IPOs

Hong Kong – a leading international market

- By market capitalisation, Hong Kong is the world’s 7th largest and Asia’s 3rd largest (after Japan & Shanghai) exchange

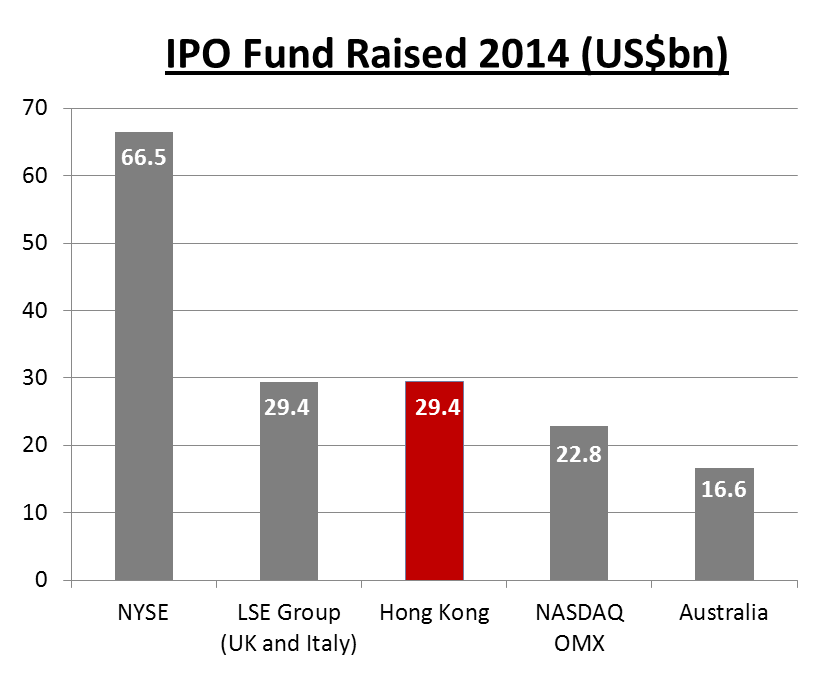

- In terms of IPO funds raised, Hong Kong ranked 3rd worldwide in 2014 (after NYSE and LSE Group) and in world’s top 5 for 13 consecutive years

Source: Data from World Federation of Exchanges (as at end of 31 December 2014). Figures for the London Stock Exchange Group include those of Borsa Italiana.

Why List in Hong Kong?

Source: World Federation of Exchange (WFE) website

- NO. 1 International Financial Centre in Asia

- Access to Mainland Chinese investors currently through Qualified Domestic Institutional Investor programme

- Shanghai-Hong Kong Stock Connect launched in November 2014 allows Mainland Chinese investors to invest directly in HK listed stocks for the 1st time. Programme helps broaden investor base and add liquidity to HK market adding momentum to the market

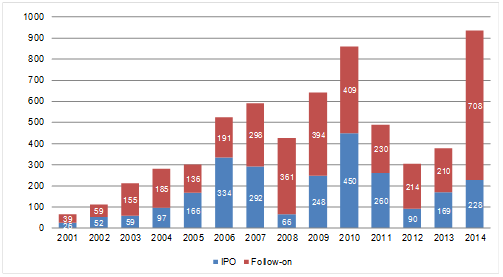

World Top Five in IPO Funds Raised

(HK$ billion)

- Ranked top 5 globally for 13th year in a row since 2002

- Active secondary market

Source: Hong Kong Exchanges and Clearing Limited

Ten Largest IPOs on the HKEx

| Company name | Industry | IPO funds raised (HK$bn) | |

| 1 | AIA Group Ltd. | Financials | 159.08 |

| 2 | Industrial and Commercial Bank of China Ltd. – H Shares | Financials | 124.95 |

| 3 | Agricultural Bank of China Ltd. – H Shares | Financials | 93.52 |

| 4 | Bank of China Ltd. – H Shares | Financials | 86.74 |

| 5 | Glencore plc | Resources | 77.75 |

| 6 | China Construction Bank Corporation – H Shares | Financials | 71.58 |

| 7 | China Unicom Ltd. | Telecommunications | 43.61 |

| 8 | China CITIC Bank Corporation Ltd. – H Shares | Financials | 32.92 |

| 9 | China Mobile Ltd. | Telecommunications | 32.67 |

| 10 | China Minsheng Banking Corp., Ltd. – H Shares | Financials | 31.23 |

Source: Hong Kong Exchanges and Clearing Limited

Ten Largest Hong Kong IPOs in 2014

| Company name | Industry | IPO funds raised (HK$bn) | |

| 1 | Dalian Wanda Commercial Properties Co., Ltd. – H Shares | Properties & construction | 28.80 |

| 2 | CGN Power Co., Ltd. – H Shares | Utilities | 28.21 |

| 3 | HK Electric Investments and HK Electric Investments Ltd. -SS | Utilities | 24.13 |

