Publications & presentations

Belt and Road – Introduction

- China’s most ambitious project – economically & diplomatically since the People’s Republic’s establishment

- Hong Kong – as the interface between Mainland China and the rest of the world – stands to benefit from the numerous business opportunities which will arise out of the Belt and Road initiative

- Hong Kong’s position is unique: it is a part of China, but under the One Country Two Systems framework, it retains its own legal system

- As China’s most cosmopolitan city and a leading international financial centre, Hong Kong is a very attractive place for Chinese companies to raise funds and for companies from around the world to invest in China

- Hong Kong is the world’s largest centre outside Mainland China for issuing debt denominated in renminbi (RMB)

- Hong Kong’s abundance of world-class professionals in financial, legal and accounting services, its lack of restrictions on capital flow, currency convertibility and simple low tax regime will allow Hong Kong to play a key role in facilitating investment under the Belt and Road initiative.

Belt and Road Today – Overview

- May 2016 – AIIB’s first loan to Pakistan for construction of M4 highway along the China-Pakistan Economic Corridor

- End May 2016 – over half of the total value of China’s overseas construction contracts came from countries along the Silk Road

- September 2016 – Silk Road Bonds were discussed as a new funding source

- December 2016 – projects worth US$ 926 billion had been signed along the belt and road

Sources:

http://www.bbc.com/zhongwen/trad/press_review/2016/07/160701_press_review ;

http://www.bbc.com/zhongwen/trad/press_review/2016/07/160701_press_review ;

http://www.chinausfocus.com/finance-economy/belt-and-road-initiative-makes-strong-progress

Belt and Road Hong Kong Stands to Benefit

- Professional services

- Capital Raising centre

- Infrastructure services

- Information technology services

Hong Kong as a Super Connector

- Hong Kong as an international financial centre

- Strong networks with China and internationally

- Fund-raising and financing capabilities

- Expertise in infrastructure development

- Independent legal system

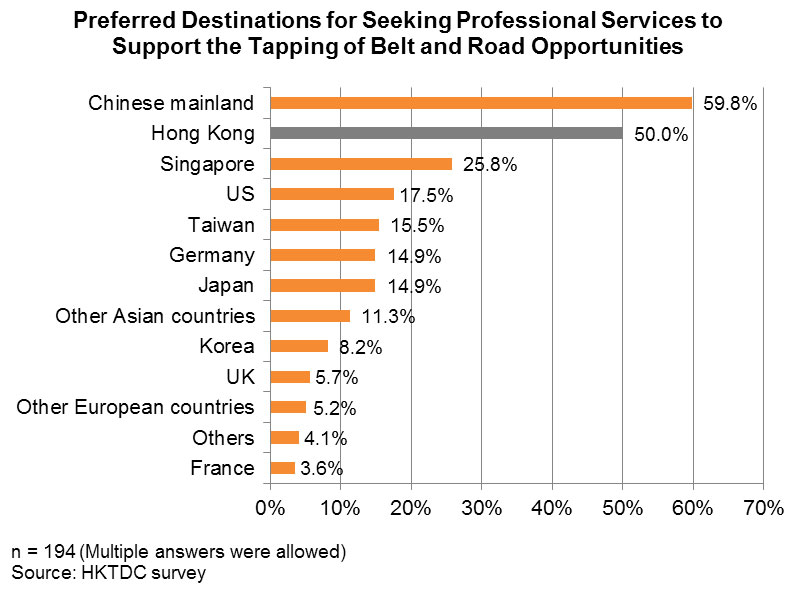

Hong Kong as a Professional Services Provider

- Professional Services

- Accounting, law and management consultancy

- International and Hong Kong law firms

- Banking, insurance, property valuation, infrastructure development, construction etc.

