On 4 March 2025, the Hong Kong Monetary Authority (HKMA), through its wholly-owned subsidiary CMU OmniClear Limited, entered into a memorandum of understanding (MOU) with Hong Kong Exchanges and Clearing Limited (HKEX) outlining joint initiatives to enhance Hong Kong’s financial market infrastructure, specifically targeting improvements in securities custody, clearing and settlement services.1 Prominent representatives including Eddie Yue, Chief Executive of the HKMA, and Bonnie Chan, Chief Executive Officer of HKEX, formally signed the MOU.

Chinese Government Bonds as Collateral

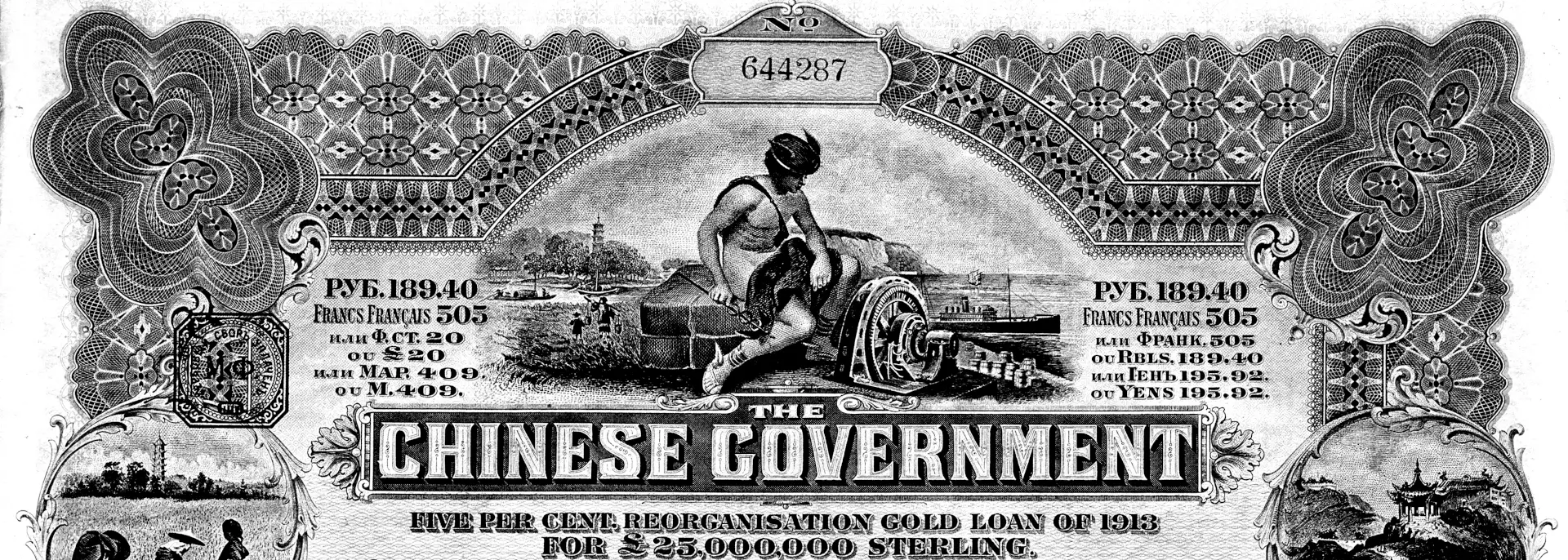

A central objective of this collaboration is facilitating greater use of Chinese government bonds as international collateral. These government and policy bank bonds, collectively valued at approximately US$16.3 trillion, are increasingly accepted globally. Recent developments have enabled international investors participating in Hong Kong’s Bond Connect scheme to use Chinese bonds as margin collateral for derivative and swap transactions via Mainland-Hong Kong mutual market access programmes.

Earlier this year, the People’s Bank of China extended the scope of acceptable collateral by allowing Northbound Bond Connect participants to use their bonds for offshore Renminbi (RMB) bond repurchase transactions in Hong Kong. This strategic move underscores the ongoing efforts to integrate China’s domestic markets with global financial systems.

