should, as at the time of listing, be held among at least 100 persons (including those whose equity securities are held through CCASS) (Rule 25.08(1)(b)).

- if at any time there are existing issued securities of the PRC issuer other than H shares, then (i) 100% of the H shares must be held by the public, except as otherwise permitted by the Exchange in its discretion; (ii) H shares held by the public must constitute not less than 10% of the total existing issued share capital of the PRC issuer; and (iii) the aggregate amount of H shares and such other securities held by the public must constitute not less than the following percentage of the total existing issued share capital of the issuer:-

- Shareholding Requirements

At the time of listing, the initial management shareholders (persons who are entitled to exercise, or control the exercise of, 5% or more of the voting power at general meeting of the issuer and who are able to direct or influence the management of the issuer, which includes all members of senior management, directors and investors with board representation) and significant shareholders (persons who are entitled to exercise, or control the exercise of, 5% or more of the voting power at general meeting), must between them, hold at least 35 per cent of the issued share capital of the new applicant (Rule 11.22).

- Mandatory Provisions for Articles of Association

The mandatory provisions which must be incorporated in a PRC issuer’s Articles of Association are set out at Appendix 3 and at Section 1 of Part C of Appendix 11 to the Listing Rules. The additional requirements for PRC issuers include:

- provisions which reflect the different nature of domestic shares and overseas listed foreign shares (including H shares) and the different rights of their respective holders (Rule 25.01(3)); and

- the appointment of a receiving agent in Hong Kong to receive from the issuer, and hold, pending payment, in trust for H shareholders, dividends declared and other moneys owing in respect of the H shares (Rule 25.38).

- Business Competition

A new applicant will not be rendered unsuitable for listing on the grounds that any director or shareholder has an interest in a business which competes or may compete with the new applicant’s business (Rule 11.03).

Full and accurate information of any business or interest of each director, management shareholder and, in relation only to the initial listing document, substantial shareholder and the respective associates of each that competes or may compete with the business of the group and any other conflicts of interest which any such person has or may have with the group must be disclosed in each listing document and circular required under the GEM Listing Rules and in the annual report and accounts, half-year report and quarterly reports of the listed issuer (Rule 11.04). For the purposes of the GEM Listing Rules, a controlling shareholder will in all cases be treated as a management shareholder. A “controlling shareholder” of a PRC listing applicant is any shareholder or persons together entitled to exercise or control the exercise of 30% (or such other amount as may from time to time be specified in applicable PRC law as the level for triggering a mandatory general offer or for otherwise establishing legal or management control over a business enterprise) or more of the voting power at general meetings of the new applicant or who is in a position to control the composition of the majority of the applicant’s board of directors (Rule 25.10). For these purposes, the Exchange will not normally regard a PRC Governmental Body (as defined at Rule 25.04) as a controlling shareholder of a PRC issuer.

- Property-related Matters

- A new applicant that is a property company must have, in respect of a substantially major portion of its PRC properties, long-term title certificates and/or, in respect of a substantially major portion of its properties not situated in the PRC, other appropriate evidence of title, regardless of whether such properties are completed or still under development;

- For any new applicant, not being a property company which has a PRC property that represents a substantial portion of its assets in terms of either asset value or profit contribution, the new applicant must obtain a long-term title certificate for that PRC property;

- In the case of infrastructure companies, an issuer must obtain long-term title certificates for all PRC properties used in infrastructure projects, whether completed or under development;

- where infrastructure companies operate under long-term concessionary arrangements awarded by the government which do not provide for long-term title certificates, the Exchange may accept other evidence of the right to use the PRC property.