| 4 | WH Group Ltd. | Consumer goods | 18.31 |

| 5 | BAIC Motor Corporation Ltd. – H Shares | Consumer goods | 11.03 |

| 6 | Shengjing Bank Co., Ltd. – H Shares | Financials | 10.40 |

| 7 | China CNR Corporation Ltd. – H Shares | Industrials | 10.03 |

| 8 | Harbin Bank Co., Ltd. – H Shares | Financials | 8.77 |

| 9 | Luye Pharma Group Ltd. | Healthcare | 6.81 |

| 10 | Tianhe Chemicals Group Ltd. | Materials | 5.80 |

Source: Hong Kong Exchanges and Clearing Limited

Gateway to Mainland China

| Unit | Total | Mainland Enterprise | % of Total | |

| As at 31 December 2014 | ||||

| No. of listed companies | Number | 1,752 | 876 | 50% |

| Market capitalisation | HK$bn | 25,072 | 15,078 | 60% |

| As of 31 December 2014 | ||||

| Total equity funds raised | HK$bn | 935.8 | 693.9 | 74% |

| – IPO funds raised | HK$bn | 227.7 | 195.1 | 86% |

| – Post IPO funds raised | HK$bn | 708.1 | 498.8 | 71% |

| Average daily equity turnover | HK$bn | 51.2 | 36.2 | 71% |

Source: Hong Kong Exchanges and Clearing Limited

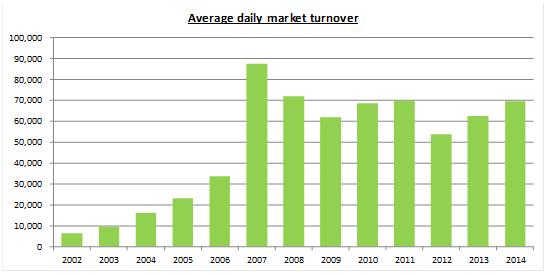

Strong Market Liquidity

(HK$ m)

Source: Hong Kong Exchanges and Clearing Limited

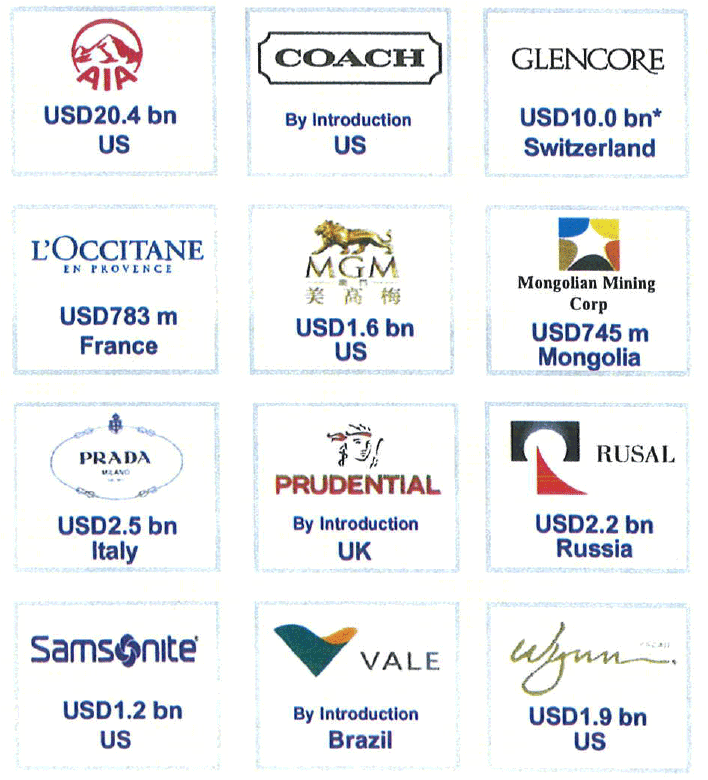

Selected International Listings

Source: Hong Kong Exchanges and Clearing Limited

Key Drivers for International Listings

- P/Es (price-earnings ratios) often higher in Hong Kong than their comparatives in other markets.

- Deep primary and secondary market liquidity.

- China Nexus :

- – Offers companies exposure in Mainland China, the world’s 2nd largest economy – particularly important for luxury goods.

- – Mainland Chinese investors currently can invest in HK stock market only through QDII (Qualified Domestic Institutional Investor scheme) – currently account for approx. 5% of turnover.

- – Importance of Mainland investors expected to grow with increasing internationalisation of RMB and increased investment choice for Mainland investors.

- Established legal system based on English common law and international accounting standards.

- Transparent and efficient listing regime.

- No capital flow restrictions, numerous tax advantages, currency convertability and free transferability of securities.

Selected Secondary Listings on HKEx

- Manulife Financial

- SouthGobi Resources

- Vale S.A.

- Glencore International

- Kazakhmys

- CapitaMalls Asia

- Coach, Inc.

