On 29 April 2022, Julia Charlton presented a webinar on the HKEX Consultation Paper on Proposed Amendments to the Listing Rules relating to Share Schemes of Listed Issuers

Webinar presented by Julia Charlton: HKEX Consultation Paper on Proposed Amendments to the Listing Rules relating to Share Schemes of Listed Issuers. Now available on the Charltons YouTube-channel.

A recording of the webinar is now available here.

The Hong kong Stock Exchange’s Consultation Paper on Proposed Amendments to the Listing Rules relating to Share Schemes of Listed Issuers

GENERAL INTRODUCTION TO THE HKEX CONSULTATION PAPER

- HKEx “Consultation Paper on Proposed Amendments to Listing Rules relating to Share Schemes of Listed Issuers” (29 October 2021)

- Proposals to amend the Listing Rules relating to share option schemes and share award schemes (collectively, “Share Schemes”) of listed companies and their subsidiaries

- Currently, Chapter 17 of the Listing Rules governs share option schemes (i.e. schemes involving grants of options to acquire newly issued shares of the listed company), but not share award schemes (i.e. schemes involving grants of actual shares)

- Chapter 17 was most recently amended in 2000

- There has been an increasing adoption of share award schemes

The HKEx is also proposing to:

- Introduce a new definition of eligible participants

- Extend the “scheme mandate limit” to cover both share award and share option schemes

- Amend the requirements for refreshments of the scheme mandate limit

- Introduce a requirement for companies to set a sublimit for the number of shares granted to service providers

- Introduce a minimum 12-month vesting period

Share Schemes Funded by the Issuance of New Shares of Listed Companies

Current position:

- Chapter 17 does not cover share award schemes (only share option schemes that are funded by the issuance of new shares of the listed company)

- To issue new shares under share award schemes, listed companies must comply with the general Chapter 13 Listing Rule requirements for the issue of shares

Proposals:

- Extend Chapter 17 to also govern share award schemes funded by newly issued shares of listed companies

- Share award schemes and share option schemes are subject to the same regulatory regime

PROPOSED ADOPTION OF “ELIGIBLE PARTICIPANTS” DEFINITION ─ PROPOSED LISTING RULE 17.03A

Current position:

- No restriction on the categories of eligible participants of Share Schemes

Proposal:

- A restriction on the categories of eligible participants of Share Schemes

- “Eligible participants” to include three categories:

- Employee Participants: directors and employees of the listed companies and their subsidiaries (including persons who are granted shares or options under the scheme as an inducement to enter into employment agreements with these companies)

- Related Entity Participants: directors and employees of listed companies’ related entities (i.e. holding companies, fellow subsidiaries and associated companies of a listed company)

- Service Providers: persons who provide services to the listed group on a continuing and recurring basis in its ordinary and usual course of business

Proposals:

- Grants of share options and share awards (collectively, “Share Grants”) to Related Entity Participants and Service Providers must be approved by the remuneration committee

- Disclosure requirements:

- Share Grants to Related Entity Participants and Service Providers – disclosure of the reasons for the grants in Share Grant announcements

- Share Grants to Service Providers – the scheme document must identify each category of Service Provider and the criteria for determining a person’s eligibility under each category

Proposed Limit on Scheme Mandate ─ proposed Listing Rules 17.03(3), 17.03B(1) and 17.03C(1)

Current position:

- The total number of shares that may be issued upon exercise of options to be granted under all share option schemes of the listed company – limited to 10% of the company’s issued shares as at the date of the shareholders’ approval of the limit

- Shareholders’ approval to refresh the scheme mandate at any time – up to 10% of the issued shares as at the date of approval of the refreshment

- All outstanding options must not be > 30% of the issued shares

Proposals:

- Extend the 10% scheme mandate limit to all Share Schemes involving the issuance of new shares

- Amend the refreshment mechanism: a scheme mandate limit may be refreshed by shareholders’ approval once every three years, and any additional refreshments within any three-year period would have to be approved by the listed company’s independent shareholders

- Waivers – large Share Grants as part of listed companies’ remuneration strategy to incentivise and retain talent (factors considered include the need for the proposed mandate, industry norms and the criteria for granting shares under the mandate)

- Remove the current Listing Rules’ requirement that limits the number of outstanding options to 30% of issued shares

SUBLIMIT ON GRANTS TO SERVICE PROVIDERS ─ PROPOSED LISTING RULES 17.03(3) and 17.03B(2)

Proposals:

- Listed companies must set a sublimit within the Scheme Mandate Limit on Share Grants to Service Providers (the “Service Provider Sublimit”)

