Hong Kong company law

Business Opportunities: Why Hong Kong?

Reasons:

- One of the world’s leading financial and business centres

- The preferred Asian regional headquarters for multinational companies- regional headquarters of 1,541 companies in 2019

- Strategic gateway to China

- Educated and highly skilled workforce

- Simple and low tax regime

- Modern infrastructure

- Internationally accepted and transparent common law legal system

How Hong Kong Scores in World Business Rankings:

- 2nd most competitive advanced economy in the world – IMD World Competitiveness Yearbook 2019

- Asia’s 4th top financial city and 6th in the world – Global Financial Centers Index 2020

- 2nd freest economy in the world and in the Asia-Pacific region – 2020 Index of Economic Freedom

- 3rd in ease of doing business – Doing Business 2020

- 2nd most business-friendly tax system in the world, Paying Taxes 2020

Source: IMD, Z/Yen Group, China Development Institute, PwC, Heritage Foundation, IFC

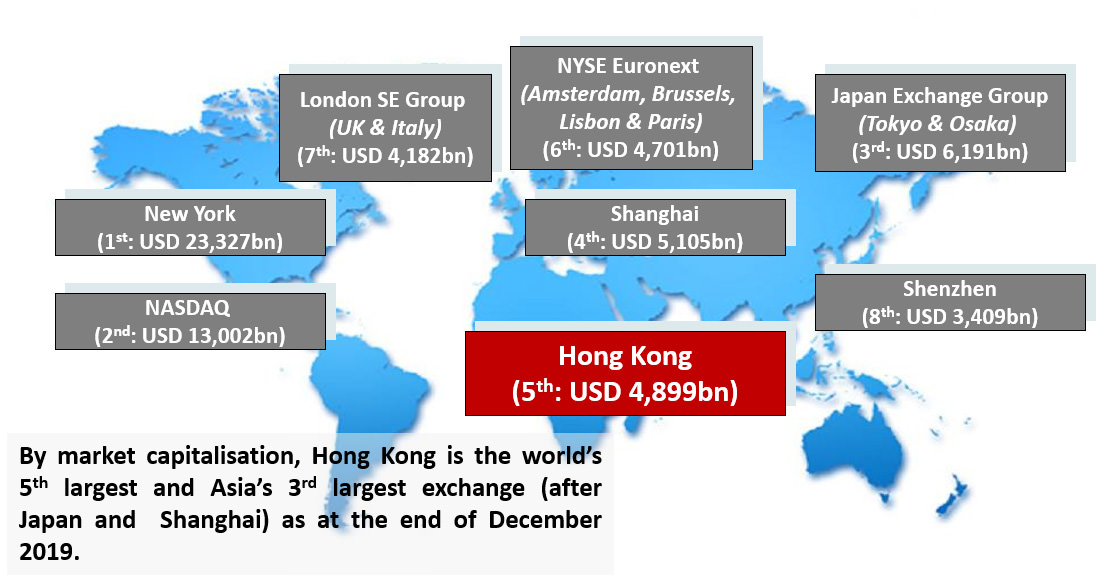

Hong Kong is the 5th largest exchange in the world and 3rd largest exchange in Asia by market capitalization.

Hong Kong is the 5th largest exchange in the world and 3rd largest exchange in Asia by market capitalization.

Source: Securities and Futures Commission (SFC) based on data from the World Federation of Exchanges and Bloomberg. Figures for Hong Kong includes the GEM board; figures for the London SE Group include those of London Stock Exchange and Borsa Italiana; figures for the NYSE Euronext include those of Euronext Amsterdam, Euronext Brussels, Euronext Lisbon and Euronext Paris; and figures for the Japan Exchange Group includes those of Tokyo Stock Exchange and Osaka Securities Exchange.

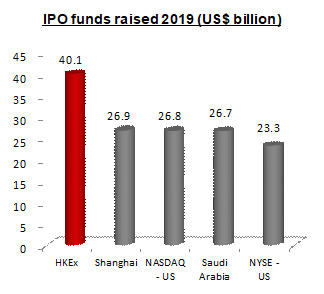

World’s 2019 Top IPO Fund Raising Platform

|

|

*Includes 20 companies which transferred from the GEM Board to the Main Board

Source: Hong Kong Exchanges and Clearing Limited

Ten Largest Hong Kong IPOs in 2019

| Company name | Industry | IPO funds raised (HK$bn) | |

| 1 | Alibaba Group Holding Ltd. – SW | Information Technology – Software & Services | 101.20 |

| 2 | Budweiser Brewing Co. APAC Ltd. | Consumer Staples – Food & Beverages | 45.08 |

| 3 | ESR Cayman Ltd. | Information Technology – Software & Services | 14.06 |

| 4 | Shenwan Hongyuan Group Co., Ltd. – H Shares | Financials – Other Financials | 9.09 |

| 5 | Hansoh Pharmaceutical Group Co. Ltd. | Healthcare – Pharmaceuticals & Biotechnology | 9.04 |

| 6 | Topsports International Holdings Ltd. | Consumer Discretionary – Specialty Retail | 9.01 |

| 7 | China Feihe Ltd. | Consumer Staples – Food & Beverages | 6.70 |

| 8 | Bank of Guizhou Co., Ltd. – H Shares | Financials – Banks | 5.46 |

| 9 | Pharmaron Beijing Co., Ltd. – H Shares | Healthcare – Pharmaceuticals & Biotechnology | 5.29 |

| 10 | China East Education Holdings Ltd. | Consumer Discretionary – Support Services | 4.96 |

