Shanghai-Hong Kong Stock Connect Success

- Success of Shanghai Hong Kong Stock Connect will be replicated to permit trading between Shenzhen and Hong Kong exchanges with effect from Monday

- Mutual Market model is symbolic of Mainland China’s opening of its capital account

- “Research Report: Stock Connect – Towards a “Mutual Market” for the Interests of Mainland and Global Investors”

- Mutual Market Access will be extended to ETFs in due course and possibly other products

Topics

- Beneficial Ownership of Stock Connect Shares

- Asserting Rights over Stock Connect Shares

- PRC Restrictions on Foreign Shareholdings: Consequences for Northbound Trading

- Reporting Short Selling of Stock Connect Shares

- Price Limits

- Stock Borrowing and Lending involving Stock Connect Shares

- Pre-trade Checking and Day Trading

- Disclosure Obligations

- Prohibition on Block Trades

- Record Keeping Obligations for Northbound Trading

Beneficial Ownership of Stock Connect Shares

Shenzhen Stock Connect expected to be similar to Shanghai Stock Connect

Nominee Holder

- HKSCC is the nominee holder for Hong Kong/overseas investors

- CSRC Stock Connect Rules: investors enjoy rights and benefits of Shanghai-listed shares acquired through Shanghai Stock Connect

- Brokers/intermediaries acquiring Stock Connect shares for their own accounts are recognised as beneficial owners

- Rights and obligations of the nominee holder set out in the CCASS Rules and CCASS Operational Procedures

- HKSCC has no proprietary interest in Stock Connect shares

- HKSCC is responsible for:

- collecting/distributing dividends;

- obtaining/consolidating voting instructions; and

- submitting combined single voting instruction to the relevant issuer

Mainland Recognition of Beneficial Ownership

- Article 30 of the CSRC Guidance on Listed Company Articles of Association requires:

- maintenance of shareholder registers.

- Section 160 of the Securities Law of the PRC requires ChinaClear to:

- provide the issuer with the register of securities holders;

- confirm the ownership or holding of the securities; and

- ensure that the securities transfer and registration records are true, accurate and complete.

- Article 7 of the ChinaClear Implementing Rules requires:

- the HKSCC to be registered in the shareholder register as nominee holder.

- Article 5 of the ChinaClear Securities Registration Rules states that:

- ChinaClear’s securities registration records are sufficient evidence of the securities holders’

Asserting Rights over Stock Connect Shares

Asserting and exercising one’s rights over Stock Connect shares

VS

Taking legal action to enforce one’s rights over Stock Connect shares

Asserting/Exercising One’s Rights

- Beneficial owner can assert/exercise its rights through HKSCC, the nominee holder:

- calling/participating in shareholders’ meetings;

- proposing matters for voting at shareholders’ meetings;

- voting at shareholders’ meetings;

- subscribing for allocated rights and entitlements; and

- receiving dividends and other declared distributions.

Taking Legal Action to Enforce One’s Rights

- HKSCC is unaware of any Mainland law that prohibits taking such action.

- HKSCC is also unaware of any express framework to take such action.

- Article 119 of the PRC Civil Procedures Law requires a claimant to have a direct interest in the case.

- Beneficial interest may constitute a direct interest.

HKSCC Assistance

- Upon request, HKSCC could:

- provide certifiction to ChinaClear to prove the CCASS Participant’s (or its client’s) holding of Stock Connect shares;

- assist the CCASS Participant or its client in bringing the legal action in Mainland China

- The HKSCC would require the necessary information, documentation and indemnities beforehand.

Beneficial Owner’s Responsibilities

- The beneficial owner is responsible for:

- deciding whether to take legal action;

- seeking proper legal advice;

- paying all relevant costs; and

- providing the required indemnities and legal representation for the HKSCC.

PRC Restrictions on Foreign Shareholdings: Consequences for Northbound Trading

No single foreign investor may hold more than 10% of a Mainland company’s total issued shares (whether they are acquired through QFII, RQFII or either of the Stock Connect schemes)

- For any PRC listed company, the total foreign shareholding of its A-shares cannot exceed 30% of its total issued shares.

- Shenzhen-HK Stock Exchange will publish a notice when the total foreign shareholding of a company reaches 26%.

- When 30% is exceeded, foreign investors will be requested to divest on a last-in-first-out basis.

- Restrictions on foreign shareholdings apply to the total number of shares held by foreign investors through all channels.

- SSE or SZSE would inform HKSE if the total foreign shareholding of a particular Shanghai- or Shenzhen- listed share has reached 28%.

