Hong Kong regulatory compliance

INTRODUCTION

The purpose of this note is to outline the duties and obligations of the directors of a company listed on the Growth Enterprise Market (“GEM”) of the Hong Kong Stock Exchange (“HKEx” or the “Exchange”).

I. THE MAJOR SOURCES OF DIRECTORS’ OBLIGATIONS

The continuing duties and obligations of the directors of the Company are derived from Hong Kong laws, the laws of the Company’s jurisdiction of incorporation (if it is not a Hong Kong company) and non-statutory regulations and contract, including the following:

- applicable Hong Kong legislation, including the Companies Ordinance and the Securities and Futures Ordinance of Hong Kong (the “SFO”);

- the Rules Governing the Listing of Securities on the Growth Enterprise Market of The Stock Exchange of Hong Kong Limited (the “GEM Rules”);

- the Code on Takeovers and Mergers and the Code on Share Buy-backs (the “Takeovers Code”);

- the Declaration and Undertaking (Form A of Appendix 6 to the GEM Rules) which each director of a company listed on the GEM is required to lodge with the Exchange; and

- the Companies Registry’s Guide on Directors’ Duties.

II. DIRECTORS’ DUTIES

1. Obligation to ensure compliance with the Listing Rules

A listed issuer undertakes in its application for listing to comply with the Listing Rules once its securities are listed on the Exchange. Under GEM Rule 17.03, the directors of a listed issuer are collectively and individually responsible for ensuring that the listed issuer complies fully with the requirements of the GEM Rules. The directors of a company listed on the GEM are required to file with the Exchange a Declaration, Undertaking and Acknowledgement in the form of Form A of Appendix 6 to the GEM Rules (or Form B of Appendix 6 to the GEM Rules for PRC companies).

In Form A of Appendix 6 to the GEM Rules, a director undertakes to:

- comply to the best of his ability with the GEM Rules and use his best endeavours to ensure that the listed issuer complies with the GEM Rules;

- comply to the best of his ability, and use his best endeavours to ensure the listed issuer’s compliance, with the requirements of the Companies Ordinance, the SFO, the Takeovers Code, the Code on Share Buy-backs and all other relevant securities laws and regulations from time to time in force in Hong Kong; and

- cooperate in any investigation conducted by the Listing Division and/or the GEM Listing Committee of the Exchange.

Any director who breaches any of the above undertakings will be subject to sanctions prescribed by the GEM Rules.

2. Directors’ fiduciary duties and duties of skill, care and diligence

The GEM Rules require directors, both collectively and individually, to fulfil fiduciary duties and duties of skill, care and diligence to a standard at least commensurate with the standard established by Hong Kong law (GEM Rule 5.01). According to GEM Rule 5.01, this means that every director must, in the performance of his duties as a director:

- act honestly and in good faith in the interests of the company as a whole;

- act for a proper purpose;

- be answerable to the listed issuer for the application or misapplication of its assets;

- avoid actual and potential conflicts of interest and duty;

- disclose fully and fairly his interests in contracts with the listed issuer; and

- apply such degree of skill, care and diligence as may reasonably be expected of a person of his knowledge and experience and holding his office within the listed issuer.

These duties are summarised in the Companies Registry’s Guide on Directors’ Duties (attached at Annex A). Directors are required to comply with that guide and failure to do so may constitute a breach of the Listing Rules (paragraph 2.8 of Guidance Letter HKEx-GL62-13).

Statutory duty of skill, care and diligence under new Companies Ordinance

The new Companies Ordinance (Cap. 622) which came into effect on 3 March 2014 codified directors’ duty of skill, care and diligence referred to in (f) above in section 465(1). The standard of skill, care and diligence expected of directors under paragraph (f) was considered too low since it used a subjective test. The standard expected was the degree of skill, care and diligence which can be reasonably expected from a person with the particular director’s knowledge and experience.

Section 465(2) adopts a mixed objective and subjective test. The standard of care, skill and diligence required is that which would be exercised by a reasonably diligent person with:

- the general knowledge, skill and experience that may reasonably be expected of a person carrying out the functions carried out by the director in relation to the company (the objective test); and

- the general knowledge, skill and experience that the director has (the subjective test).

While section 465(2) of the Companies Ordinance does not apply directly to the directors of non-Hong Kong companies (i.e. companies incorporated outside Hong Kong), the directors of a non-Hong Kong company which is listed on the Exchange must comply with it since they are required by GEM Rule 5.01 to exercise duties of skill, care and diligence to the standard set by Hong Kong law.

The standard is higher than previously since the objective test in Section 465(2)(a) is a minimum standard and cannot be adjusted downwards to accommodate a person who is incapable of attaining the basic standard of what is reasonably expected of a reasonably diligent person carrying out the same function. The subjective test means that where a person has been appointed as a director because he has some special skill, knowledge or experience (for example an accountant), a higher standard of care, skill and diligence will be required of that director compared to directors without such special skill, knowledge or experience.

III. CONSEQUENCES OF NON-COMPLIANCE WITH THE GEM RULES

Under GEM Rule 3.10, if a director breaches any of the GEM Rules, the Exchange may respond with disciplinary procedures including but not limited to:

- issuing a private reprimand;

- issuing a public statement which involves criticism;

- issuing a public censure;

- reporting the offender’s conduct to a regulatory authority (for example the Securities and Futures Commission (the “SFC”)) or to an overseas regulatory authority;

- requiring a breach to be rectified or other remedial action taken within a stipulated period;

- in the case of wilful or persistent failure by a director of a issuer to discharge his responsibilities under the GEM Rules, state publicly that in the Exchange’s opinion the retention of office by the director is prejudicial to the interest of investors and, in the event that a director remains in office following the public statement, suspend or cancel the listing of the issuer’s securities; and

- taking or refraining from taking such other action as the Exchange thinks fit.

If the Exchange considers that the listed issuer failed in a material manner to comply with the GEM Rules, the Exchange may, under GEM Rule 9.01, suspend dealings in the issuer’s securities or cancel the listing of the issuer’s securities.

Directors should also be aware that it is a criminal offence under section 384 of the SFO to intentionally or recklessly provide any information which is false or misleading in a material particular in any public disclosure document filed with the Exchange or the SFC (this will include any document filed under the GEM Rules’ continuing disclosure obligations). The offence carries a maximum penalty of 2 years’ imprisonment and a fine of HK$1 million.

Under section 214 of the SFO, the court may make orders disqualifying a person from being a director of any corporation for up to fifteen years if he is found to be wholly or partly responsible for the misconduct of a company’s affairs. Misconduct for these purposes will include where shareholders have not been given all the information with respect to the company’s business or affairs which they might reasonably expect. In March 2010, the SFC disqualified two former executive directors of Warderly International Holdings Ltd for five years for failing to inform the company’s shareholders that the company was in a substantially depleted financial position.

IV. DIRECTORS’ LIABILITY FOR MISSTATEMENTS IN PROSPECTUS

The Listing Rules require an issuer’s directors to take full responsibility for the contents of a prospectus. The prospectus must contain a responsibility statement which states that “the directors, having made all reasonable enquiries, confirm that to the best of their knowledge and belief the information contained in this document is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make any statement herein or this document misleading.”