Additionally, discussions between Hong Kong and the London Clearing House (LCH) aim to expand international acceptance of Chinese government bonds. Subject to obtaining regulatory approvals, LCH anticipates incorporating bonds denominated in US dollars and Euros into its global collateral pool initially, with future plans to include RMB-denominated bonds. This measure highlights the progressive integration of Chinese sovereign debt into international markets.

Developments at the Central Moneymarkets Unit

Concurrent with these initiatives, significant changes are underway within Hong Kong’s Central Moneymarkets Unit (CMU), traditionally a debt settlement system. In response to global trends towards cost efficiency and streamlined processes, the CMU has broadened its membership criteria, enabling eligible overseas investors, such as regulated financial institutions, sovereign entities and supranational bodies, direct access to its post-trade services.2 By reducing layers of intermediaries traditionally involved in cross-border securities trading, the CMU aims to minimise transaction costs, reduce credit risks and enhance operational efficiency. As Europe moves to seize frozen Russian assets to gain leverage in negotiations over Ukraine, these steps by the Chinese and Hong Kong authorities are also being cast as a bid to reduce dependence on Western financial systems.

These developments should also boost the RMB’s use in international markets, consolidate Hong Kong’s status as the global offshore RMB hub and its role in increasing international participation in China’s fixed income market, which is currently the world’s second largest at around US$25 trillion.3 These additions to the CMU’s operations are also expected to attract greater international participation and aim to boost the Hong Kong bond market and facilitate increased engagement with Mainland China through Bond Connect.

Global Connectivity and Investment Diversification

To cater to demands for global asset allocation, particularly from Mainland Chinese investors, the CMU is expanding its connectivity with international securities depositories. Investors from Mainland China have already channeled substantial investment — exceeding US$660 billion — into offshore markets through vehicles such as the Qualified Domestic Institutional Investor scheme and Stock and Bond Connect programmes.

The CMU’s recent memoranda of understanding with certain global financial institutions further illustrate its commitment to enhancing cross-border financial integration. Agreements have been established with the Monetary Authority of Macao, SIX SIS (Switzerland’s central securities depository) and the Central Bank of the United Arab Emirates. These partnerships aim to facilitate smoother investment flows, reduce transaction complexity, and streamline custody services, thereby providing Mainland Chinese investors easier access to overseas markets.

Creation of a Multi-Asset Custodial Platform

The collaboration between the CMU and HKEX reflects a longer-term ambition to develop a multi-asset custodial platform in Hong Kong. The platform would enable investors to manage diversified portfolios encompassing both fixed-income securities and equities. This integrated custodial solution is anticipated to support broader asset diversification and simplified portfolio management for investors.

Both the CMU and HKEX are exploring the establishment of common technological interfaces to improve operational efficiency, user experience and overall attractiveness to international market participants. By leveraging their combined expertise, the platforms aim to enhance Hong Kong’s competitiveness as a global financial centre, particularly as the leading offshore RMB hub.

Implications for Market Participants

These developments provide substantial opportunities and practical implications for investors and market participants, including:

- Expanded options for collateral, improving liquidity management and risk mitigation;

- Reduced transaction costs and risks through streamlined processes facilitated by the CMU;

- Broadened investment possibilities and simplified international custody arrangements, particularly for Mainland investors; and

- Increased operational efficiency and transparency through custodial infrastructure.

Footnotes and references:

- HKMA. (March 2025). “CMU OmniClear and HKEX sign MOU on enhancing post-trade securities infrastructure of Hong Kong’s capital markets”

- CMU Omniclear. (March 2025). “CMU Membership Eligibility Expanded to Facilitate International Participation in Hong Kong’s Bond Market”

- Financial Times, 4 March 2025. “Hong Kong targets creation of rival to Euroclear”

This newsletter is for information purposes only.

Its contents do not constitute legal advice and it should not be regarded as a substitute for detailed advice in individual cases. Transmission of this information is not intended to create and receipt does not constitute a lawyer-client relationship between Charltons and the user or browser. Charltons is not responsible for any third party content which can be accessed through the website.

If you do not wish to receive this newsletter please let us know by emailing us at unsubscribe@charltonslaw.com

Jurisdictional Law Firm of the Year: Hong Kong SAR

IFLR Asia-Pacific Awards 2024

Charltons

Floor43-59 Queen’s Road East Hong Kong

Charltons – Hong Kong Law – 682– 17 April 2025