Hong Kong regulatory compliance

1. The 10 Most Important Things To Know About Reverse Takeovers (RTOs) of HK Listed Companies

- What is a Reverse Takeover?

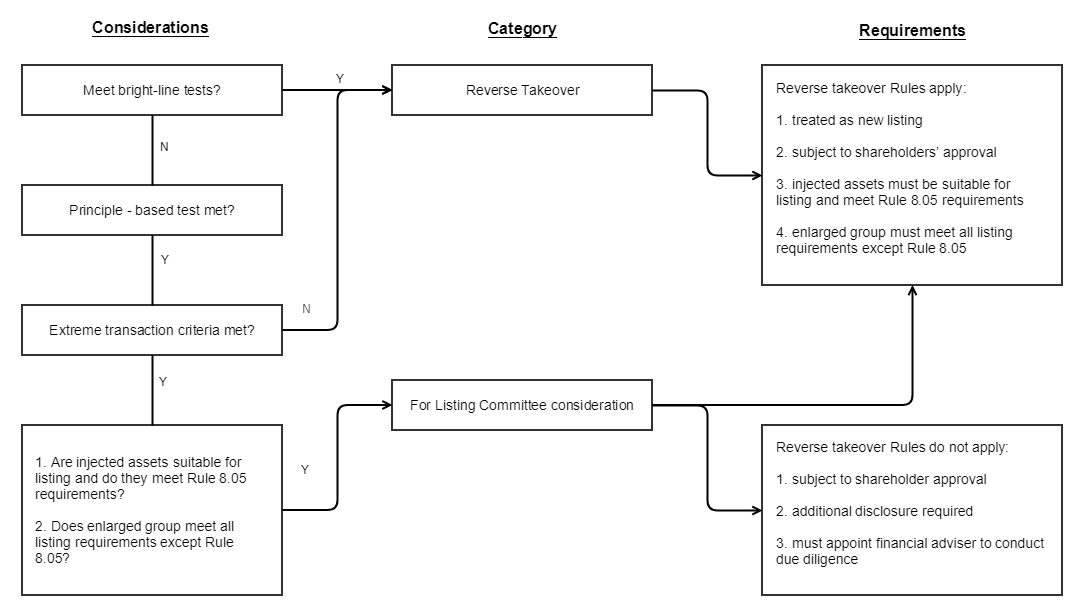

An RTO is broadly defined as an acquisition (or series of acquisitions) of assets by a listed issuer which, in the opinion of the Hong Kong Stock Exchange (the Exchange or HKEx), attempts to achieve a listing of the acquired assets and a means to circumvent the Listing Rules’ requirements for a new listing applicant.[1] This is a principle-based test.

- Is there a specific definition of Reverse Takeover?

No. The Listing Rules set out bright line tests for two specific types of RTOs which are transactions involving a change in control (i.e. 30%) of a listed issuer and a very substantial acquisition (VSA) (i.e. acquisition(s) where any percentage ratio is 100% or more) from the incoming controlling shareholder at the time of the change in control or within the following 36 months.[2] A VSA which falls within the bright line tests constitutes a reverse takeover and will require the listed issuer to follow the procedures for a new listing applicant.

- Are there any other circumstances that can give rise to a reverse takeover on HKEx?

Yes. The situations set out in the bright line tests are not exhaustive, and if a transaction falls outside the bright line tests (e.g. where there is no change of control), the HKEx will apply the principle-based test to assess whether the acquisition constitutes an attempt to list the assets to be acquired (and assets already acquired in a series of transactions) and circumvent the requirements for new listings. Hence, a listed issuer’s disposal of its existing business and acquisition of a totally new business may be regarded as a reverse takeover even if there is no change in control.[3]

- What are the consequences of entering a VSA within the bright line tests?

Where a VSA falls within the bright line tests of Note 2 to Main Board Listing Rule 14.06B or GEM Listing Rule 19.06B, the transaction will be treated as a reverse takeover, and the HKEx will treat the listed issuer proposing the reverse takeover as a new listing applicant. This requires that:

- the acquired assets must be suitable for listing (under Main Board Listing Rule 8.04 or GEM Listing Rule 11.06) and able to meet the financial tests and track record requirements of Main Board Listing Rule 8.05 (or 8.05A or 8.05B) or GEM Listing Rule 11.12A or 11.14;

- the enlarged group must meet all the listing requirements of Main Board Chapter 8 other than Rule 8.05 or GEM Chapter 11 other than Rule 11.12A;

- the listed issuer must issue a listing document containing virtually all the information required for a new listing applicant and the information required for a VSA. It must send the listing document to its shareholders with a notice convening a shareholders’ general meeting to approve the reverse takeover;

- an initial listing fee is payable; and

- the listed issuer must appoint a sponsor to conduct due diligence.

Where a reverse takeover involves a series of transactions, and the acquired assets cannot meet the management continuity and/or the ownership continuity and control requirements of Main Board Rule 8.05(1)(b) and (c) (GEM Listing Rule 11.12A(2) and (3)), due to a change in their ownership and management solely as a result of their acquisition by the listed company, the HKEx may grant a waiver of these requirements. In considering whether to grant a waiver, the HKEx will consider whether the listed company has the expertise and experience in the relevant business/industry of the acquired assets to ensure their effective management and operation.

- What factors does HKEx take into account in assessing whether a transaction(s) constitutes a reverse takeover?

In assessing whether a transaction or series of transactions constitutes an attempt to list the acquired assets and an attempt to circumvent the new listing requirements, the HKEx considers the six factors set out in Note 1 to Main Board Listing Rule 14.06B (GEM Listing Rule 19.06B). These are:

- the size of the acquisition(s) relative to the size of the listed issuer;

- a fundamental change in the listed issuer’s principal business;

- the nature and scale of the listed issuer’s business before the acquisition(s) (e.g. whether the listed issuer is a shell);

- the quality of the assets acquired/to be acquired;

- a change in control or de facto control of the listed issuer (other than at the level of its subsidiaries); and

- other transactions or arrangements which, together with the asset acquisition or acquisitions, form a series of transactions or arrangements to list the acquired assets.

The HKEx has said that in assessing shell activities, it will pay particular attention to assessment criteria (e) – change in control or de facto control and (b) a fundamental change in the listed issuer’s principal business.[4] In determining whether there has been a change in control or de facto control, the HKEx takes into account: (i) any change in the listed issuer’s controlling shareholder; or (ii) any change in its single largest shareholder who is able to exercise effective control of the listed issuer, as indicated by factors such as a substantial change to its board of directors and/or senior management.

- What are extreme transactions?

An “extreme transaction” is an acquisition or series of acquisitions of assets by a listed issuer which, individually or together with other transactions (which may include a disposal) or arrangements achieve a listing of the acquired assets, where the listed issuer can demonstrate that this does not constitute an attempt to circumvent the requirements for a new listing.

To qualify as an “extreme transaction” the following three conditions must also be met:

- either:

- the listed company has been under the control or de facto control of a person or group of persons for a long period (normally at least 36 months), and the transaction would not result in a change in control or de facto control of the listed company (other than at the level of its subsidiaries); or

- the listed company has been operating a principal business of a substantial size, which will continue after the transaction. HKEx Guidance Letter GL-104 provides guidance on what constitutes a business “of a substantial size”, which includes a listed company with annual revenue or total asset value of HK$1 billion according to its latest published financial statements. The HKEx will also take into account the listed company’s financial position, the nature and operating model of its business and its future business plans;

- the acquired assets must:

- be suitable for listing under Main Board Listing Rule 8.04 (GEM Listing Rule 11.06); and

- meet the financial and track record requirements of Main Board Listing Rule 8.05, 8.05A or 8.05B (GEM Listing Rule 11.12A or 11.14); and

- the enlarged group must meet all the new listing requirements of Chapter 8 of the Main Board Listing Rules (except Listing Rule 8.05) or Chapter 11 of the GEM Listing Rules (except GEM Listing Rule 11.12A).

- either:

- What are the HKEx requirements for extreme transactions?

