HKEx and SFC Disciplinary Actions in May 2022

In May 2022, the Stock Exchange of Hong Kong Limited (the HKEx) published four disciplinary actions. The first HKEx disciplinary action was against Wuzhou International Holdings Limited and nine directors for various breaches relating to notifiable and connected transactions Listing Rule requirements, failing to procure the company’s compliance with the Listing Rules and failing to ensure that the company had established and maintained an adequate and effective internal control system. The second disciplinary action was against two directors of CIL Holdings Limited for failing to take steps to safeguard the company’s interests and to ensure that it had implemented and maintained adequate and effective internal controls. The HKEx imposed disciplinary actions against Prosper One International Holdings Company Limited and nine directors for failing to comply with, and procure the company’s compliance with, the Listing Rules, and to ensure that it maintains an adequate and effective internal control system. The fourth disciplinary action imposed by the HKEx was against CR Construction Group Holdings Limited, six of its directors and Zhejian State-owned Capital Operation Company Limited for failing to disclose a reorganisation agreement in the IPO prospectus and to the HKEx, and for breaching the six-month post-listing disposal restrictions.

In May 2022, the Court of First Instance granted orders sought by the Securities and Futures Commission (the SFC) against DFRF Enterprises LLC and DFRF Enterprises, LLC, and their founder, Mr Daniel Fernandes Rojo Filho, to compensate Hong Kong victims of a global pyramid and Ponzi scheme. Another disciplinary action brought by the SFC in May 2022 resulted in the SFC banning Ho Pak Hay for life for misappropriating and misusing funds totalling HKD1.8 million.

HKEx’s Disciplinary Action Against Wuzhou International Holdings Limited and Nine Former Directors

On 5 May 2022, the HKEx censured Wuzhou International Holdings Limited (Wuzhou), and imposed a prejudice to investors’ interests statement against two individuals – its former chairman and executive director (Mr Shu Ce Cheng), and its former chairman, chief executive officer and executive director (Mr Shu Ce Wan). On the same day, the HKEx criticised seven other former directors (who were executive directors or independent non-executive directors (INEDs)), and directed them to attend training on regulatory and legal topics and Listing Rule compliance. The HKEx’s two Statements of Disciplinary Action are available on the HKEx’s website here and here.

Unannounced Disposals

On 21 January 2017, Wuxi Zhouyue Commercial Development Company Limited (Wuxi Zhouyue), a non-wholly owned subsidiary of Wuzhou, entered into an agreement to purchase a 100% interest in three companies (the Acquisition). After a 15-month delay, Wuzhou announced the Acquisition on 7 May 2018.

On 29 November 2017, a wholly-owned subsidiary of Wuzhou entered into agreements to dispose of an aggregate 51% equity interest (out of a total of 60%) in Wuxi Zhouyue. After a five-month delay, Wuzhou announced the disposal on 7 May 2018.

On 25 December 2017, four subsidiaries of Wuzhou (two of which were wholly owned) entered into agreements to dispose of 100% of the equity interest in another company at a consideration of RMB350 million. After an eight-month delay, Wuzhou announced this second disposal on 20 August 2018.

This second disposal agreement in December 2017 provided for the registration of the purchaser as the shareholder of the disposal company at the relevant authorities in Mainland China to take place before the deadline for full payment of the consideration (15 January 2018). This shareholder registration was effective on 27 December 2017, but the payment of RMB10 million was only received on 1 March 2018. The parties then subsequently entered into a voluntary discharge agreement and the shareholder registration was subsequently reversed in December 2019.

On 17 December 2018, a wholly-owned subsidiary of Wuzhou entered into an agreement to dispose of its entire 49.5% equity interest in another company. This third disposal was approved by Wuzhou’s board of directors on 14 December 2018. However, the disposal was only announced after a two-month delay on 26 February 2019.

The Acquisition, the first disposal, the second disposal and the third disposal are collectively referred to as the Transactions.

RSM Corporate Advisory (Hong Kong) Limited, Wuzhou’s restructuring advisor engaged in August 2018, carried out an independent investigation into Wuzhou’s transfer of its equity interests in some of its subsidiaries. It found that there were 15 transfers that were not approved by Wuzhou’s board of directors in 2018, which included, among others, six other disposals which constituted notifiable transactions (five discloseable transactions and one very substantial disposal, collectively, the Additional Disposals) as well as the second disposal.

Wuzhou never announced the Additional Disposals with the details required under Rule 14.58 of the Listing Rules, and only disclosed brief information about them in its 2018 annual report published on 24 September 2020. For a notifiable transaction (such as a discloseable transaction or a very substantial disposal), Listing Rule 14.58 requires disclosure of specified details in the announcement, such as the basis upon which the consideration was determined and the reasons for entering into the transaction.

Directors’ Involvement with the Transactions and the Additional Disposals

The two Mr Shu’s (Mr Shu Ce Cheng and Mr Shu Ce Wan) were both involved in the negotiations of the Transactions and the Additional Disposals, and the handling of the relevant agreements. They consequently had knowledge of the Transactions and the Additional Disposals at the material time. Moreover, the use of Wuzhou’s subsidiaries’ chops required Mr Shu Ce Wan’s approval. The subsidiaries’ chops were affixed to the agreements for the Transactions. Neither of the Mr Shu’s informed the board of directors at the material time of the Transactions (apart from the third disposal) and the Additional Disposals when they were entered into.

