China News Alert Issue 359

Investment

MOC seeks comments on foreign direct investment involving cross-border RMB

The Ministry of Commerce (MOC) has published draft rules for consultation designed to formalise and simplify the approval process for foreign direct investment with cross-border RMB. The MOC stopped soliciting comments on 31 August.

The new rules will allow companies applying for approval of foreign direct investment to apply to their local MOC. The existing method allowed only the central MOC and the People Bank of China (PBOC) to issue approval. The PBOC’s role will remain unchanged for the foreseeable future but the new method signifies a simplified, more direct route.

The draft rules also state the circumstances where the local MOC will be able to call a halt to the approval process and will be obligated to report their findings to the central MOC. This will occur if the investment

is for RMB 300 million or more;

involves investment in finance guarantee, finance lease, microfinance or auction industries

involves investment in foreign invested holding companies, foreign invested venture capital enterprises or foreign invested equity investment fund enterprises or;

involves investment in any industry subject to national macro-control policies, such as cement, iron and steel, electrolytic aluminium and ship-building.

After the findings have been handed over, the central MOC will then respond within 5 working days. If no objections are raised the local MOC would be free to resume the approval process.

The draft rules explicitly states that there are some areas where RMB raised offshore is not to be used. Investors are prohibited from using offshore RMB to

purchase securities listed on stock exchanges in the PRC, whether directly or indirectly,

purchase onshore financial derivatives,

provide entrustment loans, or

repay loans from onshore and offshore lenders

According to the draft, one area where foreign investors are free to invest is real estate. Here the draft circular states that any investment projects will have to be submitted to MOFCOM and the results of their reviews will be posted on the MOFCOM website. This is, however, inconsistent with an early circular released by the PBOC in June of this year (Circular 145) which explicitly prohibits offshore RMB being invested in real estate development in China

The new method will require a written statement from the applying company providing evidence of the source of their RMB funds as China’s existing foreign investment and regulations will still have to be adhered to. Offshore RMB is currently prohibited from being invested in securities or financial derivatives. Companies would have to offer assurances that this is not the case in their written statement.

Law

China criminalises foreign bribery

China has become the latest world power to criminalise the bribing of foreign officials. As of 1 May, an amendment was added to China’s Criminal Law to make it illegal to offer a bribe to officials from abroad as well as domestic officials.

The amendment adds to the wording of the original Criminal Law, whereas it once prohibited “giving money or property to any employee of a company or enterprise or other entity… for the purpose of seeking illegitimate benefits” there is now an addition at the end: “[w]hoever, for the purpose of seeking illegitimate commercial benefit, gives property to any foreign public official or official of an international public organisation” will now also be punished in the same manner as those found to be bribing PRC officials.

The punishments for violations are severe. Anyone attempting to bribe a foreign or domestic official can face up to three years imprisonment or criminal detention. Instances of large amounts can be punished by anything up to ten years imprisonment and hefty fines.

Criminalising bribing foreign officials can be seen as step towards bringing the PRC into line with other countries currently enacting similar laws such as the FCPA in the US and the UK’s own Bribery Act which came into effect earlier this year. The US and UK are similar to China’s act in that a similarly wide definition is given for a ‘foreign official’. China’s new policy defines the term as ‘any officer or employee of a foreign government, a public international organisation or any of its departments or agencies, or any person acting in an official capacity, regardless of rank or position’.

It is also worth noting that the terms ‘illegitimate commercial benefit’ and ‘international public organisation’ have not been properly defined in China’s Criminal Law. Companies may have to wait until judicial interpretations or other regulatory changes have been released to properly interpret the additional wording.

M&A

China and US to share M&A information

China and the US signed a deal in Beijing on 27 July to begin sharing information relating to cross-border mergers and acquisitions (M&A) regularly. The memorandum of understanding states that the US and China will aim to exchange an enhanced degree of information on matters concerning competition policy and law.

This does not mean the two nations are working towards merging their affairs nor that they will begin to change each others’ various M&A laws. The Federal Trade Commission Chairman Jon Liebowitz described it as “a framework for co-operation going forward” and the memorandum itself includes a mention of a desire to ‘contribute to improving and strengthening the relationship between the United States and China’ as a whole.. The Wall Street Journal has commented that the understanding is an example of China’s “gorwing clout” as an M&A watchdog, adding that “China’s Commerce Ministry has already weighed into deals that is decides impinge on its business environment. China’s ability to weigh in reflects how big the footprint of foreign business is in the No. 2 global economy”.

Specific areas of co-operation mentioned in the Memorandum of Understanding include

Keeping each other informed of significant competition policy and enforcement developments in their respective jurisdictions;

Enhancing each agency’s capabilities with appropriate activities related to competition policy and law such as training programs, workshops, study missions and internships

Exchanging experiences on competition law enforcement, where appropriate

Seeking information or advice from one another regarding matters of competition law enforcement and policy

Providing comments on proposed changes to competition laws, regulations, rules and guidelines

Exchanging views with respect to multilateral competition law and policy

Exchanging experiences in raising companies’, other government agencies’ and the public’s awareness of competition policy and law.