A listed issuer proposing an extreme transaction is required to:

- comply with the requirements for very substantial acquisitions set out in Main Board Listing Rules 14.48 to 14.53 (GEM Listing Rules 19.48 to 19.53). The circular to shareholders must contain the information required under Main Board Listing Rule 14.69 (GEM Listing Rule 19.69); and

- appoint a financial adviser to perform due diligence on the assets subject to the acquisition (and any assets and businesses subject to a series of transactions and/or arrangements, if any). The financial adviser must submit to the HKEx a declaration in relation to the due diligence conducted before the bulk-printing of the circular for the transaction. Under Listing Rule 13.87B, the financial adviser must be licensed or registered to perform sponsor work.

- Can a listed issuer’s disposal of assets constitute a reverse takeover?

The HKEx may rule that a reverse takeover exists where it considers that other transactions or arrangements, together with one or more asset acquisitions, form a series of transactions or arrangements attempting to list the acquired assets and circumvent the requirements for a new listing. The other “transactions” or “arrangements” may include changes in control, de facto control, acquisitions and/or disposals and the HKEx may regard these and an asset acquisition or series of acquisitions as a series amounting to a reverse takeover if they take place in reasonable proximity to eachother (normally within a period of 36 months) or are otherwise related.

If the HKEx considers the acquisition(s) and other transactions or arrangements to constitute a series, it will treat the entire series as one transaction. Since the other transactions can be acquisitions or disposals, it is possible for a disposal by a listed issuer to trigger a reverse takeover with respect to a previously completed acquisition. Hence, a reverse takeover may occur where a listed issuer disposes of its existing business following an acquisition of a new business.

- When will HKEx aggregate a series of transactions or arrangements?

HKEx’s Guidance Letter on reverse takeovers, HKEx-GL 104-10 provides that it will normally apply the “series of transactions and/or arrangements” factor together with other assessment factors, for example the relative size of the transaction to the listed issuer, and whether the series of transactions would lead to a fundamental change in the principal business of the listed issuer.

The guidance letter also notes that:

- This criterion should not unduly restrict listed issuers’ business expansion or diversification that occur over a reasonable period where publicly disclosed information will inform shareholders and the public about their business operations and developments.

- HKEx will not normally consider a transaction or arrangement outside the three-year period to be part of the series, except where the transactions are clearly related or there are specific concerns regarding circumvention of the reverse takeover rules. The following examples are given:

- a transaction proposed just outside the three-year period which was likely under contemplation within it;

- where a listed issuer terminates a proposed acquisition of a target business (or reduces the size of an acquisition) after the HKEx rules it to be a reverse takeover, the HKEx may treat any further acquisitions of the target business outside the three-year period as part of a series; and

- where a listed issuer acquires a new business with an option to acquire another target business and the option is exercised more than three years after the original acquisition, the HKEx may consider the acquisitions as a series.

- HKEx will normally aggregate acquisitions that are related, such as:

- acquisitions that are in a similar line of business;

- acquisitions of interests in the same company or group of companies; and

- acquisitions of businesses from the same or a related party.

Size Tests

In assessing whether the size of acquisitions in a series is substantial, the HKEx will normally compare:

- the aggregate financial figures/ consideration of the acquired assets at their respective acquisition times to:

- the size of the listed issuer being the lower of its latest published financial figures (i.e. revenue, profits and assets) or market capitalisation: (i) before the first transaction in the series; and (ii) at the time of the last transaction in the series (Guidance Letter HKEx-GL104-19 at paragraph 32).

The above is however guidance only and the HKEx will consider anomalous results case-by-case.

- What are the Takeovers Code implications of an RTO?

An offer to acquire 30% or more of the voting rights of a Hong Kong listed company will trigger the obligation under Rule 26 of the Takeovers Code to make a general offer to all shareholders of the target company on the same terms in the absence of a waiver from the SFC Executive. Rule 25 further prohibits an offeror and its associates from offering favourable conditions to one or more shareholders which are not available to all the other shareholders.

- What is a Reverse Takeover?

2. INTRODUCTION: RTOs vs. IPOs

Historically, reverse takeovers (RTOs) have been used as an alternative means of achieving a stock exchange listing. In a typical reverse takeover, a company (the Acquiree) would identify a target HKEx-listed company. The listed company would then acquire the equity interests in the Acquiree or another company or other assets of the Acquiree and issue shares (ordinary or preference shares) and/or convertible bonds in consideration, which would result in the Acquiree obtaining a controlling stake in the listed company. The fact that no significant regulatory review was required (and there was no prospectus requirement) meant that the timeframe for completion of an RTO was considerably shorter than that for an IPO. In addition, RTOs are not subject to the vagaries of the market, as is an IPO, and the new owners of the listed company would generally suffer less share dilution and thus have greater control. Costs could also be saved due to the lack of an underwriter and listing sponsor.

RTOs still offer an alternative route to listing status in some countries. In the United States (US) for example, special purpose acquisition companies (i.e. cash shells) are able to list on the New York Stock Exchange and NYSE American (a market for small and mid-cap companies). These are companies formed to raise capital in an IPO with the purpose of using the proceeds to acquire one or more unspecified businesses or assets which are identified after the IPO.

Many jurisdictions, including the US and China, tightened the regulation of reverse takeovers following a number of accounting scandals involving Chinese companies that listed by this route. The Singapore Stock Exchange also introduced additional requirements for reverse takeovers, including a minimum issue price and requirements for acquisitions involving profit guarantees, following a series of high-profile reverse takeovers falling through due to concerns over profit guarantees.

3. Background to HKEx’S POSITION ON RTos

The HKEx Listing Rules provide for stringent regulation of reverse takeovers since they are viewed by the HKEx and the Securities and Futures Commission (the SFC) as attempts to list assets while circumventing the requirements for new listing applications, including the Listing Rules’ initial listing criteria, such as suitability for listing, financial eligibility criteria and sufficiency of public interest in the business of the listing applicant. In bypassing the new listing requirements, reverse takeovers are also able to avoid the disclosure requirements, due diligence process and regulatory vetting procedures for new listings.

Specific reverse takeover rules (RTO Rules) were introduced to HKEx’s Main Board Listing Rules in March 2004 simultaneously with the revision of the existing GEM reverse takeover rules to align with the new Main Board Listing Rules. Back-door listings had been particularly popular in Hong Kong in the early 1990s when a number of companies incorporated in the People’s Republic of China (PRC) listed in this manner. The HKEx however viewed reverse takeovers with suspicion and in the ten years prior to the introduction of the Main Board reverse takeover Listing Rules in March 2004, had virtually eliminated the practice of injecting non-listed assets without a suitable track record for listing into a listed shell in conjunction with a change of control. This was achieved through the publication in 1993 of a joint announcement by the HKEx and the SFC which set out the principles governing RTO transactions. At the same time, the HKEx made it possible for PRC companies to be listed as H-share companies.

In recent years, the regulation of reverse takeovers has been tightened considerably. Further HKEx Listing Rule revisions and guidance will take effect on 1 October 2019 in response to concerns on the part of the regulators related to reports of significant increases in the value of so-called “shell companies”, thought to represent the premium that backdoor listing hopefuls were prepared to pay to acquire a listed shell to achieve a backdoor listing of an unlisted business or assets. This note sets out the regulatory position as at 1 October 2019.

In addition, backdoor listings on HKEx have provided a well-trodden route for bank creditor driven restructurings of distressed listed companies. For the creditors of a distressed listed company, the listing status is often the “asset” that is most capable of being realised, and the disposal of a “listed shell” can achieve some level of recovery of the listed issuer’s bad debts. This route may be preferable to the alternative of a liquidation from which the returns likely to be generated from the company’s underlying assets are less certain.