As to the Acquisitions, the minutes of the audit committee meeting of 31 August 2017 recorded that a then INED of Wuzhou asked if any of the acquisitions disclosed under note 23 to the interim financial information set out in the draft 2017 interim report (which included the Acquisition) constituted notifiable transactions under the Listing Rules. The company secretary responded that the company would check and report to the executive directors for taking all necessary actions to ensure Listing Rule compliance. Neither Mr Shu Ce Cheng nor Mr Shu Ce Wan followed up on the matter.

The second disposal was referred to in note 27 to the financial statements in the 2017 annual report, as well as in an entry “Amount due from disposal company” under note 25 which referred to note 27. The draft 2017 annual report was presented to the board for review and approval at a meeting on 29 March 2018, but the directors did not raise enquiries into the second disposal nor into any related Listing Rule compliance issues.

For the third disposal, all the directors who were then in office attended the board meeting on 14 December 2018 (except for Professor Shu Guo Ying and Dr Song Ming, who were both INEDs) at which the board approved the transaction. The documents regarding the third disposal were apparently circulated to all the directors before the meeting, and a brief note with the results of the meeting was sent to them following the meeting.

HKEx Listing Division’s Investigation

The two Mr Shu’s failed to respond to the Listing Division’s investigation letters and reminder letters issued to them after they ceased to be directors of Wuzhou.

HKEx Listing Rule Requirements and Breaches

Listing Rule 3.08 provides, among others, that the HKEx expects the directors of an issuer, both collectively and individually, to fulfil fiduciary duties and duties of skill, care and diligence to a standard at least commensurate with the standard established by Hong Kong law.

Each director is subject to the obligations in the Director’s Undertaking (set out in Appendix 5B to the Listing Rules) which include, among others, that he/she will comply to the best of his/her ability, and to use his/her best endeavours to procure the company’s compliance, with the Listing Rules, and cooperate in any investigation conducted by the HKEx.

The Listing Committee made the following findings:

- Wuzhou breached Listing Rule 14.34 (in effect before 1 March 2019) which stated that as soon as possible after the terms of a discloseable transaction or very substantial disposal have been finalised, the listed company must inform the HKEx and publish an announcement. Wuzhou breached Listing Rule 14.34 when it delayed announcing each of the Transactions and the Additional Disposals. It also breached Listing Rules 14.38A, 14.48 and 14.49 in failing to issue a circular and obtain shareholders’ approval for the Additional Disposal which constituted a very substantial disposal. Listing Rules 14.38A, 14.48, and 14.49 require that in the case of a very substantial disposal, the listed company must send a circular to its shareholders and that a very substantial disposal must be made conditional on shareholders’ approval in a general meeting;

- Wuzhou’s internal controls and risk management systems contained material deficiencies. It was found that there was no mechanism and/or written procedures for identifying, reporting and executing the notifiable transactions, or for compliance with the requirements under Chapter 14 (Notifiable Transactions) of the HKEx Listing Rules. The company did not have a system or control in place which required the timely reporting to the board of the progress of negotiations and/or the development of transactions, or material transactions of the company. There were also no internal procedures and systems relating to transfers of shares and assets of the group’s subsidiaries. The result of these deficiencies was that it was possible for one or two directors to enter into material and/or notifiable transactions and/or disposals of Wuzhou’s interests in its subsidiaries without the board being aware and without consideration of and compliance with the HKEx Listing Rules;

- Certain former directors – including both Mr Shu’s, Mr Zhou Chen (a former executive director), and Professor Shu Guo Ying and Dr Song Ming (both former INEDs of the company) – breached Listing Rule 3.08 and their Directors’ Undertakings by allowing the shareholder registration to proceed in the second disposal before receiving the consideration for the disposal and not using their best ability and endeavours to procure HKEx Listing Rule compliance;

- Both Mr Shu’s breached Listing Rule 3.08 and their Directors’ Undertakings by failing to take steps to ensure the company’s compliance with the HKEx Listing Rules with regards to the Transactions and the Additional Disposals, and failing to report the Transactions (apart from the third disposal) and the Additional Disposals to the board in a timely manner. They also breached their Directors’ Undertakings to cooperate in the HKEx’s investigation;

- Both Mr Shu’s, Mr Zhou Chen, Professor Shu Guo Ying and Dr Song Ming breached Listing Rule 3.08 and their Directors’ Undertakings by failing to ensure that the company had established and maintained an adequate and effective internal control system and risk management system;

- Certain current and former directors – including Mr Zhu Yong Qiu (an executive director), Ms Cai Qiao Ling (an executive director), Mr Shen Xiao Wei (chief executive officer and an executive director), Mr Zhou Chen, Mr Liu Chao Dong (a former INED), Prof Shu Guo Ying and Dr Song Ming – failed to use their best efforts to procure Wuzhou’s compliance with the Listing Rules regarding the third disposal and therefore breached their Directors’ Undertakings; and

- Both Mr Shu’s failure to discharge their responsibilities under the HKEx Listing Rules was wilful and/or persistent, and thereby warranted a public statement that, had Wuzhou remained listed or if both Mr Shu’s remained on the board, the retention of office by them would have been prejudicial to the interests of investors.

HKEx’s Disciplinary Action against Two Directors of CIL Holdings

On 17 May 2022, the HKEx criticised two directors of CIL Holdings Limited (CIL Holdings) – Mr Ke Jun Xiang (Mr Ke), an executive director and the chairman, and Mr Fu Dao Ding (Mr Fu), an executive director. The two directors failed to: (i) take sufficient steps to safeguard CIL Holdings’ interests; and (ii) ensure that CIL Holdings implemented and maintained adequate and effective internal controls for its money lending business. The HKEx’s Statement of Disciplinary Action is available on the HKEx’s website.

