HKEx Consultation Conclusions on Review of the ESG Reporting Guide and ESG Listing Rules

On 18 December 2019, the Stock Exchange of Hong Kong Limited (HKEx) published its Consultation Conclusions: Review of the Environmental, Social and Governance Reporting Guide and Related Listing Rules with respect to its May 2019 Consultation Paper, the consultation period for which closed on 19 July 2019. The Consultation Conclusions were published together with the findings of HKEx’s latest review of Environmental, Social and Governance Practice Disclosure (ESG Disclosure Review).

The revised HKEx Listing Rules and ESG Guide were initially proposed to be implemented for financial years commencing on or after 1 January 2020. Respondents however called for a longer transition period owing to a number of new requirements that may involve significantly adjusting an issuer’s ESG compliance process, namely the shortened deadline for publication of ESG reports and the mandatory disclosure requirements, in addition to the new Aspect on climate change and the new key performance indicators (KPIs) on supply chain that may necessitate the collection of new relevant data.

Accordingly, the proposals will be implemented for financial years commencing on or after 1 July 2020, with proposals in regards to the Main Board Rules (MBR) applying equally to the GEM Rules.

This newsletter also summarises the major internationally recognised ESG initiatives, which you can find set out in Annex 1.

HKEx ESG Listing Rule Amendments

-

Timeframe for HKEx Issuers to Publish ESG Reports

In the consultation paper, HKEx proposed amending MBR 13.91 and GEM Rule 17.103 to shorten the timeframe for publishing ESG reports to within 4 months for Main Board issuers and 3 months for GEM issuers after the financial year-end.

Following the consultation, HKEx will shorten the publication timeframe to within 5 months after the financial year-end, for both Main Board and GEM issuers.

Additionally, issuers will be encouraged to publish the ESG report at the same time as the annual report, although it is not required. HKEx does not however rule out aligning the publication timeframe in the future, and indeed at present, a majority (63%) of issuers published ESG reports on the same day as their annual reports, according to the ESG Disclosure Review.

-

Printing ESG Reports

HKEx proposed amending the Listing Rules and the ESG Reporting Guide to clarify that where the ESG report is not a part of the annual report, issuers are not required to provide the ESG report in a printed form to shareholders.

99% of respondents supported the proposal, citing cost-effectiveness and environmental concerns, and accordingly, HKEx will adopt the proposal.

Shareholders can however specifically request the ESG report in printed form and the issuer must notify shareholders that the report has been published on both the issuer’s website and the HKEx website.

Amendments to HKEx’s ESG Guide

Mandatory ESG Disclosure Requirements

-

Board Statement

HKEx will introduce a requirement for mandatory disclosure of a statement from the board, and while it makes clear that each issuer should consider its own circumstances in determining the level of disclosure, the statement should include:

- Disclosure of the board’s oversight of ESG issues;

- Disclosure of the board’s ESG management approach and strategy; and

- Disclosure of how the board reviews progress made against ESG-related goals and targets.

-

Reporting Principles

HKEx will revise the ESG Guide to clarify that issuers must follow all four Reporting Principles in preparing the ESG report and will be required to disclose how they have applied the Reporting Principles in the ESG report. The latter requirement will apply to three of the four Reporting Principles, namely, “materiality”, “quantitative”, and “consistency”, with HKEx considering that the application of the fourth Reporting Principle, “balance”, may be evident from the ESG report itself.

Materiality:

HKEx will amend the wording regarding the Reporting Principle “materiality” to clarify that the board is responsible for evaluating and determining “materiality” and to clarify that the issuer must disclose the identification process and selection criteria for material ESG factors, with more guidance to follow in an updated version of HKEx’s step-by-step guide to ESG reporting: “How to Prepare an ESG Report?” (Step-by-Step Guide).

