Leading Asia’s Financial Future – Hong Kong Green Investment Bank

The Financial Services Business Council (FSBC) of the European Chamber of Commerce in Hong Kong has issued a position paper, “Leading Asia’s Financial Future – Hong Kong Green Investment Bank”, which advocates establishing a Green Investment Bank to put Hong Kong at the forefront of green finance development in Asia by mobilising private funding of green infrastructure in Asian emerging markets.

The paper, which can be viewed below, was authored by Alexandra Tracy, with contributions from FSBC Chairperson, Julia Charlton, Stratos Pourzitakis and other members of the Green Investment Bank working group.

Financial Services Business Council (FSBC) of the European Chamber of Commerce in Hong Kong

Foreword – Green Finance

The European Chamber of Commerce in Hong Kong and Macao launched its Financial Services Business Council in 2010 to serve as a platform for advocacy and networking and to protect and advance the interests of its members. Members hail from the Banking, Asset Management and Insurance sectors. The Financial Services Business Council engages with market participants, regulatory authorities and other stakeholders on important issues concerning the financial services industry. Over the last 12 months, the Financial Services Business Council has written and published four position papers and has hosted four events and seminars in which Financial Services Business Council members were able to discuss and debate their opinions and ideas. Led by its Chairperson Julia Charlton and Vice-Chair Ching Yng Choi since 2016, the Financial Services Business Council actively promotes bilateral and multilateral trade relations and active engagement between key industry players. Using its unique European perspectives in order to further enable the development of European business activities in Hong Kong and Macau, the main objectives of the Financial Services Business Council include:- Writing position papers and providing additional input to the Office of the European Union to Hong Kong and Macao for the formulation of EU bilateral policies and regulatory dialogue on financial issues with the Hong Kong and Macao respective governments, as well as providing feed-back or propositions to the local authorities.

- Responding to consultation papers issued by the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Stock Exchange (HKEx).

- Developing research work on finance-related issues of concern in Hong Kong and Macao, such as green and environmental friendly finance opportunities.

- Identifying opportunities for emerging markets in the financial industry for Hong Kong and Europe.

- Organising industry events to facilitate the sharing of ideas and insights into the local markets in both Europe and Hong Kong and Macau.

- Providing a networking platform for the business community.

- Providing a channel of communication within European chambers in Hong Kong and economic circles.

- Promoting commercial, industrial, financial, scientific and other economic exchanges between Hong Kong and the European Union.

- Identifying the problems that European companies may encounter in their life cycles within Hong Kong and the Mainland Chinese market.

- Hosting functions that allow members to discuss and network with Hong Kong and European officials.

Executive Summary

To maintain its competitiveness as a global financial centre, Hong Kong must continuously adapt and identify potential for leadership in the emerging sectors of the financial services industry. Green finance is a rapidly advancing sector that capitalises on opportunities created by the increasing convergence of economic and environmental factors driving global growth. The establishment of a Hong Kong Green Investment Bank (GreenBank) would position Hong Kong in the forefront of this increasingly important area of finance in Asia. • Green finance will be a key driver of future competitiveness in the financial markets As low carbon businesses are enjoying rapid expansion globally, financial market competitiveness will be increasingly influenced by levels of expertise in green finance. Major capital markets, notably London, are establishing a strong position in this sector, while green finance is already a key policy focus in several important Asian countries, including China, Japan and Indonesia. Hong Kong has a significant opportunity to build on its existing market strengths to establish a leading position in the central activity underpinning green finance: funding for low carbon and climate friendly infrastructure. Estimated annual spending requirements for green energy, transportation and urban development in Asia run into the trillions of dollars, while investment on the ground falls far short of this. To meet this challenge, a number of governments around the world have created “green investment banks”, including in the UK, Australia and Japan, and several states in the US. These represent a new kind of government financial institution set up specifically to channel private finance into low carbon infrastructure (such as renewable energy, energy efficiency, water and waste management) and climate friendly construction. A green investment bank uses public funding to provide financing tools and market support that encourage commercial and private sector financing for green projects on acceptable terms. • Leadership through GreenBank While other global financial centres may have greater expertise in selected areas of green finance, GreenBank would directly leverage Hong Kong’s strong position in structuring and raising financing for infrastructure in Asia. Through HKEx and its banking, asset management and insurance sectors, Hong Kong has enormous experience and long established regional networks that underlie its clear leadership in this area. • Role of Hong Kong government in GreenBank As a quasi government entity, GreenBank would be backed by the financial resources and robust credit rating of the Hong Kong government, which would initially capitalise the bank. GreenBank would be operated separately from the government and its role would be to use its public funding only to the extent necessary to encourage private finance to participate in the projects it sponsored. Rather than subsidising green infrastructure, GreenBank would structure projects on a commercial basis and seek to create liquid markets that can stand on their own. GreenBank would be expected to break even and over time to return a profit. The use of government funds to move markets is not new in Hong Kong: Hong Kong Mortgage Corporation was set up to perform a similar function, for example. Hong Kong has also committed significant funds to platforms for financing infrastructure overseas, such as the World Bank and AIIB. Similar government involvement in GreenBank would support local projects and lead to direct benefits in Hong Kong itself. • GreenBank provides the vehicle for scaling up investment in low carbon infrastructure Investment in low carbon infrastructure tends to be constrained by concerns about new technology and project risks, and limited expertise of potential providers of finance with analysing and managing these risks, as well as a simple lack of awareness of the potential growth and profitability in these sectors. GreenBank would serve as a centre of expertise in Hong Kong that would help to educate banks and investors about the opportunities in low carbon sectors and increase their capacity to exploit them. GreenBank could directly finance low carbon projects, or provide capital to other financial entities which would then deploy it in projects. It would offer a range of financial mechanisms to reduce the risk of green investments for private investors, such as coinvesting, insurance, loan loss guarantees and provision of subordinated debt or equity funding. GreenBank would provide a central hub for information about green investments and a platform for companies and financial institutions to increase their competencies and develop low carbon business pipelines. It would also provide a centre for collaborating on projects with regional gov- ernments and global public and private financial institutions. • Operating in Hong Kong and across Asia GreenBank would operate both in Hong Kong and across the region. Opportunities to deploy renewable energy technologies locally may be limited, but there is a great deal of scope for improvements to energy efficiency, waste management and pollution control. In addition, GreenBank would also work with local businesses and financial institutions on projects around Asia, including funding for Belt and Road infrastructure, predicted to require US$1.4 trillion of investment over the next five years. • Economic Benefits to Hong Kong GreenBank’s involvement of the private sector in low carbon infrastructure would create a powerful “demonstration effect” – showing the market that these projects are viable. This would help to grow the pool of capital available to green businesses, increasing the number of projects that can be financed. Expanding economic activity generated by GreenBank would create multiple benefits for Hong Kong companies. For the financial services sector, GreenBank would stimulate incremental business, fee income and return on investments, while sending a strong signal to the region about Hong Kong’s ability to drive financial innovation in this area. Through working with GreenBank, local banks could develop new profitable business lines, while equity and bond markets could benefit from new listings of green bonds, asset backed securities or energy yieldcos. GreenBank funded projects and technical support could help to create more business for Hong Kong technology, construction and supply chain companies, generating local jobs and spill over benefits. It could also provide Hong Kong companies with a competitive edge when bidding for projects overseas. • Social and Environmental Impact on Hong Kong GreenBank funded projects in Hong Kong could have a direct impact on Hong Kong’s environment. Projects which improve the energy efficiency of buildings and industrial processes, for example, can achieve meaningful cost savings, which can be passed on to businesses and consumers, as well as having a positive impact on air quality, pollution levels and carbon emissions. Waste management and waste to energy investments could help to tackle Hong Kong’s significant waste problems. The operations of GreenBank would also create a positive reputational impact, confirming Hong Kong’s efforts to support China’s energy transition and positioning Hong Kong’s financial market at the forefront of Asia’s transition to a green economy.A. Rationale – Asia’s Future is Green

