China

Introduction

The tide of cultural reform in China came in three waves. The first occurred from 1978 to 1997 when the Chinese government started to open up the Chinese market and reform the socialist market economy. The second wave came between 1998 and 2002, when the Cultural Industries Division of the Ministry of Culture was established and formalised the concept of China using culture as a tool for promoting the government’s agenda. The recent third wave came in the form of a comprehensive roadmap to guide Chinese cultural development in the 6th Plenum in 2011 following on from cultural activities being elevated to the level of national strategy under the State Council’s 2009 “Cultural Industry Promotion Plan”. In the last few years, China’s cultural reform has been impressive results in many areas, including the filming industry.

Growth

China has the fastest growing film market in the world. Five years ago, China ranked 8th in the league table of global film markets. In 2012, China overtook Japan and became the world’s second largest film market. 1

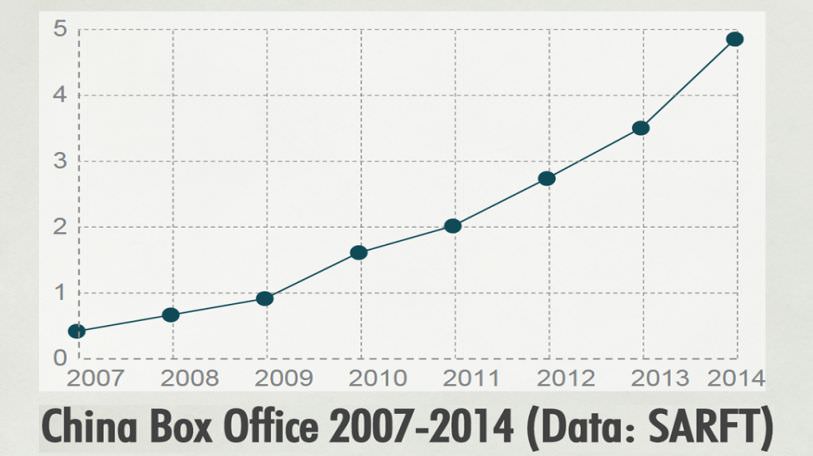

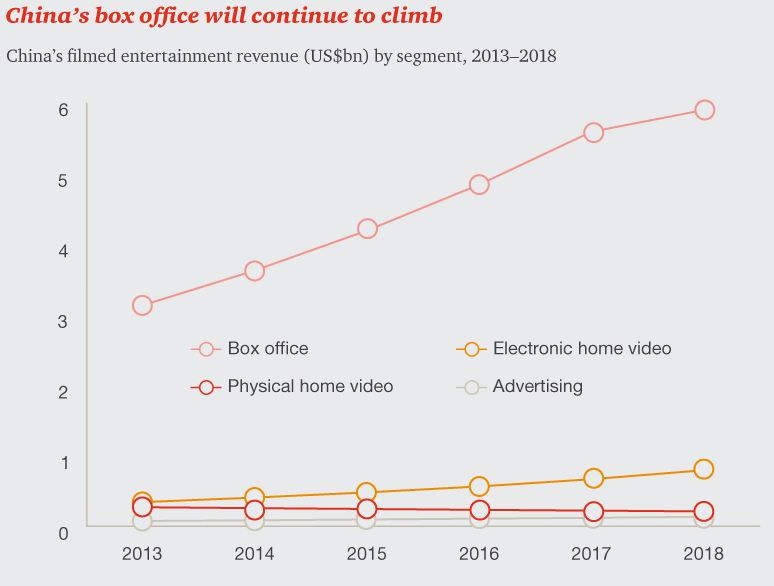

In 2014, 618 films were produced, making it the second year with decreased production. Less than half of these made it to the cinema.2 Despite producing 20 films less compared to 2013, China’s box office receipts hit USD 4.82 billion (RMB 29.6 billion) in 2014, reflecting an astonishing growth of 36.5%,3 surpassing PwC’s 2013 prediction and making China the world’s 2nd largest movie market after the US.

According to Millard Ochs, the president of Warner Bros. International, it is expected that the film market in China will become the largest in the world in five to ten years.