Untrue statements contained in a prospectus or the omission of material information (“misstatements”) may result in criminal and/or civil liability for the issuer’s directors. The principal areas of liability include:

- Section 342E Companies (Winding Up and Miscellaneous Provisions) Ordinance (“CWUMPO”) – imposes civil liability for prospectus misstatements on specified persons (including directors)

- Section 342F CWUMPO – imposes criminal liability for prospectus misstatements on persons who “authorized the issue of a prospectus” (which may include the directors)

- Section 108(1) SFO – imposes civil liability for making any fraudulent, reckless or negligent misrepresentation which induces others to invest money

- Sections 277 & 281 SFO – impose civil liability for disclosing false or misleading information to induce dealings in securities

- Section 391 SFO – imposes civil liability for false or misleading public communications to induce dealings in securities

- Section 107 SFO – imposes criminal liability for making any fraudulent or reckless misrepresentation to induce others to deal in securities

- Section 298 SFO – imposes criminal liability for disclosure of false or misleading information to induce dealings

- Section 384 SFO – imposes criminal liability for provision of false or misleading information in a prospectus or other document filed with the Exchange or the SFC

Liability can also arise: (i) under the Misrepresentation Ordinance or the Theft Ordinance; (ii) in tort; or (iii) under contract.

For further information, please see the attached note “Potential Liabilities under Hong Kong Law in Connection with the Publication of a Prospectus on the Listing of a Company on the Stock Exchange of Hong Kong”.

V. RESTRICTION ON DISCLOSURE OF MATERIAL INFORMATION TO ANALYSTS

The Hong Kong prospectus is the sole document by which the company sells its shares in the Hong Kong IPO.

Any other additional document by which securities are offered to the public (or members of the public) could constitute a “prospectus” under Hong Kong law, in which case:

- the prospectus content requirements will apply;

- the translation requirements will apply; and

- the registration requirement will apply.

Breach of the prospectus laws is a criminal offence.

To avoid the risk of liability, the directors and senior management of the company must ensure that no material information about the company or its securities is provided to any investment research analyst, unless the information is reasonably expected to be included in the prospectus or is publicly available.

- When assessing whether any such information is “material” information, the test that should be applied is whether the information is material to an investor in forming a valid and justifiable opinion of the company and its financial condition and profitability.

- This restriction covers any information provided to an analyst, directly or indirectly, formally or informally, in writing or verbally. It covers all communications in a meeting, during a presentation, site visit or interview, or in any other context.

It is of utmost importance that no additional material non-public information is provided to other persons, including analysts.

- In case of disclosure (whether intentional or not) to analysts, the company may be compelled to disclose the same information in the prospectus;

- Such information may not be appropriate for a prospectus and may not be verifiable.

Consequences of putting such a statement in the prospectus

The consequences of including information in the prospectus are that:

- any untrue statement (including any statement that is false, misleading or deceptive) in a prospectus may give rise to criminal and civil liability, including personal liabilities of each director and any other person who authorised the issue of the prospectus; and

- the directors must likewise take personal liability for the truthfulness, accuracy and completeness of any information the company may be compelled under the SFC rules to insert into the prospectus under the above circumstances.

The restriction covers any information provided to an analyst, directly or indirectly, formally or informally, in writing or otherwise.

The Company is strongly advised to seek the guidance and assistance of its sponsor(s), its Hong Kong legal advisers and those of the sponsor if there are any uncertainties.

VI. RESTRICTION ON FUNDAMENTAL CHANGE IN THE NATURE OF THE BUSINESS IN 12 MONTHS AFTER LISTING

In the first 12 months after dealings in an issuer’s securities commence on GEM, an issuer is prohibited from entering into any transaction or arrangement which would result in a fundamental change to its principal business activities or those of its group.

The Exchange may grant a waiver of this prohibition if the circumstances are exceptional and the transaction or arrangement is approved by the shareholders in general meeting by a resolution on which any controlling shareholder (or if there are no controlling shareholders, any chief executive or directors (other than INEDs) of the listed issuer) and their respective associates are required to abstain from voting in favour. Shareholders with a material interest in the transaction and their associates are also required to abstain from voting on the transaction.

VII. RESTRICTIONS ON DISPOSALS BY CONTROLLING SHAREHOLDERS FOLLOWING LISTING

The Listing Rules impose restrictions on the disposal of securities by a controlling shareholder following a company’s new listing. Any person shown by the listing document to be a controlling shareholder of the issuer at the time of listing must not:

- dispose of, or enter into any agreement to dispose of, or create any options, rights, interests or encumbrances in respect of, any shares which the listing document shows to be beneficially owned by him in the period commencing on the date on which disclosure of the shareholding is made in the listing document and ending 6 months from the date on which dealings in the securities of the new applicant commence on the Exchange; or

- dispose of, or enter into any agreement to dispose of, or create any options, rights, interests or encumbrances in respect of, any shares which the listing document shows to be beneficially owned by him if such disposal would result in him ceasing to be a controlling shareholder in the period of 6 months commencing on the date on which the period referred to in (i) above expires (GEM Rule 13.16(A)).

There are exceptions to the above prohibitions on disposals by controlling shareholders for:

- pledges or charges of shares created in favour of an authorised financial institution (as defined in the Banking Ordinance) as security for a bona fide commercial loan;

- disposals made pursuant to a power of sale under a pledge or charge referred to at (i) above;

- disposals on the death of a controlling shareholder or in other exceptional circumstances approved by the Exchange.

Controlling shareholders must however immediately inform the issuer if they pledge or charge any of their shares in favour of an authorised institution or pursuant to a waiver granted by the Exchange during the period commencing on the date by reference to which the shareholding is disclosed in the listing document and ending 12 months from the date on which dealings commence on the Exchange (GEM Rule 13.19).

VIII. DISCLOSURE OF PRICE SENSITIVE INFORMATION

The statutory regime governing listed corporations’ (“corporations”) disclosure of price sensitive information (referred to in the legislation as “inside information”) is set out in Part XIVA of the Securities and Futures Ordinance (“SFO”) which came into effect on 1 January 2013. The SFC has published Guidelines on Disclosure of Inside Information (“SFC Guidelines”) to assist corporations to comply with the disclosure obligation. The regime is referred to as “Inside Information Provisions” in the Listing Rules.

The regime creates a statutory obligation on corporations to disclose inside information to the public, as soon as reasonably practicable after inside information has come to their knowledge. Breaches of the disclosure requirement are dealt with by the Market Misconduct Tribunal (“MMT”) which can impose a number of civil sanctions including a maximum fine of HK$8 million on the corporation and on its directors and chief executive in certain circumstances.

The Securities and Futures Commission (the “SFC”) can institute proceedings directly before the MMT to enforce the disclosure requirement.

1. Key elements of the regime

Key elements of the regime include:

- The application of an objective test in determining whether information is “inside information” – whether a reasonable person, acting as an officer of the corporation, would consider that the information is inside information in relation to the corporation;

- An obligation on a corporation to disclose “inside information” as soon as reasonably practicable after it comes to the knowledge of the corporation (i.e. after the information has, or ought reasonably to have, come to the knowledge of an officer of the corporation in the course of performing functions as an officer of the corporation);

- An obligation on the directors and officers of a corporation to take all reasonable measures to ensure that proper safeguards exist to prevent the corporation breaching the statutory disclosure requirement;

- For directors and officers of a corporation to be individually liable for the corporation’s breach of the statutory disclosure obligation, if they are in breach of the obligation referred to above or if the corporation’s breach is a result of any intentional, reckless or negligent conduct on their part;

- The provision of safe harbours for legitimate circumstances where non-disclosure or late disclosure is permitted;

- The SFC can rely on its powers under the SFO to investigate suspected breaches and to institute proceedings directly before the MMT;

- The MMT can impose a range of civil sanctions, including a fine of up to HK$8 million on the corporation, a director or chief executive of the corporation and disqualification of a director or officer for up to 5 years; and

- A corporation or officer found to have breached the statutory disclosure requirement may be liable to pay compensation to any person who has suffered financial loss as a result of the breach (provided it is fair, just and reasonable that it/he should do so).