4. DEFINITION OF REVERSE TAKEOVER

- The Definition

Main Board Listing Rule 14.06B and GEM Listing Rule 19.06B define a reverse takeover as:

An acquisition or a series of acquisitions by a listed issuer which, in the opinion of the HKEx, constitutes, or is part of a transaction and/or arrangement or series of transactions and/or arrangements, which constitute:

- an attempt to achieve a listing of the assets to be acquired (and in the context of a series of transactions, assets already acquired); and

- a means to circumvent the requirements for new applicants set out in Chapter 8 of the Main Board Listing Rules (GEM Chapter 11) (our emphasis).

This is a principle-based test and gives the HKEx broad discretion to label a transaction as a reverse takeover should it view the transaction as an attempt to circumvent the HKEx Listing Rules.

- The Bright Line Tests

Note 2 to Main Board Listing Rule 14.06B and GEM Listing Rule 19.06B sets out bright line tests describing two types of transaction which normally constitute a reverse takeover. These are:

- an acquisition or a series of acquisitions of assets (aggregated under Rules 14.22 and 14.23) by a listed issuer which constitute a very substantial acquisition (VSA) where there is, or which will result in, a change of control (as defined in the Takeovers Code (i.e. 30%)) of the listed issuer (other than at the level of its subsidiaries); or

- an acquisition or acquisitions of assets by a listed issuer which constitute a VSA from a person or group of persons under any agreement or arrangement entered into by the listed issuer within 36 months of that person or group of persons gaining control of the listed issuer other than at the level of its subsidiaries where the original acquisition of control was not regarded as a reverse takeover.

A very substantial acquisition which falls within the bright line tests constitutes a reverse takeover and the listed issuer will be treated as if it were a new listing applicant. Under the bright line tests, acquisitions in the 36 months after a change in control, which individually or together cross the threshold of a VSA, will constitute a reverse takeover and be treated as a new listing.

- VSAs within the Bright Line Tests

A VSA which falls within the bright line tests will be treated as a new listing notwithstanding that the requirements for a new listing are met. In Listing Decision LD29-2012 a listed issuer’s acquisition of a company from its controlling shareholder within 24 months of a change in control was found to constitute a reverse takeover and was thus subject to the RTO Rules.

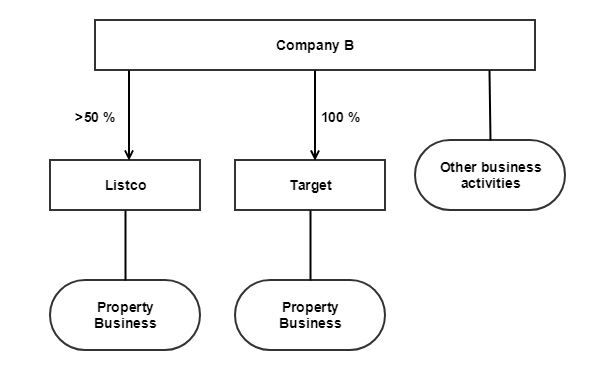

The simplified group structure was as follows:

Background

The case concerned an issuer listed on the Main Board of the HKEx (Listco) which proposed to acquire the Target from its controlling shareholder, Company B.

A year before the proposed acquisition, Company B acquired a controlling interest in Listco and accounted for Listco as a subsidiary.

Listco was principally engaged in the property business. Company B was engaged in various business activities including certain property projects held through the Target.

The Transaction

Listco proposed to acquire Target from Company B and would issue new shares to Company B as consideration.

The transaction was a very substantial acquisition for Listco based on its size. Although it was made within 24 months of a change in control of Listco, it was submitted that the transaction should not be classified as a reverse takeover because:

- Company A had been engaging in property business for many years. It had substantive business operations and was not a shell company.

- The Target and Listco were engaged in the same type of business.

- The transaction was a group reorganisation to consolidate Company B’s property business into Listco. Its purpose was not to achieve a listing of Target’s business.

- The Target’s business could meet the profit requirements for new listing applicants under Rule 8.05(1).

The Decision

The transaction was found to constitute a reverse takeover for Listco under the bright line tests because it was a very substantial acquisition and Target was to be acquired from Company B within 24 months after it acquired control of Listco.

Although the transaction was a reorganisation of property business within Company B’s group, Target was of a very significant size relative to Listco. The transaction, together with the change in control of Listco, was a means to list Target’s property business.

- Waivers where Reverse Takeover Transaction is within Bright Line Tests

The HKEx may grant a waiver from strict compliance where a reverse takeover involves a series of transactions and/or arrangements and the acquired assets cannot meet the management continuity and/or the ownership continuity and control requirements of Main Board Rule 8.05(1)(b) and (c) (GEM Listing Rule 11.12A(2) and (3)) due to a change in their ownership and management solely as a result of their acquisition by the listed company. In considering whether to grant a waiver, the HKEx will consider whether the listed issuer has the expertise and experience in the relevant business/industry of the acquired assets to ensure their effective management and operation.

- Transactions outside the HKEx Bright Line Tests – the Principle-Based Test

While the bright line tests refer to two specific forms of reverse takeovers, these are not exhaustive. Transactions which are in substance backdoor listings, but do not fall within the bright line tests, may still be considered reverse takeovers under the principle- based test. In applying the principle-based test – that is assessing whether the acquisition or acquisitions constitutes, or is part of a transaction and/or arrangement or series of transactions and/or arrangements which constitute, an attempt to achieve a listing of the assets acquired or to be acquired, and a means to circumvent the requirements for new listing, the HKEx takes into account the factors listed in Note 1 to Main Board Listing Rule 14.06B (GEM Listing Rule 19.06B). These are:

- the size of the acquisition(s) relative to the size of the listed issuer;

- a fundamental change in the listed issuer’s principal business;

- the nature and scale of the listed issuer’s business before the acquisition(s) (e.g. whether the listed issuer is a shell);

- the quality of the assets acquired/to be acquired;

- a change in control or de facto control of the listed issuer (other than at the level of its subsidiaries); and

- other transactions or arrangements which, together with the asset acquisition or acquisitions, form a series of transactions or arrangements to list the acquired assets.

The HKEx has said that in assessing shell activities, it will pay particular attention to assessment criteria (e) – change in control or de facto control and (b) a fundamental change in the listed company’s principal business.

Factor (e) – Change in Control or De Facto Control

In determining whether there has been a change in control or de facto control of a listed issuer, the HKEx will have regard to whether there has been:

- a change in the listed issuer’s controlling shareholder; or

- a change in the single largest substantial shareholder who is able to exercise effective control over the listed issuer, as indicated by factors such as a substantial change to its board of directors and/or senior management.

Issues of restricted convertible securities

A listed company’s issue of restricted convertible securities to an asset vendor as consideration for a sale of assets may trigger the reverse takeover requirements if the HKEx considers the issue to be a means to allow the vendor to gain effective control of the listed company. Restricted convertible securities are securities containing a conversion restriction mechanism aimed at preventing a change in control being triggered under the Hong Kong Takeovers Code.

Factor (f) – series of transactions and/or arrangements

In applying the principle-based test, the HKEx may take into account other transactions and/or arrangements which, together with the asset acquisition or acquisitions, form a series of transactions and/or arrangements to list the acquired assets and circumvent the listing requirements. Transactions and arrangements may include changes in control or de facto control, acquisitions and/or disposals.

The HKEx may regard these and the asset acquisition(s) as a series if they take place in reasonable proximity to each other (i.e. normally within a period of 36 months) or are otherwise related. The entire series of transactions and/or arrangements will then be treated as one transaction. Consequently, a disposal may trigger a reverse takeover ruling with respect to a previously completed acquisition in the same series, or a number of smaller acquisitions may form a reverse takeover. The reverse takeover rules may therefore be triggered where a listed company disposes of its original business following an acquisition of a new business.

Guidance on aggregation of transactions

Guidance letter HKEx-GL 104-19 on reverse takeovers provides that the “series of transactions and/or arrangements” factor is typically applied together with other assessment factors, for example the relative size of the transaction to the listed issuer, and whether the series of transactions would lead to a fundamental change in the principal business of the listed issuer. The guidance letter also notes that:

- This criterion should not unduly restrict listed issuers’ business expansion or diversification that occur over a reasonable period where publicly disclosed information will inform shareholders and the public about their business operations and developments.

