Hong Kong regulatory compliance

Plain language amendments

- In order to simplify the language of the connected transaction rules, the current Chapter 14A (GEM Chapter 20) will be replaced by the Guide on Connected Transaction Rules issued in April 2012 (currently set out in Guidance Letter HKEx-GL70-14), with modifications to take into account drafting comments from respondents to the consultation.

Scope of Connected Transactions : Connected Transactions with Third Parties

- Under the current Rules, connected transactions include any acquisition or disposal of interests in a target company in the circumstances described in current Rule 14A.13(1)(b) where each of the issuer and a controller is, or will be, a shareholder of the target company. A “controller” is a director, chief executive or controlling (>30%) shareholder of the issuer or any of its subsidiaries.

- The revised Rules exclude from the definition of connected transaction the following transactions with third parties where a controller is, or will be, a shareholder of the target company:

- any disposal of interests in the target company to a third party where a controller at the issuer level is a substantial shareholder of the target company;

- any acquisition or disposal of interests in the target company from or to a third party where a controller at the subsidiary level is a substantial shareholder of the target company; and

- transactions with third parties described in paragraphs (ii) to (iv) of current Rule 14A.13(1)(b). These relate to transactions involving the issuer (or its controller) acquiring interests in a target company in specific circumstances where the controller has or will have an interest of less than 10% in the target company

- Substantial shareholder” is defined as:

- in relation to a company, a person (including a holder of depositary receipts) who is entitled to exercise, or control the exercise of, 10% or more of the voting power at any general meeting of the company;

- for the purposes of any transaction between a listed issuer and a person who is not a connected person where the transaction involves the listed issuer acquiring or disposing of an interest in a company where a substantial shareholder of that company is, or is proposed to be, a controller or is (or will become as a result of the transaction) an associate of a controller, the Exchange may aggregate the interests of any person and his associates in determining whether together they are a “substantial shareholder” of any company

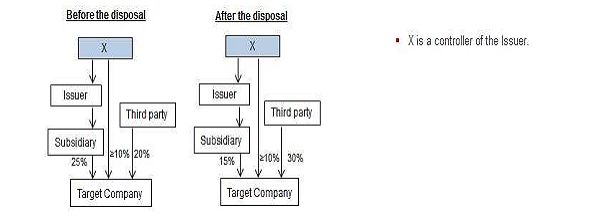

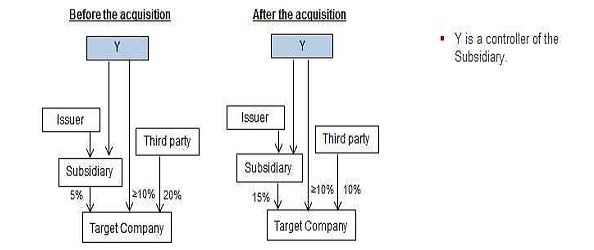

- Under revised Rules a disposal of interests in the target company to a third party where a controller at the issuer level is a substantial shareholder of the target company will no longer be a connected transaction. In the diagram below, the issuer’s disposal of its interest in the target will not be a connected transaction.

- any acquisition or disposal of interests in the target company from or to a third party where a controller at the subsidiary level is a substantial shareholder of the target company will not be a connected transaction

Exemption for Connected Transaction

De Minimis Exemption

Under the current Rules, a connected transaction is fully exempt (i.e. exempt from the reporting, announcement and independent shareholders’ approval requirements) if each of the percentage ratios (except the profits ratio) is/are:

- less than 0.1%; or

- less than 1% for transactions with persons connected with the issuer’s subsidiary only; or

- equal to or more than 0.1% but less than 5% and the total consideration is less than HK$1 million.

Under the revised Rules, the monetary threshold for fully exempt transactions will be increased from HK$1 million to HK$3 million (Rule 14A.76(1)).

Removal of the 1% Cap on Transaction Value for the Exemption for Provision or receipt of Consumer Goods or Services

The amendments remove the 1% cap on transaction value, which is one of the conditions for the exemption of an issuer’s provision or receipt of consumer goods or services to or from a connected person (Rule 14A.97).