Source: Hong Kong Exchanges and Clearing Limited

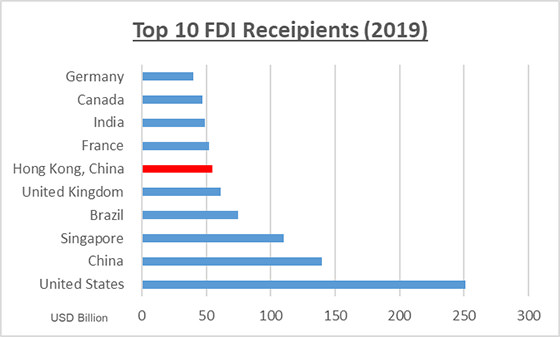

HKEX Diverse Portfolio of Issuers

|

|

Source: KMPG

Strong Market Liquidity

- HKEx is a highly active stock exchange with average daily equity turnover for the first six months of 2020 at HK$117.5billion, a 20% increase when compared with HK$97.9billion for the same period of 2019.

- High liquidity is partly driven by diverse investor base.

Source: Hong Kong Exchanges and Clearing Limited

Gateway to Mainland China

| Unit | Total | Mainland Enterprise |

% of Total |

|

| As at 31 December 2019 | ||||

| No. of listed companies | No. | 2,449 | 1,241^ | 50.1% |

| Market capitalisation | HK$bn | 38,165 | 27,953.4 | 73.2% |

| As of 31 December 2019 | ||||

| Average daily equity turnover | HK$bn | 87.15 | 50.1 | 57.5% |

| Total equity funds raised | HK$bn | 452.0 | 357.1 | 79.0% |

| – IPO funds raised | HK$bn | 312.9 | 256.0 | 81.8% |

| – Post IPO funds raised | HK$bn | 139.1 | 101.1 | 72.7% |

^ refers to H-share companies, red chip companies and Mainland private enterprises

Source: Hong Kong Exchanges and Clearing Limited

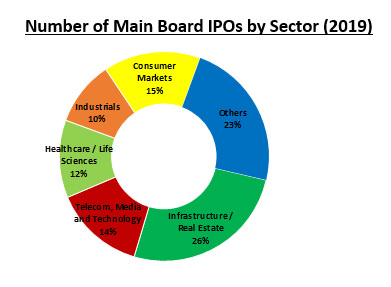

Ranked Number 5 Globally in terms of FDI Inflows

|

|

Source: UNCTAD STAT

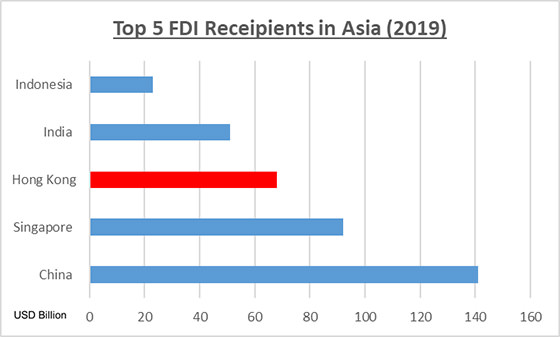

Top 5 Destinations for FDI Inflows in Asia

|

|

Source: UNCTAD STAT

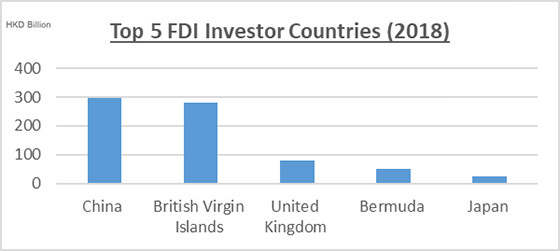

Major Investors in Hong Kong

|

|

Source: Hong Kong Census and Statistics Department

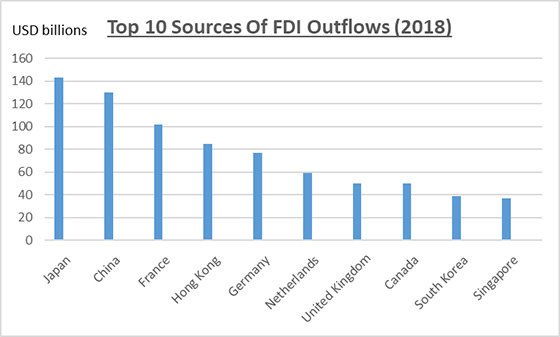

Ranked Number 4 Globally in Terms of FDI Outflows

|

|

Source: UNCTAD STAT

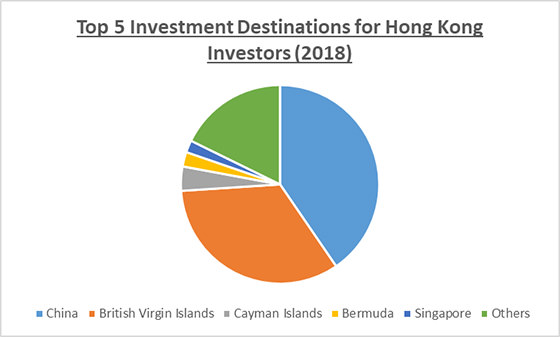

Major Investment Destinations for Hong Kong Investors

|

|

Source: Hong Kong Census and Statistics Department

Business Setup

- Step 1: Select company name and structure

- Check with Hong Kong Companies Registry to ensure that the intended company name can be used

- A company cannot use a name that had already been used, is considered offensive or otherwise contrary to public interest, or except with the Companies Registry’s prior approval, names that may give the impression that the company is connected in any way with the Central People’s Government of China or the Government of Hong Kong or any governmental department of China or Hong Kong.