Loan Impairments and Lack of an Internal Control Policy

CIL Holdings commenced a money lending business in May 2014. Between June 2016 and June 2019, it granted certain loans (the Loans). Their repayment dates were extended multiple times by entering into new agreements. The Loans remained outstanding as at 30 June 2019, and substantial impairments were recorded as follows:

- Loan 1 was granted on 19 January 2018 and due on 18 January 2019. The gross loan amount was HK$10.7 million, but a HK$981,000 impairment loss was recognised;

- Loan 2 was granted on 11 April 2017 and due on 10 October 2017. The gross loan amount was HK$1.8 million, but a HK$24,000 impairment loss was recognised;

- Loan 3 was granted on 16 June 2016 and due on 15 June 2017. The gross loan amount was HK$3.1 million, but a HK$42,000 impairment loss was recognised; and

- Loan 4 was granted on 14 June 2019 and due on 31 December 2019. The gross loan amount was HK$7.0 million, but a HK$215,000 impairment loss was recognised.

In the CIL Holdings’ annual results for the year ended 30 June 2019, the company determined the allowance for impairment losses in relation to the Loans through management estimation and without supporting documentation. The company’s auditors were unable to obtain adequate audit evidence to determine whether the allowance for impairment losses was appropriate, and whether any adjustments were necessary, and issued a qualified opinion on CIL Holdings’ annual results for the year ended 30 June 2019.

At the time, Mr Ke and Mr Fu were responsible for the company’s money lending business and had primary responsibility for implementing internal controls for that business.

During the financial year ended 30 June 2018, an independent consultant was appointed to carry out an internal control review. The review identified several deficiencies in respect of CIL Holdings’ money lending business, which included the following:

- sufficient key financial information of some borrowers for the purpose of determining their creditworthiness (e.g. income, address proof and tax returns) could not be located;

- some loan agreements required the property of the borrower to be pledged, however the relevant mortgage deeds had not been executed;

- there were loans which had matured but remained unpaid. However, the properties pledged could not be foreclosed as no proper mortgage deed had been executed; and

- CIL Holdings did not obtain the title deeds of the properties owned by the borrowers for the mortgage.

While some credit assessments had been carried out on the borrowers, they were not sufficiently comprehensive. Although there was a credit and internal control policy for the operations of the money lending business, there were no procedures dealing with loan and interest repayment defaults. Regardless, Mr Ke and Mr Fu failed to follow any policy, which contributed to the deficiencies.

In order to address the deficiencies, the board adopted a modified manual (which was in addition to the credit and internal control policy), and Mr Ke and Mr Fu took steps to recover the Loans, including following up with the borrowers on a weekly basis. Loan 4 was fully repaid on 30 December 2019. For Loans 2 and 3, CIL Holdings and the respective borrowers reached a settlement, and the settlement sums were fully paid on 30 June 2021 and 26 November 2021 respectively.

HKEx Listing Rule Breaches

The Listing Committee found that Mr Ke and Mr Fu breached Listing Rule 3.08 and their Directors’ Undertakings as they failed to: (a) take sufficient steps to safeguard CIL Holdings’ interests; and (b) ensure that CIL Holdings implemented and maintained adequate and effective internal controls in relation to the money lending business.

Mr Ke and Mr Fu relied on their own credit assessments of the borrowers’ financial position, and did not follow the relevant policy and procedures to acquire the relevant documentation (e.g. consumer credit reports from credit reference agencies or any other independent asset valuation reports) to support their assessments. As such, CIL Holdings could only estimate the allowance for impairment losses by exercising management judgement, which contributed to the qualified opinion.

Moreover, Mr Ke and Mr Fu did not verify ownership of the assets pledged and did not execute mortgage deeds over the pledged assets as required by the relevant agreements. Instead, they relied only on the restrictions on dealing with the pledged assets included in the agreements. This had an adverse impact on CIL Holdings’ ability to recover the Loans.

Mr Ke and Mr Fu were responsible for CIL Holdings’ money lending business, and had primary responsibility for implementing and maintaining an adequate and effective internal control system for the business. The internal control review found that the deficiencies were caused by: (a) the absence of procedures in the credit and internal control policy dealing with loan and interest repayment defaults; and (b) the failure by Mr Ke and Mr Fu to follow the policy and the procedures thereunder.

Accordingly, the HKEx criticised Mr Ke and Mr Fu, and directed them to attend 15 hours of training each on regulatory and legal topics and Listing Rule compliance (including at least three hours on each of directors’ duties and the Corporate Governance Code) within 90 days.

HKEx Censures Prosper One International Holdings Company Limited

On 18 May 2022, the HKEx censured Prosper One International Holdings Company Limited (Prosper One), and five former and current directors – (i) Mr Meng Guang Yin (Mr Meng), the chairman, chief executive officer, executive director, and controlling shareholder; (ii) Mr Liu Guo Qing (Mr Liu GQ), an executive director; (iii) Mr Liu Jia Qiang (Mr Liu JQ), an executive director; (iv) Mr Liao Pin Tsung Benson (Mr Liao), a former executive director; and (v) Mr Tian Zhi Yuan (Mr Tian), an INED.

The HKEx also criticised two current INEDs – Mr Lee Chun Keung (Mr Lee) and Mr Wang Lu Ping (Mr Wang) – and two former INEDs – Mr Hu Jin Rui (Mr Hu) and Mr Chan Yee Ping Michael (Mr Chan).

