Publications & presentations

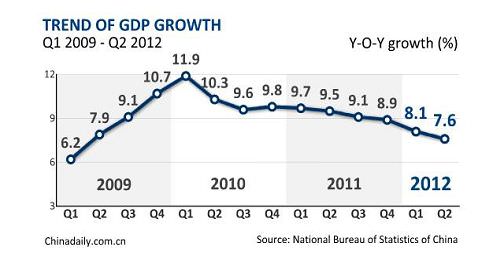

GDP growth – a downward trajectory?

Energy consumption – a more reliable indicator?

The Economy: Not By the Numbers

- (c) Describing some of the challenges he faces as Party Secretary, Li related that despite brisk economic growth of SIPDIS 12.8 percent in 2006, Liaoning’s income gaps remain severe. Liaoning ranks among the top 10 Chinese provinces in terms of per capita GDP, yet the number of its urban residents on welfare is among the highest in the country and rural disposable incomes are above the national average. Even so, incomes for Liaoning farmers are only half that of urban residents.

- (c) GDP figures are “man-made” and therefore unreliable, Li said. When evaluating Liaoning’s economy, he focuses on three figures:

- electricity consumption, which was up 10 percent in Liaoning last year;

- volume of rail cargo, which is fairly accurate because fees are charged for each unit of weight; and

- amount of loans disbursed, which also tends to be accurate given the interest fees charged. By looking at these three figures, Li said he can measure with relative accuracy the speed of economic growth. All other figures, especially GDP statistics, are “for reference only,” he said smiling.

Source: http://wikileaks.org/cable/2007/03/07BEIJING1760.html#

- National Energy Administration recent figures shows slow down in electricity consumption

- Centres of heavy industry: Shandong Province and Jiangsu Province reported 10% drop in electricity consumption

- Coal storage reached record high at Qinhuangdao, Tianjin, Caofeidian and Lianyungang, according to Wood Mackenzie

- As electricity consumption decreases, the demand for coal also decreases hence the increase in coal storage

Decelerating construction and manufacturing sectors

- Construction and manufacturing sectors account for 75% of total energy consumption

- Manufacturing PMI down from 49.3 in July 2012 to 47.8

- An eleventh successive month-on-month deterioration

- Sharpest decline in factory output since March

- Non-manufacturing PMI, which tracks construction activity, is also well below the ten-month high in March

OR, Transition to service-based economy?

- The decrease in electricity consumption is due to structural transition to the service sector, which is less energy intensive

- According to the NEA data, the service industry and residential power consumption expanded much faster than that of the industrial sectors

- In any event, China’s economy is facing significant downward pressure due to the Euro crisis

Underlying problems of China’s economy

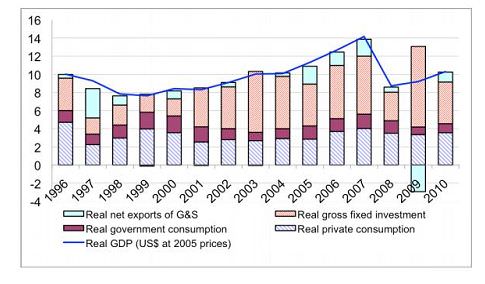

Figure 3. Composition of GDP growth (in percent)

Source: EIU Country Data.

Note: Shaded regions in each bar show the contributions (in percentage points) of each component to total GDP growth. 2010 data are EIU estimates.

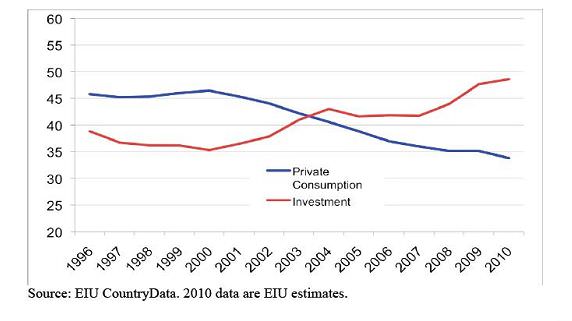

Figure 4. Shares of Private Consumption and Investment in GDP (in percent)

Source: EIU Country Data. 2010 data are EIU estimates.

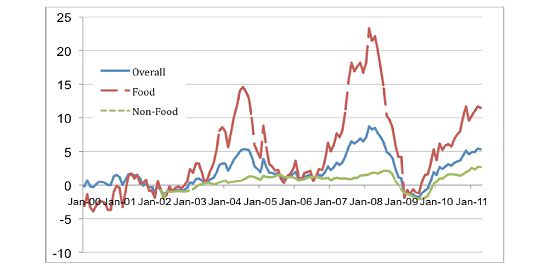

Figure 1. Inflation (12-month inflation rates based on CPI indexes)

Sources: National Bureau Statistics; Haver; CEIC

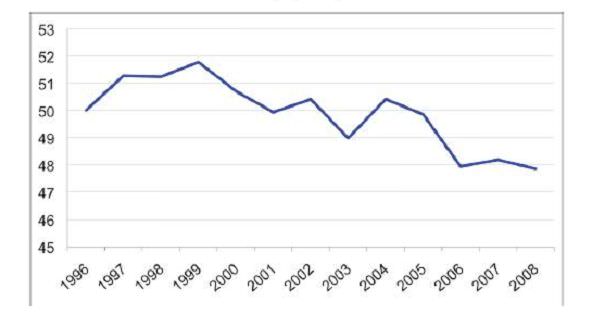

Figure 5. Labor Income as Share of National Income (in percent)

Sources: Flow of Funds data, CEIC.

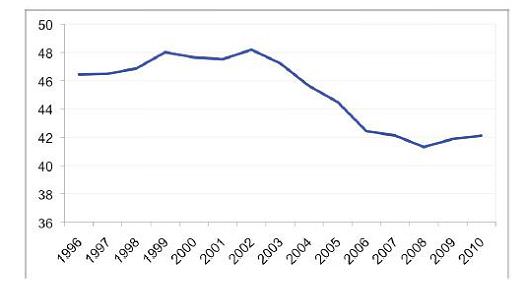

Figure 6. Personal Disposable Income as Share of GDP (in percent)

Source: EIU Country Data. 2009 and 2010 data are EIU estimates.

Why is it so difficult to boost private consumption ?

- Although the government has planned to stimulate consumption through consumer subsidies etc, these measures are not likely to offer quick results

- High inflation, combined with weak employment growth, a weak social safety net, a poor government-funded health care system and low public confidence on China’s social institutions and prospects are the key issues

- More difficult to combat these fundamental issues

Chinese government’s considerations

- increasing consumption would require the government to relinquish, rather than increase, its control over the economy

- the government remains sceptical of the contribution that domestic consumption could make to economic growth

- still prefers direct investment and public expenditure to build the economy

The financial crisis in 2008

- The Chinese government embarked on massive fiscal and monetary stimulus, which worsened the problems of high inflation and asset bubbles

- But, a U-turn would be more disastrous to employment, household income and the willingness to lend

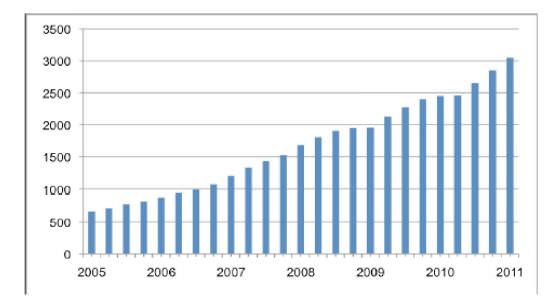

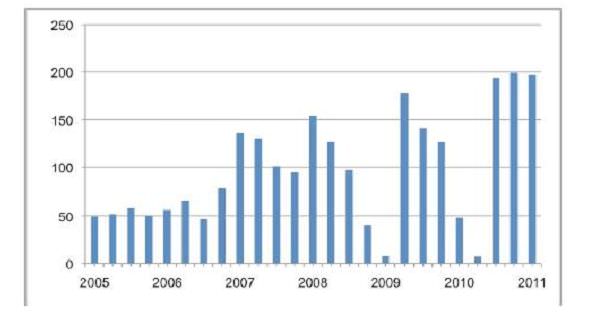

Figure 10. Foreign Exchange Reserves (USD billion)

Foreign Exchange Reserve Stocks: 2005Q1 – 2011Q1

Sources: People’s Bank of China; Haver

Note: End of quarter figures

Accumulation of Foreign Exchange Reserves: 2005Q1 – 2011Q1

Sources: People’s Bank of China; Haver

Note: End of quarter figures

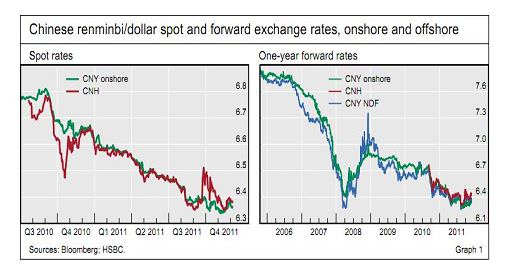

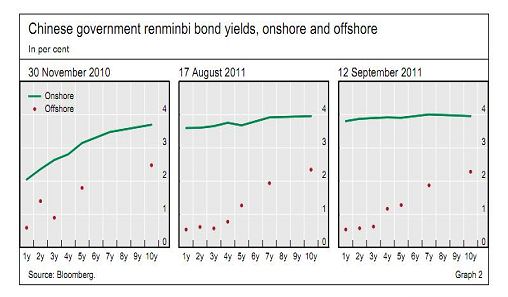

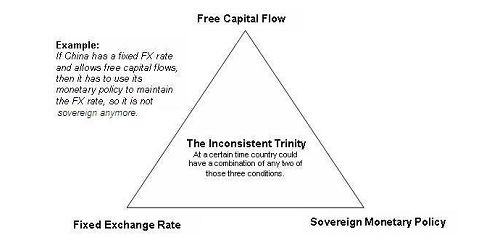

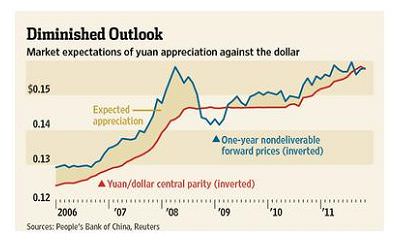

RMB internationalisation

- More exchange rate flexibility → more autonomous monetary policy in macro-economy

