- Home

- Insights

- Hong Kong Regulatory Compliance

- The 10 most important things to know about reverse takeovers (RTOs) of Hong Kong listed companies

Hong Kong regulatory compliance

1. What is a Reverse Takeover?

A reverse takeover is essentially a means to list a business or assets without conducting an IPO and typically involves a person acquiring a controlling stake in a company listed on the Hong Kong Stock Exchange (the HKEx) and injecting non-listed business or assets into it, either at the same time as acquiring control, or later. A listed issuer’s acquisition of a significant new business can also be regarded as a reverse takeover in some circumstances.

HKEx will first apply bright line tests to determine whether the transaction(s) are a reverse takeover. Transactions within the test will be a reverse takeover and will be treated as a new listing application. Transactions outside the bright line tests may still constitute reverse takeovers under the principle-based test, if the HKEx considers the transactions to be an attempt to list assets in circumvention of the requirements for new listings under the HKEx Listing Rules.

Where the listed issuer can show that it is not seeking to list assets in circumvention of the requirements for new listings, the HKEx may regard the acquisition(s) as an extreme transaction if:

-

the issuer has been under the control (or de facto control) of the same person or group of persons for 36 months and the transaction will not result in a change of control of the issuer; or

-

the issuer’s principal business is substantial (having annual revenue or total assets of HK$1 billion[1]) and will continue after the transaction(s) in question.

2. What are the Bright Line Tests for a Reverse Takeover?

The HKEx Listing Rules set out bright line tests for two specific types of reverse takeovers which are transactions involving:

-

a change in control (i.e. 30%) of a listed issuer (except at the subsidiary level); and

-

a very substantial acquisition (i.e. acquisition(s) where any percentage ratio is 100% or more) from the incoming controlling shareholder either at the time of the change in control or within the following 36 months.[2]

A very substantial acquisition within the bright line tests constitutes a reverse takeover and will require the listed issuer to follow the procedures for a new listing applicant on HKEx including the preparation of a listing document and appointment of a sponsor.

3. What Constitutes a Change in Control <i>de facto</i>/Control?

The threshold for control is 30% (as under the Takeovers Code). A change in de facto/control may also trigger the reverse takeover rules. Where an investor acquires more than 30% of a listed issuer’s enlarged share capital through a large scale subscription of new shares and the issuer uses the proceeds to acquire a new business unrelated to its original business, HKEx will treat this as a reverse takeover (Rule 14.06D/ GEM 19.06D and HKEx Guidance Letter 105-19[3]).

A change in de facto control will also arise on a listed issuer’s issue of restricted convertible securities (i.e. where there is a conversion restriction mechanism preventing the triggering of a change of control under the Takeovers Code) as consideration for an asset acquisition. The HKEx will regard this as a change of control if the vendor would become the issuer’s controlling shareholder assuming full conversion of the convertible securities where: (i) the issuer has no controlling shareholder when it proposes the acquisition; or (ii) the existing controlling shareholder would cease to be a controlling shareholder after the conversion.

4. What is the Principle-based Test for a Reverse Takeover?

HKEx will apply the principle-based test to transactions falling outside the bright line tests (e.g. where there is no change of control).

The principle-based test assesses whether the acquisition alone, or with other transactions or arrangements, attempts to list the assets to be acquired (and assets already acquired in a series of transactions) and circumvent the requirements for new listings. Other transactions or arrangements include a change of control or de facto control of the listed issuer, and acquisitions and disposals of assets. Hence, a listed issuer’s disposal of its existing business and acquisition of a totally new business may constitute a reverse takeover even if there is no change in control.[4]

HKEx takes 6 factors into account in applying the principle-based test to determine whether a transaction is a reverse takeover:[5]

-

the size of the acquisition relative to the issuer;

-

acquisition(s) which lead to a fundamental change in the issuer’s principal business;

-

the nature and scale of the listed issuer’s business before the acquisition(s) – significant acquisitions by shell companies, including issuers that have wound down or disposed of their existing business and moved into businesses that can be easily discontinued, are more likely to be classified as reverse takeovers;

-

the quality of the assets acquired/to be acquired – the acquisition of a target business which would not be suitable for listing (e.g. an early stage exploration company) is likely to constitute a reverse takeover;

-

change in control or de facto control of the listed issuer (except at the level of its subsidiaries); and

-

events and transactions which, together with the acquisition(s), form a series of transactions and/or arrangements (e.g. a series of small acquisitions or a resequencing of transactions to acquire a new business before disposing of the original business) will be considered together in determining whether there is a reverse takeover.