1| Asian Economic Growth – Switching to Low Carbon Pathways

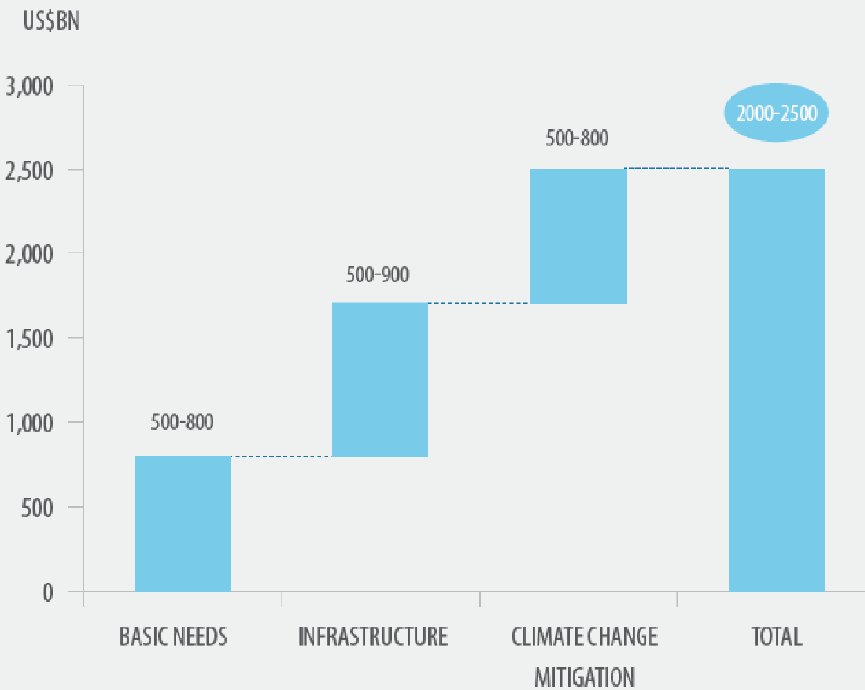

Over the past two decades, Asia has been the fastest developing region in the world. Many countries have achieved spectacular economic growth, which has delivered prosperity to many and led to significant industrial upgrades and rapid urbanisation. However, 1.6 billion people are still living in poverty, with 800 million lacking access to electricity. The region faces a significant challenge to close infrastructure gaps and build cities that offer an improved quality of life. Moreover, as home to over half of the world’s people, but much less than half of its natural resources, sustainable economic prosperity in Asia depends on being able to transition to cleaner and more efficient modes of development. The United Nations (UN) predicts that investment of some US$2.5 trillion a year until 2030 is needed for sustainable development in Asia: to upgrade basic services and infrastructure and to protect the environment, enhance energy efficiency and respond to climate change.1 Source: United Nations Economic and Social Commission for Asia and the Pacific, 2014

Policy makers in Asia increasingly recognise that economic growth strategies that cause large scale environmental damage are unlikely to be viable over the long term. Regulatory and policy trends emphasise improved management of natural resources and heightened enforcement of environmental standards. Many countries are gradually transitioning to “green growth”, by aligning economic strategy to respond to problems such as energy constraints, water availability and climate impacts.

At the same time, Asia is the fastest growing source of new greenhouse gas emissions and will need rapidly to decarbonise energy supplies and infrastructure in order to meet international commitments agreed during the global climate change negotiations.2 Not only must the region shift away from investments in carbon intensive infrastructure and towards greener alternatives, but policy makers are looking to prioritise the construction of long lasting, climate resilient assets. Roads, airports, power plants, water systems and other major installation works will be designed to withstand potential future changes in the weather and natural ecosystem.

• Developing Asia

Currently, developing Asia3 alone invests an estimated US$881 billion annually in infrastructure, but this is inadequate to support future development of emerging markets in the region, according to Asian Development Bank (ADB) forecasts. ADB estimates developing Asia will need to invest closer to US$1.7 billion per year on climate smart infrastructure up until 2030, with total investments of US$14.7 trillion required for power and US$8.4 trillion for transportation.4

“The demand for infrastructure across Asia and the Pacific far outstrips current supply. There is a huge gap still to provide power and roads and railways. All these things are missing.”

Takehiko Nakao, President, Asian Development Bank5

Moreover, increasing the volume of climate smart development is becoming more than a distant aspiration for emerging markets in Asia. Under the 2015 Paris Agreement on climate change, countries have each put forward socalled Nationally Determined Commitments (NDCs) through which they have pledged to reduce carbon emissions by developing low carbon energy and greener infrastructure. With that agreement now in force, the policy focus is shifting to how each country’s NDCs can be turned into clear investment pipelines.

• Significant new market potential

Targeted economic development on this scale creates significant markets for low carbon technologies and generates enormous opportunities for businesses in the region.

Source: United Nations Economic and Social Commission for Asia and the Pacific, 2014

Policy makers in Asia increasingly recognise that economic growth strategies that cause large scale environmental damage are unlikely to be viable over the long term. Regulatory and policy trends emphasise improved management of natural resources and heightened enforcement of environmental standards. Many countries are gradually transitioning to “green growth”, by aligning economic strategy to respond to problems such as energy constraints, water availability and climate impacts.

At the same time, Asia is the fastest growing source of new greenhouse gas emissions and will need rapidly to decarbonise energy supplies and infrastructure in order to meet international commitments agreed during the global climate change negotiations.2 Not only must the region shift away from investments in carbon intensive infrastructure and towards greener alternatives, but policy makers are looking to prioritise the construction of long lasting, climate resilient assets. Roads, airports, power plants, water systems and other major installation works will be designed to withstand potential future changes in the weather and natural ecosystem.

• Developing Asia

Currently, developing Asia3 alone invests an estimated US$881 billion annually in infrastructure, but this is inadequate to support future development of emerging markets in the region, according to Asian Development Bank (ADB) forecasts. ADB estimates developing Asia will need to invest closer to US$1.7 billion per year on climate smart infrastructure up until 2030, with total investments of US$14.7 trillion required for power and US$8.4 trillion for transportation.4

“The demand for infrastructure across Asia and the Pacific far outstrips current supply. There is a huge gap still to provide power and roads and railways. All these things are missing.”

Takehiko Nakao, President, Asian Development Bank5

Moreover, increasing the volume of climate smart development is becoming more than a distant aspiration for emerging markets in Asia. Under the 2015 Paris Agreement on climate change, countries have each put forward socalled Nationally Determined Commitments (NDCs) through which they have pledged to reduce carbon emissions by developing low carbon energy and greener infrastructure. With that agreement now in force, the policy focus is shifting to how each country’s NDCs can be turned into clear investment pipelines.

• Significant new market potential

Targeted economic development on this scale creates significant markets for low carbon technologies and generates enormous opportunities for businesses in the region.

| Cities | By 2030, more than 550 million people are expected to move to cities in Asia, where they will generate more than 85% GDP.6 Opportunities for urban housing, infrastructure and mobility systems could reach US$1.5 trillion in 2030. Investment in affordable housing alone could reach US$505 billion.7 |

| Transport | Electric vehicles are projected to reach 35% of overall car sales in Asia by 2040.8 |

| Energy and materials | By 2030, transitioning to sustainable energy and materials systems could generate business opportunities worth US$1.9 trillion.9 |

| Agriculture and food | Adoption of sustainable business models in agriculture and food produc- tion, distribution and retailing could produce business opportunities worth US$1 trillion in 2030.10 |

2| Green Finance – Strong Global Momentum

The confluence of the environmental and economic drivers underpinning future global growth is transforming energy markets and creating unprecedented demand for clean technologies and low carbon infrastructure. Nevertheless, as stated in the previous section, the funding gap between the estimated annual spending requirements for green energy, transportation and urban development around the world and actual investment on the ground is substantial. Green finance has emerged in recent years to address that funding gap. Green finance includes funding for climate and environmentally sensitive investments, as well as practices that embed sustainability more broadly across the financial services industry. “The financial system should also play an important role in promoting the green transforma- tion of our economies” Governor Zhou Xiaochuan, People’s Bank of China11 There has been considerable momentum behind green finance over the past decade, moving it rapidly from a niche agenda to an increasingly mainstream industry that is influencing financial sector development in many countries. The world’s central banks and regulators are considering sustainability in industry rules, while stronger requirements for disclosure on environmental issues have become the norm. Meanwhile, rapidly expanding appetite among investors for low carbon and green assets creates incentives for the finance industry to develop new products and processes to channel capital into these sectors.- Specialised investment institutions: green development banks, local green banks, green funds

- Policy support: guidelines for green loans, green bonds, green IPOs

- Financial infrastructure: carbon markets, green ratings, green indices, investor networks

- Legal infrastructure: disclosure requirements, mandatory insurance

- Priority allocation of capital to green sectors

- Environmentally responsive capital weighting for banks

- Enhanced reporting requirements

3| Hong Kong Can Be a Leader … Or Be Left Behind

As governments prioritise greener economic growth strategies and low carbon businesses expand rapidly around the world, financial market competitiveness will be increasingly influenced by levels of expertise in green finance. A number of the world’s leading financial centres have identified particular opportunities for leadership in supporting a global transition toward a low carbon economy, and are already taking steps to foster green finance capabilities.- Improving the flow of projects generating green bonds in the UK and pushing for a low carbon infrastructure strategy

- Enhancing transparency and accreditation standards to give market participants greater confidence in green products

- Better informing and incentivising the market to consider green investments

- Low carbon implies “mitigation”, or development of infrastructure that produces lower greenhouse gases than has been typically the case. This could include renewable energy, energy efficiency, green buildings or low carbon transportation.