- Common company structures: limited companies by shares, sole proprietorships, representative offices or partnerships

- Step 2: Incorporate the company

- A company’s registered office must be situated in Hong Kong

- A private company is required to have at least a director who is a natural person (i.e. an individual) and a company secretary can be a natural person residing in Hong Kong or a company that has its registered office in Hong Kong

- The sole director of a Hong Kong private company cannot act as the company secretary. A private company with a sole director may not have a body corporate as its company secretary if the sole director of that body corporate is also the sole director of the private company.

- No requirement for shareholder(s) or director(s) of a Hong Kong private company to be Hong Kong residents

- Fill out the incorporation documents and submit them with the appropriate fees to the Hong Kong Companies Registry

- Certificate of Incorporation and Business Registration Certificate can be issued within hours for online application or within several working days for paper application. Only an electronic copy of Certificate of Incorporation and Business Registration Certificate will be issued if a company is incorporated via online application

- Online company incorporation application can be made via Companies Registry’s electronic service portal e-Registry

- Step 3: Register business with the Business Registration Office of the Inland Revenue Department

- A Business Registration Certificate will be issued upon the incorporation of a Hong Kong company or the registration of a non-Hong Kong company with the Companies Registry via paper or online application

- All businesses must register with the Business Registration Office within 1 month of commencing business.

- Business Registration Certificate must be displayed at the place of business. A printed copy of the certificate must be displayed if it was obtained in electronic form

- Step 4: Open business bank account

- A business bank account can only be opened once a company is incorporated and a Business Registration Certificate is obtained

- The bank will collect information to verify the identity of the bank account holder to comply with the applicable anti-money laundering and counter terrorism financing obligations

- Banks in Hong Kong typically require a face to face meeting with the authorized signatory and director(s) of the company and submission of a business plan as part of the account opening process

- Step 5: Select business premises

- A wide variety of business premises are available among the central business districts in Hong Kong

- Step 6: Hire staff and apply for visa where necessary

- Visa-free entry to Hong Kong for residents from around 170 countries for period ranging from 7 days to 180 days

- Foreign nationals must obtain a visa before coming to Hong Kong to study, live, work or invest

- Every adult who enters and is permitted to stay in Hong Kong for more than 180 days must apply to the Immigration Department for a Hong Kong Identity Card within 30 days of arrival

- Different types of visa: visit, employment, investment and dependent visaEmployment Visa

- For securing an employment visa, one must have secured a job in Hong Kong and the employer (the sponsor) must be willing to apply the visa on your behalf.

- Your employer has to prove to the Immigration Department that you have the necessary skills for the position and that such cannot be found in the local workforce.

- The Immigration Department, among other factors, would consider the applicant’s background, education and job experience. Employment visas of two years are typically granted.

Dependent Visa

- For an applicant who had been granted a visa to stay in Hong Kong, they may sponsor their spouse or their children under the age of 18 to apply for a dependent visa.

- The sponsor has to prove to the Immigration Department their relationship with the dependent, whether there is known detrimental record against the applicant and that the sponsor can support the dependant’s living at a standard above the subsistence level and provide them with accommodation in Hong Kong.

Investment Visa

- For securing an investment visa, the applicant must have no known record of serious crime and a good education background, normally a first degree in the relevant field or professional qualifications and/or relevant experience.

- The applicant must also be in the position to make substantial contribution to the Hong Kong economy, with consideration to factors including but not limited to a business plan (details set out below), business turnover, financial resources, investment sum, number of jobs created locally and introduction of new technology or skills;

- Documents to submit for an investment visa application:

- Business plan- applicants wishing to establish or join a business in Hong Kong should submit a two year business plan stating the nature of their business and provide market analysis, market positioning, business direction, sales target, marketing strategy etc to demonstrate to the Immigration Department that the business is suitable for and capable of developing in Hong Kong;

- Two year forecast of the profit and loss account statement, cash flow statement and balance sheet- to demonstrate the feasibility of the business in terms of operation, finances and development;

- Documentary proof showing the amount of capital investment in Hong Kong;

- Organizational chart of the business showing the required number of staff and positions and indicate the number of actual job created locally; and

- Other documents- statements of the applicant’s personal and company bank accounts of the previous year, proof of other sources of funding, the company’s latest audited financial report (if any)- to demonstrate that the applicant has sufficient financial resources to run and grow the business in a sustainable manner in Hong Kong.

Sector Opportunities – Legal Services

- 931 Hong Kong law firms and 92 registered foreign law firms

- 2 factors leading to continual demand for legal services:

- Hong Kong is home to many corporate headquarters in the region; and

- Hong Kong is Asia’s leading financial services centre.

