Myanmar

Introduction to Doing Business in Myanmar

Myanmar: Country Profile

Official Name |

The Republic of the Union of Myanmar |

Capital |

Nay Pyi Taw (established in 2005; the former capital was Yangon) |

Landmass |

261.228 sq miles (676.577 sq km) |

Coastline |

1,759 miles (2,832 km) |

Population |

Approximately 54 million (2020) |

Population growth |

0.88% |

Geography |

Myanmar is divided into three distinct geographical regions: the Eastern Hill Region, the Central Valley Region and the Western Hill Region |

Largest rivers |

Ayeyarwaddy River, Sittaung River, Than Lwin River and Chindwin River |

Climate |

Tropical climate with three seasons: Summer (March to May) Rainy Season (June to October) Cold Season (November to February) |

Local time |

GMT + 6:30 |

Currency |

Myanmar Kyat (MMK) (US$1385) Kyats (July 2020) |

Natural resources |

Natural gas, petroleum, gold, jade, rubies and other gemstones, copper, tin, antimony, lead, zinc, silver, teak and other timbers |

Major crops |

Rice, pulses and beans, sesame, maize, rubber, fruits and vegetables |

Major ethnic groups |

Kachin, Kayah, Kayin, Chin, Bamar, Mon, Rakhine, Shan |

Major exports |

Natural gas, garments, re-export sugar, black matpe, jade, rice, green mung bean, fish, metal and ore, maize |

Major imports |

Petroleum products, vehicles, machinery and parts, iron and steel construction materials, iron and steel materials, raw plastics, palm oil, motorcycle, telephone and communication accessories, pharmaceutical |

Major trading partners |

China, Thailand, Singapore, Japan, India, Malaysia, South Korea, Indonesia, USA, Vietnam |

Myanmar: Recent Economic Development*

- Global growth is expected to remain subdued over the forecast period

- Myanmar’s GDP growth rates are lower than previously estimated

- Agricultural growth has proven resilient

- Manufacturing is driving the growth of industry, and new foreign firms are entering the market, but domestic small enterprises face challenges

- The construction sector is recovering slowly despite the huge market potential of residential buildings and transportation infrastructure

- The wholesale and retail trade continue to support growth, while financial services and tourism have yielded mixed results

- As investment growth continues to moderate, private consumption is driving GDP growth

- Myanmar’s financial services sector is rapidly modernizing

- The insurance sector has developed steadily but still has untapped potential

- The legal framework of company registration and investment have been increasingly improved

- Fintech is growing rapidly in industrial sector of Myanmar

*Source – The World Bank, Myanmar Investment Commission

Myanmar: Strengths, Constraints, Opportunities and Risks*

STRENGTHS

- Strong commitment to reform

- Large youthful population, providing a low-cost labour force attractive to foreign investment

- Rich supply of natural resources — land, water, gas, minerals

- Abundant agricultural resources to be exploited for productivity improvement

- Tourism potential

CONSTRAINTS

- Weak macroeconomic management and lack of experience with market mechanisms

- Underdeveloped financial sector

- Inadequate infrastructure, particularly in transport, electricity access, and telecommunications

- Low education and health achievement

- Limited economic diversification

OPPORTUNITIES

- Strategic location

- Potential of renewable energy

- Potential for investment in a range of sectors

RISKS

- Risks from economic reform and liberalisation

- Risks from climate change

- Pollution from economic activities

- Tension from internal ethnic conflicts

Source: Asian Development Bank

Key Considerations

- Intended business activity – restricted? Is a joint venture required?

- Incorporation under Myanmar Investment Law (MIL) or Myanmar Companies Law (MCL)?

- Taxation and applicable incentives

- MIC Permit or Endorsement

- Designation of development zones

Investment Opportunities

- Myanmar Investment Commission (MIC) will prioritize the following areas when the investors submit their proposals:

- Agriculture and its related services, value-added production of agricultural products

- Livestock production, breeding and production of fishery products

- Export promotion industries

- Import substitution industries

- Power sector

- Logistics industries

- Education services

- Health care industry

- Construction of affordable housing

- Establishment of industrial estate

- Myanmar Investment Commission welcomes both foreign and local investors to invest in these investment areas and the MIC and government of respective States and Regions will provide necessary assistance to investors.