Plans are also being laid out for training programs, workshops, study missions, and internships between the two countries’ departments.

The understanding was signed by all of the following: US Federal Trade Commission, the US Department of Justice, China’s National Development and Reform Commission, the Chinese Ministry of Commerce, China’s State Administrations for Industry and Commerce.

Source (see archive

US regulators to ramp up China reverse merger scrutiny

The US Securities and Exchange Commission (the SEC) is increasing the scrutiny Chinese companies with securities traded on the US stock exchanges come under. In particular, companies that went public through a reverse merger transaction will come under more pressure.

In the past, reverse mergers have been an attractive alternative to launching Initial Public Offerings (IPOs) as the process is significantly faster and cheaper. A reverse merger is brought about by a Chinese private company allowing itself to be acquired by a US-based shell company that has no significant operations or value other than its stock is publicly traded. Control is then turned over to the China based company and the name is usually changed to the Chinese company also. The resulting China reverse merger (CRM) company is then able to issue equity.

A press release on 8 August followed the Sino-US Symposium on Audit Oversight held in Beijing in July and detailed the increased efforts the SEC will employ to tighten their focus on CRMs. These include a closer working relationship with Chinese regulators as well as the Public Company Accounting Oversights Board (PCAOB) who will be examining company auditors more closely. Other efforts described in the press release included sending members of staff from both jurisdictions to observe the inspection of accounting firms. Other changes mean that China-based auditors now face liability under US law if they have worked for companies who trade in the US.

This is not the first time the SEC has taken steps to increase scrutiny of CRMs. Previously six CRMs have seen their trading suspended and an internal task force was created to investigate fraud concerns in overseas companies trading in the US.

Due to this regulatory scrutiny, Chinese companies planning on going public in the US using the reverse merger method should keep the following measures in mind:

Review current D&O insurance and/or obtain adequate D&O insurance – such insurance packages cover legal costs and may also cover internal investigations.

Conduct internal investigations as necessary – any complaints lodged by shareholders should be investigated immediately so as to avoid any accusation of improper conduct. When in doubt, committees are advised to act rather than wait.

Retain experienced counsel – regardless of whether a lawsuit has been filed, companies should engage the services of outside counsel with experience of dealing with government inquiries.

Source (see archive), Source 2 (see archive)

Foreign M&A to come under review

China’s Ministry of Commerce (MOC) has announced further changes to the way mergers and acquisitions are regulated in China. Mergers and acquisitions of domestic companies by foreign companies will now be reviewed to determine any potential risk to national security. The new regulation states that should a merger or acquisition be determined to be a risk to national security, they will be terminated.

The regulations mainly concern military-industrial business and companies near ‘major and sensitive military facilities’ but also cover any other M&A deal that the MOC may consider related to national security. In addition, any foreign merger or acquisition of a domestic company which will eventually be controlled by foreign investors will also fall under review. The MOC plans to set up a ministerial joint committee to oversee the M&A deals it will now be reviewing.

The rules cover the defense, resources and technology sectors meaning that some foreign companies looking to invest in China’s Internet sector are looking to change contracts. Further complications have risen after additional rules stated that investments made through variable interest entity (VIE) might also come under review. Existing VIE deals are unlikely to be affected however.

Source: China Daily (see archive)