Previously, there was no strict requirement for such a disclosure, and the implications are evident from the ESG Disclosure Review. The review identified that two thirds of issuers disclosed an assessment had been undertaken, with varying degrees of detail as to how it was performed, and less than one third of ESG Reports disclosed the criteria adopted for selection of material ESG factors

Quantitative:

HKEx will amend the wording regarding the Reporting Principle “quantitative” to require disclosure of standards and methodologies used for calculation of data in order to improve transparency and increase stakeholders’ understanding of ESG data.

HKEx will also clarify that targets may be expressed by way of directional statements or quantitative descriptions in order to provide flexibility to issuers, and examples will be available in the Step-by-Step Guide.

HKEx also state that issuers are encouraged to refer to or adopt international ESG reporting standards or guidelines relevant to their industries or sectors. Issuers can refer to the FAQs on ESG reporting, which offer a comparison of the provisions of the ESG Guide against a number of international reporting guidelines.

-

ESG Reporting Boundary

HKEx will introduce a mandatory disclosure of an explanation of the ESG report’s reporting boundary to improve the transparency and understanding of ESG reports.

There will be no minimum financial threshold prescribed for reporting as HKEx does not consider that the financial significance of a business operation will always be directly proportional to associated ESG risks. HKEx advise that issuers should determine their appropriate criteria for determining the reporting boundary and, if they adopt different boundaries for different Aspects, then this must be disclosed in the ESG report.

The new requirement is motivated by the findings of the ESG Disclosure Review that identified that many ESG reports contained little or no description of board involvement (less than one third). As such, HKEx is emphasising that it is crucial that boards are meaningfully involved in assessing and addressing ESG-related risks.

-

-

Environmental Reporting

-

New Aspect A4

HKEx will introduce a new Aspect A4 to require disclosure of significant climate-related issues which have impacted and/or may impact the issuer, a stark change from the previous lack of such a disclosure.

This is in response to the serious risk posed by climate change to the global economy and the resultant investor demand for more information on how it may impact the company. It is also in line with Task Force on Climate-related Financial Disclosure (TCFD) Recommendations.

Aspect A4 will consist of a General Disclosure and a Key Performance Indicator (KPI). The former requires disclosure of policies on measures to identify and mitigate significant climate-related issues which have impacted or may impact the issuer, and the latter requires a description of the significant climate-related issues which have impacted or may impact the issuer, and the actions taken to manage them.

HKEx clarifies that climate-related issues refer to both transition risks and physical risks, and this will be included in the updated guidance materials.

The new disclosure obligation will apply on a “comply or explain” basis.

-

Amending KPIs

The ESG Disclosure Review found that the reporting rate in relation to Environmental KPIs was very high overall. Accordingly, HKEx is taking the next step by firstly revising the Environmental KPIs to require disclosure of a description of targets set regarding emissions, energy use and water efficiency, waste reduction etc. and the steps taken to achieve them. This is a change to the previous position, where issuers were required to disclose “results achieved” but not targets.

This revision, like all Environmental KPIs, is on a “comply or explain” basis and targets may be expressed by way of directional statements, with HKEx also providing guidance on target-setting in the Step-by-Step Guide.

Secondly, while the majority of issuers already voluntarily report on Greenhouse Gas (GHG) emissions in ESG reports, HKEx will revise an Environmental KPI to require disclosure of Scope 1 and Scope 2 GHG emissions, in line with most international standards, with disclosure of Scope 3 emissions not being required at present. Previously, the FAQs encouraged issuers to report on emissions by scope, but it was not a requirement.

The Step-by-Step Guide will also be updated to provide guidance to issuers.

-

-

Social KPIs

-

Upgrading Social KPIs to “Comply or Explain”

With the level of disclosure for Social KPIs being relatively low, the disclosure obligation of Social KPIs will be upgraded from recommended (i.e. voluntary) to “comply or explain”, in an effort to emphasise the equal treatment of environmental and social risks.

Importantly, HKEx emphasises that “explain” is not a less-preferable option. Indeed, the ESG Disclosure Review found that of all provisions reported by issuers, only 3% were explained, leading HKEx to conclude that issuers considered it a less desirable option or did not properly determine whether a provision was material to them. Accordingly, HKEx stresses that where a “comply or explain” provision is immaterial to the issuer, it is perfectly acceptable to explain.