Exemption for Provision of Director’s Indemnity/Purchase of Director’s Insurance (Rules 14A.91 and 14A.96)

The revised Rules exempt from the connected transaction rules the provision of an indemnity to, or the purchase of insurance for, a director of the issuer or its subsidiaries if:

- the indemnity/insurance is for liabilities that may be incurred in the course of the director performing his duties; and

- the indemnity/insurance is in a form allowed under the laws of Hong Kong, and, where the company providing or purchasing the insurance is incorporated outside Hong Kong, the laws of the company’s place of incorporation.

For example, if under the terms of a director’s service contract, a listed company will indemnify him against liabilities arising from negligence, default and breach of duty by the director, the listed company will not be able to rely on the new exemption for directors’ indemnities because the Companies Ordinance does not allow a director to be indemnified against negligence, default or breach of duty.

Nor can the listed company rely on the existing exemption for directors’ service contracts under Rule 14A.95 in respect of a director’s indemnity or insurance which is not exempt under Rule 14A.91 or 14A.96 (FAQ 19 of FAQ Series 28)

Option arrangements

Termination of Options (Rule 14A.79(4))

- Currently, the termination of an option is a transaction for the purposes of the connected transaction Rules but the Rules do not specify how the size tests should be calculated.

- The revised Rules treat the termination of an option in the same way as the transfer or non-exercise of an option, such that the termination should be classified as if the option is exercised, unless the issuer has no discretion over the termination, for example if it is triggered by an event specified in the original agreement and is outside the control of the issuer.

Alternative Tests to Classify Transfer, Non-exercise or Termination of Options (Rule 14A.79(4)(b))

The revised Rules provide an alternative test for classifying the transaction based on the asset and consideration ratios using the higher of:

-

- for a put option held by the listed issuer’s group, the exercise price less the value of the assets subject to the option; or

- for a call option held by the listed issuer’s group, the value of the assets subject to the option less the exercise price; and

- the consideration or amount payable or receivable by the issuer group.

An issuer may adopt the alternative classification test if the value of the option assets is readily ascertainable and the issuer is able to provide:

- a valuation of the option assets prepared by an independent expert using generally acceptable methodologies;

- a confirmation from the INEDs and an independent financial adviser that the transfer, termination or non-exercise of the option is fair and reasonable and in the interests of the listed issuer and its shareholders as a whole.

If an issuer adopts the alternative method, it must announce the transfer, termination or non-exercise of the option with the views of the INEDs and independent financial adviser.

Independent Board Committees (Rule 14A.40)

- The revised Rules clarify that the independent board committee on a connected transaction must also advise whether the connected transaction is on normal commercial terms and in the issuer’s ordinary and usual course of business.

- “ordinary and usual course of business” means the entity’s existing principal activities or an activity wholly necessary for its principal activities.

- “normal commercial terms or better” are terms which a party could obtain if the transaction were on an arm’s length basis or terms no less favourable to the listed issuer’s group than terms available to or from independent third parties.

Auditors’ Confirmation Letter

- The Rules relating to auditors’ confirmations on continuing connected transactions have been revised in line with Practice Note 740 issued by the Hong Kong Institute of Certified Public Accountants.

Transitional Arrangements : Agreements Entered into before 1 July 2014

- For one-off connected transactions, issuers should comply with the connected transaction requirements in effect at the date of entering into the agreement.

- An issuer which entered into an agreement for CCTs before 1 July 2014 can apply the exemption for the reporting or annual review requirements in their next annual reports provided all the exemption conditions under the relevant new/revised Rules (e.g. the transactions have a total value of less than HK$3 million and are therefore fully exempt under the revised Rules).

- It should however announce that it will apply the exemption to these transactions, and the reporting or annual review of the transactions will not be required in the next annual report (FAQ 25 of FAQ Series 28).

Continuing Connected Transactions (CCTs)

- The Exchange decided not to proceed with proposals in the consultation paper (a) to codify in the Rules the current waiver practice of allowing an issuer to obtain a shareholder mandate for CCTs over a period in lieu of a framework agreement subject to meeting specified conditions; and (b) to allow percentage caps for CCTs of a revenue nature.