- HKEx will not normally consider a transaction or arrangement outside the three-year period to be part of the series, except where the transactions are clearly related or there are specific concerns regarding circumvention of the reverse takeover rules. The following examples are given:

- a transaction proposed just outside the three-year period which was likely under contemplation within it;

- where a listed issuer terminates a proposed acquisition of a target business (or reduces the size of an acquisition) after the HKEx rules it to be a reverse takeover, the HKEx may treat any further acquisitions of the target business outside the three-year period as part of a series; and

- where a listed issuer acquires a new business with an option to acquire another target business and the option is exercised more than three years after the original acquisition, the HKEx may consider the acquisitions as a series.

- HKEx will normally aggregate acquisitions that are related, such as:

- acquisitions that are in a similar line of business;

- acquisitions of interests in the same company or group of companies; and

- acquisitions of businesses from the same or a related party.

Size Tests

In assessing whether the size of acquisitions in a series is substantial, the HKEx will normally compare:

- the aggregate financial figures/ consideration of the acquired assets at their respective acquisition times to:

- the size of the listed issuer being the lower of its latest published financial figures (i.e. revenue, profits and assets) or market capitalisation: (i) before the first transaction in the series; and (ii) at the time of the last transaction in the series (Guidance Letter HKEx-GL104-19 at paragraph 32).

The above is however guidance only and the HKEx will consider anomalous results case-by-case.

- No Requirement for a Change of Control

It was made clear that a change of control of the HKEx-listed issuer is not required for a transaction to be classified as a reverse takeover in the HKEx’s Listing Decision 75-1 of October 2009.[5] The case concerned a company (Company A) which had long been suspended from trading. At the time of suspension, Company A and its subsidiaries (the Group) were principally engaged in the business of nurturing, selling and trading tree seedlings and seeds. Company A agreed with a third party to dispose of its entire interest in a subsidiary, which at the time conducted the principal business of the Group (the Disposal). The Disposal constituted a VSA for Company A.

As part of the proposal to resume trading, Company A would enter other transactions and arrangements including:

- equity fund raising; and

- acquisitions of serviced apartments and elderly home businesses (New Businesses) from independent third party vendors for cash consideration (the Acquisitions).

Following the Disposal, the Group had ceased to operate its original principal business and Company A intended to focus on the New Businesses.

The Company argued that notwithstanding that based on the percentage ratio calculations, the Acquisitions would be a VSA, the transaction did not constitute a reverse takeover since the Acquisitions and other transactions did not involve a change in control.

The HKEx disagreed noting that the bright line tests are not exhaustive and that transactions that are in substance backdoor listings but fall outside the bright line tests may still constitute reverse takeovers.

How does the Exchange look at “Change in Control”?

Listing Decision 75-2

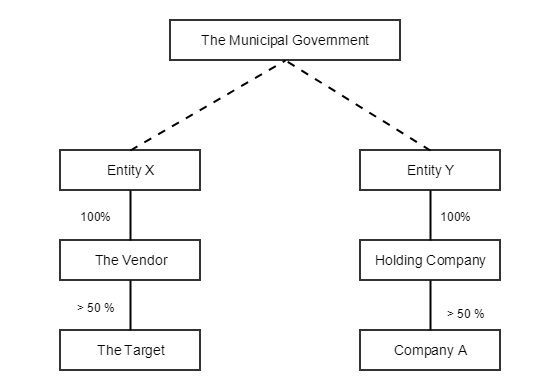

The case involved a change in direct control between two subsidiaries of the municipal government. The simplified group structures before and after the Acquisition are:

Before the Acquisition

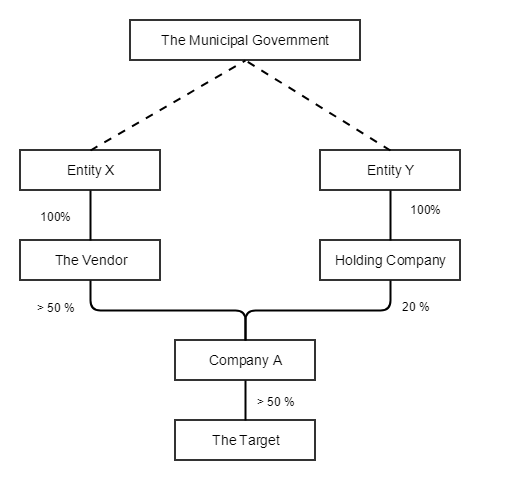

After the Acquisition

- Company A was a Main Board listed issuer and proposed to acquire from the Vendor its interest in the Target (the Acquisition). Company A and the Target had the same line of business.

- Since Company A would settle part of the consideration by issuing new shares to the Vendor, the Acquisition would result in a change in its shareholding structure:

- the Holding Company’s shareholding in Company A would be diluted to about 20% of the enlarged issued share capital;

- the Vendor would hold more than 50% of Company A’s enlarged issued share capital. Under Note 6(a) to Rule 26.1 of the Takeovers Code, the Vendor was granted a waiver from its obligation to make a general offer for Company A as a result of the Acquisition.

- The Acquisition was a connected transaction for Company A as the Exchange had deemed the Vendor and its associates to be Company A’s connected persons since the listing of Company A. Based on the percentage ratio calculation, the Acquisition was also a very substantial acquisition.

- Company A sought the Exchange’s confirmation that the Acquisition was not a reverse takeover. It submitted that although the Acquisition would result in the Vendor acquiring a controlling interest in Company A, there would not be a change in control under Rule 14.06(6) because:

- both Entity X and Entity Y were subordinate departments of the Municipal Government and under its supervision. Through these entities, the Municipal Government had exercised control over each of the Holding Company, Company A, the Vendor and the Target, including through the exercise of voting rights; and

- The Municipal Government had, and would continue to have, ultimate control over Company A before and after the Acquisition.

The Decision

The Acquisition was not regarded as a reverse takeover of Company A since the Municipal Government would remain Company A’s controlling shareholder following the acquisition, and there would not therefore be a change in its ultimate control as a result of the Acquisition.

The Exchange also took into account the assessment of “control” under the Takeovers Code. In this case, the Takeovers Executive had granted a waiver to the Vendor from its obligation to make a general offer under Note 6(a) to Rule 26.1 of the Takeovers Code. This was different from the situation where the control of an issuer changed and a whitewash waiver was granted subject to independent shareholders’ approval under the Takeovers Code.

The decision has implications for the possible use of reverse takeovers to restructure organisations, as so long as the ultimate control of the organisation remains with the same entity, and that entity takes an active controlling role, then the subsidiaries should be free to change their lower level control structure.

- Backdoor Listing on HKEx through Large Scale Issue of Securities

Main Board Listing Rule 14.06D (GEM Listing Rule 19.06D) disallows backdoor listings through large scale issues of securities for cash, where:

- there is, or will result in, a change of control or de facto control of the listed issuer; and

- the proceeds will be applied to acquire and/or develop a new business that is expected to be substantially larger than the listed issuer’s existing principal business.

- Restriction on Disposals after a Change in Control

Main Board Listing Rule 14.06E (GEM Listing Rule 19.06E) prohibits a listed issuer from carrying out a disposal or distribution in specie (or a series of disposals and/or distributions in specie) of all or a material part of its existing business:

- where there is a proposed change in control of the listed issuer (other than at the level of its subsidiaries); or

- within thirty-six months of a change in control,

unless the remaining group, or the assets acquired from the person or group of persons gaining control or his/her associates and any other assets acquired by the listed issuer after the change in control, can meet the requirements of Main Board Rule 8.05 (or Rule 8.05A or 8.05B)/GEM Rule 11.12A or 11.14. If this is not the case, the transaction is treated as a new listing. In determining whether to apply this rule, the HKEx will consider whether the disposal(s) and/or distribution(s) in specie form part of a series of arrangements to circumvent the new listing requirements.

These Listing Rules may pose a problem in cases where an outgoing shareholder is reluctant to sell the listed vehicle without retaining certain assets.