- Meet twin objectives of high growth and low inflation

- RMB appreciation → increase purchasing power → rebalance growth from investment and export-led economy to consumption-based economy

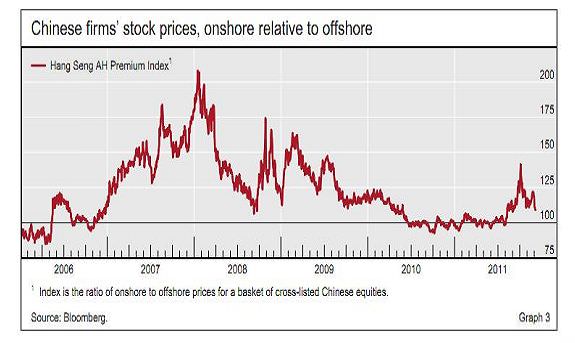

China’s banking system

- Notorious for its persistent incentives to lend to state-owned enterprises

- Weak risk management capacity

- Poor quality of asset portfolios

- Limited financing options for private enterprises, especially due to capital control

Benefits of making use of offshore markets

- Increase efficiency in China’s financial market

- Increase access to capital for private sector

- Better price mechanism in allocating capital

Is the level of government debt sustainable?

- National Audit Office (June 2011):

- More than 6,576 financing vehicles set up by local governments by end of 2010

- 20% of these companies were found to have defects in management

- 85% of these companies had sufficient income to cover debt servicing payment

- Total local government debt: RMB 10.7 trillion (equal to 27% of China’s 2010 GDP)

- 2010 total local government revenue: RMB 8.3 trillion

- Total local government debt could be as high as RMB36 trillion, or 90% of China’s GDP

- Of 483 urban construction investment bonds sold by local governments, 33% had negative cash flow

- Minghang District in Shanghai: 46% debt ratio of the district’s total product, with RMB 1 billion annual interest payment

- Hongkou District in Shanghai: 190% debt ratio with 200% negative cash flow

- China’s “economic tsunami”

- China’s local government debt level “unsustainable”

- Other opinions:

- Mr Cheng Siwei, former deputy head of NPC: local government debt is China’s equivalent of U.S. subprime crisis

- Mr Qu Hongbin, China chief economist at HSBC: local government debt poses a potential risk to China’s banking system

Solutions to build a sustainable economy

A report jointly conducted by the World Bank and the Development Research Center of the State Council of the PRC – seeking to address the underlying risks to China’s economy and find solutions to make the economy more sustainable

Six broad recommendations

- Implement structural reforms to strengthen the foundations for a market-oriented economy

- Accelerate the pace of innovation and create an open innovation system

- Seize the opportunity to develop “green” energy

- Improve social security for all

- Strengthen the fiscal system and

- Seek mutually beneficial relations with the world

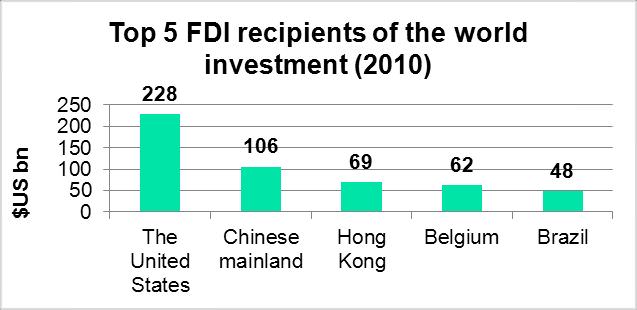

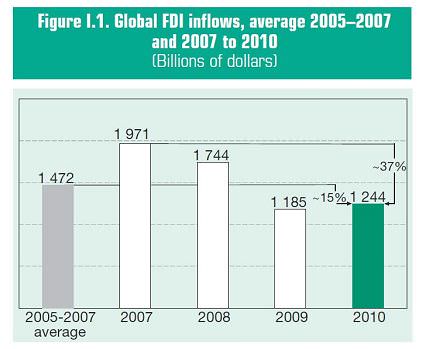

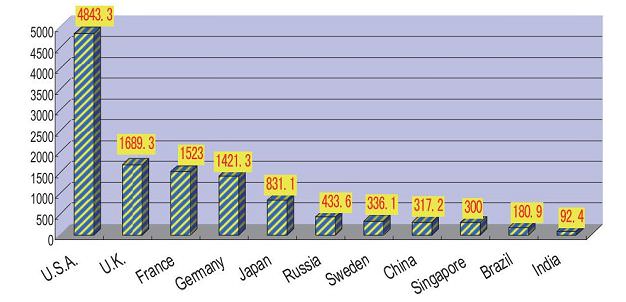

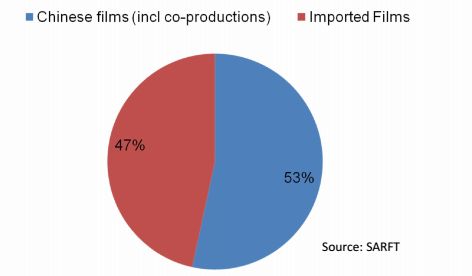

Inward Foreign Direct Investment

- Inward FDI into China in 2011 hit US$116bn, up 9.7% from 2010

- China was the world’s second-largest FDI recipient in 2010

- only after the U.S.

- US$106bn

- Hong Kong has always been the major source of China’s FDI inflow.

- Other major investors in China include companies from Taiwan, Japan, Singapore and USA

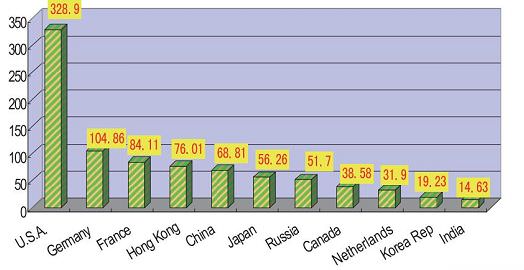

Top 10 nations and regions with investment in China in 2011 (as per actual input of foreign capital)

| Rank | Nations / regions | Investment in PRC |

| 1 | Hong Kong | US$77.011bn |

| 2 | Taiwan | US$6.727bn |

| 3 | Japan | US$6.348bn |

| 4 | Singapore | US$6.32bn |

| 5 | USA | US$2.995bn |

| 6 | ROK | US$2.551bn |

| 7 | UK | US$1.61bn |

| 8 | Germany | US$1.136m |

| 9 | France | US$802m |

| 10 | Holland | US$767m |

Source: FID of MOFCOM

Source: China Daily

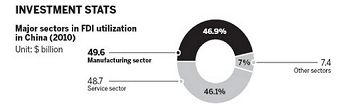

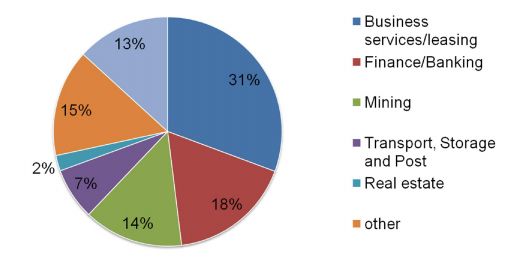

- About half of the inward FDI (~US$50bn) was invested in manufacturing projects in 2010

- Investment in China’s real estate sectors was also popular

- it accounted for one-fifth of the total FDI inflow in 2010

- Strong development in China’s poorer and less developed interior and western regions

- lower cost of labour there

- Transformation of China’s industrial structure

- manufacturing sectors → high technology sectors and services

- China’s position as the top destination for low-cost offshore manufacturing is under pressure

- rising wages, production costs and transportation costs

- With a predicted growth rate in the region of 8.4% (down from 9.2% in 2011), China remains an attractive investment destination

- China is targeting annual inward FDI of US$120 bn by 2015

- Rapid expansion of Chinese consumer market will mean China continues to attract FDI inflows, particularly in the service sector

- FDI predicted to continue to flow to booming inland cities in search of cheaper labour and fast growing markets

- End of 2011, China saw decline in FDI from U.S. and Europe as developed countries struggled to keep economies afloat

- China’s 2012 target: to stabilise scale of FDI and improve quality

- Aim to bring high-tech and management experience from developed countries to transform China to innovative economy

- Foreign investment encouraged in non-traditional sectors

- During 5-day visit to US by Vice-President Xi Jinping, a package of agreements worth US$38.6 billion was agreed, including 25 investment projects by US investment companies in China

NEW POLICIES ON FDI IN CHINA

Foreign Direct Investment in China

- In 2009, China was the second largest recipient of FDI, attracting US$95 billion