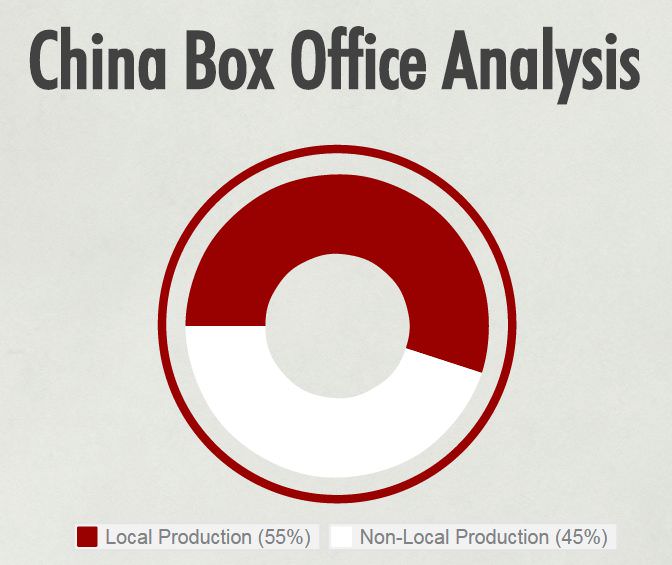

Local production accounts for 55% (USD2.64 billion) of the market share. Combined overseas gross of Chinese films reached USD 305 million (RMB 1.87 billion), up 32 % compared to the previous year. Although there are no official figures on post-distribution revenues, which are usually a multiple of box office revenues, market analysts have estimated these revenues to total more than USD 16 billion in aggregate.4

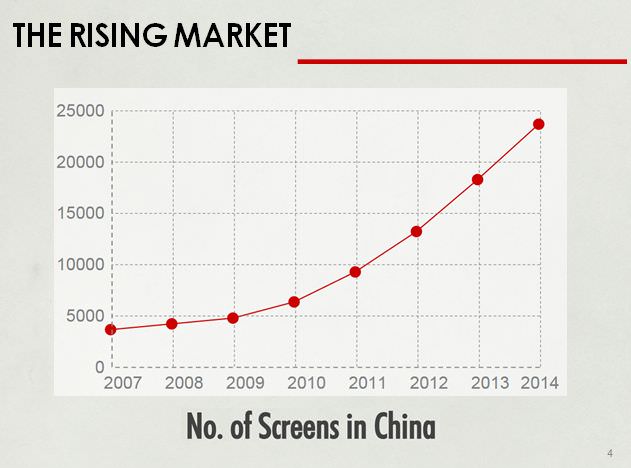

Some 1,015 cinemas were opened in 2014, delivering 5,397 new screens (on average 15 new screens per day) and bringing the total number of screens to 23,600. Urban cinema admissions also reached 830 million, showing an increase of 34.5% compared with 617 million in 2013. As more cinemas open in second and lower tier regions, the national ticket price is expected to be pulled further lower and boost cinema admissions.

Due to the need for cinemas for rural residents, the Chinese government launched the “Rural Film Projection Programme” that aims for at least one screening in per village each month. With the input of hundreds of millions of RMB every year to allocate digital cinema equipment in rural areas, a Public Service System has now taken shape, offering diverse films to a rural audience.

Types of Movies Screened in China

Movies shown in China are either imported from overseas markets or produced by local companies, sometimes jointly with a foreign production house.

1) Cinematic Imports

China maintains a tight control over foreign films that are allowed to be screened, potentially spurred by the fear that the local filming industry would be compromised by a completely open market as happened in Taiwan. There are currently two business models for foreign films releasing in China: revenue-sharing and flat-rate (i.e. a buy-out).

Revenue-Sharing

Since 1995, China has been importing a set number of foreign movies on a revenue-sharing basis (the “Quota system”), a model commonly adopted in other jurisdictions. The initial quota was 10 and has been relaxed over time. The Chinese government later agreed to raise the quota to 20 as a condition to join the WTO in 2000. In 2007, the US filed a complaint against China at the WTO regarding the Chinese “Measures Affecting Trading Rights and Distribution Services for Certain Publications and Audiovisual Entertainment Products” (WTO/DS363). In the 2012 settlement agreement, China agreed to increase market access for US films and part of the agreement allows screening of 14 premium format films (i.e IMAX, 3D) on top of the original import quota of 20. At the moment, foreign films are imported through only two authorised distributors, namely China Film Group Corporation and Huaxia Film Distribution Co., Ltd. Under the quota system, foreign producers’ take is capped at 25% of the box office (18% pre-2012).5 On top of that, foreign producers are responsible for all marketing costs which averaged 11% of the box office takings in 2014.

