HKEx Announces Planned Launch of Master SPSA Service for Fund Managers

On 18 March 2020, the Stock Exchange of Hong Kong (the HKEx) announced[1] its latest enhancement to its mutual market access programme with the Shanghai and Shenzhen Stock Exchanges (Hong Kong China Stock Connect) – a new optional Master Special Segregated Account (Master SPSA) which will allow pre-trade checking of China A shares on Northbound trading at a fund manager, or aggregate level, rather than at an individual fund level.

Subject to approval from the Securities and Futures Commission and market readiness, it is expected that the Master SPSA service for fund managers will be launched in the first half of 2020.

Further information on the operation of the Master SPSA Service is set out in HKSCC’s Circular: Introduction of Master SPSA Service for Northbound Stock Connect [2] and the Master SPCA Service FAQ of 18 March 2020.

Pre-trade Checking of Northbound Sell Orders under Hong Kong China Stock Connect

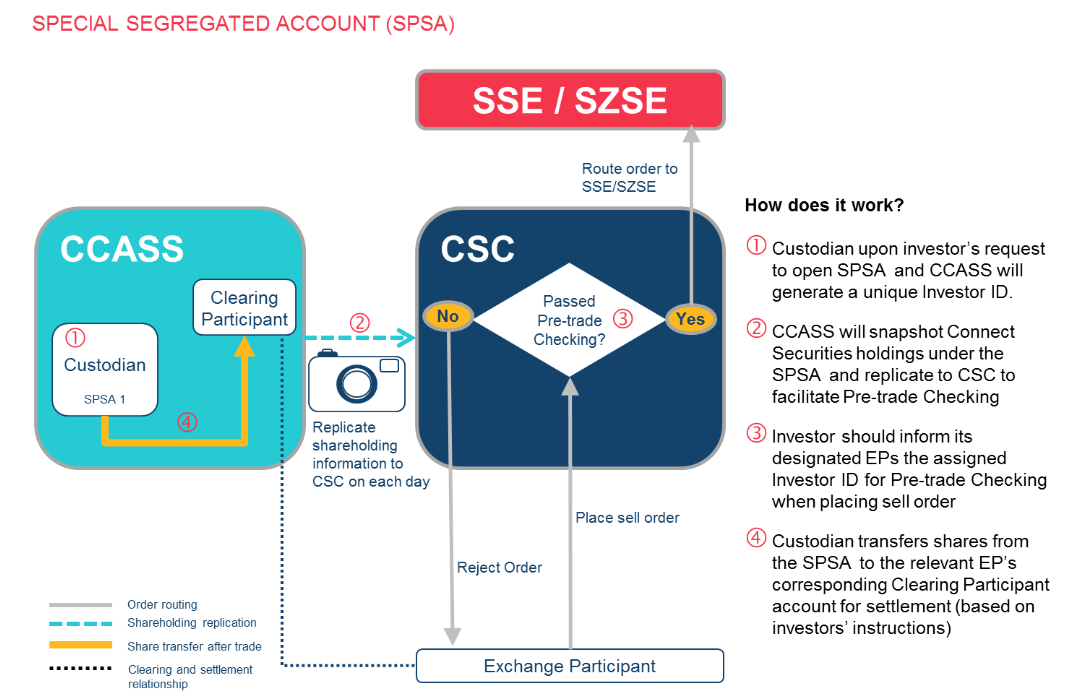

Mainland investors can only sell shares listed on the Shanghai and Shenzhen Stock Exchanges which are available in their stock accounts at the end of the previous day. A sell order will be rejected if there are insufficient shares in a seller’s account. Similarly, pre-trade checking applies to all Northbound sell orders through Hong Kong China Stock Connect to prevent overselling.

Under this pre-trade checking model, sellers must first ensure there are sufficient shares in their accounts opened with their selling broker. Unless a special segregated account arrangement (SPSA) has been put in place, investors must first transfer the shares to the selling broker on T-1 in order to sell their shares on T day if the shares are kept in an account opened with a custodian.