- Climate resilience implies “adaptation”, and refers to the need to address climate risks and vulnerability to potential weather impacts in the future. Adaptation measures include physical infrastructure and climate proofing for companies, as well as new ways of managing resources such as water.

B. Getting Ahead – with a Green Investment Bank

4| What is a Green Investment Bank ?

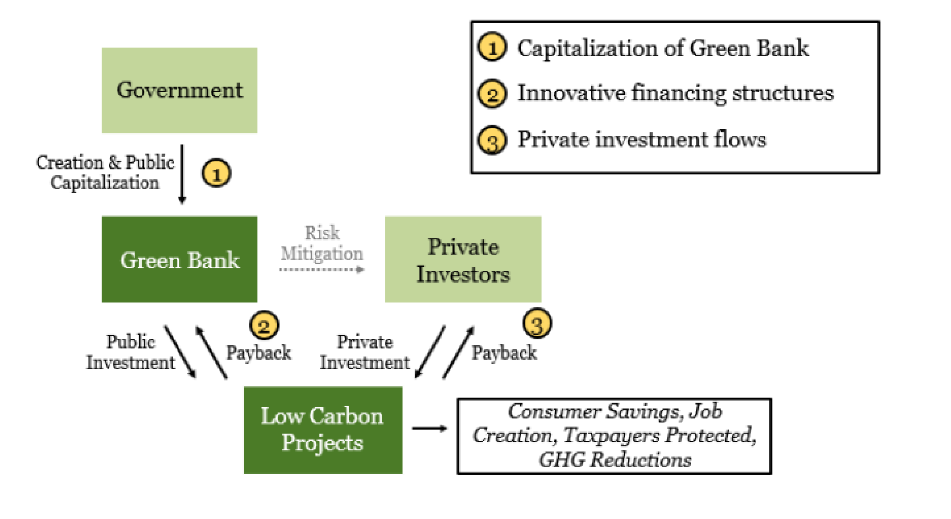

A Green Investment Bank (GIB) is a new type of public financial institution set up specifically to channel finance into LCR infrastructure. Its role is to accelerate the funding of renewable energy, energy efficiency and other green sectors, such as water and waste management or sustainable transportation, in partnership with private investors. A GIB maximises efficient use of public resources to overcome investment barriers and encourage private sector participation in financing for these sectors. Source: The Canadian Coalition for Green Finance,12 Things You Need to Know About Green Investment Banks, 2016

Source: The Canadian Coalition for Green Finance,12 Things You Need to Know About Green Investment Banks, 2016

4.1 Why is a GIB needed?

In most markets, the scale of investment in LCR infrastructure falls far short of the amounts required. Many projects simply do not go ahead because they are unable to raise financing. Typically, financial institutions have had limited appetite for green sectors for a number of reasons: • Lack of awareness and expertise Employees of financial institutions may have no information about the opportunities presented by LCR infrastructure or little experience with these industry sectors or technologies. Professionals do not have the expertise to value an investment or to analyse the risks associated with it. Gaining this expertise (externally or in house) takes time and can be expensive. • Projects are too risky Employees of financial institutions, especially one with a limited track record with low carbon sectors, may consider the risks of LCR infrastructure projects to be unacceptable. Typical considerations may include:- Technology is new or has a limited track record

- Project developer is inexperienced

- Revenues from the project may not flow as predicted

- Uncertainty about energy regulations and related policies

- Country where project is located is considered high risk

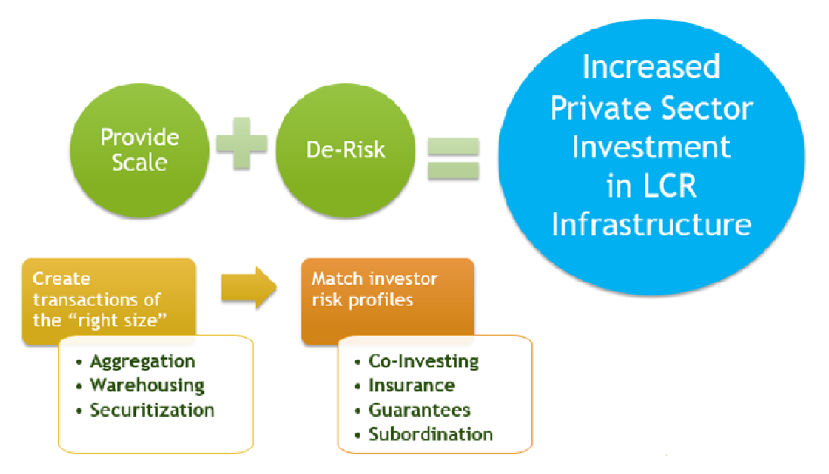

4.2 What does a GIB do?

A GIB is not a “bank” according to the traditional definition, meaning that it does not take deposits, manage savings or provide direct financing to consumers. It is a specialist institution which addresses the specific barriers constraining private investment in LCR infrastructure sectors. Scaling investment quickly in new markets or new technologies requires risk mitigation, project pipeline development and focused technical assistance. A GIB exists to fill gaps along the project origination, execution and finance spectrum. It plays a critical role in making the local financial sector comfortable with green investments, as well as in linking its home market with international capital providers looking to make such investments. • Attracts private funds Public funding alone cannot supply the capital needed to build out green infrastructure and transition to a clean energy economy. A GIB is designed to attract, or “crowd in”, private sector investment into green projects. The GIB provides financing tools and market support that allow for participation by private funders on terms that are acceptable to them.- Information and training A GIB plays a key role as an information hub for the market, increasing understanding of opportunities in LCR infrastructure projects and often providing training and technical assistance to both financial and project development partners.

- Coordination with government GIBs seek to complement existing policies and programmes offered by governments, such as subsidies, tax incentives, rebates or grants. Such support is often scattered across multiple departments and accessing it can be complex. The GIB provides a single point of contact for companies or consumers and help to facilitate easier adoption of green solutions.

- International finance partners GIBs are critical hubs in the global network of financial institutions, both public and private, coordinating with their programmes and investments in LCR infrastructure to design projects and enable private capital to flow at scale.

4.3 How is a GIB organised?

Source: Coalition for Green Capital

The existing GIBs are all different, with varying structures, missions and tools, but they have important characteristics in common:

• Structure

Source: Coalition for Green Capital

The existing GIBs are all different, with varying structures, missions and tools, but they have important characteristics in common:

• Structure

- Specific mandate: GIBs focus on mobilising private capital for LCR infrastructure investments, using financial tools to mitigate risks and enable transactions.

- Public capitalisation: GIBs are typically capitalised with government funds, which may come from tax proceeds, budget allocations or utility surcharges.

- Independent: A GIB is a special purpose public or quasi public entity with independent authority to carry out its mandate. This is essential to allow a GIB to maintain its operating focus, regardless of potential political changes or administrative revisions, and to have flexibility to design and implement investment products dependent on market needs.