2. Definition of inside information

The regime uses the term “inside information” to refer to price sensitive information which a corporation must disclose. “Inside information” is defined in Section 307A SFO as:

specific information that:

- is about:

- the corporation;

- a shareholder or officer of the corporation; or

- the listed securities of the corporation or their derivatives; and

- is not generally known to the persons who are accustomed or would be likely to deal in the listed securities of the corporation but would if generally known to them be likely to materially affect the price of the listed securities.

The inside information which a corporation is required to disclose is the same information that is prohibited from being used for dealing in the securities of the corporation under the insider dealing regime in Parts XIII and XIV of the SFO.

Objective test

An objective test should be applied in considering whether a piece of information is inside information. The test is whether a reasonable person, acting as an officer of the corporation, would consider that the information is inside information in relation to the corporation.

Key elements of the definition

The three key elements of the definition are that:

(a) the information must be specific;

(b) the information must not be generally known to that segment of the market which deals or which would likely deal in the corporation’s securities; and

© the information would, if generally known be likely to have a material effect on the price of the corporation’s securities.

The SFC Guidelines provide guidance as to how these terms have been interpreted by the MMT in the past.

Specificity of information

- The information must be capable of being identified, defined and unequivocally expressed

Information regarding a corporation’s affairs will be sufficiently specific if “it carries with it such particulars as to a transaction, event or matter, or proposed transaction, event or matter, so as to allow that transaction, event or matter to be identified and its nature to be coherently understood”. - The information need not be precise

Information may be specific even though the particulars or details are not precisely known. For example, information that a corporation is in financial difficulty or proposes to conduct a share placing would be regarded as specific even if the details are not known. - Information on a transaction that is only contemplated or under negotiation (and not yet subject to a final agreement (formal or informal) can be specific information

To constitute specific information, a proposal should be beyond the stage of a vague exchange of ideas or a “fishing expedition”. If negotiations or contracts have occurred, there should be a substantial commercial reality to the negotiations which should be at the stage where the parties intend to negotiate with a realistic view to achieving an identifiable goal. - Mere rumours, vague hopes or worries, wishful thinking and unsubstantiated conjecture are not specific information.

“Not generally known”

The SFC Guidelines note that rumours, media speculation and market expectation about an event or circumstances of a corporation cannot be equated with information which is generally known to the market. There is a clear distinction between the market having actual knowledge of a hard fact which has been properly disclosed by the corporation and speculation or expectation as to an event or circumstances which will require proof.

In determining whether information the subject of media comments or analysts’ reports or carried by news service providers is generally known, the corporation should consider the accuracy, completeness and reliability of the information disseminated and not only how widely the information has been disseminated. Where the information disseminated is incomplete or there are material omissions or there are doubts as to its bona fides, the information cannot be regarded as generally known and the corporation is required to make full disclosure.

“Likely to have a material effect on the price of the listed securities”

Whether inside information is likely to materially affect the price of a corporation’s securities is judged based on whether the inside information would influence persons who are accustomed to or would be likely to deal in the corporation’s shares, in deciding whether or not to buy or sell such shares. The test is necessarily a hypothetical one since it must be applied at the time the information becomes available.

The SFC Guidelines contain a non-exhaustive list of events or circumstances where a corporation should consider whether a disclosure obligation arises.

3. Timing of disclosure

A corporation must disclose inside information to the public as soon as reasonably practicable after any inside information has come to its knowledge (section 307B(1) SFO). Inside information has come to the corporation’s knowledge if:

- the inside information has, or ought reasonably to have, come to the knowledge of an officer of the corporation in the course of performing functions as an officer of the corporation; and

- a reasonable person, acting as an officer of the corporation, would consider that the information is inside information in relation to the corporation (section 307B(2) SFO).

Corporations must therefore ensure that they have effective systems and procedures in place to ensure that any material information which comes to the knowledge of any of their officers is promptly identified and escalated to the board to determine whether it needs to be disclosed.

Meaning of “as soon as reasonably practicable”

According to the SFC Guidelines, “as soon as reasonably practicable” means that the corporation should immediately take all steps that are necessary in the circumstances to disclose the information to the public. The necessary steps that the corporation should take immediately before the publication of an announcement may include: ascertaining sufficient details; internal assessment of the matter and its likely impact; seeking professional advice where required and verification of the facts (paragraph 40 of the SFC Guidelines).

The corporation must ensure that the information is kept strictly confidential until it is publicly disclosed. If the corporation believes that the required degree of confidentiality cannot be maintained or that there may have been a breach of confidentiality, it should immediately disclose the information to the public (paragraph 41 of the SFC Guidelines). The SFC Guidelines also raise the possibility of a corporation issuing a “holding announcement” to give the corporation time to clarify the details and likely impact of an event before issuing a full announcement.

The definition of “officer”

Under the SFO, an officer is a director, manager, secretary or any other person involved in a corporation’s management. In the context of the inside information disclosure regime, a “manager” generally connotes a person who, under the immediate authority of the board, is charged with management responsibility affecting the whole or a substantial part of the corporation. A secretary refers to a company secretary. The information which must be disclosed is restricted to that which becomes known in situations where the officer is acting in that capacity.

4. Manner of disclosure

Inside information must be disclosed by way of publication of an announcement on the websites of GEM and the listed corporation. Publication on the Exchange’s website fulfils the requirement of section 307C(1) SFO that disclosure of inside information must be made in a manner that can provide for equal, timely and effective access by the public to the information disclosed (by virtue of section 307C(2) SFO).

The SFC Guidelines provide that corporations can use additional means to disseminate inside information such as press releases issued through news or wire services, press conferences in Hong Kong and/or posting an announcement on their own websites. These must be additional to announcing the information on the GEM website as they would not themselves satisfy the requirements of section 307C(1) SFO.

If a corporation is listed on more than one stock exchange, the inside information must be disclosed to the public in Hong Kong at the same time as it is released to the overseas markets. If inside information is released to an overseas market while the Hong Kong market is closed, the corporation should issue an announcement in Hong Kong before the Hong Kong market opens for trading. If necessary, the corporation can request a suspension of trading in its securities pending issue of the announcement in Hong Kong.

The information contained in an announcement of inside information must be complete and accurate in all material respects and not be misleading or deceptive (whether by omission or otherwise).

5. The safe harbours

Section 307D SFO provides four safe harbours to permit corporations to not disclose or delay disclosing inside information. Except for Safe Harbour A, corporations may only rely on the safe harbours if they have taken reasonable precautions to preserve the confidentiality of the inside information and the inside information has not been leaked.

Safe Harbour A: When disclosure would breach an order by a Hong Kong court or any provisions of other Hong Kong statutes

This grants a safe harbour to corporations if they are prohibited from disclosing inside information under a Hong Kong court order or any Hong Kong statute.

Safe Harbour B: When the information relates to an incomplete proposal or negotiation

The SFC Guidelines give the following examples:

- when a contract is being negotiated but has not been finalised;

- when a corporation decides to sell a major holding in another corporation;

- when a corporation is negotiating a share placing with a financial institution; or

- when a corporation is negotiating the provision of financing with a creditor.

The SFC Guidelines note that where a corporation is in financial difficulty and is negotiating with third parties for funding, reliance on this safe harbour will mean that it will not be necessary to disclose the negotiations. The safe harbour does not however allow the corporation to withhold disclosure of any material change in its financial position or performance which led to the funding negotiations and, to the extent that this is inside information, should be the subject of an announcement.

Safe Harbour C: When the information is a trade secret

There is no statutory definition of trade secret. However the SFC Guidelines provide that a “trade secret” generally refers to proprietary information owned by a corporation:

- used in a trade or business of the corporation;

- which is confidential (i.e. not already in the public domain);

- which, if disclosed to a competitor, would be liable to cause real or significant harm to the corporation’s business interests; and

- the circulation of which is confined to a limited number of persons on a need-to-know basis.