5. Can a Listed Issuer’s Disposal of Assets Trigger a Reverse Takeover?

The HKEx may rule that a reverse takeover exists where it considers that other transactions or arrangements, together with one or more asset acquisitions, form a series of transactions or arrangements which attempt to list the acquired assets and circumvent the requirements for a new listing. The other “transactions” or “arrangements” may include changes in control, de facto control, acquisitions and/or disposals. The HKEx may regard these and an asset acquisition (or series of acquisitions) as a series amounting to a reverse takeover, if they take place in reasonable proximity to each other (normally within a period of 36 months) or are otherwise related.

If the HKEx considers the acquisition(s) and other transactions or arrangements to constitute a series, it will treat the entire series as one transaction. Since the other transactions can be acquisitions or disposals, it is possible for a disposal by a listed issuer to trigger a reverse takeover with respect to a previously completed acquisition. Hence, a reverse takeover may occur where a listed issuer disposes of its existing business following an acquisition of a new business.

6. When will HKEx Aggregate a Series of Transactions or Arrangements?

HKEx’s guidance letter on reverse takeovers, HKEx-GL 104-19 provides that it will normally apply the “series of transactions and/or arrangements” factor together with other assessment factors, for example the relative size of the transaction to the listed issuer, and whether the series of transactions would lead to a fundamental change in the principal business of the listed issuer.

Transactions (i.e. acquisitions, disposals and changes in control) will normally be aggregated if they occur within a 36-month period or are otherwise related, such as:

-

acquisitions that are in a similar line of business;

-

acquisitions of interests in the same company or group of companies; and

-

acquisitions of businesses from the same or a related party.

However, the reverse takeover rules are not intended to unduly restrict listed issuers’ business expansion or diversification that occurs over a reasonable period where appropriate information is publicly disclosed. Transactions or arrangements outside the three-year period will not be regarded as part of a series, unless the transactions are clearly related or there are specific concerns regarding circumvention of the reverse takeover rules.

Size Tests

In assessing whether the size of acquisitions in a series is substantial, the HKEx will normally compare:

-

the aggregate financial figures/ consideration of the acquired assets at their respective acquisition times to:

-

the size of the listed issuer being the lower of its latest published financial figures (i.e. revenue, profits and assets) or market capitalisation: (i) before the first transaction in the series; and (ii) at the time of the last transaction in the series (Guidance Letter HKEx-GL104-19 at paragraph 32).

The above is however guidance only and the HKEx will consider anomalous results case-by-case.

7. What are the Consequences of a Reverse Takeover?

A listed issuer proposing a reverse takeover will be treated as a new listing applicant. This requires that:

-

the acquired assets must be suitable for listing (under Main Board Listing Rule 8.04 or GEM Listing Rule 11.06) and able to meet the financial tests and track record requirements of Main Board Listing Rule 8.05 (or 8.05A or 8.05B) or GEM Listing Rule 11.12A or 11.14;

-

the enlarged group must meet all the listing requirements of Main Board Chapter 8 other than Rule 8.05 or GEM Chapter 11 other than Rule 11.12A;

-

an announcement pre-vetted by HKEx must be published as soon as possible after the reverse takeover’s terms are finalised;

-

the reverse takeover must be approved by the issuer’s independent shareholders in general meeting;

-

the listed issuer must issue a listing document containing virtually all the information required for a new listing applicant and the information required for a VSA. It must send the listing document to its shareholders with a notice convening a shareholders’ general meeting to approve the reverse takeover;

-

an initial listing fee is payable; and

-

the listed issuer must appoint a sponsor to conduct due diligence.

Where a reverse takeover involves a series of transactions, and the acquired assets cannot meet the management continuity and/or the ownership continuity and control requirements of Main Board Listing Rule 8.05(1)(b) and (c) (GEM Listing Rule 11.12A(2) and (3)), due to a change in their ownership and management solely as a result of their acquisition by the listed issuer, the HKEx may grant a waiver of these requirements. In considering whether to grant a waiver, the HKEx will consider whether the listed issuer has the expertise and experience in the relevant business/industry of the acquired assets to ensure their effective management and operation.

8. What are Extreme Transactions?

An “extreme transaction” is an acquisition or series of acquisitions of assets by a listed issuer which, individually or together with other transactions (which may include a disposal) or arrangements, achieve a listing of the acquired assets, where the listed issuer can demonstrate that this does not constitute an attempt to circumvent the requirements for a new listing.