- The Exchange confirmed in its Consultation Conclusions that it will continue to consider waiver applications from the requirement for a written agreement on a case-by-case basis having regard to the particular circumstances.

Listing Rule Amendments – Changes to Definitions of “Connected Persons” and “Associate” effect from 1 July 2014

New Exemption for Connected Persons at the Subsidiary Level : Rule 14A.101

The definition of connected person currently includes persons connected at the subsidiary level (i.e. a director, chief executive or substantial shareholder of any subsidiary of the issuer or an associate of any of them).

The Listing Rules will be amended to exempt transactions with persons connected only at the subsidiary level from the shareholders’ approval requirement if:

- the transactions are on normal commercial terms or better;

- the transactions are approved by the issuer’s board of directors; and

- the issuer’s independent non-executive directors (INEDs) confirm that the terms of the transactions are fair and reasonable, and they are on normal commercial terms and in the interests of the issuer and its shareholders as a whole.

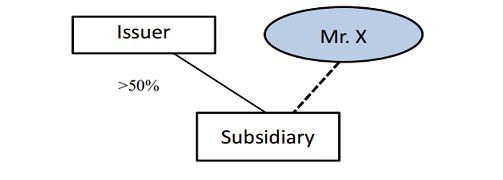

In the diagram below, Mr. X, as a director or substantial shareholder of the issuer’s subsidiary, is a connected person of the issuer.

Subject to meeting the specified conditions, transactions between the issuer group and Mr. X will be exempt from the shareholders’ approval requirement.

As a consequential amendment, the shareholder approval exemption for qualified property acquisitions with connected persons at the subsidiary level will be removed since it will be redundant in light of the new exemption under Rule 14A.101 which applies to all transactions with connected persons at the subsidiary level.

Exclude Persons Connected with an Issuer’s Insignificant Subsidiaries (Rule 14A.09)

- The Listing Rules currently exempt transactions between the issuer group and persons connected with the issuer’s insignificant subsidiaries, subject to a 10% restriction on the consideration test for any capital transaction between an insignificant subsidiary and the person connected with that subsidiary.

- An “insignificant subsidiary” is a subsidiary of the issuer whose total assets, profits and revenues are less than: (i) 10% under the percentage ratios for each of the three preceding financial years; or (ii) 5% under the percentage ratios for the latest financial year.

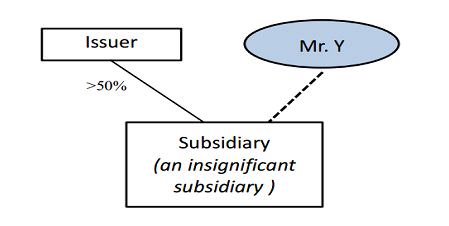

- The Rules will be revised to exclude all persons connected with the issuer’s insignificant subsidiaries from the definition of connected person, rather than exempting transactions conducted with these persons.

In the diagram below, Mr. Y is a director or substantial shareholder of the issuer’s subsidiary. Mr. Y will not be a connected person of the issuer so long as the subsidiary is an insignificant subsidiary.

Amendments to Definition of Associate

Exemption for Trustee Interests (Rule 14A.12(1)(b))

- The current definition of “associate” includes the trustees acting in the capacity as trustees of any trust of which a director, chief executive or substantial shareholder (or, if such person is an individual, any of his immediate family) is a beneficiary.

- The revised Rules exclude from the definition of “associate” the trustees of an employee share scheme or occupational pension scheme if:

- the scheme is established for a wide scope of participants; and

- the connected persons’ interests in the scheme are together less than 30%

Amendments to Definition of Associate

Exemption for Interest in an Associate held through Issuer

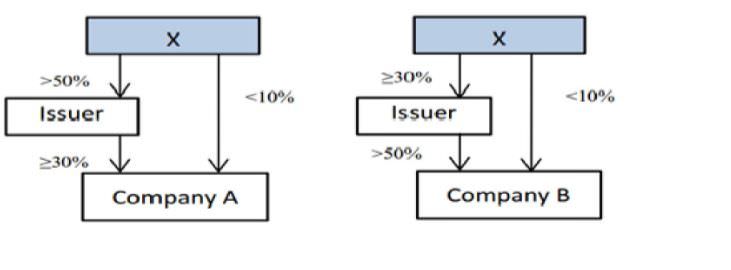

Under the Rules, the definition of “associate” includes an entity in which a connected person has a 30% or more direct or indirect interest. However, the Rules exempt an entity from being treated as an associate if the connected person holds an interest in the entity only through his/its shareholding in the issuer.