- In 2010, China attracted FDI of US$105.7 billion

- In the months to November 2011, FDI into China reached US$103.8 billion

Opinions on Further Improving the Work of Utilizing Foreign Investment (“2010 State Council Opinions”)

- Issued by the State Council of China on 13 April 2010

- A high level policy document spelling out broadly the industries and geographic regions in which foreign investment is to be encouraged

- cover five key areas:

- promoting foreign investment in specific high tech and environmentally friendly industries

- encouraging foreign investment in China’s central and western regions

- diversifying the use of foreign investment

- streamlining the foreign investment approval system

- improving the investment environment for foreign investors

Promoting foreign investment in specific high tech and environmentally friendly industries

The 2010 State Council Opinions confirmed that the Foreign Investment Catalogue would be revised to encourage foreign investment in:

- high-end manufacturing

- high-tech development

- modern services

- new energy

- environment protection

- energy saving

Foreign investment in high polluting and high-energy-consuming projects or in industries already suffering from overcapacity, would be restricted

Specific measures to benefit qualified foreign investment include:

- the introduction of an exemption for qualified foreign-invested research and development centres from China customs duty and value-added tax on the import of goods required for research work

- discounted land prices at 70% of the statutory minimum price for some qualified projects failing under the “encouraged” category

- the improvement of procedures for determining new and high technology enterprises to enable foreign invested enterprises (“FIEs”) to benefit from the status

Encouraging foreign investment in China’s central and western regions

- the encourage FDI in labour intensive industries meeting environmental protection standards

- local governments to offer incentives (e.g. preferential corporate income tax treatment)

- Foreign banks encouraged to set up operating branches in the central and western regions

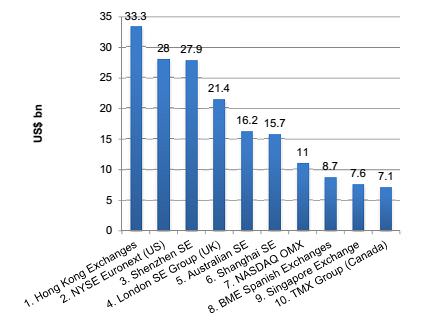

Diversifying Foreign Investment

- foreign investors to be encouraged to buy into Chinese enterprises through mergers and acquisitions

- foreign investors encouraged to become strategic investors in companies listed on China’s domestic stock exchanges

- China will expand the qualifications for foreign issuers authorized to issue RMB-denominated bonds

- China aims to list more qualified FIEs on its domestic stock exchanges

- China will expedite, on a pilot basis, market opening to foreign-invested guarantee companies

- China to encourage investment from foreign-invested venture capital and private equity funds, and improve exit mechanisms

FDI Approval System Reform

Commitment to streamlining and simplifying China’s foreign investment approval process

Provincial level branches of MOFCOM and the National Development and Reform Commission (NDRC) should have authority to approve foreign investment projects with a total investment amount of up to US$300 million (increased from US$100 million) in the “encouraged” or “permitted” categories under the Foreign Investment Catalogue

Increased threshold does not apply to projects expressly reserved for approval at the central government level

The threshold for foreign-invested projects under the “restricted” category requiring central level approval remains at US$50 million

The increased approval authority of provincial level authorities formally implemented by MOFCOM’S “Circular on Delegating the Examination and Approval Power for Foreign Investment Projects” (10 June 2010) and the NDRC’S “Circular on Effectively Delegating Approval Authority for Foreign-Invested Projects” (4 May 2011)

Improvements to the Investment Environment for Foreign Investors

Proposals include:

- measures to improve foreign exchange control procedures for foreign invested enterprises

- regulators to be permitted to delay or extend the approved capital contribution schedule for foreign investors encountering temporary financial difficulties

12th Five Year Plan – Strategic Emerging Industries (SEI)

- Approved by the National People’s Congress in March 2011

- Key aspects: economic restructuring, the environment and energy efficiency, scientific development and developing SEIs

- Introduces 7 strategic emerging industries (“SEI”) designated as the drivers for China’s future economic development

The seven SEIs are:

- Bio-technology

- New energy

- High-end equipment manufacturing

- Energy conservation, environmental protection

- Clean-energy vehicles

- New materials

- Next-generation IT

Central government aims to grow these seven industries from 5% of GDP in 2010, to 8% by 2015 and 15% by 2020

Guiding Opinions on Promoting the International Development of Strategic Emerging Industries

- jointly issued by MOFCOM and the NDRC on 8 September 2011

- provide a broad framework for adoption of specific policies to develop SEIs and to attract FDI in SEIs

- FDI in SEIs to be actively promoted

- R&D by foreign investors and joint sino-foreign R&D to be encouraged

2011 New Guidelines for Foreign Direct Investment

- Catalogue for Guiding Foreign Investment in Industry (Foreign Investment Catalogue) revised December 2011 (“New Catalogue”)

- New Catalogue came into force on 30 January 2012 replacing the 2007 version

- Cornerstone of China’s regulatory regime for foreign investment

- Structure unchanged: divides China’s industrial sectors into “encouraged,” “restricted” and “prohibited” categories

- New Catalogue reflects priorities established by the 2010 State Council Opinions and the 12th Five Year Plan

- Prioritizes foreign investment in high-technology industries, high-end manufacturing, energy conservation, environmental protection and advanced services

Further opening-up to foreign investment

Compared to the 2007 catalogue, the New Catalogue :

- increased the number of industries in the encouraged category by 3 to a total of 354 industries

- removed 7 industries from the “restricted” category to leave 80 industries in this category

- removed 1 industry from the “prohibited” category leaving 39 industries in this category

- reduced by 11 the number of industries subject to restrictions on foreign investment equity ratio

Encourage transformation and upgrading of the manufacturing industry

- new products and technologies in the textile, chemical and mechanical manufacturing industries added to the “encouraged” category

- collection and treatment of waste electronic appliances and electronic products, mechanical and electrical equipment, and batteries added to the “encouraged” category

- whole vehicle manufacturing removed from the “encouraged” category

- production of polysilicon and chemical products using coal as a raw material removed from the “encouraged” category

Cultivation of strategic new industries

- foreign investment encouraged in the seven strategic emerging industries identified under the 12th Five Year Plan

- manufacture of key component parts for new energy vehicles and next-generation internet system equipment based on IPv6 added to “encouraged category”, and removes the equity ratio requirement for new energy electricity-generating equipment

Promotion of the development of service industries

- nine service industries added to the “encouraged” category including motor vehicle charging stations, venture capital enterprises, intellectual property rights services, marine oil pollution clean-up services and vocational skills training services

- medical service institutions moved from the “restricted” to the “permitted” category

- Financial leasing companies moved from the “restricted” to the “permitted” category (but foreign investment in banks and other financial institutions (including insurance companies) remains restricted)

- in the real estate sector, construction of villas (single family homes) moved from the “restricted” to the “prohibited” sector

Promote coordinated regional development

- items removed from the “encouraged” category may be included in the proposed revisions to the Catalogue for Guiding Foreign Investment in the Dominant Industries of the Central and Western Regions 2008 expected this year

- will encourage foreign investment in labour-intensive projects that meet environmental protection requirements in central and western regions

Relationship with other industrial policies and Bilateral Treaties

- in case of discrepancies between Catalogue and other industrial policies, State Council rules or treaties that China has entered into with other countries, the latter will prevail

China Approves 12th 5 Yr Plan for Western Regions

- 20 February 2012: China State Council announced approval of 12th Five Year Plan for Further Promoting the Economy of the Western Regions

- Aim: narrow gap between wealthy coastal regions and under-developed western regions

- 12 provinces: Xinjiang, Tibet, Inner Mongolia, Guangxi, Ningxia, Gansu, Qinghai, Sichuan, Chongqing, Shaanxi, Guizhou and Yunnan consolidated into economic zones

- Key to success will be infrastructure development

- Western China to be better integrated in national transport network by connecting it with booming Yangtze River Delta, Pearl River Delta and Bohai Bay Zone Regions

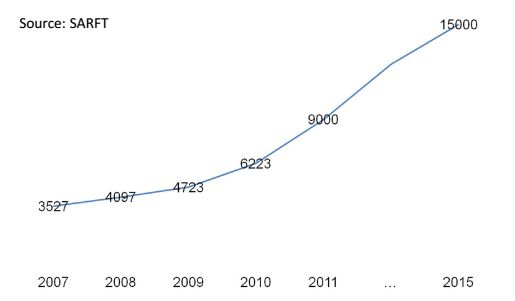

- Region’s railway network expected to expand by circa 15,000 km by 2015. Investment in highways, airports, and oil and gas network expected

- Over last 5 yrs, western provincial economies expanded by average of 13.6% and over 365,000 km of highways and 8,000 km of railways built

- Plan has strong ecological focus: by 2015, almost 20% of land is required to be covered by forests

- 15% cut in energy use per GDP unit required from that at end of 2010

Cross-border Direct Investment in RMB

- MOFCOM issued the Notice on Cross-border Direct Investment in RMB on 12 October 2011 (“MOFCOM Notice”)

- “Cross-border direct investment in RMB” refers to direct investment in a Chinese company by a foreign investor using legitimately obtained offshore RMB funds.