Source: Hong Kong Exchanges and Clearing Limited

Secondary Listing on HKEx

| Company Name | Country of Incorporation | Listing Date on HKEx | Primary Exchange |

| Manulife Financial | Canada | 27 Sep 1999 | Toronto |

| SouthGobi Resources | Canada | 29 Jan 2010 | Toronto |

| Midas Holding | Singapore | 6 Oct 2010 | Singapore |

| Vale S.A. | Brazil | 8 Dec 2010 | Brazil |

| SBI Holdings | Japan | 14 Apr 2011 | Tokyo & Osaka |

| Glencore International | Jersey | 25 May 2011 | London |

| Kazakhmys | England & Wales | 29 Jun 2011 | London |

| CapitaMalls Asia | Singapore | 18 Oct 2011 | Singapore |

| Coach, Inc. | Maryland, US | 1 Dec 2011 | New York |

| Fast Retailing Co., Ltd. | Japan | 5 Mar 2014 | Tokyo |

Source: Hong Kong Exchanges and Clearing Limited

Key Area – Mining and Natural Resources Sector

- Key HKEx objective: development of HKEx as an international market for mining companies to list and raise funds.

- China is key consumer of mining commodities whose growth spurring huge increase in mineral demand.

- Overseas resources companies attracted by valuations premium and deep capital pool.

- Currently over 150 companies listed on HKEx are pure play metals and mining or energy companies.

- Another 100 or so have mineral or oil and gas assets or are somehow exposed to the industry.

- The market capitalisation of resource sector companies on HKEx increased x 30 since 1999.

- Numbers growing due to increasing number of natural resource companies listing in Hong Kong and significant M & A activity.

- New HKEx Listing Rules for Mining and Natural Resource Companies introduced June 2010.

Source: Hong Kong Exchanges and Clearing Limited

Mining and Natural Resources Sector

“Hong Kong will become the largest mining finance market in the world,” – Robert Friedland, executive chairman of Ivanhoe Mines speech at the Mines and Money Conference (Hong Kong 2010).

- United Company Rusal PLC – world’s largest aluminium producer – listed in January 2010 on HKEx and Euronext Paris, although HKEx accounts for 91% of trading volume.

- Mongolian Mining Corp. – producer of coal used in steel production, listed in October 2010 raising US$746 million.

Increasing Trend for Secondary Listings on HKEx

- Brazil’s Vale S.A. – the world’s largest iron ore producer listed on HKEx by way of secondary listing (no new fund raise) in December 2010 – rationale for HK listing – to obtain more investment from Asia and particularly China – accounting for 50% of its sales.

- South Gobi Energy Resources – Mongolia-based coal mining company (owned by Canadian Ivanhoe Mines) and listed on Toronto Stock Exchange raised US$439 million – trading apparently increased x 5 after its HK listing due to international exposure gained.

- Kazakhmys PLC – UK incorporated Kazakhstan copper miner – listed by way of secondary listing in 2011 – reasons for HK listing include closer relations with Chinese investors – China accounting for approx. 48% of its sales.

- Glencore International Plc – Swiss-based commodities trader – raised US$10 bn in IPO on HK and London exchanges in May 2011 – HK listing was a secondary listing.

According to HKEx, interest seen from iron ore, coal and gold companies from Australia, Canada, Kazakhstan and Mongolia.

Hong Kong’s Markets

- Main Board – caters for established companies able to meet its profit or other financial requirements.

- Growth Enterprise Markets (“GEM”) – a second board for smaller growth companies. Has lower admission criteria and provides a stepping stone to Main Board listing.

Overseas Companies: Eligibility for Listing

- Attracting more overseas companies to list in Hong Kong is one of the Exchange’s key policy initiatives.

- The Main Board and GEM Listing Rules allow the listing of companies incorporated in Hong Kong, China, Bermuda and the Cayman Islands (the “Recognised Jurisdictions”)

- Companies incorporated in other jurisdictions may list on the Exchange if they can demonstrate to the Exchange that their jurisdiction of incorporation has standards of shareholder protection which are at least equivalent to those provided in Hong Kong.

- Secondary listings are permitted on the Main Board (but not GEM) if the exchange of the applicant’s primary listing provides standards of shareholder protection equivalent to those provided in Hong Kong.

Overseas Companies: Eligibility for Listing

- In order to be eligible to list in Hong Kong, companies not incorporated in a Recognised Jurisdiction must either establish that their jurisdictions of incorporation provide comparable standards of shareholder protection to Hong Kong or amend their constitutional documents to provide the required standards of shareholder protection.

- The key shareholder protection standards required are set out in the Joint Policy Statement Regarding the Listing of Overseas Companies issued by HKEx and the SFC, which was updated on 27 September 2013 (the “Joint Policy Statement”).