- When foreign shareholding reaches 28%, no more Northbound buy orders in that share is permitted until the total foreign shareholding in that share drops to 26%.

- If a Northbound Stock Connect buy order causes the total foreign shareholding of a Shanghai- or Shenzhen-listed share to exceed 30%, the Exchange Participant that made that order must follow the forced-sale requirements.

- The HKEx will publish a notification when Northbound buy orders of a Mainland security are:

- suspended (28% foreign shareholding); or

- resumed (foreign shareholding drops back to 26%).

- Foreign shareholders can sell A shares through the Stock Connect even when the aggregate foreign shareholding of the particular share is at 26% or 28%, or exceeds 30%.

- Forced-sale exemption: if another foreign shareholder sells enough of the same A share to cause the foreign shareholding to drop to ≤ 26% within 5 trading days.

- SEHK Participants should remind clients of the 10% single-foreign-investor restriction and bring their attention to the possibility of the forced-sale arrangement.

Reporting Short Selling of Stock Connect Shares

- Naked short selling is prohibited for Northbound trading through the Stock Connect.

- Covered short selling is allowed, subject to requirements:

- only eligible Stock Connect shares can be shorted (“Short Selling Securities”); and

- mandatory reporting requirements.

- The list of Shanghai-listed shares eligible for short selling is available on the HKEx website. The list of eligible Shenzhen-listed stocks will also be made available.

Short Selling Weekly Report

- Short selling activities for each Short Selling Security

- CCEPs must submit a weekly report if:

- they have conducted any short selling activities;

- any borrowed shares have been returned in respect of open short positions; and/or

- there are outstanding short positions as at the end of the week.

- Submitted via the Electronic Communication Platform on or before the first working day of the next week.

- Only China Connect Exchange Participants that input short selling orders directly into the Stock Connect and have them executed are required to submit the Short Selling Weekly Report.

- Does not affect the requirement to submit a Stock Borrowing and Lending Monthly Report.

Large Open Short Position Report

- Any open short position of any Short Selling Security after market close on the last Stock Connect trading day of a calendar week, that equals or exceeds either:

- RMB 25 million; or

- 0.02% of the total issued shares of the relevant Short Selling Security.

Price Limit on Shanghai- and Shenzhen-listed Shares

Shanghai- and Shenzhen-listed shares

- General price limit of ±10% (and ±5% for stocks under special treatment under risk alert) based on the previous closing price.

- All orders input have to be at or within the price limit.

- An order with a price beyond an existing price limit will be rejected.

Stock Borrowing and Lending involving Stock Connect Shares

- Allowed in the following situations:

- to cover short selling; and

- to allow a client to sell Stock Connect shares when they cannot be transferred to the CCEP’s clearing account in time to meet the pre-trade checking requirement.

- Stock Connect shares can be borrow/lent for short selling only if they are eligible for buy and sell orders through both Stock Connects.

- No restrictions on stock borrowing/lending to meet the pre-trade checking requirement.

- SSE and SZSE restrictions:

- stock borrowing/lending agreements for short selling cannot exceed one calendar month;

- stock borrowing/lending agreements for meeting the pre-trade checking requirement cannot exceed one day (no roll-overs allowed);

- only certain types of persons can be stock lenders (determined by the SSE or SZSE); and

- stock borrowing and lending activities must be reported to the SEHK.

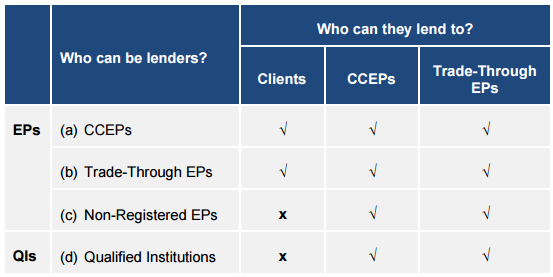

Lenders of Stock Connect Shares

- China Connect Exchange Participants;

- Trade-through Exchange Participants;

- Non-registered Exchange Participants; and

- Qualified Institutions, including:

- HKSCC participants (except Investor Participants);

- funds, unit trusts or collective investment schemes managed by persons with Type 9 SFC licences; and

- other persons accepted or specified by the SSE or SZSE.

CCEPs and Trade-through EPs

- Stock Connect shares lent by a CCEP or Trade-through EP must:

- be held or owned by it as a principal; or

- have been borrowed from another CCEP, Trade-through EP, Non-registered EP or QI that is lending as principal.

- Must give the SEHK with an undertaking or confirmation, depending on whether they are lender or borrower.

- Must submit monthly report of their Stock Connect stock borrowing/lending activities to the SEHK.

