Hong Kong Monetary Authority and Bank of Thailand Report on a joint Central Bank Digital Currency research project

The Hong Kong Monetary Authority (HKMA) and the Bank of Thailand published a Report on a joint Central Bank Digital Currency (CBDC) research project, Project Inthanon-LionRock, on 22 January 2020. The project studied the use of central bank digital currency in cross-border payments and developed a Thai baht-Hong Kong dollar cross-border corridor network prototype to allow participating banks in Hong Kong and Thailand to transfer funds and conduct foreign exchange transactions on a peer-to-peer basis, which assists in reducing settlement layers. The successful completion of the study has confirmed the technical feasibility of implementing practical solutions to address key pain points in cross-border payments.

CBDCs have been under discussion in a number of jurisdictions, with China’s digital renminbi likely to be first off the starting block. The People’s Bank of China has reportedly filed 84 patents relating to the issue and supply of digital renminbi, an interbank settlement system for the CBDC and the integration of digital currency wallets with retail bank accounts.[1] However, as noted in the Bank for International Settlements January 2020 report,[2] while some 80% of the central banks surveyed are engaged in CBDC-related work, only 10% of these have developed pilot projects and all of these are central banks of emerging market economies (using the IMF World Economic Outlook’s country classification). CBDCs fall into two broad categories: wholesale CBDC – a restricted access token used for wholesale settlements (such as interbank payments) – and general use CBDC which would be available to the public and could be used in retail transactions among others. While China’s planned digital renminbi would be a general use CBDC, the Hong Kong and Thai CBDCs looked at by Project Inthanon-LionRock would be wholesale CBDC used only to settle cross-border payments.

Hong Kong-Thailand Memorandum of Understanding

Project Inthanon-LionRock was a follow-up to the Memorandum of Understanding signed between the HKMA and the Bank of Thailand in May 2019, which was aimed at fostering collaboration between Hong Kong and Thailand in developing financial innovation, fintech and cross-border payment. Under the Hong Kong-Thailand Memorandum of Understanding, HKMA and the Bank of Thailand are collaborating on the referral of innovative business, information and experience sharing, and joint innovation projects. Project Inthanon-LionRock is a product of the collaboration between the two regulatory authorities, which applies the knowledge and experience gained from their respective CBDC research studies, HKMA’s Project LionRock and the Bank of Thailand’s Project Inthanon.

Project LionRock and Hong Kong Monetary Authority Research on Central Bank Digital Currency

The HKMA has been researching Central Bank Digital Currency since 2017 to gain a better understanding of the potential benefits and risks of HKMA launching its own Central Bank Digital Currency. HKMA conducted Project LionRock in collaboration with Hong Kong’s three note-issuing banks, the Hong Kong Interbank Clearing Limited and an enterprise blockchain technology company. The project evaluated the technical viability of issuing Central Bank Digital Currency, including the use of the Central Money Markets Unit for delivery-versus-payment of tokenised debt securities. Project LionRock included a proof-of-concept study on token-based CBDC and debt securities issued into a single distributed ledger technology.

Given that Hong Kong already has an efficient and trusted retail payment system, which includes a variety of retail payment services such as credit card, debit card and some leading tech companies’ newly developed digital wallets, the scope for issuing a Central Bank Digital Currency for retail purposes (i.e. to replace the use of banknotes and coins in retail transactions) is apparently considered to be limited.[3] Project LionRock thus focused on exploring other potential applications of Central Bank Digital Currency for wholesale purposes, such as cross-border fund transfers for wholesale purposes. Project LionRock also studied the development and impact of Central Bank Digital Currency with other central banks.

Project Inthanon-LionRock and Cross-border Fund Transfers between Hong Kong and Thailand

Project Inthanon-LionRock was conducted to explore the application of Distributed Ledger Technology (DLT) to improve efficiency in cross-border fund transfers. Its focus was overcoming the following pain points in the transfer process: inefficiencies; high cost; limited traceability and complex regulatory compliance. Adopting DLT is intended to allow real-time cross-border funds transfer and foreign exchange settlement in an atomic payment-versus-payment manner.

The Project Inthanon-LionRock report identifies four potential benefits:

Improving settlement efficiency

Using token transfers between the corridor network and Inthanon/LionRock networks, cross-border transactions can occur in real-time without intermediaries or settlement layers.