- RMB funds will be “legitimately obtained” if :

- obtained from RMB settlement of cross-border trade

- RMB profits and RMB funds from share transfer, capital reduction, liquidation and advance recovery of investment obtained from within China and remitted out of China

- raised outside China, including from offshore issues of RMB-denominated bonds or other securities

- offshore RMB can be invested in any industry (subject to compliance with all other regulations governing foreign investment), but using offshore RMB to purchase Chinese listed securities or financial derivatives or for entrustment loans is prohibited

FDI made in RMB subject to the same rules and regulations governing foreign investment as investments made in foreign currencies, including the requirement for approvals from Central MOFCOM or its provincial counterparts

Central MOFCOM approval required for:

- investment of RMB funds of RMB 300 million or more

- investment in the sectors of financing guarantee, financial leasing, microfinance or auction

- investment in a foreign-funded investment company, a foreign-funded venture capital enterprise or a foreign-funded equity investment enterprise

- investment in an industry under the macroeconomic control of the government, such as cement, iron and steel, electrolytic aluminum and shipbuilding

Additional documents to be submitted for RMB FDI are:

- a certificate or explanation as to the source of the RMB funds

- a statement as to how the funds will be used

- a standard government form, the Statement on Cross-border Direct Investment in RMB

PBOC Administrative Measures on RMB Settlement in Foreign Direct Investment

- published by PBOC on 13 October 2011

- significantly simplify approval process for repatriating RMB funds to China

- repatriation of offshore RMB to foreign-invested enterprises no longer requires PBOC approval, whether in the form of debt or capital contribution

- application for opening an RMB settlement account need only be made to the Chinese receiving bank which is then required to make a filing with the local branch of PBOC only after opening of the account

- Chinese receiving banks given primary responsibility for monitoring the use of RMB funds repatriated into China

Relaxation of withholding tax on earnings of foreign companies

- The SAT reduced the withholding tax on dividends repatriated from China by 50% (from 10% to 5%)

- The new tax reduction also applies to QFII

- The new tax reduction will only apply to companies and shareholders based in foreign countries where they have double taxation agreements with China, including Hong Kong, Singapore and United Kingdom

- The current arrangement does not have any conditions attached, unlike the previous reduction in 2009

- In 2011, almost USD 65 billion of dividends was repatriated and USD 8.6 billion withholding tax was collected

- It is hoped that the reduction can save foreign investors billions of dollars of tax payments, therefore encouraging more foreign investments in China

CHINA’S MINING LAW

Key facts of China’s mineral reserves

- 92% of the country’s primary energy

- 80% of the industrial raw and processed materials

- 70% of the agricultural means of production

…come from mineral resources in China

General characteristics

- Fairly large in quantities

- Fairly complete in variety

- Geographic mismatch between production and consumption

- Superior ores exist side-by-side with inferior ores

| Characteristics | |

| Eastern region |

|

| Central region |

|

| Western region |

|

- Core policy: rely on foreign capital and technology for exploitation of domestic mineral resources

- All mineral resources belong to the Chinese government

- Major legislation: Mineral Resources Law (amended in August 1996)

- Main authority: the Ministry of Land and Resources

Exploration of mineral resources

- Exploration permit:

- Issued in the form of 3-year leases renewable upon discovery of resources

- Rights

- A priority and an exclusive right to obtain the “mining right”

- Transfer the exploration permit subject to approval and compliance with exploration expenditure

- Obligations:

- Pay scheduled minimum exploration expenditure and permit fees

- Commence and complete the exploration within the term

- No unauthorised mining activities

- Reports on regional geological surveys

- Submit a preliminary comprehensive assessment regarding the mineral deposits explored

- Comply with safety requirements when exploring fragile, explosive and radioactive minerals

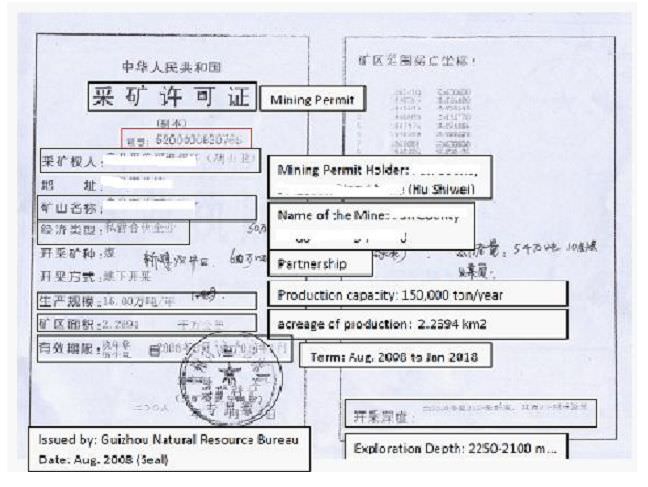

Sample of an exploration permit

- Documents to be submitted for forming foreign-invested exploration enterprise (Article 8 of “Measures for the Administration of Foreign-Invested Mineral Exploration Enterprise”):

- Application

- Feasibility study report

- Contract and bylaws

- List and letters of appointment of board directors

- Notice of pre-approval of enterprise name issued by administrative department of industry and commerce

- Registration and credit certifications

- A statement on the formation of exploration rights and survey input (if applicable)

- A statement on the status of business operation

- A land use right certificate

Mining of mineral resources

- Mining rights:

- Holders called “concessionaires”

- For large mining projects, maximum term is 30 yrs

- For smaller mining projects, the term may be lowered to 10 yrs

- Rights:

- Sell the mineral products privately

- Gold and silver can now be sold freely

- Obligations:

- Commence mining within the terms of the mining permit

- Adopt rational and proper mining methods

- Observe labour, production safety and health and environmental laws

- Rehabilitate the land to its previous conditions if damage is done

- Obtain approval before construction of infrastructures necessary for the mining

- Pay resources tax and compensation RMB 1,000 per sq. km. of mining area per annum

Sample of a mining right permit

Foreign investment

| Mineral resources | |

| Encouraged projects | Coal-bed gas, mine gas, oil & natural gas, low permeability oil & gas, technology for enhanced oil recovery, technologies for geophysical prospecting, drilling, well logging, mud logging, down-hole operation, oil shale, oil sand, heavy crude oil, extra-heavy crude oil, shale gas and marine gas hydrate |

| Restricted projects | Rare coal, barites, precious metal, diamonds, high-aluminum fireclay, wollastonite, graphite, szaibelyite, ludwigite, celestite, marine manganese nodule |

| Prohibited projects | Tungsten, molybdenum, tin, stibonium, fluorite, rare earths minerals, radioactive minerals |

Since April 2010, any encouraged projects with investment less than USD 300 million can be approved at local level instead of central government level

Tax

- Taxes include:

- Value-added tax

- Mineral resources compensation

- Corporate income tax

- City construction tax

- Land use tax

- Business tax

- New resources tax

- Instead of taxing based on output volume, the new resources tax regulation imposes a 5% – 10% levy on the basis of sales amount

Environmental protection

- Requirements:

- Registration with environmental protection authorities

- Prepare a report on the environmental impact of any mining infrastructure

- Pay air pollutants and wastewater discharge fees

- Install de-sulphurising devices for discharge of sulphur dioxide

Production safety

- Requirements:

- Must hold valid production safety certificate

- Allow inspection of relevant authorities

- Install at least two safety exits for each underground mine shaft

- Equip mines with transportation and communication facilities connecting the mine to the outside

- Only trained workers are allowed to work in mines

WTO Disputes

WTO ruling

- Highlights:

- China’s restrictions on mineral exports violate WTO rules

- Rare earths minerals were not the subject of the ruling

- But … the ruling may have important implications for China’s restrictions on exports of rare earths minerals

- Now, China holds 37% of the world’s known reserves and produces 95% of rare earths minerals

- Rare earths minerals are considered strategic resources of China

- China has indicated its intention to comply with WTO

- Therefore, China might need to further open up its market of strategic minerals to foreign enterprises

Recent development – WTO Complaint

- Highlights:

- the US, Japan and the European Union jointly filed a case of complaint against China at the WTO, challenging China’s restriction on rare earth exports

- China indicated its intention to defend the case

- But … Two months following the filing of complaint, China decided to allow 11 more companies to export rare earths

- Export quota increased by 10,680 tonnes, on top of the 10,546 tonnes initially allowed for the year

- China is set to release additional annual quotas during the summer which is likely to match last year’s quota

China’s Anti-Monopoly Law

- China’s Anti-Monopoly Law (“AML”) came into effect on 1 August 2008

- Supplemented by a number of implementing rules and guidelines

AML prohibits three types of monopolistic conduct:

- “monopoly agreements” (i.e. anti-competitive agreements) made between business operators

- abuse of a dominant market position

- concentrations of business operators (inc. mergers/acquisitions) that may eliminate or restrict competition

Chapter V AML prohibits the abuse of administrative powers to restrict competition

The Enforcement Agencies

3 Anti-Monopoly Law Enforcement Agencies (“AMEAs”):

- Anti-monopoly Bureau of the Ministry of Commerce (“MOFCOM”) – responsible for merger review

- National Development & Reform Commission (the “NDRC”) – responsible for price-related anti-competitive agreements, abuse of market dominance and abuse of administrative power

- State Administration for Industry and Commerce (“SAIC”) – responsible for non-price related anti-competitive agreements, abuse of market dominance and abuse of administrative power

Primary enforcement focus to date – merger control

Up to mid-December 2011, some 369 merger applications reviewed – vast majority (97%) cleared unconditionally

Only one merger application rejected outright (Coca Cola’s proposed 2009 acquisition of Huiyuan juice)

To date, 15 mergers have been approved subject to conditions

Far fewer enforcement actions of anti-competitive agreements and abuse of market dominance