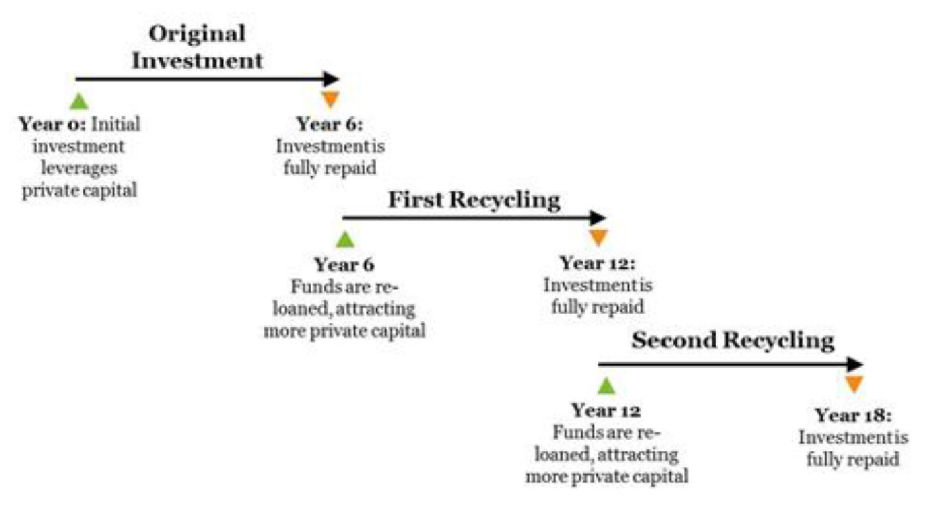

- Cost effective: A GIB uses as little public capital as is necessary to drive private investment, and revolves and recycles its capital to maximise the efficient use of public funding.

Source: Coalition for Green Capital, Growing Clean Energy Markets with Green Bank Financing, 2015

Source: Coalition for Green Capital, Growing Clean Energy Markets with Green Bank Financing, 2015 - Commercial: GIB projects and programmes are generally expected to succeed on commercial (or near commercial) terms. Rather than subsidising green industries, GIBs seek to create markets that can stand on their own.

- Profitable: A GIB should be self sustaining, in order to reduce its dependence on public funding, and is intended to create a return for its sponsoring government and private sector partners.

4.4 Benefits of a GIB

A GIB catalyses market development and investor appetite. Its involvement of the private sector in LCR infrastructure creates a powerful “demonstration effect” – proving to the market that these projects are viable. As private investors become familiar with LCR infrastructure sectors, they become better able to analyse the actual and perceived risks and potential profits associated with such projects. With greater experience, private investors become more confident to participate in these markets – even without GIB support. A GIB’s role is for a limited period to stimulate and develop private markets for LCR infrastructure investment. Once it has helped to create a commercial market for a particular product – so that private sector investment increases, with capital becoming available on reasonable terms – its backing is no longer needed for that product and it can move on to focus its resources on a different activity which still requires public support. “Based on our experience in Connecticut mobilising over $1 billion of investment into the state’s green energy economy, green banks are dynamic market institutions that are flexible, responsive and able to drive positive change over time. The Connecticut Green Bank, with our public and private partners, has been able to be market responsive by applying risk mitigation where it is most needed to scale up markets while being able to move on and be a catalyst in new market challenges as they emerge.” Bryan Garcia, President and CEO, Connecticut Green Bank26 This model of using specialised expertise and selected public financing in order to encourage private sector participation in low carbon projects, thereby generating a new market for funding these sectors, is well established. Many GIBs, as well as multilateral and development banks, have successfully carried out such programmes around the world.4.5 GIBs Around the World

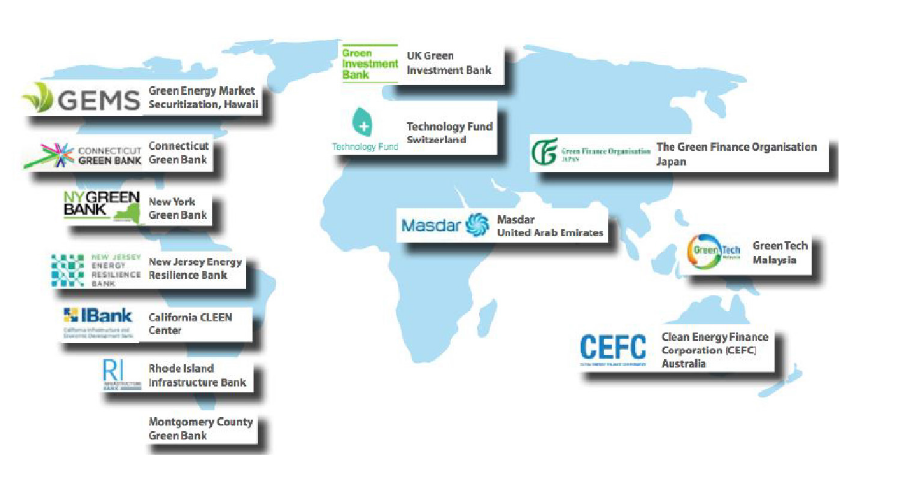

The first GIB to receive government approval was the UK Green Investment Bank (UK GIB) in 2012. There are now 14 GIBs operating at national, state or city level. Most of them are located in developed countries, but policy makers in a number of emerging markets are also considering the creation of similar institutions. Source: The Canadian Coalition for Green Finance,12 Things You Need to Know About Green Investment Banks, 2016

Based on their particular national and local contexts, each government defines its own rationale and targets underlying the operations of its GIB. Whereas all GIBs share the goal of accelerating private financing of LCR infrastructure, they may also have differing local priorities. For example, Switzerland’s Technology Fund focuses on scaling up innovative environmental and low carbon technologies that face a deployment gap, while GIBs in Connecticut and Rhode Island emphasise local job creation and lowering energy costs for businesses and consumers.28

• GIBs in Asia

The two GIBs in Asia serve very different markets. The Green Finance Organisation in Japan is operating in a highly sophisticated and mature economy, whereas the Malaysia Green Tech- nology Corporation (GreenTech Malaysia) seeks to catalyse financing of green energy in a high growth emerging market.

Source: The Canadian Coalition for Green Finance,12 Things You Need to Know About Green Investment Banks, 2016

Based on their particular national and local contexts, each government defines its own rationale and targets underlying the operations of its GIB. Whereas all GIBs share the goal of accelerating private financing of LCR infrastructure, they may also have differing local priorities. For example, Switzerland’s Technology Fund focuses on scaling up innovative environmental and low carbon technologies that face a deployment gap, while GIBs in Connecticut and Rhode Island emphasise local job creation and lowering energy costs for businesses and consumers.28

• GIBs in Asia

The two GIBs in Asia serve very different markets. The Green Finance Organisation in Japan is operating in a highly sophisticated and mature economy, whereas the Malaysia Green Tech- nology Corporation (GreenTech Malaysia) seeks to catalyse financing of green energy in a high growth emerging market.

| Progress Towards GIBs in China | |

| 2015 | China Council for International Cooperation on Environment and Development (CCICED) recommended the creation of a National Green Development Fund, with a capitalisation of approximately US$47 billion to invest in “resource efficiency, renewable energy, industrial pollution control and advanced vehicle technologies”32 |

| 2016 | Ma Jun, PBOC Chief Economist, announced at the OECD Green Investment Financing Forum that 12 of China’s provinces will launch green banks modelled on the UK GIB33 |

| 2017 | PBOC announced green finance pilot zones to be set up in Guangdong, Guizhou, Jiangxi, Zhejiang and Xinjiang34 |

5| GreenBank – A Vehicle That Plays To Hong Kong’s Strengths

Financial services is one of four pillar economic sectors in Hong Kong, generating nearly 20% of gross domestic product (GDP)35and employing over 220,000 people.36The city houses a sophisticated and liquid financial market and the world’s largest offshore renminbi centre. It is a centre of fund raising, insurance, legal and business services for companies operating throughout Asian emerging markets. To maintain its competitive position over the longer term, however, Hong Kong’s financial services companies have to demonstrate innovation and the ability to meet (and to lead) market demand in the emerging sectors of the financial services industry. Scaling up investment in LCR infrastructure is a core part of green finance which offers a valuable opportunity to leverage on Hong Kong’s particular strengths. “Hong Kong possesses the right conditions for developing green finance.” Financial Secretary, Hong Kong, 2017-2018 Budget Speech37 The establishment of GreenBank as a specialised institution for catalysing private funding of LCR infrastructure in Asia would be predicated on the unique combination of attributes Hong Kong enjoys:- Extensive expertise with investment and capital raising for infrastructure