- The HKEx has approved 21 jurisdictions as acceptable places of incorporation (the “Acceptable Jurisdictions”). These are Australia, Brazil, the British Virgin Islands, Canada (Alberta), Canada (British Columbia), Canada (Ontario), Cyprus, France, Germany, Guernsey, the Isle of Man, Italy, Japan, Jersey, Republic of Korea, Labuan, Luxembourg, Singapore, the United Kingdom, the States of California and Delaware in the United States.

Overseas Companies: Eligibility for Listing

- Guidance on meeting the required standards of shareholder protection for each Acceptable Jurisdiction is currently set out in the listing decision which approved the relevant jurisdiction. HKEx proposes to issue a Country Guide for each Acceptable Jurisdiction before the end of 2013 which will incorporate this guidance and replace the relevant listing decision. Companies incorporated in an Acceptable Jurisdiction should refer to these documents.

- If a company is not incorporated in a Recognised Jurisdiction, the Joint Policy Statement also requires that the statutory securities regulator of the overseas company’s jurisdiction of incorporation and place of central management and control (if different) must:

- – be a full signatory of the IOSCO Multilateral Memorandum of Understanding Concerning Consultation and Cooperation and the Exchange of Information; or

- – have entered into a bilateral agreement with the SFC to provide for mutual assistance and exchange of information for the purpose of enforcing and securing compliance with the laws and regulations of the relevant jurisdiction and Hong Kong. The HKEx may exempt certain companies from this requirement, subject to the SFC’s consent.

Overseas Companies: Eligibility for Listing

- Factors which the HKEx takes into account in determining an overseas company’s place of central management and control are:

- – where its senior management direct, control and coordinate the company’s activities;

- – where its principal books and records are kept; and

- – where its business operations or assets are located.

Principal Listing Requirements

| Main Board | GEM | ||||

| Financial Tests | Applicants must meet one of 3 financial tests below: | A GEM applicant must have :

|

|||

| Profit Test | Market Cap/ Revenue Test | Market Cap/ Revenue / Cash flow Test | |||

| Profit | Profit in respect of the most recent financial year of not less than HK$20,000,000 and, in respect of the two preceding years, be in aggregate of not less than HK$30,000,000 | ||||

| Market Cap | At least HK$200 million (US$26 million) at the time of listing | At least HK$4 billion (US$515 million) at the time of listing | HK$2 billion (US$257 million) at the time of listing | ||

| Revenue | – | At least HK$500 million (US$64 million) for the most recent audited financial year | At least HK$500 million (US$64 million) for the most recent audited financial year | ||

| Cash flow | – | – | Positive cash flow from operating activities of at least HK$100 million (US$13 million) in aggregate for the 3 preceding financial years | ||

| Public Float |

The Exchange has a discretion to accept a lower percentage of between 15% and 25% for issuers with an expected market capitalisation at the time of listing of over HK$10 billion (US$1.3 billion). |

||||

| Spread of Shareholders |

|

|

|||

| At the time of listing, not more than 50% of the publicly held securities can be beneficially owned by the 3 largest public shareholders | |||||

Other Listing Requirements

- Accountants’ Report: A listing document must include an accountant report on the financial information for the track record period. The latest period reported on must end no more than 6 months before the date of the listing document.

- Independent non-Executive Directors: Must be at least 3: one must have appropriate professional qualifications or accounting or related financial management expertise. From 31 December 2012, INEDs must make up at least 1/3 of the Board.

- Authorised Representatives: Must be at least 2: either 2 directors or a director and the company secretary.

- Share Registrar: Issuer must employ an approved share registrar in HK to maintain register of members.

- Audit Committee: Must be made up of non-executive directors only; have 3 or more members; one must have appropriate professional qualifications or accounting or related financial management expertise; majority of members must be INEDs.

- Remuneration Committee: Majority of members (incl. Chairman) must be INEDs.

- Process Agent for Overseas Issuer: An overseas company must appoint a person authorised to accept service of process and notices on its behalf in Hong Kong.

- Compliance Adviser: Newly listed companies must appoint a Compliance Adviser for the period starting on the listing date and ending on the date of publication of results for the first full financial year commencing after listing (for MB issuers) and on the date of publication of results for the second full financial year commencing after listing (for GEM issuers).

- Compliance Officer (for GEM issuers only): GEM issuers must appoint one of their executive directors as a compliance officer.