The HKEx directed each of the above nine directors to attend 21 hours of training on regulatory and legal topics and HKEx Listing Rule compliance. The HKEx also directed a review of Prosper One’s internal controls for procuring compliance with the HKEx Listing Rules’ requirements governing notifiable and connected transactions.

The HKEx imposed these disciplinary actions due to, among others, failures to comply with, and procure the company’s compliance with, the HKEx Listing Rule requirements governing notifiable and connected transactions, and failures to ensure that the company maintains an adequate and effective internal control system. The HKEx’s Statement of Disciplinary Action is available on the HKEx’s website.

As noted by the HKEx, the case illustrates the need for listed company directors to ensure that the company’s internal control system is kept up-to-date and effective. Under the Corporate Governance Code, this review must take place at least annually. The HKEx notes in its regulatory announcement that significant changes in a company, such as the commencement of new business, should prompt an immediate review.

Failing to Announce or Seek Shareholders’ Approval

Prosper One’s principal business prior to late 2017 was solely watch retailing and wholesaling. At that time, only a few and insubstantial connected transactions were carried out. In September 2017, Mr Meng obtained a controlling interest in Prosper One and took over its control and management from the original controlling shareholder who was an executive director, the chief executive officer and chairman (the ex-CEO). As a result, the entire board of directors changed. Prosper One introduced a new business segment (trading of fertiliser and related products), and began to conduct connected transactions in relation to that business segment, while the ex-CEO continued to run the watch business segment for the company.

However, the board failed to: (a) ensure the company’s compliance with the HKEx Listing Rule requirements for notifiable and connected transactions in carrying out these transactions; and (b) effectively monitor the notifiable and connected transactions arising from the watch business, including the granting of a call option to the ex-CEO to buy back a yacht berth originally acquired by the company’s subsidiary from the ex-CEO.

Prosper One also failed to announce or seek shareholders’ approval for the notifiable and connected transactions arising from the fertiliser trading segment and the watch segment (the PO Transactions), and failed to disclose certain PO Transactions in its 2018 financial year report. The board first realised the non-compliance in June 2019 during the 2019 financial year audit process, with the non-compliance announced on 23 July 2019.

Additional PO Transactions were carried out in the 2020 financial year after the 23 July 2019 announcement. Prosper One carried on with these PO Transactions as they involved purchases or sales for which prepayments had been made or received by the company and its subsidiaries before 30 April 2019. According to the company, the board determined to proceed with these PO Transactions in early August 2019. Prosper One did not announce these PO Transactions.

Moreover, Prosper One implemented an internal control manual in 2014, but did not update it until after the discovery in June 2019 of the non-compliances relating to the PO Transactions. There were material deficiencies in its internal controls for procuring compliance with Chapters 14 (Notifiable Transactions) and 14A (Connected Transactions) of the Listing Rules.

HKEx Listing Rule Requirements and Breaches

Prosper One admitted breaching Listing Rules 14.34, 14.38A, 14.40, 14.41, 14A.35, 14A.36, 14A.49, 14A.53, 14A.55 and 14A.56 in respect of the PO Transactions. These rules imposed notification, announcement, circular, shareholders’ approval and annual reporting requirements on issuers in respect of notifiable and/or connected transactions, as well as annual cap and annual review requirements for continuing connected transactions.

Mr Meng, Mr Liu GQ and Mr Liu JQ, in conducting and managing the PO Transactions, did not comply with Listing Rule 3.08 and their Directors’ Undertakings. They were aware of the fertiliser transactions, and had all held management positions in the transactions’ counterparty group. Mr Liu GQ is the brother-in-law of Mr Meng, and Mr Liu JQ had been working under Mr Meng’s leadership in the counterparty group since 2003. The HKEx considered that they should have reasonably been aware that the counterparties to those transactions were connected persons, but they failed to make sure that Prosper One’s staff correctly understood the requirements of Chapters 14 and 14A of the Listing Rules, and determine that the fertiliser transactions were subject to the HKEx Listing Rules.

Mr Meng, Mr Liu GQ and Mr Liu JQ also did not take steps to procure Prosper One’s compliance with the Listing Rules in relation to, or keep the board informed of entering into, the fertiliser transactions; nor did they raise with the board the Listing Rule implications of these transactions. They also failed to ensure that the company announce the PO Transactions which took place in the 2020 financial year as soon as possible, even after they realised by mid-July 2019 that Prosper One had failed to comply with the announcement and/or the shareholders’ approval requirements. In addition, they failed to ensure that Prosper One maintained an adequate and effective internal control system, and had not procured the company to review and update the internal control manual in light of the change in business.

Mr Liao also breached Listing Rule 3.08 and his Director’s Undertaking in his role as an executive director, vice chairman and chief operating officer. He:

- failed to take an active interest in Prosper One’s affairs, and failed to follow up with Mr Meng, Mr Liu GQ, and/or Mr Liu JQ with regards to the fertiliser business that was introduced after Mr Meng took control of Prosper One. If he had taken an active interest in the company’s affairs, he would have been aware of the PO Transactions that occurred in financial year 2018 (due to the significant HK$49 million transaction value), the counterparty and its connection to Mr Meng, and therefore that they were subject to the Listing Rules on connected transactions;

- failed to take steps to make enquiries with Prosper One’s PRC finance manager about whether the fertiliser transactions should be presented as connected or related transactions in the company’s financial statements; and

- failed to take steps to procure Prosper One’s compliance with the HKEx Listing Rules in respect of the relevant transactions in the 2018 and 2019 financial years, such as suggesting that the company seek professional advice on the HKEx Listing Rule implications, and not raising with the board the HKEx Listing Rule implications of the fertiliser transactions.