Trade secrets may concern inventions, manufacturing processes or customer lists. However a trade secret does not cover the commercial terms and conditions of a contractual agreement or the financial information of a corporation, which cannot be regarded as proprietary information or rights owned by the corporation.

Safe Harbour D: When the government’s exchange fund or a central bank provides liquidity support to the corporation

Under this safe harbour, no disclosure is required for information concerning the provision of liquidity support from the exchange fund of the government or from an institution which performs the functions of a central bank (including one located outside Hong Kong) to the corporation or any member of its group.

Safe harbour condition of confidentiality

Except for Safe Harbour A, the safe harbours are only available if and so long as:

- the corporation takes reasonable precautions for preserving the confidentiality of the information; and

- the confidentiality of the information is preserved.

If confidentiality is lost or the information is leaked, the safe harbour will cease to be available and the corporation must disclose the inside information as soon as practicable.

If confidentiality is lost, the corporation will not be regarded as in breach of the disclosure requirement in respect of inside information if it can show that it:

- has taken reasonable measures to monitor the confidentiality of the information in question; and

- made disclosure as soon as reasonably practicable, once it became aware that the confidentiality of the information had not been preserved.

SFC’s power to grant waivers

The SFC can grant waivers where the disclosure of inside information in Hong Kong would be prohibited under a court order or legislation of another jurisdiction or would contravene a restriction imposed by a law enforcement agency or government authority in another jurisdiction (section 307E(1)SFO). The SFC will grant waivers on a case-by-case basis and may attach conditions. A corporation must copy to the Exchange any application to the SFC for a waiver from the disclosure obligation and the SFC’s decision when received.

6. Liability of officers

The officers of a corporation are required to take all reasonable measures to ensure that proper safeguards exist to prevent the corporation’s breach of the inside information disclosure requirement (section 307G(1)). Although an officer’s breach of this provision is not actionable of itself, an officer will be regarded as having breached the inside information disclosure obligation if the listed corporation has breached such obligation and either:

- the breach resulted from the officer’s intentional, reckless or negligent conduct; or

- the officer has not taken all reasonable measures to ensure that proper safeguards exist to prevent the breach (section 307G(2) SFO).

In relation to officers’ obligation to take all reasonable measures to ensure the existence of proper safeguards, the SFC Guidelines focus on the responsibility of officers, including non-executive directors, to ensure that appropriate systems and procedures are put in place and reviewed periodically to enable the corporation to comply with the disclosure requirement. Officers with an executive role will also have a duty to oversee the proper implementation and functioning of the procedures and to ensure the detection and remedy of material deficiencies in a timely manner. The particular needs and circumstances of the listed corporation should be taken into account in establishing appropriate systems and procedures. The SFC Guidelines provide a non-exhaustive list of examples of systems and procedures which listed corporations should consider implementing.

7. Sanctions

The MMT can impose one or more of the following penalties:

- a fine of up to HK$8 million on the corporation, a director or chief executive (but not officers) of the corporation;

- disqualification of the director or officer from being a director or otherwise involved in the management of a corporation for up to five years;

- a “cold shoulder” order on the director or an officer (i.e. the person is deprived of access to market facilities for dealing in securities, futures contracts and other investments) for up to five years;

- a “cease and desist” order on the corporation, director or officer (i.e. an order not to breach the statutory disclosure requirement again);

- an order that any body of which the director or officer is a member be recommended to take disciplinary action against him: and

- payment of costs of the civil inquiry and/or the SFC investigation by the corporation, director or officer.

To try and prevent the occurrence of further breaches of the disclosure requirement, the MMT may additionally require:

- the appointment of an independent professional adviser to review the corporation’s procedures for disclosure of PSI and advise it on matters relating to compliance; and

- the officer to undertake a training programme approved by the SFC on compliance with Part XIVA SFO, directors’ duties and corporate governance.

8. Civil liability – Private right of action

A corporation or officer found to be in breach of the statutory disclosure obligation may be found liable to pay compensation to any person who has suffered financial loss as a result of the breach in separate proceedings brought by such person under Section 307Z SFO. The corporation or officer will be liable to pay damages provided that it is fair, just and reasonable that it/he should do so. A determination by the MMT that a breach of the disclosure requirement has taken place or identifying a person as being in breach of the requirement will be admissible in evidence in any such proceedings to prove that the disclosure requirement has been breached or that the person in question has breached that requirement. The courts may also impose an injunction in addition to or in substitution for damages.

IX. LISTING RULE DISCLOSURE OBLIGATIONS

1. The role and duties of the SFC and the Exchange

The SFC is responsible for enforcement of the statutory obligation to disclose inside information. The Exchange will not give guidance on the interpretation or operation of the SFO or the SFC Guidelines. Where, however, the Exchange is aware of a possible breach of the statutory disclosure obligation, the Exchange will refer it to the SFC. The Exchange will not take any disciplinary action itself under the Rules, unless the SFC considers it inappropriate to pursue the matter under the SFO and the Exchange considers action under the Rules for a possible breach of the Rules to be appropriate. An issuer will not face enforcement action by the SFC and the Exchange at the same time, in respect of the same set of facts.

2. Obligation to avoid false market (GEM Rule 17.10(1))

If it is the Exchange’s view that there is, or is likely to be, a false market in a listed issuer’s securities, the issuer must announce the information necessary to avoid a false market as soon as reasonably practicable after consultation with the Exchange.

An issuer is also required to contact the Exchange as soon as reasonably practicable if it believes that there is likely to be a false market in its securities.

Under GEM Rule 17.10(2), where an issuer is required to disclose inside information under the SFO, it must simultaneously announce the information. An issuer is also required to simultaneously copy to the Exchange any application to the SFC for a waiver from the requirement to disclose inside information and to promptly copy to the Exchange the SFC’s decision whether to grant such a waiver.

3. Obligation to respond to the Exchange’s enquiry

Under GEM Rule 17.11, if the Exchange makes an enquiry concerning unusual movements in the price or trading volume of an issuer’s listed securities, the possible development of a false market in its securities, or any other matters, an issuer will be required to respond promptly to the Exchange’s enquiries in one of the following two ways:

- provide to the Exchange and, if requested by the Exchange, announce any information relevant to the subject matter(s) of the enquiries available to it, so as to inform the market or to clarify the situation; or

- if appropriate, and if requested by the Exchange, issue a standard announcement confirming that, the directors, having made such enquiry with respect to the issuer as may be reasonable in the circumstances, are not aware of any information that is or may be relevant to the subject matter(s) of the enquiries, or of any inside information which needs to be disclosed under the SFO.

The standard form of the announcement in response to an enquiry is set out in Note 1 to GEM Rule 17.11:

“This announcement is made at the request of The Stock Exchange of Hong Kong Limited.

We have noted [the recent increases/decreases in the price [or trading volume] of the [shares/warrants] of the Company] or [We refer to the subject matter of the Exchange’s enquiry]. Having made such enquiry with respect to the Company as is reasonable in the circumstances, we confirm that we are not aware of [any reasons for these price [or volume] movements] or of any information which must be announced to avoid a false market in the Company’s securities or of any inside information that needs to be disclosed under Part XIVA of the Securities and Futures Ordinance.

This announcement is made by the order of the Company. The Company’s Board of Directors collectively and individually accept responsibility for the accuracy of this announcement.”

GEM Rule 17.11 states that an issuer does not need to disclose inside information under the Rules if the information is exempt from disclosure under Part XIVA SFO.

The Exchange reserves the right to direct a trading halt of an issuer’s securities if an announcement under GEM Rule 17.11 cannot be made promptly.