Flat-rate (buy-out) – China also imports foreign films on a flat-rate basis each year, under which film owners will sell the China distribution right to authorised distributors at a flat rate (the “Flat-rate system”).

Foreign films under both the Quota system and the Flat-rate system have to pass a censorship review in China.

Despite import restrictions, the PRC is fast becoming a major overseas market for Hollywood filmmakers.

In 2014, the 34 foreign films allowed under the quota grossed US$1.81 billion, an increase of 60% on the 2013 figure, and accounting for about one third of the total box office in China. 2014’s most successful foreign film by far was Transformers 4: Age of Extinction which with revenues of US$319.58 million was China’s highest grossing film ever, way ahead of the best performing Chinese film, Breakup Buddies which took US$188 million.6

Possible Relaxations

China is reportedly planning to relax its current quota of 34 foreign films per year in February 2017 on the expiry of its current quota system which is valid for 5 years from 2012. There have also been reports that China may increase the current 34 foreign film quota to 44 in the meantime.

Top 10 grossing foreign quota films 20147

| Ranking | Cinematic Imports | Box office (USD million) |

| 1 | Transformer IV: Age of Extinction | 319.58 |

| 2 | Interstellar | 121.63 |

| 3 | X-Men: Days of Future Past | 118.24 |

| 4 | Captain America: the Winter Soldier | 115.50 |

| 5 | Dawn of the Planet of the Apes | 108.47 |

| 6 | The Amazing Spider-Man 2 | 96.11 |

| 7 | Guardians of the Galaxy | 93.37 |

| 8 | Godzilla | 78.63 |

| 9 | The Hobbit: the Desolation of Smaug | 74.87 |

| 10 | Need for Speed | 67.28 |

Although cinematic imports appear to be highly grossing, foreign films that make it to the list of 34 are often subject to protective measures such as competitive release scheduling, not to mention the fact that they only get to keep 25% of the Chinese box office receipts. In 2014, although there were 34 quota films, only 33 were screened. The Hunger Games: Mockingjay Part 1 was given a quota place and was due to be released in November 2014 but was reportedly pulled from release by film authorities to give an easier ride to domestic films in the final quarter of 2014 to try and even up the box office cumulative audience for domestic and foreign films before the year end. The film was released in China in February 2015 on 2D screens and in a 3D version created especially for the China market and raised nearly US$10 million on its opening day.

2) Production Joint-Ventures

Many foreign production houses have now turned to the China Film Co-Production Corporation (CFCC) instead and opt for a joint-production model. The economic split between distributor and producer for Sino-foreign co-productions is on a negotiated basis and generally this split gives foreign producers a larger share than movies imported under the quota system.

Co-production is not subject to the import quota if films qualify as co-production projects under the relevant regulations, and this thus offers production houses better access to the Chinese market. These movies also benefit from the creativity and expertise of both the local and foreign producers. Co-production also allows production houses easier access to low cost resources for filming in China.

A Sino-foreign co-production is a contractual arrangement between a foreign party and a Chinese party to conduct filming in the PRC. There may be multiple parties on each side, provided that the lead Chinese party or parties must be a production entity or entities that have obtained the applicable Film Production Licenses from the film regulator State Administration of Radio, Films and Televisions (SARFT). For the purposes of Sino-foreign co-production, investors or producers from Hong Kong and Macau and the territory of Taiwan are considered as overseas parties.

Modes of Co-Production

There are three types of co-production allowed under the current regime, namely joint production, assisted production and commissioned production. The first two methods are described below and are the methods which are most commonly adopted.

Joint Production (collaboration)

This involves the PRC and foreign parties jointly investing in and producing the film. They also share the copyright sin the film and the profits or losses arising from the project. Joint production is by far the most popular mode of co-production and Chinese elements usually feature prominently in the film. In fact, it is requirement that Chinese cast constitute at least one-third of the main cast members. Joint productions are regarded as domestic films and can be directly released in the PRC after they are completed and pass censorship review.

The Sino-French coproduced film ‘The Nightingale” was China’s entry to the 2015 Oscars for “Best Foreign Film”.