Taxation

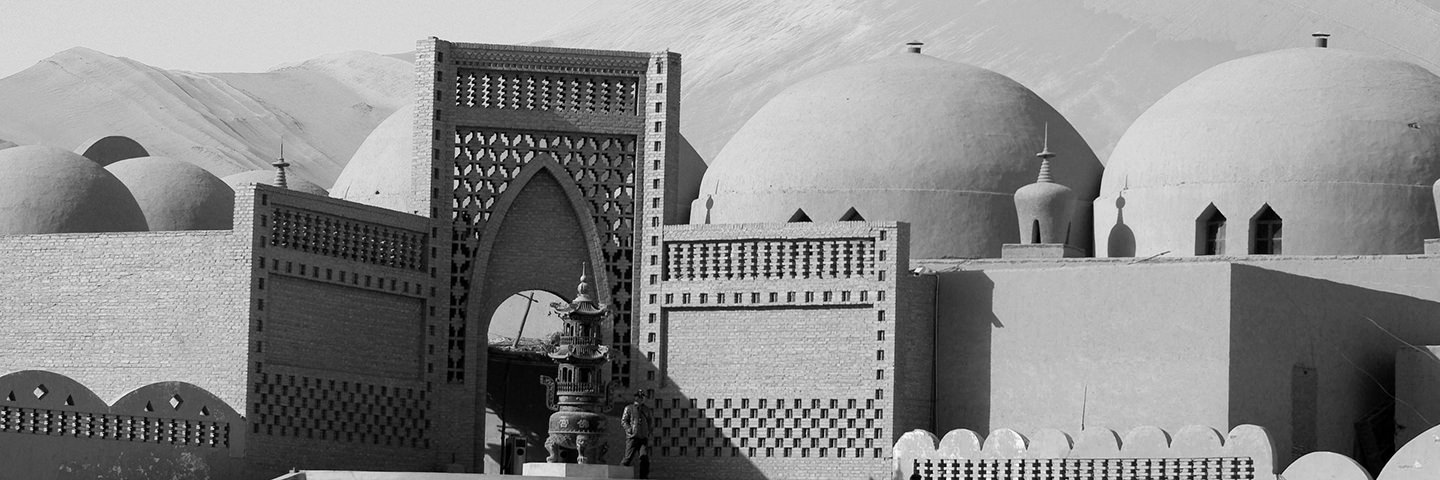

China extends tax incentive in Western regions

In order to encourage continuing investment in the Western regions of China, the Chinese government has made the decision to extend tax incentives in the area another ten years beyond the original ending date of December 2010. Incentives will now last until 31 December 2020.

The Ministry of Finance, the General Administration of Customs and the State Administration of Taxation issued the Notice on the Relevant Tax Policies for the Implementation of the Strategy of Extensive Development of the Western Regions [2011] No. 58 (the Notice), defining the extension at the end of July. Much of the regulations included remain the same as before.

The businesses that qualify for a reduced corporate income tax rate of 15% will have to be incorporated in an area that the Notice defines as belonging to the Western regions. The area is defined much the same as the old regulations and includes the following locations:

Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shanxi, Gansu, Ningxia, Qinghai, Xinjiang, Inner Mongolia and Guangxi as well as Xiangxi Tujia-Miao Autonomous Prefecture in Hunan Province, Enshi Tujia-Miao Autonomous Prefecture in Hubei Province, and Yanbian Korean Autonomous Prefecture in Jilin Province.

Business incorporated in the Western regions will also have to derive at least 70% of their income from industries listed in the Catalog of Encouraged Industries in the Western Regions. In the past these areas have included transportation, electricity, water, post, broadcasting, and television services. If they qualify, businesses in these areas will reap the benefits of a two-year exemption and a three-year 50% reduction in the Corporate Income Tax rate from the first profit making years for foreign invested companies and from the first operating year for domestic companies.

The Notice points out that enterprises established before 1 January 2011 that qualify for the tax incentives as described under the old policy terms can still enjoy the same benefits as they did under the old terms.

Other

MOFCOM’s new antitrust rules shed light on its competitive assessment process

On 2 September MOFCOM released the Provisional Rules on Assessment of Competitive Effects of Concentration of Business Operators (MOFCOM 2011 Announcement No. 55, the “Rules”) in order to make the factors taken into consideration when assessing the competitive effects of a business concentration a little more clear. The 14 articles in the new rules came into effect on 5 September.

The Rules make four changes that can be identified as major or key alterations:

The Rules outlined the basic methodology MOFCOM applies in assessing competitive effects of a concentration.

Article 4 states that MOFCOM’s competitive analysis will include an evaluation of whether or not a concentration will strengthen or create the capability, likelihood and incentive for a single operator to exclude or restrict competition. Where the parties involved are not in direct or potential competition in the same market, MOFCOM will assess the impact a concentration will have on the upstream/downstream market or adjacent market.

The Rules outlined the elements that are relevant for assessment of whether the merging parties have “market control power

Article 5 of the new Rules lays out factors taken into consideration when assessing the merging parties’ market control power. These include market shares, sustainability of their products or services, ability to control the sales market or the procurement market for raw materials, production capability of non-merging parties, and purchasing power of the merging parties’ downstream customers.

The Rules confirmed that market concentration level can generally be measured by the Herfindahl-Hirschman Index (HHI) and the Concentration Ration Index (CRn)

Both HHI and CRn methods are widely used by other major antitrust jurisdictions. This shows a degree of conformity with similar U.S. and E.U. antitrust methodologies but unlike the U.S and E.U. systems, MOFCOM did not define a scale for measurement for any competitive assessment by HHI or CRn

The Rules have explicitly identified (without furnishing any details) public interests, economic efficiency, bankruptcy defense, and countervailing buyer power as additional factors that MOFCOM will weigh in during its review process

The rules seem to suggest that market share/market control power and market concentration levels are the most important factors MOFCOM will consider in their assessments. Under the clarified rules it would appear there is a lower threshold to establish ‘market control power’ than ‘dominant market position’.

Though it is a step towards transparency the new information included in the provisional rules’ 14 articles is still lacking in details.