Investing in Myanmar: A Changing Legal Framework

- Myanmar is in the process of updating numerous laws and regulations including its foreign investment regime

- Many old colonial laws still in force. (Burma Code 13 volumes 1841 – 1954)

- Myanmar Companies Law (2017) (MCL)

- Myanmar Companies Regulations (2018)

- State-owned Economic Enterprises Law (1988)

- Myanmar Special Economic Zone Law (2014)

- Competition Law (2015)

- Myanmar Investment Law (2016) (MIL)

- Myanmar Investment Rules (2017)

- Arbitration Law (2016)

- Condominium Law (2016)

- Condominium Rules (2017)

- Insolvency Law (2020)

- Insolvency Rules (2020)

- Industrial Zone Law (2020)

Categories of Business Activities

- Business activities are divided into threebroad categories:-

- Industrial (Manufacturing)

- Services / Construction

- Trading (Wholesale and Retail Business)

- Previously, trading activities are reserved to Myanmar nationals and companies wholly owned by Myanmar nationals. However, foreign companies are now permitted, with the approval of the Ministry of Commerce, to conduct trading business such as wholesale and retail under Notification No. 15/2017 of Myanmar Investment Commission.

Myanmar Investment Law (MIL), 2016

- MIL was enacted in 2016 by combining the Foreign Investment Law, 2012 and Myanmar Citizens Investment Law, 2013

- The government separately passed implementing rules (Myanmar Investment Rules) on 30 March 2017

- MFL introduced two categories of investment approval procedures, one is a MIC permit and the other is an investment endorsement

- MIC permit is mandatory for the investment activities that are necessary to obtain MIC permit

- MIC endorsement is optional and it can be applied by those who wish to enjoy benefits including tax exemptions and long-term use of land

- Under the MIL foreign investors can benefit from significant tax exemptions and other benefits

- Myanmar Investment Commission (MIC) established

- Directorate of Investment and Company Administration (DICA) serves as the Secretariat of MIC

- The MIL applies to three forms of foreign investment

- 100% foreign owned companies

- Joint ventures with a local investor or a government department or organization

- Investments carried out through contractual relationships with local investors

MIL: Objectives

- Infrastructure development (various professional fields)

- Development of high functioning production, service and trading sectors

- Employment creation

- Environmental protection

- Development of technology and the agriculture, livestock and industrial sectors

- Development of businesses and investments that meet international standards

MIL: Incentives

- Guarantee against expropriation/nationalization

- Guaranteed remittance of profits; remittance upon exiting the investment

- Equity in an MIL company can be transferred with the approval of the MIC

- Foreigners are permitted to lease land for up to 50 years as well as two continuous extensions of 10 years if approved by the MIC

- MIL allows promoted investment sectors to enjoy corporate income tax holidays depending on the type of development zone specified under Notification No. 10/2017 of MIC

MIL: Tax Incentives

- Corporate income tax holidays for the period from three to seven consecutive years depending on the zones specified by MIL

- Tax exemptions or reliefs for capital assets imported and used in the business during the construction period

- Tax exemptions or reliefs for the importation of the raw materials and partially manufactured goods

- Tax reimbursement for the importation of the raw materials and partially manufactured goods

- Tax exemptions for re-invested profits

- Right to deduct depreciation on capital assets

- Tax deductions for research and development

MIL: MIC Notifications

- Three prominent Notifications of MIC issued under MIL :-

- Notification 10/2017 sets out the designation of the development zones by specifying less developed regions as zone 1, moderate developed regions as zone 2 and developed regions as zone 3 for the purpose of income tax exemption and relief.

- Notification 13/2017 sets out the classification of promoted sectors which shall be granted income tax exemptions if it is apply to MIC.

- Notification 15/2013 sets out various regulations and procedural information in relation to investment licences

MIL: Promoted Sectors

- Under Notification 13/2017 of MIC, the following types of business are classified as being a promoted sector;

- Agriculture and its related services (except cultivation and production of tobacco and virginia)

- Plantation and conservation of forest, and other businesses with forests

- Livestock production, breeding and production of fishery products, and its related services

- Manufacturing (except manufacturing of cigarette, liqueur, beer, and other harmful products to health)

- Establishment of industrial zones

- Establishment of new urban areas

- City development activities

- Construction of road, bridge and railway line

- Construction of seaport, river port and dry port

- Management, operation and maintenance of airport

- Maintenance of aircrafts

- Supply and transport services

- Power generation, transmission and distribution

- Production of renewable energy

- Telecommunication businesses

- Education services

- Health services

- Information technology services

- Hotel and tourism

- Science research development business

- The investments covered in the above investment promoted sectors shall be granted income tax exemptions if it applies to MIC.

MIL: List of Restricted Investment Activities

Notification 15/2017 of MIC divides investment activities into four categories. These are:-

- Investment activities allowed to be carried out only by the Union

- Investment activities that are not allowed to be carried out by foreign investors

- Investment activities allowed only in the form of a joint venture with any citizen owned entity or any Myanmar citizen (Local partner or Myanmar citizen must invest and hold a minimum of 20% in the form of a joint venture)

- Investment activities to be carried out with the approval of the relevant ministries

Designated insurance businesses to be insured

- The investor who obtained an MIC permit or tax exemption or relief for the following insurance business types must insure in line with Notification No. 76/2018 which was amended by the Myanmar Investment Rules.