Mr Tian, Mr Hu and Mr Chan breached their Directors’ Undertakings as they failed to ensure that Prosper One maintained an adequate and effective internal control system. In addition, they failed to discharge their duties as members of Prosper One’s audit committee. They may not have been aware of the fertiliser transactions at the relevant time; however, the issue is that they did not procure the company to update its 2014 internal control manual and implement an effective internal control system. There was also no evidence that any internal control issues were raised during the audit committee meetings.

Mr Tian, Mr Lee and Mr Wang1 breached their Directors’ Undertakings by failing to procure Prosper One’s compliance with the announcement and shareholders’ approval requirements under Listing Rules 14A.35 and 14A.36 for the fertiliser transactions that were conducted in the 2020 financial year. Even after they became aware of the Listing Rule implications of the fertiliser transactions in mid-July 2019, they did not take steps to ensure that the company would announce the transactions either immediately or shortly after the board decided to proceed with the transactions in early August 2019.

The HKEx therefore determined to impose the disciplinary actions against Prosper One and the nine directors.

HKEx’s Disciplinary Action Against CR Construction Group Holdings Limited, Six Directors and Zhejiang State-owned Capital Operation Company Limited

On 25 May 2022, the HKEx censured CR Construction Group Holdings Limited (CR Construction) and six of its directors – (i) Mr Guan Manyu, an executive director and chairman; (ii) Mr Li Kar Yin, an executive director and chief executive officer; (iii) Ms Chu Ping, an executive director; (iv) Mr Law Ming Kin, an executive director; (v) Mr Chan Tak Yiu, an executive director; and (vi) Mr Yang Haojiang, a non-executive director. The HKEx also censured Zhejiang State-owned Capital Operation Company Limited (Zhejiang SC).

The HKEx imposed the disciplinary actions for failures to disclose in the IPO prospectus and to the HKEx a reorganisation agreement for CR Construction’s corporate structure (involving a reduction in Zhejiang SC’s effective interest in CR Construction), leading to an inaccurate, incomplete, misleading and/or deceptive prospectus. The six-month post-listing disposal restrictions under the HKEx Listing Rules were also breached. The HKEx’s Statement of Disciplinary Action is available on the HKEx’s website.

Summary of Facts

CR Construction was listed on the HKEx’s Main Board on 16 October 2019 and the prospectus of the company was published on 27 September 2019.