Under the revised Rules, an entity is excluded from the definition of associate if the interests of the connected person and his associates in the entity (other than those held through the issuer) are together less than 10%.

In the diagrams below, neither Company A nor Company B is an associate of X because X’s direct interest is less than 10%.

Application of Chapter 14A Definitions of “Connected Person” and “Associate”

Application of Chapter 14A Definitions of “Connected Person” and “Associate” to other parts of the Listing Rules

Chapter 1 of the Listing Rules currently contains the general definitions of “connected person” and “associate” which are narrower than those used in Chapter 14A for the purpose of the connected transactions requirements.

The revised Rules apply the Chapter 14A definitions of “connected person” and “associate” to other parts of the Rules. The effect is to extend the application of the affected Rules to:

- extended connected persons: i.e. any former directors of the issuer or its subsidiaries in the last 12 months and their associates; and

- extended associates: extended family members of a connected person who is an individual. These include any person cohabiting with him as a spouse; his or his spouse’s children aged 18 years or above; his parents; his siblings; and companies controlled by them.

The revisions clarify however that a person may be deemed as a connected person only for the purposes of Chapter 14A.

There is no change to the definition of “associate” of a connected person that is a company.

|

Reverse Takeover RulesRules 14.06(6)(b) and 14.23B(2)) GEM Rules 19.06(6)(b) and 20.23B(2) |

Apply to acquisition of assets from the issuer’s incoming controlling shareholder or his/its associates Extends scope of reverse takeover Rules to cover acquisitions from the incoming controlling shareholder’s extended family members and companies controlled by them. These acquisitions are also connected transactions. |

|

Restriction on Disposal of Business w/in 24 Months of Change of ControlRule 14.92 GEM Rule 19.91 |

Restriction on disposal of an issuer’s existing business within 24 months after a change in control unless the assets acquired from the person(s) gaining control and his/their associates and any other assets acquired after the change in control can meet Rule 8.05. |

|

Notifiable Transaction Announcement Rules 14.58(3) and 14.63(3) GEM Rules 19.58(4) and 19.63(3) |

Issuer to disclose in the announcement and circular of a notifiable transaction that the counterparty and ultimate beneficial owner of the counterparty are third parties independent of the issuer and its connected persons |

|

Valuation of Property Interests Acquired from Connected PersonRule 5.03 and PN12 Para 15 GEM Rule 8.03 |

Requirements for valuation of property interests acquired from a connected person |

|

Investment Companies Rule 21.08 |

A listing document of a new applicant investment company to contain a statement as to whether the directors of the investment company, the management company, any investment adviser or any distribution company, or any associate of any of them, is or will become entitled to receive any part of any brokerage charged to the investment company, or any re-allowance of other types on purchases charged to the investment company. |

| Issues of Securities | |

|

Rules 7.21(2) and 7.26A(2) GEM Rules 10.31(2) and 10.42(2) |

Shareholder approval requirements for a rights issue or open offer underwritten by a director, chief executive or substantial shareholder of the issuer (or an associate of any of them) if there is no arrangement for excess applications |

|

Note 1 to Rule 13.36(2)(b) and Rule 19A.38 Note to GEM Rule 17.41(2) and Note 1 to GEM Rule 25.23 |

Any issue of securities by an issuer to a connected person under a general mandate is permitted only if it complies with Chapter 14A |

|

Practice Note 4 para 4(c) GEM Rule 21.07(3) |

For a proposal to issue new warrants to existing warrantholders or to change the exercise period or exercise price of existing warrants, the Exchange has the right to require that any connected person of the issuer who holds more than 10% of the outstanding existing warrants to abstain from voting. |

| Voting at General Meeting | |

|

Significant Corporate Actions Rules 6.12, 6.13, 7.19, 7.24, 13.36(4), 14.90, 14.91, Note to Rule 13.39 GEM Rules 9.20, 9.21, 10.29, 10.29A, 10.39, 10.39A, 17.42A, 19.89, 19.90, Note to Rule 17.47 |