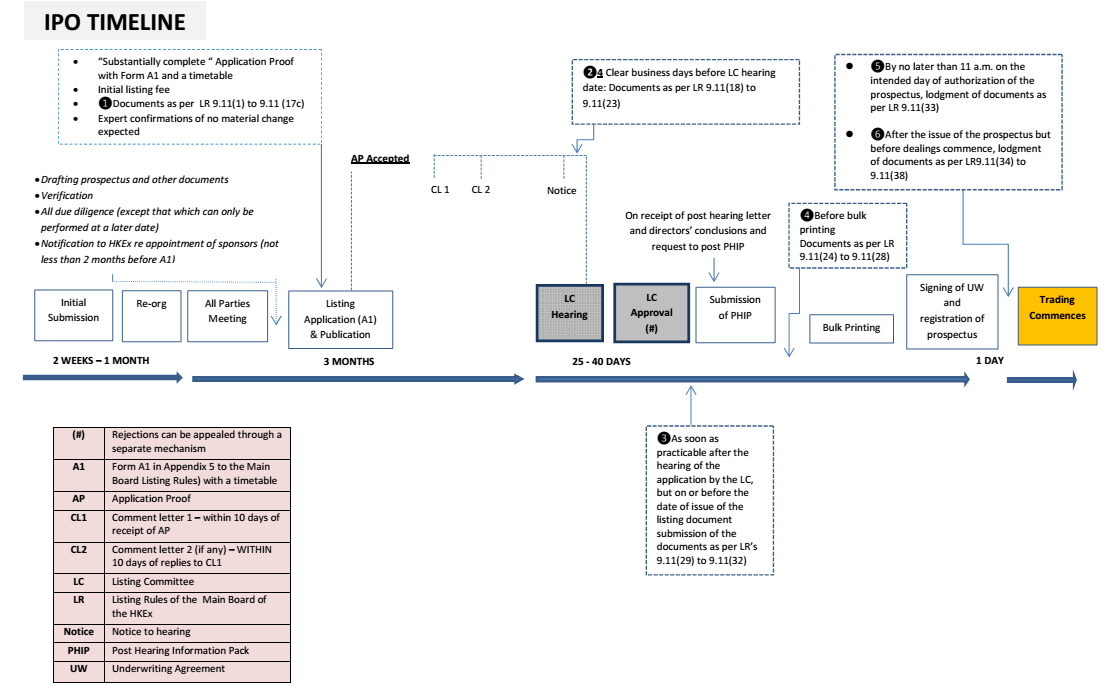

Documents Required to be Submitted in Support of a MB Listing Application

| ❶ Documents as per LR 9.11(1) to 9.11(17c) | ❷ 4 Clear days before LC hearing date: Documents as per under LR 9.11(18) to 9.11(23) | ❸ As soon as practicable after the hearing of the application by the LC, but on or before the date of issue of the listing document submission of the documents as per LR’s 9.11(29) to 9.11(32) |

|

|

|

| ❹ Before bulk printing Documents as per LR 9.11(24) to 9.11(28) | ❺ By no later than 11 a.m. on the intended day of authorization of the prospectus, lodgment of documents as per LR 9.11(33) (In case of a listing document which constitutes a prospectus under the CO) | ❻ After the issue of the prospectus but before dealings commence, lodgment of documents as per LR9.11(34) to 9.11(38) |

|

|

|

IPO timeline

Listing Rules for Mineral Companies

Came into effect on 3 June 2010.

- Mineral Company is a new listing applicant whose “major activity (whether directly or through its subsidiaries) is the exploration for and/or extraction of natural resources (including minerals and petroleum).”

- Major activity is an activity representing 25% or more of total assets, revenue or operating expenses.

- Listing Requirements

- – Must have at least discovered a portfolio of Indicated Resources (for minerals) or Contingent Resources (for petroleum) under applicable reporting standards “of sufficient substance” to justify a listing (MB Rule 18.03 (2) / GEM Rule 18A.03 (2)). Early stage exploration companies are not acceptable for listing.

- – Must have rights to actively participate in exploration and/or extraction through either (i) an interest of >50% of assets (by value) or (ii) rights acceptable to HKEx giving it sufficient influence in decisions (e.g. under joint ventures, production sharing contracts or specific government mandates) (MB Rule 18.03 (1) / GEM Rule 18A.03 (1)). HKEx normally expects an interest of >30% in relevant assets. Companies with interest of <30% may be considered, e.g. if they actively operate mining project.

- – Either meet the Main Board financial tests and track record requirement or senior management and directors taken together have minimum of 5 years’ experience relevant to exploration and or extraction activity pursued by applicant (MB Rule 18.04)

- – A pre-production stage company seeking a waiver of Main Board financial tests/track record requirement will need to show a clear path to commercial production. Companies already in production that cannot meet the profit requirements are unlikely to be considered favourably unless they have development activity on hand and can show a path to commercial production.

- – For GEM listings, HKEx may waive 2-year trading record requirement if senior management and directors together have a minimum of 5 years’ relevant experience, but HK$20 million cash flow requirement must be met for shorter period (GEM Rule 18A.04).

- – Sufficient working capital for 125% of budgeted needs for the next 12 months (MB Rule 18.03 (4) / GEM Rules 18A.03 (4)).

Disclosure Requirements for New Applicant’s Listing Document

MB Rules 18.05 – 18.08 / GEM Rules 18A.05 – 18A.08 set out the required disclosures, including:

- A Competent Person’s Report on reserves and resources.