- International reach, including extensive relationships in China and across Asia

- Significant public financial resources

5.1 Extensive expertise with investment and capital raising for infrastructure

Companies in Hong Kong have high levels of expertise both in underwriting, raising and managing capital, and in implementing and operating infrastructure businesses. GreenBank could draw on the skills of local bankers, accountants, lawyers and risk managers with extensive experience in transactions across Asia to develop and execute a strong pipeline of LCR infrastructure financing. Many financial institutions in Hong Kong are also already exploring new opportunities to provide products and services and to invest in green businesses. • Trusted regulatory environment Hong Kong’s status as a leading infrastructure finance centre rests largely on its robust regulatory regime for the banking, securities and futures, insurance and retirement scheme industries, in line with the best global practices and standards. Its emphasis of the rule of law and fair, open and orderly markets maintain Hong Kong’s position as a location of choice for companies and individuals seeking to invest or do business in Asia. The confidence that investors have in the city’s legal and regulatory frameworks also generates a potential competitive advantage for Hong Kong in developing new environmentally focused products and services, such as green ETFs, themed investment funds and green bonds, which raise capital for LCR infrastructure. To be credible, these instruments must be based on transparent and reliable data, which is trusted by buyers (in order to avoid accusations of “greenwashing”). • Leading centre for infrastructure capital and transactions Hong Kong institutions enjoy a strong track record in infrastructure investment and financing with both debt and equity instruments. Whereas “infrastructure” as an asset class has only reached its current prominence relatively recently, Hong Kong’s financial services industry has long been servicing companies developing projects and operating businesses in the region. As interest has grown globally in investment in long term, real assets, new emphasis is being given to financing for infrastructure. This can be seen in Asia in initiatives such as China’s Belt and Road, which aims to accelerate economic development across South East and Central Asia, as well as in the establishment of platforms to facilitate investment in these activities.- Project finance Hong Kong is the market leader in Asia for project finance: the provision of non recourse finance for infrastructure projects, which is a specialised, complex business, requiring a high degree of expertise. Project finance transactions may involve multiple tranches of equity and debt, which could include bonds, leasing and other financial instruments. Risk sharing or credit enhancement, and the involvement of government linked or multilateral financing institutions, often form part of the financing structure. Many of Hong Kong’s international and local banks are thus well positioned to be potential partners for GreenBank, bringing their experience and expertise to project structuring, and working with GreenBank to deploy its capital in an efficient manner. They may also have the ability to introduce potential transactions to GreenBank and to identify additional investors or lenders from their own commercial networks.

- Fixed income The Hong Kong bond market grew in 2016 to HK$74 billion of Hong Kong dollar denominated bonds issued, up 46% on 2015. Although the market is dominated by government and public sector debt issues, there has been growth in the corporate bond sector. Corporate issuers were principally financial institutions which accounted for 47% of corporate issues in 2016, while energy companies and real estate companies accounted for 27% and 13% respectively.39 GreenBank may tap the considerable proficiency with this asset class in Hong Kong’s banks and professional advisory firms to explore opportunities for financing LCR infrastructure with “green bonds” or through asset backed securitisation. Hong Kong saw its first labelled green bond issue in June 2015, when Chinese wind energy firm, Xinjiang Goldwind Science & Technology, raised US$300 million.40

- Hong Kong Stock Exchange Hong Kong was the top IPO fund raising exchange in 2016. Total equity funds raised through 120 IPOs on HKEx amounted to US$25.1 billion, and post IPO fund raising in 2016 comprised approximately US$37 billion.41

- covering the costs of rebuilding to higher environmental standards

- encouraging builders to create more energy efficient structures

- offering consumers replacement appliances that are certified green48

5.2 International reach, including extensive relationships in China and across Asia

GIBs around the world currently focus almost exclusively on projects within their home markets. Their mandate is to scale up deployment of LCR infrastructure locally. By contrast, recognising Hong Kong’s physical size but reflecting its status as a global financial centre, GreenBank’s mandate would include both local and regional elements. Hong Kong’s small land area means that opportunities to deploy renewable energy technologies within the territory are limited, although there is a great deal of scope for improvements to energy efficiency, waste management and pollution control. In addition to financing green initiatives within Hong Kong, therefore, GreenBank would also leverage the considerable experience built up by local development companies and financial institutions of doing business in diverse countries around Asia, and work with them to identify suitable opportunities for coinvestment across the region. “.. satisfying local demand while looking ahead to up our game as an international financial centre” Peter Tam, Chief Executive Officer, Hong Kong Federation of Insurers49 Financial institutions in Hong Kong have extensive knowledge of Asian markets, risk levels and local policy regimes. They often have relationships with local infrastructure developers and government bodies are able to source project deals in many markets. They also have close contact with other public and private financing specialists in the region and long histories of doing business together in many cases. Hong Kong’s links with China, in particular, and its participation as a partner in some of China’s regional development aspirations, may create sizable deal pipelines for GreenBank and generate opportunities to design innovative financing structures for projects that catalyse substantial international capital investment flows. • Belt and Road initiative China’s Belt and Road initiative covers more than 60 countries with a population of 4.5 billion, accounting for about 60% of the world’s population. However, the combined GDP of these countries, amounting to US$23 trillion, accounts for around 30% of the world’s total GDP50. Infrastructure in many emerging economies in the Belt and Road region is lacking, severely constraining their economic and social development. This creates enormous potential for infrastructure development in these countries, which is the focus of Belt and Road strategy. The Research Institute of Finance, part of the Development Research Centre of China’s State Council, estimates infrastructure financing needs of Belt and Road countries (excluding China) at US$1.4 trillion between 2016 and 2020. China is currently playing the leading role in committing funding to Belt and Road development – at the recent Belt and Road Forum in Beijing, the government allocated an additional US$14.5 billion to the $40 billion Silk Road Fund, and instructed Chinese financial institutions to provide approximately U$100 billion of funding to Belt and Road projects.51 The Hong Kong government has also stated its commitment to support Belt and Road development, through its involvement in the Asia Infrastructure Investment Bank and elsewhere, which has the potential to create huge opportunities for local companies, both in financing and in sustainable construction and green supply chain businesses.5.3 Significant public financial resources

It is the capacity to utilise public funding to catalyse investment in low carbon and carbon resilient investment through partnership with the private sector that would transform GreenBank from another “talking shop” into a powerful economic tool. The Hong Kong government has considerable financial assets and a favourable credit rating. The government’s financial resources underpin the viability of GreenBank, as the initial capitalisation of the entity would be made out of public funds. • Government funds Hong Kong’s latest budget forecasts total fiscal reserves will reach HK$952 billion (US$123 billion) by the end of March 2018. Taking into account additional government resources, but excluding reserves held separately by the HKMA, this figure is estimated at closer to HK$1.8 trillion.53 This means in practical terms that the Hong Kong government has enough money on hand to cover all its spending for two and half years, which has led to calls for the government to spend some of these funds on projects to benefit the territory and its people. There would be a strong argument for using an allocation from the reserves to capitalise GreenBank, which would be a domestic financial institution directly generating incremental returns for Hong Kong’s economy as well as broader benefits to Hong Kong society. The use of government funds to move markets is not new in Hong Kong. For example, the Hong Kong Mortgage Corporation (HKMC), a company wholly owned by the government through the Exchange Fund, was established in 1997 in order to develop Hong Kong’s secondary mortgage market. HKMC purchases portfolios of mortgages and loans and provides mortgage credit enhancement to local banks.54 In addition, the Hong Kong government has already committed considerable amounts of public funds to external financial institutions for investment in development around the world:- As of December 2016, Hong Kong had contributed US$777 million in capital for its membership of the ADB. It has also committed to US$115 million to ADB special funds.55

- In May 2017, the Finance Committee of the Legislative Council approved Hong Kong government funding for its membership of the AIIB of approximately HK$1.2 billion (US$154 million).56

- In September 2017, HKMA announced a US$1 billion commitment to the Managed Colending Portfolio Programme operated by the International Finance Corporation (IFC), which is part of the World Bank.57