Any controlling shareholder (or where there is no controlling shareholder, the directors and chief executive of the issuer) and its/their associates must abstain from voting to approve:voluntary withdrawal of listing large scale rights issue or open offer refreshment of general mandate a transaction that would result in a fundamental change in the issuer’s principal business activities within 12 months after listing Parties that are required to abstain from voting may vote against the resolution provided that their intention to do so is disclosed |

|

Spin-offs PN15 para 3(e)(2) GEM PN 3 para 3(e)(2) |

If a controlling shareholder has a material interest in a spin-off proposal, it and its associates must abstain from voting |

|

Directors’ Service Contracts Rule 13.68 GEM Rule 17.90 |

A director and his associates must abstain from voting on his service contract for a duration of more than 3 years |

| Granting Share Options to Connected Persons | |

|

Rule 17.04(1), Note 1 to Rule 17.04(3)(d) GEM Rule 23.04(1), Note 1 to Rule 23.04(3)(d) |

Requirement for INEDs to approve a grant of share options to any director, chief executive or substantial shareholder of an issuer or any of their associates Shareholder approval requirement for granting share options to a substantial shareholder or INEDs, or any of their associates which exceeds the limits set out in the Rule; or any change in the terms of options granted to any such person |

|

Rules 17.06A and 17.07 GEM Rules 23.06A and 23.07 |

Requirements to disclose information relating to share options granted to a director, chief executive or substantial shareholder of the issuer or any of their associates |

|

Rule 17.03(4) and 17.04 GEM Rules 23.04 and 23.04(1) |

Where the grantee is a connected person under Chapter 14A the grantee and his associates will need to abstain from voting to approve the grant of options |

|

Remuneration Committee Terms Appendix 14 Para B.1.2(h) GEM Appendix 15 Para B.1.2(h) |

Under the Corporate Governance Code, the remuneration committee’s terms of reference should include provision to ensure that no director or any of his associates is involved in deciding his own remuneration |

| Persons to Abstain from Voting on Connected Transactions | |

|

Rule 2.16 GEM Rule 2.27 |

In the case of a connected transaction, the Chapter 14A definition of associate will apply when determining whether a shareholder or any of his associates has a material interest in the transaction |

|

Rule 13.44 GEM Rule 17.48A |

In the case of a connected transaction, a director of the issuer must not vote on any board resolution approving the transaction in which he or any of his associates has a material interest |

|

Depositary Rule 19B.03 |

A depositary cannot be: (a) an “associate”; (b) a “controlling shareholder”, (c) a “substantial shareholder”; or (d) excluded from being treated as a member of the public under Rule 8.24, merely by reason of the fact that it is holding shares of an issuer as depositary for the benefit of depositary receipt holders |

|

Independence of Sponsors New Rule 3A.07(3A) New GEM Rule 6A.07(3A) |

Sponsor to confirm that it is not a connected person of the new applicant |

|

Assistance to Sponsor Rule 3A.05 GEM Rule 6A.05 |

A new applicant and its directors must assist the sponsor to perform its role and must ensure that its substantial shareholders and associates also assist the sponsor |

| Independence of Independent Financial Advisers (IFAs) | |

|

New Rule 13.84(1A) New GEM Rule 17.96(1A) |

In the case of a connected transaction, the IFA to confirm whether it holds more than 5% of the issued share capital of an associate of another party to the transaction |

|

New Rule 13.84(2) New GEM Rule 17.96(2A) |

In the case of a connected transaction, the IFA to confirm whether it is an associate of another party to the transaction |

Rename the Definitions in Chapter 1 of the Listing Rules

- The revised Rules rename the definition of “connected person” and “associate” in Chapter 1 as “core connected person” and “close associate”, respectively.