- Property and Business Interruption Insurance;

- Engineering Insurance;

- Professional Liability Insurance;

- Bodily Injury Insurance;

- Marine Insurance; or

- Workmen Compensation Insurance;

- Life Insurance; and

- Fire Insurance.1

Investment in the Education Sector

- The MIC published the Notification No. 7/2018 regulating local and foreign investment activities in the education sector. The investors who need to carry out the investments in the following types of education services in the form of private schools with the permission of the MIC.

- Private basic education school;

- Private technical, vocational and training school;

- Private higher education school;

- Private subject based school; and

- Private school designated by the Ministry.2

About MIC

- The Myanmar Investment Commission (MIC) is a government-appointed body which is responsible for verifying and approving investment proposals, and regularly issues notifications about sector-specific developments. The Myanmar Investment Law changes the role of the MIC – with fewer investment proposals now requiring formal MIC approval. A new Endorsement process – whereby proposals are fast-tracked by being ‘endorsed’ by the MIC – is now also available to investors. The MIC is comprised of representatives and experts from government ministries, departments, and governmental and non-governmental bodies

- Objectives of the MIC include:

- To protect investors according to the new investment law promulgated by Union Hluttaw (Parliament)

- To safeguard environmental conservation

- To deeply emphasise social impact

- To practice accounting and auditing in accordance with international standards in financial matters – including transparency and accountability

- To create job opportunities

- To abide by existing labour laws

- To support corporate social responsibility

- To transfer technology

Investment Procedures: MIC Permit and Investment Endorsement

MIL introduces two categories of investment approval procedures, one is a MIC permit and the other one is an investment endorsement. These are generally referred to as MIC Permit Procedure and Investment Endorsement Procedure. The introduction of investment endorsement procedure has significantly simplified and eased the investment procedures in Myanmar. It is impossible to apply for both a MIC permit and an endorsement.

MIC Permit

- Before MIL, any investor had to submit a proposal to the MIC for a permit, regardless of the business size if they intend to benefit from the MIC incentives.

- According to MIL, far fewer proposals will be screened and permitted by MIC. Investors shall submit a proposal to the MIC and invest after receiving the permit for the following investment activities stipulated in Myanmar Investment Rules:

- Investment activities that are essential to the national strategy;

- Large capital intensive investment projects;

- Projects which are likely to cause a large impact on the environment and the local community;

- Investment activities which use state owned land and buildings; or

- Investment activities which are designated by the Government to require the submission of a proposal to MIC.