2011/2012 Update

Clear signs that enforcement authorities ready to step-up enforcement actions

NDRC and SAIC issued 5 new implementing rules – greater clarity re. conduct prohibited under anti-competitive agreements and abuse of dominance provisions

NDRC imposed highest fine to date (US$1.1 million) on 2 pharmaceutical companies for market division and price fixing

NDRC’s anti-trust investigation into China’s two largest state-owned telecommunications companies – China Telecom and China Unicom

Mergers – 4 conditional clearances in 2011, 5 conditional clearances in 2012

February 2012 implementation of new MOFCOM Rules imposing fines for failure to notify a merger

New National Security review process implemented

Monopoly Agreements

“Monopoly agreements” = agreements, decisions or other concerted behaviour that eliminate or restrict competition

Specific types that are prohibited:

- horizontal monopoly agreements between competing business operators, which:

- fix or change the price of commodities

- restrict the production quantity or sales volume of commodities

- divide the sales market or raw materials supply market

- restrict the purchase of new technology or new facilities, or restrict the development of new technology or new products

- jointly boycott transactions

- any other monopoly agreements as determined by the relevant Anti-monopoly Law Enforcement Agency (Article 13 AML)

- vertical monopoly agreements between business operators and their trading partners, which:

- fix the resale price of commodities to third parties

- restrict the minimum resale price of commodities to third parties

- of a type specified by the relevant Anti-monopoly Law Enforcement Agency (Article 14 AML)

Possible Exemptions

Possible exemption for monopoly agreements having valid purpose:

- improving technology or researching and developing new products

- improving product quality, reducing costs, increasing efficiency, unifying product specifications and standards, or implementing a division of labour based on specialisation

- improving the efficiency and competitiveness of small and medium-sized enterprises

- a purpose in the public interest – e.g. conservation of energy or environmental protect

- mitigating a severe decrease in sales volume or excessive over-production during an economic recession

- protecting the legitimate interests of foreign trade or foreign economic cooperation

AND business operators must be able to prove:

- agreement will not substantially restrict competition in the relevant market and

- Consumers will benefit from the agreement (Article 15 AML)

Penalties

Penalties include:

- Orders to cease prohibited conduct

- Confiscation of illegal gains

- Fine of between 1% and 10% of the entity’s turnover for previous year (unclear if fines based on world-wide or China-wide turnover)

Where monopoly agreement not yet implemented – fine of up to RMB500,000

Trade associations that breach AML by facilitating the entering into of anti-monopoly agreements by members – fine up to RMB500,000 or loss of authorisation status

Abuse of a Dominant Market Position

Business operators with a dominant market position prohibited from:

- selling commodities at unfairly high prices or buying commodities at unfairly low prices

- selling commodities at prices below cost without legitimate reasons

- refusing to transact without legitimate reasons

- compelling the counter party to trade exclusively with party in a dominant market position or its designated party

- imposing unreasonable trading conditions or “tie-ins” to sales without legitimate reasons

- applying discriminatory treatment on transaction terms (e.g. prices) to counter parties of equal standing

- any other behaviour that abuses the dominant market position as determined by the AMEA (AML Article 17)

Abuse of a Dominant Market Position

Definition of “dominant market position”

“Dominant market position” = position of a business operator able to:

- control price or quantity of products or other trading conditions in relevant market or

- block or affect ability of other business operators to enter relevant market

“Other trading conditions” include commodity grades, terms of payment, methods of delivery, after-sale services etc

Factors in determining existence of dominant market position:

- business operator’s market share and competitive status in relevant market

- business operator’s ability to control sales market or raw materials supply market

- business operator’s financial position and technical prowess

- extent to which other business operators rely on the business operator

- degree of difficulty for other business operators to enter relevant market

- other relevant factors (Article 18)

Presumption of dominant position

Rebuttable presumption of a dominant market position previously where:

- sole business operator has market share of half or more

- 2 business operators have joint market share of two-thirds or more

- 3 business operators have joint market share of three quarters or more (Article 19)

No dominant market position under (b) or (c) for business operator with market share < 10%

Penalties

Penalties: orders to cease prohibited conduct, confiscation of illegal gains and fines of 1% – 10% of previous year’s turnover

Supreme Court’s Regulations on issues in civil cases arising from monopolistic conduct

- the plaintiff bears the burden of proof of dominant market position and abuse

- the plaintiff may use publicly available information as prima facie evidence of dominance

- once dominance and abuse are established, the defendant bears the burden to establish acceptable justification

Public utility enterprise and monopoly protected by law

- the court can conclude the existence of dominant market position having regard to the market structure, competitive status of the enterprise and any other evidence tendered by the defendant

Abuse of Administrative Power

Administrative bodies prohibited from exercising powers to eliminate/restrict competition

- designating suppliers of goods or services and compelling others to use them

- prevent the free circulation of goods or services by:

- setting or implementing discriminatory charges or fixing discriminatory prices for non-local commodities

- imposing technical requirements or inspection standards that discriminate in favour of local commodities

- adopting administrative licensing aimed at non-local commodities

- setting barriers or taking other measures to restrict commodities from outside the region entering the local market or local commodities from moving outside the local region

- operating bidding procedures which favour local suppliers

- restricting investment or preventing non-local companies establishing presence through requirements not applicable to local counterparts

- compelling business operators to engage in prohibited conduct

New 2011 NDRC and SAIC Rules

1 February, 2011 – 5 sets of implementing rules came into effect

NDRC Rules are:

- the Rules on Anti-Pricing Monopoly

- the Rules on the Administrative Procedures of Anti-Pricing Monopoly

SAIC Rules are:

- the Rules on Prohibiting Monopoly Agreements

- the Rules on Prohibiting the Abuse of Dominant Market Positions

- the Rules on the Abuse of Administrative Authority to Exclude or Restrict Competition

NDRC Rules deal with price-related AML infringements: SAIC Rules deal with non price-related infringements

NDRC Rules = first price-related regulations published by the NDRC

Key points on Monopoly Agreements

- NDRC and SAIC Rules define “concerted practices” – but with slight differences

- concerted practice if evidence of parallel conduct and communications between competing companies

- NDRC will take into account market structure and market trends

- SAIC will consider parties’ reasonable explanations

NDRC Rules give examples of prohibited pricing agreements between competitors:

- fixing or changing prices

- fixing or changing range of price variation

- fixing or changing fees affecting prices or discounts

- using agreed prices as basis for third party dealings

- agreeing standard formula for price calculation

- providing prices will not be changed without the consent of competing companies party to the agreement

- disguised forms of price-fixing e.g. restricting supplies to artificially inflate prices

Prohibited non-price related anti-competitive agreements include:

- restrictions on production or sales

- market sharing and customer allocation including allocation of raw materials procurement or suppliers

- restricting purchase of new technology or equipment or restricting development of new technology or products

- joint boycotts of customers or suppliers

Vertical agreements – only fixing of resale price and setting minimum resale price are prohibited

Trade associations prohibited from:

- formulating rules or issuing orders restricting competition

- arranging for members to enter into anti-competitive pricing agreements

Key Points on Abuse of Market Dominance

NDRC Rules elaborate on prohibited pricing practices for companies in dominant market position, including:

- selling products at substantially higher prices than same products sold by other companies or purchasing products at substantially lower prices

- price discrimination among parties of equal standing

- increasing sales price (or decreasing purchase price) “beyond a normal range” when costs are stable

- increasing sales price substantially higher than cost increase or decreasing sales price substantially lower than cost decrease

- selling below cost price

- refusing to trade by setting “extraordinarily” high or low prices

- trade exclusivity through use of a price discount

- imposing “unreasonable” charges

Except for charging substantially higher prices than competitors, under NDRC Rules there is no abuse if business operators can justify conduct

Sales below cost can be justified for:

- sales of fresh, seasonal, expiring or overstock goods

- sales due to debt payment, transfer of business or going out of business

- promotion of new products

Refusing to trade by setting “extraordinarily” high or low prices justified if counterparty:

- has bad credit history or deteriorating operations

- can purchase / sell same or substitute goods at reasonable price

Non-price related abuse of dominant market position includes, without justification:

- refusal to deal, including by limiting sales volumes or delaying transactions

- imposing exclusivity obligations

- tying products or imposing other unreasonable transaction terms

- other forms of discrimination

SAIC Rules give no specific examples of acceptable “justification” of prohibited conduct

SAIC considers whether conduct:

- is part of business operator’s normal business

- is the public interest and its effect on national economy

Key Points concerning Abuse of Administrative Authority to Eliminate or Restrict Competition

Further detail of types of prohibited conduct on part of administrative bodies:

- administrative bodies prohibited from abusing powers to restrict entry of non-local products through discriminatory charges or prices

- administrative bodies cannot compel business operator to breach new rules or restrict competition

- if so, both the administrative body and business operator will be liable for the anti-competitive conduct

NDRC’s Procedural Rules

Give AML enforcement authority to price administration departments at provincial level

Investigative power can be delegated to price administrative department at next level below

Important cases to be handled by NDRC

Business operator under investigation can apply for suspension of investigation if it commits to eliminate consequences of anti-competitive behaviour

- 1st business operator to report a price-related monopoly agreement and provide material evidence may be granted full immunity from penalties

- 2nd business operator reporting monopoly agreement may be given a reduced penalty of no more than 50% of statutory sanction

- Business operators who subsequently report may be given reduced penalties of no less than 50% of statutory sanction

SAIC’s Procedural Rules

Under SAIC’s June 2009 procedural provisions, different leniency provisions:

- 1st business operator to report infringing conduct will be granted immunity (under NDRC’s provisions, immunity is discretionary)

- no leniency for business operators subsequently reporting

- no leniency for ring-leaders

Possibility of forum shopping?