Assisted Production (entrusted production)

This is where the foreign party provides all the capital and the PRC party is hired for production of the film. The product of an assisted production is owned by the foreign party and the film cannot be released in the PRC unless it is imported by an authorised import agent such as China Film Group Film Import & Export Corporation, a subsidiary of the authorized distributor China Film Group Corporation. However, assisted productions are still subject to import quota. The 2014 hit Transformer is the third sino-foreign co-produced film that adopts this production mode.

Joint Production House

According to the Provisional Rules on Operation Qualifications for Entry into Film Production, Distribution, and Exhibition revised in 2004, foreign investors may incorporate a film production company in the form of an equity joint venture or cooperative joint venture with China film production companies. However, the investors are required to have controlling interests in the equity joint venture or cooperative joint venture. Warner China Film HG Corporation, incorporated in December 2004, was the first China-foreign equity joint venture established in China for film production. However, the attempt to allow foreign investment in film production was suspended very shortly when the PRC Ministry of Culture, SARFT and several other government agencies jointly issued a circular, Opinions on Foreign Investment in Culture Related Areas (“Opinions”), which prohibits foreign investors from establishing or investing in film production companies in China, in July 2005.

Such investment opportunity again became available in 2012 after China and US signs the WTO settlement. The first sino-foreign animation production house, Oriental DreamWorks, was established in February the same year by CMC, SMG, SAIL and Dream Works Animation. The first round of investment involves USD 330 million US capital, with Dream Works holding 45% of the production house’s equity stake. The first production, Kung Fu Panda 3 is expected to be released in 2017. Disney also announced plans on cooperating with ACG China and Tencent later.

Regulatory Regime Overview

Film production and distribution has been a restricted and prohibited category from the first edition of the Foreign Investment Catalogues. Despite China’s recent attempt to open up mainland markets, the country has been reluctant to release its grip. In the 2014 Catalogue released in December 2014, film production is placed under the restricted band 12 and restricted to co-operation while film distribution and production houses are placed under the prohibited band 11. Many industry players used to hope that the negative list adopted in the Shanghai Pilot Zone would finally allow direct foreign investment in film production and distribution, the lists published in the past few years, however, included them in the restricted and prohibited bands.

However, the Chinese government carved out an exception for Hong Kong and Macau. Investors from these two jurisdictions are permitted to establish wholly-owned subsidiaries in China for the distribution of China-made films, owing to the Supplementary Provisions to the Film Market Entry Rules issued by the SARFT on March 7, 2005 and effective from January 1, 2005.

The Chinese film industry is regulated by SARFT which issued a number of regulations. Below is a list of laws regulating production and distribution of films in China:

General:

- Film Administrative Regulations, or the Film Regulations (2002)

- Interim Provisions on the Qualifications for a Film Enterprise’s Access to Commencement of Operation, or the Film Enterprise Qualification Provisions (2004)

- Provisions on the Filing of Film Scripts (Abstracts) and the Administration of Films, or the Film Filing Provisions (2006)

Co-Production:

- Regulations on the Sino-foreign Corporation in Film Production, or the Sino-foreign Co-Production Regulations (2004)

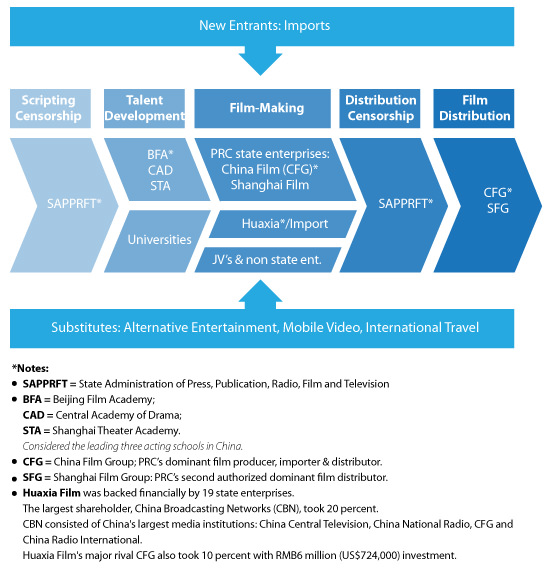

Below is a China film value chain illustrating the barriers to foreign investors.

SARFT is the responsible regulator for film production and distribution. Any films screened in China need to obtain various approvals from the SARFT or its provincial equivalent at different stages.