Hong Kong as a Capital Raising Centre

- ADB estimates a funding shortfall for Asian infrastructure projects of US$ 750 billion per year through 2020

- Hong Kong to play key role as an infrastructure financing centre for Belt and Road projects

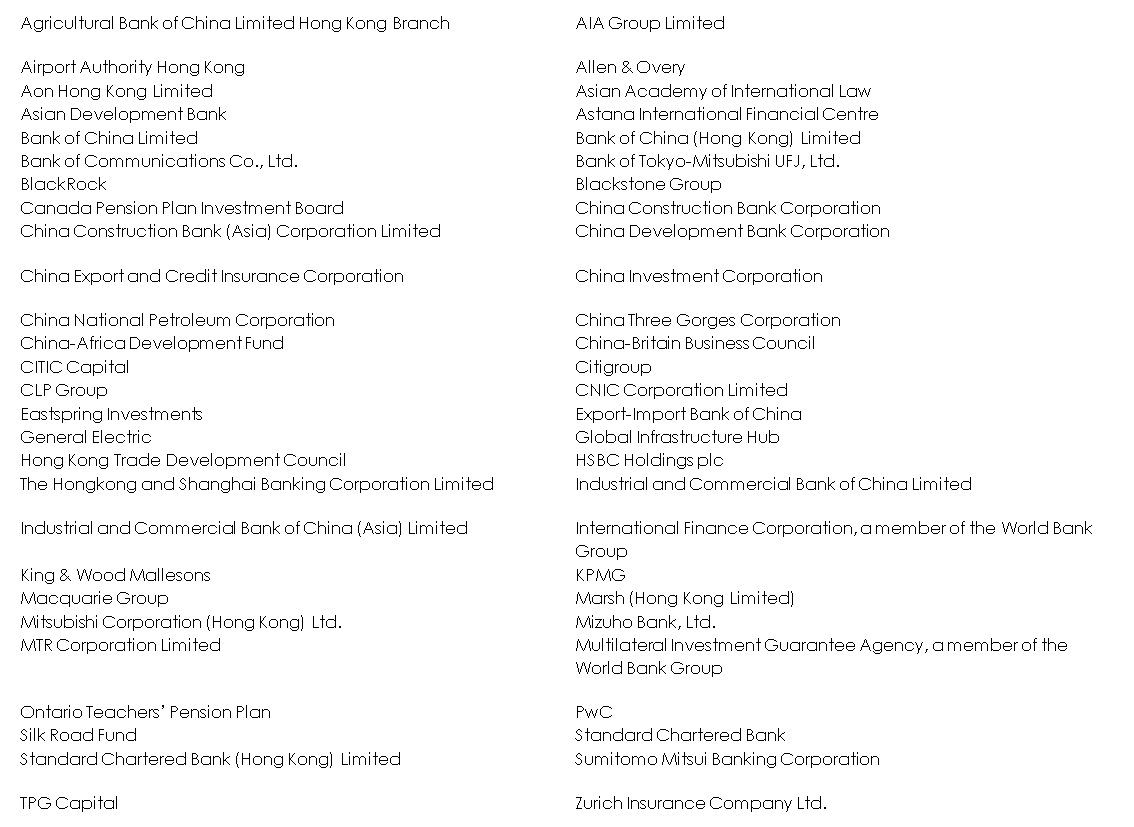

- Hong Kong’s International Financing Facilitation Office (IFFO)

- Established in July 2016 by the Hong Kong Monetary Authority

- Platform to facilitate infrastructure investments and their financing

- Mission – Facilitate exchange of information and strategies, collaborate efforts

- Some key partners – Bank of China, China Construction Bank Corporation, Citigroup, Standard Chartered Bank, HSBC, Asian Development Bank, Silk Road Fund etc.