- Details of all prospecting, exploration, exploitation, land use and mining rights, and details of material rights to be obtained.

- Specific and general risks (Main Board Guidance Note 7 / GEM Practice Note 4 provide suggested risk assessment for mineral companies)

- Disclosure on social and environment considerations, if relevant and material.

- For those not yet in production, plans to production with indicative dates and costs supported at least by a Scoping Study.

- Production stage companies must disclose estimate operating cash cost per unit of minerals or petroleum.

Requirement for Competent Person’s Report

- A new applicant’s listing document must include a technical report or Competent Person’s Report on its reserves and resources.

- A Competent Person must:

- – Have > 5 years’ experience relevant to the type of mineral/petroleum assets and to the mining activity undertaken by the listing applicant;

- – Be professionally qualified and a member of a Recognised Professional Organisation; and

- – Be independent of the listing applicant

(MB Rules 18.21 – 18.23 / GEM Rules 18A.21 – 18A.23).

- Competent Person’s Report (CPR) must be prepared in accordance with the JORC Code, NI 43-101 or the SAMREC Code (for mineral reserves and resources) or PRMS (for petroleum reserves and resources)

- If information is presented in accordance with other reporting standards (e.g. Chinese or Russian), reconciliation to the accepted reporting standards is required.

- CPR must have an effective date < 6 months before the date of the listing document;

- Listing document must contain a statement of no material change since effective date of CPR or description of material changes.

- Content requirements of a CPR for petroleum are set out in MB Appendix 25/GEM Appendix 18.

Requirements for Valuation Report

- Valuation is not mandatory at IPO (although valuation is required for post-listing acquisitions of mineral/petroleum assets requiring shareholders’ approval).

- Valuations must be prepared by Competent Evaluators who must be Competent Persons and have (i) >10 years’ relevant and recent general mineral/petroleum experience and (ii) >5 years’ relevant and recent experience in assessing and/or valuing mineral or petroleum assets.

- Valuation must be prepared in accordance with the VALMIN Code, CIMVAL or SAMVAL Code and must disclose basis of valuation, assumptions and reasons for selection of valuation method.

Mineral Reporting

- For CPR on mineral reserves and/or resources, issuer must also satisfy the modifications under MB Rule 18.30 / GEM Rule 18A.30:

- – Estimates of mineral reserves are supported, at a minimum, by a pre-feasibility study.

- – Estimates of mineral reserves and resources must be disclosed separately.

- – Indicated and measured resources can be included in economic analyses but basis on which they are economically extractable and the discount for conversion to mineral Reserves must be disclosed.

- – Valuation for inferred resources are not permitted.

- – For profit forecasts and forward looking valuations, the basis for commodity prices and material assumptions must be including, as well as sensitivity analyses on price.

- For CPR on petroleum reserves and/or reserves, issuers must also satisfy the modifications under MB Rule 18.33 / GEM Rule 18A.33:

- – Method and reason for choice of estimation of petroleum reserves must be disclosed (i.e. deterministic or probabilistic).

- – If NPVs attributable to proved and proved plus probable reserves are disclosed, they are presented:

- On a post-tax basis at varying discount rates or a fixed discount rate of 10%.

- Using a forecast price or a constant price as base case.

- – Economic values must not be attached to possible reserves, contingent resources or prospective resources.

Continuing Obligations

Mineral Companies’ Acquisitions of Mineral/Petroleum Assets

Where a Mineral Company proposes to acquire assets which are solely or mainly mineral or petroleum assets as part of a major transaction (i.e. 25% or more of existing activities) or above, the circular must:

- Comply with the notifiable transaction requirements of MB Chapter 14/GEM Chapter 19 and, if applicable, the connected transaction requirements of MB Chapter 14A/GEM Chapter 20

- Include a Competent Person’s Report on the resources and/or reserves being disposed of (MB Rule 18.09 (2) /GEM Rule 18A.09 (2)).

- Contain details of any material liabilities that remain with the issuer after disposal (Note to MB Rule 18.09 (4) / GEM Rule 18A.09 (4)).

Note: HKEx may dispense with the requirement for a CPR on disposals where shareholders have sufficient information on the assets being disposed of. (Note to MB Rule 18.09 (2) /GEM Rule 18A.09 (2))

Where a Mineral Company proposes to acquire assets which are solely or mainly mineral or petroleum assets as part of a major transaction (i.e. 25% or more of existing activities) or above, the circular must:

- Contain a statement of no material change or descriptions of material changes since the effective date of the Competent Person’s Report (MB Rule 18.05 (2) / GEM Rule 18A.05 (2)).

- Include a Valuation Report on the mineral or petroleum assets being acquired (MB Rule 18.09 (3) / GEM Rule 18A.09 (3)).

- Disclose specific and general risks (MB Rule 18.05 (5) / GEM Rule 18A.05 (5)).