Possible overlapping jurisdiction of NDRC and SAIC?

Enforcement Decisions against Anti-Competitive Agreements

The Rice Noodle Cartel (30 March 2010)

- Finding: 33 rice noodle producers colluded to raise prices

- Violation of the Price Law, the AML and related regulations

- 3 organizers of cartel each fined RMB 100,000

- 18 participants fined between RMB 300,000 and RMB 800,000

- 12 participants who cooperated received administrative warnings only

Paper Manufacturing Cartel (4 January 2011)

- Fuyang Paper Making Industry Association (“Association”) organized meetings to coordinate prices of paper product

- Association breached AML and Price Law for facilitating members’ engagement in monopolistic conduct

- Association fined RMB 500,000

Cement Cartel (26 January 2011)

- SAIC’s first published enforcement decision under AML

- Non-price related cartel organized by trade association between 16 concrete producers

- Trade association had divided market and sold zones of control to members

- Association members also in breach for entering monopoly agreement to divide market

- Trade association fined RMB 200,000 for organizing cartel

- 5 members fined total of just over RMB 530,000 and illegal gains

Unilever Price Signalling (6 May 2011)

- Wide-spread media reports of plans of Unilever (and 3 other companies) to raise prices of consumer products

- Panic buying led to NDRC investigation

- 1st time NDRC fined a foreign company under Price Law

- Unilever fined RMB 2 million

- NDRC noted that Unilever’s press announcements could have amounted to “price concerted practices” in breach of AML (potentially far higher fine of up to 10% of previous year’s turnover)

“Shuntong” & “Huaxin” Price Cartel (14 November 2011)

- Shuntong and Huaxin signed exclusive sales agreements with China’s only producers of raw material for blood pressure tablet, then raised price

- Shuntong and Huaxin fined total of about US$1.1 million (including confiscated gains) for monopolizing bulk sales of raw material

- Highest fine imposed to date for anti-competitive conduct

- First pharmaceutical sector antitrust action under AML

Enforcement Actions for Abuse of Dominant Market Position

Wuchang Salt Company Tying Case (15 November 2010)

- Only published decision on abuse of dominant market position

- Wuchang branch of Hubei Salt Group Co., Ltd. (“Wuchang Salt”) made its supply of salt to 2 local distributors conditional on purchase of washing detergent powder, another of Wuchang Salt’s products

- Wuchang Salt, only company authorised to sell salt in the area, held a dominant market position

- Finding: Wuchang Salt had engaged in anti-competitive tying

NDRC’s Investigation of China Telecom and China Unicom

- November 2011, NDRC confirmed investigation of China Telecom and China Unicom for alleged abuse of a dominant market position in the broadband access market

- Most high profile investigation under AML to date

- 1st antitrust investigation of SOEs

- NDRC preliminary finding of joint market share of > two-thirds of broadband access market = dominant market position

- Preliminary finding that companies charged competitors significantly higher prices than non-competitors (i.e. price discrimination)

- China Telecom and China Unicom have applied to the NDRC to suspend anti- trust investigation

Enforcement Actions For Abuse Of Administrative Power

- 2011 saw first enforcement action for abuse of administrative power

- Municipal government abused administrative powers and restricted competition in breach of AML by implementing decisions favouring particular company

Merger Control: Notification of a Concentration of Business Operators

Anti-Monopoly Bureau of MOFCOM must be given prior notification of concentrations of business operators reaching certain turnover thresholds

“Concentration of Business operators” is:

- a merger of business operators

- a business operator’s acquisition of control of other business operators through acquisition of shares or assets

- a business operator’s acquisition of control of other business operators, or its ability to exert a decisive influence over other business operators, by contract or any other means

No notification is required:

- if one business operator involved in the concentration holds 50% or more of the voting shares or assets of every other business operator involved in the concentration or

- a business operator not involved in the concentration holds 50% or more of the voting shares or assets of every business operator involved in the concentration (Article 22 AML)

Notification thresholds

Filing mandatory if:

- EITHER combined worldwide turnover of all business operators involved exceeded RMB 10 billion in previous financial year OR combined China revenue of all business operators involved exceeded RMB 2 billion in previous financial year AND

- China revenue of each of at least two business operators exceeded RMB 400 million in previous financial year

Provisions on the Notification of Concentrations of Business Operators:

- contain detailed rules on calculation of turnover (group-wide turnover)

- give MOFCOM residual power to investigate transaction if it may eliminate or restrict competition in China even where thresholds are not met

MOFCOM to publish guidance on investigation of mergers below thresholds in 2012

Review Process

- Pre-Review Discussions (no fixed time limit)

- Phase 1 Review – 30 days

- Phase 2 Review – 90 days extendable for further 60 days

Transaction cannot be implemented until cleared

But transaction deemed approved if MOFCOM fails to make decision by end of Phase 2

MOFCOM consults widely and puts burden on parties to respond to third party objections

Parties can propose restrictive conditions to eliminate/reduce negative impact on competition at time of notification or during review process

Conditions can be structural (e.g. divestiture of assets or business) or behavioural (e.g. providing access to technology or terminating exclusive agreements)

Possible changes on Review Process

- creation of a “fast-track” procedure for cases of simple relevant markets and small market shares

- this may be achieved by classifying M&A applications according to the market shares companies held before formal investigations

Rationale behind the possible changes

- number of M&A applications surged from 17 in 2008 to 200 in 2011

- increasing complexity of M&A cases

- increasing plans for global companies to expand in China

- lack of human resources of MOFCOM

- worries that delay in approval procedure may upset optimal time for the M&As

The Substantive Review

In assessment of whether concentration will eliminate or restrict competition, MOFCOM considers:

- the market share of the business operators and their ability to control relevant market

- the degree of concentration in the relevant market

- the impact of proposed transaction on market access and technological progress

- the impact of proposed transaction on consumers and other relevant business operators

- the impact of proposed transaction on development of the national economy and

- other relevant factors (as determined by MOFCOM) (Art. 27 AML)

The Interim Provisions on Assessing the Impact of Concentration of Business Operators on Competition

- Interim Provisions on Assessing the Impact of Concentration of Business Operators on Competition (Interim Provisions) came into effect on 5 September 2011

- In assessing negative impact on competition, MOFCOM first considers whether concentration will give any one business operator the ability, incentive or possibility to exclude or restrict competition on its own (i.e. unilateral effect)

- If there are very few business operators in relevant market, MOFCOM considers whether concentration will result in or enhance the ability, incentive or possibility of those business operators to jointly exclude or restrict competition (i.e. co-ordinated effect)

- When business operators not actual/potential competitors, MOFCOM assesses whether concentration likely to exclude or restrict competition in an upstream, downstream or related market

Interim Provisions:

- identify market share/control of relevant market and market concentration levels as most important factors

- list factors relevant to determining whether parties will obtain or increase control of relevant market

- recognise Herfindahl-Hirschman Index (HHI index) and Concentration Ration Index (CRn index) as useful means of calculating degree of market concentration

MOFCOM can approve transaction if beneficial outcome outweighs its negative impact on competition. Acceptable beneficial outcomes are where transaction:

- Will allow better integration of resources or research capacity/development facilitating technical progress

- Will achieve economies of scale and scope, reduce production costs and increase product variety

- Will increase competitive pressure on other business operators to improve product quality and reduce product prices

- Will facilitate expansion of business scale and enhancement of market competitiveness

Burden of proving beneficial outcome falls on parties to notified transaction

MOFCOM also able to consider whether any party is facing bankruptcy

Remedies

MOFCOM must prohibit a concentration if it will or may eliminate or restrict competition

But MOFCOM can approve a concentration if parties can prove that:

- the positive impact of concentration on competition outweighs its adverse impact or

- the concentration is in the public interest

3 possible outcomes – MOFCOM:

- Blocks transaction

- Clears transaction

- Clears transaction subject to conditions

Conditions may be structural and/or behavioural

Any divestiture must be conducted in accordance with the Interim Provisions on the Divestiture of Assets or Businesses in Concentrations of Business Operators which came into effect in July 2010

- business operator required to divest assets must enter final agreement with purchaser w/in time limit prescribed by MOFCOM

- transfer of legal title must be complete w/in 3 months of transfer agreement

- seller must appoint a “supervision trustee” to oversee divestiture

- “divestiture trustee” will carry out divestiture if business operator does not

Clearance Statistics

| Year | Total | Without conditions | With conditions | Rejected |

| 2008 | 17 | 16 | 1 | 0 |

| 2009 | 80 | 75 | 4 | 1 |

| 2010 | 117 | 116 | 1 | 0 |

| 2011 | 155 | 151 | 4 | 0 |

| 2012 | (2012 figures not yet available) | (2012 figures not yet available) | 5 | 0 |

| Total | More than 500 (estimated) | (2012 figures not yet available) | 15 | 1 |

Merger Control Decisions

Coca-Cola / Huiyuan (18 March 2009)

- Coca-Cola’s proposed US$ 2.4 billion acquisition of China Huiyuan Juice Group Limited (“Huiyuan”)

- Only transaction blocked to date

- Huiyuan = China’s largest juice manufacturer and well known brand

- Coca-Cola controlled 52.5% of China’s carbonated drinks market and 12% of fruit and vegetable juice market

- MOFCOM’s decision: Coca-Cola acquisition would eliminate or restrict competition in China fruit juice market

- 1st reason: after acquisition, Coca-Cola would be able to take advantage of dominant position in carbonated soft drinks market to increase sales in fruit juice market, in turn restricting competition between other fruit juice suppliers

- 2nd reason: Coca-Cola’s control of juice market would be increased by control of 2 well-known brands: Huiyuan and “Minute Maid” brand already owned by Coca-Cola

- 3rd reason – small & medium size juice companies would find it difficult to compete (Art. 27 AML allows MOFCOM to consider effect on competitors and consumers)

- Overseas criticism of decision: view that primary motivation was protectionist

Recent Approvals of Foreign Acquisitions of Chinese brands

Recent decisions eased concerns that AML will be used to prevent foreign acquisition of Chinese brands

Unconditional Clearance of Nestle S.A.’s Acquisition of Hsu Fu Chi International Ltd.