Exchange Listing Decision (HKEx-LD7-2011) – Restrictions on Disposal after Change in Control

The HKEx published a listing decision (HKEx-LD7-2011) on an attempt by a Main Board issuer (Company A) to circumvent certain elements of the regulatory regime, set out in Chapter 14 of the Listing Rules, governing the conduct of reverse takeovers in March 2011. The attempted circumvention concerned Listing Rule 14.92 (the predecessor rule to Rule 14.06E), which prevents a listed issuer from disposing of its current business for a period after a change in its control. Company A sought a waiver from this Rule which the HKEx refused on the grounds that Company A was attempting to defeat the policy goals of the prohibition. It stated that if Company A persisted with the disposal, it would be treated as a new listing applicant.

The attempt at circumventing the relevant rules of Chapter 14 involved delaying the disposal of Company A’s current business until after it had signed an agreement to acquire another business, in the hope of avoiding triggering the percentage ratio[6] which constitutes a “very substantial acquisition”[7] under Chapter 14. The classification of an acquisition as a very substantial acquisition triggers the RTO Rules.

The HKEx emphasised that the rules are intended to prevent companies circumventing the effect of Rule 14.06(6) for example where a new controlling shareholder structures a reverse takeover as a series of transactions. The specific example given by the HKEx was where the new controller(s) inject assets into the listed issuer soon after assuming control, but defers the disposal of the issuer’s existing business. This procedure permits the new controller(s) to avoid classifying the asset injection as a very substantial acquisition, as it ensures that the percentage ratios of the asset acquired will not reach 100% or more. The HKEx noted in its decision that the rule should be interpreted to meet the policy intent of obstructing the circumvention of Rule 14.06.

- The Definition

5. HKEX REQUIREMENTS FOR REVERSE TAKEOVERS

Where the HKEx rules that a transaction or series of transactions constitutes a reverse takeover, it will treat the listed issuer concerned as a new listing applicant. The listed issuer will need to provide to the HKEx sufficient information to show that the acquired assets can meet the financial and track record requirements of Main Board Listing Rule 8.5 (or 8.05A or 8.05B) or GEM Listing Rules 11.12A or 11.14 (Main Board Listing Rule 14.57A/ GEM Listing Rule 19.57A). The track record period for the acquired assets normally covers the three financial years (for Main Board issuers) or two financial years (for GEM issuers) prior to the issue of the listing document for the latest proposed transaction of the series.

-

HKEx Reverse Takeover Announcement Requirement

The listed issuer must publish an announcement as soon as possible after the reverse takeover’s terms are finalised which must include the identity and a description of the principal business activities of the counterparty to the transaction. The announcement must be pre-vetted by the HKEx before publication. Prior to the publication of the announcement, the listed issuer must apply to the HKEx to suspend dealing in its securities and the suspension must remain in force until sufficient information has been announced.[8]

-

Reverse Takeover Listing Document

The listed issuer must comply with the procedures and requirements for new listing applicants set out in Chapter 9 of the Main Board Rules (Chapter 12 of the GEM Rules) and must issue a listing document and pay the initial listing fee. The listing document must contain the information required under Main Board Listing Rules 14.63 to 14.69 (GEM Listing Rules 19.63 to 19.69) including:

- the information required for a new listing applicant under Part 1 of Appendix A to the Listing Rules;

- information on the enlarged group’s property interests under Main Board Listing Rules 5.01A and 5.01B (GEM Listing Rules 8.01A and 8.01B).

The listing document must be sent to the listed issuer’s shareholders together with a notice convening the meeting at which the reverse takeover will be voted on by shareholders.

The listed issuer must also appoint a sponsor which will need to conduct full due diligence and the new listing will need to be approved by the HKEx.

-

6. EXTREME TRANSACTIONS

Definition

An “extreme transaction” is an acquisition or series of acquisitions of assets by a listed issuer, which individually or together with other transactions (which may include a disposal) or arrangements, achieve a listing of the acquired assets, but the listed issuer can demonstrate that this is not an attempt to circumvent the requirements for a new listing (Main Board Listing Rule 14.06C/ GEM Listing Rule 19.06C). It is thus a reverse takeover where there is no intent to circumvent the Listing Rules’ new listing requirements.

To qualify as an “extreme transaction” the following three conditions must also be met:

- either:

- the listed company has been under the control or de facto control of a person or group of persons for a long period (normally at least 36 months), and the transaction would not result in a change in control or de facto control of the listed company (other than at the level of its subsidiaries); or

- the listed company has been operating a principal business of a substantial size, which will continue after the transaction. HKEx Guidance Letter GL-104 provides guidance on what constitutes a business “of a substantial size”, which includes a listed company with annual revenue or total asset value of HK$1 billion according to its latest published financial statements. The HKEx will also take into account the listed company’s financial position, the nature and operating model of its business and its future business plans;

- the acquired assets must:

- be suitable for listing under Main Board Listing Rule 8.04 (GEM Listing Rule 11.06); and

- meet the financial and track record requirements of Main Board Listing Rule 8.05, 8.05A or 8.05B (GEM Listing Rule 11.12A or 11.14); and

- the enlarged group must meet all the new listing requirements of Chapter 8 of the Main Board Listing Rules (except Listing Rule 8.05) or Chapter 11 of the GEM Listing Rules (except GEM Listing Rule 11.12A).

A listed issuer proposing an extreme transaction must:

- comply with the requirements for very substantial acquisitions set out in Main Board Listing Rules 14.48 to 14.53 (GEM Listing Rules 19.48 to 19.53);

- publish an announcement which must be pre-vetted by the HKEx and include the identity and a description of the principal business activities of the counterparty to the transaction;

- issue a circular containing the information required under Main Board Listing Rule 14.69 (GEM Listing Rule 19.69) including:

- the information required by Part A of Appendix 1 to the Listing Rules, to the extent applicable; and

- the information required under Main Board Chapter 5 (GEM Chapter 8) on the property interests acquired and/or to be acquired by the listed issuer; and

- appoint a financial adviser to perform due diligence on the assets subject to the acquisition (and any assets and businesses subject to a series of transactions and/or arrangements, if any). The financial adviser must submit to the HKEx a declaration in relation to the due diligence conducted before the bulk-printing of the listing document (Main Board Listing Rule 14.53A (GEM Listing Rule 19.53A).

- either:

-

Track record period

The track record period for an extreme transaction involving a series of transactions and/or arrangements will be three years (for Main Board listed companies) and two years (for GEM listed companies) before the issue of the circular for the latest proposed transaction in the series (new Main Board Listing Rule 14.57A (GEM Listing Rule 19.57A)). The listed company must provide the HKEx with sufficient information to demonstrate that the acquired assets can meet the requirements of Main Board Listing Rule 8.05, 8.05A or 8.05B or GEM Listing Rule 11.12A or 11.14.

-

HKEx Announcement Requirement

Under Rule 13.52(2)(a) (GEM Rule 17.53(2)(a)), an announcement of a reverse takeover (or a VSA) is subject to pre-vetting by the HKEx. The announcement must contain all pertinent information about the transaction, including the matters listed in Main Board Listing Rules 14.58 and 14.60 (GEM Listing Rules 19.58 and 19.60). Any other pertinent information must also be included.

An issuer may be required to suspend trading in its shares pending publication of the acquisition announcement. The suspension period must be kept as short as possible and issuers should note that suspension does not relieve them of their obligation to announce inside information under the Securities and Futures Ordinance.

7. DEALING WITH SHAREHOLDERS

- Requirement for Shareholders’ Approval

A reverse takeover or extreme transaction must be approved by the listed issuer’s shareholders in general meeting and the listing document or circular must be sent to shareholders at the same time as, or before, the listed issuer gives notice of the general meeting to approve the transaction. The announcement must state the expected date of despatch of the listing document or circular and, if this is more than 15 business days after the publication of the announcement, reasons must be given.

Where a reverse takeover or extreme transaction involve a series of transactions, the shareholders’ approval requirement applies only to the proposed transaction (i.e. the last in the series of transactions).