- Arbitration

Disputes involving holders of H shares and arising from a PRC issuer’s articles of association, or from any rights or obligations conferred or imposed by the PRC Company Law and any other relevant laws and regulations concerning the affairs of the PRC issuer, are to be settled by arbitration in either Hong Kong or the PRC at the election of the claimant (Rule 25.01(3)). - Service Agent

The PRC issuer must appoint, and maintain throughout the period its securities are listed on the GEM the appointment of, a person authorised to accept service of process and notices on its behalf in Hong Kong (Rule 25.07). - Register of Shareholders

Provision must be made for a register of holders to be maintained in Hong Kong, or such other place as the Exchange may agree, and for transfers to be registered locally (Rule 25.07). - Free Transferability

The securities for which listing is sought must be freely transferable. There must be no restrictions on their transfer under PRC law or the constitutional documents of the PRC issuer. To facilitate transferability, the securities must be accepted by HKSCC as eligible for deposit, clearance and settlement in CCASS from the date on which dealings are to commence (Rule 11.29). - Sponsor

A new applicant seeking a listing of equity securities on GEM must appoint one or more sponsors to assist with its listing application (Rule 6A.02). To be eligible to act as the sponsor of a new applicant, a company or bank must be licensed or registered under the Securities and Futures Ordinance to advise on corporate finance and must be permitted to conduct sponsor work under the terms of its licence or certificate of registration.If only one sponsor is appointed, that sponsor must be independent from the applicant in accordance with the independence test set out at Rule 6A.07. If there are two or more sponsors, at least one sponsor must be independent and the listing document must disclose whether each sponsor is independent in accordance with the Rule 6A.07 test (Rule 6A.10(2)). In addition, one sponsor must be designated as the primary channel for communication with the Exchange. Each sponsor is responsible for ensuring that the sponsor’s obligations under the Listing Rules are discharged (Rule 6A.10(3)).

Each sponsor is required to undertake to the Exchange to comply with the Listing Rules, ensure the accuracy of information provided to the Exchange and cooperate in any listing division investigation (Rule 6A.03). Sponsors must also submit to the Exchange a Statement Relating to Independence addressing each of the Rule 6A.07 independence tests (Rule 6A.08). Between the date of the GEM Listing Committee hearing of the listing application and the date of issue of the listing document, sponsors must submit to the Exchange a Sponsor’s Declaration giving specific confirmations as to the accuracy of information in the directors’ declarations, the applicant’s compliance with the conditions for listing, the sufficiency and accuracy of information in the prospectus and as to the adequacy of the applicant’s systems and its directors’ experience and understanding of the Listing Rules to ensure the applicant’s compliance with the Listing Rules post-listing (Rules 6A.13 to 6A.16). Sponsors are required to conduct reasonable due diligence inquiries in order to put themselves in a position to give the Sponsor’s Declaration (Rule 6A.11(2)). The typical due diligence steps expected of sponsors of initial listing applications are set out at Practice Note 2. The Exchange expects sponsors to document their due diligence planning and significant deviations from their plans.

Where the PRC issuer has securities listed on one or more other stock exchanges, the sponsor must make a written submission to the Exchange stating whether in its opinion the PRC issuer’s directors appreciate the differences as well as the similarities between the H shares and the shares listed on such other stock exchanges and between the rights and obligations of holders of such shares and the basis for such opinion. The sponsor must also explain how the PRC issuer’s directors propose to co-ordinate and comply in a timely manner with the requirements of the Exchange and such other stock exchanges (Rule 25.05).

A sponsor’s main responsibilities to a new applicant are:

- to be closely involved in the preparation of the applicant’s listing documents;

- to conduct reasonable due diligence inquiries having regard to Practice Note 2 to put itself in a position to give the Sponsor’s Declaration required by Rule 6A.13;

- to submit the listing application and all supporting documents on behalf of the applicant;

- to ensure that there is no unauthorised publication or leakage of publicity material or price sensitive information about a new applicant prior to the hearing of the GEM Listing Committee;

- to use reasonable endeavours to address all matters raised by the Exchange in connection with the listing application;

- to accompany the applicant to meetings with the Exchange unless otherwise requested by the Exchange; and

- to comply with the terms of the undertaking given to the Exchange pursuant to Rule 6A.03 (Rule 6A.11).

- Compliance Adviser

A PRC issuer is required to retain a compliance adviser for the period commencing on the date of listing and ending on the publication of its financial results for the second full financial year after listing (Rule 6A.19). A compliance adviser must be either a corporation licensed or authorised institution registered to advise on corporate finance matters under the Securities and Futures Ordinance. It must also be permitted to conduct sponsor work under the terms of its licence or certificate of registration. A compliance adviser must act impartially but is not required to be independent of the issuer. An issuer is not obliged to appoint as its compliance adviser the same firm that acted as the sponsor of its initial public offering.