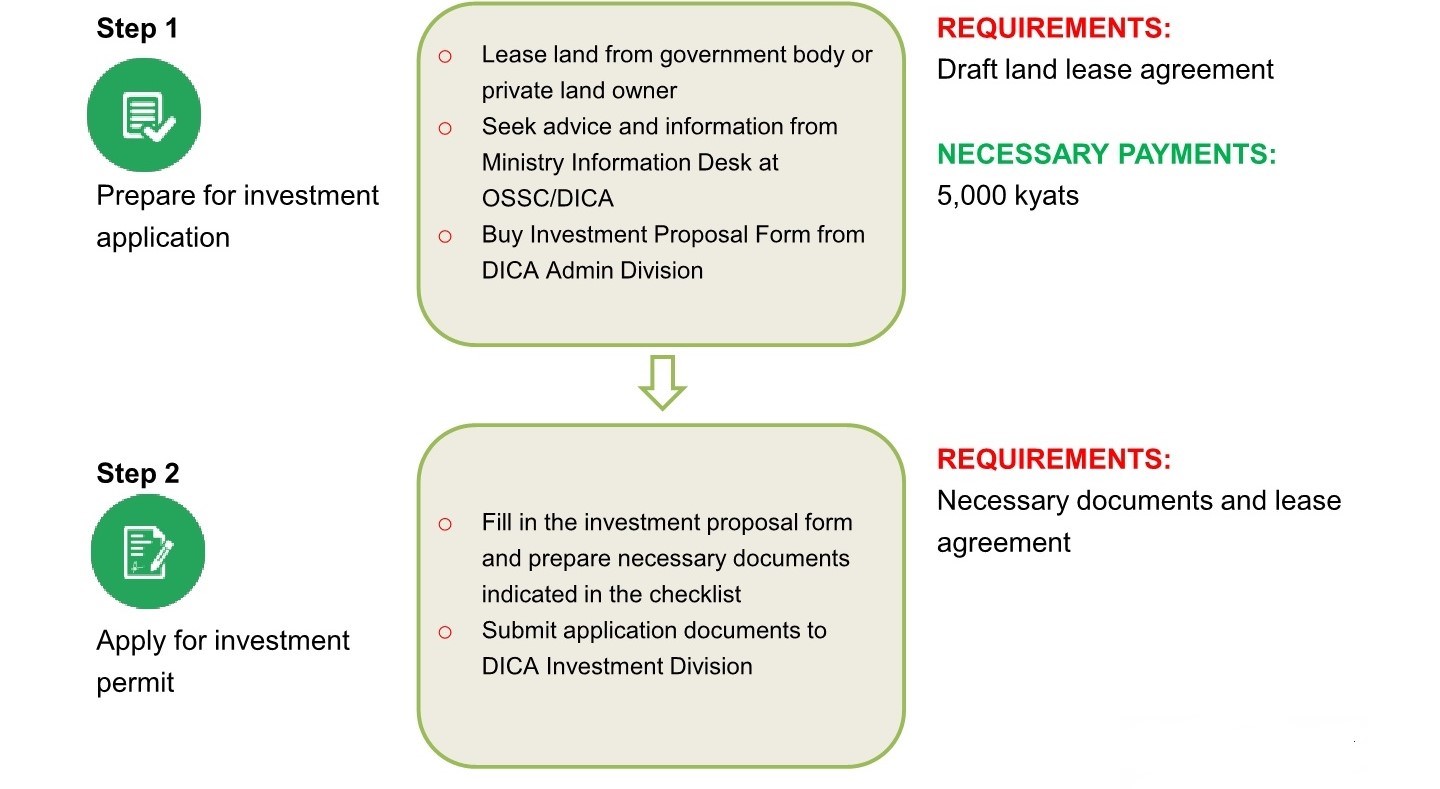

MIC Application Process

Investment Endorsement

- If investment activities are not in the category of investment activities which require a MIC permit as described in the above-mentioned activities, the investors are not required to submit a permit proposal to MIC.

- However, in order to enjoy long-term land use right, tax exemptions and reliefs described in MIL, the investors may undergo an investment endorsement application process.

