China’s Ministry Of Commerce Rejects Coca-Cola’s Bid To Acquire China Huiyuan Juice Group

China’s Ministry of Commerce (“MOFCOM”) announced on 18 March 2009 that it has rejected Coca-Cola Company’s (“Coca-Cola”) US$2.4 billion (HK$19.65 billion) bid to acquire China Huiyuan Juice Group Limited (“Huiyuan”). MOFCOM cited the Anti-Monopoly Law as grounds for the rejection. China’s Anti-Monopoly Law came into effect on 1 August 2008.

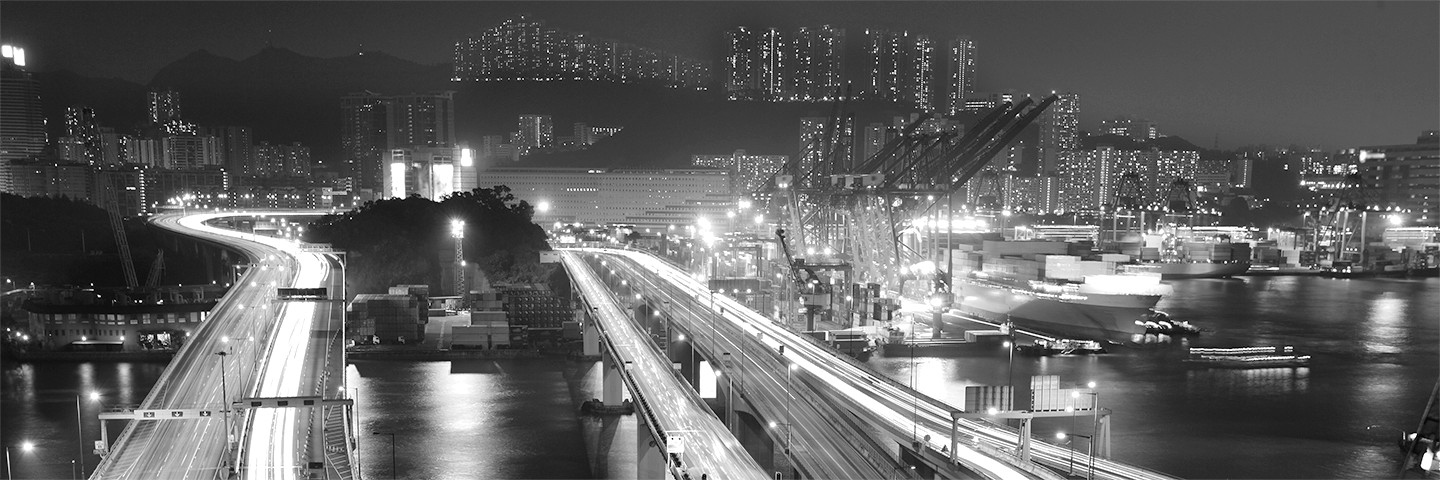

China is Coca-Cola’s fourth largest market. Last year, Coca-Cola controlled 52.5 per cent of China’s carbonated drinks market and 12 per cent of the fruit and vegetable juice market. Huiyuan is China’s largest juice manufacturer, holding over 45 per cent of the pure juice market and over 10 per cent of China’s US$2 billion fruit and vegetable juice market. Huiyuan listed on the Hong Kong Stock Exchange in February 2007.

On 3 September 2008 Coca-Cola made a US$2.4 billion bid for Huiyuan. On 20 November MOFCOM accepted Coca-Cola’s application and launched a preliminary review, which was extended on 20 December. MOFCOM announced that it had rejected the bid on 18 March 2009, saying that the acquisition would be a negative influence on competition. If the deal had gone ahead it would have been Coca-Cola’s largest overseas acquisition.

MOFCOM rejected Coca-Cola’s bid on the basis of Article 28 of China’s Anti-Monopoly Law. Article 28 states that “where the concentration of business operators will or may eliminate or restrict competition, the Anti-monopoly Law Enforcement Agency under the State Council shall make a decision to prohibit the concentration” 1 . MOFCOM stated in their published decision that the acquisition would adversely affect competition within China’s fruit juice market. Coca-Cola’s dominant position in the carbonated drinks market may mean that, after their acquisition with Huiyuan, they could take advantage of their market position to sell juice drinks through sales arrangements involving tie-ins, bundling or other exclusive trade conditions. MOFCOM suggested that this could lead to higher prices for consumers or limited product choice. MOFCOM also highlighted their concern over branding. The “Huiyuan” brand and “Minute Maid” brand, owned by Coca-Cola, are major brands in the Chinese juice market. Coca-Cola’s ownership of both names could raise barriers for competition and restrict the entry of other brands into the market. The acquisition could also threaten small and medium-size enterprises, damaging the development of the juice industry in China. In 2003, the Australian Competition and Consumer Commission blocked Coca-Cola’s acquisition of Australian juice maker, Berri, on grounds similar to those raised by MOFCOM in the Huiyuan case.

There has been speculation over MOFCOM’s decision. MOFCOM cited concerns that the acquisition could lead to exclusive trade conditions, thus limiting competition in the market. This would suggest that carbonated and fruit juice drinks are supplied through the same channels, though MOFCOM did not provide details regarding this channel overlap, making it difficult to verify MOFCOM’s concern over tie-in or bundling sales arrangements. MOFCOM also announced that Coca-Cola had failed to provide details on how the acquisition was in the public interest or to explain how they would reduce the adverse impact on competition. MOFCOM did not state what information they required from Coca-Cola in order to approve the bid.

The Anti-Monopoly Law does allow Coca-Cola to seek an administrative review of the decision. However, Coca-Cola has said that they respect and will accept MOFCOM’s decision. There has been speculation that this decision will cause foreign investors and private equity funds to withdraw from China and concentrate on home markets. However, until now MOFCOM have accepted all merger applications reviewed under the Anti-Monopoly Law. A MOFCOM official stated that this decision is an isolated case and does not suggest any change in China’s policy on foreign investors. Concerns have also been raised that this decision could impact Chinese companies looking to expand overseas through mergers and acquisitions.

The purpose of this note is to provide a summary only of information included in MOFCOM’s announcement of 18 March 2009. Its contents do not constitute legal advice and specific advice should be sought in relation to any particular situation.