Hong Kong regulatory compliance

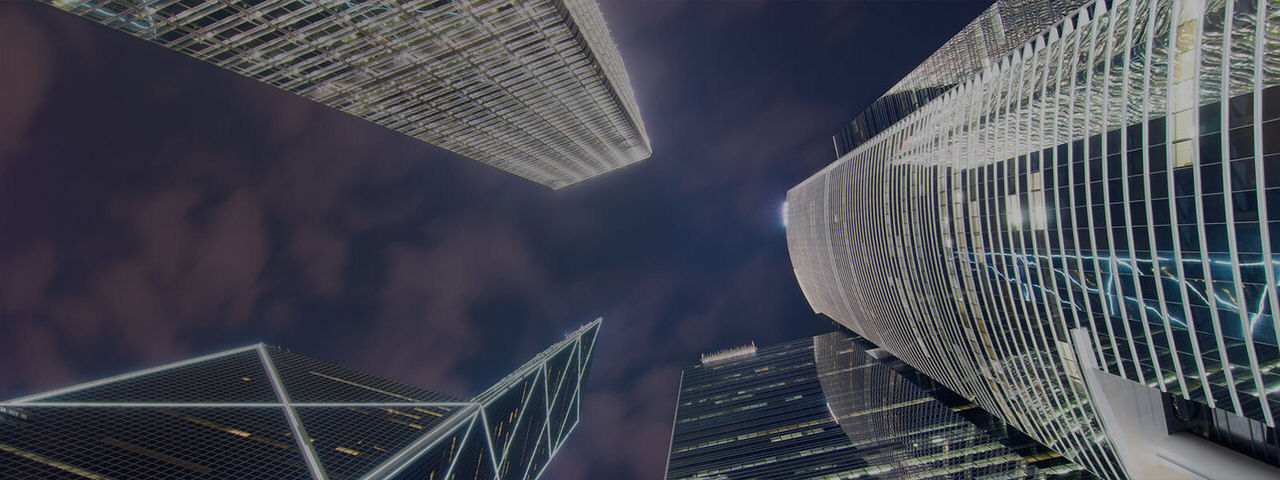

Possible fund structures

Note: Alternative structures possible if no type 9 licence and part of asset management function in Hong Kong

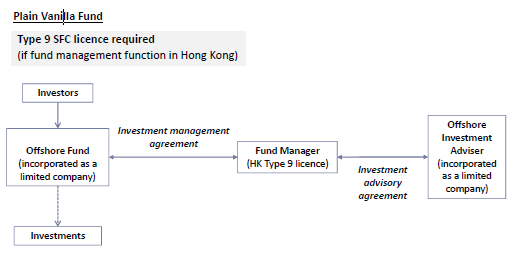

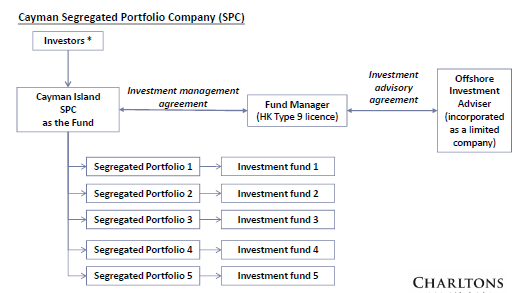

B. Segregated portfolio company

Cayman Segregated Portfolio Company (SPC)

Note: Alternative structures possible if no type 9 licence and part of asset management function in Hong Kong

B. Segregated portfolio company

Cayman Segregated Portfolio Company (SPC)