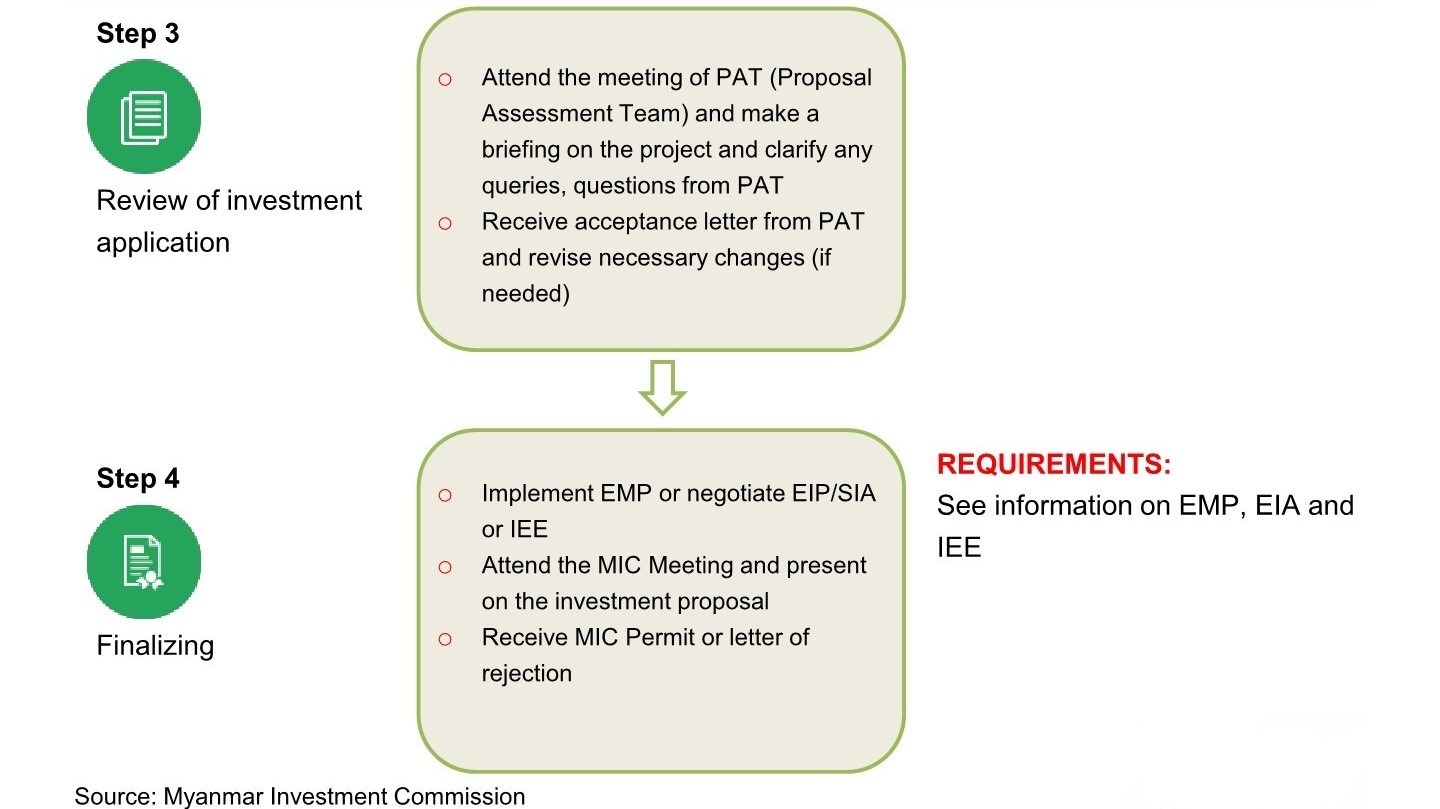

Endorsement Application Process

Myanmar Companies Law (MCL), 2017

- The MCL removes the requirement for foreign companies to hold a separate “permit to trade”, significantly reducing another regulatory burden and levelling the playing field.

- According to new Myanmar Companies Law (MCL), there is no restriction on conducting any business activities including trading business for foreign companies. They can conduct any business activities as long as they are in compliance with the law and have the requisite permits and licenses.

- The MCL allows non-Myanmar investors to have up to a 35% stake in a local business, before it is categorized as a foreign company.

- This encourages domestic businesses to seek overseas expertise and capital via joint-ventures. In addition, the law has opened-up the Yangon Stock Exchange for foreign customers.

- For private companies being set-up, only one director and one shareholder is required. The sole director can also be the sole shareholder of a private company. Therefore, a single person can now register a company in Myanmar.

- Public companies require three or more Directors.

- Directors must carry out their duties in such manner as to ensure that the company is properly managed in the best interests of their stakeholders and shareholders. 3

Types of companies and entities

The following companies and entities which can be registered under the MCL are:

- Private Company Limited by Shares

- Public Company Limited by Shares

- Company Limited by Guarantee

- Unlimited Company

- Business Association

- Public Company Limited by Shares (under the Special Company Act 1950)

- Private Company Limited by Shares (under the Special Company Act 1950)

- Overseas Corporation4

Main Types of Companies

Company Limited by Shares

In a company limited by shares, the liability of shareholders is limited to the amount unpaid on their shares. A company limited by shares is the most common type of company used in Myanmar and in international business.

Company Limited by Guarantee

In a company limited by guarantee, the liability of members is limited to the amount that the member undertakes to contribute if the company is liquidated and there are insufficient assets to pay any outstanding debts. The sum guaranteed by member is usually specified in the company’s constitution.

Unlimited Company

An unlimited company does not have any limit on the liability of its members. Therefore, members have an obligation to meet any outstanding financial liability of the company which cannot be repaid from its asset in the event of liquidation. This type of company is much less commonly used.

Requirements for Directors

Under the MCL, a private company must have at least one director and a public company must have at least three directors. At least one director of every company must be ordinary resident in Myanmar. The ordinary resident director may be a permanent resident of Myanmar or be resident in the country for at least 183 days in every 12-month period.

The MCL sets out the minimum qualifications for directors of companies:

- a director must be a natural person who is at least 18 years old;

- a director must be of sound mind;

- a director must not be a person who has been disqualified from acting as a director under the MCL or any other applicable law; and

- a director must not be an undischarged bankrupt.

A company may set out additional qualifications of directors in the company constitution such as a requirement to hold shares in the company.

MCL: Some Distinct Changes

Single Director and Single Shareholder Company

Under MCL, a private company can be established with at least one shareholder and one director who ordinarily reside in Myanmar. The sole director can also be the sole shareholder of a private company. Therefore, a single person can now register a company in Myanmar.

What is Company Constitution?

According to MCL, Memorandum of Association and Articles of Association (MOA & AOA) are replaced by a single document, the company constitution, and the requirement to have objects has been removed. The company constitution is an important document which sets out the rules for how the company is governed, including the rights and obligations of shareholders. It has legal effect as a contract between the company and its shareholders and is legally binding on all shareholders.

Ownership Ratio

The MCL allows foreigners or foreign companies to obtain up to 35% equity in a Myanmar company and this company will still be categorized as a Myanmar company. If the threshold of 35% is exceeded, the company will be categorised as a foreign company.

MCL: Overseas Corporation

- Foreign companies that carry on business in Myanmar may have to be registered as an overseas corporation with the Directorate of Investment and Company Administration (DICA). Otherwise, an overseas corporation is basically a Myanmar branch of a company that has been incorporated outside Myanmar.

- In the case of registration of an overseas corporation – section 47(b) (ix) of the MCL provides that the application must be accompanied by evidence of incorporation of the overseas corporation and a copy of the instrument constituting or defining the constitution of the corporation, and, if not in Myanmar language, a Myanmar language translation of such documents and a summary statement in the English language (if the original is not in English language) duly certified by a director.