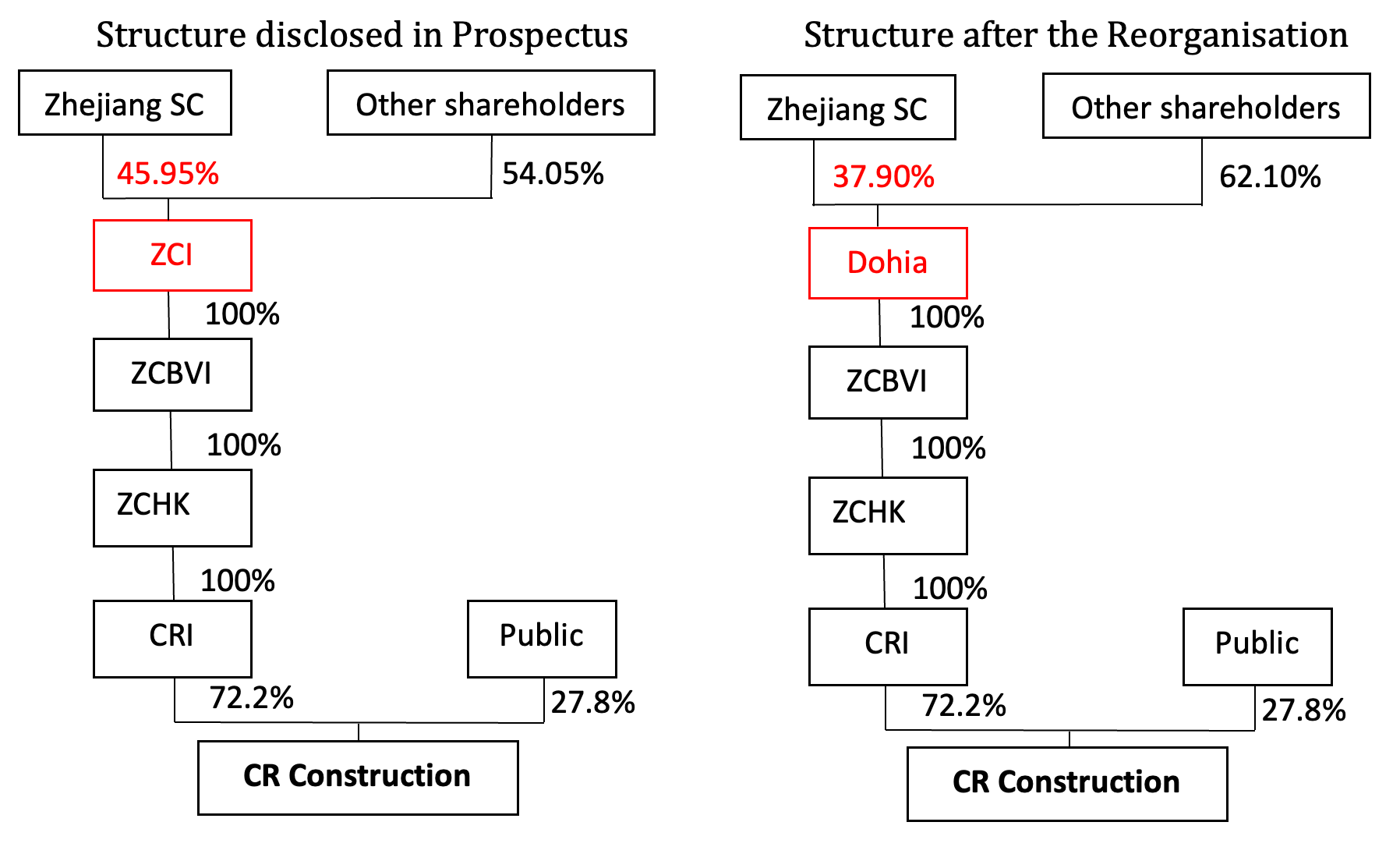

According to prospectus disclosures, Zhejiang SC, Zhejiang Construction Investment Group Co., Ltd. (ZCI), Zhejiang Construction Group (H.K.) Holdings Limited (ZCBVI), China Zhejiang Construction Group (H.K.) Limited (ZCHK) and CR Construction Investments Limited (CRI) would each be a controlling shareholder of CR Construction following its listing. Zhejiang SC was to hold 45.95% of the equity interest in ZCI, and ZCI would in turn hold 72.2% of CR Construction’s issued shares through ZCBVI, ZCHK and CRI, being a chain of companies wholly-owned by ZCI.

Prior to the October 2019 listing, each of the above companies made a lock-up undertaking, i.e. each company undertook to the HKEx that it would not (and would procure that the relevant registered holders would not), among other things, dispose of any shares in CR Construction in the first six months post-listing (until 16 April 2020).

Prior to the issue of the prospectus, Zhejiang SC entered into an agreement with a number of parties in April 2019, including Dohia Group Company Limited (Dohia) and other shareholders of ZCI, in order to achieve the securitisation and listing of ZCI (the Reorganisation). The Reorganisation involved the injection of all of ZCI’s assets and liabilities (including its interest in CR Construction held through ZCBVI, ZCHK and CRI) into Dohia, a Shenzhen-listed company, and the corresponding issuance of shares by Dohia to ZCI’s shareholders. The intention was for Dohia to replace ZCI and take its place as CR Construction’s controlling shareholder. It was also anticipated that, upon the Reorganisation’s completion, ZCI would be deregistered and cease to be a legal entity. In December 2019, the China Securities Regulatory Commission (the CSRC) officially approved the Reorganisation.

The Reorganisation was not disclosed to the HKEx during CR Construction’s listing application process, and the prospectus did not disclose any information regarding the Reorganisation.

During the first six-month lock-up period, Zhejiang SC carried out the Reorganisation, transferring all of its interest in ZCI to Dohia, breaching the lock-up undertaking. As a result, the interest of Zhejiang SC in the intermediate controlling shareholders of CR Construction (Dohia, ZCBVI, ZCHK and CRI) was reduced from 45.95% to 37.90%, thereby reducing the effective interest of Zhejiang SC in CR Construction. On 25 June 2021, ZCI was deregistered.

Shareholding Structure

Listing Rule Requirements and Breaches

Listing Rule 2.13(2) requires that information contained in any announcement or corporate communication required under the HKEx Listing Rules (which includes a prospectus) must be accurate and complete in all material respects and not be misleading or deceptive. The Listing Committee found that CR Construction breached Listing Rule 2.13(2) as its prospectus was not accurate and complete in all material respects and/or was misleading or deceptive, because the prospectus did not include any information about the Reorganisation.

All six relevant directors breached their Directors’ Undertakings to use their best endeavours to procure CR Construction’s compliance with the HKEx Listing Rules:

- prospective investors in CR Construction had a legitimate entitlement to accurate and complete information about the identity of the controlling shareholders and the shareholding structure of the company in order to make informed investment decisions. The Reorganisation materially impacted the accuracy and/or completeness of the shareholding structure information disclosed in the prospectus. The fact that CR Construction might have a listed parent could affect investors’ consideration of their potential investment in the company; and

- all six relevant directors were aware of the Reorganisation when the prospectus was prepared and issued. Nonetheless, the Reorganisation was not disclosed to: (i) the HKEx during the listing vetting process; and (ii) CR Construction’s INEDs in a timely fashion so that the issue of disclosure could be explored by the full board of directors.

Listing Rule 10.07(1)(a) and the lock-up undertaking prohibited required that a person (or group of persons) shown by the listing document issued at the time of the issuer’s listing application to be controlling shareholders of the issuer should not, and should procure that the relevant registered holder(s) should not, amongst others, dispose of any shares in the issuer in respect of which he/she/they is/are shown by that listing document to be the beneficial owner(s) in the first six months after the listing date.

Zhejiang SC breached Listing Rule 10.07(1)(a) and its lock-up undertaking to the HKEx. Zhejiang SC was aware that the execution of the Reorganisation would result in these breaches. Zhejiang SC was advised to consult the HKEx and obtain its clearance prior to conducting the Reorganisation, but failed to follow the advice. The breaches indicated its lack of regard for HKEx Listing Rule compliance.

The HKEx’s Listing Committee therefore determined to impose the disciplinary actions against CR Construction, Zhejiang SC and the six directors.