- Disclosures in the circular to shareholders:

- The basis for determining the Service Provider Sublimit

- The remuneration committee’s views on whether the Service Provider Sublimit is appropriate and reasonable

- The Service Provider Sublimit will also need to be separately approved by the company’s shareholders in general meeting

Minimum vesting period for Share Grants ─ proposed note to Listing Rule 17.03(6)

Current position:

- Chapter 17 does not have specific requirements on the vesting period

Proposals:

- A requirement of a minimum 12-month vesting period

- Exception: the remuneration committee approves a shorter vesting period for Share Grants made to Employee Participants specifically identified by the listed company

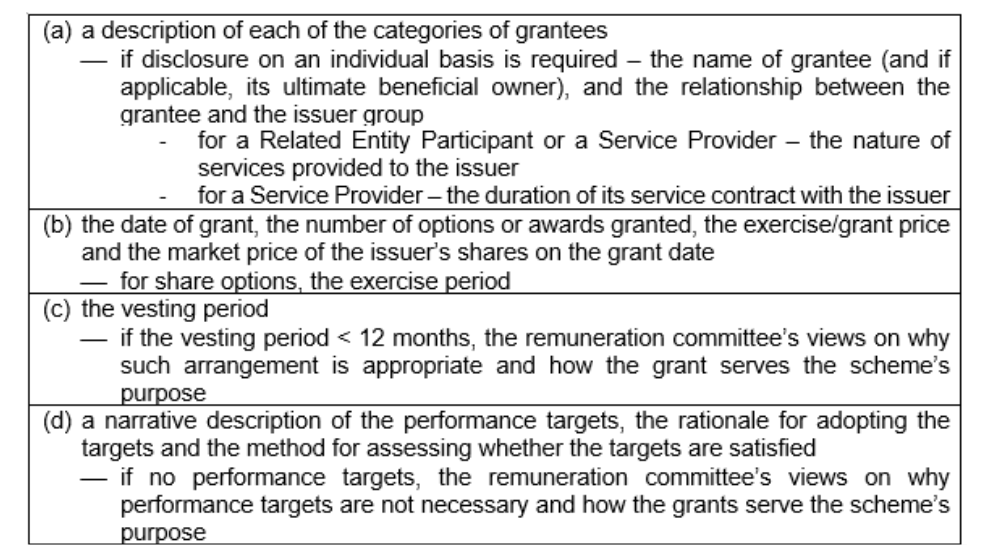

- Disclosures in the Share Grant announcement

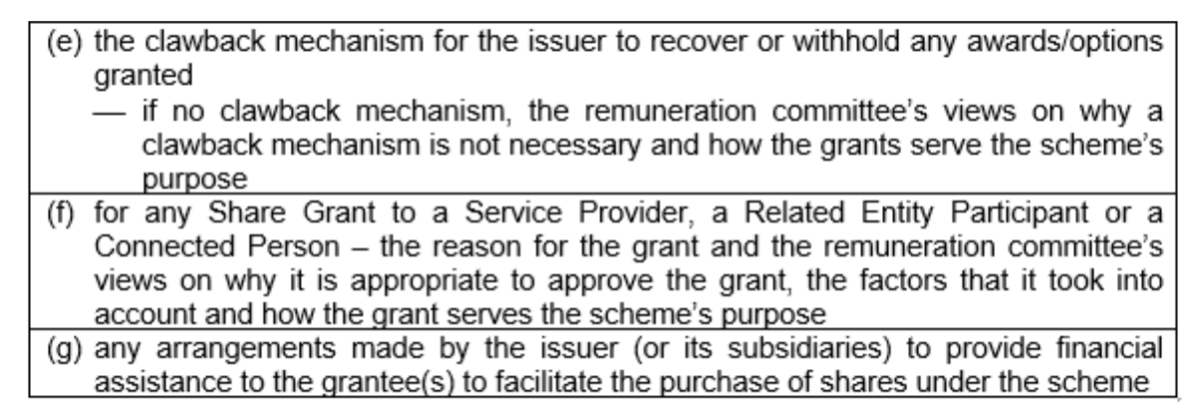

Performance targets and clawback mechanism ─ proposed Listing Rules 17.03(7), 17.03(19), 17.06B(7) and 17.06B(8)

Current position:

- Scheme document disclosure requirement of any performance targets that must be achieved before the options can be exercised (or a negative statement)

Proposal:

- Where Share Grants are made with performance targets – the grant announcement must include a narrative description of the performance targets attached to the Share Grants

Performance targets and clawback mechanism ─ proposed Listing Rules 17.03(7), 17.03(19), 17.06B(7) and 17.06B(8) (cont.)