- Opportunities:

- Demand for corporate finance related services such as IPO as Hong Kong is a leading financial centre and a platform for Mainland Chinese companies to internationalize and raise capital from a diverse range of investors; and

- Hong Kong is a platform for growing overseas Chinese investment, leading to high demand for corporate finance related professional services.

More about the Legal System in Hong Kong

- Introduction

- Under the principle of “One Country, Two Systems” enshrined in the Basic Law, Hong Kong enjoys high degree of autonomy from Mainland China. Hong Kong does not practice the Mainland economic, legal and political systems and exercises high degree of autonomy and enjoys executive, legislative and independent judicial power, including that of final adjudication

- The Basic Law (“BL”) is Hong Kong’s mini-constitution:

- The BL took effect on 1 July 1997 on the establishment of the HKSAR

- The BL ensures that all the laws previously in force in Hong Kong i.e. common law, rules of equity, ordinances, subordinate legislation and customary law shall be maintained and enforced except for any that contravene the Basic Law and subject to any amendment by the HKSAR legislature, the Legislative Council

- National laws of the People’s Republic of China shall not be applied in the HKSAR except for those laws listed in Annex III of the BL relating to defence, foreign affairs and matters outside the autonomy of Hong Kong. The laws listed in Annex III shall be applied in Hong Kong by way of promulgation or legislation

- Relationship between the Central Authorities and HKSAR

- The Mainland government is responsible for the foreign affairs and defence of Hong Kong

- HKSAR is authorized to conduct external affairs on its own in accordance with the BL

- Fundamental rights protected by the BL

- Right to equality before the law; freedom of speech; freedom of the press and of publication; freedom of association; freedom of assembly; freedom of procession and of demonstration; right and freedom to form and join trade unions; freedom to strike; freedom of movement; freedom of conscience; freedom of religious belief, etc.

- BL guarantees that the provisions of the International Covenant on Civil and Political Rights, the International Covenant on Economic, Social and Cultural Rights, and the International Labour Conventions as previously applied to Hong Kong will remain in force

- Political structure of the HKSAR

- Chief Executive (“CE”) is the head of the HKSAR and is accountable to the Central People’s Government and the HKSAR

- The CE is assisted by the Executive Council, the cabinet of the HKSAR government and advisers to the CE

- The CE shall consult the Executive Council prior to making important policy decisions, introducing bills to the Legislative Council, making subordinate legislation or dissolving the Legislative Council, except for the appointment, removal and disciplining of officials and the adoption of measures in emergencies

- How Does the Legal System in Hong Kong Work?

- Common law

- Hong Kong is a common law jurisdiction so common law and rules of equity are to be found primarily in judgments of the courts of Hong Kong and other common law jurisdictions.

- Statute law enacted in Hong Kong

- Vast majority of statute law in force is made locally and contained in the Laws of Hong Kong

- Some aspects of Chinese customary law also apply

- E.g. in relation to land in the New Territories

- International law

- Over 260 international treaties and agreements have been applied in Hong Kong

- However, a treaty does not constitute part of Hong Kong’s domestic law until given effect by local legislation

- International law may be relied upon by Hong Kong courts as an aid to interpretation even if local legislation has yet been enacted to give effect to it.

- Criminal law

- Secretary for Justice is responsible for the conduct of criminal prosecutions in Hong Kong

- The Secretary of Justice and those who prosecute on the Secretary’s behalf decide whether to commence prosecution or not

- Criminal proceedings are instituted in the name of HKSAR

- The most serious criminal offences e.g. murder, manslaughter, rape, armed robbery and certain drug offences etc are tried by a judge sitting in the Court of First Instances with a jury of seven people or where a judge orders, a jury of nine people

- The jury determines whether the defendant is guilty or not beyond reasonable doubt

- Individuals may institute criminal proceedings under common law in the Magistrate Court, but the Secretary of Justice may at any stage of the proceedings intervene and assume conduct of the proceedings under the Magistrates Ordinance (Cap. 227)

- Civil law

- Civil actions can be taken by the HKSAR Government against individuals or corporations and vice versa, or more commonly individuals and corporations against each other

- Civil actions are initiated for purposes included but not limited to recover property, to enforce obligations, to protect individuals against abuse of power by the government or public bodies or to assess and recover tax and duties

- The civil burden of proof is easier to discharge than the criminal burden of proof, i.e. balance of probabilities rather than beyond reasonable doubt

- The Judiciary

- The Courts

- Court of Final Appeal (“CFA”)

- Under provisions of the BL and the Hong Kong Court of Final Appeal Ordinance (Cap. 484), the Chief Justice and the permanent judges of the CFA shall be appointed by the CE

- The CFA is normally comprised of the Chief Justice, 3 permanent judges and 1 non-permanent Hong Kong judge

- An Appellant has to either secure leave to appeal in the CFA or Court of Appeal (“CA”) prior to a CFA hearing. The CFA hears appeals concerning important questions of law, particularly points of law of public and constitutional importance or cases where leave to appeal have been granted.