The original SPSA arrangement was introduced on 30 March 2015 to satisfy this requirement and remove the need to transfer shares controlled by investors to executing brokers prior to a sale. Essentially, investors whose securities are maintained with custodians may sell their securities without having to pre-deliver the securities from their custodians to their executing brokers.

The following diagram illustrates how the original SPSA arrangement works.

Source: HKEx

Master Special Segregated Account Service for Fund Managers

The recently announced Master SPSA service is an optional service designed to facilitate pre-trade checking of sell orders at an aggregate level and the calculation of average price in Northbound trading. It enhances the existing SPSA by allowing pre-trade checking to be conducted at a fund manager or aggregate level to increase operational efficiencies while maintaining the same post-trade settlement processes at the individual SPSA level.

-

Master SPSA Eligibility

In order to qualify as a Master SPSA holder and utilise the Master SPSA service, entities including, but not limited to, fund managers, asset managers and invest managers must:

-

maintain two or more SPSAs with one or multiple Custodian Participants and/or non-EP GCPs;

-

agree on the Terms and Conditions of the Services for Master SPSA Holder (a draft of which is available at https://www.hkex.com.hk/-/media/HKEX-Market/Mutual-Market/Stock-Connect/Reference-Materials/Master-SPSA-Service/Master_SPSA_Holder_Application_or_Change_of_Details_Form.pdf?la=en); [3] and

-

be of good financial standing and integrity. Whether or not a company is of good financial standing and integrity would be determined on a case-by-case basis taking into account all relevant factors at the relevant time. Factors that would be taken into account include: whether a company is validly existing and of good standing, without any event of bankruptcy, liquidation, winding up or be a subject of adverse finding by any competent authority.

-

-

Applying for Master SPSA Holder Status

Application should be made using the Master SPSA Holder Application/ Change of Details Form. [4] Applicants should:

-

read the Terms and Conditions of the Services for Master SPSA Holder;

-

work with Custodian Participants and/or non-EP GCPs (or global custodians if needed) to prepare for a full list of SPSAs to be mapped under each Master SPSA ID;

-

determine a list of designated CCEPs to be assigned as its executing brokers for the Master SPSA ID (at most 20 CCEPs can be assigned) and complete the account opening process with these CCEPs; and

-

prepare for the technical set-up for the Internet Report Access Platform (iRAP) user account(s).[5]

-

-

Master SPSA Operations

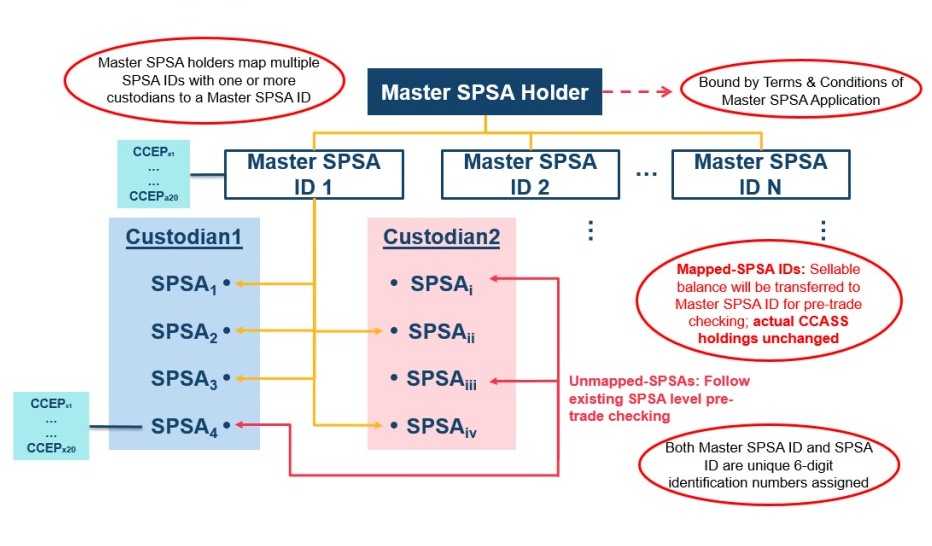

Upon successful application, a Master SPSA Holder ID and a unique 6-digit Master SPSA ID will be assigned to the entity as a “Master SPSA Holder”. The Master SPSA ID serves the purpose of mapping its SPSAs maintained with one or multiple Custodian Participants and/or General Clearing Participants which are non-Exchange Participants and can designate at most 20 China Connect Exchange Participants as executing brokers for the Master SPSA ID. In this way, pre-trade checking for Northbound sell orders at the aggregate level can be conducted by using the Master SPSA ID. The following diagram serves as a summary of the process of the Master SPSA Service:

Source: HKEx

There is no limit on the number of Master SPSA IDs fund managers can apply for but HKEx encourages applications to be based on business needs. A one-time application fee of HK$50,000 per Master SPSA ID will be charged. Applicants must comply with the Terms and Conditions of the Services for Master SPSA Holder and Hong Kong Securities Clearing Company Limited may terminate the service for a defaulting Master SPSA Holder in the event of any material breach of those Terms and Conditions.

Master SPSA Holders will have to indicate their intended allocations prior to trading by providing a breakdown of the sell quantity per SPSA (i.e. the so-called “pre-allocation”), such that CCEPs and China Connect Clearing Participants ( CCCPs) will have visibility as to the potential allocations at SPSA level to address the sellable balance adjustment process in the event of failed settlement. CCEPs are advised to work closely with their respective Northbound clients to identify any potential procedural or technical changes required in their operations and systems prior to accepting any Master SPSA orders for Master SPSA Holders.

-

Master SPSA Daily Post Trade Operational Processes

As the service is aimed solely at facilitating pre-trade checking, Custodian Participants and non-EP GCPs (Custodians) and CCCPs, the actual shareholdings of China Connect Securities will remain in the individual SPSAs, even if these SPSAs are mapped under a Master SPSA ID. Therefore, there will be no change to any existing post-trade related procedures.

Securities trades through China Stock Connect which are executed via Master SPSA ID will be settled according to the three current individual SPSA post-trade settlement procedures. Custodians will still need to arrange settlement instructions with the corresponding CCCPs to transfer the China Stock Connect Securities between the relevant SPSAs and the relevant CCCPs for CCASS Continuous Net Settlement. CCCPs will need to have the underlying SPSA ID, stock code and quantity for adjustment to adjust the sellable balance in the event of an SPSA Delivery Failure under a Master SPSA ID. In the event a Master SPSA Holder fails to identify or correctly instruct the responsible SPSA ID for settling short stock positions, HKSCC can at its discretion reduce the sellable balance of a single stock or multiple stocks of the relevant Master SPSA ID to zero on the next China Stock Connect trading day.

[1] HKEx Enhances Stock Connect with Planned Launch of Master SPSA Service For Fund Managers. 18 March 2020. Available at: https://www.hkex.com.hk/News/News-Release/2020/200318news?sc_lang=en

[2] Hong Kong Securities Clearing Company Limited. Circular: Introduction of Master SPSA Service for Northbound Stock Connect.18 March 2020. Available at: https://www.hkex.com.hk/-/media/HKEX-Market/Services/Circulars-and-Notices/Participant-and-Members-Circulars/HKSCC/2020/ce_HKSCC_SET1_011_2020.pdf

[3] https://www.hkex.com.hk/-/media/HKEX-Market/Mutual-Market/Stock-Connect/Reference-Materials/Master-SPSA-Service/Terms_and_Conditions_of_the_Services_for_Master_SPSA_Holder.pdf?la=en

[4] Master SPSA Holder Application/ Change of Details form is available at https://www.hkex.com.hk/-/media/HKEX-Market/Mutual-Market/Stock-Connect/Reference-Materials/Master-SPSA-Service/Master_SPSA_Holder_Application_or_Change_of_Details_Form.pdf?la=en

[5] Instructions are accessible at https://www.hkex.com.hk/-/media/HKEX-Market/Mutual-Market/Stock-Connect/Reference-Materials/Master-SPSA-Service/HKSCC_Internet_Report_Access_Platform_(iRAP)_Technical_Guide.pdf?la=en