* Investors can choose to invest in all or some of the single country portfolios

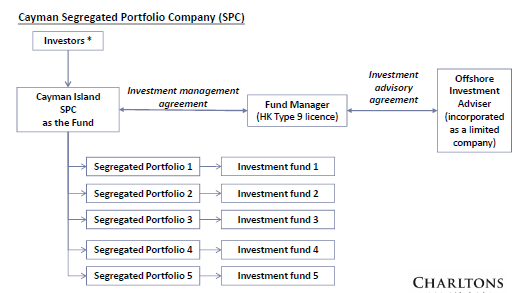

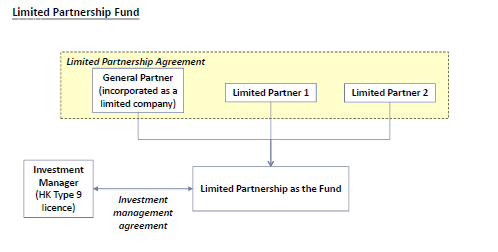

C. Limited partnership (1)

Limited Partnership Fund

* Investors can choose to invest in all or some of the single country portfolios

C. Limited partnership (1)

Limited Partnership Fund

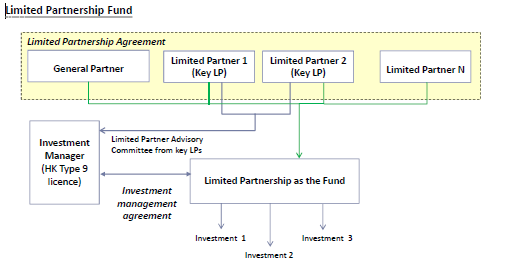

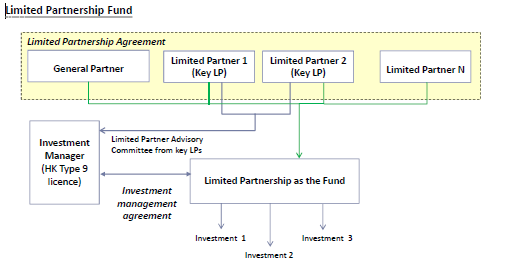

C. Limited partnership (2)

Limited Partnership Fund

C. Limited partnership (2)

Limited Partnership Fund

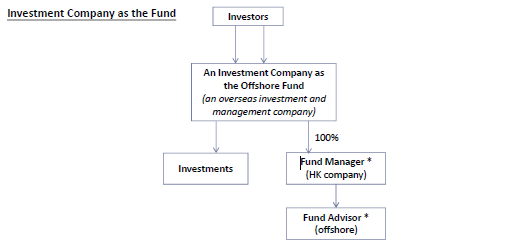

* Optional – fund management / advisory function can be located in the investment company

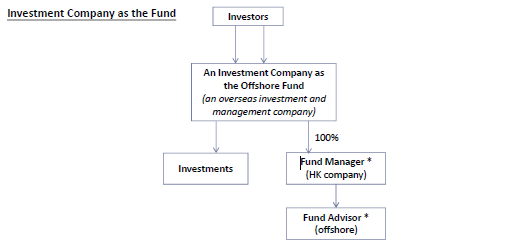

D. Investment company as the fund

* Optional – fund management / advisory function can be located in the investment company

D. Investment company as the fund

* Optional – fund management / advisory function can be located in the investment company

Charltons

* Optional – fund management / advisory function can be located in the investment company

Charltons

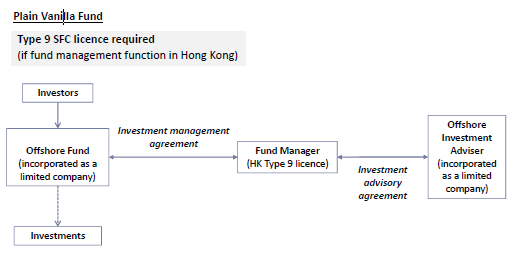

- Possible fund structures involving management of offshore fund or an offshore company:

- Plain vanilla fund structure

- Segregated portfolio company

- Limited partnership (1)

- Limited partnership (2)

- Investment company as the fund

Note: Alternative structures possible if no type 9 licence and part of asset management function in Hong Kong

B. Segregated portfolio company

Cayman Segregated Portfolio Company (SPC)

Note: Alternative structures possible if no type 9 licence and part of asset management function in Hong Kong

B. Segregated portfolio company

Cayman Segregated Portfolio Company (SPC)

* Investors can choose to invest in all or some of the single country portfolios

C. Limited partnership (1)

Limited Partnership Fund

* Investors can choose to invest in all or some of the single country portfolios

C. Limited partnership (1)

Limited Partnership Fund

C. Limited partnership (2)

Limited Partnership Fund

C. Limited partnership (2)

Limited Partnership Fund

* Optional – fund management / advisory function can be located in the investment company

D. Investment company as the fund

* Optional – fund management / advisory function can be located in the investment company

D. Investment company as the fund

* Optional – fund management / advisory function can be located in the investment company

Charltons

* Optional – fund management / advisory function can be located in the investment company

Charltons

- Charltons’ extensive experience in corporate finance makes us uniquely qualified to provide a first class legal service

- Extensive initial public offering and listing experience

- Representative offices in Shanghai, Beijing and Yangon

- “Boutique Firm of the Year” was awarded to Charltons by Asian Legal Business for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015

- Charltons was named the “Corporate Finance Law Firm of the Year in Hong Kong” in the Corporate INTL Magazine Global Award 2014

- “Hong Kong’s Top Independent Law Firm” was awarded to Charltons in the Euromoney Legal Media Group Asia Women in Business Law Awards 2012 and 2013

- “Equity Market Deal of the Year” 2011 was awarded to Charltons by Asian Legal Business for advising on the AIA IPO

- Excellent links and networks with law firms worldwide.