- High Court (i.e. Court of Appeal and Court of First Instance (“CFI”))

- CA hears appeals on all matters including civil and criminal from the CFI and District Court (“DC”), as well as appeals from the Lands Tribunal

- CA also makes rulings on questions of law referred to by the lower courts

- CFI has unlimited jurisdiction in criminal and civil matters

- CFI also hears appeals from the Magistrate Court (“MC”), Labour Tribunal, Small Claims Tribunal and the Obscene Articles Tribunal

- District Court

- DC has limited jurisdiction in criminal and civil matters

- For civil matter, the DC can hear monetary claims over HK$75,000 but no more than HK$3,000,000

- For criminal matter, the DC may try all serious cases except murder, manslaughter and rape. The maximum term of imprisonment it can impose is 7 years

- Magistrates’ Courts (“MC”)

- All criminal matters appear initially in MC

- MC hear a wide range of criminal offences, both summary and indictable offences. The more serious indictable offences are referred to either the DC or the CFI.

- Under normal circumstances, the maximum sentence MC can impose is 2 years’ imprisonment and a fine of $100,000. The court may impose sentences of up to 3 years’ imprisonment where there are two or more indictable offences being dealt with at the same time.

- Minor offences such as hawking, traffic contraventions and littering are heard by special magistrates in the MC. Special Magistrates cannot impose a prison sentence and the normal maximum fee is HK$50,000 except where a greater sum is expressly provided for in any of the ordinances concerning the offence.

- Some securities-related offences are also heard in MC, such as insider dealing proceedings initiated by the SFC under the Securities and Futures Ordinance (Cap. 571)

- Coroner’s Court

- Under the Coroners Ordinance (Cap. 504), 20 categories of deaths should be reported to the Coroner which includes but not limited to deaths the medical cause of which is uncertain, deaths caused by accident, injury, crime, suspected crime or suicide

- May hold an inquest with a jury of five or without a jury when the death occurred suddenly or as a result of accident, violence or under suspicious circumstances or when the body is found in or brought into Hong Kong

- Juvenile Court

- The Juvenile Court in the MC hear charges against children under the age of 14 and young persons aged between 14 and 16, except where the charge is homicide.

- It may also make care of protection orders in respect of children or juveniles under the Protection of Children and Juveniles Ordinance (Cap. 213).

- Under the Juvenile Offenders Ordinance (Cap. 226), there’s an irrebuttable presumption that children under the age of 10 cannot commit a criminal offence

- Lands Tribunal

- Determine sums payable by the Government and others for compensation to persons whose land is compulsorily resumed or the value of which is reduced because of public or private developments

- Determine building management disputes, applications made by majority owners of a land for the sale of the land for redevelopment purposes under the Land (Compulsory Sale for Redevelopment) Ordinance (Cap. 545), appeals from decisions of the Commissioner of Rating and Valuation, and appeals against assessment of the prevailing market value of property made by Director of Housing

- Determine matters brought under the Landlord and Tenant (Consolidation) Ordinance (Cap. 7) such as landlords’ applications for possession of premises

- Labour Tribunal

- Provides a quick, inexpensive and informal method of settling disputes between employers and employees

- The Labour Tribunal has the jurisdiction to handle:

- claims with a sum of more than HK$8,000 (claims lodged by not more than 10 claimants of less than HK$8,000 per claimant are handled by the Minor Employment Claims Adjudication Board);

- claims arising from failure to comply with the Employment Ordinance (Cap. 57), the Minimum Wage Ordinance (Cap. 608) or the Apprenticeship Ordinance (Cap. 47);

- claims involving breach of an employment contract, whether the performance of which is in Hong Kong or wholly or partially outside of Hong Kong and subject to Contracts for Employment Outside Hong Kong Ordinance (Cap. 78); and

- claims transferred by the Minor Employment Claim Adjudication Board and the Small Claims Tribunal

- No legal representation is permitted to appear on behalf of their clients in any Labour Tribunal proceedings. The parties are required to appear in person and conduct the case themselves.

- Small Claims Tribunal

- Hears minor monetary claims not exceeding HK$75,000 in an informal manner

- No legal representation is permitted

- Obscene Articles Tribunal

- Classifies articles submitted by authors, printers, manufacturers, publishers, importers, distributors, copyright owners, the Secretary for Justice, any authorized public officer or any person who commissions the design, production or publication of the articles concerned.

- Determine whether an article referred to it by a court or a magistrate is an obscene or indecent article under the Control of Obscene and Indecent Articles Ordinance (Cap. 390)

- Classify whether an article falls under Class I (neither obscene nor indecent) or Class II (indecent) or Class III (obscene)

- The Tribunal may impose conditions or restrictions on the publication of Class II article. Class III articles are prohibited from publishing.

- Role of the Secretary for Justice

- Nominated by the CE, appointed by the Central People’s Government and a member of the Executive Council

- Determines whether to commence criminal proceedings on behalf of the HKSAR Government and is also the defendant in any civil action brought against the HKSAR Government

- Other powers and responsibilities- Initiate judicial review application to enforce public legal rights, has the right to intervene in any case of great public interest, represents the public interest as counsel to tribunal inquiries, acts as the Protector of charities and must be joined as a party in any action against charity

- The Department of Justice (“DOJ”)

- Secretary of Justice is the head of the DOJ

- DOJ comprises mainly of 5 divisions:

- Civil Division- provides legal advice on civil law to all government bureaus and departments. Represents the Government as solicitors and barristers in all civil litigations and arbitrations such as administrative law, personal injury and immigration matters. Advises on a wide range of matters from commercial law to town planning and policy initiatives.

- International law- provides advice on public international law to the government and negotiates or provides legal advisers to negotiate bilateral agreements and handles legal co-operation requests between Hong Kong and other jurisdictions.