At a general meeting to approve a reverse takeover, any shareholder and his associates are barred from voting if the shareholder has a “material interest” in the transaction. In relation to a reverse takeover, the Listing Rules further require that where there is a change in control of the listed issuer and the existing controlling shareholder(s) will dispose of shares to any person, the existing controlling shareholder(s) cannot vote in favour of the acquisition of assets from the incoming controlling shareholder or his associates at the time of the change in control. This prohibition does not however apply where the decrease in the outgoing shareholder’s shareholding results solely from a dilution through the new issue of shares to the incoming controlling shareholder rather than a disposal of shares by the outgoing shareholder.

- Hong Kong Takeovers Code Issues

Rule 25 of the Takeovers Code on Special Deals with Favourable Conditions prohibits an offeror and its associates from entering into a deal to buy a company’s shares which involves favourable conditions being offered to one or more shareholders which are not available to all the other shareholders.

In addition, if there is a whitewash application for a waiver from the obligation to make a general offer to all shareholders by the incoming shareholder, all connected shareholders are likely to be barred from voting on it, as one of the conditions for the grant of a waiver of the mandatory offer obligation is that the transaction is approved at a shareholders’ meeting by an “independent vote” – i.e. by shareholders “who are not involved in or interested in, the transaction”. (Note 1 to Rule 26)

- Meeting the Initial Listing Criteria: HKEx Listing Decision 44-1

Listing Decision 44-1 related to satisfaction of the public float. The issue was whether in a case where an asset injection caused Company A to be deemed a new listing applicant, the minimum public float requirement under Main Board Rule 8.08 could be satisfied by the placing of existing and/or new shares of Company A prior to the completion of the asset injection.

The HKEx decided that the placing arrangements by the company and/or its parent to maintain the public float before completion of the assets injection were acceptable. It further granted a waiver of Main Board Listing Rule 10.07 which prohibits a person shown by the listing document to be a controlling shareholder from disposing of its shares in the listed company for 6 months following listing. The waiver allowed the parent company, a controlling shareholder, to place down its shares during the restricted period.

- Requirement for Shareholders’ Approval

8. IMPLICATIONS OF A REVERSE TAKEOVER OF MINERAL OR PETROLEUM ASSETS

Chapter 18 of the Main Board Listing Rules and Chapter 18A of the GEM Listing Rules impose specific requirements to be met by new applicant mining and petroleum companies in addition to the basic requirements for listing contained in Chapters 8 and 11 of the Main Board Rules and GEM Rules, respectively.

Chapter 18 (GEM Chapter 18A) apply to a Mineral Company which is defined as “a new applicant whose Major Activity (whether directly or through its subsidiaries) is the exploration for and/or extraction of Natural Resources, or a listed issuer that completes a Relevant Notifiable Transaction involving the acquisition of Mineral or Petroleum Assets”.

The term “Major Activity” is an activity of an issuer and/or its subsidiaries which represents 25% or more of the total assets, revenue or operating expenses of the issuer and its subsidiaries. When assessing whether or not this threshold has been reached, reference should be made to the issuer’s latest audited consolidated financial statements.

Listed issuers engaged in the resources sector when the new regime became effective were not automatically treated as Mineral Companies. However, they will become Mineral Companies once they complete a Major Transaction, Very Substantial Acquisition or Reverse Takeover involving the acquisition of Mineral or Petroleum Assets.

Thus a listed issuer which engages in a reverse takeover of a company involved in the resources sector will be treated as a Mineral Company. In addition to adhering to the basic conditions for listing, as set out in Chapter 8 of the Main Board Rules or Chapter 11 of the GEM Rules, if treated as a new applicant under the RTO Rules, the listed issuer must also satisfy the additional eligibility requirements for mineral and petroleum companies which are summarized in Annex B to this Note.

9. HKEX’S REVIEW OF POTENTIAL REVERSE TAKEOVERS

The HKEx identifies potential reverse takeovers through: (i) post-vetting announcements for transactions below the very substantial acquisition threshold; (ii) vetting draft announcements for very substantial acquisitions; and (iii) handling enquiries relating to potential reverse takeovers. Where HKEx’s Listing Department considers a transaction to be a reverse takeover, it will not be presented to the HKEx Listing Committee.

10. ASSET INJECTIONS SATISFYING THE HKEX LISTING REQUIREMENTS

One of the paths for rescuing a distressed listed company remains the injection of assets which meet the HKEx Listing Rules’ requirements for listing. This is acceptable to the HKEx as the issuer is subject to the full requirements of the Listing Rules and will follow the process for a new listing. Transactions in the thirty-six months after the restructuring may be subject to the HKEx notifiable transactions requirements, but will not need to be aggregated with the original reverse takeover transaction which has already triggered the new listing requirements.

The downside for bank creditors leading a restructuring is that the pool of investors with assets meeting the listing requirements, and who are willing to invest in this type of restructuring, is likely to be small. As the investor is bringing his own assets, the likelihood is that he’ll be in a strong position to negotiate down the price for the listed company. Creditor banks who take an equity position in the restructuring should benefit in the long term given the injection of new assets. In the short-term, however, commentators have remarked that the immediate cash payout is likely to be substantially less than on a cash subscription type restructuring.

11. CASH SUBSCRIPTIONS AND BUSINESS RESUSCITATIONS: MAIN BOARD LISTING RULE 13.24/GEM 17.26

Cash injections and business resuscitations as a route to corporate rescues run into problems under Main Board Listing Rule 13.24 (GEM 17.26).

These Rules provide that:

“An issuer shall carry out directly or indirectly, a business with a sufficient level of operations and assets of sufficient value to support its operations to warrant the continued listing of the issuer’s securities.”

Where a listed issuer’s assets consist wholly or substantially of cash and/or short-term investments (i.e. securities that are held by the issuer for investment or trading purposes and are readily realisable or convertible into cash (including bonds, bills or notes which have less than a year to maturity and listed securities held for investment or trading purposes), it will not be considered suitable for listing and trading in its securities will be suspended (Main Board Listing Rule 14.82 and GEM Listing Rule 19.92). Cash and short-term investments held by a banking company, insurance company or a securities house will not normally be taken into account. However, the exemption for securities houses will not apply if the HKEx has concerns that the listed company is holding cash and short-term investments through a member to circumvent the rule on cash companies. For example, a listed company holding excessive cash and/or securities investments cannot circumvent the rule by holding such assets through a group member that is a licensed broker with minimal brokerage operations.

The difficulty in rescue situations is that in many cases the operations of the listed issuer have ceased to operate. The problems with a cash injection (which has never been classed as a notifiable transaction) stem from Listing Rule 13.24. If the Listing Rule 13.24 requirements are satisfied, there is then the issue of the 36-month period during which any injection of new assets into the listed company will be aggregated with the restructuring transaction and the aggregated transaction constituting a VSA. The issuer would then be treated as a new listing applicant. For the investor, the question will be whether the business can be sustained for 36 months without any injection of assets.

October 2019

This note is provided for information purposes only and does not constitute legal advice. Specific advice should be sought in relation to any particular situation. This note has been prepared based on the laws and regulations in force at the date of this note which may be subsequently amended, modified, re-enacted, restated or replaced.