A. Evidence of incorporation

Submit a Certificate of Incorporation, a Certified Extract, a Certificate of Good Standing or equivalent document from the registrar of corporations in its jurisdiction of incorporation dated no more than thirty (30) days before the date of submission of the application.

B. Constitution

The overseas corporation must include a copy of its Constitution (or equivalent), a Myanmar language translation of such document and a summary statement in the English language (if the original is not in English language) duly certified by a director.

Myanmar Companies Online (MyCO) Registry

- The MyCO registry is established and maintained by DICA as a public registry of all companies and entites registered under MCL. The information on the MyCO registry is maintained electronically and is publicly accessible 24 hours a day.

- All forms and documents required to be filed with the Registrar under MCL can be submitted by a representative of the company or a third party on behalf of the company in the following ways:

- Online on the MyCO registry at www.myco.dica.gov.mm; or

- In person at a DICA office to be uploaded electronically on the MyCO registry.

- Directors of a company (or the company secretary if the company has appointed one) are legally responsible for filing documents and for the accuracy of the information filed with the Registrar. Directors are also legally responsible even if they have appointed a third party (such as an accountant, agent or lawyer) to lodge documents on behalf of the company.

Share Capital Requirement

There is no minimum capital requirement when registering a company in Myanmar. For details pertaining to the minimum requirement for banking, Insurance, securities and trading companies, reference should be had to the Central Bank of Myanmar, and Ministry of Planning and Finance and Ministry of Commerce.

Wholesale and Retail (Trading) Business

Registration and permits

- Pursuant to the Myanmar Ministry of Commerce Notification No. 25/2018 dated 9 May 2018, wholly foreign-owned companies and joint ventures with foreign shareholdings are permitted to engage in retail and wholesale trading (of domestically produced and/or imported goods) in Myanmar, subject to compliance with certain requirements and investment criteria.

- All wholly foreign-owned companies and joint ventures with foreign shareholdings are required to register with the Ministry of Commerce, and obtain a permit before they can engage in trading activities. The following documents and information must be submitted to the Ministry of Commerce for purposes of registration:

- certification of incorporation;

- copy of Myanmar Investment Commission (MIC) permit or MIC endorsement (where applicable);

- recommendation letter from the relevant City Development Committee or Township Development Committee in each region or state in which the company proposes to trade;

- list of goods proposed to be traded; and

- detailed business plan (including the initial investment amount, the proposed trading location(s), area of land use and proposed trade volumes).

TAXES

Corporate Tax (Profit Tax)

A company that is incorporated in Myanmar and established under the Myanmar Companies Law and Special Company Act 1950 and businesses that receive approval from Myanmar Investment Commission have their income taxed at a rate of 25%.

Salaries Tax

Myanmar residents are subject to tax on their worldwide income subject only to a few exceptions. Taxable income includes salaries income. Myanmar has a progressive tax rate from 0% – 25% which applies to income received from salary, property, business and others.

Nonresident foreigners are charged tax on their salary income at rates which range from 0% – 25% before any exemptions are applied.

Commercial Tax

Commercial tax is payable on goods that are imported or produced in Myanmar, as well as trading sales and services. The commercial tax levied on the export of electricity is at a rate of 8% and crude oil at a rate of 5%. Commercial tax does not apply to the rest of the sales of exported products.

Specific Goods Tax

The Specific Goods Tax Law replaces commercial tax on a list of specific goods that are imported into Myanmar, manufactured in Myanmar, or exported to a foreign country. The list of specific goods include cigarettes, tobacco leaves, virginia leaves, cheroots, cigars, pipe tobaccos, and betel-chewing tobacco; beers, wine, and alcoholic beverages; wood logs and wood cuttings; vans, saloons, sedans and estate wagons, and coupe cars except double cab 4-door pickups from the range of 1501 cc to 4001 cc and above; and kerosene, petrol, diesel, and aviation jet fuel, as well as natural gas. The specific goods tax rates range from 5% to 60%.

Gems Tax

Under the UTL 2019, with effect from 1 October 2019, gemstones, whether it is rough or cut or jewellery or things made with gemstones, shall be subject to gems tax (as opposed to specific goods tax) in accordance with section 38 of the Myanmar Gemstone Law 2019. The tax rates are range from 5% to 11%.

Stamp Duties

Stamp duty is levied on various types of instruments including but not limited to, the following instruments:

- 2% of the amount or value of the consideration for conveyances of properties, for the sale or transfer of immovable property. Immovable properties located in Nay Pyi Taw, Yangon, and Mandalay are subject to an additional 2% of stamp duty on the consideration equal to the market value of the properties.

- 0.1% of share value on the transfer of shares.

- 0.5% of the amount or value secured on bonds.