- Law Drafting- responsible for drafting all the ordinances and the subsidiary ordinances such as rules and regulations put forward by the government and vets all non-governmental bills and all subsidiary legislation put forward by non-government bodies.

- Legal Policy- advises government departments and bureaus on whether proposed legislation or policy is consistent with the BL, international human rights standards and established legal principles and advice and promotes understanding of common law in the Mainland

- Prosecutions- prosecute trials and appeals on behalf of the government, to provide legal advice to law enforcement agencies, to exercise the discretion whether to bring criminal proceedings or not on behalf of the Secretary of Justice and to advise and provide assistance to government bureaus and departments on any criminal law aspects of proposed legislation

- The Legal Profession

- Unlike in the US, the legal profession in Hong Kong is divided into 2 distinct branches:

- Barristers (also known as “counsel”):

- Over 1,500 practising barristers in Hong Kong

- All members of the Hong Kong Bar Association

- Barristers can only accept instructions from a firm of solicitors, legal aid or the government

- Practise as sole-proprietor or in a set of chambers formed by a group of barristers

- Solicitors:

- Over 10,000 practising solicitors

- Members of the Law Society

- Over 350 solicitors are admitted to practice as notaries public

- Barristers (also known as “counsel”):

- Hong Kong is the most liberal Asian jurisdiction in terms of permitting foreign lawyers to practice; no entry barriers for foreign law firms or foreign lawyers

- Home to 935 local solicitor firms and 91 foreign law firms

- Arbitration and Mediation

- Hong Kong is Asia’s leading international arbitration centre

- Arbitration is one of the preferred methods of alternative dispute resolution in Hong Kong and the Hong Kong Arbitration Centre (HKIAC) was established in 1985

- Governed by the Arbitration Ordinance (Cap. 341), adopting most of the provisions of the UNCITRAL Model Law on International Commercial Arbitration 1985, bringing Hong Kong law in line with international practice

- 503 cases were submitted to HKIAC, with 308 arbitrations cases, 12 mediation cases, 182 domain name disputes and an adjudication case conducted by a sole adjudicator

- Mediation is another method of alternative dispute resolution voluntarily entered into by the parties and in confidence in which a neutral third party (i.e. mediator) is engaged to facilitate the parties in arriving a negotiated settlement

Securities Regulation in Hong Kong

- The Securities Market: A General Overview

- In terms of market capitalization globally, Hong Kong has the world’s 5th largest securities market and the 3rd largest in Asia after Tokyo and Shanghai

- Influx of Mainland Chinese issuers into Hong Kong has accelerated growth of the Hong Kong market

- Hong Kong is the most liquid and strategically important overseas market for Mainland enterprises

- Securities Regulation: Regulatory Structure

- The securities market in Hong Kong is regulated by the SFC

- SFC was founded in 1989

- It is an independent statutory body with investigative, remedial, licensing and supervisory powers over Hong Kong’s securities and futures sector

- It has the power to take appropriate action to protect Hong Kong’s securities and futures markets and to prosecute individuals who violate the applicable ordinances, rules, regulations and codes of conduct

- Securities and Futures Ordinance (Cap. 571) came into force on 1st April 2003 to regulate the following market misconducts and to offer better investor protection:

- Insider Dealing;

- False Trading;

- Price Rigging;

- Disclosure of Information about Prohibited Transactions;

- Disclosure of False or Misleading Information Inducing Transactions; and

- Stock Market Manipulation.

- The securities market in Hong Kong is regulated by the SFC

- The HKEx is the operator of Hong Kong’s central securities and derivatives marketplace and the front line regulator of listed securities. SFC’s approval is required for amendments to the listing rules or implementation of new rules.

- SFC’s statutory objectives are:

- To maintain and promote the fairness, efficiency, competitiveness, transparency and orderliness of the securities and futures industry;

- To promote understanding by the public of the operation and functioning of the securities and futures industry;

- To provide protection for public investors;

- To reduce systemic risks in the securities and futures industry; and

- To assist the Financial Secretary in maintaining the financial stability of Hong Kong by taking appropriate steps in relation to the securities and futures industry

Gateway to Mainland China

- Hong Kong’s physical proximity to Mainland China:

- Hong Kong is proximate to the Special Economic Zones in the southeastern coast with tax and business incentives to attract foreign investment and adjacent to China’s biggest and most productive manufacturing region (i.e. the Pearl River Delta, often known as ‘the factory of the world’)

- Many overseas companies involved in China trade have established their head offices in Hong Kong because of its strategic location

|

|

- The Mainland and Hong Kong Closer Economic Partnership Arrangement (CEPA):

- A free trade agreement that grants easier access to Mainland China markets for Hong Kong products and services and further enhances the close economic cooperation and integration between Hong Kong and Mainland China.

- CEPA is also beneficial to the Mainland as Hong Kong serves as an outbound investment platform for Mainland businesses and further accelerates the integration of the Mainland economy with the world.

- CEPA is applicable to the following 4 areas:

Trade in goods

- Tariff free export to Mainland China for Hong Kong-made products accompanied by a Certificate of Hong Kong origin

Trade in services

- Preferential treatment for Hong Kong-based service providers in 56 service sectors, mostly sectors that Hong Kong has a competitive edge;

- Many forms of preferential treatment such as relaxed restrictions on equity shareholding and registered capital of companies

Investment facilitation

- Hong Kong and Mainland China have broaden the scope of CEPA with the implementation of an Investment Agreement on 1 January 2018 to extend market access to non-services sectors such as manufacturing, mining and investment sectors and to introduce investment protection obligations.