Source: https://www.iffo.org.hk/about-us/IFFO_Partners

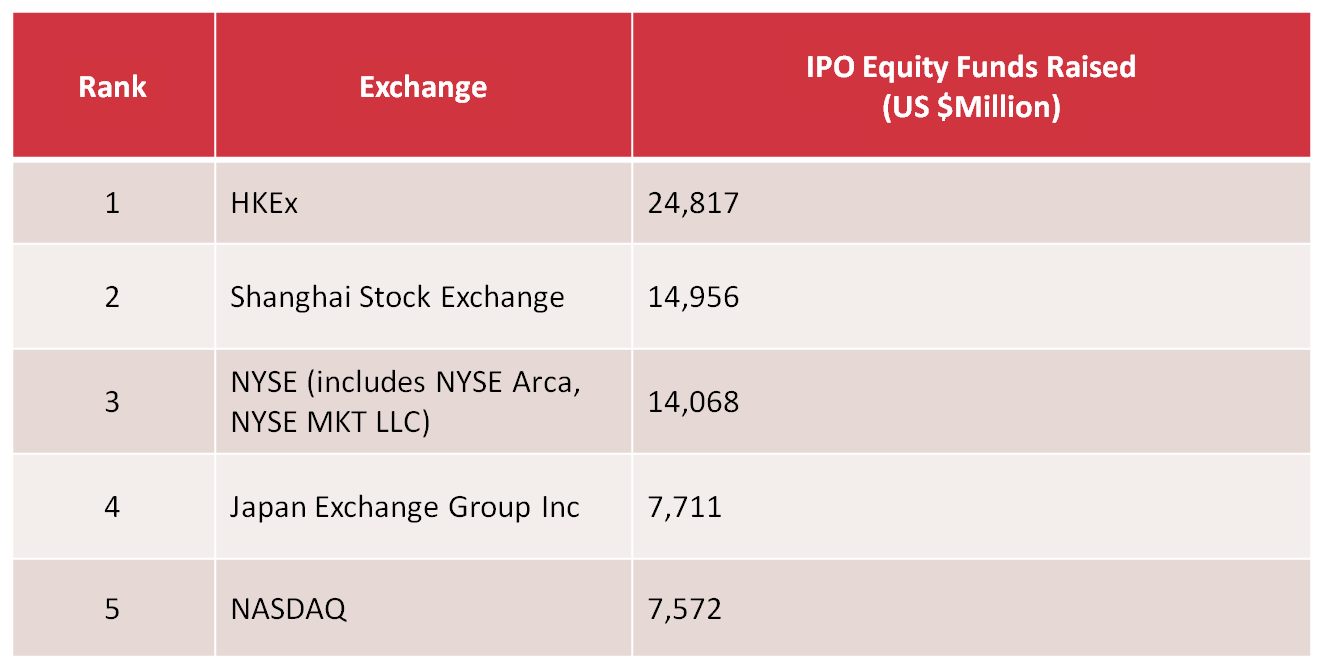

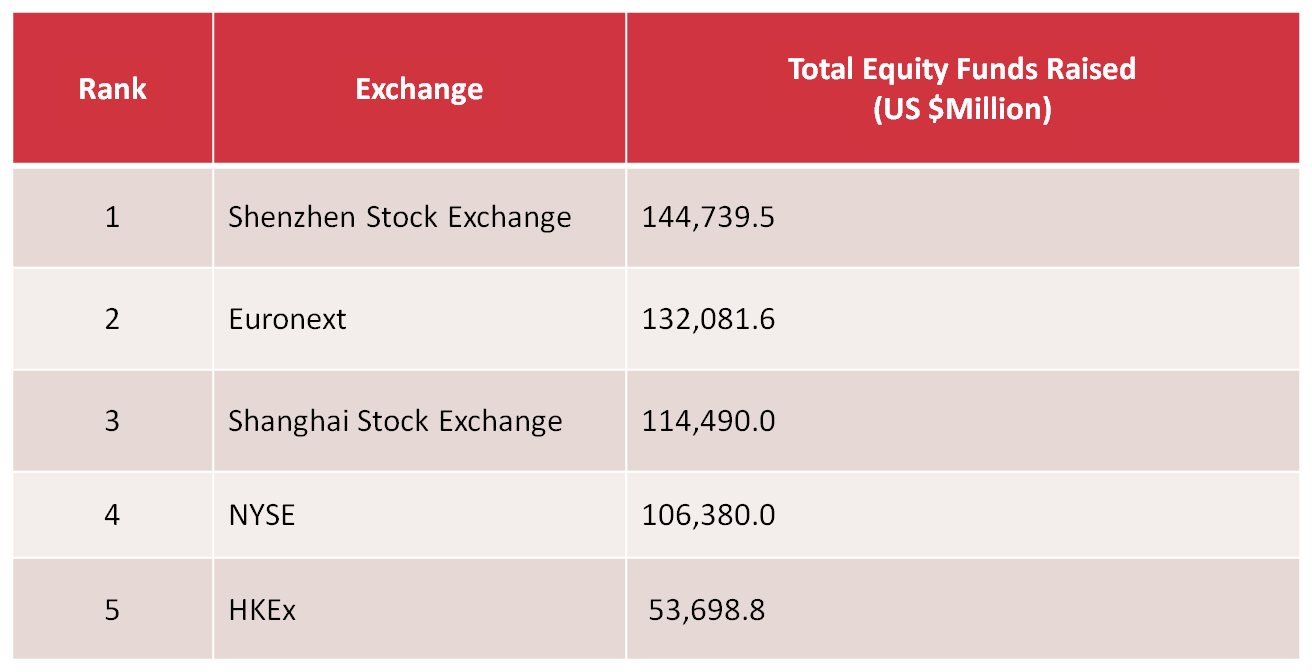

- Stock Exchange of Hong Kong:

- Equity

- Commodities

- Fixed Income and Currency

IPO Equity Funds Raised (1 Jan – 15 Dec 2016)

Source: https://www.hkex.com.hk/eng/newsconsul/hkexnews/2016/Documents/1612202news.pdf

Total Equity Funds Raised (Jan – Nov 2016)

Source: https://www.hkex.com.hk/eng/newsconsul/hkexnews/2016/Documents/1612202news.pdf

- Equity

- Stock Connect schemes

- Shanghai-Hong Kong Stock Connect (2014)

- Shenzhen-Hong Kong Stock Connect (2016)

- Future trends

- introduce new products, such as Exchange Traded Funds (ETFs), listed bonds and convertible bonds

- Primary Equity Connect to allow investors to buy IPO shares through Stock Connect schemes

Listing on the Hong Kong Stock Exchange

- Two Markets: Mainboard and Growth Enterprise Market

- “Recognised jurisdictions” – Hong Kong, China, Bermuda and the Cayman Islands

- 24 “accepted jurisdictions” of incorporation – Australia, Brazil, the British Virgin Islands, Canada (Alberta, British Columbia and Ontario), Cyprus, France, Germany, Guernsey, the Isle of Man, India, Italy, Japan, Jersey, Luxembourg, Republic of Korea, Labuan, Russia, Singapore, the United Kingdom and the United States (State of California, State of Delaware and State of Nevada)

- Companies from other jurisdictions must satisfy requirements of Joint Policy Statement Regarding the Listing of Overseas Companies (September 2013), including demonstration that shareholder protection standards under the laws of their jurisdiction are equivalent to those under Hong Kong law