- 0.5% of the annual value of rent for immovable properties on lease agreements ranging between one and three years, and 2% of the average annual value of rent where the term of the lease agreement is more than three years. 2% stamp duty will also be applicable on lease premium.

Capital Gains Taxes

- Capital gains tax is levied on gains from the sale, exchange, or transfer of capital assets (i.e. any land, building, vehicle, and any capital assets of an enterprise, which include shares, bonds, and similar instruments).

- Capital gains from the sale, exchange, or transfer of capital assets in the oil and gas sector (companies engaged in upstream oil and gas activities relating to exploration, drilling, and extraction) are taxed at different rates from those in other sectors.

Type of taxpayer |

Tax rate (%) |

Resident companies |

10 |

Non-resident companies |

10 |

Transfer of shares in companies engaged in upstream oil and gas activities relating to exploration, drilling, and extraction or interest in production sharing contracts |

40 to 50 |

- Tax returns for capital gains must be filed within 30 days from the date of disposal of the capital assets. Capital gains tax payments are required to be made within 30 days from the date of disposal of the capital assets. The date of disposal refers to the date of execution of the deed of disposal or the date of delivery of the capital assets, whichever is earlier.

Property

- Generally, foreigners not permitted to own property in Myanmar

- Foreigners may own up to 40% of the total units of a condominium building under the Condominium Law

- MIC must consent to foreigners leasing land

- MIC has the right to require the lease to be terminated in certain circumstances i.e. failure to pay rent or environmental damage

- Foreigners cannot enter into leases for land that are in excess of 50 years. MIC can agree to an extension of the term by two periods of 10 years, i.e. to a total of 70 years.

- Leases of immovable property require registration if they last over one year or have yearly rent

- Leases are not granted for religious land; land restricted for state security; land under litigation; and land restricted by the state

- At present demand for modern commercial and residential property in Yangon is strong whereas supply is limited

- Mortgage market yet to develop

- Yangon’s housing stock comprised primarily of apartments / condominiums

- Design and build quality of many condominiums/apartments remains poor

- Complimentary infrastructure/amenities also remain underdeveloped

- Opportunities exist to develop modern serviced apartments and commercial centers and tourist/hospitality orientated real estate projects

Special Economic Zones Law (SEZs)

The Special Economic Zone Law was enacted in 2014, and its implementing Rules were published in 2015. The law has paved the way for Special Economic Zones (SEZs) in Myanmar.

There are currently three SEZs in development: Kyauk Phyu in Rakhine State, Dawei in the Thanintharyi Region and the Thilawa in Yangon Region. In order to carry out their implementation, the Central Body, Central Working Body and Management Committee was formed under the SEZ Law.

SEZs: Investment opportunities

- Infrastructure development

- Roads construction

- Bridge construction

- Airport construction

- Port construction

- Electricity production

- Telecommunications infrastructure development

- Water supply production

- Environmental conservation

- Waste control systems

- Production based industries

- Goods processing

- Hi-tech goods manufacturing

- Agriculture

- Livestock breeding and fisheries

- Mineral produce

- Forestry produce

- Services based industries

- Trade

- Logistics and transport

- Storage and warehousing

- Hotels and tourism

- Education and health

- Residential facilities

- Infrastructure supply and support centers

- Green spaces

- Recreation centers and resorts

SEZs: Incentives

The Myanmar Special Economic Zones Law (No. 1/2014) was passed in January 2014 and stipulates the following tax incentives for investors in SEZs:

- Income tax exemption for the first seven years from the date commercial operations commence within an exempted zone or an exempted business

- Income tax exemption for the first five years from the date commercial operations commence for businesses located within a promoted zone or a SEZ

- 50% income tax reduction for the second five year period for businesses within an exempted or promoted zone

- 50% income tax reduction for the third five year period on profits derived from the reinvestment of a business that is within an exempted or promoted zone (subject to conditions)

- Import duty exemption on the importation of raw materials, machinery, equipment and other specific goods which are used for prescribed activities in an exempted zone

- Import duty exemption or 50% reduction for up to five years on raw materials, machinery and equipment that is imported by a business located within a promoted zone

- Losses carried forward for five years from the date the loss was incurred

Right to transfer foreign currency

According to Section 56 of the MIL, foreign investors may transfer the following funds abroad relating to the investments made under this Law:

- capital designated under the provisions relating to capital account rules stipulated by the Central Bank of Myanmar;

- proceeds, profits from the asset, dividends, royalties, patent fees, license fees, technical assistance and management fees, shares and other current income resulting from any investment under this Law;

- proceeds from the total or partial sale or liquidation of an investment;

- payments made under a contract, including a loan agreement;

- payments resulting from any settlement of investment disputes;

- other compensation or money as compensation under the investment or expropriation;

- remuneration, salary and earnings of foreign experts legally employed in the Union of Myanmar

Employment Issues

- No consolidated employment law – numerous acts containing provisions relating to employment and workers’ rights

- Minimum wage stipulated by minimum wage committee

- Only Myanmar citizens must be appointed for works which do not require skills

- Skilled citizen and foreign workers, technicians, and staff shall be appointed by signing an employment contract between employer and employee in accordance with the labour laws and rules;

- The entitlements and rights in the labour laws and rules, including minimum wages and salary, leave, holiday, overtime fee, damages, compensation of the workman, social welfare, and other insurance relating to workers in stipulating the rights and duties of employers and employees and occupational terms and conditions should be stipulated in the employment contract

- The disputes arising among employers, among workers, between employers and workers, and technicians or staff shall be settled in accordance with the applicable laws.