Issuers are required to consult with, and if necessary, seek advice from their compliance advisers on a timely basis in the following 4 situations:

- before publication of any regulatory announcement, circular or financial report;

- where a notifiable or connected transaction is contemplated;

- where the issuer proposes to use the IPO proceeds differently to the manner detailed in the listing document or where the issuer’s business activities, developments or results deviate from any forecast, estimate or other information in the listing document; and

- where the Exchange makes an inquiry of the issuer under Rule 17.11 regarding unusual movements in the price or trading volume of its securities (Rule 6A.23).

The Exchange may also require an issuer to appoint a compliance adviser at any other time after the second full financial year after listing, for example if the issuer has breached the Listing Rules (Rule 6A.20). In this case the Exchange will specify the period of appointment and the circumstances in which the compliance adviser must be consulted.

- Authorised representatives

Every issuer must ensure that, at all times, it has 2 authorised representatives (Rule 5.24). The authorised representatives must be 2 individuals from amongst the issuer’s executive directors and company secretary (unless the Exchange, in exceptional circumstances, agrees otherwise). The responsibilities of an authorised representative are as follows (Rule 5.25):

- supplying the Exchange with details in writing of how he can be contacted including home, office and mobile phone telephone numbers and, where available, facsimile numbers and electronic mail addresses;

- for so long as the issuer continues to have a Sponsor, assisting the Sponsor in its role as the principal channel of communication with the Exchange concerning the affairs of the issuer.

- Directors and Supervisors

The board of directors of an issuer is collectively responsible for the management and operations of the issuer (Rule 5.01). Every director and supervisor must satisfy the Exchange that he has the character, experience and integrity and is able to demonstrate a standard of competence commensurate with his position as a director or supervisor of the issuer (Rules 5.02 and 25.13(2)).

- Independent Non-executive Directors

Every issuer must ensure that, at all times, its board of directors includes at least 3 independent non-executive directors (“INEDs”). At least one INED must have appropriate professional qualifications or accounting or related financial management expertise (Rule 5.05). Each INED must confirm his independence in accordance with new guidelines under Rule 5.09 to the Exchange at the time of submission of his declaration, undertaking and acknowledgement.INEDs of PRC issuers are further required to demonstrate an acceptable standard of competence and adequate commercial or professional experience to ensure that the interests of the general body of shareholders will be adequately represented (Rule 25.13).

- Company Secretary

The secretary of the issuer must be a person who has the requisite knowledge and experience to discharge the functions of the secretary of the issuer and who possesses the qualifications prescribed under the GEM Listing Rules (Rule 5.14). - Compliance Officer

Every issuer must ensure that, at all times, one of its executive directors assumes responsibility for acting as the issuer’s compliance officer (Rule 5.19). The compliance officer’s responsibilities must include, as a minimum, the following matters:-- advising on and assisting the board of directors of the issuer in implementing procedures to ensure that the issuer complies with the GEM Listing Rules and other relevant laws and regulations applicable to the issuer; and

- responding promptly and efficiently to all enquiries directed at him by the Exchange.

- Audit committee

Every issuer must establish an audit committee comprising non-executive directors only and a minimum of 3 members, at least one of whom is an INED with appropriate professional qualifications or accounting or related financial management expertise (Rule 5.28). The majority of the committee members must be INEDs of the issuer. The audit committee must be chaired by an INED. The duties of the audit committee must include at least the following matters:- reviewing, in draft form, the issuer’s annual report and accounts, half-year report and quarterly reports and providing advice and comments thereon to the issuer’s board of directors; and

- reviewing and supervising the issuer’s financial reporting and internal control procedures.