New Guidance Letter HKEx-GL37-14 on Pricing Policies for Continuing Connected Transactions and their Disclosure

New Guidance Letter on Pricing Policies for CCTs and their Disclosure

The Exchange published new Guidance Letter HKEx-GL73-14 on Pricing Policies for Continuing Connected Transactions and their Disclosure in March 2014 which provides guidance on:

- Pricing policies;

- Disclosure of Information;

- Internal Controls;

- Role of INEDs; and

- Annual Review by Auditors

Pricing Policies

- In practice, there are two types of agreements for CCTs:

- “Fixed Term Agreements” –setting out the specific terms for a CCT, including the actual consideration in monetary terms, or a fixed formula for determining the consideration, or the per unit consideration may be fixed but the total consideration would depend on the volume transacted; and

- “Framework agreement” – setting out the framework within which a series of CCTs are to be conducted over a period. The actual terms of each transaction would be negotiated on a per transaction basis. The consideration for individual transactions may be subject to pricing guidelines or based on a range of parameters, a majority of these agreements require the transactions to be conducted at market prices. The agreement will provide for the terms of individual transactions to be negotiated on an arm’s length basis.

The Guidance Letter contains the following guidance:

In the case of fixed term agreements, issuers should agree on specific pricing terms, such as fixed monetary consideration, a pre-determined formula, or fixed per unit consideration. Examples include:

- provision of management services charged at a fixed sum or a percentage of the issuer’s sales or asset value;

- interest rate to be charged on a revolving loan facility and the maximum loan amount; and

- sales or purchase of goods at a fixed unit price, or some reference price published from time to time (e.g. prices prescribed by government, or commodity prices quoted on an exchange). If the pricing of the goods is determined based on a reference price, the issuer should disclose the relevant details, for example: i) the name of government authority or organisation publishing the price, ii) how and where the price is disclosed or determined; and iii) the frequency of update to the reference price.

In the case of framework agreements, the following guidelines should be observed:

- Description of pricing policies in generic terms, such as “prevailing market price” or “prices based on arm’s length negotiations” or prices “on normal commercial terms”, is insufficient;

- To demonstrate that the transactions are conducted on normal commercial terms, or on terms no less favourable than terms available to independent parties, the issuer should disclose the methods and procedures the management will follow to determine the price and terms of the transactions.

- The issuer should explain why its directors consider that the methods and procedures can ensure that the transactions will be conducted on normal commercial terms and are not prejudicial to the interests of the issuer and its minority shareholders.

Examples of methods and procedures

Sale of off-the-shelf products or standard services

An indicative range of prices for goods/services, or the minimum/maximum mark-up rate for transactions that are charged on a cost-plus basis, and the procedures for reviewing and approving these price lists or guidelines from time to time.

Sale of proprietary goods or services

The process for estimating and approving the selling prices for the goods or services, and the procedures to ensure that the prices are no less favourable to the issuer than those offered to, or quoted by, independent customers.

Purchases of goods or services

The procedures for obtaining quotations or tenders from the connected persons and a sufficient number of independent suppliers, the assessment criteria and the approval process.

- If an agreement covers transactions of different nature, issuers should avoid using a generic “boilerplate” pricing mechanism where the pricing methods are not applicable to certain categories of transactions.

The following is an example of generic “boilerplate” disclosure where some of the pricing methods do not apply to the subject transaction in practice:

“The transaction shall be priced in accordance with the following terms: (i) government-prescribed price; (ii) where there is no government-prescribed price, the government-guidance price; (iii) where there is neither a government-prescribed price nor a government-guidance price, the relevant market price; (iv) where none of the above is available or applicable, the price to be agreed between the parties which shall be determined on the basis of reasonable cost plus reasonable profit margin and by reference to the historical price.”

Disclosure of Information

- The issuer should disclose in its announcement and circular to shareholders (if any) the specific pricing terms or formula set out in the agreement and material information about pricing policies and guidelines.

- The issuer should also disclose in its annual report whether it has followed these policies and guidelines when determining the price and terms of the transactions conducted during the year.

Internal Controls

- Issuers should ensure that they have an adequate system of controls to safeguard the transactions, and to provide information for the INEDs and auditors for the purposes of their annual review of CCTs.

Role of INEDs

INEDs are required to ensure that the terms of the agreement are fair and reasonable at the time the agreement is announced, and must give a confirmation annually that transactions entered into are in the issuer’s ordinary course of business, on normal commercial terms (or terms no less favourable to the issuer than terms available to or from third parties), and that the terms are fair and reasonable and in the interest of shareholders as a whole.