Court of First Instance Orders Ponzi Scheme Operators to Compensate Investors

On 16 May 2022, the Court of First Instance (the CFI) granted orders sought by the SFC against DFRF Enterprises LLC and DFRF Enterprises, LLC (collectively, DFRF) and their founder, Mr Daniel Fernandes Rojo Filho (Filho), to compensate victims of a fraudulent scheme under section 213 of the Securities and Futures Ordinance. Under a global pyramid and Ponzi scheme, DFRF and Filho falsely claimed that DFRF’s main business was in gold mining operations and that the business would soon be listed in the US, inducing a number of Hong Kong investors to acquire “membership units” of its membership programme for a monthly return. In around May 2015, they falsely claimed that DFRF had been listed in the US and offered investors the option to convert their “membership units” into preferred shares of DFRF at a specified price. The CFI’s full judgement can be found on the Judiciary’s website.

Fraudulent Misrepresentations

DFRF Enterprises LLC (a Massachusetts limited liability company), DFRF Enterprises, LLC (a Florida limited liability company) and Filho are three defendants in this case. In around the summer of 2014, Filho commenced selling memberships in DFRF through meetings with potential investors, many of which took place in Massachusetts, USA. In October 2014, he began promoting DFRF through videos available to the public on the internet. From at least March/April 2015, DFRF began carrying out marketing activities in Hong Kong where investors were told that DFRF would become a listed company and that the value of their investments would rise threefold post-listing.

In around late March 2015, DFRF, Filho and their associates claimed in online videos that DFRF was registered with the US Securities and Exchange Commission (the SEC), that their stocks were about to become publicly traded, and that members could convert part or all of their membership units into stock options at USD15.06 per share. The SEC observed that following that announcement, receipts from investors soared to more than USD4.3 million, with DFRF raising over USD2.5 million in April 2015 and over USD4.1 million in May 2015.

According to promotional materials and a business model summary published by DFRF on the internet, their purported business model was as follows:

- DFRF claimed to have headquarters in the US and Canada and that their main business was gold mining in Mali, Brazil and the US. DFRF further claimed that they had made 13 to 16 metric tonnes of gold per month and made a gross return of 100% on every kilogram of gold produced, donating 25% of their profits to charitable organisations;

- DFRF offered individuals around the world to subscribe to its membership programme by investing in DFRF by acquiring “membership units” priced at USD1000 per unit. The member benefits would be returns of up to 15% per month and placed in a Platinum Swiss Trust in Geneva Switzerland with access available via an issued DFRF Visa debit card. Contributions made by members were said to be a zero-risk business and was to be fully insured by Accedium, an insurance company;

- potential investors were only invited to join through an existing DFRF member. The newcomer would then be vetted by DFRF and, once approved, would receive: (i) an “operating agreement” contract which must be counter-signed and returned to DFRF; (ii) information on the Accedium insurance policy (each member was required to pay an annual insurance fee of 7% calculated by reference to the initial subscription fee); (iii) a debit card issued by the Platinum Swiss Trust that provided “towering limits for daily shopping and ATM”; and (iv) instructions on how to access and manage his/her online account balance;

- a referring member would receive a 10% commission of the initial subscription fee of the newly referred member with a further 10% to be paid on any reinvestment of the returns by the newly referred member;

- any returns would be paid by DFRF on the first day of every month on a pro-rata basis into the approved member’s account at the Platinum Swiss Trust, which would then be accessible via the Visa debit card; and

- approving members who wished to withdraw from the membership programme could do so on the expiry of 12 months from the time of their initial subscription (if the fee paid was USD1,000), 6 months from the time of their initial subscription (if the fee paid was between USD1,000.01 and USD5000), or every month (if their initial subscription fee exceeded USD10,000.01).

DFRF maintained an official website, a Facebook webpage and a YouTube channel promoting their business. On or around 6 May 2015, DFRF released three promotional videos featuring interviews with Filho in Cantonese, Putonghua and English. In the videos, Filho announced that:

- DFRF had become a listed company in the US on 5 May 2015 and that all members would have the option to convert all or part of their membership units into preferred DFRF shares at USD15.06 per share and claimed that DFRF shares were already priced at USD18 per share; and

- DFRF’s stock code would not be released to the public until after the conversion process had been completed and that the reason for this was to protect the value of the DFRF stock.

The most important representation of fact made by Filho was that DFRF had been listed in the US on 5 May 2015. However, the SEC confirmed that DFRF had never been listed in the US. Filho’s claim was a false representation.

The webpages also contained a video attempting to convince viewers that the business was legal. A man introduced as a former FBI special agent with a history of investigating Ponzi schemes, claimed that Filho’s business had been set up properly and was perfectly legal.

Nevertheless, there were in fact:

- no gold mines, no gold reserves and no gold operations;

- “Platinum Swiss Trust” had not been authorised to conduct banking activities in Switzerland and had been on a warning list of the Swiss Financial Market Supervisory Authority (the FIAMA). There was also no banking transaction between DFRF and Platinum Swiss Trust;

- there was a real company called Accedium Insurance Company, which was a company registered in Barbados and London. However, it was not a “top-rated” company. There was also no premium paid by DFRF to Accedium nor were there any banking transactions between them;

- monies received from the members were dissipated to Filho personally and his associates; and

- the small returns that some members received apparently came from other members’ investments.

Hong Kong Investors

From June 2014 to May 2015, DFRF raised over USD15 million from more than 1,400 investors globally, including investors from Hong Kong.