-

Revision of Relevant KPIs

HKEx will amend Social KPIs to:

Clarify “employment types”; and

Require disclosure of the number and rate of work-related fatalities in each of the past three years.

HKEx will amend a KPI to clarify that “employment types” includes full-time or part-time staff, while emphasising that employment may fall into categories other than those. Indeed, issuers are encouraged to categorise employment type based on their business models. HKEx will list the most common forms of employment, but will remind issuers that the list is non-exhaustive.

HKEx will also amend a KPI to require disclosure of the number and rate of work-related fatalities occurring in each of the past three years, a change from previously where disclosure was merely recommended, to encourage issuers to better monitor workplace safety, with issuers encouraged to consider extending the reporting to other forms of employment considered material to their workforce. HKEx specifies that where disclosure is not possible due to legal restrictions, a description of the legal restrictions will be necessary.

-

Introduction of New KPIs

HKEx will introduce three new KPIs relating to supply chain management and anti-corruption.

With regard to supply chain management, the first new KPI will require issuers to disclose practices used to identify environmental and social risks along the supply chain and how they are implemented and monitored, and the second will necessitate a description of the practices used to promote environmentally preferable products and services when selecting suppliers, and how practices are implemented and monitored. This is in an effort to heighten awareness of ESG risks in the procurement process and allow investors to assess risks associated with the supply chain. How far down the supply chain the disclosure goes is subject to the issuer’s own circumstances, with recognition that disclosure of direct suppliers may be sufficient in some cases.

HKEx emphasises that this does not require issuers to select suppliers based on social factors, despite the importance of issuers considering ESG risks in the procurement process.

With regard to anti-corruption, HKEx will introduce a new KPI requiring disclosure of anti-corruption training provided to directors and staff, with no requirement imposed on the training provider at present. Previously, issuers were merely recommended to disclose:

The number of concluded legal cases regarding corrupt practices brought against the issuer or its employees during the reporting period and the outcomes; and

A description of preventative measures and whistle-blowing procedures and how they are implemented and monitored.

Respondents suggested additional disclosures under this KPI, such as the number of directors or staff trained and the content and the outcomes of the training. HKEx noted this and emphasised that the ESG Guide sets out the minimum parameters for ESG reporting and issuers are accordingly encouraged to disclose any additional information they consider appropriate and material.

Also of note is that some respondents opposed the proposal citing concerns that issuers may not have resources to organise anti-corruption training and workshops regularly. HKEx however emphasises that anti-corruption is necessary in facilitating a good corporate culture and so adequate resources should be devoted.

-

-

Independent Assurance of ESG Information

-

Encouraging Issuers to Seek Independent Assurances

Previously, there was no guidance on the information that was to be disclosed if independent assurance is obtained. Accordingly, HKEx will revise the ESG Guide to state that an issuer may seek independent assurance to strengthen the credibility of ESG information disclosed, and where the issuer obtains independent assurance, they should describe the level, scope and processes adopted for assurance clearly in the ESG report.

HKEx acknowledges that there are concerns about the cost and compliance burden and so emphasises that seeking independent assurance is not a requirement.

-

-

Other Comments on ESG Reporting Requirements

In the consultation conclusions, HKEx also acknowledges the additional valuable comments that they received and states that while they cannot bring the new proposals in at this stage, they will consider them in future reviews.

-

Diversity

HKEx acknowledges the recommendations on introducing additional KPIs on gender statistics in the workplace and on the board, policies on fair and equal payments to employees and sexual harassment in the workplace.

In May 2019 however, HKEx revised the Guidance Letter on disclosure in listing documents by new applicants to require additional disclosure on policy of board diversity and how gender diversity of the board can be achieved if the board lacks this.[1]

-

ESG Reporting Requirements for HKEx Listing Applicants

HKEx also acknowledges a comment that listing applicants should look to ESG-related risks from the outset and be prepared to tackle them as soon as they are listed, with specific ESG disclosure guidance also provided to listing applicants.