4. Trading halts or suspension

GEM Rule 17.11A requires an issuer to request a trading halt or trading suspension if an announcement cannot be made promptly in any of the following circumstances:

- where an issuer has information which must be disclosed under the GEM Rule 17.10;

- an issuer reasonably believes that there is inside information which must be disclosed under Part XIVA SFO; or

- inside information may have been leaked where it is the subject of an application to the SFC for a waiver from compliance with the statutory disclosure obligation or where it is exempt from the statutory disclosure obligation (except if the exemption concerns disclosure prohibited by Hong Kong law or an order of a Hong Kong court).

Under GEM Rule 9.04, the Exchange also has the right to direct a trading halt or suspend dealings in an issuer’s securities in a number of circumstances, including where:

- there are unexplained movements in the price or trading volume of the issuer’s listed securities or where a false market for the trading of such securities has developed and the issuer’s authorised representative cannot immediately be contacted to confirm that the issuer is not aware of any matter that is relevant to the unusual price movement or trading volume or the development of a false market;

- the issuer delays in issuing an announcement in response to enquiries from the Exchange under GEM Rule 17.11; or

- there is uneven dissemination or leakage of inside information in the market giving rise to an unusual movement in the price or trading volume of the issuer’s listed securities.

X. ANNOUNCEMENTS

1. The Listing Rules require listed companies to publish announcements in a wide range of situations.

The Exchange’s Guide on Pre-vetting Requirements and Selection of Headline Categories for Announcements (“Pre-Vetting Guide”) (attached at Annex C) sets out the situations in which an announcement is required under the GEM Rules, whether or not the announcement is required to be vetted by the Exchange before publication and the headline categories which will generally apply. The following is a summary of the main situations in which a listed issuer is required to publish an announcement.

Price-sensitive information – any price-sensitive information which is discloseable as inside information under Part XIVA SFO must be announced and kept strictly confidential until a formal announcement is made.

Notifiable transactions – any notifiable transaction within Chapter 19 of the GEM Rules.

Connected transactions – any connected transaction (unless an exemption is available) within Chapter 20 of the GEM Rules.

Advances and financial assistance to third parties – the listed issuer or any of its subsidiaries makes a “relevant advance to an entity” which:

- exceeds 8% of the total assets of the listed issuer (GEM Rule 15); or

- is greater than the previously disclosed relevant advance by 3% or more of the listed issuer’s total assets (GEM Rule 16).

The expression “relevant advance to an entity” means the aggregate of amounts due from and all guarantees given on behalf of an entity, its controlling shareholder, its subsidiaries, its affiliated companies and any other entity with the same controlling shareholder as itself (Note 2 to GEM Rule 17.14). An advance to a subsidiary of the listed issuer, or between subsidiaries of the listed issuer, is not regarded as a relevant advance to an entity (GEM Rule 17.15).

Financial assistance to affiliated companies – where financial assistance and guarantees of financial assistance given by the listed issuer or any of its subsidiaries to affiliated companies (being those which are equity accounted for by the issuer) of the listed issuer together exceed 8% of the listed issuer’s total assets (GEM Rule 17.18).

Pledge of controlling shareholder’s interest – where the controlling shareholder of the listed issuer has pledged its interest in shares of the issuer to secure debts of the issuer or to secure guarantees or other support of obligations of the issuer (GEM Rule 17.19).

Loan agreements – where:

- the listed issuer (or any of its subsidiaries) enters into a loan agreement that imposes specific performance obligations on any controlling shareholder (e.g. a requirement to maintain a specified minimum holding in the share capital of the listed issuer) and breach of such obligation will cause a default in respect of loans that are significant to the operations of the listed issuer (GEM Rule 20); or

- the listed issuer or any of its subsidiaries breaches the terms of a loan that is significant to the operations of the group, such that the lender may demand immediate repayment and the breach has not been waived by the lender (GEM Rule 21).

Takeover offers – an announcement must be made once a takeover offer is made or accepted, as required by the Takeovers Code.

Accounts and auditors

Board meeting for approval of results – an issuer must inform the Exchange and publish an announcement at least 7 clear business days in advance of the date fixed for any board meeting at which the profits or losses for any period are to be approved for publication (GEM Rule 17.48).

Annual, half-year and quarterly results – must be published by way of announcement under Chapter 18 of the GEM Rules.

Change in auditor or financial year end – any change in a listed issuer’s auditors or financial year end, the reason(s) for the change and any other matters that need to be brought to the attention of holders of the company’s securities. The issuer’s announcement must state whether the outgoing auditors have confirmed that there are no matters that need to be brought to the attention of holders of the company’s securities (GEM Rule 17.50(4)). The issuer must appoint an auditor at each annual general meeting (AGM) to hold office until the next AGM. Any proposal to remove an auditor before the end of its term of office must be approved by shareholders in general meeting (GEM Rule 17.100).

Company matters

Change of company name – once the board decides to change the company name (Schedule to Appendix 24 of the GEM Rules).

Memorandum and Articles of Association – any proposed alteration of the memorandum or articles of association (or equivalent documents) of the listed issuer (GEM Rule 17.50(1)).

Registered office – any change in the company’s registered address, agent for service of process in Hong Kong or registered office or registered place of business in Hong Kong (GEM Rule 17.50(5)).

Share registrar – any change of the company’s share registrar (including any overseas branch share registrar) (GEM Rule 17.50(3)).

Dividends – an issuer must inform the Exchange and publish an announcement at least 7 clear business days in advance of the date fixed for any board meeting at which the declaration, recommendation or payment of a dividend is expected to be decided (GEM Rule 17.48). Any decision of the board to declare, recommend or pay a dividend or not to do so must be announced immediately, and include the rate, amount and expected payment date (GEM Rules 17.49(1) and (2)).

Change in nature of business – a proposed fundamental change in the principal business activities of the issuer or its group must be announced immediately after it has been the subject of any decision (GEM Rule 17.25).

Winding-up or Liquidation – the appointment of a receiver or manager, the presentation of any winding-up petition or the passing of any resolution authorising the winding up of the listed issuer, its holding company or any of its major subsidiaries (i.e. a subsidiary representing 5% under any of the percentage ratios (please see “Notifiable Transactions” below) or any similar insolvency events (GEM Rule 17.27(1)).

Decision to withdraw listing – a proposed withdrawal of listing must be notified to shareholders by way of publication of an announcement (GEM Rule 9.23).

Corporate governance

Audit committee – if the issuer fails to set up an audit committee or does not meet the membership requirements (GEM Rule 5.33). An announcement must also be published of any change in membership of the audit committee (GEM Rule 17.50(3)).

Remuneration committee – if the issuer fails to set up a remuneration committee or does not comply with the requirements as to its composition or terms of reference (GEM Rule 5.36).

Directors and officers

Board composition and independent non-executive directors – an announcement must be made if the number of the issuer’s independent non-executive directors (“INEDs”) is less than three or one third of the number of directors on the board, or if it does not have at least one INED with appropriate professional qualifications or accounting or related financial management expertise (GEM Rule 5.06).

Change in company secretary – an announcement must be made once the board has decided to change the company secretary (GEM Rule 17.50(3)).

Change in compliance adviser – an announcement must be made as soon as a compliance adviser resigns, and arrangements must be made immediately to appoint a new compliance adviser. Once a new compliance adviser has been appointed, another announcement must be made (GEM Rules 17.50(3) and 6A.29).

Change in compliance officer – an announcement must be published of any change to the issuer’s compliance officer (GEM Rule 17.50(3)). The issuer must also immediately publish an announcement if it does not have a compliance officer at any time (GEM Rule 5.23).

Change in directors – any change of directors, including, in the case of the resignation of a director, the reasons given by the director for his resignation (GEM Rule 17.50(2)). An announcement of the appointment of a new director or re-designation of a director must include the information specified in GEM Rule 17.50(2).