6| Multiple Benefits – Across Hong Kong’s Economy and Society

The establishment of GreenBank would act as a catalyst for the development of a strong green finance industry in Hong Kong. The operations of GreenBank would create a positive demonstration effect of the potential for low carbon and climate resilient projects and the feasibility of financing them on acceptable terms. Crowding in of private sector funders grows the pool of capital available to green businesses and increases the number of projects that can be financed. The resulting acceleration of investment in LCR infrastructure and green businesses could generate multiple benefits for Hong Kong’s economy and wider society, creating significant positive impact – financially, socially and environmentally.6.1 Economic benefits

Increased economic activity by Hong Kong companies would generate additional revenues, profits and returns to investors, in addition to potential multiplier effects on the wider economy created by additional spending and employment. The most immediate impact is likely to be on the financial services industry in Hong Kong. • Financial services industry For the financial services industry, GreenBank would represent the commitment of the public and private sectors to working together on the development of a green finance industry in Hong Kong. The creation of GreenBank would also send a powerful signal to the region that Hong Kong’s financial services industry is evolving. As China’s financial markets open up, Hong Kong would seek to maintain its status as an offshore renminbi centre, but must also increase its focus on promoting innovation and harnessing opportunities in other major growth sectors. In addition to creating a powerful reputational impact for the market as a whole, GreenBank could bring practical benefits to Hong Kong financial services businesses:- Through working with GreenBank, Hong Kong firms would earn additional revenues (returns on investment and lending, fee income etc.) and would gain skills and experience in new areas. Additional business would generate the need for new headcount, including in middle and back office activities.

- As local banks, in particular, become more comfortable with LCR infrastructure projects, and as the costs of these transactions fall, they would be able to develop their own pipelines of customers and generate profitable business The potential to securitise loans through GreenBank would give Hong Kong banks the ability to recycle capital and expand their loan coverage in these sectors.

- Much of GreenBank’s activity is likely to involve fixed income transactions, which could assist in developing the maturity of the local bond market. Issuance of infrastructure related bonds with longer tenors would contribute to building out the yield curve in Hong Kong. This would support the Hong Kong government’s stated objective “to increase the breadth and depth of the local bond market”.60

London Stock Exchange – Green Bond Listings As of April 2017, there are 42 green bonds listed on the London Stock Exchange that have raised around US$11.2 billion in seven different currencies. Issuers include Agricultural Bank of China, Bank of China, NTPC Limited (India’s largest energy conglomerate) and National Bank of Abu Dhabi.61Institutional investors, such as pension funds and insurance companies, are increasingly seeking to invest in low risk, long term assets. A strong pipeline of long dated instruments related to GreenBank transactions could expand the number and broaden the profile of institutional investors active in the local market.

- GreenBank’s focus on risk allocation and credit enhancement may provide impetus to the insurance and reinsurance sectors, which are also looking to create new products and services to meet the demands of investors and companies facing technology and environmental risks. Financing of LCR infrastructure is also likely to generate significant opportunities, including public private insurance partnership structures.

- The evidence of greater expertise in funding LCR infrastructure, and of green finance more generally, in Hong Kong could encourage companies in these sectors to consider primary or secondary listings on HKEx. For example, Hong Kong could become an attractive venue for listing Asian renewable energy yieldcos (listed vehicles supported by a portfolio of operating assets). In addition to IPO revenues, listing of a company in Hong Kong creates potential for further cash flows from trading and follow on capital raising activity.

Yieldcos Like Real Estate Investment Trusts, yieldcos are pass through stock entities designed to allow for generous generate attractive dividend yields. Yieldcos first emerged in 2013, when the largest American independent power producer, NRG Energy, launched NRG Yield to hold operating wind and solar farms that it had built or acquired. Revenues from those assets funded dividends for investors in the yieldco. Since then, yieldcos in the United States (US) and Europe have raised around US$10 billion in public equity.62

- The operations of GreenBank, and heightened engagement of financial institutions with it, may encourage growth in related products and services across the local capital markets. Greater awareness of the risks and opportunities of low carbon sectors may increase demand for green investment products in Hong Kong, for example, which would create incremental fee income for fund managers and may encourage the establishment of new investment funds.

- GreenBank funded projects taking place in Hong Kong would create jobs for local technology and construction companies, subcontractors and supply chain businesses.

- The provision of technical information and training by GreenBank to local construction firms and contractors, especially small and medium sized companies (SMEs) with limited internal resources, would raise awareness of opportunities in green sectors and enable them to enter new business lines.

- Hong Kong based developers, infrastructure companies and suppliers are also likely to participate in GreenBank funded projects across the region. The availability of funding on reasonable terms could provide Hong Kong companies with a competitive edge when bidding for projects overseas.

- The presence of GreenBank may encourage green technology firms to be located in Hong Kong. Growing familiarity with green finance may enable them more easily to raise debt or equity capital to fund future growth.

- GreenBank coordination with other government programmes and incentives, such as the Building Energy Efficiency Funding Scheme and the Pilot Green Transport Fund, as well as incentives for research and development (R&D), may help to channel public funding more efficiently to companies carrying out green projects.

6.2 Social and environmental impacts

The growth of LCR infrastructure and green businesses in Hong Kong and the region may help to generate a range of societal benefits. These include potentially lower energy costs in some markets, as well as a positive impact on pollution levels and carbon emissions. • Reduced energy costs- Costs of some renewable energy technology, such as solar photovoltaics, are equal to or cheaper than grid electricity in many markets. The cost of funding is a significant driver of the price of renewable electricity, so by providing affordable financing for the installation of this technology, GreenBank could help to lower electricity prices for businesses and consumers.

- Considerable cost savings can be achieved by improving the energy efficiency of buildings and industrial processes. Upfront costs of installing the technology are typically outweighed by the energy cost savings in a few years. By making financing available for the necessary energy audit and technology installation, GreenBank could again help to lower electricity prices for businesses and consumers.

- GreenBank financing for advanced waste to energy plants in Hong Kong could help to tackle the city’s current waste management challenge. Hong Kong’s three landfills are expected to reach full capacity in two years.

- GreenBank may play a role in financing development of climate resilient construction or upgrading public infrastructure in Hong Kong, which is vulnerable to the impacts of violent weather events, such as high winds, flooding and storm surge. Improvements to public infrastructure, such as roads, railways, ports and Hong Kong International Airport could increase Hong Kong’s ability to withstand climate impacts and minimise consequent disruption and financial loss.

Typhoon Hato A category 10 tropical storm which hit Hong Kong in August 2017, Typhoon Hato caused mass business closures, flight cancellations, widespread flooding and the suspension of public transport. Economic loss to the city has been estimated at up to HK$8 billion (US$1 billion).65 In neighbouring Macau, Hato left 10 people dead, over 150 injured and knocked out over half of water and electricity supplies. Two days of lost business for its powerful casino industry alone may have cost nearly US$160 million.66

- Deployment of renewable energy or energy efficiency technology in Hong Kong would have a positive impact on air pollution levels in the city. Hong Kong’s power plants currently run almost entirely on fossil fuels, with coal supplying 52% of the city’s energy.67 Deployment of such technology throughout China’s Greater Bay Area would also make a major contribution to improving Hong Kong’s air quality. The Environmental Protection Department estimates that 60-70% of particulate matter affecting Hong Kong comes from China.68

- Deployment of renewable energy and energy efficiency technology locally would reduce Hong Kong’s carbon emissions. The major source of carbon emissions currently is the building sector, which accounts for about 90% of the city’s electricity usage and 60% of total emissions.69 There is substantial potential for energy savings by retrofitting existing buildings.

- There would be a reputational benefit for Hong Kong in being seen to be playing a role in supporting China’s obligations under the Paris Agreement. Although Hong Kong, as a Special Administrative Region, is not a party to the agreement, it has undertaken to review its own climate change efforts every five years and commit to more ambitious climate reduction targets over time.