Accordingly, HKEx draws attention to the revised Guidance Letter, and favours guidance on prospectus disclosure in one single document, as compared to across numerous topic-specific guidance.

-

International ESG Disclosure Standards

HKEx also acknowledges calls from some respondents for alignment with or reference to international standards for some disclosure requirements, mainly the Reporting Principles, materiality assessment, the new Aspect on climate change and some Social KPIs. HKEx however considers that prescribing specific standards are beyond the scope of the Guide and note that they encourage issuers to refer to or adopt international ESG reporting standards relevant to their industries or sectors.[2]

-

Suggestions re. HKEx’s Corporate Governance Code

Some respondents also suggested introducing corresponding requirements into the Corporate Governance (CG) Code and a further suggestion that ESG reporting and CG reporting could be merged into one document in the future.

HKEx did not specifically address this, but noted generally that the additional comments would be considered in due course.

-

Annex 1

Other Frameworks and Guidance to ESG Management Practices

In addition to the ESG disclosure requirements stipulated by governing bodies like stock exchanges or financial regulators, some organisations voluntarily conform to additional ESG, sustainability, or corporate social responsibility frameworks, instruments or standards.

There are a variety of initiatives which offer organisations frameworks, tools and guidance in developing sustainability strategy, management tools and reporting. Set out below are a selection of key internationally recognised initiatives, some of which are well-established whilst others are gaining momentum. The list below is neither complete nor exhaustive and is provided for general reference purposes only.

|

INITIATIVES |

DESCRIPTION[3] |

||||||||||||||||||||||||||||||||||

|

CDP (formerly the Carbon Disclosure Project) URL: https://www.cdp.net/en |

Founded in 2000, CDP is an international non-profit organisation which runs the global environmental disclosure system. Each year, at the request of investors, purchasers and city stakeholders (i.e. CDP’s investor signatories and members), CDP collects information supplied by companies, cities, states and regions in respect of climate change, water security and deforestation and scores companies and cities based on their performance on climate change, water security and deforestation. There are now over 8,400 companies, over 800 cities, and over 120 states and regions from over 90 countries disclosing through CDP on an annual basis. |

||||||||||||||||||||||||||||||||||

|

Climate Disclosure Standards Board (CDSB) URL: https://www.cdsb.net/ |

CDSB is an international consortium of business and environmental NGOs. The CDSB Framework provides guidance for organisations to integrate environmental information into mainstream corporate reporting. The first CDSB Framework, the Climate Change Reporting Framework, was released in 2010. The Framework has been expanded since its first release. The latest updated CDSB Framework was updated to outline the areas of alignment between the TCFD recommendations and the CDSB Framework. The CDSB Framework is used in 32 countries – by 373 companies across 10 sectors with a combined market capitalisation of US$5.2 trillion. (Source: TCFD Implementation Guide) The CDSB Framework is available at: https://www.cdsb.net/sites/default/files/cdsb_framework_2.1.pdf |

||||||||||||||||||||||||||||||||||

|

Corporate Reporting Dialogue URL: https://corporatereportingdialogue.com/ |

A platform convened by the International Integrated Reporting Council to promote greater coherence, consistency and comparability between corporate reporting frameworks, standards and related requirements. The participants in the Corporate Reporting Dialogue are:

The Corporate Reporting Dialogue launched the Better Alignment Project (a two-year project) in 2018 to seek to improve the coherence, consistency and comparability of the frameworks and standards of the five of its participants (i.e. CDP, CDSB, GRI, IIRC and SASB) so as to better support organisations in preparing ESG disclosures. The first report of the Better Alignment Project can be found at https://corporatereportingdialogue.com/climatereport2019/ |

||||||||||||||||||||||||||||||||||

|

Global Reporting Initiative (“GRI”) URL: https://www.globalreporting.org/ |

Founded in 1997, GRI is an international organisation which pioneered corporate sustainability reporting. Since the first release of the GRI Guidelines in 2000, the GRI Guidelines/ Standards have undergone continuous development. The GRI Standards are the most widely adopted global standards for sustainability reporting. According to KPMG’s Survey of Corporate Responsibility Reporting 2017, 93% of the world’s largest 250 corporations report on their sustainability performance and 74% of these companies use GRI Standards to do so. Sustainability reporting, as promoted by the GRI Standards, is an organisation’s practice of reporting publicly on its economic, environmental, and/ or social impacts, and hence its contributions – positive or negative- towards the goal of sustainable development. Issued by the Global Sustainability Standards Board (“GSSB”), GRI Standards are structured as a set of modular and interrelated standards (with three universal standards applicable to all organisations and 33 topic-specific GRI Standards for reporting on material topics). Based on its material topics, an organisation can use the GRI Standards as a set to prepare a sustainability report (choosing between the Core or Comprehensive option) OR use selected GRI Standards, or parts of their content, to report specific information, provided that the relevant standards are referenced correctly. The options reflect the degree to which the GRI Standards have been applied. The Core option indicates that a report contains the minimum information needed to understand the nature of the organisation, its material topics and related impacts, and how these are managed. The Comprehensive Option builds on the Core option by requiring additional disclosures on the organisation’s strategy, ethics and governance and the organisation is required to report more extensively on its impacts by reporting all the topic-specific disclosures for each material topic covered by the GRI Standards. The 33 topics are:

The latest GRI Standards can be found at https://www.globalreporting.org/standards GRI and the GSSB also provide linkage documents which highlight the connections between the GRI Standards and other frameworks and initiatives to assist organisations to fulfil multiple reporting requirements using the standards. Such linkage documents can be found at https://www.globalreporting.org/standards/gri-standards-download-center/ |

||||||||||||||||||||||||||||||||||

|

ISO 26000 Guidance on Social Responsibility URL:https://www.iso.org/iso-26000-social-responsibility.html |

ISO (the International Organization for Standardization) is a worldwide federation of national standards bodies (ISO member bodies). International standards are drafted in accordance with the rules given in the ISO/IEC Directives, Part 2. ISO 26000 was prepared by ISO/TMB Working Group on Social Responsibility. Published in 2010, the ISO 26000 Guidance on Social Responsibility contains voluntary guidance on social responsibility and is to complement other instruments and initiatives for social responsibility (not to replace them). It is not a management system standard nor a requirement standard and it is not intended nor appropriate for certification purposes. The ISO 26000 Guidance on Social Responsibility provides guidance to all types of organizations, regardless of their size or location, on:

The ISO 26000 Guidance on Social Responsibility are available at https://www.iso.org/obp/ui/#iso:std:iso:26000:ed-1:v1:en ISO also provides linkage documents on how ISO 26000 relates to other social responsibility/ sustainability initiatives such as the UN Global Compact, the UN SDGs, the GRI etc. These linkage documents can be accessed at https://www.iso.org/iso-26000-social-responsibility.html. |

||||||||||||||||||||||||||||||||||

|

Sustainability Accounting Standards Board (SASB) URL: https://www.sasb.org/ |

Established in 2011, SASB is an independent standard-setting arm of the SASB Foundation whose mission is to establish industry-specific disclosure standards across environmental, social, and governance topics that facilitate communication between companies and investors about financially material, decision-useful information. SASB has developed a complete set of 77 industry standards. It published in November 2018 these industry-specific standards which identify the minimal set of financially material sustainability topics and their associated metrics for the typical company in an industry. Such standards can be downloaded at: https://www.sasb.org/standards/download/. When formulating accounting metrics for its disclosure topics, SASB considers the existing body of reporting standards and uses existing metrics (from more than 200 entities) whenever possible. SASB standards are used by companies and investors to implement principles-based frameworks, including integrated reporting and the recommendations of the TCFD. |

||||||||||||||||||||||||||||||||||

|

Task Force on Climate-related Financial Disclosures (TCFD) URL: https://www.fsb-tcfd.org/ |