Current position:

- No requirement to make specific disclosure relating to a clawback mechanism

Proposals:

- The scheme document must describe the clawback mechanism (or where there is no clawback, a negative statement)

- Where Share Grants are made without performance targets and/or a clawback mechanism – the circular and the grant announcement must disclose the remuneration committee’s views on why performance targets and/or a clawback mechanism is/are not necessary and how the grants serve the scheme’s purpose

Exercise price or share grant price ─ proposed Listing Rule 17.03E

Current position:

- The exercise price of share options must not be < the market price of the underlying shares at the time of grant

Proposals:

- Retain the current requirement

- No proposal to impose any restriction on the grant price of shares under share award schemes

Restrictions on large Share Grants to Individual Participants ─ proposed Listing Rule 17.03D

Current position:

- Shareholders’ approval is required for grants of options to an individual if the number of shares covered by the grants > 1% of the listed company’s issued shares over any 12-month period

Proposals:

- Extend the current requirement: shareholders’ approval will be required if the number of shares covered by grants of share awards and share options to an individual participant in aggregate > 1% of the listed company’s issued shares over a 12-month period

GRANTS OF SHARE OPTIONS AND SHARE AWARDS TO CONNECTED PERSONS ─ PROPOSED LISTING RULE 17.04

Current position:

- Under Chapter 17:

- Each grant of share options to a director, chief executive or substantial shareholder of a listed company (or their respective associates) (“Connected Person”) requires INED approval – excluding any INED who is a grantee

- Independent shareholders’ approval is required for grants of share options to INEDs or substantial shareholders (or their respective associates) if the aggregate number of shares covered by the share options granted > 0.1% of the listed company’s issued shares and they have a value > HK$5 million over a 12-month period

- Any grant of share awards to a Connected Person constitutes a connected transaction under Chapter 14A of the Listing Rules – independent shareholders’ approval required (irrespective of the size of the grant)

Proposals:

- All Share Grants to Connected Persons must be approved by the remuneration committee (excluding any director who is a grantee), instead of INEDs

- Weighted voting right (“WVR”) structures – explicit requirement that the Corporate Governance Committee must make a recommendation on any Share Grants to a WVR beneficiary

Proposals:

- Independent shareholders’ approval requirements – introduce a new de minimis exemption for grants of share awards to Connected Persons:

- Where the grantee is a director (other than an INED) or the chief executive of the listed company (or any of their respective associates) – independent shareholders’ approval will only be required if a proposed grant of share awards would result in the share awards granted to the individual representing in aggregate > 0.1% of the listed company’s issued shares in any 12-month period

- Where the grantee is an INED or a substantial shareholder of the listed company (or any of their respective associates) – independent shareholders’ approval will be required if a proposed Share Grant would result in the aggregate number of shares covered by all grants of share awards and share options to the individual in any 12-month period > 0.1% of the listed company’s issued shares

Proposals:

- Extend the de minimis exemption for grants of share awards to Connected Persons to controlling shareholders

- Remove the current HK$5 million de minimis threshold for grants of share options to INEDs or substantial shareholders

ANNOUNCEMENTS OF SHARE GRANTS ─ PROPOSED LISTING RULES 17.06A, 17.06B and 17.06C

Current position:

- Requirement of disclosure of details of option grants by way of announcement and disclosure of grants to a Connected Person made on an individual basis

Proposals:

- Extend the current requirement: disclosure on an individual basis of grants of share awards and options to three categories of persons:

- Connected Persons

- Related Entity Participants or Service Providers with Share Grants in any 12-month period > 0.1% of the listed company’s issued shares

- Participants with Share Grants > 1% individual limit

- Listed companies may disclose Share Grants to other participants in aggregate by category

- The HKEx may require a listed company to provide it with a list of grantees and the movements of shares and options granted to each grantee

Announcements of Share Grants ─ proposed Listing Rules 17.06A, 17.06B and 17.06C

Proposals:

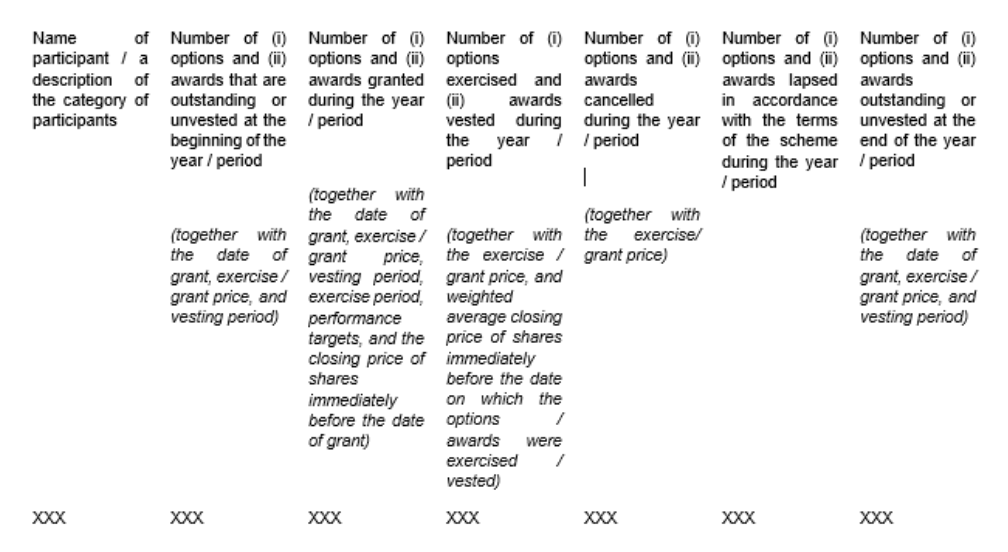

The grant announcement must include in a tabular format:

- Share Grant announcement disclosure of the number of shares available for future grant under the scheme mandate limit and the Service Provider Sublimit (if applicable)

- Waivers – concerns about commercial sensitivity or data privacy

Disclosure in interim reports and annual reports ─ proposed Listing Rules 17.07 and 17.09

Proposals:

Listed companies’ interim reports and annual reports must disclose:

- Details of all Share Grants to (i) each participant on an individual basis (if required) and (ii) other participants on an aggregate basis by category, and their respective movements during the reporting period:

Proposals:

Listed companies’ interim and annual reports must disclose (cont.):

- For options and awards granted during the reporting period – their fair value at the time of grant and the accounting policy adopted (currently a recommended disclosure under Chapter 17 in respect of share options)

- The number of options and awards granted under all Share Schemes during the reporting period divided by the weighted average number of issued shares for the period

- The number of shares that are available for grant under the scheme mandate limit (and if applicable, the Service Provider Sublimit) at the beginning and the end of the reporting period

- A summary of each Share Scheme (for annual reports only)

DISCLOSURE OF THE WORK PERFORMED BY THE REMUNERATION COMMITTEE ─ PROPOSED LISTING RULE 17.07A

Current position:

- Corporate Governance Report disclosure of a summary of the work performed by the remuneration committee during the year

Proposals:

- Corporate Governance Report disclosure of each Share Scheme-related matter reviewed and/or approved by the remuneration committee during the financial year

- The remuneration committee will also have to explain why it was appropriate to approve those matters, the factors it took into account, such as the listed company’s business needs, remuneration policy and hiring practices, and how the Share Grants serve the purpose of the scheme

- The remuneration committee must make a confirmation in the listed company’s annual and interim reports: that the Service Provider provides services to the listed group on a continuing and recurring basis in its ordinary and usual course of business which are material to the listed group’s long term growth, and as a result of that it was determined to be an eligible participant of the share scheme

Approval for changes to terms of share award or option granted ─ proposed note 2 to Listing Rule 17.03(18) and proposed note 1 to Listing Rule 17.04(5)

Current position:

- Shareholders’ approval is required for any changes to the terms of a share option already granted

Proposals:

- Changes to the terms of a share award or share option already granted may be approved by the remuneration committee and/or the listed company’s shareholders, if the initial grant of the share award or option was approved by the listed company’s remuneration committee and/or its shareholders

TRANSFER OF SHARE AWARDS OR OPTIONS ─ PROPOSED NOTE TO LISTING RULE 17.03(17)

Current position:

- A transfer of share options by the grantee to other persons is prohibited

Proposals:

- A provision that the HKEx may consider granting a waiver to allow a transfer of share awards/options to a trust, a private company or other vehicles for the benefit of the grantee and his/her family members, e.g. for estate planning or tax planning purposes, provided that:

- Continue to meet the scheme’s purpose and comply with the other Chapter 17 requirements

- Disclosure of the beneficiaries of the trust or the ultimate beneficial owners of the transferee vehicles

VOTING RIGHTS OF THE TRUSTEE HOLDING UNVESTED SCHEME SHARES ─ PROPOSED LISTING RULE 17.05A and 13.25

Proposals:

- A trustee holding unvested shares of a Share Scheme must abstain from voting on matters that require shareholders’ approval under the Listing Rules

- Disclosure in the listed company’s monthly returns of the number of unvested shares held by the trustee of its Share Scheme

DISCLOSURE IN GRANT ANNOUNCEMENTS AND FINANCIAL REPORTS ─ PROPOSED LISTING RULE 17.01(2)

Current position:

- Share award schemes funded by existing shares that are purchased on-market do not require shareholders’ approval under the Listing Rules

Proposals:

- Disclosure requirement of the terms of share award schemes and details of the grants of listed companies’ existing shares in share grant announcements and in their financial reports, consistent with the proposed disclosure requirements applicable to share option schemes funded by the issuance of new shares

VOTING RIGHTS OF THE TRUSTEE HOLDING UNVESTED SCHEME SHARES ─ PROPOSED LISTING RULE 17.01(2) and 13.25B

Proposals:

- The trustee holding unvested shares of share award schemes funded by a listed company’s existing shares must abstain from voting on matters that require shareholders’ approval under the Listing Rules

- Disclosure in the listed company’s monthly returns of the number of unvested shares held by the trustee of its share award scheme

Extend the scope of Chapter 17 to govern subsidiaries’ share award schemes ─ proposed Listing Rule 17.01(1)

Current position:

- Chapter 17 governs share option schemes of subsidiaries of listed companies that are funded by the issuance of new shares

Proposals:

- Extend the current requirements for share option schemes of subsidiaries to also apply to subsidiaries’ share award schemes, whether the schemes are funded by new shares or existing shares of the subsidiaries

Share Schemes of insignificant subsidiaries ─ proposed Listing Rule 17.10

Proposals:

- For Share Schemes of listed companies’ insignificant subsidiaries – the adoption of the scheme and the refreshment of the scheme mandate will be exempt from the Chapter 17 shareholders’ approval requirements, provided that:

- they are approved by the the listed company’s remuneration committee;

- the scheme complies with the other Chapter 17 requirements; and

- the subsidiary is still an insignificant subsidiary

- The listed company would still be required to comply with the Chapter 17 disclosure requirements in respect of the subsidiary

Trust arrangements ─ proposed Listing Rule 17.01(1)

Proposals:

- Amend Chapter 17 to clarify that the chapter would apply to Share Schemes involving grants of shares or options through trust or similar arrangements for the benefit of participants specifically identified by the listed company prior to the grants

Removal of the recommended disclosure of fair value of options in the circular relating to the adoption of a new share option scheme ─ proposed removal of current Listing Rule 17.02(3)

Current position:

- If a listed company proposes to adopt a new share option scheme, it is encouraged to disclose in the circular the fair value of all options that can be granted under the scheme as if they have been granted at the latest practicable date prior to the approval of the scheme

Proposals:

- Remove this recommended disclosure requirement

Other proposed Listing Rule amendments relating to Share Schemes ─ proposed Listing Rules 3.13(2), 10.08(1), 13.52(1)(e)(ii) and Paragraph 7 of Appendix 10

Proposals:

- Extend certain Listing Rules that currently apply to share option schemes to also apply to share award schemes:

- Listing Rule 3.13(2)

- Listing Rule 10.08(1)

- Listing Rule 13.52(1)(e)(ii)

- Paragraph 7 of Appendix 10 to the Listing Rules

DRAFTING AMENDMENTS TO CHAPTER 17

The HKEx is also proposing certain drafting amendments, such as:

- Re-arranging the sequence of various requirements

- Deleting duplicative requirements

TRANSITIONAL ARRANGEMENTS

Proposals:

- The new Listing Rules would apply to new Share Schemes adopted on of after the effective date of the Listing Rule amendments

- Transitional arrangements for existing Shares Schemes that are valid as at the effective date:

- For all existing Share Schemes – would be required to comply with the new disclosure requirements from the effective date

Proposal:

- Share award schemes with advanced mandates and share option schemes, which are valid as at the effective date – may continue to grant share awards/options only to eligible participants under the revised Chapter 17 after the effective date

- Share option schemes – when the listed company refreshes the scheme mandate of its existing schemes, it must comply with the revised Chapter 17 and amend its existing schemes’ terms

- Share award schemes with advanced mandates – prohibition on further refreshment of the scheme mandate

- For share award schemes involving grants of new shares under general mandate – would be allowed to continue to grant share awards to eligible participants under the revised Chapter 17 until the date of the first general meeting after the effective date

- Thereafter, amend the schemes’ terms to comply with the revised Chapter 17