Change in disclosed information about directors – any change to the information specified in paragraphs (h) to (v) of GEM Rule 17.50(2) previously disclosed about a director must be announced (GEM Rule 17.50A). Such information relates mainly to matters which may cast doubt on the integrity of the directors involved and their suitability for continuing to serve as directors. Any change in the information specified in paragraphs (a) to (e) and (g) of GEM Rule 17.50(2) must be set out in the next published annual or interim report (GEM Rule 17.50A(1)). The Rules include an obligation for directors to inform the issuer immediately of any information specified in GEM Rule 17.50(2) and any change to such information (GEM Rule 17.50B).

Meetings

Notice of general meetings – notice of an issuer’s annual general meeting and other general meetings must be announced (GEM Rules 17.44 and 17.46(2)).

Results of general meetings – the results must be published before commencement of trading on the business day following the meeting (GEM Rule 17.47(5)).

Shares

Issues of securities – an issue of securities (including convertible securities or warrants, options or similar rights) will almost always require an announcement (except an exercise of options under an employee share scheme) either as inside information under GEM Rule 17.10(2)(a), or under Chapter 19 or 20, or under GEM Rule 17.30.

Changes in number of issued shares – certain changes in the number of issued shares must be reported to the Exchange for publication on the Exchange’s website on the following business day (GEM Rule 17.27A). Issuers must also submit a monthly return of changes in their equity securities, debt securities and other securitised instruments (GEM Rule 17.27B).

Share option schemes – an employee share option scheme must be approved by shareholders in general meeting and a listed issuer must publish an announcement of the outcome of the meeting as soon as possible and no later than the business day following the meeting (GEM Rule 23.02(1)(a)). Further announcements must be published on the grant of share options pursuant to a share option scheme specifying the information required by GEM Rule 23.06A. The announcement is required to include details of the date of grant, the exercise price and number of options granted, the market price of the issuer’s securities on the date of the grant, the name of any grantee who is, or is an associate of, a director, chief executive or substantial shareholder of the listed issuer and the number of options granted to such person, and the validity period of the options.

Basis of allotment of securities – the basis of allotment of any securities offered to the public for subscription or sale or an open offer and of the results of the offer and, if applicable, of the basis of any acceptance of excess applications. The company must notify the Exchange of such matters no later than the morning of the next business day after the allotment letters or other relevant documents of title are posted (GEM Rule 16.13).

Public float – the company must inform the Exchange immediately and publish an announcement if it becomes aware that the number of its listed securities held by the public has fallen below the prescribed minimum percentage (i.e. 25% unless a lower percentage of between 15% and 25% was approved by the Exchange on listing for a company having an expected market capitalisation at the time of listing of more than HK$10 billion) (GEM Rules 11.23(7), 11.23(10) and 17.36).

Share Repurchases – Listed issuers must submit a completed return after any purchase, sale, drawing or redemption by the issuer or its group members of its listed securities (whether on the Exchange or not) (GEM Rule 17.35). The issuer should also be aware of the provisions of the Code on Share Buy-backs which sets out detailed rules governing any offer to purchase, redeem or otherwise acquire the shares of a listed issuer made by or on behalf of the listed issuer to any of its shareholders.

2. Announcements which require pre-vetting by the Exchange

Announcements of the following matters or transactions must be submitted to the Exchange for review and approval before publication under GEM Rule 17.53(2):

- very substantial acquisitions, very substantial disposals or reverse takeovers under GEM Rules 19.34 and 19.35;

- transactions or arrangements within 12 months after listing which would result in a fundamental change in principal business activities under GEM Rules 19.88 to 19.90; and

- matters relating to cash companies under GEM Rules 19.82 and 19.83.

Announcements other than those specified in GEM Rule 17.53(2) do not need to be pre-vetted by the Exchange, although companies may consult the Exchange regarding rule compliance issues. The Exchange also reserves the right under GEM Rule 17.53A to require listed companies to submit for review any draft announcement, circular or other document in individual cases.

For a summary of the pre-vetting requirements for announcements, reference should be made to the Exchange’s Pre-vetting Guide at Annex C.

3. Matters requiring prior consultation with Exchange prior to announcement

There are a number of Rule compliance issues relating to notifiable transactions or issues of securities which need the Exchange’s prior consent or confirmation prior to the publication of announcements. These include, but are not limited to, the following:

- whether the Exchange will allow the listed issuer to adopt alternative size test(s) to classify a notifiable transaction under GEM Rule 19.20;

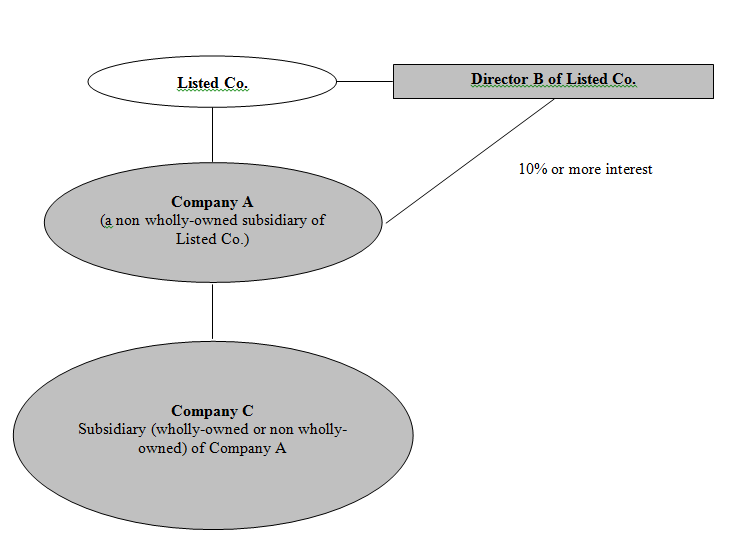

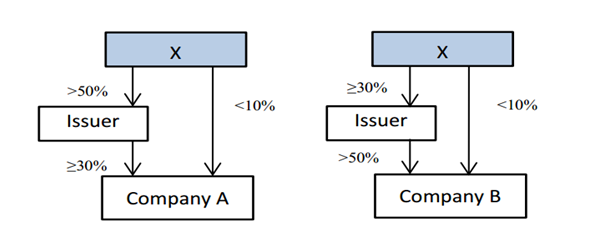

- whether the Exchange will deem a party to a transaction to be a connected person of the listed issuer under GEM Rules 20.17 to 20.19. GEM Rule 20.20 requires a listed issuer to notify the Exchange of any proposed transaction with a party described in such rules unless the transaction is exempt;

- whether the transaction/matter falls under the special or exceptional circumstances described in the Listing Rules, e.g. a proposed issue of securities for cash under general mandate at a price representing a discount of 20% or more to the benchmarked price under GEM Rule 17.42B; or a proposed issue of warrants that would not meet certain specific requirements under GEM Rule 21.02; and

- in the case of matters affecting trading arrangements (including suspension or resumption of trading, and cancellation or withdrawal of listing), GEM Rule 17.53B requires that:

- listed issuers must consult the Exchange before issuing the relevant announcement; and

- the announcement must not include any reference to a specific date or timetable which has not been agreed in advance with the Exchange.

4. Publication of announcements

Announcements are required to be published on the GEM website and on the listed issuer’s own website in accordance with the provisions of GEM Rule 16.17, 16.18 and 16.19. Listed companies must submit an electronic copy of the announcement through the Exchange’s electronic submission system (HKEx-EPS). When doing so, companies must select all appropriate headlines from the list of headline categories which are set out in Appendix 17 to the GEM Rules. Unless stated otherwise in the Rules, all announcements must be published in both English and Chinese.

With the exception of certain limited types of announcements that can be published at all times during the operational hours of the e-Submission System, announcements must only be submitted during the designated publications windows which are:

On a normal business day:

- 6.00 a.m. to 8.30 a.m.