The Guidance Letter requires INEDs to ensure that:

- the pricing mechanism and the terms of the transactions set out in the agreement are clear and specific;

- the annual caps are reasonable taking into account historical transactions and management projections;

- the methods and procedures established by the issuer are sufficient to ensure that the transactions will be conducted on normal commercial terms and not prejudicial to the interests of the issuer and its minority shareholders;

- appropriate internal control procedures are in place, and its internal audit would need to review these transactions; and

- they are provided by the management with sufficient information for the discharge of their duties.

Auditors’ Annual Review

The Rules require issuers’ auditors to report annually on CCTs. Auditors may refer to Practice Note 740 “Auditor’s Letter on Continuing Connected Transactions under the Hong Kong Listing Rules” issued by the Hong Kong Institute of Certified Public Accountants for guidance as to their responsibilities and procedures when undertaking the annual review.

New Headline Categories for Announcements effective from 1 April 2014

Listing Rule Amendments

Previously, a large number of issuers’ announcements were classified under the headlines “Overseas Regulatory Announcement” and “Other”. These two headline categories were replaced from 1 April 2014 with narrower, more specific headline categories.

| Before 1 Apr 2014 | After 1 Apr 2014 |

| Other | Other – Business Update |

| Other – Corporate Governance Related Matters | |

| Other – Litigation | |

| Other – Miscellaneous | |

| Other – Trading Update | |

| Overseas Regulatory Announcement | Overseas Regulatory Announcement – Board/Supervisory Board Resolutions |

| Overseas Regulatory Announcement – Business Update | |

| Overseas Regulatory Announcement – Corporate Governance Related Matters | |

| Overseas Regulatory Announcement – Issue of Securities and Related Matters | |

| Overseas Regulatory Announcement – Other | |

| Overseas Regulatory Announcement – Trading Update |

Frequently-Asked-Questions (FAQ)

The Exchange also published Frequently Asked Questions Series 27 on “Selection of Headline Categories and Titles for Announcements” to provide guidance on the selection of headlines and titles for announcements.

Selection of headline categories (MB Rule 2.07C(3) and Appendix 24; GEM Rules 16.18(2) and Appendix 17)

- Issuers are required to select all appropriate headlines that are applicable to the content of an announcement, from the list of headlines as set out in Appendix 24 to the Listing Rules. If an announcement relates to more than one subject matter or is issued to satisfy different Rule requirements, all headlines relating to the subject matters and the Rule requirements must be selected. Headline(s) under “Other” should not be chosen unless all other headlines in Appendix 24 are not applicable to the announcement.

- For more information, issuers may refer to the Exchange’s guide on pre-vetting requirements and selection of headline categories of 2 January 2013 which sets out the generally applicable headline categories for various types of announcements issued under specific Listing Rules and the Exchange’s letter of 25 July 2007 which sets out common errors made by issuers. (FAQ No. 1)

Types of announcements that may fall under the “Other” headline categories

Other – Business Update

Updates on business activities of the issuer group:

e.g. the signing of a business contract, a letter of intent to acquire/dispose of assets or a business cooperation agreement, public tender for acquisition/disposal and status update on a project.

Other – Trading Update

Periodic updates of sales and other key performance indicators:

e.g. sales turnover, key performance indicators such as same store sales, new orders booked, monthly premium income for insurance companies and interim management accounts.

Other – Corporate Governance Related Matters

Report on internal control review, updates of corporate governance matters:

e.g. change in corporate personnel.

Other – Litigation

Status update on litigation, arbitration or other legal proceedings.

Other – Miscellaneous

Issuers should only choose this headline if no other headline is applicable. (FAQ No. 2)

Relevant Listing Rules: MB Rule 2.07C(3); GEM Rules 16.18(2)

Types of announcements that may fall under the “Overseas regulatory announcement” headline categories

If an overseas regulatory announcement is to be published in one language only, the issuer should only select these new headline(s) under “Overseas Regulatory Announcement”.

Relevant Listing Rules: MB Rule 2.07C(3); GEM Rules 16.18(2)