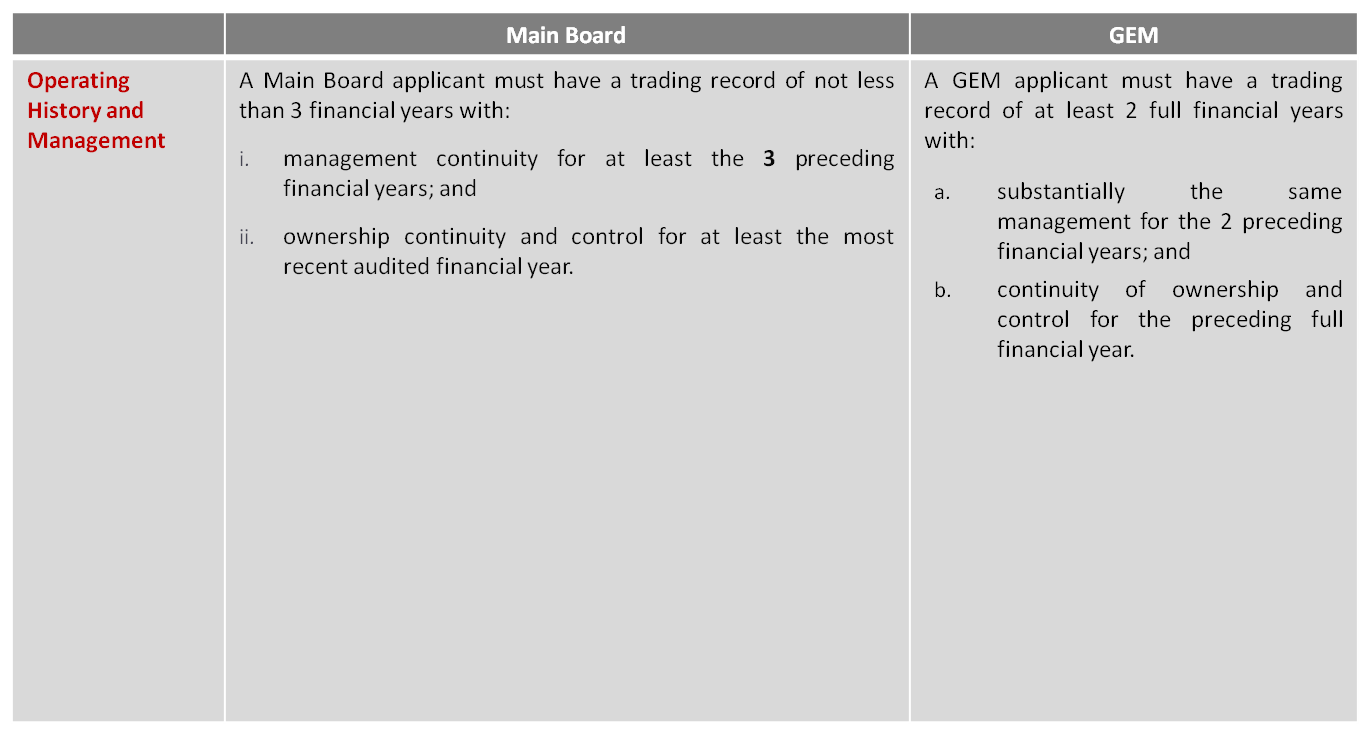

Operating History and Management

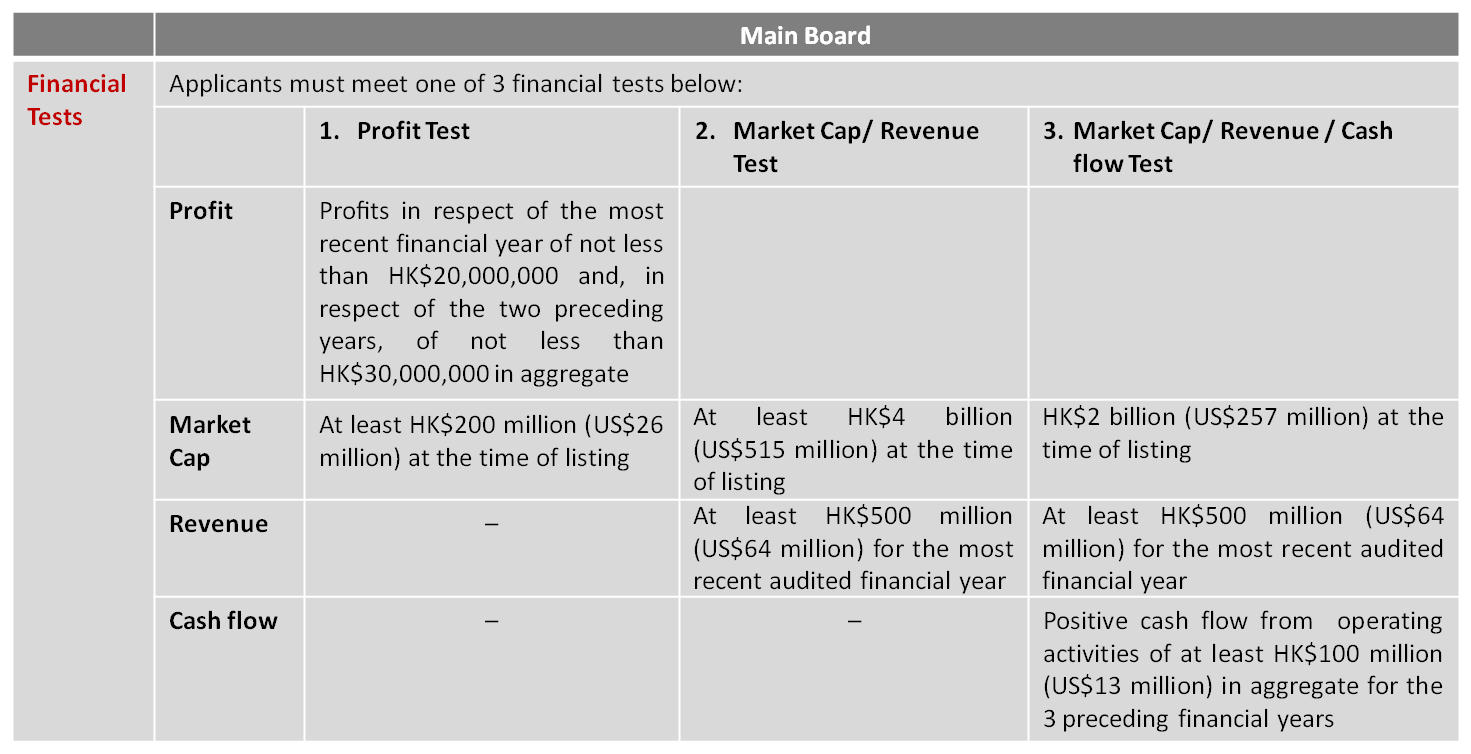

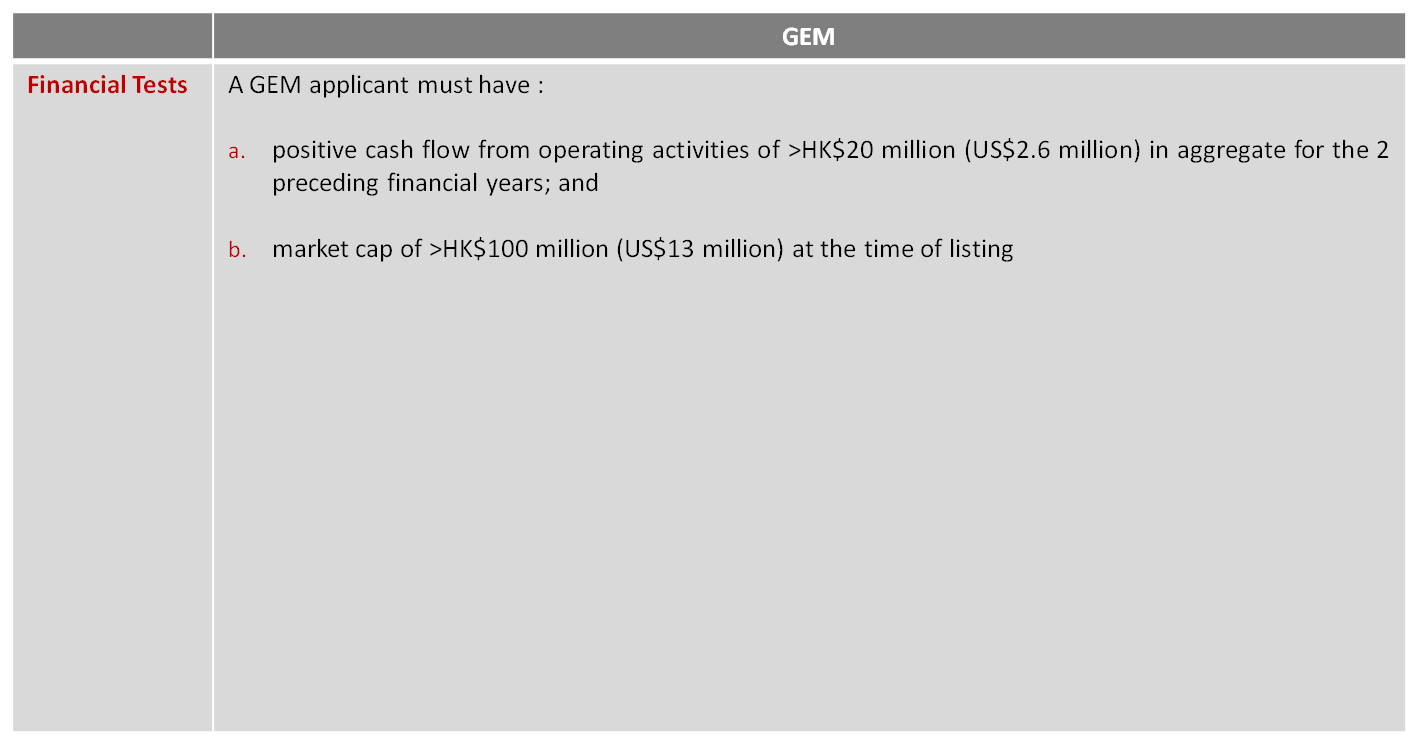

Financial Tests

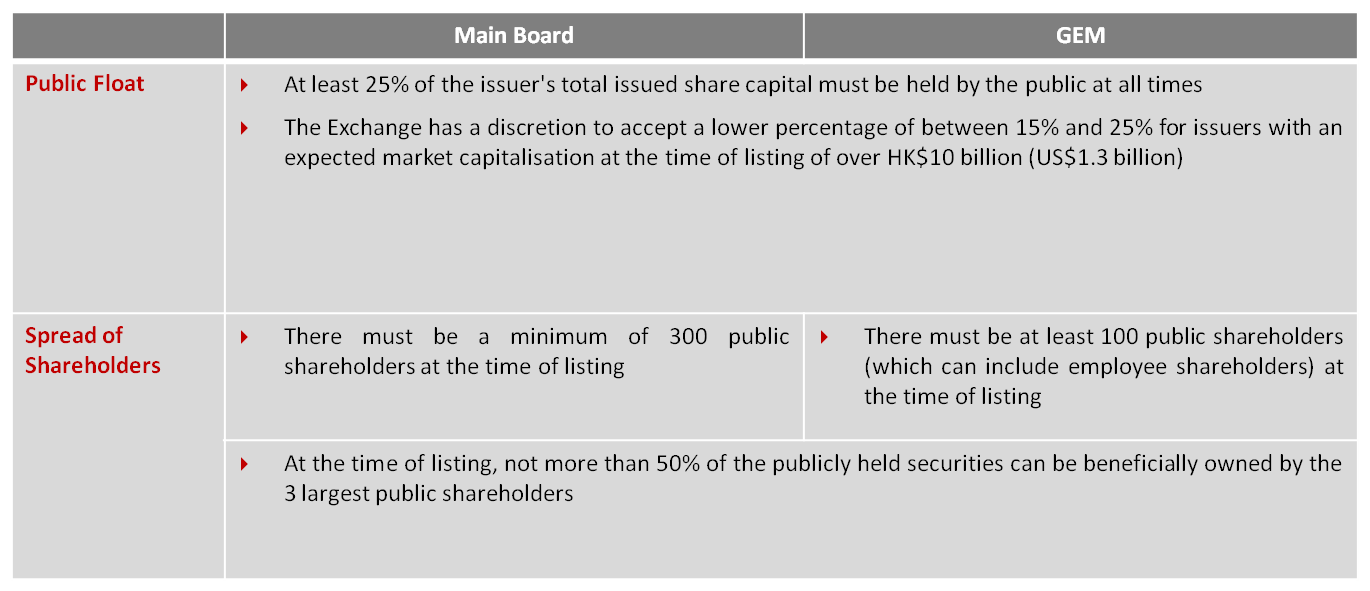

Public Float and Spread of Shareholders

Post-Listing Fundraising

- Hong Kong Main Board in 2016

- HK$145,945 million share placings and HK$45,863 million rights issues

- Top-up-placings

- Mechanism – the controlling shareholder places shares to new investors then the company issues new replacement shares to the controlling shareholder

- No requirement for offering document

A New Third Board

- Calls for a new third board to attract tech companies to list