1) Production

Pre-production Approvals

Under the Film Regulations, there are two types of SARFT licences allowing production and distribution (within China) and export of films.

- Film Production Licence (Single Film) (SFL)

- Granted on a film-by-film basis

- Film Production Licence (FPL)

- Companies that have produced 2 or more films with the Single Film licence are qualified for application

- Effective for 2 years once granted

The Sino-Foreign Co-Production Regulations further stipulate that:

- Foreign entities are prohibited from independently producing films in China

- Sino-foreign entities must consist of a Chinese party with an FPL or SFL and seek a Co-production permit (effective for a term of 2 years) from SARFT before film production.

It should be noted that the CFCC does not approve all applications for a co-production permit. An example of a rejected co-production was Cloud Atlas whose 2013 application was turned down despite the film containing many elements accommodating Chinese sensibilities. Later that year, the President of CFCC delivered a cautionary reminder at the 2013 US-China Film Summit and stated that China wants “films that are heavily invested in Chinese culture, not one or two shots.”8

Post-Production

If post-production is to be conducted outside China, parties must apply for approval in advance.

Once post-production is completed, the product must be submitted to SARFT for censorship. If the film fails at this stage, it cannot be released anywhere in the world.

After censorship, the film will be ready for screening upon receipt of a Licence for Film Public Screening. If parties wish to submit their work to any overseas film festival, they need to report to SARFT 20 days in advance for filing purposes.

2) Distribution

A Film Distribution Licence valid for 2 years from SARFT is necessary for distribution in two or more provinces (or regions). The approval process will be deferred to the provincial level if distribution is only made in one province (or region) but the licence is only valid for 1 year.

Censorship

On 11 July 2013, the State Council issued the Circular of General Office of the State Council Concerning Printing & Distributing of Rules for Major Internal Organizations and Staffing in GAPPRFT. According to Article 14 of that circular, it is proposed that censorship will be replaced with a requirement for the announcement of a synopsis for film scripts with general themes. Although there is some ambiguity as to the meaning of “general themes”, the circular is indicative of intentions to reform film censorship.

In the meantime, censorship remains the major form of pre-screening approval. Although the Chinese government has released a list of film contents prohibited for distribution, it is often difficult to predict what will be censored.

The list of prohibited contents includes:

- Contents that defy the basic principles of the Constitution;

- Contents that endanger China’s unity, sovereignty or territorial integrity;

- Contents that disclose State secrets, endanger national security or damage China’s reputation ;

- Contents that incite hatred or discrimination, undermine solidarity or infringe upon national customs and habits;

- Contents that propagate evil cults or superstition;

- Contents that negatively affect public order or public stability;

- Contents that include obscenity, gambling, violence or crime;

- Contents that insult others or the lawful rights of others;

- Contents that endanger public ethics or traditions;

- Contents prohibited by laws.

Although the criteria are vague and broad and severely limit the types of film genres that can be made, many film producers manage to find a way of satisfying both the censorship requirements and their commercial needs. This can be achieved by avoiding issues which are even slightly controversial and playing safe. Many reluctantly allow substantial removal of sensitive scenes in return for screening in China. Some even create different story endings to suit both the international and the Chinese market.

Relevant considerations in structuring a co-production

It is generally up to the parties to decide which mode of co-production they would like to adopt. Nevertheless, there are a few issues which parties should consider in structuring the preferred mode of co-production. The following list is by no means exhaustive and readers should be aware that the relevant issues are intertwined and should not be considered in isolation:

1. Nature of co-production

This involves a consideration of whether the investments will be contributed jointly by the Chinese and foreign parties (in which case the parties should adopt joint production), or solely by the foreign party (in which case the parties should consider assisted production).

2. Creative elements

If the story has no Chinese elements, or insufficient Chinese cast members to constitute at least one-third of the main cast, the parties should either consider revising the story if joint production is the preferred mode, or adopting assisted production.

3. Division of obligations

Generally, the Chinese party to joint production will participate heavily across all stages of production up to promotion and release of the film. In an assisted production, their level of participation and decision-making will be lower, and they are usually not involved in the promotion and release of the film.

4. Censorship

Regardless of the mode of co-production, all films made in China must be submitted to the SARFT for censorship review.