- December 2011, MOFCOM approved Nestle S.A.’s US$1.7 billion acquisition of 60% stake in Chinese candy maker, Hsu Fu Chi International

- Approval makes Nestle China’s second-largest confectionary company by sales after Mars Inc. of USA

Nestle’s acquisition of 60% stake in Xiamen Yinlu Group

- MOFCOM unconditionally cleared Nestle’s acquisition of 60% stake in Xiamen Yinlu Group (privately-owned drink and porridge maker) in September 2011

Acquisition by Yum Brands Inc. of Little Sheep Group Ltd.

- MOFCOM unconditionally cleared acquisition by Yum Brands Inc. of U.S.A. of Chinese hot-pot restaurant operator Little Sheep Group in November 2011

- Yum already operated approx 4,000 restaurants in China (inc. KFC/Pizza Hut chains)

- Comments that reason for approval was Little Sheep’s small share of Chinese restaurant market

- Also China’s restaurant industry already open to foreign takeovers (Philippine fast-food giant Jollibee Co. acquired fast-food noodle chain Yonghe King in 2004)

Diageo PLC’s increased stake in Sichuan Chengdu Quanxing Group

- June 2011, MOFCOM approved UK-based liquor giant, Diageo PLC’s acquisition of a further stake in Sichuan Chengdu Quanxing Group taking its stake to 53%

- Deal gave Diageo indirect control of Shujingfang, well-known liquor producer and owner of renowned brand of “baijiu”

Conditional Approvals

Inbev/Anheuser Busch (18.11.2008)

- 1st conditional approval: Acquisition of Anheuser-Busch Companies, Inc/ (“Anheuser Busch”) by InBev NV/SA (“InBev”)

- Anheuser Busch and InBev were part of corporate groups with significant sales revenues/operations in China

- Both parties held sizeable shareholdings in popular Chinese brewers

- Decision found transaction could negatively impact competition in Chinese beer market due to size of acquisition, large market share of post-merger entity and increased competitive strength of post-merger entity

- Conditions required MOFCOM’s consent before:

- increasing Anheuser Busch’s 27% stake in Tsingtao Brewery

- increasing InBev’s 28.56% stake in Zhujiang Brewery

- purchasing any stake in two of China’s largest domestic brewers

- merged entity required to inform MOFCOM of any change to controlling shareholders

Mitsubishi Rayon/Lucite International (24.04.2009)

- US$1.6 bn acquisition of Britain’s Lucite International Group Limited (“Lucite”) by Japan’s Mitsubishi Rayon Co. Ltd. (“Mitsubishi Rayon”) both leading methyl methacrylate (“MMA”) manufacturers with plants in China

- 1st decision to require partial business disposal as condition for clearance

- overlapping MMA business would give merged entity market share of approx 64%: potential to eliminate/restrict competition in MMA market

- Mitsubishi Rayon also had business activities in 2 downstream markets

- Mitsubishi Rayon could restrict competitors’ access to downstream markets due to dominant position in MMA market

- conditions proposed and adopted

- Merged entity to divest 50% of annual MMA production capacity over 5 years w/in 6 months

- Until completion of divestiture, merged entity to operate independently of Mitsubishi Rayon

- merged entity prohibited from expanding MMA monomer, PMMA polymer or cast sheet production in China, without MOFCOM approval, for 5 years

Wyeth Corp (Wyeth) by Pfizer Inc. (Pfizer) (29.09.2009)

- Pfizer’s US$68 billion acquisition of rival pharmaceutical company Wyeth

- Clearance granted subject to condition that Pfizer divest its PRC swine vaccine business to a third party approved by MOFCOM within 6 months to address MOFCOM’s concerns as to the merged entity’s combined market share of about 49.4%

- Other conditions

- divested business to include all assets (including intellectual property) necessary for the divested business to be viable and competitive

- Pfizer to provide technical support to purchaser for 3 years on request

- Pfizer sold swine vaccine business to Harbin Pharmaceutical Group

2011 Conditional Approvals

OAO Uralkali and OAO Silvinit (02.06.2011)

7th conditional clearance of US$7.8 billion merger of two Russian potash producers, OAO Uralkali and OAO Silvinit

- Relevant product market was market for supply of potassium chloride

- MOFCOM found that proposed merger would increase concentration in potassium chloride supply market, give merged entity greater control of market and increase risk of co-ordination among global suppliers

- MOFCOM agreed to behavioural remedies (rather than insist on structural remedies such as divestment)

- Merged entity required to:

- to maintain existing sales practices and procedures in supplying potassium chloride to Chinese customers

- meet Chinese customers’ requirements as to product quantity and range, to satisfy demand for different uses (i.e. agricultural and industrial uses)

- maintain established price negotiation practices with Chinese customers

- appoint a trustee to monitor its compliance with above conditions and report to MOFCOM on implementation every six months

Alpha Private Equity Fund V’s (“Alpha V”) acquisition of Savio Macchine Tessili S.p.A. (“Savio”) (31.10.2011)

- Alpha V’s acquisition of Savio approved subject to condition that Alpha V divest its 27.9% interest in Savio’s Swiss competitor, Uster Technologies AG (“Uster”)

- Transaction not subject to merger control filing in any jurisdiction other than China

- Uster and Savio were only producers of electronic yarn clearers for automatic winders and barriers to market entry were very high

- MOFCOM looked at Alpha V’s influence over Uster and found only that “a possibility that Alpha V may participate in or influence Uster’s business activities cannot be ruled out”

- MOFCOM concluded that Uster and Savio would be able to coordinate through Alpha V to restrict and eliminate competition

- Conditions imposed:

- Alpha V required to divest its interest in Uster to an independent 3rd party w/in 6 months

- Alpha V prohibited from participating in/influencing Uster’s business activities until divestiture completed

- Decision is relevant for private equity groups with large number of significant but non-controlling portfolio company interests

Joint Venture between General Electric (China) Co., Ltd. (“GE China”) and China Shenhua Coal to Liquid and Chemical Co., Ltd. (“Shenhua”) (10.11.2011)

- Establishment of Joint venture (“JV”) between GE China and SOE, Shenhua, approved subject to conditions

- JV would conduct coal-water slurry gasification (CWSG) technology licensing and engineering services

- MOFCOM defined relevant market as technology licensing for CWSG

- GE had largest share of that market

- Shenhua was largest supplier of coal type needed for CWSG

- MOFCOM alleged JV might be able to take advantage of Shenhua’s position as leading supplier of coal for CWSG to restrict competition in CWSG technology licensing market (i.e. in downstream market)

- MOFCOM accepted conditions proposed by Shenhua prohibiting parties from:

- forcing potential licensees of CWSG technology to use JV’s technology by restricting supply of coal or conditioning supply of coal on purchase of JV’s technology and

- engaging in any conduct that would raise licensees’ cost of using other technologies

- Decision significant as:

- 1st decision re. a joint venture project – clarifies that joint ventures subject to AML merger control notification requirements

- 1st “adverse” decision concerning a Chinese company – conditions imposed on Shenhua

- 1st decision involving a major state-owned enterprise – clarifies that SOEs equally subject to AML

Seagate Technology’s (“Seagate”) Acquisition of Samsung Electronics’ (“Samsung”) Hard Disc Drive Business (12.12.2011)

- Conditional approval of acquisition by Seagate of USA of the hard disc drive (“HDD”) business of Samsung of Korea

- MOFCOM’s approval granted subject to significant behavioural remedies to ensure that Samsung, while controlled by Seagate, remains an independent competitor

- Antitrust regulators of USA and EU gave unconditional clearance

- MOFCOM found relevant market (worldwide HDD market) to be highly concentrated

- Of 5 HDD suppliers, Seagate and Samsung had market shares of approx.33% and 10%, respectively

- MOFCOM concluded acquisition would result in removal of key market participant which would allow remaining market participants to co-ordinate their conduct (contrast EU finding that removal of Samsung not likely to lead to risk of coordination among remaining HDD suppliers)

- Far-reaching behavioural remedies imposed requiring Seagate to:

- Invest at least USD 800 million each year for the next three years in R&D

- Keep Samsung as an independent competitor post-transaction in terms of pricing (with firewalls between their respective pricing teams), sales, production and R&D

- Not substantially change its business model and not directly or indirectly force customers to enter into exclusive supply contracts with Seagate or entities under its control

- Not force a supplier of upstream HDD components to enter into an exclusive supply arrangement with Seagate, and not limit the number of upstream components that the supplier may supply to other HDD manufacturers

- Fulfil its commitment to expand Samsung’s HDD production capacity within 6 months, and report the production capacity and volumes of Samsung’s products thereafter

- Appoint an independent trustee to monitor the performance of the above remedies.