China’s NDCs China’s national commitments under the Paris Agreement70, which it aims to achieve by 2030, include:

- Ensure that carbon dioxide emissions peak and start to fall (and make best efforts to peak early)

- Lower carbon dioxide emissions per unit of GDP by 60-65% from the 2005 level

- Defend against climate risks in key sectors such as agriculture, forestry and water resources, as well as in cities and coastal areas

Endnotes

1 United Nations Economic and Social Commission for Asia and the Pacific, “Asia Pacific: Landscape & State of Sustainable Financing,” Presentation by Dr. Shamshad Akhtar, Under-Secretary-General of the United Nations & Executive Secretary of the Economic and Social Commission for Asia and the Pacific, Indonesia: Jakarta, June 10, 2014. 2 The Paris Agreement on climate change agreed at COP 21 in December 2015 obligates countries to take steps to reduce carbon emissions to the degree necessary to limit future warming to 2°C. 3 Estimates based on 25 developing country members of ADB for which adequate data is available. 4 Asian Development Bank, “Meeting Asia’s Infrastructure Needs,” Manila: Asian Development Bank, 2017, 1-106. 5 Speaking upon the launch of Asian Development Bank, “Meeting Asia’s Infrastructure Needs,” in February 2017. 6 Fraser Thompson et al., “No Ordinary Disruption: The Forces Reshaping Asia,” Special report for The Singapore Summit, Singapore: McKinsey Global Institute, September 2015, 1-18. 7 Jonathan Woetzel et al., “A blueprint for addressing the global affordable housing challenge,” McKinsey Global Institute, October 2014, 1-21. 8 Sophie Vorrath, “Electric vehicle boom driving EVs to 35% new car sales in Asia by 2040,” ReNew Economy, July 5, 2016, accessed September 20, 2017, http://reneweconomy.com.au/electric-vehicle-boom-driving-evs-35-new-car-sales-asia-2040. 9 Business and Sustainable Development Commission, “Better Business Better World: Sustainable Development Opportunities in Asia,” London: Business and Sustainable Development Commission, June 2017, 1-79. 10 ibid 11 Paulson Institute, “Green Finance – A Growing Imperative,” Washington DC.: Paulson Institute, March 6, 2016, accessed September 5, 2017, http://www.paulsoninstitute.org/wp-content/uploads/2016/05/Green_Finance_A_Growing_Imperative.pdf. 12 Novethic, “The European green funds market,” Novethic Research Centre, March 2017, accessed September 10, 2017, http://www.novethic.com/fileadmin/user_upload/tx_ausynovethicetudes/pdf_syntheses/Green-funds-study-Novethic-Ademe-2017.pdf. 13 Climate Bonds Initiative, “Explosive growth in green bonds market,” accessed September 12, 2017, https://web.archive.org/web/20170606204222/https://www.climatebonds.net/market/history. 14 Climate Bonds Initiative, “Bonds and Climate Change: State of the Market 2017,” September 2017, accessed September 30, 2017, https://www.climatebonds.net/files/files/CBI-SotM_2017-Bonds&ClimateChange.pdf. 15 “G20 Leaders’ Communique,” Hangzhou: Hangzhou Summit, September 4-5, 2016, 1-9. 16 United Nations Environment Programme, “Green Finance Progress Report,” United Nations Environment Programme, July 2017, accessed September 15, 2017, http://unepinquiry.org/wp-content/uploads/2017/07/Green_Finance_Progress_Report_2017.pdf. 17 The Stock Exchange of Hong Kong News Release, “Exchange to Strengthen ESG Guide in its Listing Rules,” December 21, 2015, accessed September 13, 2017, https://www.hkex.com.hk/eng/newsconsul/hkexnews/2015/151221news.htm. 18 United Nations Environment Programme Inquiry (UNEP Inquiry) and People’s Bank of China (PBC), “Establishing China’s Green Financial System,” Report of the Green Financial Task Force, April 2015. 19 Otoritas Jasa Keuangan (OJK), “Roadmap Keuangan Berkelanjutan di Indonesia. Roadmap for Sustainable Finance in Indonesia,” December 2014, accessed September 15, 2017, https://www.banktrack.org/download/roadmap_ojk_2015_2019_pdf/roadmap_ojk_2015-2019.pdf. 20 Otoritas Jasa Keuangan (OJK), “Directing financial Services Industry to Support Sustainable Development Goals (SDGS) Program,” Press Release NO. SP+94/DKNS/OJK/11/2015, Jakarta: Speech of Chairman of OJK Board of Commissioners Muliaman D. Hadad, November 23, 2015. 21 City of London, “City launches initiative to make London the world leader in Green Finance,” January 14, 2016, accessed September 14, 2017, http://news.cityoflondon.gov.uk/city-launches-initiative-to-make-london-the–world-leader-in-green-finance/. 22 Paulson Institute, “Paulson Institute Partners With PBOC on Green Finance Initiative,” Beijing, July 14, 2015, accessed September 15, 2017, http://www.paulsoninstitute.org/events/2015/07/14/paulson-institute-partners-with-pboc-on-green-finance-initiative. 23 Andrea Colnes et al., “National Green Banks in Developing Countries: Scaling Up Private Finance to Achieve Paris Climate Goals,” Washington DC: Coalition for Green Capital, July 2017, 1-55. 24 OECD, “Green Investment Banks: Scaling Up Private Investment in Low-Carbon, Climate-Resilient Infrastructure,” Green Finance and Investment, Paris: OECD Publishing, May 31, 2016, 1-117. 25 Melina Heinrich, “Demonstrating Additionality in Private Sector Development Initiatives: A Practical Exploration of Good Practice for Challenge Funds and other Cost-Sharing Mechanisms,” Cambridge: The Donor Committee for Enterprise Development (DCED), April 2014, 1-34. 26 Andrea Colnes et al., “National Green Banks in Developing Countries: Scaling Up Private Finance to Achieve Paris Climate Goals,” Washington DC: Coalition for Green Capital, July 2017, 1-55. 27 Horizon International Solutions Site, “UNEP’s India Solar Loan Programme Wins Energy Globe,” April 13, 2007, accessed September 15, 2017, http://www.solutions-site.org/node/258. 28 OECD, “Green Investment Banks: Innovative Public Financial Institutions Scaling up Private, Low-carbon Investment,” Paris: OECD Environment Policy Paper No. 6, January 2017, 1-15. 29 Green Bank Network, “Green Finance Organisation (Japan),” August 16, 2017, accessed September 16, 2017, http://greenbanknetwork.org/green-finance-organisation-japan/. 30 OECD, “Green Investment Banks: Innovative Public Financial Institutions Scaling up Private, Low-carbon Investment,” Paris: OECD Environment Policy Paper No. 6, January 2017, 1-15. 31 Anjali Jaiswal et al.,“Greening India’s Financial Market: Opportunities for a Green Bank in India,” National Resources Defense Council and Council on Energy Environment and Water, August 2016, accessed September 16, 2017, https://www.nrdc.org/sites/default/files/india-financial-market-opportunities-green-bank-report.pdf. 32 China Council for International Cooperation on Environment and Development, “Green Finance Reform and Green Transformation,” Report to the Annual Conference of CCICED, November, 9-11, 2015, accessed September 17, 2017, http://www.cciced.net/cciceden/POLICY/rr/prr/2015/201511/P020160810466261886257.pdf. 33 New York Green Bank, “Green Bank Network Announces US$ 22 Billion Milestone at OECD’s Green Investment Financing Forum,” October 27, 2016, accessed September 16, 2017, https://greenbank.ny.gov/News/In-The-News/2016-10-27-Green-Bank-Network-Announces-Milestone-at-OECD-Green-Investment-Financing-Forum. 34 Reuters, “China launches five ‘green finance’ pilot zones,” Reuters, June 27, 2017, accessed September 17, 2017, http://www.reuters.com/article/us-china-environment-finance-idUSKBN19I060?il=0. 