5. Rights and release of the film

In a joint production, it is a requirement of the law that the Chinese and foreign parties share profits derived from the film. The parties, however, are allowed to specify in the co-production agreement how the rights and profits will be divided. In a straightforward assisted production, however, the foreign party will usually be the owner of the film’s copyright.

Hong Kong – the Gateway to China

The Closer Economic Partnership Agreement (CEPA) signed between Hong Kong and China serves as a great way to circumvent the quota system. Chinese language films produced by Hong Kong companies are not subject to the import quota set for foreign films, provided that the Hong Kong companies own more than 50% of the copyright, contribute at least 50% of the invested budget of the film and are the leading producer. In addition, there is no requirement as to the percentage of principal creative personnel who must be from Hong Kong. In contrast, foreign – mainland co-productions are required to have at least a 50:50 ratio of foreign and mainland crews. In addition, Hong Kong films need not have a China theme as their focus. These productions in the Chinese language are treated as mainland productions after receiving approval from mainland authorities.

Apart from the advantage of the statutory exemption, companies can benefit from the expertise of Hong Kong’s film industry and its understanding of the preferences of Chinese audiences. Hong Kong has a pool of directors, actors/actresses, art directors, action directors and photographers etc. who have established impressive track records in Chinese cinema.

Another advantage of using Hong Kong as a base for entering the China market is that Hong Kong has a sophisticated and effective legal system based on the rule of law. Hong Kong’s corporate tax and other forms of taxation are also among the lowest in the region.

Choosing the Right Partner

There are a number of Chinese production companies that are frequently engaged by Hong Kong or foreign production companies for co-productions. Some of the main players are Huayi Brothers, China Film Group Corporation, Beijing Bu Yi Le Hu Film Company, Shanghai Film Group Corporation and Polybona Films.

The only real source of film income in China is box office receipts since other income streams are generally unavailable. As China’s box office is still being developed and is far from transparent, it has been notoriously difficult for foreign production companies to get a fair and accurate share of the box office receipts. There are no trusted intermediaries for film in China; collection agents, escrow account holders and trustees do not exist in China. Thus, the Chinese co-producer becomes the only party to rely on for a share of box office receipts and even then, this can’t be guaranteed. On top of that, a number of tax issues arise with respect to remitting box office receipts overseas. The approval of the State Administration of Foreign Exchange (“SAFE”) is also required. Even in the developed world, taxation of international films is one of the most difficult areas. For China, the situation is compounded by a magnitude of administrative orders, a non-convertible currency and the intervention of SAFE.

It is therefore recommended that the co-production agreement should be structured in a way to provide for the foreign party to be paid in advance by the Chinese party, instead of sharing the box office receipts. The foreign party thus needs to be realistic as to its possible net share of domestic Chinese box office receipts, after accounting for taxation.

Alternatively, the foreign party may appoint its own independent inspectors to count cinema attendance and work back from there. Another possibility is to take photos of the audience before the house lights go down at the start of each session.

April 2015

This note is provided for information purposes only and does not constitute legal advice. Specific advice should be sought in relation to any particular situation. This note has been prepared based on the laws and regulations in force at the date of this note which may be subsequently amended, modified, re-enacted, restated or replaced.

1 http://stephenfollows.com/the-rise-and-rise-of-chinas-film-business/

2 http://variety.com/2015/film/news/china-confirmed-as-global-number-two-after-36-box-office-surge-in-2014-1201392453/

3 Data from State Administration of Radio, Film and Television (SARFT), http://www.sarft.gov.cn/articles/2015/01/05/20150105174531720823.html In 2013, China’s box office hit USD 3.57 billion, making it the first box office exceeding $3 billion in the Asia Pacific region.

4 http://www.china-briefing.com/news/2014/02/11/chinas-film-industry-strategic-opportunities.html

5 Which was also a result of the settlement agreement. In other countries, the split usually comes close to 50-50.

6 The Guardian. “China’s Hunger Games: MockingjayPart 1 release delay ‘no cause for panic’”. 28 November 2014. http://www.theguardian.com/film/2014/nov/28/china-hunger-games-mockingjay-part-1-release-delay

7 The Hollywood Reporter. “China Box Office: Foreign Quota Movies Saw Revenue Rise 60 Percent in 2014” http://www.hollywoodreporter.com/news/china-box-office-foreign-quota-758767

8 http://www.theguardian.com/film/2013/nov/06/china-hollywood-positive-images-movies