To qualify as an “extreme transaction” the following three conditions must also be met:

-

either:

-

the listed issuer has been under the control or de facto control of a person or group of persons for a long period (normally at least 36 months), and the transaction would not result in a change in control or de facto control of the listed issuer (other than at the level of its subsidiaries); or

-

the listed issuer has been operating a principal business of a substantial size, which will continue after the transaction. HKEx Guidance Letter GL104-19 provides guidance on what constitutes a business “of a substantial size”, which includes a listed issuer with annual revenue or total asset value of HK$1 billion according to its latest published financial statements. The HKEx will also take into account the listed issuer’s financial position, the nature and operating model of its business and its future business plans;

-

-

the acquired assets must:

-

be suitable for listing under Main Board Listing Rule 8.04 (GEM Listing Rule 11.06); and

-

meet the financial and track record requirements of Main Board Listing Rule 8.05, 8.05A or 8.05B (GEM Listing Rule 11.12A or 11.14); and

-

-

the enlarged group must meet all the new listing requirements of Chapter 8 of the Main Board Listing Rules (except Listing Rule 8.05) or Chapter 11 of the GEM Listing Rules (except GEM Listing Rule 11.12A).

9. What are the Consequences of Classification as an Extreme Transaction?

A listed issuer proposing an extreme transaction is required to:

-

comply with the requirements for very substantial acquisitions set out in Main Board Listing Rules 14.48 to 14.53 (GEM Listing Rules 19.48 to 19.53). The circular to shareholders must contain the information required under Main Board Listing Rule 14.69 (GEM Listing Rule 19.69); and

-

appoint a financial adviser to perform due diligence on the assets subject to the acquisition (and any assets and businesses the subject of a series of transactions and/or arrangements, if any). The financial adviser must submit to the HKEx a declaration in relation to the due diligence conducted before the bulk-printing of the circular for the transaction. Under Listing Rule 13.87B, the financial adviser must be licensed or registered to perform sponsor work.

10. What are the Hong Kong Takeovers Code implications of a Reverse Takeover?

An offer to acquire 30% or more of the voting rights of a Hong Kong listed issuer will trigger the obligation under Rule 26 of the Takeovers Code to make a general offer to all shareholders of the target company on the same terms in the absence of a waiver from the SFC Executive. Application for a whitewash waiver can be made which will require the whitewash application to be approved by 75% of the issuer’s independent shareholders and the reverse takeover to be approved by 50% of those shareholders. Rule 25 further prohibits an offeror and its associates from offering favourable conditions to one or more shareholders which are not available to all the other shareholders.

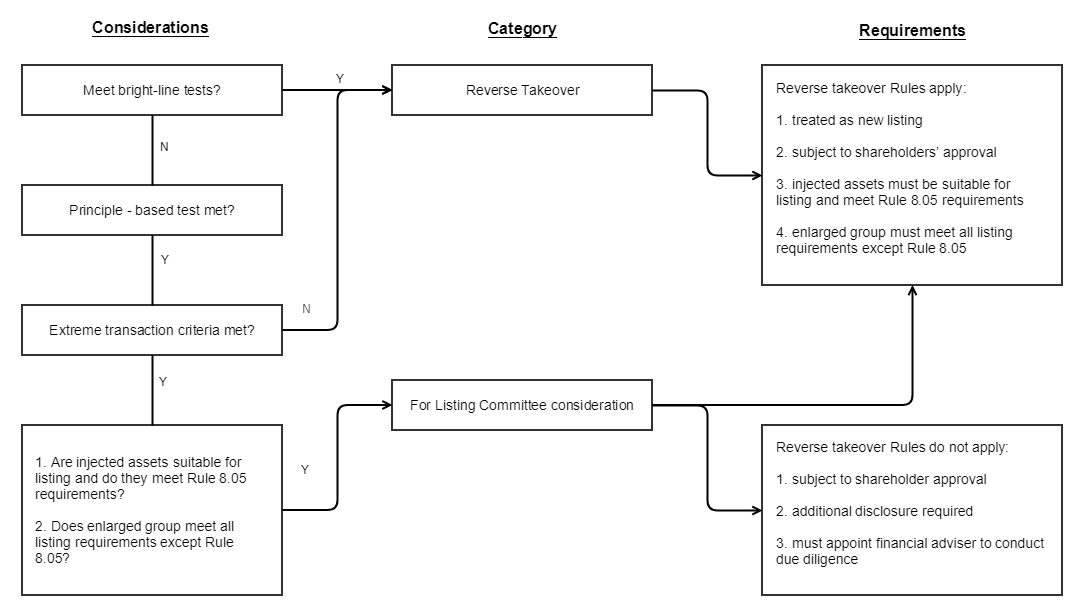

Summary of RTO Assessment Process and Requirements