- Qualified Accountant

Every issuer must ensure that, at all times, it retains an individual, on a full time-basis, whose responsibility must include oversight of the issuer and its subsidiaries in connection with its financial reporting procedures and internal controls and compliance with the requirements under the GEM Listing Rules with regard to financial reporting and other accounting-related issues. The individual must be a member of the senior management of the issuer (preferably an executive director) and must be a qualified accountant and a fellow or associate member of the Hong Kong Society of Accountants or a similar body of accountants recognised by that Society for the purpose of granting exemptions from the examination requirement for membership of that Society (Rule 5.15).

2. Application Procedures and Requirements

GEM Listing Committee/Division

- Application for listing on the GEM is to be made to the GEM Listing Committee.

- All documents have to be submitted to the GEM Listing Division which will review all applications.

Application Procedures

- An application must be made to the Exchange for the purpose of listing securities issued by a new applicant. The sponsor must contact the GEM Listing Division to ascertain a date on which the GEM Listing Committee may consider the new applicant’s application for listing (the “Provisional Hearing Date”)

- Each sponsor must submit to the Exchange the Sponsor’s Undertaking required by Rule 6A.03 in the form set out in paragraph 21 of Appendix 5a and the Sponsor’s Statement Relating to Independence in the form of Form K of Appendix 7 no later than the date on which documents in connection with the listing are submitted to the Exchange. If a sponsor is appointed after that date, the Undertaking and Statement Relating to Independence should be submitted on the earlier of the sponsor agreeing its terms of engagement and its commencing work for the applicant.

- A new applicant must apply to the GEM Listing Division on the prescribed listing application form at least 25 clear business days prior to the Provisional Hearing Date. The listing application form must be accompanied by:

- The documents, as applicable, stipulated in Rules 12.22 and 12.23 of the GEM Listing Rules (the “25-day Documents” as referred to below);

- A certified extract from the board minutes of the new applicant authorising the submission of the listing application form; and

- The non-refundable initial listing fee in the amount specified in Appendix 9 of the GEM Listing

- Hearing (the meeting at which the GEM Listing Committee considers the new applicant’s application for listing)

- Preliminary approval/rejection notice issued in respect of the listing application

- Registration of the prospectus

- Issue of the listing document

- Official notification issued in respect of the listing approval

- Trading commences

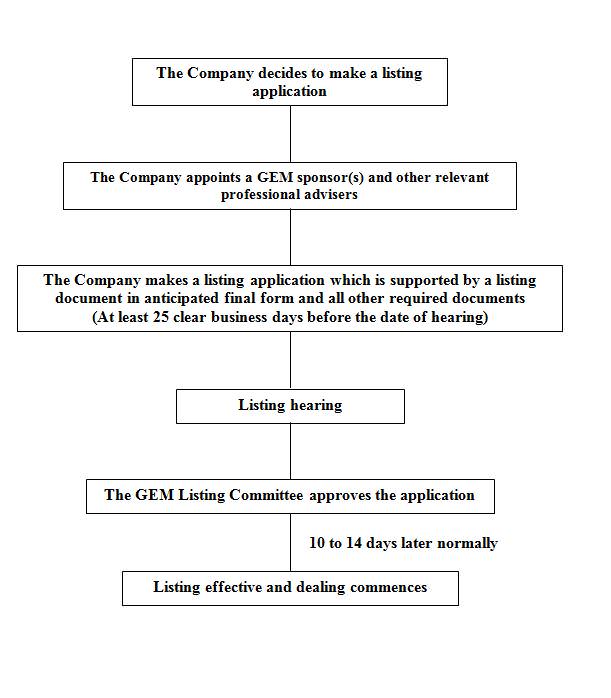

Here is a GEM Listing Flowchart

Documentary requirements

PRC Issuer

Documentary Requirements

(At the time of application for listing on GEM)

Set out below is a list of the documents which must accompany the listing application (as set out in Rules 12.22, 12.23 and 25.16 and required under Rule 12.14). All references to rules and appendices are to the rules and appendices of the GEM Listing Rules.

| Required document(s) | Form | Responsible Party | |

| 1. | Board minutes of PRC issuer authorising submission of listing application and approving undertaking, declaration and acknowledgements | Certified extract | Company’s HK legal adviser/Company’s PRC legal adviser |

| 2. | Non-refundable initial listing fee (see Appendix 9) | Company/Sponsor | |

| 3. | Prospectus duly annotated in the margin of its anticipated final form | 6 proofs | Sponsor/Sponsor’s HK legal adviser |

| 4. | Memorandum and articles of association of PRC issuer duly annotated in the margin | 3 certified copies |