- Julia Charlton was named a “Leading Lawyer” by Asia Law & Practice for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015.

- “Asian Restructuring Deal of the Year” 2000 awarded to Charltons by International Financial Law Review for their work with Guangdong Investment Limited.

- Finalist for China Law & Practice’s “Deal of the Year (M&A)” 2007 for their work on Zijin Mining Group Co Ltd.’s bid for Monterrico Metals plc.

- Capital markets

- Corporate and commercial

- Securities

- Mergers and acquisitions

- Investment funds: China and offshore

- Derivatives

- Restructuring

- Venture capital

- Investment

- Conducting due diligence in Hong Kong and China

- Negotiating terms and conditions of the transaction

- Advising on transaction structure and relevant legal issues

- Liaising and coordinating with professional advisers from various jurisdictions

- Preparing completion documents and attend completion

- Julia, LL.B (1st class Honours), A.K.C (Kings College, London) was admitted as a solicitor in England & Wales in 1985 and has practised as a solicitor in Hong Kong since 1987.

- Julia is a member of the Listing Committee of the Stock Exchange of Hong Kong Limited and the Takeovers Panel and the Takeovers Appeal Panel of the SFC.

- Julia was named a “Leading Lawyer” by Asia Law & Practice for the years 2002, 2003, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014 and 2015.

- Julia was named a “Leading Advisor” by Acquisition International for 2013.

- Julia was also named the “Capital Markets Lawyer of the Year – Hong Kong” in the Finance Monthly Global Awards 2014.

- Julia has extensive experience in China work and is a Mandarin speaker.

- Charltons has considerable experience in advising on and establishing hedge funds and funds investing in PRC securities and other assets.

- Charltons has worked with funds listing in Hong Kong, London, Luxembourg, Dublin, Bermuda and the Cayman Islands.

- Charltons has extensive experience in China.

- Established BVI regulated processional hedge fund.

- Advised FSA-regulated “fund of funds” investment management company in respect of SFC-licensing application.

- Established Cayman based fund investing in international futures contracts and foreign currency exchanges.

- Advised SFC-licensed investment manager in respect of the establishment of a Cayman based CIMA-regulated fund investing in China-related securities.

- Established BVI “professional” regulated mutual fund listed on the Irish Stock Exchange and investing in Asian convertible bonds, debt, and various arbitrage and absolute return strategies.

- Established Mauritius-based investment fund listed on the Irish Stock Exchange and investing in Chinese “B” Shares, and assisted in authorisation of the fund under the SFC Code on Unit Trusts and Manual Funds.

- Advised SFC-licensed fund manager on ongoing compliance issues under the SFO and SFC Codes.

- Established Cayman CIMA-regulated SPC focused on real estate investments in Dubai, Abu Dhabi, Bahrain, Qatar and Oman, as well as investments in property-related securities listed on the Dubai Financial Market, the Abu Dhabi Securities Market, and other stock exchanges in the Gulf region.

- Advised Hong Kong based investment management company on marketing and distribution in Hong Kong of fund generating returns through a UK litigation funding scheme secured by insurance contracts.

- Advised a European fund manager on a private equity investment in a PRC based fire protection group subsequently listed on the Hong Kong Stock Exchange.

- Advised a European fund manager on the subscription and investment in convertible bonds of a PRC based food group subsequently listed on the Hong Kong Stock with two rounds of financing.

- Advised a European fund manager on private equity investment in an offshore holding company of a PRC battery-manufacturing group by way of a pre-initial public offer placement of the Convertible Bonds of the Company, which was subsequently listed on the Hong Kong Stock Exchange.

- Advised a European fund manager on private equity investment in an offshore holding company of a PRC fish products and manufacturer.

- Advised a Shanghai based IT company on 1st and 2nd round convertible share financing.

- Advised a Hong Kong and PRC vpn group on several rounds of preference share financing from a US based venture capital firm.