- 12.00 p.m. to 12.30 p.m.

- 4.15 p.m. to 11.00 p.m.

On the eves of Christmas, New Year and Lunar New Year when there is no afternoon session:

- 6.00 a.m. to 8.30 a.m.

- 12.00 p.m. to 11.00 p.m.

The categories of announcements which can be published during trading hours as well as outside trading hours are:

- suspension announcements;

- announcements made in response to unusual movements in share price or trading volume;

- announcements denying the accuracy of news reports or clarifying that only its published information should be relied upon; and

- overseas regulatory announcements.

XI. LISTING DOCUMENTS AND CIRCULARS WHICH REQUIRE PRE-VETTING

GEM Listing Rule 17.53(1) requires the following documents to be submitted to the Exchange for review and approval before publication:

- listing documents (including prospectuses);

- circulars relating to cancellation or withdrawal of listing of listed securities;

- circulars for notifiable transactions which are subject to shareholders’ approval;

- circulars for connected transactions;

- circulars to the company’s shareholders seeking their approval of issues of securities that require specific mandates from the shareholders (under GEM Rule 17.39 and GEM Rule 17.40);

- circulars to the issuer’s shareholders seeking their approval of transactions or arrangements that require independent shareholders’ approval and the inclusion of separate letters from independent financial advisers to be contained in the relevant circulars under GEM Rule 17.47(7), which include:

- spin-off proposals;

- transactions which the Rules require to be subject to independent shareholders’ approval (see GEM Rule 17.47(5)(b)) such as:

- rights issues under GEM Rule 10.29;

- open offers under GEM Rule 10.39;

- refreshments of general mandates before next AGM under GEM Rule 17.42A;

- withdrawal of listings under GEM Rule 9.20; and

- transactions or arrangements that would result in a fundamental change in the principal business activities of the listed issuer within 12 months after listing under GEM Rules 19.88 to 19.90;

- circulars to the issuer’s shareholders seeking consent to an allotment of voting shares that will alter the control of the issuer (under GEM Rule 17.40);

- circulars to shareholders seeking their approval of any matter in relation to a share option scheme which is required under Chapter 23 of the GEM Listing Rules;

- circulars to shareholders seeking their approval of warrant proposals involving approvals by shareholders and all warrant holders under GEM Rule 21.07(3); and

- circulars or offer documents issued by the issuer in connection with takeovers, mergers or offers.

XII. DISCLOSURE OF CHANGES IN THE NUMBER OF ISSUED SHARES

1. Next Day Disclosure Requirements

The Listing Rules (GEM Rule 17.27A) require next day disclosure on the GEM website of 2 categories of changes in the number of issued shares. The first category comprises changes which always require next day disclosure. The second category comprises changes in the number of issued shares which only require next day disclosure in specified circumstances.

Changes Always Requiring Next Day Disclosure

Changes in the number of issued shares, which always require next day disclosure under GEM Rule 17.27A(2)(a) are changes resulting from the following:

- placings;

- consideration issues;

- open offers;

- rights issues;

- bonus issues;

- scrip dividends;

- repurchases of shares or other securities;

- exercise of an option under a share option scheme by a director of the listed issuer;

- exercise of an option other than under a share option scheme by a director of a listed issuer;

- capitalisation reorganisation; or

- change in the number of issued shares not falling within any of the categories referred to at (i) to (x) above or in GEM Rule 17.27A(2)(b).

Categories of Changes Requiring Next Day Disclosure in Specified Circumstances

The following changes in the number of issued shares specified in GEM Rule 17.27A(2)(b) require next day disclosure in specified circumstances:

- exercise of an option under a share option scheme other than by a director of the listed issuer;

- exercise of an option other than under a share option scheme not by a director of the listed issuer;

- exercise of a warrant;

- conversion of convertible securities; or

- redemption of shares or other securities.

The circumstances in which these categories require next day disclosure are:

- where the event, either individually or when aggregated with other events specified in GEM Rule 17.27A(2)(b) that have occurred since the last monthly return or next day disclosure, whichever is the later, results in a change of 5% or more in the number of the listed issuer’s issued shares; or

- where the listed issuer is in any case required to disclose some other change in the number of issued shares under GEM Rule 17.27A(2)(a) and a change in the number of issued shares resulting from an event specified in GEM Rule 17.27A(2)(b) has occurred but has not yet been disclosed in either a monthly return or pursuant to next day disclosure (because the 5% de minimis threshold has not been reached).

The percentage change in the listed issuer’s number of issued shares is calculated by reference to its total number of issued shares as it was immediately before the earliest relevant event which has not yet been reported in either a monthly return or pursuant to next day disclosure.

The next day disclosure return comprises two sections. Section I deals with disclosure under GEM Rule 17.27A and Section II deals with disclosure under GEM Rule 13.13 (the share buyback regime). Share repurchases are discloseable under GEM Rule 17.27A and under GEM Rule 13.13, in which case both sections of the return must be completed.

The next day disclosure return must be submitted through the Exchange’s e-Submission System no later than 30 minutes before the earlier of the commencement of the morning trading session or any pre-opening session on the business day following the relevant event.

2. Monthly Return

A listed issuer is required to submit through HKEx-EPS for publication on the Exchange’s website a monthly return in relation to movements in its equity securities, debt securities and any other securitised instruments during the period to which the monthly return relates (17.27B of GEM Rules). The return must be submitted no later than 30 minutes before the earlier of the commencement of the morning trading session or any pre-opening session on the fifth business day next following the end of each calendar month.

The monthly return must be submitted irrespective of whether there has been any change in the information provided in the previous monthly return. The return must be submitted electronically through the Exchange’s e-submission system and will be published on the Exchange website.

XIII. DISCLOSURE OF FINANCIAL INFORMATION

1. Annual Report and Accounts

The requirements in relation to a company’s annual report and accounts are set out in the Companies Ordinance and in Chapter 18 of the GEM Rules.

Timing of Distribution of Annual Report

A GEM listed issuer must send a copy of its annual report including its annual accounts (and, if it prepares consolidated financial statements, its consolidated financial statements) together with a copy of the auditors’ report to every shareholder and every holder of its listed securities not less than 21 days before the date of its annual general meeting (“AGM”) and no later than 3 months after the end of the financial year (GEM Rule 18.03).

The annual accounts, directors’ report and auditors’ report must be laid before the AGM and must be prepared in both English and Chinese.

In the case of overseas shareholders, it is sufficient for the listed issuer to mail the English language version of the relevant documents only, provided that such documents contain a prominent statement in English and Chinese that a Chinese language version is available from the company on request.

Financial statements must include the disclosures required under the relevant accounting standards adopted as well as the information specified in Chapter 18 of the GEM Rules (“Chapter 18”), including a statement of profit or loss and other comprehensive income, a statement of financial position and information on the rates of dividend paid or proposed for each class of shares

Annual financial statements must be prepared in accordance with Hong Kong or International Financial Reporting Standards or China Accounting Standards for Business Enterprises (“CASBE”) in the case of a Chinese issuer that has adopted CASBE (GEM Rule 18.08).

2. Half-year Reports and Accounts

Listed companies are also required to prepare either half-year reports or summary half-year reports (GEM Rules 18.55 and 18.82) and must send them to the company’s shareholders and holders of their listed securities within 45 days of the end of the first 6 months of each financial year (GEM Rules 18.53 and 18.54).

The contents requirements for half-year reports are set out in GEM Rules 18.55 to 18.65.

There is a requirement that half-year reports are reviewed by the listed issuer’s audit committee (Note 2 to GEM Rule 18.55(9)).

3. Quarterly Reporting

Quarterly reporting is a mandatory obligation under GEM Rule 18.66. A GEM listed issuer must publish quarterly financial results and send them to the company’s shareholders and holders of their listed securities within 45 days of the end of the first and the third quarters.