- Disclose other relevant and material information (MB Rule 18.05 (3), (4) & (6) / GEM Rule 18A.05 (3), (4) & (6).

Note: Where an asset is acquired from a company which already has an independent CPR/Valuation Report, the issuer may use those reports if:

- The report is no more than 6 months old and complies with the required reporting standards,

- The issuer includes in the circular/listing document a statement of no material change since the effective date of the report; and

- The issuer obtains the prior written consent of the Competent Person or Competent Evaluator to the inclusion of its report in the circular/listing document

(MB Rules 18.12 & 18.13 / GEM Rules 18A.12 & 18A.13).

Continuing Obligations

Reporting Requirements

- Annual update of reserves and resources in annual reports in accordance with the reporting standard under which they were previously disclosed accepted. Need NOT be done by Competent Persons, but must be substantiated by the issuer’s internal expert. Statements of no material change acceptable (MB Rule 18.16 / GEM Rule 18A.16; Note to MB Rule 18.17 / GEM Rule 18A.17).

- Annual and half-year financial reports must include details of exploration, development and mining production and expenditure incurred (MB Rule 18.14 / GEM Rule 18A.14).

Charltons

- Charltons’ extensive experience in corporate finance makes us uniquely qualified to provide a first class legal service

- Charltons have representative offices in Shanghai, Beijing and Yangon

- Charltons was named the “Corporate Finance Law Firm of the Year in Hong Kong ” in the Corporate Intl Magazine Global Award 2014

- “Boutique Firm of the Year” was awarded to Charltons by Asian Legal Business for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015

- “Hong Kong’s Top Independent Law Firm” was awarded to Charltons in the Euromoney Legal Media Group Asia Women in Business Law Awards 2012 and 2013

- “Equity Market Deal of the Year” was awarded to Charltons in 2011 by Asian Legal Business for advising on the AIA IPO

- Excellent links and networks with law firms worldwide.

- Julia Charlton was named a “Leading Lawyer” by Asia Law & Practice for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015.

- “Asian Restructuring Deal of the Year” 2000 awarded to Charltons by International Financial Law Review for their work with Guangdong Investment Limited.

- Finalist for China Law & Practice’s “Deal of the Year (M&A)” 2007 for the work on Zijin Mining Group Co Ltd.’s bid for Monterrico Metals plc.

Team Profile

The team is composed of individuals with the following knowledge and skills:

- A detailed knowledge of Hong Kong law and practice in relation to IPOs and equity fund raising transactions of public companies.

- Extensive experience of providing legal services for Hong Kong and PRC-related IPO transactions.

- In depth knowledge of the Listing Rules of both GEM and the Main Board of the Hong Kong Stock Exchange.

- Depth and range of experience in advising companies in connection with IPO and Listing transactions.

Team Profile: Julia Charlton

- Julia Charlton – Partner

- – Julia, LL.B (1st class Honours), A.K.C (Kings College, London) was admitted as a solicitor in England & Wales in 1985 and has practised as a solicitor in Hong Kong since 1987.

- – Julia is a member of the Listing Committee of the Stock Exchange of Hong Kong Limited and the Takeovers Panel and the Takeovers Appeal Panel of the SFC.

- – Julia was named a “Leading Lawyer” by Asia Law & Practice for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015.

- – Julia was named a “Leading Advisor” by Acquisition International for 2013.

- – Julia was also named the “Capital Markets Lawyer of the Year – Hong Kong” in the Finance Monthly Global Awards 2014.

- – Julia has extensive experience in China work and is a Mandarin speaker.

Professional Experience

- Charltons has considerable experience in assisting companies to list on both the Main Board and the Growth Enterprise Market (“GEM”) of the HKSE

- Extensive experience in China

Recent IPO Experience

- Medicskin Holdings Limited (listed on the GEM of the SEHK in December 2014, Charltons acted as the Hong Kong legal adviser to the company)

- Orient Securities International Holdings Limited (listed on the GEM of the SEHK in January 2014, Charltons acted as the Hong Kong legal adviser to the sponsor)

- Mastercraft International Holdings Limited (listed on the GEM of the SEHK in July 2012, Charltons acted as the Hong Kong legal adviser to the sponsor)

- Branding China Group Limited (listed on the GEM of the SEHK in April 2012, Charltons acted as the Hong Kong legal adviser to the sponsor)

- AIA Group Ltd. (listed on the Main Board of the SEHK in October 2010, Charltons acted as the Hong Kong legal adviser to AIG, a shareholder)

- United Company RUSAL Plc (listed on the Main Board of the SEHK in January 2010, Charltons acted as the Hong Kong legal adviser to the controlling shareholder)

- China Titans Energy Technology Group Co., Limited (listed on the Main Board of the SEHK in May 2010, Charltons acted as the Hong Kong legal adviser to the sponsor)

Other IPO Experience

- Mingfa Group (International) Company Limited (listed on the Main Board of the SEHK in November 2009, Charltons acted as the Hong Kong legal adviser to the company)

- Greens Holdings Limited (listed on the Main Board of the SEHK in November 2009, Charltons acted as the Hong Kong legal adviser to the company)

- China All Access (Holdings) Limited,

- sponsored by Guotai Junan Capital Limited

- listed on the Main Board of the Exchange in September 2009, Charltons acted as the Hong Kong legal adviser to the sponsor

- China Tianyi Fruit Holdings Limited (listed on the Main Board of the SEHK in July 2008, Charltons acted as the Hong Kong legal adviser to the sponsor)

- China High Speed Transmission Equipment Group Co., Ltd.