Enhancing liquidity efficiency

Liquidity efficiency is maximised through multi-currency liquidity saving mechanisms. Foreign exchange transactions are made available on the corridor network supporting foreign currency liquidity. Liquidity providing agents can offer intra-day liquidity provision for foreign currency.

Better regulatory compliance and improved reporting ability

Since all transactions between the two jurisdictions are reported in real-time, the post-trade reporting effort of banks can be reduced. The system would generate an alert for the enforcement of regulations, leading to better regulatory compliance, particularly with Thai non-resident requirements.

Allow for wider scope with extensible architecture

It is believed that the outcome of Project Inthanon-LionRock will help determine the ease and feasibility of extending the model to other markets and enhance functionalities linked to the corridor network.

Design of Cross-border Payments System

In this Hong Kong-Thailand CBDC model, the central bank is the sole issuer of its currency, and the wholesale CBDC is only tokenised and redeemed against the issuing central bank, namely, the HKMA and the Bank of Thailand. Thus the HKMA will issue digital HK$ tokens to banks in exchange for Hong Kong dollars and will redeem the tokens for Hong Kong dollars. The Central Bank of Thailand performs the same role with respect to Thai Baht. Participating banks then distribute the tokens to their corporate customers to make wholesale payments to other banks or companies. The domestic settlement networks are separated from cross-border transactions, non-resident banks are not allowed to access the domestic network and hold respective wholesale CBDC.

The Corridor Network

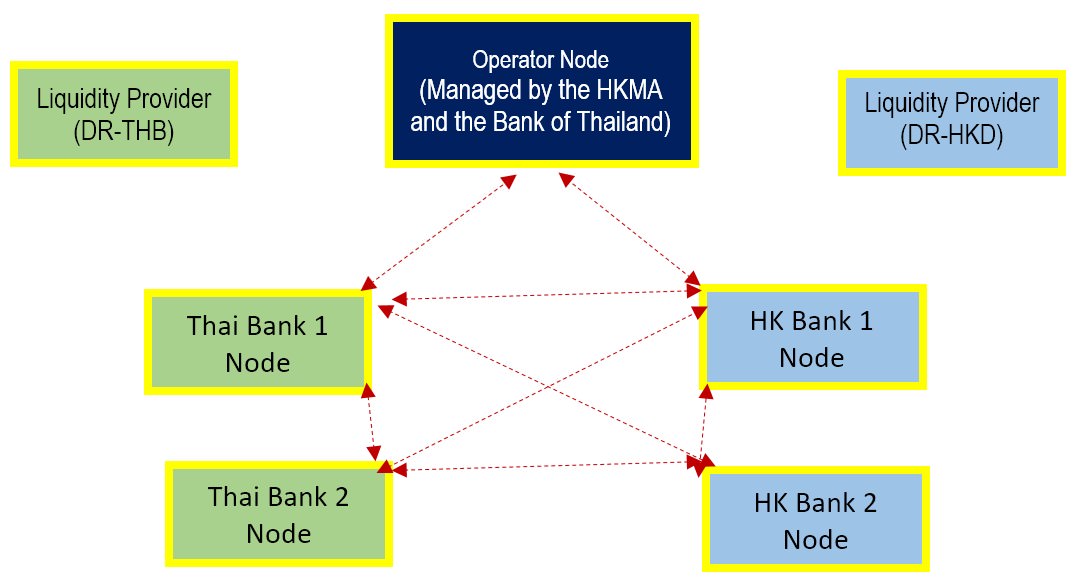

The Project features a “corridor network” which links the Hong Kong and Thai participating banks and central banks. The “corridor network” facilitates cross-border settlement.

The corridor network acts as a bridge connecting the domestic wholesale CBDC payment networks of Hong Kong and Thailand. There are three main types of corridor network participants:

The participating banks, i.e. the HSBC, ZA Bank Ltd. and Bangkok Bank Public Co. Ltd., which will have their own nodes on both the local payment network and corridor network. The participating banks’ nodes are designed to:

initiate and settle cross-border payments and foreign exchange payments between Hong Kong and Thailand;

manage liquidity in both local and foreign currencies.

The HKMA and the Bank of Thailand which will also have their own nodes in the local payment networks and a separate node in the corridor network called the “operator node”, control of which is shared by HKMA and the Bank of Thailand. The operator node is responsible for:

issuing and destroying HK dollar and Thai baht tokens in response to requests from participating banks;

resolve any gridlock which arises: and

ensure regulations are complied with.