- The Investment Agreement will uphold investors’ confidence, facilitate investment and stabilize the investment regime in Mainland China and Hong Kong.

- In terms of extending market access to non-services sectors, the Mainland will provide national treatment i.e. treatment no less favorable to its own investors and investment, to Hong Kong investment and investors, except to investment in certain sectors such as petroleum oil and natural gas.

- In terms of investment protection and facilitation, measures such as restriction on expropriation of investments and compensation for losses are put in place.

- A dispute mechanism was also introduced to settle investment disputes arising from alleged breaches of the Investment Agreement by Hong Kong or Mainland China. The mechanism is applicable to investments made prior to or after the coming into effect of the Investment Agreement, apart from investment disputes settled before the implementation of the Investment Agreement.

Economic and Technical Cooperation

- The economic and technical cooperation set out in CEPA was consolidated by the Agreement on Economic and Technical Cooperation (Ecotech Agreement) in 2017 to cater for the development trends and needs of Hong Kong and the Mainland and to set out future cooperation direction.

- The Ecotech Agreement also incorporates the economic and trade aspects of the “Belt and Road” Initiative and sub-regional cooperation into the CEPA framework, providing opportunities for Hong Kong businesses to participate in national development strategies.

- Mainland China and Hong Kong agreed to enhance cooperation in 22 sectors including but not limited to legal, finance, trade and investment promotion

Potential business opportunities in PRC

- Foreign direct investments into Mainland China are subject to four “negative lists”, with two applicable to domestic and foreign investors and the remaining two applicable to foreign investors only. The lists set out the “prohibited” or “restricted” industries for foreign investment.

- For prohibited industries, no foreign investment in any form is allowed. For restricted industries, specific conditions such as shareholding restrictions or government approval must be met or obtained by the foreign investors for investing into such industries.

- For investments not on the negative lists, foreign investors will receive “national treatment” for their investments into Mainland China i.e. they face the same market entry rules that are applicable to domestic investment into the relevant industries.

- The negative list “Free Trade Zone Special Administrative Measures on Access to Foreign Investment” is applicable to the 18 Free Trade Zones in Mainland China and is generally less restrictive than the national restrictive list “The Special Administrative Measures on Access to Foreign Investment” that is applicable to regions outside of Free Trade Zones.

- The latest negative lists that are applicable to foreign investors only have further reduced the number of sectors that foreign investors are prohibited from investing and/or the measures that are adopted to limit foreign investment into certain sectors.

- The “Catalogue for Guiding Industry Restructuring” (Industry Restructuring Catalogue) is a comprehensive guide to China’s management of investment projects and has fiscal, tax, credit, land, import and export implications to various industries.

- The Industry Restructuring Catalogue contains three categories, namely “encouraged”, “restricted” and “obsolete” sectors. Industries in the “restricted” sector uses dated technology that is wasteful and harmful to the environment or does not contribute to restructuring and upgrading the industrial structure. “Obsolete” industries leads to unsafe production practices, resources wastage and environmental pollution. Local government impose restrictive measures against “obsolete” and “restrictive” sectors to varying degree.

- The “Catalogue of Encouraged Industries for Foreign Investments” (Encouraged Industries Catalogue) issued by the Chinese government is used to guide foreign direct investment to specific industries and regions of China through measures including but not limited to preferential tax treatments and simplified approval procedures.

- The draft 2020 Encouraged Industries Catalogue encourage foreign investors to invest in:

- the development of high end manufacturing industries such as noise and vibration pollution control equipment manufacturing;

- the production service industry such as research and development of blockchain technology; and

- to invest in the central and western regions of China such as in the production, R&D and testing of hydraulic pipes in Henan Province.

- Forms of investment vehicles:

- Sino-Foreign Equity Joint Ventures (EJV)

- Cooperative Joint Ventures (CJV)

- Wholly Foreign-Owned Enterprises (WFOE)

- PRC Holding Companies

- Representative Offices (RO)

- Branches

- Sino-Foreign Equity Joint Ventures (EJV), Cooperative Joint Ventures (CJV) and Wholly Foreign-Owned Enterprises (WFOE)Sino-Foreign Equity Joint Ventures (EJV)

- EJVs are established in accordance with PRC’s Sino-Foreign Equity Joint Venture Law and the relevant implementation regulations. It is a limited liability company set up for a specific purpose with joint PRC and foreign ownership. The permitted duration of a joint venture depends on the type of business.

- Typically, the foreign investor provides at least 25% of the EJV’s registered capital, the capital the shareholders promised to inject into the company over a period of time when the company is incorporated, technical expertise and management skills and arranges for technology transfer and the Chinese investor makes available land, buildings and labour.

- A board of directors governs an EJV, with the foreign and Chinese investor each appointing a chairman or vice chairman.

- The share of profits, risk and losses are proportionate to the equity shareholding of the investors.

Cooperative Joint Ventures (CJV)

- CJVs are established in accordance with PRC’s Sino-Foreign Cooperative Joint Venture Law and associated implementation regulations.