Non-registered EPs and QIs

- Stock Connect shares lent by a Non-registered EP or QI must be held or owned by it as principal.

- Non-registered EPs and QIs lending to CCEPs and Trade-through EPs must undertake to the borrower that they are not restricted from engaging in stock lending activities.

Pre-trade Checking and Day Trading

- Investors cannot conduct Northbound day trading of shares listed in Shanghai or Shenzhen because they cannot be sold before settlement.

- SEHK applies checks on Northbound sell orders to ensure SEHK Participants have sufficient shares to cover their sell orders.

- SEHK pre-trade checking model will reject sell orders of the total number of shares to be sold is higher than the number of shares held by the SEHK Participant at market open.

- Where investors hold shares in an account with another SEHK Participant or custodian, they must first transfer the shares to the selling SEHK Participant on T-1, unless a Special Segregated Account (“SPSA”) arrangement is in place.

- Investors can only sell Stock Connect shares that are available in their HKSCC omnibus stock accounts at T-1.

- Pre-trade checking: every trading day, the SSE and SZSE will check sell orders against HKSCC account balances as of the end of T-1.

- To trade in Stock securities, an Exchange Participant must:

- be a Clearing Participant (i.e. a Direct Clearing Participant); or

- appoint a General Clearing Participant of CCASS to maintain its Stock Connect shares in a designated sub-account and clear its Northbound trades on its behalf.

- HKSCC will replicate the CCASS shareholding records to the Stock Connect for pre-trade checking before market open.

- For Direct Clearing Participants, pre-trade checking applies to all Stock Connect shares in their CCASS stock accounts.

- For Non-Clearing Participants, pre-trade checking is done against the Stock Connect shares balances in their General Clearing Participants’ CCASS stock segregated accounts.

- Two models for pre-trade checking:

- SPSA (Special Segregated Accounts)

- Non-SPSA

Non-SPSA Model

- EPs cannot put through a larger sell quantity of a Stock Connect share than its shareholding balance as at 8:30 a.m. on T day.

- Stock Connect shares that are committed for sale must remain in the relevant stock account until CCASS settles their Continuous Net Settlement short positions on T day.

- CPs cannot transfer stocks through Settlement Instructions before 7:00 p.m. on each settlement day.

SPSA Model

- Special Segregated Accounts (“SSA”)

- Custodian Participants / General Clearing Participants that are not EPs can hold Stock Connect shares for investors.

- Each SSA has a unique investor ID.

- CCASS will take snapshot of Stock Connect shares under each SSA and replicate those holdings to China Stock Connect to perform pre-trade checking.

- Exchange Participant inputs unique investor ID with sell order.

- China Stock Connect verifies whether the investor has sufficient holdings in their SSA.

- Investor may transfer Stock Connect shares from their SSA to their broker’s account after execution.

- Future feature: optional input of investor IDs in buy orders (for reference only).

- No intraday update to client’s SSA holdings.

Disclosure Obligations

- Under PRC law, an investor who holds/controls ≥ 5% of the issued shares of a Mainland-listed company must, within 3 working days:

- report this to the CSRC and the relevant exchange; and

- inform the relevant listed company.

- The investor cannot buy/sell shares in that listed company within that 3-day period.

- Any change in the investor’s holding that reaches 5% must also be reported within 3 working days to the same bodies.

Prohibition on Block Trades

There is no block trading facility available for either Northbound or Southbound trading.

Record Keeping Obligations for Northbound Trading

- Exchange Participants must keep proper books and records of all orders and trades input or executed and the related client instructions (including the telephone recording).

- These records must be kept for a minimum period of 20 years.

Tax Policy

Southbound trading link (Mainland investors)

- individual income tax temporarily exempt: 5 December 2016 to 4 December 2019 (transfer of eligible HK shares through Stock Connect)

- corporate investors will have such gains taxed in accordance with corporate income tax law;

- dividend income from eligible HK shares will be subject to individual income tax of 20% (dividend distribution withheld by the H-share company, or by ChinaClear for non-H shares); and

- dividend income from eligible HK shares will be subject to corporate income tax except for dividends from H shares held by a Mainland corporate investor for no less than 12 months.

Northbound trading link (investors of the HK market)

- gains from the transfer of eligible A shares will be temporarily exempted from individual income tax and corporate income tax;

- dividend income from eligible A shares will be subject to 10% withholding tax; and

- recipients who are entitled to a lower treaty rate (e.g. residents of countries who have signed relevant tax treaties with the PRC) may seek a refund from the PRC tax authorities.