35 Hong Kong Trade Development Council Research (HKTDC), “Economic and Trade Information on Hong Kong,” September 29, 2017, accessed September 30, 2017, http://hong-kong-economy-research.hktdc.com/business-news/article/Market-Environment/Economic-and-Trade-Information-on-Hong-Kong/etihk/en/1/1X000000/1X09OVUL.htm. 36 The Government of the Hong Kong Special Administrative Region, Census and Statistics Department, “Hong Kong Monthly Digest of Statistics,” Hong Kong, September 2017. 37 The Government of the Hong Kong Administrative Region, “The 2017-2018 Budget: Budget Speech,” February 22, 2017, accessed September 17, 2017, https://www.budget.gov.hk/2017/eng/budget13.html. 38 Hong Kong Monetary Authority, Infrastructure Financing Facilitation Office (IFFO), accessed September 18, 2017, https://www.iffo.org.hk. 39 Henrik Raber, “Hong Kong’s 2017 bond issuances may extend last year’s bull run,” South China Morning Post, January 20, 2017, accessed September 17, 2017 http://www.scmp.com/business/banking-finance/article/2064044/hong-kongs-2017-bond-issuances-may-extend-last-years-bull. 40 Sean Kidney, “Wkly blog: First green bond from Chinese issuer Goldwind ($300m, 3yr) + more green bonds from Gothenburg SEK1bn ($126.6m), KfW £500m ($780m) & Terraform ($300m) + exciting unlabelled climateproject bond: Peruvian Metro Line ($1.15bn, 19.1yrs),” Climate Bonds Initiative, August 3, 2015, accessed September 18, 2017, https://www.climatebonds.net/2015/08/wkly-blog-first-green-bond-chinese-issuer-goldwind-300m-3yr-more-green-bonds-gothenburg. 41 The Stock Exchange of Hong Kong, “Market Statistics 2016,” accessed September 18, 2017, http://www.hkex.com.hk/eng/newsconsul/hkexnews/2017/Documents/1701092news.pdf. 42 https://www.hkex.com.hk, accessed October 1, 2017 43 Christina Choi, “The way forward for Hong Kong as an asset management centre,” Thought Leadership, February 2017, accessed September 18, 2017, http://app1.hkicpa.org.hk/APLUS/2017/02/pdf/17_Thought_Leadership.pdf. 44 Impax Asset Management Group, accessed September 18, 2017, https://www.impaxam.com. 45 Kenix Lee, “Insurance Industry in Hong Kong,” Hong Kong Trade Development Council, January 19, 2017, accessed September 18, 2017, http://hkmb.hktdc.com/en/1X003UWM/hktdc-research/Insurance-Industry-in-Hong-Kong. 46 The Government of the Hong Kong Special Administrative Region, Census and Statistics Department, “Hong Kong Monthly Digest of Statistics,” Hong Kong, September 2017. 47 Kenix Lee, “Insurance Industry in Hong Kong,” Hong Kong Trade Development Council, January 19, 2017, accessed September 18, 2017, http://hkmb.hktdc.com/en/1X003UWM/hktdc-research/Insurance-Industry-in-Hong-Kong. 48 Annika Schünemann, “Reinstating Buildings to Green Specifications: Allianz and HSBC Insurance Partner on Green Reinstatement,” Allianz, accessed September 18, 2017, http://www.agcs.allianz.com/insights/expert-risk-articles/reinstating-buildings-to-green-specifications/#. 49 James Johnston, “Diversity and Transparency: Addressing Hong Kong bond market’s Achilles heel,” Harbour Times, June 13, 2017, accessed September 18, 2017, http://harbourtimes.com/2017/06/13/diversity-and-transparency-addressing-hong-kong-bond-markets-achilles-heel. 50 Hong Kong Monetary Authority, “Infrastructure Financing: Belt and Road Strategy and Hong Kong’s Role”, April 2016, accessed 1st October, 2017, http://www.hkma.gov.hk/eng/key-information/insight/20160407.shtml 51 Shouqing Zhu, “4 Ways China’s Belt and Road Initiative Could Support Sustainable Infrastructure,” World Resources Institute, May 22, 2017, accessed September 19, 2017, http://www.wri.org/blog/2017/05/4-ways-china%E2%80%99s-belt-and-road-initiative-could-support-sustainable-infrastructure. 52 Asian Infrastructure Investment Bank, accessed September 20, 2017, https://www.aiib.org. 53 Francis Moriarty, “Hong Kong’s nearly HK$2tr fiscal reserves should be spent, to benefit the people who own them,” South China Morning Post, April 8, 2017, accessed September 19, 2017, http://www.scmp.com/business/global-economy/article/2085785/hong-kongs-nearly-hk2tr-fiscal-reserves-should-be-spent. 54 Hong Kong Monetary Authority, “The Hong Kong Mortgage Corporation Limited,” August 1, 2011, accessed September 20, 2017, http://www.hkma.gov.hk/eng/about-the-hkma/hkma/hkma-related-organisations/hong-kong-mortgage-corporation-limited.shtml. 55 Asian Development Bank, “Asian Development Bank and Hong Kong, China: Fact Sheet,” April 2017, accessed September 19, 2017, https://www.adb.org/publications/hong-kong-china-fact-sheet. 56 The Government of the Hong Kong Special Administrative Region, “Hong Kong becomes new member of Asian Infrastructure Investment Bank,” Press Releases, June 13, 2017, accessed September 20, 2017, http://www.info.gov.hk/gia/general/201706/13/P2017061300528.htm. 57 Hong Kong Monetary Authority, “The HKMA Commits US$1 Billion to IFC’s MCPP for Investing Across Sectors in Emerging Markets,” Press Releases, September 20, 2017, accessed September 21, 2017, http://www.hkma.gov.hk/eng/key-information/press-releases/2017/20170920-3.shtml. 58 Hong Kong’s local and foreign currency issuer ratings have recently been downgraded, due to a similar downgrade of China’s rating. 59 KFW Group, “KFW at a Glance: Facts and Figures,” Frankfurt: Kreditanstalt für Wiederaufbau, March 2017, accessed September 20, 2017, https://www.kfw.de/PDF/Download-Center/Konzernthemen/KfW-im-%C3%9Cberblick/KfW-an-overview.pdf. 60 The Government of the Hong Kong Special Administrative Region, Government Bond Programme, “Introduction,” accessed September 20, 2017, http://www.hkgb.gov.hk/en/overview/introduction.html. 61 London Stock Exchange Group, “Green Bonds,” Factsheet, April 2017, accessed September 21, 2017, https://www.lseg.com/sites/default/files/content/documents/20170403%20Green%20Bonds. pdf. 62 Brian Eckhouse, “Wall Street Sours on $9 Billion Mechanism for Green Projects,” Bloomberg, July 10, 2017, accessed September 21, 2017, https://www.bloomberg.com/news/articles/2017-07-10/wall-street-sours-on-9-billion-mechanism-for-green-projects. 63 OECD, “Green Investment Banks: Innovative Public Financial Institutions Scaling up Private, Low-carbon Investment,” Paris: OECD Environment Policy Paper No. 6, January 2017, 1-15. 64 New York Green Bank, “Green Bank Network Announces US$ 22 Billion Milestone at OECD’s GreenInvestment Financing Forum,” October 27, 2016, accessed September 16, 2017, https://greenbank.ny.gov/News/In-The-News/2016-10-27-Green-Bank-Network-Announces-Milestone-at-OECD-Green-Investment-Financing-Forum. 65 Su-San Sith, “Typhoon Hato could cost Hong Kong $1bn,” Supply Management, August 24, 2017, accessed September 22, 2017, https://www.cips.org/supply-management/news/2017/august/typhoon-hato-may-cost-hk-economy-8bn-in-losses. 66 Alex Frew McMillan, “Hong Kong and Macau Count the Cost of Typhoon Hato,” The Street, August 24, 2017, accessed September 22, 2017, http://realmoney.thestreet.com/articles/08/24/2017/hong-kong-and-macau-count-cost-typhoon-hato. 67 The Government of the Hong Kong Administrative Region, Environment Bureau, “Policy Responsibilities: Energy Supplies.” February 25, 2017, accessed September 22, 2017, http://www.enb.gov.hk/en/about_us/policy_responsibilities/energy.html. 68 Alexis Lau et al., “Integrated Data Analysis and Characterization of Particulate Matter in Hong Kong,” Final Report AS09-056, The Government of the Hong Kong Administrative Region, Environmental Protection Department, February 2012, 1-93. 69 The Government of the Hong Kong Administrative Region, Environment Bureau, “Energy and Carbon Efficiency in Buildings and Infrastructure,” accessed September 22, 2017, https://www.climateready.gov.hk/files/report/en/5.pdf. 70 Climate Action Tracker, “China,” September 18, 2017, accessed September 22, 2017, http://climateactiontracker.org/countries/china.html.