- Hong Kong missed out on the listing of Alibaba Group in 2014

- “One share one vote” principle and “weighted voting rights structure”

Hong Kong as a Capital Raising Centre

Commodities

- Hong Kong Stock Exchange (HKEx) bought London Metals Exchange (LME) in 2012

- Stock Exchange 2016-18 Strategic Goal:

- Extend its existing global price benchmarks in commodities

- Attract international and Mainland investors

- London-Hong Kong Connect – a new trading link between the Hong Kong Futures Exchange and the LME

Fixed Income and Currency

- Internationalisation of the Renminbi

- Further drive cross-border investment

- The Belt and Road Initiative will encourage the continued growth of the offshore RMB market

- HKEx strategic goal – creation of a ‘Bond Connect’ Scheme

Hong Kong Law and Legal System

- Competitiveness of Hong Kong law and legal system for governing Belt and Road projects

- One Country, Two Systems

- The Basic Law and concepts of rule of law

- Dispute resolution – arbitration

- Extensive experience of serving multi-jurisdictional clients

- Experience of complex cross-border matters

Hong Kong’s Debt Market

- Recent Development

- The Hong Kong dollar-denominated bond market

- The dim sum market

- Hong Kong is the premier offshore RMB centre

- Provision of renminbi services from cross-border trade settlement to bond issues