Annex A

Summary of Listing Criteria for New Applicants

|

MAIN BOARD |

GEM |

||||

|

Financial Requirements |

Applicants must meet one of 3 financial tests |

A GEM applicant must have: Positive cashflow from operating activities in the ordinary and usual course of business of HK$30 million in aggregate for the latest 2 financial years |

|||

|

1. Profit Test |

2. Market Cap/ Revenue Test |

3. Market Cap/ Revenue Cash flow Test |

|||

|

Profit |

At least HK$50 million in the last 3 financial years (with profits of at least HK$20 million in the most recent year, and aggregate profits of at least HK$30 million recorded in the 2 years before that) |

– |

– |

||

|

Market Cap |

At least HK$500 million |

At least HK$4 billion at the time of listing |

At least HK$2 billion at the time of listing |

Market cap of HK$150 million at the time of listing |

|

|

Revenue |

– |

At least HK$500 million for the most recent audited |

At least HK$500 million for the most recent audited |

||

|

Cashflow |

– |

– |

Positive |

||

|

Operating History and |

Main Board applicants must have:

|

GEM applicants must have:

|

|||

|

Public Float |

At least 25% of the issuer’s total issued share capital (subject to a minimum of HK$125 million for Main Board applicants and HK$45 million for GEM applicants) must be held by the public at all times. For issuers with an expected market capitalisation at listing of at least HK$10 billion, the Exchange may accept a public float of between 15% and 25%. |

||||

|

Spread of Shareholders |

The shares in the hands of the public must be held by at least 300 persons. No more than 50% of the publicly held shares at the time of listing can be beneficially owned by the 3 largest public shareholders. |

The shares in the hands of the public must be held among at least 100 persons. No more than 50% of the publicly held shares at the time of listing can be beneficially owned by the 3 largest public shareholders. |

|||

Annex B

Listing Eligibility Requirements for Mineral and Petroleum Companies

- Right to explore for and/or extract Natural Resources (MB Rule 18.03(1)/GEM Rule 18A.03(1))

New applicant Mineral Companies must be able to demonstrate that they have the right to participate actively in the exploration for and/or extraction of resources, either by having control over a majority (by value) of the assets in which they have invested or through other rights, which give them significant influence in decisions concerning the exploration for and/or extraction of those resources (MB Rule 18.03(1) (GEM Rule 18A.03(1)).

The Exchange recognises that in practice, companies often engage in mineral extraction or exploration activity under joint venture agreements, product sharing contracts or specific government mandates. Therefore, the Exchange will consider, on a case-by-case basis, whether or not to allow an applicant to rely on adequate agreements where a third party possesses relevant rights, in order to satisfy this eligibility requirement.

- Ineligibility of Early Stage Exploration Companies

New applicant Mineral Companies must have at least a portfolio of Indicated Resources (in the case of minerals) or Contingent Resources (in the case of petroleum) that are identifiable under one of the accepted reporting standards and substantiated in the report of an independent expert (MB Rule 18.03(2)/GEM Rule 18A.03(2)). The portfolio must also be of sufficient substance to justify a listing. These requirements therefore render early stage exploration companies ineligible for listing.

- Working Capital Requirement

New applicant Mineral Companies must demonstrate that they have sufficient working capital for 125% of their budgeted needs for the next twelve months (MB Rule 18.03(4)/GEM Rule 18A.03 (4)). The working capital requirements must include, as a minimum, general and administrative costs, property holding costs and the cost of proposed exploration and development. Applicants that have commenced production must also provide an estimate of its cash operating costs.

- Waiver of Main Board Financial Tests/GEM Trading Record Requirement

Main Board Rule 18.04 provides that if a new applicant Mineral Company cannot meet the financial track record requirements under Listing Rule 8.05, those requirements may be waived if the board and senior management, taken together, have a minimum of five years’ experience relevant to the mining and/or exploration activity that the applicant is pursuing.

Under GEM Rule 18A.04, the Exchange may accept a trading record period of less than the two financial years specified in Rule 11.12A (and an accountants’ report covering a shorter period than that specified in rule 11.10) for a new applicant Mineral Company, provided that its directors and senior managers, taken together, have at least five years’ relevant industry experience. However, where the Exchange accepts a trading record of less than two financial years, a new applicant must still meet the cash flow requirement of HK$20 million for that shorter trading record period, in accordance with Rule 11.14.

ANNEX C

Summary of Listing Decisions involving VSAs falling outside the bright line tests

Note: these were decided under the pre-October 2019 Listing Rules

Listing Decision LD 95-1: the Approach where an extreme case does not attempt to circumvent the requirements for new listings applicants

In this Listing Decision, released in July 2010, the Exchange considered whether a company, whose main business was in security investments and manufacturing and trading battery products (Company A), would:

- become a cash company due to its proposed placing of convertible notes; and

- have its proposed acquisition of an insurance company (the Target) treated as a reverse takeover by the Exchange.

Company A proposed to raise funds to be used as working capital and for potential investment prospects by placing new shares to independent placees (the First Placing). This placing would result in Company A’s assets being comprised almost entirely of cash, making it a cash company under Main Board Rule 14.82. A listed issuer is treated as a cash company when, for any reason, its assets consist entirely or largely of cash or short dated securities. This leads to the company not being regarded as fit for listing and trading in its securities being suspended.

Soon after the announcement of the First Placing, Company A made an agreement to acquire the Target from an independent vendor in cash (the Acquisition), a transaction amounting to a very substantial acquisition. The Target was a considerably larger entity than Company A, which created an issue as to whether the Acquisition constituted a reverse takeover under Rule 14.06 (6).

In order to avoid being treated as a cash company and having trading in its securities suspended, Company A cancelled the First Placing, replacing it with a scheme involving the issuing of convertible notes to raise funds (the Second Placing), which would be redeemed within two weeks if the Acquisition did not go ahead.

Company A argued that Rule 14.06 (6) did not apply to the Acquisition as it would not cause a change in control to occur at the company, and also that the vendor had no intention of circumventing the IPO requirements. Rather the transaction constituted a forced sale by the vendor of its major assets with no prerequisite in relation to the listing status of the purchaser.

The Exchange on whether Company A was a cash company

Despite the revised technique of fund raising adopted by Company A, the Exchange determined that its assets would still largely consist of cash immediately after the Second Placing transaction. This would result in trading in its securities being suspended under Rule 14.83 and in order to avoid this, Company A restructured the Second Placing to prevent itself from becoming a cash company at any time, by making it subject to the conclusion of the Acquisition.

The Exchange on whether the Acquisition should be regarded as a reverse takeover

It was noted that the two tests detailed in Rule 14.06(6) are not exhaustive, and transactions effectively amounting to backdoor listings can be treated as reverse takeovers, although in practice this only occurs in extreme cases. The Exchange considered the Acquisition to be an extreme case, primarily on the grounds that it was very significant for Company A and the target operated in a completely different business. The Acquisition would have the effect of changing Company A’s business and was an attempt to achieve a listing of the Target’s business.

However the Exchange found that the Acquisition was not an attempt to circumvent the requirements for new listing applicants detailed in Rule 8.05(1)(a). Key factors in this finding were that the Target only failed to comply with the profit requirements under that section due to the effect of the global economic downturn, as opposed to a substantial decline in its ability to generate revenue, and the Target’s ability to meet the capitalisation/revenue test under Rule 8.05(3).

The Exchange decided that it would not treat the Acquisition as an RTO, and that the policy aims of the RTO Rules would be satisfied, once the following conditions were adhered to:

- Company A would publish a circular with a level of disclosure comparable to an IPO prospectus;

- The Circular would explain that the Target’s loss in the most recent year was transitory in nature and not due to serious deterioration of its operational capabilities; and

- Company A would appoint an adviser to perform due diligence on the Target and undertake duties and obligations commensurate with those of a sponsor for a new listing application under the Rules.

Listing Decision LD 95-2

In this Listing Decision, released in July 2010, the Exchange assessed whether an acquisition by a Main Board issuer (Company A) constituted a reverse takeover under Rule 14.06(6), and also considered the issue of whether or not the occurrence of a change in control was relevant to the evaluation of whether or not an acquisition constituted an RTO.

Company A was involved in the sale, design and manufacture of toys (the Original Business) and conducted an open offer in order to raise funds for general working capital. When this open offer was made, Company A’s chairman and controlling shareholder (Mr B) did not avail of the opportunity to take up new shares and as a consequence his interest in Company A diminished from 40% to 8%. He then retired as chairman and as a director. Almost contemporaneously with this, Company A started in the business of property holding and research and the development of electric bus batteries. However, these activities were small in scale and not of great importance to Company A.