- – sponsored by Morgan Stanley

- – listed on the Main Board of the Exchange in 2007, Charltons acted on behalf of the company

- – with market capitalisation on listing of approximately HK$2,442,000,000 (US$313,600,000)

- Zhejiang Shibao Co., Ltd., (listed on the GEM in May 2006, Charltons acted as the Hong Kong legal adviser to the company)

- Fu Ji Food and Catering Services Holding Ltd. (listed on the Main Board of the SEHK in December 2004, Charltons represented the strategic investor)

- China Fire Safety Enterprise Group Holdings Ltd. (listed on the GEM of the SEHK in September 2002, Charltons represented the strategic investor)

- Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co. Ltd. (listed on GEM of the Exchange in August 2002, Charltons acted as the Hong Kong legal adviser to the sponsor)

- Tianjin TEDA Biomedical Engineering Co. Ltd. (listed on GEM of the Exchange in June 2002, Charltons acted as the Hong Kong legal adviser to the sponsor)

- Zheda Lande Scitech Ltd. (listed on GEM of the Exchange in May 2002, Charltons acted as the Hong Kong legal adviser to the company)

- TradeEasy Holdings Ltd. (listed on GEM of the Exchange in March 2002, Charltons acted as the Hong Kong legal adviser to the company) (it is now renamed as Merdeka Resources Holdings Limited)

- Bon Holdings Ltd. (listed on the Main Board of the Exchange in April 2000, Charltons acted as the Hong Kong legal adviser to the sponsor)

- Great Wall Technology Co. Ltd. (listed on the Main Board of the Exchange in August 1999, Charltons acted as the Hong Kong legal adviser to the company) (the then market capitalisation was valued approximately at HK$3,772,890,000)

The Regulatory Regime for IPO Sponsors

- The new sponsors regulatory regime includes :

- – Prospectus liabilities

- The amended Companies Ordinance clearly states that sponsors have both civil and criminal liabilities for misstatements in prospectus.

- – Paragraph 17 of the Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission (the “Code of Conduct”)

- And higher standards applicable to IPO sponsors, emphasising the standard of due diligence and requirements in relation to the recording of the work undertaken.

- – Listing Rules by the HKEx covering listing timetable, guidance materials and templates)

- – Prospectus liabilities

- Paragraph 17 of the Code of Conduct sets out the outcomes expected by the SFC, but does not address how such outcomes are to be achieved.

- In order to help sponsors and other IPO participants better understand the revised standards contained in the Code of Conduct, Charltons acted as the co-ordinating law firm in relation to the publication of the Hong Kong Sponsors Due Diligence Guidelines (“Due Diligence Guidelines”) produced jointly by leading Hong Kong law firms, two of the Big Four accounting firms and more than 40 banks or financial advisory businesses.

- In addition to drafting the Due Diligence Guidelines, Charltons is responsible for managing and leading the publication of the Due Diligence Guidelines.

- The Due Diligence Guidelines can be downloaded for free at duediligenceguidelines.com, a web site created and managed by Charltons.

- The Due Diligence Guidelines are 762 pages long and were completed over a year of extensive consultation.

- A number of international and PRC investment banks in Hong Kong, medium-sized local sponsors and professional institutions (e.g. CCB International (Holdings) Limited, Linklaters and KPMG) were involved in the consultation process.

- The Due Diligence Guidelines include chapters on :

- – Knowing the Listing Applicant and its Management

- – Verification Practice

- – Business Model

- – Interviews of Major Business Stakeholders

- – Controlling Shareholders’ Relationship with the Listing Applicant

- – Connected Persons and Connected Transactions

- – Financials

- – Internal Controls

- – Material Contracts

- – Biological Assets

- Charltons represented a number of sponsors in submitting comments to the SFC and HKEx, and acted as the co-ordinating law firm in the Due Diligence Guidelines initiative and therefore has a deep understanding of the new regulatory regime applicable to IPO sponsors, the related amended Listing Rules and related compliance issues.

- Charltons provides the followings services to ensure sponsors meeting the requirements set out in the Code of Conduct:

- – sponsor training session

- – Review and re-draft their sponsor engagement letter

- – Review and re-draft their due diligence plan