- Unlike EJVs, the terms of CJVs are negotiated between the parties and are set out in the joint venture contract. Such gives parties further flexibility to agree to profit distribution ratio that is not proportionate to their capital contributions. There is no minimum foreign contribution.

- Depending on the type of CJV formed, CJVs may not be separate legal entities and the contracting parties have to bear their own risks.

- Typically, the joint venture contract specifies the minimum registered capital, capital contributions of each party and their respective shares of profits.

Wholly Foreign-Owned Enterprises (WFOE)

- WFOEs are established in accordance with PRC’s Foreign-Owned Enterprise Law and associated implementation regulations. They are wholly owned by one or more foreign investors and not any Chinese investor, which gives the foreign investor complete control over the WFOE, simplifying the decision making process, eliminating the risk of partnering with a Chinese investor and no profit sharing with local investors.

- A WFOE is treated as a separate legal entity with limited liability, enabling foreign investors to own real estates and to better protect its intellectual property in China.

Recent Developments with EJV, CJV and WFOE

- China’s new foreign investment law (New FIL) took effect on 1 January 2020 and replaced the laws and regulations governing EJVs, CJVs and WFOEs.

- The New FIL provides for a five-year transition period (Transition Period) for FIEs established under the previous foreign investment law regime to comply with PRC Company Law and PRC Partnership Enterprise Law that were previously applicable to domestic companies with regards to company organs and governing structure.

- The regulations implementing the New FIL (New FIL Implementation Regulation) provides that the relevant registration authority will not register any changes to FIEs that failed to complete corporate change by the end of the six month grace period after the Transitional Period i.e. by 30 June 2025 and will also report FIEs that failed to update the information on the national enterprise information publication system.

- The New FIL Implementation Regulation made clear that Sino foreign joint ventures established under the previous regime can retain the following terms which were previously agreed upon, even where they are inconsistent with PRC company law:

- Share or equity interest transfer mechanism;

- Profit distribution arrangements; and

- Asset distribution arrangements in case of liquidation.

- PRC Holding Companies

- Foreign investors can establish holding companies in PRC to hold equity interests in FIEs as well as to trade goods manufactured by investees and provide certain services such as financing, marketing, hiring and consulting.

- PRC holding companies and subsidiaries are taxed as separate entities

- Representative Offices (RO)

- Some corporations may elect to establish a RO in China as their first entry into the Chinese market. It is not a separate legal entity and does not require the injection of registered capital to set up.

- It has limited scope of permitted activity, mainly nonprofit making activities. More specifically:

- To conduct market survey, exhibition and publicity for the company’s products or services; and

- Liaising in relation to the company’s product sales, services, domestic procurement and investment.

- ROs are suitable for the following types of foreign companies:

- Companies considering investing into China;

- Companies with restricted budget and resources; and

- Companies requiring a small local presence to liaise with suppliers and for quality assurance.

- Generally, RO are only required to be registered with local authorities, except in certain industries where pre establishment approval is required and the term of such RO would vary.

- Branches

- Branch offices could be set up in China to enable WFOE to conduct businesses in more than one location in China.

- The WFOE is legally liable for its branch office, which can sign contracts, operate for profit and hire employees.

- Branch offices are required to obtain all the necessary permits and business license for branch registration and register with the tax authorities.

- Procedures for establishing a Foreign Investment Enterprise (including EJV, CJV, WFOE):

- provide documents to the Ministry of Commerce or provincial commerce departments:

- Application form

- Feasibility research report compiled by all parties

- Bank credit certificates

- Audit report

- Evaluation report

- Name list of members of board of directors

- Notice of pre-approval of enterprise name

- Certificate documents for the use of land

- application will be approved or dismissed within 3 months as of date of receipt of documents

- within 1 month after receiving certificate of approval, investor must go through the registration formalities

- provide documents to the Ministry of Commerce or provincial commerce departments:

- Resolving commercial disputes in PRC:

- Negotiation

- Commonly the first step to resolve dispute in the PRC

- Sometimes the preferred method to resolve commercial dispute as it leads to voluntarily accepted settlement by the parties and court judgments could be hard to enforce in the PRC

- Mediation

- The first formal step to resolving commercial dispute

- Court conducted mediation- conducted by a judge in civil proceedings, which is part of the litigation procedure according to PRC Civil Procedure Law. After settlement is reached, the court will make a settlement statement that is enforceable by the court.

- Commercial mediation- conducted by commercial mediation institution such as China Council for the Promotion of International Trade and the China International Chamber of Commerce on a fee paying basis.

- Arbitration

- Arbitration with foreign elements are usually conducted by the China International Economic and Trade Arbitration Commission (CIETAC) in accordance with its own Arbitration Rules and subject to the PRC Arbitration Law and other relevant laws

- For contracts with foreign parties, the foreign investors may prefer arbitration outside of the PRC where arbitrators with international experience and expertise can be appointed

- It is important to have a well-drafted arbitration clause in the contract or in a separate agreement in accordance with the requirements of PRC Arbitration Law to ensure arbitration is applicable

- Litigation

- Basic framework for civil litigation in PRC is laid down in the PRC Civil Procedure Law

- other relevant sources of authority: various judicial interpretations by the Supreme People’s Court or the Supreme People’s Procurate; the PRC Contract Law; the laws and regulations that govern foreign investment enterprises, and the Foreign Investment Enterprise Winding Up Measures