Proposed acquisition and disposal

Four months subsequent to the open offer completing, Company A proposed to acquire the Acquisition Target company, which was engaged in the manufacture of solar panels, from the Vendor (the Acquisition). This transaction would amount to a very substantial acquisition. Company A also intended to sell the Original Business to Mr B (the Disposal), with this transaction amounting to a very substantial disposal and also being contingent on the completion of the Acquisition. The rationale behind the Acquisition and Disposal, according to Company A, was that the former would allow it to commence business in a new high growth area and the latter would permit the realisation of its investment in what was a loss making venture. Company A claimed that the Acquisition did not amount to an RTO under Rule 14.06(6) due to the fact that:

- there would be no change of control of Company A (as defined in the Takeover Code) as a consequence of the Acquisition and the Disposal; and

- the controlling stake in Company A had not changed hands in the 24 months before the agreements for the Disposal and Acquisition completed (Listing Rule 14.92 states that a listed issuer which disposes of its current business in the 24 months subsequent to a change in control will be treated as a new listing applicant).

The Exchange’s Analysis

The two bright line tests for RTOs detailed in Rule 14.06 (6) are not exhaustive, and transactions effectively amounting to backdoor listings can be treated as RTOs. The Exchange accepted that the bright line tests did not apply in this case as the Acquisition would not result in a change in control, nor did the Vendor take control of Company A within the 24 month period before the completion of the Acquisition.

However, if the Acquisition was viewed by the Exchange as an RTO under Rule 14.06(6), and furthermore as an extreme case, then the initial listing requirements would apply to the acquisition. In evaluating whether or not this was the case, the Exchange took the following into account:

- the consequence of the Acquisition and Disposal would be a complete change in the business undertaken by Company A. The outcome of the transactions, when taken together, was that Company A would sell the Original Business to Mr B, while acquiring a whole new business from the Vendor and effectively listing it.

- the Acquisition Target had no trading record and was not capable of meeting the profit test for new applicants detailed in Rule 8.05 (1)(a).

The Exchange stated that the argument advanced by Company A, that the Acquisition could not be an RTO, as it would not cause a change in control (under the Takeover Code), was irrelevant. The Exchange highlighted the definition of an RTO under Rule 14.06 (6), which is an acquisition which the Exchange believes to be an attempt to list the assets acquired and circumvent the new listing requirements.

After considering the above factors, the Exchange found that the Acquisition was a component of a series of transactions designed to circumvent the obligations placed on new applicants and was also an extreme case. The listed issuer was therefore treated as a new listing applicant.

Listing Decision LD57-2013

Another extreme case of an RTO that did not meet the bright line tests in Rule 14.06(6) is Listing Decision LD57-2013. The Main Board listed issuer in this case (Company A) attempted to acquire half of the share capital of the target company (Target) in consideration of cash, consideration shares and convertible bonds. The consideration shares and convertible bonds issued would have comprised 180% of Company A’s existing share capital, but the terms of the convertible bonds would not allow a conversion which would trigger a mandatory general offer under the Takeovers Code. The acquisition would have constituted a very substantial acquisition according to size tests. The Target’s principal business was entirely different from those of Company A and following completion, the Target’s shares would be accounted for as an interest in an associated company or an investment in Company A’s financial statements.

The Exchange’s Analysis

Neither of the bright line tests under Rule 14.06(6) applied; the transaction would not have resulted in a change in control under Rule 14.06(6)(a), nor would the target company have gained control of Company A within the 24 months prior to completion of the acquisition as required under Rule 14.06(6)(b). However, the Exchange concluded that the acquisition would be an RTO in essence for the following reasons:

- Not only would the transaction be a very substantial acquisition, but on completion, Company A’s existing business and assets would be relatively immaterial to the enlarged group; and

- Neither the assets being acquired nor the enlarged group could meet the requirements of Rule 8.05(1), which requires new listing applicants to have a trading record of:

- three financial years;

- HK$20 million in profits for the most recent year; and

- HK$30 million in profits (in aggregate) for the preceding two years.

Company A argued that the enlarged group would satisfy the profits test under Rule 8.05(1), but the Exchange determined that the Target’s trading record should not be included for the purposes of the Rule since Company A would account for the assets being acquired as an interest in an associated company or an investment. Company A had recorded losses in the years before the proposed acquisition and the enlarged group (excluding the shares in the Target) could not meet Rule 8.05. The Exchange considered this to be an extreme case of an RTO. The acquisition did not meet the bright line tests under Rule 14.06(6), but as a transaction intended to list the shares in the target while circumventing the listing requirements, it was nevertheless an RTO in essence.

Listing Decision 95-4 on Application of the RTO Rules to Extreme Cases

In this Decision, released in July 2010, the Exchange was tasked with assessing whether or not a company’s proposed acquisition should be regarded as an RTO under Rule 14.06 (6). It also considered the effect of both the old and new Chapter 18 Rules.

The company (Company A) was engaged in the sale of machinery and equipment (the Existing Business) and proposed to acquire a company (the Target) from an independent third party (the Vendor), in a transaction constituting a very substantial acquisition. The Target was active in the oil and natural gas exploration, extraction and processing sectors. It held exploration and extraction rights in two gas fields, with one being in the preliminary exploration stage and exploration yet to commence on the other. However, Company A intended to continue the Existing Business after the Acquisition.

Main Board Rule 18.02(1)

This Rule was part of the pre-June 2010 regulatory framework for mineral companies, which was in force at the time of this case. It stated that an application for listing from a company whose current activities consist solely of exploration will not normally be considered by the Exchange, save where the issuer is able to demonstrate “the existence of adequate economically exploitable reserves of natural resources, which must be substantiated by the opinion of an expert, in a defined area over which the issuer has exploration and exploitation rights.”

The Exchange’s Analysis

In classifying the Acquisition as an RTO under Rule 14.06(6), the Exchange was swayed by the following factors:

- the Acquisition met the requirements for classification as a very substantial acquisition, and, in terms of scale, would be significant for Company A. After the Acquisition, the Target’s business would represent a considerable portion of Company A’s business, and would involve an activity totally different from the Existing Business. The Exchange concluded that the Acquisition was a method of achieving a listing of the Target’s business.

- the Target had generated no revenue at the time when the Acquisition was due to take place, meaning that it could not meet the profit test for new applicants in Rule 8.05(1).

- the Target fell within the classification of an early stage exploration company, as described in Rule 18.02(1), and was unsuitable for listing as Company A failed to demonstrate that the gas fields had the required reserves.

The Exchange also noted that even had the current Chapter 18 been in effect, the Target would still have been unsuitable for listing, as it would not have been able to show that it had a portfolio of identifiable resources (i.e. for oil and gas companies, Contingent Resources as defined in the new Chapter 18).

The Exchange finished by stating that the proposed Acquisition was a transaction aimed at achieving a listing of the Target’s business and circumventing the requirements for new listings. It was an extreme case and must be viewed as an RTO under Rule 14.06 (6).

[1] Rule 14.06B of the Main Board Listing Rules and Rule 19.06B of the GEM Listing Rules.

[2] Note 2 to Rules 14.06B and 19.06B of the Main Board and GEM Listing Rules, respectively.

[3] See HKEx’s Listing Decision 75-1 of October 2009.

[4] HKEx. “Consultation Conclusions Backdoor Listing, Continuing Listing Criteria and other Rule Amendments”. July 2019.

[5] https://www.hkex.com.hk/listing/rules-and-guidance/interpretation-and-guidance-contingency/listing-decisions/2009?sc_lang=en

[6] Under Rule 14.07 the percentage ratios are the figures, expressed as percentages, which are the result of various calculations designed to relate the scale of a transaction to the scale of a listed issuer engaged in a transaction. For example, the total assets which are the subject of the transaction divided by the total assets of the listed issuer will give one the assets ratio of the transaction.

[7] Rule 14.06 (5) defines a very substantial acquisition as an acquisition or a series of acquisitions (aggregated under rules 14.22 and 14.23) of assets by a listed issuer where any percentage ratio is 100% or more.

[8] Main Board Listing Rule 14.37(5)/ GEM Listing Rule 19.37(5).