Company’s PRC legal adviser/ Company’s HK legal adviser |

| 5. | A letter of compliance in respect of the memorandum and articles from the sponsor or legal adviser | Original | Sponsor/Company’s HK legal adviser |

| 6. | Anticipated final draft of any statement of adjustments relating to the accountants’ report | 3 copies | Accountant |

| 7. | Every material contract required by paragraph 17 of the Third Schedule of the Companies Ordinance to be summarised in the prospectus, or, in the case of a contract not reduced into writing, a memorandum giving full particulars thereof | Copy |

Company’s PRC legal adviser/ Company’s HK legal adviser |

| 8. | The anticipated final draft or proof of any formal notice, where applicable | 3 copies | Sponsor |

| 9. | The anticipated final draft or proof of any applicable application form (including any excess or preferential application form) to subscribe or purchase the securities for which listing is sought | 3 copies | Sponsor |

| 10. | Notice(s) of meeting (if any) referred to in the prospectus | Copy | Company’s HK legal adviser/Company’s PRC legal adviser |

| 11. | The resolution(s) of PRC issuer in general meeting (if any) authorising the allotment of all securities for which listing is sought | Certified copy | Company’s HK legal adviser/Company’s PRC legal adviser |

| 12. | All resolutions which have been passed by the PRC issuer and which are required to be registered under the Companies Ordinance | Copy | Company’s HK legal adviser/Company’s PRC legal adviser |

| 13. | Resolution(s) of the board of directors or board committee authorising the allotment of securities, making of application for listing, admission into CCASS, and approving and authorising the issue of prospectus | Certified copy | Company’s HK legal adviser/Company’s PRC legal adviser |

| 14. | Anticipated final drafts or proofs of the definitive certificate or other document of title (which must comply with Part B of Appendix 2) | 3 copies | Sponsor |

| 15. | The anticipated final draft of a letter from the sponsor confirming that it is satisfied that the statement by the issuer’s directors in the prospectus as to the sufficiency of working capital has been made by the directors after due and careful enquiry and that persons or institutions providing finance have stated in writing that such facilities exist | Copy | Sponsor/Accountant |

| 16. | Where the prospectus contains a profit forecast, the anticipated final draft reports thereon by the reporting accountants and the sponsor | 3 copies | Sponsor/Accountant |

| 17. | The anticipated final draft of the profit forecast memorandum with principal assumptions, accounting policies and calculations for the forecasts | 3 copies | Sponsor/Accountant |

| 18. | Any application for a waiver of any provision of the GEM Listing Rules. | Original | Sponsor/Company’s HK legal adviser |

| 19. | Annual report and accounts of the companies which comprise or will comprise the group of PRC issuer for each of the years forming the subject of the accountants’ report (Rule 11.10 of the GEM Listing Rules) | Original | Accountant |

| 20. | A formal declaration, undertaking and acknowledgement, duly signed by each director and proposed director, each supervisor and proposed supervisor | Original (in the form set out in Appendix 6B & 6C) | Company’s HK legal adviser |

| 21. | The certificate of incorporation and any certificates of incorporation on change of name or equivalent document of the PRC issuer | Certified copy |

Company’s HK legal adviser/ Company’s PRC legal adviser |

| 22. | The certificate (if any) entitling the PRC issuer to commence business | Certified copy | Company’s HK legal adviser |

| 23. | Any checklist(s) in the form prescribed by the Stock Exchange from time to time, duly completed | Original | Company’s HK legal adviser |

| 24. |

Where the promoter or other interested party is a limited company or a firm, a statutory declaration as to the identity of those who control it or are interested in its profits or assets: (responsible for checklist on (1) property valuation; (2) articles of association; (3) documents of title; (4) share schemes) Sponsor’s HK legal adviser: (responsible for checklist on (1) third schedule of CO; (2) other CO requirements; (3) GEM listing rules Appendix 1A; (4) general compliance with GEM listing rules Valuers: (responsible for checklist on property valuation) |