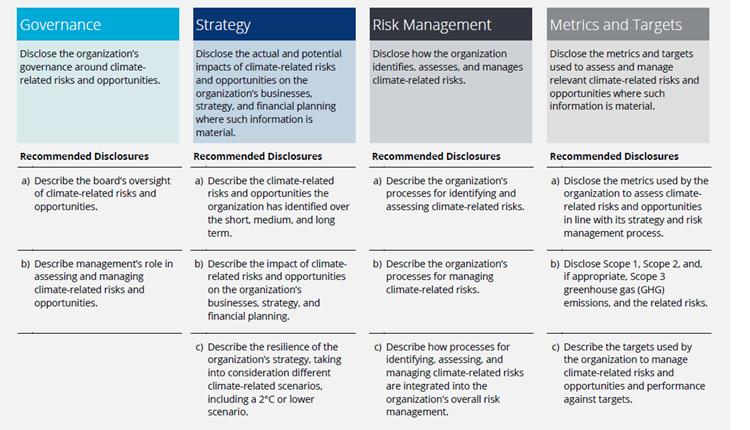

A task force was established in December 2015 by the Financial Stability Board at the G20’s request to develop voluntary consistent climate-related financial disclosures that would help investors, lenders and insurance underwriters to appropriately assess and price climate-related risks and opportunities. In June 2017, final TCFD Recommendations report and supporting materials were released. TCFD structured its recommendations around four thematic areas that represent core elements of how organisation operate: governance, strategy, risk management, and metrics and targets. The four overarching recommendations are supported by key-climate-related financial disclosures (referred to as recommended disclosures) as presented in Figure 1 below. |

||||||||||||||||||||||||||||||||||

|

Figure 1 – TCFD Recommendations and supporting recommended disclosures

|

|||||||||||||||||||||||||||||||||||

|

TCFD reporting is recommended to be included in the mainstream (i.e. public) annual financial filings. If certain elements of the recommendations are incompatible with national disclosure requirements for financial filings, the TCFD encourages companies to disclose those elements in other official company reports that are issued at least annually, widely distributed and available to investors and others, and subject to internal governance process that are the same or substantially similar to those used for financial reporting. As at 31 May 2019, nearly 800 public and private sector organisations had announced their support for the TCFD and its work, including global financial firms responsible for assets in excess of US$118 trillion. Also, five governments and 36 central banks/ supervisors encourage TCFD reporting. The Securities and Futures Commission (the SFC) of Hong Kong has signed up as a supporter of the TCFD recommendations. The SFC mentioned in its paper “Strategic Framework for Green Finance” issued in September 2019 that the SFC is working with the SEHK to consider enhancing listed companies’ disclosure of environmental (including climate change-related) information, aiming to align with the TCFD recommendations. The SEHK had stated in its “Consultation Paper: Review of the Environmental, Social and Governance Reporting Guide and Related Listing Rules” of May 2019 that many of the features in the ESG Guide, as well as the proposals in its Consultation Paper of May 2019, are aligned with the TCFD Recommendations. In the Consultation Conclusions: Review of the Environmental, Social and Governance Reporting Guide and Related Listing Rules of December 2019, the SEHK introduced a new Aspect A4 on climate change. The new Aspect reflects the TCFD Recommendations’ call for disclosure of the actual and potential impacts of climate-related risks and opportunities on the company. |

|||||||||||||||||||||||||||||||||||

|

United Nations Environment Programme Finance Initiative (“UNEP FI”) URL: https://www.unepfi.org/about/ |