The central bank operator node will act as the foreign currency liquidity provider.

x

x

Key Functionalities of Cross-Border Payments System

With the overall aim of enhancing the efficiency of cross-border funds transfers and foreign exchange transactions, the proposed corridor network (as described above) is designed to provide six key functionalities:

Token Conversion

To obtain tokens, participating banks will need to convert their wholesale CBDC into tokens. The bank will request a number of tokens to be converted in the corridor network and the request will be validated. The conversion will take place if the bank has sufficient wholesale CBDC in the domestic settlement network. So if a bank in Hong Kong wants more Hong Kong dollar liquidity in the corridor, it can submit a request for conversion of wholesale CBDC Hong Kong dollars from the LionRock network to the Hong Kong dollar tokens available in the corridor network.

Tokens can also be converted back to wholesale CBDC by destroying the tokens in the corridor network and issuing wholesale CBDC in an equivalent amount in the domestic settlement networks.

Cross-border Funds Transfer

Cross border funds transfer is a one-way payment from one bank to another in the corridor network and involves the sending bank submitting intructions to transfer funds in either local or foreign currency to a receiving bank.

Foreign Exchange Execution

When a bank in the corridor network wants to do a foreign exchange transaction, there are three different ways of effecting this: (i) Board Rate; (ii) Request for Quote; and (iii) Off-corridor arrangement. All foreign exchange transactions are settled on an atomic payment versus payment basis.

Cross-Border Funds Transfer with Embedded Foreign Exchange Execution

The corridor network offers a solution for banks in managing their foreign currency liquidity. The funds transfer function is bundled with a foreign exchange transaction to provide on-demand foreign currency funds for instant cross-border foreign currency funds transfers.

Liquidity management

Four mechanisms are in place to manage liquidity of automatic foreign currency including: (i) a queueing mechanism; (ii) a multi-asset liquidity saving mechanism; (3) allowing just-in-time liquidity to resolve deadlock; and (iv) token conversion for liquidity management.

Regulatory compliance and enforcement

The Proof-of-Concept aims to improve the visibility of transactions occurring in the corridor network to the central banks. It also takes into account the regulatory compliance and reporting requirements, especially those related to Thailand’s foreign exchange regulations or specifically the Measures to Prevent Speculation on Thai Baht.

Future Development and Considerations

In preparing for the next stage of the study – a full production-grade system in a sandbox environment – the HKMA and Bank of Thailand envisage elaborating on a number of legal, operational and technical matters.

In terms of future legal and regulatory considerations, the Project Inthanon-LionRock report highlights the importance of anti-money laundering given its role as a pillar in global financial crime policing. The system should support anti-money laundering practices to enhance efficiency in overseeing suspicious transactions. Also, the report found that the future build-out should scrutinise the onboarding of new regulations and continue periodic revision of existing regulations to adapt to the continuously changing regulatory environment in Hong Kong, Thailand and other jurisdictions. Besides, legal claims to central banks and financial data privacy concerns should also be included to outline escalation and remediation protocols for such claims and issues.

The following table summarises the outcomes of Project Inthanon-LionRock and how it compares with the current correspondent bank model.

|

Key considerations |

Pain points in current correspondent bank model |

Project Inthanon-LionRock CBDC model |

|

Cost |

|

|

|

Operational process |

|

|

|

Settlement Risk |

|

|

|

Transparency |

|

|

|

Regulatory compliance |

|

|

[1] Hannah Murphy and Yuan Yang. 12 February 2020. Patents reveal extent of China’s digital currency plans. Financial Times. https://www.ft.com/content/f10e94cc-4d74-11ea-95a0-43d18ec715f5

[2] Codruta Boar, Henry Holden and Amber Wadsworth. Impending arrival – a sequel to the survey on central bank digital currency. Bank for International Settlements, Monetary and Economic Department. Paper 107. https://www.bis.org/publ/bppdf/bispap107.pdf

[3] “Hong Kong, Thailand to roll out two-tier tokens in digital currency in digital currency prototype to speed up cross-border trade settlement”, South China Morning Post, 4 December 2019. Available at: https://www.scmp.com/business/banking-finance/article/3040582/hong-kong-thailand-roll-out-two-tier-tokens-digital