Original | Company’s HK legal adviser/Company’s PRC legal adviser |

| 25. | If the PRC issuer has any corporate shareholder holding over 5% of the issued capital, a declaration by a duly authorised officer of each such corporate shareholder, giving details of its registered office, directors, shareholders and business | Original | Company’s HK legal adviser |

| 26. | If the securities of the PRC issuer are or are to be listed on one or more stock exchange, a written submission to the Exchange stating whether in the sponsor’s opinion the PRC issuer’s directors appreciate the differences as well as the similarities between H Shares and the shares listed on such other stock exchanges and between the rights and obligations of holders of such shares and the basis for such opinion. The sponsor must also explain how the PRC issuer’s directors propose to co-ordinate and comply in a timely manner with their obligations under the requirements of the Exchange and such other stock exchanges | 3 copies | Sponsor |

| 27. | The anticipated final draft contract between the PRC issuer and every director and officer, each of which must contain the undertakings and arbitration clause required by and referred to in rule 25.41 and which must be marked in the margin to indicate where such provisions appear | 3 copies | Company’s HK legal adviser/Company’s PRC legal adviser |

| 28. | The anticipated final draft contract between the PRC issuer and every supervisor, each of which must contain the undertakings and arbitration clause required by and referred to in rule 25.42 and which must be marked in the margin to indicate where such provisions appear | 3 copies | Company’s HK legal adviser/Company’s PRC legal adviser |

| 29. | The anticipated final draft legal opinion by the PRC’s issuer’s HK legal adviser, citing and attaching the legal opinion by PRC lawyers authorised by the relevant authorities in the PRC to advise on securities laws, confirming the due incorporation and legal person status of PRC issuer as a joint stock limited company under PRC law and the obtaining of all relevant regulatory approvals in the PRC required for the issue and listing contemplated by the PRC’s issuer’s listing application | 3 copies | Company’s HK legal adviser/Company’s PRC legal adviser |

| 30. | Draft share option scheme Note 1 | Draft |

Company’s PRC legal adviser/ Company’s HK legal adviser |

3. PRC Application and Approval Procedures for Listing on GEM

There are four steps for PRC application and approval procedures for listing on GEM.

PRC Application and Approval Procedures

Qualification Requirement

The applicant must be an entity which is (a) duly incorporated and operated as a joint stock limited company; (b) did not materially breach laws and regulations in the most recent two years; (c) meets the qualification requirements prescribed under the GEM Listing Rules; and (d) has retained a qualified sponsor to support the application and bear the underwriting liability.

Approval Procedure and Documentary Requirements

|

Step One: |

three months prior to the submission to the HKSE of the listing application, the sponsor should submit to the CSRC, on behalf of the applicant, the (a) company’s application letter; (b) sponsor’s report in respect of feasibility study and intent of underwriting; and (c) approval documents on the incorporation of the company. A copy of the foregoing documents shall also be sent to the provincial government and the ministry in charge of the applicant. |

|

Step Two: |

within 20 clear days following the receipt of the documents referred to above, the CSRC shall issue a notification informing the acceptance/rejection of the application. |

|

Step Three: |

upon obtaining the CSRC’s notification of acceptance, the applicant may submit (a) a PRC legal opinion issued by a qualified PRC law firm confirming the lawful incorporation and operation of the company; (b) the accountant’s audit report on the company which is prepared in accordance with the international accounting standards; (c) the approval issued by the authority in charge of State-owned assets in respect of the management of State-owned shares (if applicable) and (d) the comparatively completed draft of the prospectus. |

|

Step Four: |

within 10 clear days following receipt of the documents referred to above, the CSRC shall issue, after consultation with the other governmental agencies, the approval/rejection letter to the applicant. |

November 2007

This note is provided for information purposes only and does not constitute legal advice. Specific advice should be sought in relation to any particular situation. This note has been prepared based on the laws and regulations in force at the date of this note which may be subsequently amended, modified, re-enacted, restated or replaced.