A partnership between UNEP and the global financial sector to mobilise private sector finance for sustainable development. UNEP FI works with more than 290 members – banks, insurers, and investors – and over 100 supporting institutions to integrate sustainability into financial market practice. UNEP FI has established or co-created a number of frameworks which helps private finance to integrate sustainability into financial market practice. These frameworks include:

|

||||||||||||||||||||||||||||||||||

|

United Nation’s Global Compact (“UN Global Compact”) URL: https://www.unglobalcompact.org/ |

Launched in 2000, the UN Global Compact is an initiative which provides a framework for all businesses regardless of size, sector, complexity or location to align strategies and operations with ten universally accepted principles on human rights, labour, environment and anti-corruption (the “Ten Principles”). The UN Global Compact is also mandated to support companies in advancing societal goals such as the 2030 Agenda for Sustainable Development) through responsible corporate practices. The Ten Principles of the United Nations Global Compact are derived from: the Universal Declaration of Human Rights, the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work, the Rio Declaration on Environment and Development, and the United Nations Convention Against Corruption. They are: Human Rights Principle 1: Businesses should support and respect the protection of internationally proclaimed human rights; and Principle 2: make sure that they are not complicit in human rights abuses. Labour Principle 3: Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining; Principle 4: the elimination of all forms of forced and compulsory labour; Principle 5: the effective abolition of child labour; and Principle 6: the elimination of discrimination in respect of employment and occupation. Environment Principle 7: Businesses should support a precautionary approach to environmental challenges; Principle 8: undertake initiatives to promote greater environmental responsibility; and Principle 9: encourage the development and diffusion of environmentally friendly technologies. Anti-Corruption Principle 10: Businesses should work against corruption in all its forms, including extortion and bribery. Companies from any industry sector (except those that meet the exclusionary criteria) are eligible to participate in the UN Global Compact on a voluntary basis. The UN Global Compact is the largest voluntary corporate sustainability initiative in the world with more than 9,500 companies and 3,000 non-business signatories based in over 160 countries (both developed and developing) and participating. As a participant of the UN Global Compact, a company:

Each COP must contain a statement by the chief executive expressing the participating company’s continuing commitment to the initiative and the Ten Principles; a description of practical actions which the company has taken or plans to undertake to implement the Ten Principles; and a measurement of outcomes regarding the extent to which targets/ performance indicators were met, or other qualitative or quantitative measurements of results. The COP should be fully integrated into the company’s main stakeholder communications, very often their annual or sustainability reports. If a company does not publish formal reports, a COP can be created as a standalone document. The UN Global Compact provides a range of guidance on sustainability reporting. The UN Global Compact also collaborates with other frameworks, e.g. the UN Global Compact and GRI produce a “Making the Connection” document to illustrate how the two initiatives complement each other. |

||||||||||||||||||||||||||||||||||

|

United Nation’s Sustainable Development Goals (“SDGs”) URL: https://sustainabledevelopment.un.org/ |

The 2030 Agenda for Sustainable Development, adopted by all United Nations Member States in 2015, comprises 17 sustainable development goals (the “SDGs”) and 169 associated targets across the economic, social and environmental dimensions of sustainable development for implementation by 2030 to address the most pressing sustainability issues faced by the world. The 17 goals are:

Full details of the SDGs can be found at https://www.unglobalcompact.org/sdgs. The 2030 Agenda recognises that business has an important role in contributing to the SDGs. One of the SDG targets (12.6) encourages companies, especially large and transnational companies to adopt sustainable practices and to integrate sustainability information into their reporting cycle. |

||||||||||||||||||||||||||||||||||

[1] See section 3.5 and 3.6 of the “Directors, Supervisors and Senior Management” section of the HKEx Guidance Letter (HKEX-GL86-16).

[2] See: GRI’s Sustainability Reporting Standards, CDP’s Climate Change Questionnaire and Water Security Questionnaire, TCFD Recommendations, ISO 26000, International Organisation for Standardisation’s Guidance on Social Responsibility, and Corporate Sustainability Assessment for Inclusion in the Dow Jones Sustainability Indices.

[3] All descriptions are sourced from the websites and/ or publications of the respective initiatives unless otherwise stated.