Corporate Matters

Directors

- The minimum number of directors of a private company and a public company in Myanmar is one and three respectively.

- The MCL requires a return of particulars of directors, managers and managing agents and any changes of such particulars to be lodged with the DICA no later than 21 days after the relevant appointment or changes

- Directors can be foreign or local

Meetings of Shareholders (General Meetings)

- General meetings of a company are called to present matters for approval by shareholders (by passing shareholder resolutions). Shareholders have a right to receive notices of meetings. At least 21 days’ advance notice must be given for general meetings for private companies and 28 days’ advance notice must be given for general meetings for public companies.

- Company directors have the power to call general meetings. Shareholders who hold at least 10% of the issued shares of the company may also request the directors to call and hold a general meeting.

- There are three types of meetings of shareholders under MCL:

- An annual general meeting (AGM) which must be held 18 months from the date of incorporation and once every calendar year. At the AGM, the usual proceedings include election of directors of the company (by shareholders) and if a company is required to prepare an annual financial report, directors’ report and auditor’s report, they must also be presented to the shareholders at the AGM.

- A special general meeting which is any other meeting of the members of a company (other than an AGM).

- A statutory meeting which only public companies and companies limited by guarantee with share capital are required to call within 6 months and less than 28 days from the date of incorporation.

Accounting Standards

- Accounting standards in Myanmar are set by the Myanmar Accountancy Council which is headed by the Union Auditor General of the Republic of the Union of Myanmar

- On 5 June 2010, Myanmar Financial Reporting Standards were introduced. These are identical to the International Financial Reporting Standards (IFRS) that existed on that date

- Commitment made to formally adopt IFRS standards

- Accounting and audit services can be provided legally by 100% Myanmar owned firms as well as JV companies and foreign companies.

- Fiscal year in Myanmar is 1 April to 31 March

Foreign Participation in Stock Exchange

- Started from 20th March 2020, foreign investors are allowed to participate in Myanmar stock market in line with Notification no. 1/2019 and Instruction no. 1/2020 of the Securities and Exchange Commission in Myanmar (SECM).

- It follows the legislation of Myanmar Companies Law in 2017 and Myanmar Investment Law giving equal investment opportunities for all foreigners except for in some regulated industries.

- Myanmar securities market is still in its initial stage of growth and investment opportunities are expected to grow gradually.

- Foreign investors who need to participate in listed companies must open the following bank accounts for securities trading in Myanmar at one of the banks operating in Myanmar:

- Resident individuals/institutions: Resident Kyat Account for Securities (R-KAS)

- Nonresident individuals/institutions: Nonresident Kyat Account for Securities (N-KAS) and Nonresident Foreign currency Account for Securities (N-FAS)

- Investors who are considering the Myanmar Capital Market can buy securities from –

- the government which is issuing through the Central Bank of Myanmar treasury bonds; and

- public companies where shares can be traded on the YSX if they are publicly listed. 5

Legislation on Intellectual Property Rights

- Although IP Laws such as trademark, copyright, patents and industrial design Laws in Myanmar were drafted in 2014 and have been passed, they laws have yet to be enacted. These laws will come into effect by notification of the president.

- Presently, investors will need to rely on the current laws for protection. For instance, companies may register a trademark by means of Declaration at the Registry Office, which is accepted as evidence of ownership of a mark. Further, the Competition Law 2015 outlaws unfair competition, including disclosure of business secrets, such as protected business information and business procedures without the owner’s consent.6

1 https://www.dica.gov.mm/sites/dica.gov.mm/files/document-files/mir_amendment_english.pdf

2 https://www.dica.gov.mm/sites/dica.gov.mm/files/document-files/edu_noti_7-2018.-e.pdf

3 https://www.dica.gov.mm/sites/dica.gov.mm/files/news-files/pamphlet_-_invest_in_myanmar.pdf

4 https://www.dica.gov.mm/sites/dica.gov.mm/files/news-files/pamphlet_-_invest_in_myanmar.pdf

5 https://secm.gov.mm/en/foreign-investors/

6 https://eurocham-myanmar.org/uploads/686fc-eb95c-business-2019-draft-11-page.pdf