The contents requirements for quarterly reports are set out in GEM Rules 18.68 to 18.77.

4. Preliminary Announcements of Results

A company listed on the GEM must publish a preliminary announcement of its annual, half-year and quarterly results on the GEM website and the listed issuer’s website as soon as possible and, in any event, not later than 30 minutes before the earlier of the commencement of the morning trading session or any pre-opening session on the business day after their approval by the board.

Preliminary year-end results must be published no later than 3 months after the financial year end. Preliminary half-year results and preliminary quarterly results must be published no later than 45 days after their respective periods.

5. Consequences of Failure to Publish Financial Information

For GEM issuers, the Listing Rules do not provide that the Exchange will require trading in a listed issuer’s shares to be suspended if it fails to publish its financial information on time. However, failure to publish financial information may be interpreted as a breach of the obligation to disclose inside information under Part XIVA SFO.

6. Additional Information Required in Financial Reports of Mineral Companies

- Mineral Companies are required to include in their half-yearly and annual reports details of their exploration, development and mining production activities and a summary of expenditure incurred on these activities during the period under review. If there has been no exploration, development or production activity, that fact must be stated (GEM Rule 18A.14).

However, to the extent that there are material changes in funding requirements or exploration activity, companies may be required to update shareholders immediately under the obligation to disclose inside information under Part XIVA SFO. - Mineral Companies must provide an annual update of their resources and/or reserves in their annual reports (GEM Rule 16). Such updates must be prepared in accordance with the accepted reporting standard under which they were previously disclosed or, if none, under one of the accepted reporting standards (GEM Rule 18A.15). The annual updates are not required to be supported by a Competent Person’s Report and thus may be prepared by the company’s own internal experts. Annual updates may also be provided by way of a no material change statement which can be prepared by companies’ internal management (Note to GEM Rule 18A.17).

- Other (non-Mineral Company) listed issuers that publicly disclose details of resources and/or reserves are also required to provide annual updates of those resources/reserves in their annual reports. Such updates must be prepared in accordance with the reporting standard under which they were previously disclosed or one of the accepted reporting standards (GEM Rule 18A.15). They may also be achieved by way of a no material change statement (Note to GEM Rule 18A.17).

The Exchange has published guidance on the disclosures required in the annual and interim reports of Mineral Companies and other listed issuers which publicly disclose details of their resources and/or reserves. This is set out in Exchange Guidance Letter HKEx-GL47-13 “Continuing Obligations under Chapter 18 (Chapter 18A of GEM Rules)”

XIV. BOARD MEETINGS

The board should meet regularly and board meetings should be held at least four times a year at approximately quarterly intervals (Code Provision A.1.1).

1. Notice to Exchange in certain circumstances

The issuer must inform the Exchange and publish an announcement on the websites of GEM and the issuer at least seven clear business days before the date of any board meeting to consider the declaration, recommendation or payment of a dividend or at which an announcement of the profits or losses for any period are to be approved for publication (GEM Rule 17.48).

2. Voting at Board Meetings

Subject to certain exceptions, a director of a listed issuer may not vote on, nor be counted in the quorum for, any board resolution approving any contract or arrangement or any other proposal in which he or any of his close associates has a material interest (GEM Rule 17.48A).

3. Notice to Exchange after Meetings

The issuer must inform the Exchange immediately of any decision:

- to declare, recommend or pay a dividend or make any other distribution on its listed securities and the rate and amount thereof;

- not to declare, recommend or pay a dividend which would otherwise have been expected;

- on preliminary announcement of profits or losses for any period; and

- on any proposed change in the capital structure, including a redemption of listed securities (GEM Rule 17.49).

XV. SHAREHOLDERS’ MEETINGS

1. Notice of General Meetings

Code Provision E.1.3 in the Corporate Governance Code requires:

- at least 20 clear business days’ notice for AGMs; and

- at least 10 clear business days’ notice for all other general meetings.

Under the “comply or explain” principle underlying the Code, issuers must explain any failure to comply with these requirements in their interim and annual reports.

Notice of general meetings must be given to all shareholders whether or not their registered address is in Hong Kong (GEM Rule 17.46(1)). An issuer must also ensure that notice of every general meeting is announced (GEM Rule 17.44).

2. Mandatory Voting by Poll on all Resolutions at General Meetings

Voting by poll is mandatory on all resolutions at all general meetings under GEM Rule 17.47(4).

Listed issuers must appoint a scrutineer (who may be the issuer’s auditors or share registrar or external accountants who are qualified to serve as auditors) to oversee the voting procedures. The results of the poll must be announced by the issuer as soon as possible and no later than 30 minutes before the earlier of the commencement of the morning trading session or any pre-opening session on the business day following the general meeting.

The chairman of a general meeting is required to ensure that the detailed procedures for conducting a poll are explained and to answer any questions that are raised (Code Provision E.2.1).

3. Parties Required to Abstain from Voting

Any shareholder that has a “material interest” in a transaction or arrangement to be approved at a general meeting of shareholders is required to abstain from voting on the resolution (GEM Rule 2.26).

Factors relevant to determining whether a shareholder has a “material interest” include:

- whether the shareholder is a party to the transaction or a close associate of such a party; and

- whether the transaction confers upon the shareholder or his associate a benefit not otherwise available to other shareholders of the issuer (GEM Rule 2.27).

XVI. ISSUES OF NEW SECURITIES

1. Pre-Emption Rights

One of the primary aims of the Listing Rules’ continuing obligations is to ensure the equal treatment of all shareholders. A key aspect of this is ensuring that members’ shareholdings are not diluted by the issue of new shares to third parties.

Accordingly, GEM Rule 17.39 provides that, except in the case of a pro rata offer to existing shareholders, the directors of a listed issuer must obtain the consent of shareholders in general meeting prior to the allotment, issue or grant of shares, securities convertible into shares, or options, warrants or similar rights to subscribe for shares or such convertible securities.

Alternatively, GEM Rule 17.41(2) allows a general mandate to be obtained from shareholders at a general meeting of shareholders to issue shares, convertible securities or rights to acquire shares. The general mandate must be subject to a restriction that the maximum number of securities which may be allotted may not exceed 20% of the number of the company’s issued shares as at the date of the resolution granting the general mandate. If a share consolidation or subdivision is conducted after the approval of the issue mandate in general meeting, the maximum number of securities that may be issued will be adjusted accordingly. The general mandate can also separately authorise the company to issue shares equivalent to the number of shares repurchased since the date of the mandate (up to a maximum of 10% of the number of the company’s issued shares as at the date of the resolution granting the repurchase mandate). A general mandate granted under these Rules will lapse at the end of the next annual general meeting (“AGM”) unless it is renewed by ordinary resolution passed at that meeting. General mandates can also be revoked or varied by ordinary resolution of the shareholders in general meeting (GEM Rule 17.42).

The restrictions in GEM Rules 17.39 to 17.42B do not apply to pro rata offers provided that the pro rata offer is made to all existing shareholders excluding shareholders resident in a place outside Hong Kong which the directors, after making enquiry as to the legal restrictions under the laws of such place and the requirements of the relevant body or stock exchange, consider it necessary or expedient to exclude because of such restrictions or requirements. The circular or offer document must contain an explanation for the exclusion of such shareholders and must be delivered to shareholders excluded from the offer, subject to compliance with the local laws and regulations (GEM Rule 17.41(1)).

In view of the Listing Rules’ restrictions, notices of AGMs generally include a resolution granting a general mandate to the directors to issue shares, other than on a pro rata basis, up to the permitted maximum amount, i.e. 20% of the number of issued shares plus a number equivalent to the number of shares repurchased subject to a cap of 10% of the number of issued shares at the date of the repurchase mandate.