- Hong Kong is the primary offshore renminbi debt market

- Renminbi (dim sum) bond market

- First offshore RMB bond was issued in Hong Kong in 2007

Hong Kong’s RMB Debt Market

- Dim sum bonds

- RMB-denominated bonds issued in Hong Kong

- Growth triggered by China’s continuing financial reforms

- Used by overseas companies to fund trade in RMB with China

- Issuers – banks, Chinese state-owned-enterprises, Chinese private companies, foreign companies e.g. McDonalds and Caterpillar

- Diversified investor base. No Hong Kong restrictions on investors

- Bonds trade through HK’s Central Moneymarkets Unit or Euroclear or Clearstream

- Offshore RMB are expected to follow the course of Eurodollar

- Hong Kong has an active private-sector bond market – trading in the OTC market

- Bonds can be offered without HK regulatory approval via:

- “Professional only” offers

- Private placements

- Debt securities listed on HKEx

- Debt securities offered to public investors in a retail offering

- Debt securities offered to professional investors only

- Recent growth in numbers of debt securities listed on HKEX

- Simplified regime for listing debt securities

- More RMB bonds issued in Hong Kong

Foreign Exchange

- Hong Kong is a hub for foreign exchange transactions

- In US$, RMB and many other currencies

- Capable of assisting in cross-border investment transactions

- Capable of facilitating cross-border trade payments

- Internationalisation of the Renminbi

- International Monetary Fund decided to include renminbi in its Special Drawing Rights currency basket

Asset Management

- Hong Kong as Asia’s premier asset management centre

- Potential funding source for companies involved in Belt and Road projects

- Recent growth driven by

- Demand for renminbi investment opportunities

- Hong Kong’s growth as the major offshore renminbi centre

- Mutual Recognition of Funds Scheme

- Mutual retail distribution of authorised funds

Other advantages of Hong Kong

- Geographical advantage

- Transportation network

- Free economic system – no restrictions on capital flow and free currency convertibility

- Cultural advantage

Infrastructure Development

- Belt and Road is set to develop infrastructure throughout the region

- Opportunities for China to strengthen ties with Belt and Road countries

- Extension of rail network to Belt and Road regions opens up new export markets

- Countries with railway construction projects with China under Belt and Road

- Thailand: High-speed rail line from southern China through Laos to Thailand’s industrial east coast

- Laos: railway line between Laos’ capital Vientiane and China’s Yunnan province

- Indonesia: Indonesia’s first high-speed rail link between Jakarta and Bandung

- The Philippines looks to China and Belt and Road

- Asian Development Bank projects that the Philippines needs US$127 billion per year to finance its infrastructure needs up to 2020

- President Duterte has expressed intention to look to China for funding

- AIIB and the World Bank have agreed to lend US$470 million for a flood control project in Manila

- Huge need for better roads and railways throughout the OBOR region

- In the Philippines, new infrastructure will increase agricultural exports

- Africa has huge demand for infrastructure

- China is leading infrastructure construction in developing the world

Opportunities for Hong Kong

Hong Kong will play a key role in Belt and Road projects:

- Acting as an international financing centre for Belt and Road projects

- Supporting the internationalisation of the RMB and the gradual easing of controls of China’s capital account

- Developing an Asian bond market and establishing bond market connectivity

- As the market for issuing the “Silk Road Bonds” which have been proposed as a fund-raising source for Belt and Road projects

- Capitalising on its position as the premier offshore market for the listing of Chinese companies

- Hong Kong’s construction, engineering and infrastructure development companies will get involved in regional infrastructure development projects

- Provide a link to investment projects and finance providers for overseas construction and engineering companies

- Hong Kong law has been used for many years for governing financial and commercial contracts for trade and infrastructure development in Asia. Hong Kong also has first-class dispute resolution and arbitration capabilities.

- Offers access to the world’s banks and investment funds more than any other international financial centre

- As one-stop-shop for companies looking to take advantage of opportunities offered by China’s Belt and Road

- Large pool of experienced professionals in project management, financing, legal, accounting, construction, etc.