On 19 May 2015, the British Columbia Securities Commission (the BCSC) wrote to the SFC under the International Organisation of Securities Commissions Multilateral Memorandum of Understanding (the IOSCO MMOU) for assistance in relation to DFRF. The BCSC also provided information on investments that might have been made by over 300 Hong Kong residents. The SFC contacted these individuals as far as possible and invited them to participate in interviews or complete questionnaires, but only received responses from about 18 individuals. The responses also showed that a further 27 individuals had also been deceived. The total amounts invested by the Hong Kong investors who the SFC was able to identify were USD3.3 million and HKD117,000.

On 13 May 2016, the SFC issued a Direction to Investigate2 on the grounds that there was reasonable cause to believe that during or around the period from 1 May 2015 to 13 May 2015, DFRF (and/or its related companies and/or persons connected with it) may have committed offences under Hong Kong’s Securities and Futures Ordinance (the SFO). On 24 August 2016, the SFC commenced proceedings. Mareva injunctions were granted on 13 December 2016 and 22 March 2017, freezing two other defendants’ accounts which still had some remaining balances. Most of the monies paid by the Hong Kong investors were gone except for the remaining balances in these accounts.

Breaches of the SFO

The CFI made declarations that DFRF and Filho had contravened the following sections of the SFO:

- sections 114(1)(a) and 114(1)(b) for carrying on a business and holding themselves as carrying on a business in a regulated activity (Type 4, advising on securities) without a licence;

- section 109(1) for issuing advertisements in which they held themselves out as being prepared to carry on Type 4 (advising on securities) regulated activity, whilst in fact unlicensed;

- section 103(1) for issuing unauthorised advertisements, invitations or documents (the promotional videos, emails and oral representations) containing an invitation to the public to enter into an agreement to acquire or subscribe for securities; and

- section 107(1) for making fraudulent misrepresentations in order to induce another person to enter into an agreement to acquire or subscribe for securities.

The CFI granted various prohibitory injunctions against the defendants, including a continuation of the mareva injunctions already granted and orders restraining Filho and DFRF (under his control) from committing similar illegal activities in Hong Kong in the future.

The CFI also ordered the appointment of administrators to receive and distribute the proceeds of the scheme remaining in the two bank accounts (approximately HKD2.8 million in total) for the benefit of the investors on a pro-rata basis.

In relation to DFRF and Filho who were out of the jurisdiction of Hong Kong, the CFI made orders for substitution service of the orders made and any other necessary notification concerning the enforcement to be made.

SFC Bans Ho Pak Hay For Life

On 19 May 2022, the SFC prohibited Mr Ho Pak Hay (Mr Ho) from re-entering the industry for life for misappropriating and misusing funds totalling HK$1.8 million. Mr Ho used a portion of funds received from clients for personal purposes (and did not invest as agreed with the clients), and issued eight cheques as purported investment repayments that were subsequently dishonoured. The SFC’s Statement of Disciplinary Action is available on the SFC’s website.

Misappropriating Funds for Personal Purposes

Mr Ho was employed by KGI Asia Limited and KGI Futures (Hong Kong) Limited as an investment representative licensed to carry on Type 1 (dealing in securities) and Type 2 (dealing in futures contracts) regulated activities between 10 October 2017 and 12 July 2019, and was the account executive for the trading accounts held by the clients, namely Clients A, B and C. Between February and July 2018, Mr Ho entered into four private agreements with the clients, where he agreed with each client that:

- the client would pay Mr Ho a fixed amount and entrust him to invest on the client’s behalf;

- the investment period was for one year and the client would receive interest on a monthly basis;

- Mr Ho would invest the amount received from the client at his sole discretion; and

- Mr Ho would make up for the difference if the funds in the client’s account were less than the investment amount that the client had paid to Mr Ho.

In accordance with the agreements:

- Client A paid Mr Ho HK$1.4 million for investment; and

- Clients B and C each paid Mr Ho HK$200,000 for investment.

Although Mr Ho had agreed with each client that he would return their respective investment amount at the end of the one-year investment period, Mr Ho only paid a portion of the agreed monthly interest to each client and never returned any of the investment amounts to the clients as agreed. In fact, evidence indicates that Mr Ho had spent part of the HK$1.8 million investment amounts on gambling and had never invested any of the amounts on behalf of the clients. The SFC therefore found that Mr Ho had misappropriated and misused the HK$1.8 million investment amounts received from the three clients for personal purposes and never invested the investment amounts as agreed with the clients.

Issuing Dishonoured Cheques

Further investigation by the SFC also found that Mr Ho had issued eight cheques drawn in Client A’s favour between August 2018 and April 2019 as purported repayment of the investment money that Mr Ho owed to Client A. However, all eight cheques were dishonoured because there were either insufficient funds in Mr Ho’s bank account at the time or the cheques were dated on or after Mr Ho’s bank account was closed. The SFC considers such conduct to be a negative reflection of Mr Ho’s honesty and reliability.

Fit and Proper Person under the SFO

Under section 129 of the SFO, in considering whether a person is a fit and proper person to be licensed, the SFC will consider, among others, the person’s ability to carry on the regulated activity honestly, and the person’s reliability and financial integrity.

Having considered the circumstances, the SFC found that Mr Ho is not a fit and proper person to be licensed as his conduct casts serious doubt on his integrity and reliability, and his ability to carry on regulated activities honestly. The SFC therefore determined that prohibition for life is appropriate.