- Decision included a review clause entitling Seagate to apply to MOFCOM for a release from its obligations under the remedies (2) and (5) above after 12 months

2012 Conditional Approvals

Google Inc.’s (“Google”) acquisition of Motorola Mobility Holdings Inc. (“Motorola”)

- Google’s $12.5 billion acquisition of Motorola

- China was the last jurisdiction to clear the transaction

- The third time that MOFCOM imposed conditions on a transaction that had been unconditionally cleared in Europe and the US

- This merger review exhausted all the statutory review periods

Consideration

- Relevant market: Smart mobile devices and smart mobile operatingsystems (“OS”)

- MOFCOM however did not define the relevant market for Motorola’s patent portfolio, which was an important target asset of the transaction

- MOFCOM held that Google enjoyed a dominant market position in the OS market

- MOFCOM held that Google might systematically favour Motorola’s handsets for its Android system

- This conclusion is contrary to that of the European Commission

Remedies

Google was required to:

- keep the Android system free and open; and

- Treat all other handsets manufacturers in a non-discriminatory manner with regard to the use of the Android system.

Google and Motorola were required to keep Motorola’s pre-existing commitment to license its patents on fair, reasonable and non-discriminatory terms.

Wal-Mart Stores Inc.’s (“Wal-Mart”) acquisition of Niu Hai Holdings (“Niu Hai”)

- Wal-Mart obtained a controlling stake in Yihaodian (一号店) through acquiring Niu Hai

- Yihaodian is a popular online shopping platform in China which engages in internet direct retail business as well as the service of providing on-line trading platform to other retailers

- Foreign investors are prohibited from participating in the business of providing on-line trading platform to others in China (“Value-added telecommunication service (VATS)”)

- MOFCOM defined the relevant market as “business-to-consumer” online retail business

- MOFCOM was concerned that Wal-Mart would use its existing strength to expand in the restricted business of VATS

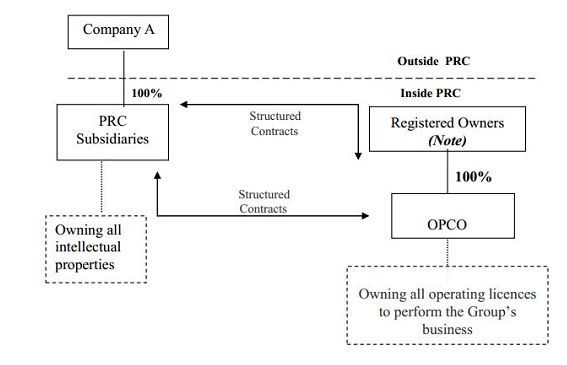

- Other aspects of the decision will be discussed further in the “VIE (Variable Interest Entity)” section of the seminar

Lesson from four years of enforcement history of AML

- Merger control is the main area of focus of AML enforcement

- In four years, China became one of the most active merger control jurisdictions alongside Europe and the USA

- Features of China’s AML regime: Low thresholds, lengthy process and the importance of “national economic development” in antitrust analysis

“National economic development”

- Even in transactions that involve relevant geographic markets wider than China, MOFCOM will invariably require parties to provide China-specific data and assess the impact of the transactions on Chinese consumers and suppliers

- For transactions that involve vital products to China’s economy, MOFCOM will definitely impose conditions on the transactions to ensure that the supply of the products will continue, even if there is no evidence that the merging parties will stop supplying after the transactions.

- Examples: Russian Potash, Google/Motorola, Samsung/Seagate etc

Lesson from four years of enforcement history of AML

- Apart from MOFCOM, SAIC and NDRC also play an important role in the enforcement of AML in China

- They are not required to publish their enforcement decisions, therefore seen as less active

- However, it would be a mistake to regard the two agencies as less important in the enforcement of AML.

Conclusion

- As the enforcement of AML continues to mature, a body of precedents has been developing for the reference of market participants in China. Companies with significant business activities in China should always take into account the specific features of the enforcement of AML when assessing anti-trust compliance.

Penalties for Failure to Notify a Concentration

MOFCOM may:

- Order parties to cease implementing the transaction

- Order parties to dispose of any relevant shares, assets or business and take other measures to restore pre-transaction market situation

- Impose relatively small fine of up to RMB500,000

- no record of MOFCOM having penalised any party for failure to notify a concentration

Interim Measures on Investigating and Treatment of Violation of the Notification Obligation for Concentrations of Business Operators (“Interim Measures”)

- Interim Measures came into effect on 1 February 2012

- Whistle-blowing: MOFCOM can initiate investigation of its own accord or following report by a third party (such as a customer or competitor) of a possible violation

- MOFCOM takes charge of investigation and imposition of sanctions, but can authorise provincial commerce authorities to assist

- MOFCOM must give written notice of commencement of investigation to relevant business operator who must respond within 30 days

- MOFCOM will complete preliminary investigation w/in 60 days

- MOFCOM can then launch a further in-depth investigation (in which case business operator must suspend implementation of concentration and notify transaction to MOFCOM w/in 30 days)

- In-depth review must be completed w/in 180 days

Sanctions for failure to file

Orders to:

- Cease implementation of transaction

- Unwind transaction by disposal of shares, assets or business within prescribed time limit

- Take other necessary steps to restore situation existing prior to transaction

- Impose fine up to RMB 500,000

- MOFCOM has discretion to publish decisions on failure to notify: deterrent effect of potential “naming and shaming”

MOFCOM’S Legislative Plans

According to Mr. Shang Ming, Director General of MOFCOM’s Anti-Monopoly Bureau

MOFCOM will introduce 2 new rules on merger control in 2012:

- Rules on Imposing Restrictive Conditions on Concentrations of Business Operators

- Rules on the Investigation and Handling of Concentrations of Business Operators below the Notification Thresholds

Rules on Civil Litigation Under the AML

- Article 50 AML entitles individuals and companies to bring private actions against business operators that have engaged in anti-competitive conduct

- Majority of cases filed related to abuse of dominant market position

- Lack of success due to plaintiffs’ inability to provide evidence of defendants’ dominant market position

- Supreme Court published draft Rules on Civil Litigation in April 2011

- Supreme Court finalised and issued the Judicial Interpretation laying the foundation of the antitrust litigation framework in China

A Case Study

- In February 2012 Johnson & Johnson (“J&J”) was sued by a distributor alleging that J&J had set minimum resale prices for its products

- The distributor also alleged that J&J terminated its distributor agreement after the plaintiff sold equipment below the minimum price

- The distributor plaintiff failed to adduce evidence proving anticompetitive effects of the setting of minimum prices

- Due to insufficient evidence, the court ruled in favour of J&J

- The court did not even proceed to consider other factors such as J&J’s market share

- The case suggests that the court will take a reasonable approach in assessing abuse of market dominance, rather than outright prohibition of certain kind of market conduct.

Judicial Interpretation regarding Civil Litigation Under the AML

Jurisdiction: intermediate courts of the capital cities of the provinces and autonomous region, the cities specifically designated by the state plan, municipalities directly under the administration of the central government and those designated by the Supreme Court

Eligible plaintiffs: Broad approach to eligibility, availability of joinder of actions and joinder of parties

Burden of proof:

- For horizontal monopoly agreements, plaintiffs do not need to prove anticompetitive effects

- It is unclear whether the same rules apply to vertical monopoly agreements.

- For abuse of dominance, where allegations involve public utility companies, companies enjoying monopolies granted by law, undertakings operating in markets lacking effective competition, or companies on which transaction counterparties are highly dependent, the courts may find dominant market positions without requiring proof from plaintiffs (unless defendants produce evidence to the contrary).

- Courts may accept as prima facie evidence of dominance: information disclosed by a publicly listed company, acknowledgements of allegedly dominant firms, market research, economic analysis, and statistics from qualified independent third parties

Discovery: court order to compel defendant to produce relevant evidence necessary to prove plaintiff’s case is no longer available

Impact

- an attempt of the Supreme Court to reduce hurdles for instituting civil litigations under the AML

- evidential rules, though improved, are still inadequate and inefficient

- other issues surrounding AML litigation remain unclear e.g. the standing of indirect purchaser to bring an action, the interaction between court and AMEA investigations, calculation of damages

- enterprises need to be more cautious in publishing market share information to the public as it may be tendered as evidence against the enterprise in AML litigation

- International Co-Operation

- July 2011, key agencies in China and US signed an anti-trust Memorandum of Understanding

- MOU provides for cooperation on country-to-country and agency to-agency basis

- Guidance given on areas for co-operation including: information exchange, advice on enforcement, policy developments, training, and cooperation on specific cases or investigations

- Envisages exchange of information on mergers under review in both countries (e.g. as to investigation’s timing, assessment of anti-competitive impact, definition of relevant market, theories of harm and remedies)

- Aims to reduce conflicting outcomes

ESTABLISHMENT OF NEW NATIONAL SECURITY REVIEW SYSTEM FOR M&A OF CHINESE ENTERPRISES BY FOREIGN INVESTORS

New system set out in 2 sets of provisions:

- Notice on Establishment of a Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (“Circular 6”) came into effect on 5 March 2011 – sets out broad principles of national security review system (incl. industry sectors/transaction types subject to review

- Regulations on Implementation of the Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (“Circular 53”) which came into effect on 1 September 2011 – Circular 53 deals with procedures for implementation of the new review system

Background